Form 6-K Grupo Aval Acciones Y For: May 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report Of Foreign Private Issuer

Pursuant To Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of May 2022

___________________

Commission File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact name of registrant as specified in its charter)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X |

Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

GRUPO AVAL ACCIONES Y VALORES S.A.

TABLE OF CONTENTS

| ITEM | |

| 1. | Report of First Quarter 2022 Consolidated Results |

| 2. | First Quarter 2022 Consolidated Earnings Results Presentation |

Item 1

|

Disclaimer |

Grupo Aval Acciones y Valores S.A. (“Grupo Aval”) is an issuer of securities in Colombia and in the United States (“SEC”). As such, it is subject to compliance with securities regulation in Colombia and applicable U.S. securities regulation. Grupo Aval is also subject to the inspection and supervision of the Superintendency of Finance as holding company of the Aval financial conglomerate.

The consolidated financial information included in this document is presented in accordance with IFRS as currently issued by the IASB. Details of the calculations of non-IFRS measures such as ROAA and ROAE, among others, are explained when required in this report.

Banco de Bogotá executed a spin-off of a 75% equity stake in BAC Holding International, Corp (“BHI”); to its shareholders and Grupo Aval subsequently spun-off its equity interest to its shareholders on March 29, 2022. Prior to the spin-off, Banco de Bogotá was the direct parent of BHI. Grupo Aval has retained an indirect stake of approximately 17.2% in BHI (representing our proportional interest in the 25% equity stake in BHI retained by Banco de Bogotá). This interest in BHI is reported as discontinued operations for reporting periods prior to the spin-off, including for the full period in the three months ended March 31, 2022 and, will be reported under the “share of profit of equity accounted investees, net of tax (equity method)” line item for subsequent periods.

As a result, for comparability purposes, we have prepared and present supplemental unaudited pro forma financial information for the three months ended March 31, 2021 and the three months ended December 31, 2021 that assumes the spin-off was completed on January 1, 2021 and October 1, 2021, respectively. The supplemental unaudited pro forma financial information does not purport to be indicative of our results of operations or financial position had the relevant transactions occurred on the dates assumed and does not project our results of operations or financial position for any future period or date. The pro forma financial information is unaudited and the completion of the external audit for the year ended December 31, 2022 may result in adjustments to the unaudited pro forma financial information presented herein any such adjustments may be material.

This report includes forward-looking statements. In some cases, you can identify these forward-looking statements by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these and other comparable words. Actual results and events may differ materially from those anticipated herein as a consequence of changes in general, economic and business conditions, changes in interest and currency rates and other risk described from time to time in our filings with the Registro Nacional de Valores y Emisores and the SEC.

Recipients of this document are responsible for the assessment and use of the information provided herein. Matters described in this presentation and our knowledge of them may change extensively and materially over time but we expressly disclaim any obligation to review, update or correct the information provided in this report, including any forward looking statements, and do not intend to provide any update for such material developments prior to our next earnings report.

The content of this document and the figures included herein are intended to provide a summary of the subjects discussed rather than a comprehensive description.

When applicable, in this document we refer to billions as thousands of millions.

| 1 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions and under IFRS, except per share information |

Bogotá, May 18th, 2022. Grupo Aval S.A. (NYSE: AVAL) reported a consolidated attributable net income of Ps 1,729.7 billion (Ps 77.6 pesos per share) for 1Q22. ROAE was 35.3% and ROAA was 3.8% for 1Q22.

Key results of the quarter:

