Form 6-K MAVERIX METALS INC. For: May 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUERPURSUANT TO

RULE 13a-16 or 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2021

Commission File Number 001-38934

Maverix Metals

Inc.

(Translation of registrant’s name into English)

Suite 575,

510 Burrard Street

Vancouver, British Columbia V6C 3A8

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 14, 2021

| MAVERIX METALS INC. | ||

| By: | /s/ C. Warren Beil | |

| C. Warren Beil | ||

| General Counsel | ||

INDEX TO EXHIBITS

| Exhibit No. | Description of Exhibit |

| 99.1 | Management’s Discussion and Analysis for the three month period ended March 31, 2021 |

| 99.2 | Condensed Consolidated Interim Financial Statements for the Three Month Periods Ended March 31, 2021 and 2020 |

| 99.3 | Form 52-109F2 – Certification of Interim Filings Full Certificate – CEO |

| 99.4 | Form 52-109F2 – Certification of Interim Filings Full Certificate – CFO |

| 99.5 | News Release dated May 14, 2021 |

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

Date of Report: May 13, 2021

This Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand the significant factors that have affected the performance of Maverix Metals Inc. and its subsidiaries (collectively “Maverix”, “we”, “us”, “our” or the “Company”) and such factors that may affect its future performance. This MD&A should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements for the three month period ended March 31, 2021 and related notes thereto which have been prepared in accordance with International Financial Reporting Standards (“IFRS”), applicable to preparation of interim financial statements including International Accounting Standard 34-Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”). Readers are encouraged to consult the Company’s audited consolidated financial statements for the year ended December 31, 2020 and related notes thereto, which are available under Maverix’s profile on SEDAR at www.sedar.com or EDGAR at www.sec.gov. All amounts are in U.S. dollars unless otherwise indicated.

Readers are cautioned that the MD&A contains forward-looking statements and that actual events may vary from management’s expectations. Readers are encouraged to read the “Forward-Looking Statements” at the end of this MD&A and to consult Maverix’s condensed consolidated interim financial statements for the three month period ended March 31, 2021 and related notes thereto which are available on SEDAR at www.sedar.com and on Form 6-K filed with the United States Securities and Exchange Commission on EDGAR at www.sec.gov.

Additional information, including the primary risk factors affecting Maverix, are included on our Annual Information Form (“AIF”) and Form 40-F available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov, respectively. These documents contain descriptions of certain of Maverix’s royalty, stream and other interests, as well as a description of risk factors affecting the Company.

Table of Contents

| Description of the Business | 3 |

| Highlights and Key Accomplishments for Three Months Ended March 31, 2021 | 3 |

| COVID-19 Pandemic | 4 |

| Outlook for 2021 | 4 |

| Portfolio of Royalty, Stream and Other Interests Owned by Maverix at March 31, 2021 | 4 |

| Summary of Quarterly Results | 8 |

| Non-IFRS and Other Measures | 12 |

| Liquidity and Capital Resources | 13 |

| Outstanding Share Data | 15 |

| Off-Balance Sheet Arrangements | 15 |

| Related Party Transactions | 15 |

| Critical Accounting Judgements and Estimates | 15 |

| Financial Instruments | 15 |

| Internal Controls Over Financial Reporting | 17 |

| Disclosure Controls and Procedures | 17 |

| Forward-Looking Statements | 18 |

| Technical and Third-Party Information | 19 |

2

Description of the Business

Maverix is a resource-based company that seeks to acquire and manage royalties and metal purchase agreements (a “Stream” or “Streams”) on projects that are in an advanced stage of development or on operating mines producing precious or other metals. Royalty interests (“Royalty” or collectively, “Royalties”) are non-operating interests in mining projects that provide Maverix with the right to a percentage of the gross revenue from the metals produced from the project (a “Gross Revenue Royalty” or “GRR”) or the net revenue after the deduction of specified costs (a “Net Smelter Returns Royalty” or “NSR” royalty). Under a Stream interest, Maverix makes an upfront payment to acquire the Stream and then receives the right to purchase, at a fixed or variable price per unit based on the spot price of the precious or other metal, a percentage of a mine’s production for the life of mine or a specified time period.

The Company’s business strategy is to acquire existing Royalty and Stream interests, or to finance production, development, or in some circumstances, exploration stage projects in exchange for Royalty or Stream interests. In the ordinary course of business, Maverix engages in a continual review of opportunities to acquire existing Royalty or Stream interests, or to create new Royalties or Streams on operating mines, development projects and exploration projects. The Company currently has over 100 Royalties and Streams, of which 13 of the underlying mines are paying, excluding royalty payments from industrial minerals and power assets.

Highlights and Key Accomplishments for Three Months Ended March 31, 2021

Financial and Operating:

| ● | Total revenue of $13.1 million; |

| ● | Operating cash flows of $13.5 million; |

| ● | Operating cash flow, excluding working capital changes of $9.01 million; |

| ● | Gold Equivalent Ounces (“GEOs”) sold of 7,3021; |

| ● | Cash operating margin of $1,5681 per GEO sold; |

| ● | Average cash cost of $2231 per GEO sold; |

| ● | Net income of $14.8 million; and |

| ● | Adjusted net income of $5.01 million. |

TMAC Acquired by Agnico Eagle2

In February 2021, TMAC Resources Inc. (“TMAC”) announced it had concluded the previously announced plan of arrangement pursuant to which Agnico Eagle Mines Limited (“Agnico Eagle”) acquired all the issued and outstanding common shares of TMAC at a price of C$2.20 per share (the “Transaction”). TMAC was the owner of the Hope Bay mine, where the Company previously held a 2.5% NSR royalty interest.

TMAC had the right to buy back 1.5% of the NSR royalty interest held by the Company for a cash payment of $50.0 million in the event of a change in control transaction of TMAC (as defined in the royalty agreement) that was announced prior to June 30, 2021 (the “Hope Bay Buyback”). Concurrent with the closing of the Transaction, Agnico notified the Company that it would exercise the Hope Bay Buyback. The Company has received the $50.0 million payment and retained a 1% NSR royalty interest on the Hope Bay mine that is not subject to any reductions. Maverix acquired the additional 1.5% NSR royalty on Hope Bay in August 2019 for a cash payment of $40.0 million and received $4.6 million of related royalty payments up until the exercise of the Hope Bay Buyback.

El Mochito Silver Stream

In March 2021, Maverix converted all amounts outstanding under a $1.0 million convertible debenture into an additional 5% silver Stream on the operating El Mochito mine on the same terms as the Company’s existing El Mochito silver Stream. Upon conversion, Maverix has a 27.5% silver Stream on the El Mochito mine.

Quarterly Dividends Declared

On May 13, 2021, the Board of Directors of the Company declared a quarterly dividend of $0.0125 per common share payable on June 15, 2021 to shareholders of record as of the close of business on May 31, 2021. The dividend represents a 25% increase from the previous dividends of $0.01 per common share.

1 Refer to section on non-IFRS and other measures of this MD&A.

2 Refer to TMAC’s news release dated February 2, 2021 on www.sedar.com, under TMAC’s SEDAR profile.

3

COVID-19 Pandemic

The Company continues to monitor and assess potential impacts of the novel coronavirus, also known as COVID-19, on its employees and business. In response to the COVID-19 pandemic, the Company closed its office, implemented a travel ban, and directed all of its employees to work remotely. No employees have contracted COVID-19 as of the date of this report.

There are a number of potential impacts that could restrict our operating partners’ ability to operate as a result of the COVID-19 pandemic. Mining operations in which Maverix holds a Royalty or Stream interest could be suspended for precautionary purposes or as governments declare states of emergency or take other actions in an effort to combat the spread of COVID-19. For further discussion of COVID-19 and the related risks to the Company refer to the AIF and Form 40-F available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov, respectively.

Outlook for 20211

In 2021, Maverix continues to expect 27,000 to 30,000 attributable GEOs2 at approximately a 90% cash margin2 with approximately 99% of expected revenue derived from gold and silver.