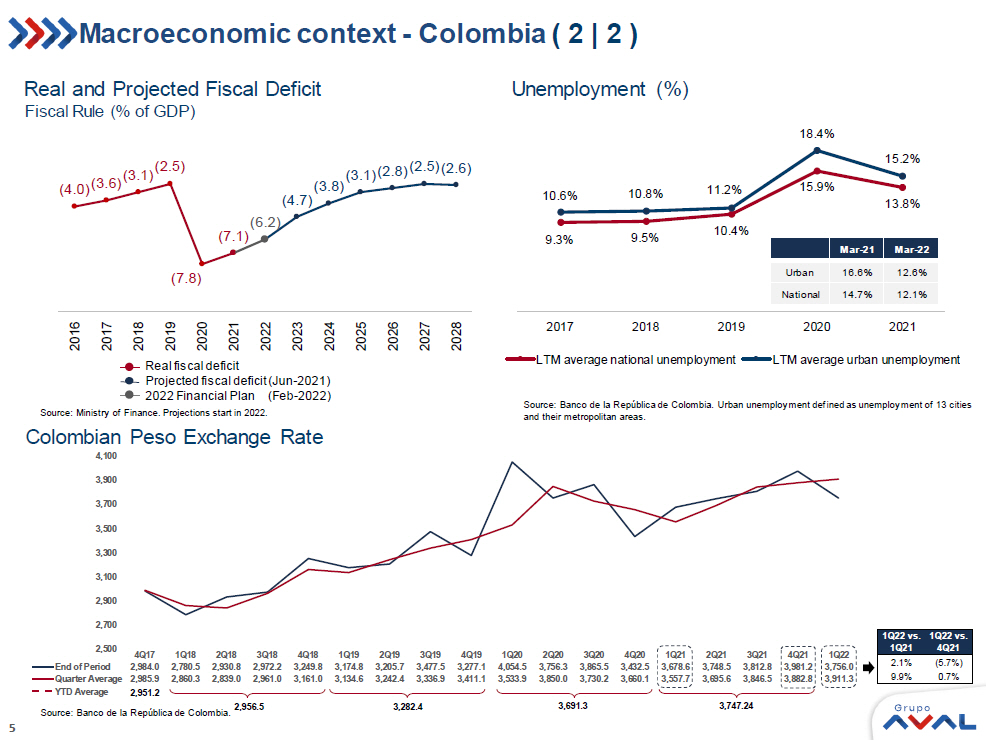

1Q22 brought good news to the Colombian economy, which grew at 8.5% (8.2% seasonally adjusted). The economy has grown at a pace of approximately 3% per year since 2019; in other words, the contraction experienced during the pandemic has been more than nullified.

The spin-off of 75% of BHI was completed at the end of this quarter, and consequently BHI is no longer consolidated into either Banco de Bogota’s or Grupo Aval’s balance sheets. As a result of the spin-off, Banco de Bogota’s total shareholders’ equity and Grupo Aval’s attributable equity was reduced by approximated Ps 9.66 trillion and Ps 6.64 trillion respectively. Additionally, total assets decreased by approximately Ps 111.2 trillion, total loans by approximately Ps 69.8 trillion and total deposits by approximately Ps 83.8 trillion. Because the spin-off was completed at the end of the quarter, Aval’s 1Q22 P&L incorporates a full quarter of 100% of BHI’s net income, approximately COP 545 billion, which appears identified in the P&L statement as net income from discontinued operations. In future quarters, Banco de Bogota (and thus Aval) will receive 25% of BHI’s net income.

Aval reported strong results for the quarter. Attributable net income for the quarter reached Ps 1.73 trillion pesos or Ps 77.63 per share, an increase of 118% versus attributable net income during the first quarter of 2021 (Ps 0.79 trillion) and of almost 123% versus the previous quarter (Ps 0.78 trillion). This result includes a one-time gain of approximately Ps 720 billion, mostly because of the realization of OCI accounts related to the spin-off. ROAE was 35.3% and ROAA was 3.8%.

For ease of comparison the 1Q22 presentation contains certain historical figures expressed on a pro-forma basis to reflect consolidated numbers excluding BHI’s contribution. As such,

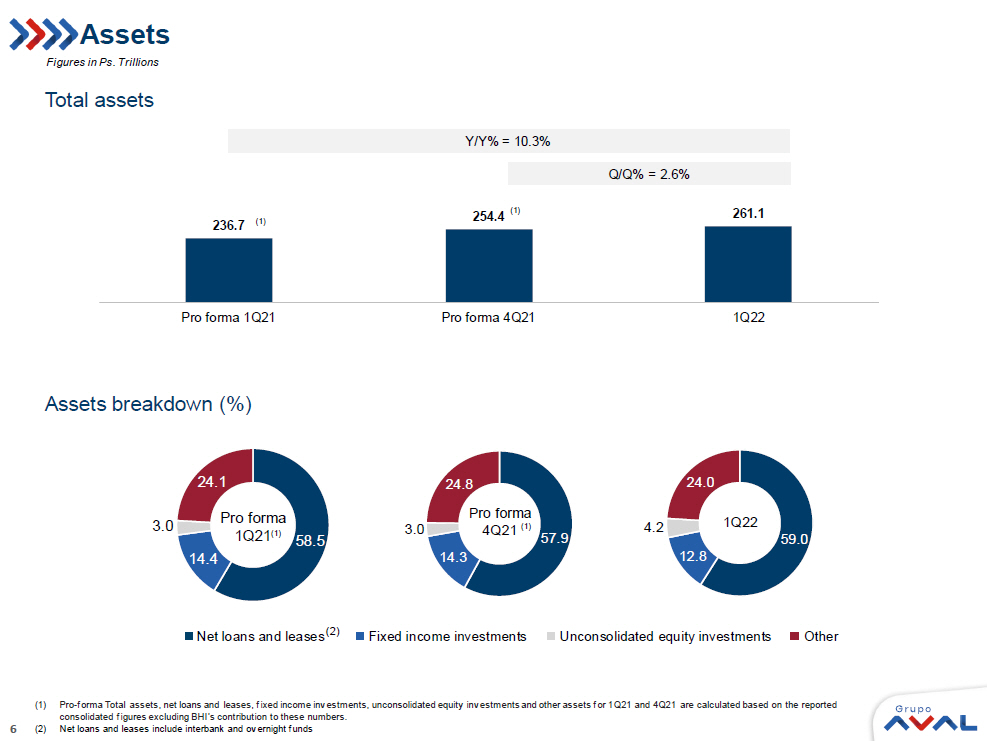

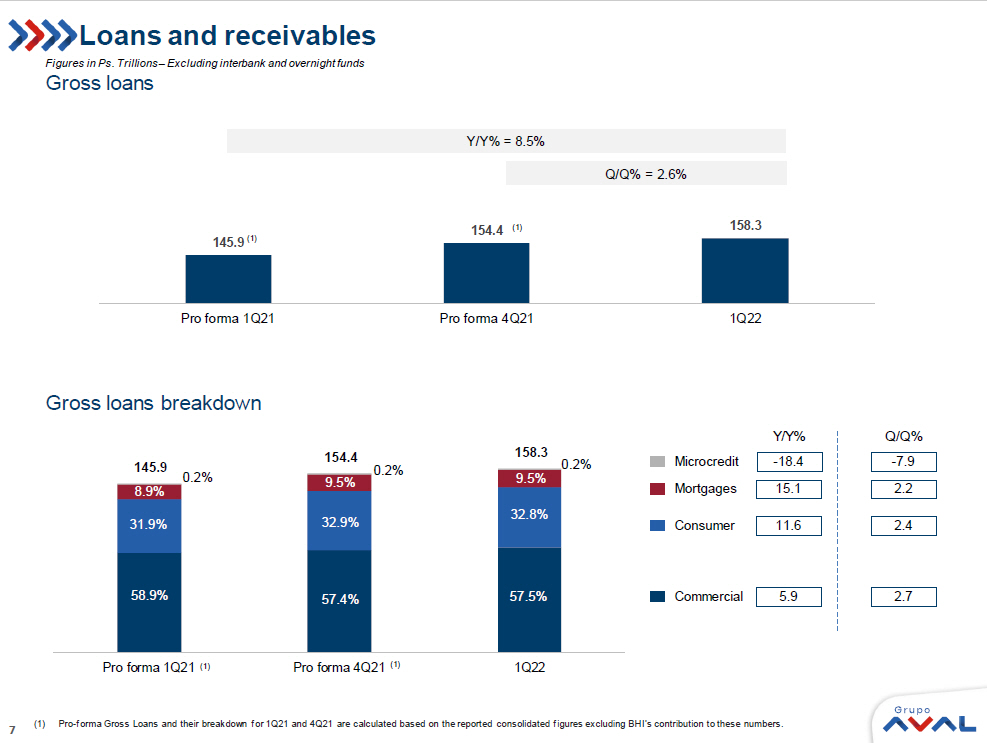

| · | Year-on-year, Consolidated assets grew 10.3%, to Ps 261.1 trillion, consolidated gross loans grew 8.5%, to Ps 158.3 trillion and consolidated deposits grew 4.7%, to Ps 152.7 trillion. |