Portfolio of Royalty, Stream and Other Interests Owned by Maverix at March 31, 2021

As at March 31, 2021, the Company owned over 100 Royalties, Streams and other interests. Maverix has thirteen Royalties and Streams that are currently paying, including three in Australia, three in the United States, two in Mexico, two in Canada, and one in each Honduras, Burkina Faso and Russia. In addition, the Company owns a number of Royalties and Streams on development and exploration/evaluation stage projects in North America, South America, and Australia, amongst others. The Company uses “evaluation stage” to describe exploration stage properties that contain mineralized material and on which operators are engaged in the search for reserves. We do not conduct mining operations on the properties in which we hold Royalty and Stream interests, and we are not required to contribute to capital costs, exploration costs, environmental costs or other operating costs on those properties.

Primary Properties:

The following table summarizes Maverix’s principal Stream interests:

| Asset | Location | Operator | Status | MMX Attributable Production | MMX Purchase Price |

| El Mochito | Honduras | Kirungu Corporation | Paying | 27.5% of silver(1) | 25% of silver spot price |

| La Colorada | Mexico | Pan American Silver Corp. | Paying | 100% of gold | Lesser

of (i) US$650 per ounce and (ii) spot price |

| Moss | USA | Northern Vertex Mining Corp. | Paying | 100% of silver(2) | 20% of silver spot price |

(1) If 3.0 million ounces of silver are produced prior to April 1, 2022, Maverix’s silver purchase entitlement will decrease to 25% of life of mine silver production.

(2) After 3.5 million ounces of silver are delivered, Maverix’s silver purchase entitlement will be 50% of the remaining life of mine silver production.

1 Statements made in this section contain forward-looking information. Reference should be made to the “Cautionary Statement on Forward Looking Information” section at the end of this MD&A. For a description of material factors that could cause our actual results to differ materially from the forward-looking statements, please see the “Risk Factors” section in the most recent AIF and Form 40-F available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov, respectively.

2 Refer to section on non-IFRS and other measures of this MD&A.

4

The following table summarizes Maverix’s principal Royalty interests:

| Asset | Location | Operator | Status | Royalty Interest |

| Beta Hunt | Australia | Karora Resources Inc. | Paying | 3.25% GRR, and 1.5% NSR Royalties on all Gold production; and aggregate 1.5% NSR Royalties on all Nickel production |

| Camino Rojo | Mexico | Orla Mining Ltd. | Development | 2.0% NSR Royalty (1) |

| Cerro Blanco | Guatemala | Bluestone Resources Inc. | Development | 1.0 NSR Royalty |

| Cerro Casale | Chile | Barrick Gold Corporation and Newmont Corporation | Development | 1.25% GRR on 25% of Revenues(2) |

| Converse | USA | Waterton Global Resource Management | Development | 5.0% NSR Royalty(3) |

DeLamar (DeLamar) |

USA | Integra Resources Corp. | Development | 2.5% NSR Royalty(4) |

| Florida Canyon | USA | Argonaut Gold Inc. | Paying | 3.0% NSR Royalty |

Goldfield (Gemfield) |

USA | Waterton Global Resource Management | Development | 5.0% NSR Royalty on the Gemfield deposit |

| Hasbrouck-Three Hills | USA | West Vault Mining Inc. | Development | 1.25% NSR Royalty |

| Hope Bay | Canada | Agnico Eagle Mines Limited | Paying | 1.0% NSR Royalty |

| Karma | Burkina Faso | Endeavour Mining Corporation | Paying | 2.0% NSR Royalty on 85.5% of total production |

| Kensington | USA | Coeur Mining, Inc. | Operating | 2.5% NSR(5) |

| McCoy-Cove | USA | Premier Gold Mines Ltd. | Development | 3.5% NSR Royalty(6) |

| Monument Bay | Canada | Yamana Gold Inc. | Advanced Exploration | 1.5% NSR Royalty |

Moose River (Touquoy) |

Canada | St Barbara Limited | Paying | 1.0% NSR Royalty on the Touquoy deposit |

| Morondo | Côte d’Ivoire | Montage Gold Corp. | Exploration | 2.0% NSR Royalty |

| Mt Carlton | Australia | Evolution Mining Ltd. | Paying | 2.5% NSR Royalty |

| Omolon | Russia | Polymetal International plc | Paying | 2.0% GRR Royalty(3) |

| Railroad | USA | Gold Standard Ventures Corp. | Development | 2.0% NSR Royalty(3) |

| Relief Canyon | USA | Americas Gold and Silver Corp. | Operating | 2.0% NSR Royalty(3) |

San Jose (Taviche Oeste) |

Mexico | Fortuna Silver Mines Inc. | Paying | 1.5% NSR Royalty on production from the Taviche Oeste concessions |

| Silvertip | Canada | Coeur Mining, Inc. | Suspended | 2.5% NSR Royalty |

| Vivien | Australia | Ramelius Resources Ltd. | Paying | 3.5% GRR |

(1) Royalty is on oxide and transitional ore only.

(2) Royalty commences after US$10M payable under the agreement.

(3) Royalty covers a portion of the existing mineral resource.

(4) NSR royalty covers a portion of the existing resource and decreases to a 1.0% NSR Royalty after CAD$10 million in royalties have been paid.

(5) NSR royalty not payable until after a recoupment period.

(6) 2.0% of the NSR royalty only covers a portion of the deposit.

Significant Portfolio Updates - Paying and Operating Assets:

Hope Bay

Agnico announced that it has launched a major delineation, conversion and exploration drilling program at the Hope Bay mine, using three rigs from underground and three rigs at surface. In the first quarter of 2021, 124 holes were drilled, totaling 18,100 metres. Agnico expects to spend $16.2 million for 69,600 metres of drilling at the Hope Bay mine in 2021, including $5.5 million for 29,800 metres of delineation drilling to support production at the Doris mine and $10.7 million for 39,800 metres of drilling on 33 exploration targets around the Doris, Madrid and Boston deposits and other regional targets along the 80-kilometre-long Hope Bay greenstone belt.

5

An internal team at Agnico has been established to evaluate expanded production scenarios that would potentially involve the Madrid and Boston deposits, with a new internal technical evaluation expected in 2022. Agnico believes that Hope Bay has the potential to be a 250,000 to 300,000 ounces of gold per year operation.

Agnico plans to continue mining at the Doris deposit in 2021 with quarterly production guidance remaining unchanged at approximately 18,000 to 20,000 ounces of gold.

For more information, please refer to www.agnicoeagle.com and see the news release dated April 29, 2021.

Beta Hunt

Karora Resources Inc. (“Karora”) announced it had intersected a new high-grade nickel discovery at the Beta Hunt mine – the 50C Nickel Trough. The drilling aimed to test for the offset extension of the historic Beta nickel belt south of the Gamma Island Fault and confirmed the presence of massive and matrix nickel sulphide mineralization along the prospective ultramafic/basalt contact. The 50C Nickel Trough has the potential to represent a repeat of the historic Beta Zone which to date has produced in excess of 32,000 tonnes of nickel metal.

While Karora’s drilling in the 50C discovery area was aimed at nickel targets, the drilling also intersected gold mineralization above and below the 50C Trough and suggests the Beta Hunt gold mineralized system extends for over 3.5 kilometres of strike from the northern end of the A Zone.

For more information, please refer to www.karoraresources.com and see the news release dated April 6, 2021.

Florida Canyon

Argonaut Gold Inc. announced that it has received all necessary regulatory approvals, including a modification to the existing Air Quality permit, to allow for the construction, installation and operation of a new conveying and stacking system to deliver ore from the crushers to the leach pad. Currently, ore is being delivered from the crushers to the leach pad by haul truck. The new system will eliminate the re-handling of the ore and also free up mobile equipment to transport more ore tonnes from the open pit to the crusher and is expected to increase the annual production profile at Florida Canyon beginning in 2022. The conveying and stacking system is expected to be operational and ramped up to design capacity during the third quarter of 2021.

For more information, please refer to www.argonaut.com and see the news release dated April 28, 2021.