| · | As of March, active debt reliefs in Colombia amounted to approximately 4% of the total consolidated loan portfolio and active debt reliefs in Panama (Multibank, which was not spun-off and is still owned 100% by Banco de Bogota) amounted to approximately 2% of the total consolidated loan portfolio. Of all loans that have concluded their relief periods, less than 1% are currently past due 90 days or more (1.4% are currently past due 30 days or more). |

| · | The quality of Aval’s loan portfolios continues to improve; the ratio of +30 days past due loans improved by 82 basis points, from 5.47% at the end of 1Q21 to 4.65% at the end of 1Q22 (unchanged vs 4Q21). +30 day past due loans for our commercial and consumer loan portfolios improved by 76 and 110 basis points, respectively, versus 1Q21. +90 day past due loans improved by 59 basis points, from 4.13% at the end of 1Q21 to 3.53% at the end of 1Q22 (10 bps vs 4Q21). Additionally, year-on-year, IFRS Stage 1 loans increased by 225 basis points (90 bps in the quarter), while Stage 2 loans decreased by 227 basis points (72bps in the quarter) and Stage 3 loans remain unchanged (decreased 20 bps in the quarter). |

| · | Cost of Risk (1.7%) improved by 59 basis points when compared to 1Q21 (2.3%) and remained stable vs 4Q21. |

| · | Total NIM remained stable at 4.1% vs 1Q21. During the quarter, total NIM contracted 11 bps mainly driven by a 20bps decrease in NIM on Loans |

| · | Aval’s consolidated Cost to Assets ratio improved by 51 bps, to 2.6%, during 1Q22 (versus 3.1% in 4Q21), partially because of a decrease (14.5%) in quarterly total expenses during the quarter. |

| · | Income from our non-financial sector grew strongly (by 32.5%) when compared to 1Q21 and also when compared to 4Q21 (by 51%), mostly due to robust contributions from the energy & gas and infrastructure sectors. |

| 2 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions , except per share information |

Bogotá, May 18th, 2022. Grupo Aval S.A. (NYSE: AVAL) reported a consolidated attributable net income of Ps 1,729.7 billion (Ps 77.6 pesos per share) for 1Q22. ROAE was 35.3% and ROAA was 3.8% for 1Q22.

| Presented for comparability purposes | ||||||||||||

| COP $tn | Pro forma 1Q21 |

Pro forma 4Q21 |

Pro forma (PF) where indicated 1Q22 | 1Q22 vs Pro forma 4Q21 | 1Q22 vs Pro forma 1Q21 | |||||||

| Balance Sheet | Gross Loans | $ 145.9 | $ 154.4 | $ 158.3 | 2.6% | 8.5% | ||||||

| Deposits | $ 145.9 | $ 148.1 | $ 152.7 | 3.1% | 4.7% | |||||||

| Deposits/Net Loans | 1.05 x | 1.00 x | 0.99 x | -0.01 x | -0.06 x | |||||||

| Loan Quality | 90 days PDLs / Gross Loans | 4.1% | 3.6% | 3.5% | (10) bps | (59) bps | ||||||

| Allowance/90 days PDLs | 1.43 x | 1.55 x | 1.58 x | 0.03 x | 0.15 x | |||||||

| Cost of risk | 2.3% | 1.7% | 1.7%(PF) | 4 bps | (59) bps | |||||||

| Other ratios | Net interest margin | 4.1% | 4.2% | 4.1%(PF) | (11) bps | (1) bps | ||||||

| Fee income Ratio | 19.1% | 21.0% | 13.0% | (794) bps | (603) bps | |||||||

| Efficiency Ratio | 39.0% | 51.2% | 30.9% | (2,035) bps | (820) bps | |||||||

| Reported 1Q21 | Reported 4Q21 | 1Q22 | 1Q22 vs Reported 4Q21 | 1Q22 vs Reported 1Q21 | ||||||||

| Profitability | Attributable net income | $ 0.79 | $ 0.78 | $ 1.73 | 122.7% | 118.5% | ||||||

| ROAA | 1.8% | 1.4% | 3.8% | 236 bps | 204 bps | |||||||

| ROAE | 15.4% | 13.7% | 35.3% | 2,156 bps | 1,982 bps |

| • | Pro-forma Loans, Allowances, Net Interest, Fees and Operating costs for 1Q21 and 4Q21 are calculated based on the previously reported consolidated figures excluding BHI’s contribution to these numbers. |

| • | Pro-forma ratios for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above. |

| • | Pro-forma ratios for 1Q22 are based on reported revenues and expenses, associated to each ratio; however, the denominators averages used to calculate these ratios contain pro-forma figures from previous quarters. |