Significant Portfolio Updates - Development and Exploration Assets:

Camino Rojo

Orla Mining Ltd. announced the results of an updated feasibility study for the Camino Rojo oxide gold project after the recently completed layback agreement with Fresnillo plc. The updated feasibility study highlights a 54% increase in contained gold mineral reserves and an updated mine life of over 10 years with an average gold production rate of 94,000 ounces per annum. The mine is currently in construction with first production planned for late 2021.

For more information, please refer to www.orlamining.com and see the news release dated January 11, 2021.

Cerro Blanco

Bluestone Resources Inc. announced the filing of a preliminary economic assessment (“PEA”) that highlights an optimized project which doubles the gold resource ounces and production profile. The recent completion of advanced engineering and optimization work has significantly enhanced the understanding of the project and presented an opportunity to capitalize on its near-surface, high-grade mineralization through an open pit scenario. The PEA highlights an initial 11 year life of mine with production of approximately 2.4 million ounces of gold and 10.3 million ounces of silver and measured and indicated resources of 3.0 million ounces of gold and 13.2 million ounces of silver (61.5 million tonnes at 1.5 grams per tonne gold and 6.7 grams per tonne silver).

For more information, please refer to www.bluestoneresources.ca and see the news release dated April 13, 2021.

6

Silvertip

Coeur Mining, Inc. (“Coeur”) significantly increased the size of its resource base at Silvertip following the execution of the largest and most successful exploration program in the history of the property. Silver, zinc and lead measured and indicated resources increased by approximately 50%, 45% and 50%, respectively. Similarly, silver, zinc and lead inferred resources grew by approximately 46%, 69% and 37%, respectively.

Coeur highlighted key outcomes of the internal pre-feasibility study for Silvertip during its virtual investor day in December 2020. Notably, Coeur developed a new flowsheet that would help support a potential expansion to a throughput rate of 1,750 tonnes per day. Coeur is now progressing the project through a more comprehensive front-end engineering and design phase for the revised flowsheet, while also continuing to build on the momentum of its exploration program. Technical work remains focused on advancing engineering to de-risk capital estimates, increasing confidence in the expected concentrate qualities from all of the existing zones of the ore body with confirmatory metallurgical testing, and enhancing schedule certainty with respect to a potential restart.

For more information, please refer to www.coeur.com and see the news releases dated February 17, 2021 and April 28, 2021.

Morondo

Montage Gold Corp. (“Montage”) announced an updated mineral resource at its Koné Gold Project in Côte d’Ivoire. The inferred mineral resource at the Koné deposit was increased significantly to 123 million tonnes grading 0.80 gram per tonne gold at a 0.40 gram per tonne gold cut-off grade. A 35,000 metre drill program targeting further growth in resources and infill drilling has recently been expanded to a 55,000 metre drill program to increase the drilling below the current Koné resource and includes drilling at the nearby high-grade Petit Yao target. The expanded 55,000 metre drill program is 78% complete as of May 6, 2021 and Montage expects PEA results in mid-May 2021 and the completion of a feasibility study by the end of 2021.

For more information, please refer to www.montagegoldcorp.com and see the news releases dated January 28, 2021 and May 11, 2021.

7

Summary of Quarterly Results

Quarter Ended (in thousands of USD, except for GEO and per share amounts) | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | ||||||||||||

| Statement of Income and Comprehensive Income | ||||||||||||||||

| Royalty revenue | $ | 6,883 | $ | 10,140 | $ | 8,689 | $ | 7,784 | ||||||||

| Sales | 6,197 | 6,429 | 6,162 | 3,187 | ||||||||||||

| Total revenue | 13,080 | 16,569 | 14,851 | 10,971 | ||||||||||||

| Cash flow from operating activities | 13,479 | 7,746 | 13,792 | 6,616 | ||||||||||||

| Net income | 14,769 | 5,346 | 14,437 | 3,076 | ||||||||||||

| Basic earnings per share | 0.10 | 0.04 | 0.11 | 0.03 | ||||||||||||

| Diluted earnings per share | 0.10 | 0.04 | 0.11 | 0.02 | ||||||||||||

| Dividends declared per share | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | ||||||||

| Non-IFRS and Other Measures1 | ||||||||||||||||

| Adjusted net income | $ | 4,959 | $ | 6,282 | $ | 5,336 | $ | 3,010 | ||||||||

| Adjusted basic earnings per share | $ | 0.04 | $ | 0.05 | $ | 0.04 | $ | 0.02 | ||||||||

| Total GEOs sold | 7,302 | 8,836 | 7,797 | 6,412 | ||||||||||||

| Average realized gold price per GEO | $ | 1,791 | $ | 1,875 | $ | 1,905 | $ | 1,711 | ||||||||

| Average cash cost per GEO | 223 | 184 | 195 | 139 | ||||||||||||

| Cash flow from operating activities, excluding changes in non-cash working capital | $ | 8,998 | $ | 11,474 | $ | 10,841 | $ | 8,479 | ||||||||

| Statement of Financial Position | ||||||||||||||||

| Total assets | $ | 362,047 | $ | 379,607 | $ | 325,396 | $ | 340,190 | ||||||||

| Total non-current liabilities | $ | 1,882 | $ | 32,000 | $ | 35,000 | $ | 76,000 | ||||||||

Quarter Ended (in thousands of USD, except for GEO and per share amounts) | March 31, 2020 | December 31, 2019 | September 30, 2019 | June 30, 2019 | ||||||||||||

| Statement of Income (Loss) and Comprehensive Income (Loss) | ||||||||||||||||

| Royalty revenue | $ | 6,076 | $ | 6,741 | $ | 6,469 | $ | 4,418 | ||||||||

| Sales | 3,214 | 3,758 | 4,085 | 2,573 | ||||||||||||

| Total revenue | 9,290 | 10,499 | 10,554 | 6,991 | ||||||||||||

| Cash flow from operating activities | 4,846 | 7,456 | 6,034 | 5,343 | ||||||||||||

| Net income (loss) | 860 | (11,237 | ) | 1,803 | 610 | |||||||||||

| Basic earnings (loss) per share | 0.01 | (0.10 | ) | 0.02 | 0.01 | |||||||||||

| Diluted earnings (loss) per share | 0.01 | (0.10 | ) | 0.02 | 0.01 | |||||||||||

| Dividends declared per share | $ | 0.01 | $ | 0.01 | $ | 0.00 | $ | 0.00 | ||||||||

| Non-IFRS and Other Measures1 | ||||||||||||||||

| Adjusted net income | $ | 996 | $ | 3,008 | $ | 1,797 | $ | 831 | ||||||||

| Adjusted basic earnings per share | $ | 0.01 | $ | 0.03 | $ | 0.02 | $ | 0.01 | ||||||||

| Total GEOs sold | 5,871 | 7,096 | 7,208 | 5,359 | ||||||||||||

| Average realized gold price per GEO | $ | 1,582 | $ | 1,480 | $ | 1,464 | $ | 1,305 | ||||||||

| Average cash cost per GEO | 167 | 171 | 169 | 156 | ||||||||||||

| Cash flow from operating activities, excluding changes in non-cash working capital | $ | 5,733 | $ | 7,869 | $ | 7,655 | $ | 4,050 | ||||||||

| Statement of Financial Position | ||||||||||||||||

| Total assets | $ | 307,420 | $ | 315,135 | $ | 257,736 | $ | 217,064 | ||||||||

| Total non-current liabilities | $ | 66,000 | $ | 69,000 | $ | 51,000 | $ | 12,500 | ||||||||

1 Refer to section on non-IFRS and other measures of this MD&A.

8

Changes in sales, net income and cash flow from operating activities from quarter to quarter are affected primarily by fluctuations in production at the underlying mines, the timing of shipments, changes in the price of commodities, as well as acquisitions of Royalties and Streams and the commencement of operations of mines under construction. For more information, refer to the quarterly commentary below.