Gross loans excludes interbank and overnight funds. PDLs 90+ defined as loans more than 90 days past due. Cost of Risk calculated as Impairment loss on loans and other accounts receivable net of recoveries of charged-off assets divided by average gross loans. Net Interest Margin includes net interest income plus net trading income from debt and equity investments at FVTPL divided by total average interest-earning assets. Fee income ratio is calculated as net income from commissions and fees divided by net interest income plus net income from commissions and fees, gross profit from sales of goods and services, net trading income, net income from other financial instruments mandatory at FVTPL and total other income. Efficiency Ratio is calculated as total other expenses divided by net interest income plus net income from commissions and fees, gross profit from sales of goods and services, net trading income, net income from other financial instruments mandatory at FVTPL and total other income. ROAA is calculated as annualized Net Income divided by average of total assets. ROAE is calculated as Net Income attributable to Aval's shareholders divided by average attributable shareholders' equity. NS refers to non-significant figures.

| 3 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Grupo Aval Acciones y Valores S.A.

Consolidated Financial Statements

Supplemental unaudited pro forma financial information

Information in Ps. Billions

| ∆ | |||||||||

| Consolidated Statement of Financial Position | Pro forma 1Q21 |

Pro forma 4Q21 |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Cash and cash equivalents | 17,869.6 | 17,752.1 | 16,407.1 | -7.6% | -8.2% | ||||

| Trading assets | 11,202.7 | 10,796.4 | 9,846.7 | -8.8% | -12.1% | ||||

| Investment securities | 29,908.9 | 33,144.6 | 31,550.3 | -4.8% | 5.5% | ||||

| Hedging derivatives assets | 29.5 | 44.2 | 53.8 | 21.5% | 82.1% | ||||

| Total loans, net | 138,480.9 | 147,432.4 | 154,054.5 | 4.5% | 11.2% | ||||

| Tangible assets | 7,031.2 | 7,066.7 | 7,003.4 | -0.9% | -0.4% | ||||

| Goodwill | 2,328.6 | 2,230.3 | 2,220.5 | -0.4% | -4.6% | ||||

| Concession arrangement rights | 9,540.9 | 11,098.1 | 11,338.9 | 2.2% | 18.8% | ||||

| Other assets | 20,325.7 | 24,869.9 | 28,648.9 | 15.2% | 40.9% | ||||

| Spun-off assets from BHI | 100,193.6 | 112,469.1 | - | N.A | N.A | ||||

| Total assets | 336,911.6 | 366,903.9 | 261,124.1 | -28.8% | -22.5% | ||||

| Trading liabilities | 825.7 | 1,049.7 | 1,360.4 | 29.6% | 64.8% | ||||

| Hedging derivatives liabilities | 74.0 | 55.8 | 52.6 | -5.8% | -29.0% | ||||

| Customer deposits | 145,913.7 | 148,098.5 | 152,708.1 | 3.1% | 4.7% | ||||

| Interbank borrowings and overnight funds | 8,739.8 | 10,278.1 | 11,156.8 | 8.5% | 27.7% | ||||

| Borrowings from banks and others | 13,195.7 | 18,044.6 | 17,937.9 | -0.6% | 35.9% | ||||

| Bonds issued | 28,914.3 | 31,504.7 | 30,414.2 | -3.5% | 5.2% | ||||

| Borrowings from development entities | 3,878.4 | 3,227.3 | 3,270.0 | 1.3% | -15.7% | ||||

| Other liabilities | 14,471.8 | 14,734.4 | 14,623.5 | -0.8% | 1.0% | ||||

| Spun-off liabilities from BHI | 85,703.1 | 100,439.2 | - | N.A | N.A | ||||

| Total liabilities | 301,716.6 | 327,432.3 | 231,523.5 | -29.3% | -23.3% | ||||

| Equity attributable to owners of the parent | 20,376.0 | 23,013.7 | 16,230.3 | -29.5% | -20.3% | ||||

| Non-controlling interest | 14,818.9 | 16,458.0 | 13,370.3 | -18.8% | -9.8% | ||||

| Total equity | 35,195.0 | 39,471.6 | 29,600.6 | -25.0% | -15.9% | ||||

| Total liabilities and equity | 336,911.6 | 366,903.9 | 261,124.1 | -28.8% | -22.5% | ||||

| Consolidated Statement of Income Continued operations |

Pro forma 1Q21 |

Pro forma 4Q21 |

1Q22 | ∆ | |||||

| Interest income | 3,111.8 | 3,320.4 | 3,759.8 | 13.2% | 20.8% | ||||

| Interest expense | 1,085.6 | 1,312.8 | 1,679.2 | 27.9% | 54.7% | ||||

| Net interest income | 2,026.2 | 2,007.5 | 2,080.6 | 3.6% | 2.7% | ||||

| Loans and other accounts receivable | 929.8 | 793.7 | 807.3 | 1.7% | -13.2% | ||||

| Other financial assets | 0.7 | (0.2) | 18.9 | N.A | N.A. | ||||

| Recovery of charged-off financial assets | (91.7) | (148.1) | (130.8) | -11.6% | 42.7% | ||||

| Net impairment loss on financial assets | 838.7 | 645.4 | 695.4 | 7.8% | -17.1% | ||||

| Net interest income, after impairment losses | 1,187.4 | 1,362.2 | 1,385.2 | 1.7% | 16.7% | ||||

| Net income from commissions and fees | 756.2 | 805.0 | 710.0 | -11.8% | -6.1% | ||||

| Gross profit from sales of goods and services | 770.7 | 676.6 | 1,020.6 | 50.8% | 32.4% | ||||

| Net trading income | 189.6 | 230.7 | (287.3) | N.A | N.A | ||||

| Net income from other financial instruments mandatory at FVTPL | 81.6 | 62.8 | 73.9 | 17.7% | -9.5% | ||||

| Total other income | 140.2 | 52.9 | 1,845.9 | N.A. | N.A. | ||||

| Total other expenses | 1,548.1 | 1,963.7 | 1,679.5 | -14.5% | 8.5% | ||||

| Net income before income tax expense | 1,577.7 | 1,226.4 | 3,068.8 | 150.2% | 94.5% | ||||

| Income tax expense | 491.9 | 379.4 | 633.0 | 66.8% | 28.7% | ||||

| Net income for the period of continued operations | 1,085.8 | 847.0 | 2,435.9 | 187.6% | 124.3% | ||||

| Net income for the period of discontinued operations | 365.8 | 444.6 | 544.9 | 22.6% | 49.0% | ||||

| Net income for the period | 1,451.6 | 1,291.6 | 2,980.8 | 130.8% | 105.3% | ||||

| Non-controlling interest | 659.8 | 514.9 | 1,251.1 | 143.0% | 89.6% | ||||

| Net income attributable to owners of the parent | 791.8 | 776.8 | 1,729.7 | 122.7% | 118.5% | ||||

| Key ratios | Pro forma 1Q21 |

Pro forma 4Q21 |

Pro forma (PF) where indicated 1Q22 | ||||

| Net Interest Margin(1) | 4.7% | 4.3% | 4.4%(PF) | ||||

| Net Interest Margin (including net trading income)(1) | 4.1% | 4.2% | 4.1%(PF) | ||||

| Efficiency ratio(2) | 39.0% | 51.2% | 30.9% | ||||

| 90 days PDL / Gross loans (5) | 4.1% | 3.6% | 3.5% | ||||

| Provision expense / Average gross loans (6) | 2.3% | 1.7% | 1.7%(PF) | ||||

| Allowance / 90 days PDL (5) | 1.43 | 1.55 | 1.58 | ||||

| Allowance / Gross loans | 5.9% | 5.6% | 5.6% | ||||

| Charge-offs / Average gross loans (6) | 2.9% | 2.2% | 2.0%(PF) | ||||

| Total loans, net / Total assets | 58.5% | 57.9% | 59.0% | ||||

| Deposits / Total loans, net | 105.4% | 100.5% | 99.1% | ||||

| Key ratios | 1Q21 Reported | 4Q21 Reported | 1Q22 | ||||

| Equity / Assets | 10.4% | 10.8% | 11.3% | ||||

| Tangible equity ratio (7) | 7.8% | 8.2% | 10.0% | ||||

| ROAA(3) | 1.8% | 1.4% | 3.8% | ||||

| ROAE(4) | 15.4% | 13.7% | 35.3% | ||||

| Shares outstanding (EoP) | 22,281,017,159 | 22,281,017,159 | 22,281,017,159 | ||||