Three Months Ended March 31, 2021 Compared to the Three Months Ended March 31, 2020

For the three months ended March 31, 2021, the Company had net income of $14.8 million and cash flow from operations of $13.5 million compared with net income and cash flow from operations of $0.9 million and $4.8 million for the three months ended March 31, 2020. The increase in net income and cash flow were attributable to a combination of factors including:

| · | An $11.0 million gain recognized in net income during the three months ended March 31, 2021 for the Hope Bay Buyback; |

| · | An increase in working capital of $2.5 million from previously deferred amounts for a portion of the Hope Bay royalty revenue and $2.5 million for the receipt of the remaining amount owed under the Beta Hunt royalty amendment completed in September 2020; |

| · | A $2.4 million revaluation adjustment recognized during the three months ended March 31, 2021 from the conversion of a debenture into an additional 5% silver Stream on the El Mochito mine; |

| · | An increase in the El Mochito silver Stream combined with continued operational improvements at the mine resulted in an increase in both sales and cash flows of $2.0 million and $1.5 million, respectively; |

| · | Production at the Moss mine has continued to ramp up, resulting in an increase in both sales and cash flows of $0.7 million and $0.6 million, respectively; |

| · | An increase in royalty revenue of $0.6 million from the Omolon mine and $0.4 million from each of the Beta Hunt and Vivien mines due to increased attributable production and deferred revenue of $0.8 million recognized for Beta Hunt; |

| · | A reduction in finance expense of $0.5 million due to repayments of the credit facility during 2020 and the three months ended March 31, 2021; and |

| · | A 13% increase in the average realized gold price per GEO. |

Partially offset by:

| · | Both net income and cash flow from operations were reduced by $0.7 million from the cost of acquiring more gold and silver under the Company’s Stream agreements with respect to increased sales; |

| · | Net income decreased by $0.3 million due to the increase in depletion charges associated with the increase in total revenue for the period; |

| · | Net income decreased by $0.8 million due to the Hope Bay Buyback in early February and the scale down of mining operations in relation to COVID-19 measures to reduce the workforce at site; and |

| · | Net income was decreased by the recognition of a deferred income tax expense of $3.2 million due to taxable temporary differences arising from the Company’s royalty, stream and other interests after the Hope Bay Buyback. |

For the three months ended March 31, 2021, the Company had total revenue of $13.1 million and GEOs of 7,3021 compared with total revenue of $9.3 million and GEOs of 5,8711 for the three months ended March 31, 2020.

1 Refer to section on non-IFRS and other measures of this MD&A.

9

The following table summarizes the Company’s total revenues and GEOs for the three months ended March 31, 2021 and 2020:

| Three months ended March 31, 2021 | Three months ended March 31, 2020 | |||||||||||||||||||||||||

| (in thousands of USD, except for GEO amounts) | Primary Product | Royalty Revenue ($) | Sales ($) | GEOs1 | Royalty Revenue ($) | Sales ($) | GEOs1 | |||||||||||||||||||

| Beta Hunt | Gold | 2,350 | - | 1,310 | 1,933 | - | 1,219 | |||||||||||||||||||

| El Mochito | Silver | - | 2,218 | 1,236 | - | 266 | 168 | |||||||||||||||||||

| Florida Canyon | Gold | 693 | - | 386 | 465 | - | 293 | |||||||||||||||||||

| Hope Bay | Gold | 370 | - | 206 | 1,209 | - | 762 | |||||||||||||||||||

| Karma | Gold | 677 | - | 377 | 700 | - | 441 | |||||||||||||||||||

| La Colorada | Gold | - | 1,785 | 1,006 | - | 1,485 | 950 | |||||||||||||||||||

| Moose River | Gold | 316 | - | 176 | 386 | - | 244 | |||||||||||||||||||

| Moss | Silver | - | 2,194 | 1,223 | - | 1,463 | 922 | |||||||||||||||||||

| Mt Carlton | Gold | 374 | - | 209 | 341 | - | 215 | |||||||||||||||||||

| Omolon | Gold | 753 | 420 | 169 | - | 107 | ||||||||||||||||||||

| San Jose | Silver | 622 | - | 347 | 440 | - | 278 | |||||||||||||||||||

| Vivien | Gold | 680 | - | 379 | 292 | - | 184 | |||||||||||||||||||

| Other | Various | 48 | - | 27 | 141 | - | 88 | |||||||||||||||||||

| Consolidated total | 6,883 | 6,197 | 7,302 | 6,076 | 3,214 | 5,871 | ||||||||||||||||||||

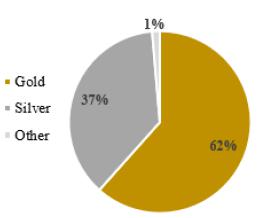

| Q1 2021 Royalty Revenue and Sales by Region | Q1 2020 Royalty Revenue and Sales by Region |

|

|

|

| Q1 2021 GEOs by Product | Q1 2020 GEOs by Product |

|

|

|

1 Refer to section on non-IFRS and other measures of this MD&A.

10

For the Three Months Ended March 31, 2021 Compared to Other Quarters Presented

When comparing net income of $14.8 million and cash flow from operations of $13.5 million for the three months ended March 31, 2021 with net income (loss) and operating cash flows for other quarters presented in the table of Summary of Quarterly Results above, the following items impact comparability of the analysis:

| · | An $11.0 million gain recognized in net income during the three months ended March 31, 2021 for the Hope Bay Buyback; |

| · | An increase in working capital of $2.5 million from previously deferred amounts for a portion of the Hope Bay royalty revenue and $2.5 million of the remaining amount owed under the Beta Hunt royalty amendment completed in September 2020 received during the three months ended March 31, 2021; |

| · | A $2.4 million revaluation adjustment recognized during the three months ended March 31, 2021 from the conversion of the convertible debenture into an additional 5% silver Stream on the El Mochito mine; |

| · | In September 2020, the company completed the Beta Hunt royalty amendment. As a result, the Company recognized a gain on the amendment of its Beta Hunt royalty interest of $9.3 million and current income tax expense and taxes paid of $4.3 million during the three months ended September 30, 2020; |

| · | The Company recognized an increase in net income of $2.9 million due to revaluation of warrants held during the three months ended September 30, 2020; |

| · | The Company recognized a non-cash impairment of $14.2 million on its Amulsar royalty interest during the three months ended December 31, 2019; |

| · | The Company acquired a silver stream on the El Mochito mine in March 2019, an additional 1.5% NSR royalty on Hope Bay in August 2019 and the Kinross royalty portfolio in December 2019, all of which contributed full quarters of royalty or stream income subsequent to their acquisitions; |

| · | A number of underlying mines on which the Company has a Royalty or Stream interest have continued to ramp up or began production over the past years, including the Beta Hunt mine, the Florida Canyon mine, the Moss mine, and the El Mochito mine; and |

| · | Net income being reduced by $0.3 million related to the initial listing costs for the NYSE American and TSX during the three months ended June 30, 2019. |

Change in Total Assets

Total assets decreased by $17.6 million from December 31, 2020 to March 31, 2021 primarily resulting from the $32.0 million repayment of the Company’s credit facility, the decrease in the Hope Bay royalty interest from the Hope Bay Buyback, and depletion of the Company’s royalty, stream and other interests. The decrease in total assets was partially offset from the $50.0 million received from the Hope Bay Buyback.

Total assets increased by $54.2 million from September 30, 2020 to December 31, 2020 primarily resulting from the acquisition of a royalty portfolio from Newmont Corporation (“Newmont”), which was financed by the issuance of common shares of the Company and a cash payment of $15.0 million. The net increase in total assets from the acquisition of the royalty portfolio from Newmont was partially offset by the cash consideration paid of $15.0 million, a $3.0 million repayment under the Company’s credit facility and depletion of the Company’s royalty, stream and other interests.

Total assets decreased by $14.8 million from June 30, 2020 to September 30, 2020 primarily resulting from the repayment of $41.0 million under the Company’s credit facility, depletion of the Company’s royalty, stream and other interests and amendment of the Company’s royalty interest on the Beta Hunt mine. The decrease in total assets was partially offset by funds received on closing of the Beta Hunt Royalty amendment and increase in the carrying value of investments due to fair value adjustments.