| Shares outstanding (Average) | 22,281,017,159 | 22,281,017,159 | 22,281,017,159 | ||||

| Common share price (EoP) | 1,188.0 | 1,054.0 | 965.0 | ||||

| Preferred share price (EoP) | 1,144.0 | 1,059.0 | 852.0 | ||||

| BV/ EoP shares in Ps. | 914.5 | 1,032.9 | 728.4 | ||||

| EPS | 35.5 | 34.9 | 77.6 | ||||

| P/E (8) | 8.0 | 7.6 | 2.7 | ||||

| P/BV (8) | 1.3 | 1.0 | 1.2 |

| • | Pro-forma Loans, Allowances, Net Interest, Fees and Operating costs for 1Q21 and 4Q21 are calculated based on the previously reported consolidated figures excluding BHI’s contribution to these numbers. |

| • | Pro-forma ratios for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above. |

| • | Pro-forma ratios for 1Q22 are based on reported revenues and expenses, associated to each ratio; however, the denominators averages used to calculate these ratios contain pro-forma figures from previous quarters. |

(1) NIM is calculated as Net Interest Income divided by the average of Interest Earning Assets; (2) Efficiency Ratio is calculated as total other expenses divided by net interest income plus net income from commissions and fees, gross profit from sales of goods and services, net trading income, net income from other financial instruments mandatory at FVTPL and total other income; (3) ROAA is calculated as Income before Minority Interest divided by the average of total assets for each quarter; (4) ROAE is calculated as Net Income attributable to Grupo Aval’s shareholders divided by the average of shareholders´ attributable equity for each quarter; (5) PDLs 90+ defined as loans more than 90 days past due include interest accounts receivables. Gross loans excluding interbank and overnight funds; (6) Refers to average gross loans for the period; (7) Tangible Equity Ratio is calculated as Total Equity minus Intangibles (excluding those related to concessions) divided by Total Assets minus Intangibles (excluding those related to concessions); (8) Based on Preferred share prices.

| 4 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Statement of Financial Position Analysis

| • | Pro-forma figures for 1Q21 and 4Q21 are calculated based on the previously reported consolidated figures excluding BHI’s contribution to these numbers. |

| • | Pro-forma ratios for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above. |

| • | Pro-forma ratios for 1Q22 are based on reported revenues and expenses, associated to each ratio; however, the denominators averages used to calculate these ratios contain pro-forma figures from previous quarters. |

1. Assets (1)

Total assets as of March 31st, 2022 totaled Ps 261,124.1 billion showing an increase of 10.3% versus pro forma total assets in March 31st, 2021 and of 2.6% versus pro forma December 31st, 2021. Growth was mainly driven by (i) a 11.2% year over year growth in total loans, net to Ps 154,054.5 billion, (ii) a 40.9% yearly growth in other assets, net to Ps 28,648.9 billion and (iii) a 5.5% year over year growth in investment securities to Ps 31,550.3 billion.

Reported total assets as of March 31st, 2021 and December 31st, 2021 were 336,911.6 and 366,903.9, respectively.

1.1 Loan portfolio (1)

Gross loans (excluding interbank and overnight funds) increased by 8.5% between March 31st, 2022 and pro forma March 31st, 2021 to Ps 158,293.9 mainly driven by (i) a 11.6% increase in Consumer loans to Ps 51,984.3 billion, (ii) a 5.9% increase in Commercial loans to Ps 91,006.7 billion and (iii) a 15.1% increase in Mortgages loans to Ps 15,010.3 billion.

Interbank & overnight funds increased by 158.1% to Ps 4,584.7 billion versus the pro forma 4Q21.