11

Total assets increased by $32.8 million from March 31, 2020 to June 30, 2020 primarily resulting from an increase in cash on hand from $15.6 million in gross proceeds received from the exercise of warrants, the drawdown of an additional $10.0 million under the credit facility and the results of operations for the quarter. The net increase in total assets was partially offset by depletion of the Company’s royalty, stream and other interests.

Total assets decreased by $7.7 million from December 31, 2019 to March 31, 2020 primarily resulting from the partial repayment of outstanding amounts under the credit facility using right of first refusal proceeds which were receivable at December 31, 2019, a decrease in carrying value of investments due to disposal and fair value adjustments and depletion of the Company’s royalty, stream and other interests. The net decrease in total assets was partially offset by an increase in cash on hand from drawing down $10.0 million under the credit facility.

Total assets increased by $57.4 million from September 30, 2019 to December 31, 2019 primarily resulting from the acquisition of a royalty portfolio from Kinross Gold Corporation (“Kinross”), which was financed by the issuance of common shares of the Company, cash flow from operations and drawdown of an additional $18.0 million from the credit facility. The net increase in total assets from the acquisition of the royalty portfolio from Kinross was partially offset by impairment of the Company’s royalty interest on the Amulsar mine and depletion of the Company’s royalty, stream and other interests.

Total assets increased by $40.7 million from June 30, 2019 to September 30, 2019 primarily resulting from the acquisition of an additional 1.5% NSR royalty on the Hope Bay mine and the acquisition of common shares in conjunction with the royalty acquisition.

Non-IFRS and Other Measures

The Company has included, throughout this document, certain performance measures, including (i) adjusted net income and adjusted basic earnings per share, (ii) Average realized gold price per GEO, (iii) Average cash cost per GEO, (iv) cash operating margin per GEO, and (v) operating cash flows excluding changes in non-cash working capital. The presentation of these non-IFRS and other measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These non-IFRS and other measures do not have any standardized meaning prescribed by IFRS, and other companies may calculate these measures differently.

i. Adjusted net income and adjusted basic earnings per share are calculated by excluding the effects of other income/expenses, impairment charges, gains/(losses) on sale or amendment of royalty and streams and unusual non-recurring items. The Company believes that in addition to measures prepared in accordance with IFRS, certain investors use this information to evaluate the results of the underlying business of the Company. Management believes that this is a useful measure of the Company’s performance because it adjusts for items which may not relate to or have a disproportionate effect on the period in which they are recognized, impact the comparability of our core operating results from period to period, are not always reflective of the underlying operating performance of our business and/or are not necessarily indicative of future operating results.

The table below provides a reconciliation of the adjusted net income and adjusted earnings per share:

| (in thousands of USD, except share and per share amounts) | Three months ended March 31, 2021 | Three months ended March 31, 2020 | ||||||

| Net income | $ | 14,769 | $ | 860 | ||||

| Gain on buy back of royalty interest | (10,983 | ) | - | |||||

| Gain on conversion of debenture | (2,410 | ) | - | |||||

| Other (income) expense | (46 | ) | 136 | |||||

| Effect of taxes on adjusting items | 3,629 | - | ||||||

| Adjusted net income | $ | 4,959 | $ | 996 | ||||

| Divided by: | ||||||||

| Basic weighted average number of common shares | 140,775,953 | 119,691,047 | ||||||

| Equals: | ||||||||

| Adjusted basic earnings per share | $ | 0.04 | $ | 0.01 | ||||

12

| ii. | Average realized gold price per GEO is calculated by dividing the Company’s total revenue by the GEOs sold. The Company presents average realized gold price per GEO as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other royalty and streaming companies in the precious metals mining industry that present results on a similar basis. The table below provides a reconciliation of average realized price per GEO: | |

| (total revenue presented in thousands of USD) | Three months ended March 31, 2021 | Three months ended March 31, 2020 | ||||||

| Total revenue | $ | 13,080 | $ | 9,290 | ||||

| Divided by: | ||||||||

| GEOs sold1 | 7,302 | 5,871 | ||||||

| Equals: | ||||||||

| Average realized gold price per GEO | $ | 1,791 | $ | 1,582 | ||||

| iii. | Average cash cost per GEO is calculated by dividing the Company’s cost of sales, excluding depletion, by the GEOs sold. The Company presents average cash cost per GEO as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other royalty and streaming companies in the precious metals mining industry who present results on a similar basis. The table below provides a reconciliation of average cash cost per GEO: | |

| (cost of sales presented in thousands of USD) | Three months ended March 31, 2021 | Three months ended March 31, 2020 | ||||||

| Cash cost of sales is comprised of: | ||||||||

| Cost of sales, excluding depletion | $ | 1,629 | $ | 979 | ||||

| Divided by: | ||||||||

| GEOs sold | 7,302 | 5,871 | ||||||

| Equals: | ||||||||

| Average cash cost per GEO | $ | 223 | $ | 167 | ||||

| iv. | Cash operating margin per GEO is calculated by subtracting the average cash cost per GEO from the average realized gold price per GEO. The Company presents cash operating margin as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other royalty and streaming companies in the precious metals mining industry that present results on a similar basis. |

| v. | The Company has also used the non-IFRS measure of operating cash flows excluding changes in non-cash working capital. This measure is calculated by adding back the decrease or subtracting the increase in changes in non-cash working capital to or from cash provided by operating activities. |

Liquidity and Capital Resources

As at March 31, 2021, the Company had cash and cash equivalents of $49.3 million (December 31, 2020: $7.8 million) and working capital of $59.1 million (December 31, 2020: $35.1 million). As at March 31, 2021, the Company had $120.0 million available under its credit facility.

Cash flow from operations

For the three months ended March 31, 2021, cash flow from operations was $13.5 million, compared with $4.8 million for the three months ended March 31, 2020, with the increase primarily attributable to the Company’s growing portfolio of cash flowing Royalties and Streams, $2.6 million received for previously deferred amounts for a portion of the Hope Bay royalty revenue, $2.5 million received for the remaining amount owed under the Beta Hunt royalty amendment completed in September 2020, and a 13% increase in the realized gold price per GEO, as previously discussed in more detail.

1 The Company’s royalty revenue and silver sales are converted to a GEO basis by dividing the royalty revenue plus silver sales for a period by the average gold price based on the LBMA Gold Price PM Fix per ounce for the same respective period. Total GEOs sold includes the GEOs from the Company’s royalty revenue and silver sales plus the gold ounces sold from the Company’s gold Stream.

13

Cash flow from investing activities

For the three months ended March 31, 2021, the Company had net cash inflows of $60.6 million from investing activities primarily due to the proceeds received from the Hope Bay Buyback and the sale of 19.5 million common shares of Northern Vertex Mining Corp. for CAD$0.50 per common share as part of their financing which closed in February 2021. For the three months ended March 31, 2020, the Company had net cash inflows from investing activities of $12.0 million from the receipt of right of first refusal proceeds in connection with the acquisition of a portfolio of royalties from Kinross.

Cash flow used in financing activities

During the three months ended March 31, 2021, the Company had net cash outflows from financing activities of $32.5 million, which was primarily the result of Company repaying $32.0 million of its credit facility, dividend payments of $1.4 million and financing costs associated with our credit facility of $0.2 million. The net cash outflows were partially offset by proceeds received from the exercise of stock options. During the three months ended March 31, 2020, the Company had net cash outflows from financing activities of $4.8 million, which was primarily the result a net repayment of the Company’s credit facility and payment of dividend declared in December 2019.

Liquidity

We believe our current financial resources and funds generated from operations will be adequate to cover anticipated expenditures for general and administration and project evaluation costs and anticipated minimal capital expenditures for the foreseeable future. Our long-term capital requirements are primarily affected by our ongoing activities related to the acquisition or creation of Royalties and Streams.

The Company currently, and generally at any time, has acquisition opportunities in various stages of active review. In the event of the acquisition of one or more significant Royalties or Streams, we may seek additional debt or equity financing as necessary.

Purchase Commitments:

In connection with its Streams, the Company has committed to purchase the following:

| Percent of life of mine production | Per ounce cash payment: Lesser of amount below and the then prevailing market price (unless otherwise noted) | |||||||

| Gold Stream interests | ||||||||

| La Bolsa | 5 | % | $ | 450 | ||||

| La Colorada | 100 | % | $ | 650 | ||||

| Silver Stream interests | ||||||||

| El Mochito | 27.5 | %(1) | 25% of silver spot price | |||||

| Moss | 100 | %(2) | 20% of silver spot price | |||||

| (1) | If 3.0 million ounces of silver are produced prior to April 1, 2022, Maverix’s silver purchase entitlement will decrease to 25% of life of mine silver production. |

| (2) | After 3.5 million ounces of silver are delivered, Maverix’s silver purchase entitlement will be 50% of the remaining life of mine silver production. |

In connection with the acquisition of the Silvertip Royalty in 2017, the Company may issue an additional 1,400,000 common shares of the Company when the Silvertip mine achieves commercial production and a cumulative throughput of 400,000 tonnes of ore through the processing plant is achieved.

In connection with the acquisition of a portfolio of royalties from Newmont in October 2020, the Company agreed to make certain contingent cash payments of up to $15.0 million if certain production milestones at certain assets are achieved within five years of closing the acquisition.

14

Outstanding Share Data

As at May 13, 2021, the Company had 141,216,784 outstanding common shares, 4,169,000 outstanding share purchase options outstanding with a weighted average exercise price of CAD$4.83, 302,939 outstanding restricted share units, and 10,000,000 outstanding share purchase warrants with a weighted average exercise price of $2.84.

Off-Balance Sheet Arrangements

The Company does not utilize off-balance sheet arrangements.

Related Party Transactions

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities, including any director of the Company. Compensation for key management personnel of the Company was as follows:

Three months ended March 31, 2021 | Three months ended March 31, 2020 | |||||||

| Compensation and benefits | $ | 1,473 | $ | 1,266 | ||||

| Share-based compensation | 301 | 396 | ||||||

| Total compensation | $ | 1,774 | $ | 1,662 | ||||

During the three months ended March 31, 2021 and 2020, the Company purchased $0.7 million and $0.6 million, respectively, of refined gold from Pan American at a price of $650 per ounce purchased under its La Colorada gold Stream agreement. As a consequence of its shareholding and other factors, Pan American is deemed to have significant influence over the Company.

Critical Accounting Judgements and Estimates

The preparation of the consolidated financial statements in conformity with IFRS requires the Company’s management to make judgments, estimates and assumptions that affect the amounts reported in the consolidated financial statements. Estimates and assumptions are based on management’s best knowledge of the relevant facts and circumstances. However, actual results may differ from those estimates included in the consolidated financial statements.

The Company’s significant accounting policies and estimates are disclosed in Notes 2 and 3 of the annual consolidated financial statements for the year ended December 31, 2020.

Financial Instruments

The Company has exposure to a variety of financial risks from its use of financial instruments. This note presents information about the Company's exposure to each of these risks, the Company's objectives, policies and processes for measuring and managing risk, and the Company's management of capital.

Capital Risk Management

The Company’s primary objective when managing capital is to maximize returns for its shareholders by growing its asset base through accretive acquisitions of royalties, streams and other interests, while optimizing its capital structure by balancing debt and equity. At March 31, 2021, the capital structure of the Company consists of $354.4 million (December 31, 2020: $341.0 million) of total equity, comprising share capital, reserves, accumulated other comprehensive income, and retained earnings, and no amounts (December 31, 2020: $32.0 million) drawn under the Company’s credit facility. The Company was not subject to any externally imposed capital requirements with the exception of complying with certain covenants under the credit facility. The Company is in compliance with its debt covenants as at March 31, 2021.

15

Credit Risk

Credit risk is the risk of potential loss to the Company if the counterparty to a financial instrument fails to meet its contractual obligations. The Company's credit risk is primarily attributable to its liquid financial assets including cash and cash equivalents and accounts receivables in the ordinary course of business. In order to mitigate its exposure to credit risk, the Company maintains its cash and cash equivalents in several high-quality financial institutions and closely monitors its accounts receivable balances. The Company’s accounts receivable are subject to the credit risk of the counterparties who own and operate the mines underlying Maverix’s royalty portfolio.

Currency Risk

Financial instruments that affect the Company’s net income due to currency fluctuations include cash and cash equivalents, accounts receivable, investments, trade payables and other denominated in Canadian and Australian dollars. Based on the Company’s Canadian and Australian dollar denominated monetary assets and liabilities at March 31, 2021, a 10% increase (decrease) of the value of the Canadian and Australian dollar relative to the US dollar would increase (decrease) net income by $0.2 million and other comprehensive income by $0.5 million, respectively.

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they come due. The Company’s approach to managing liquidity is to ensure it will have sufficient liquidity to meet liabilities when due. In managing liquidity risk, the Company considers anticipated cash flows from operations, its holding of cash and cash equivalents and its revolving credit facility. As at March 31, 2021, the Company had cash and cash equivalents of $49.3 million (December 31, 2020: $7.8 million) and working capital of $59.1 million (December 31, 2020: $35.1 million). In addition, at March 31, 2021 the Company had $120.0 million available under its credit facility.

Other Risks

The Company is exposed to equity price risk as a result of holding common shares in other mining companies. The combined fair market value as at March 31, 2021 is $5.4 million (December 31, 2020: $18.2 million). The equity prices of investments are impacted by various underlying factors including commodity prices and the volatility in global markets as a result of COVID-19 and the daily exchange traded volume of the equity may not be sufficient for the Company to liquidate its position in a short period of time without potentially affecting the market value of the equity. Based on the Company’s investments held as at March 31, 2021, a 10% increase (decrease) in the equity prices of these investments would increase (decrease) other comprehensive income by $0.5 million.

16

Internal Controls Over Financial Reporting

The Chief Executive Officer (“CEO”) and the Chief Financial Officer (“CFO”) as certifying officers of the Company, with the participation of management under the supervision of the CEO and CFO, are responsible for establishing and maintaining internal control over financial reporting (“ICFR”) and disclosure controls and procedures (“DC&P”) as such terms are defined in National Instrument 52-109 – Certification of Disclosure in Issuer’s Annual and Interim Filings in Canada (“NI 52-109”) and under the Securities Exchange Act of 1934, as amended, in the United States.

The Company’s internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of the Company’s financial reporting for external purposes in accordance with IFRS as issued by the IASB. The Company’s internal control over financial reporting includes:

| · | maintaining records, that in reasonable detail, accurately and fairly reflect our transactions and dispositions of the assets of the Company; |

| · | providing reasonable assurance that transactions are recorded as necessary for preparation of the consolidated financial statements in accordance with IFRS as issued by the IASB; |

| · | providing reasonable assurance that receipts and expenditures are made in accordance with authorizations of management and the directors of the Company; and |

| · | providing reasonable assurance that unauthorized acquisition, use or disposition of Company assets that could have a material effect on the Company’s consolidated financial statements would be prevented or detected on a timely basis. |

The Company’s internal control over financial reporting may not prevent or detect all misstatements because of inherent limitations. Additionally, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with the Company’s policies and procedures.

There were no changes to the Company’s internal controls over financial reporting during the three months ended March 31, 2021 that have materially affected, or are likely to materially affect, the Company’s internal control over financial reporting or disclosure controls and procedures.

Disclosure Controls and Procedures

Maverix’s DC&P are designed to provide reasonable assurance that material information relating to Maverix, including its consolidated subsidiaries, is made known to management by others within those entities, particularly during the period in which this report is prepared and that information required to be disclosed by Maverix in its annual filings, interim filings or other reported filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in the securities legislation.

17

The CEO and CFO have evaluated whether there were changes to the DC&P during the three months ended March 31, 2021 that have materially affected, or are reasonably likely to materially affect, the DC&P. No such changes were identified through their evaluation.

Limitation of Controls and Procedures

The CEO and CFO, in consultation with management, believe that any disclosure controls and procedures or internal control over financial reporting, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, they cannot provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been prevented or detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by unauthorized override of the controls. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Forward-Looking Statements

This MD&A contains “forward-looking information” or "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking information is provided as of the date of this MD&A and Maverix does not intend to and does not assume any obligation to update forward-looking information, except as required by applicable law. For this reason and the reasons set forth below, investors should not place undue reliance on forward-looking statements.

Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is based on reasonable assumptions that have been made by Maverix as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Maverix will purchase precious metals or from which it will receive stream or royalty payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related Maverix’s dividend policy; the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of novel coronavirus (COVID-19), on the Company's business, operations and financial condition; also, those risk factors discussed in this MD&A and under the heading “Risk Factors” in the Company’s AIF for the year ended December 31, 2020 available at www.sedar.com and www.sec.gov.

Forward-looking information in this MD&A includes disclosure regarding payments to Maverix pursuant to Royalties and Streams by owners or operators of the underlying mining operations or projects. Forward-looking statements are based on a number of material assumptions, which management of Maverix believe to be reasonable, including, but not limited to, the continuation of mining operations in respect of which Maverix will receive Royalty payments or from which it will purchase precious or other metals, that commodity prices will not experience a material adverse change, mining operations that underlie Royalties or Streams will operate in accordance with disclosed parameters and such other assumptions as may be set out herein.

Although Maverix has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results to not be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Readers of this MD&A should carefully review the risk factors set out in this MD&A and those risk factors that are set out in the AIF under the heading “Risk Factors”.

18

Technical and Third-Party Information

Brendan Pidcock, P.Eng., Vice President Technical Services for Maverix and a qualified person as defined under NI 43-101 has reviewed and approved the written scientific and technical disclosure contained in this document.

Except where otherwise stated, the disclosure in this MD&A relating to properties and operations in which Maverix holds Royalty, Stream or other interests is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Maverix. Specifically, as a Royalty or Stream holder, Maverix has limited, if any, access to properties on which it holds Royalties, Streams, or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Maverix is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Maverix, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds Royalty, Stream or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Maverix’s Royalty, Stream or other interest. Maverix’s Royalty, Stream or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

19

Exhibit 99.2

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

MARCH 31, 2021 AND 2020

|

Maverix Metals Inc. Condensed Consolidated Interim Statements of Financial Position |

| (in thousands of United States dollars) |

| March 31, 2021 | December 31, 2020 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 49,303 | $ | 7,760 | ||||

| Accounts receivable | 8,158 | 13,533 | ||||||

| Investments (Note 5) | 5,437 | 18,238 | ||||||

| Asset held for sale | 1,500 | 1,500 | ||||||

| Prepaid expenses and other | 458 | 653 | ||||||

| Total current assets | 64,856 | 41,684 | ||||||

| Non-current assets | ||||||||

| Royalty, stream and other interests (Notes 3&4) | 295,646 | 334,210 | ||||||

| Investments (Notes 3&5) | - | 1,000 | ||||||

| Deferred financing costs and other | 853 | 960 | ||||||

| Deferred tax asset (Note 12) | 692 | 1,753 | ||||||

| Total assets | $ | 362,047 | $ | 379,607 | ||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Trade and other payables | $ | 3,241 | $ | 3,285 | ||||

| Deferred revenue | 2,500 | 3,333 | ||||||

| Total current liabilities | 5,741 | 6,618 | ||||||

| Non-current liabilities | ||||||||

| Credit facility (Note 6) | - | 32,000 | ||||||

| Deferred tax liability (Note 12) | 1,882 | - | ||||||

| Total liabilities | 7,623 | 38,618 | ||||||

| Equity | ||||||||

| Capital and reserves | ||||||||

| Share capital (Note 7a) | 320,248 | 318,530 | ||||||

| Reserves | 10,408 | 10,654 | ||||||

| Accumulated other comprehensive income | 2,928 | 4,326 | ||||||

| Retained earnings | 20,840 | 7,479 | ||||||

| Total equity | 354,424 | 340,989 | ||||||

| Total liabilities and equity | $ | 362,047 | $ | 379,607 | ||||

Contractual Obligations (Note 15)

Subsequent Events (Note 16)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

ON BEHALF OF THE BOARD:

“signed” Geoff Burns, Director “signed” Dan O’Flaherty, Director

2

Maverix Metals Inc. Condensed Consolidated Interim Statements of Income and Comprehensive Income (Loss) | ||||||||

| (in thousands of United States dollars, except for per share and share data) | ||||||||

| Three months ended | ||||||||

| March 31 | ||||||||

| 2021 | 2020 | |||||||

| Royalty revenue (Note 13) | $ | 6,883 | $ | 6,076 | ||||

| Sales (Note 13) | 6,197 | 3,214 | ||||||

| Total revenue | 13,080 | 9,290 | ||||||

| Cost of sales, excluding depletion | (1,629 | ) | (979 | ) | ||||

| Depletion (Note 4) | (3,539 | ) | (3,306 | ) | ||||

| Total cost of sales | (5,168 | ) | (4,285 | ) | ||||

| Gross profit | 7,912 | 5,005 | ||||||

| Administration expenses (Note 8) | (1,415 | ) | (1,346 | ) | ||||

| Project evaluation expenses (Note 8) | (1,095 | ) | (1,242 | ) | ||||

| Income from operations | 5,402 | 2,417 | ||||||

| Other income and expenses | ||||||||

| Gain on buy back of royalty interest (Note 3) | 10,983 | - | ||||||

| Gain on conversion of debenture (Note 3) | 2,410 | - | ||||||

| Foreign exchange loss | (44 | ) | (204 | ) | ||||

| Other income (expense) | 46 | (136 | ) | |||||

| Finance expense | (294 | ) | (831 | ) | ||||

| Income before income taxes | 18,503 | 1,246 | ||||||

| Income tax expense (Note 12) | (3,734 | ) | (386 | ) | ||||

| Net income | $ | 14,769 | $ | 860 | ||||

| Earnings per share (Note 9) | ||||||||

| Basic earnings per share | $ | 0.10 | $ | 0.01 | ||||

| Diluted earnings per share | $ | 0.10 | $ | 0.01 | ||||

| Weighted average number of common shares outstanding: | ||||||||

| Basic | 140,775,953 | 119,691,047 | ||||||

| Diluted | 147,054,535 | 129,742,828 | ||||||

| Other Comprehensive Income (Loss) | ||||||||

| Net income | $ | 14,769 | $ | 860 | ||||

| Item that will not be subsequently re-classified to net income: | ||||||||

| Changes in fair value of investments, net of tax (Note 5) | (1,398 | ) | (4,191 | ) | ||||

| Comprehensive income (loss) | $ | 13,371 | $ | (3,331 | ) | |||

| The accompanying notes are an integral part of these condensed consolidated interim financial statements. |

3

Maverix Metals Inc. Condensed Consolidated Interim Statements of Cash Flows | ||||||||

| (in thousands of United States dollars) | ||||||||

| Three months ended | ||||||||

| March 31 | ||||||||

| 2021 | 2020 | |||||||

| Operating activities | ||||||||

| Net income | $ | 14,769 | $ | 860 | ||||

| Depletion and amortization | 3,576 | 3,343 | ||||||

| Income tax expense | 3,734 | 386 | ||||||

| Share-based compensation | 344 | 468 | ||||||

| Finance expense | 294 | 831 | ||||||

| Unrealized foreign exchange loss and other | 200 | 160 | ||||||

| Withholding and income taxes paid | (526 | ) | (315 | ) | ||||

| Gain on buy back of royalty interest (Note 3) | (10,983 | ) | - | |||||

| Gain on conversion of debenture (Note 3) | (2,410 | ) | - | |||||

| Changes in non-cash working capital (Note 10) | 4,481 | (887 | ) | |||||

| Net cash provided by operating activities | $ | 13,479 | $ | 4,846 | ||||

| Investing activities | ||||||||

| Acquisition of royalty, stream and other interests (Note 4) | (82 | ) | - | |||||

| Proceeds from buy back of royalty interest and other (Note 3) | 49,500 | - | ||||||

| Proceeds from disposal of equity investments (Note 5) | 11,186 | - | ||||||

| Right of first refusal proceeds | - | 12,000 | ||||||

| Net cash provided by investing activities | $ | 60,604 | $ | 12,000 | ||||

| Financing activities | ||||||||

| Proceeds from credit facility (Note 6) | - | 10,000 | ||||||

| Repayment of credit facility (Note 6) | (32,000 | ) | (13,000 | ) | ||||

| Financing costs and interest paid | (234 | ) | (759 | ) | ||||

| Dividends paid (Note 7e) | (1,408 | ) | (1,196 | ) | ||||

| Proceeds from exercise of stock options (Note 7c) | 1,128 | 147 | ||||||

| Net cash used in financing activities | $ | (32,514 | ) | $ | (4,808 | ) | ||

| Effect of exchange rate changes on cash and cash equivalents | (26 | ) | (37 | ) | ||||

| Increase in cash and cash equivalents | 41,543 | 12,001 | ||||||

| Cash and cash equivalents at the beginning of the period | 7,760 | 4,828 | ||||||

| Cash and cash equivalents | $ | 49,303 | $ | 16,829 | ||||

Supplemental cash flow information

(Note 10)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

4

| Maverix Metals Inc. Condensed Consolidated Interim Statements of Changes in Equity | |||||||||||||||

| (in thousands of United States dollars, except for number of shares) | |||||||||||||||

| Issued shares |

Share capital $ |

Share warrant reserve $ |

Share option reserve $ |

Accumulated other comprehensive income (loss) $ |

Retained earnings (deficit) $ |

Total equity $ |

|||||||||

| As at December 31, 2020 | 140,488,309 | 318,530 | 6,609 | 4,045 | 4,326 | 7,479 | 340,989 | ||||||||

| Total comprehensive income | - | - | - | - | (1,398 | ) | 14,769 | 13,371 | |||||||

| Dividend declared (Note 7e) | - | - | - | - | - | (1,408 | ) | (1,408 | ) | ||||||

| Shares issued for options exercised (Note 7c) | 664,351 | 1,713 | - | (585 | ) | - | - | 1,128 | |||||||

| Share-based compensation | 1,026 | 5 | - | 339 | - | - | 344 | ||||||||

| As at March 31, 2021 | 141,153,686 | 320,248 | 6,609 | 3,799 | 2,928 | 20,840 | 354,424 | ||||||||

| As at December 31, 2019 | 119,578,489 | 237,509 | 10,999 | 3,010 | 1,262 | (11,074 | ) | 241,706 | |||||||

| Total comprehensive income | - | - | - | - | (4,191 | ) | 860 | (3,331 | ) | ||||||

| Dividend declared (Note 7e) | - | - | - | - | - | (1,198 | ) | (1,198 | ) | ||||||

| Shares issued for options exercised (Note 7c) | 178,750 | 317 | - | (170 | ) | - | - | 147 | |||||||

| Share-based compensation | 9,240 | 35 | - | 433 | - | - | 468 | ||||||||

| As at March 31, 2020 | 119,766,479 | 237,861 | 10,999 | 3,273 | (2,929 | ) | (11,412 | ) | 237,792 | ||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

5

Maverix Metals Inc.

Notes to the Condensed Consolidated Interim Financial Statements

For the Three Month Periods Ended March 31, 2021 and 2020

(Expressed in thousands of United States dollars, unless stated otherwise)

| 1. | NATURE OF OPERATIONS |

Maverix Metals Inc. (“Maverix” or the “Company”) is incorporated and domiciled in Canada and its registered head office address is Suite 575, 510 Burrard Street, Vancouver, British Columbia, V6C 3A8, Canada. The Company’s common shares trade on the New York Stock Exchange American and Toronto Stock Exchange under the symbol “MMX”.

Maverix is a resource-based company that seeks to acquire and manage royalties and metal purchase agreements (a “Stream” or “Streams”) on projects that are in an advanced stage of development, on operating mines producing precious or other metals, or in some circumstances, exploration stage projects. Royalty interests (“Royalty” or collectively, “Royalties”) are non-operating interests in mining projects that provide Maverix with the right to a percentage of the gross revenue from the metals produced from the project (a “Gross Revenue Royalty” or “GRR”) or the net revenue after the deduction of specified costs (a “Net Smelter Returns Royalty” or “NSR” royalty). Under a Stream interest, Maverix makes an upfront payment to acquire the Stream and then receives the right to purchase, at a fixed or variable price per unit based on the spot price of the precious or other metal, a percentage of a mine’s production for the life of mine or a specified time period.

These consolidated financial statements were approved and authorized for issue by the Board of Directors of the Company on May 13, 2021.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

| a) | Statement of Compliance |

These condensed consolidated interim financial statements, including comparatives, have been prepared in accordance with International Financial Reporting Standards (“IFRS”), applicable to preparation of interim financial statements including International Accounting Standard 34, Interim Financial Reporting, as issued by the International Accounting Standards Board. Accordingly, certain disclosures included in the annual financial statements prepared in accordance with IFRS have been condensed or omitted. These unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2020 (the “2020 Annual Financial Statements”).

The accounting policies applied in the preparation of these unaudited condensed consolidated interim financial statements are consistent with those applied and disclosed in the Company’s 2020 Annual Financial Statements. The Company’s interim results are not necessarily indicative of its results for a full year.

| b) | Basis of Preparation |

These condensed consolidated interim financial statements have been prepared on a historical cost basis except for certain financial instruments, which are measured at fair value. The condensed consolidated interim financial statements are presented in United States dollars (“USD”), unless otherwise noted.

| c) | Estimation Uncertainty and COVID-19 |

In March 2020, the World Health Organization declared a global pandemic related to COVID-19. The current and expected impacts on global commerce are anticipated to be far reaching. To date there has been significant volatility in the stock market and in the commodity and foreign exchange markets, restrictions on the conduct of business in many jurisdictions and the global movement of people and some goods has become restricted. In the current environment, estimates and assumptions about future production, commodity prices, exchange rates, discount rates, future capital expansion plans and associated production implications at the underlying mines in which the Company holds a royalty or stream interest are subject to greater variability than normal, which could significantly affect the valuation of our assets, both non-financial and financial. As at March 31, 2021, the Company has not recorded any adjustments related to the COVID-19 pandemic.

6

Maverix Metals Inc.

Notes to the Condensed Consolidated Interim Financial Statements

For the Three Month Periods Ended March 31, 2021 and 2020

(Expressed in thousands of United States dollars, unless stated otherwise)

| 3. | ROYALTY AND STREAM TRANSACTIONS |

Hope Bay

In August 2019, Maverix entered into an agreement to purchase an additional 1.5% NSR royalty on the Hope Bay mine in Nunavut, Canada, previously owned and operated by TMAC Resources Inc. (“TMAC”) for a cash payment of $40.0 million (the “Additional Royalty”). Under the Additional Royalty agreement, TMAC had the right to buy back the entire Additional Royalty for a cash payment of $50.0 million in the event of a change of control transaction of TMAC (as defined in the Additional Royalty agreement) that was announced prior to June 30, 2021.

In February 2021, Agnico Eagle Mines Limited (“Agnico”) completed the acquisition of TMAC. Concurrent with the acquisition, Agnico provided notice to the Company and exercised the buyback right with respect to 1.5% of the total 2.5% NSR royalty the Company owned on the Hope Bay mine. As a result of the buy back, the Company received $50.0 million and recorded a gain on the buy back of the Hope Bay royalty interest of $11.0 million. The Company has retained a 1% NSR royalty on the Hope Bay mine that is not subject to any reductions.

Additional El Mochito Stream