Loss allowance was Ps 8,824.2 billion as of March 31st, 2022 taking net loans to Ps 154,054.5 billion.

| ∆ | |||||||||

| Total loans, net | Pro forma 1Q21(1) | Pro forma 4Q21(1) | 1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Gross loans | |||||||||

| Commercial loans | 85,924.5 | 88,591.1 | 91,006.7 | 2.7% | 5.9% | ||||

| Consumer loans | 46,596.5 | 50,765.3 | 51,984.3 | 2.4% | 11.6% | ||||

| Mortgages loans | 13,039.2 | 14,681.5 | 15,010.3 | 2.2% | 15.1% | ||||

| Microcredit loans | 358.8 | 317.7 | 292.6 | -7.9% | -18.4% | ||||

| Gross loans | 145,918.9 | 154,355.6 | 158,293.9 | 2.6% | 8.5% | ||||

| Interbank & overnight funds | 1,188.2 | 1,776.3 | 4,584.7 | 158.1% | 285.9% | ||||

| Total gross loans | 147,107.1 | 156,131.8 | 162,878.7 | 4.3% | 10.7% | ||||

| Loss allowance | (8,626.2) | (8,699.4) | (8,824.2) | 1.4% | 2.3% | ||||

| Allowance for impairment of commercial loans | (4,704.7) | (5,171.1) | (5,346.5) | 3.4% | 13.6% | ||||

| Allowance for impairment of consumer loans | (3,471.2) | (3,026.7) | (3,014.8) | -0.4% | -13.1% | ||||

| Allowance for impairment of mortgages | (329.2) | (396.5) | (373.4) | -5.8% | 13.4% | ||||

| Allowance for impairment of microcredit loans | (121.2) | (105.1) | (89.5) | -14.8% | -26.1% | ||||

| Total loans, net | 138,480.9 | 147,432.4 | 154,054.5 | 4.5% | 11.2% | ||||

Reported total loans, net as of March 31st, 2021 and December 31st, 2021 were billion and Ps 201,016.7 billion and Ps 220,297.8, respectively.

(1) Pro-forma total assets and total loans, net for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

| 5 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

The following table shows the gross loan composition per product of each of our loan categories.

| ∆ | |||||||||

| Gross loans | Pro forma 1Q21(1) | Pro forma 4Q21(1) | 1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| General purpose | 61,792.6 | 63,952.8 | 65,254.4 | 2.0% | 5.6% | ||||

| Working capital | 9,821.0 | 10,693.9 | 11,682.5 | 9.2% | 19.0% | ||||

| Financial leases | 9,925.2 | 10,107.8 | 10,042.3 | -0.6% | 1.2% | ||||

| Funded by development banks | 3,741.8 | 3,198.6 | 3,250.1 | 1.6% | -13.1% | ||||

| Overdrafts | 323.4 | 347.6 | 413.5 | 19.0% | 27.9% | ||||

| Credit cards | 320.5 | 290.4 | 363.8 | 25.3% | 13.5% | ||||

| Commercial loans | 85,924.5 | 88,591.1 | 91,006.7 | 2.7% | 5.9% | ||||

| Payroll loans | 27,323.9 | 29,965.0 | 30,860.5 | 3.0% | 12.9% | ||||

| Personal loans | 9,293.7 | 10,037.9 | 10,429.1 | 3.9% | 12.2% | ||||

| Credit cards | 5,627.1 | 5,962.6 | 5,932.9 | -0.5% | 5.4% | ||||

| Automobile and vehicle | 4,135.9 | 4,557.8 | 4,557.9 | 0.0% | 10.2% | ||||

| Financial leases | 29.7 | 25.4 | 23.9 | -6.0% | -19.5% | ||||

| Overdrafts | 46.9 | 48.0 | 50.4 | 5.2% | 7.5% | ||||

| Other | 139.2 | 168.7 | 129.6 | -23.2% | -6.9% | ||||

| Consumer loans | 46,596.5 | 50,765.3 | 51,984.3 | 2.4% | 11.6% | ||||

| Mortgages | 11,190.0 | 12,619.8 | 12,878.1 | 2.0% | 15.1% | ||||

| Housing leases | 1,849.2 | 2,061.7 | 2,132.2 | 3.4% | 15.3% | ||||

| Mortgages loans | 13,039.2 | 14,681.5 | 15,010.3 | 2.2% | 15.1% | ||||

| Microcredit loans | 358.8 | 317.7 | 292.6 | -7.9% | -18.4% | ||||

| Gross loans | 145,918.9 | 154,355.6 | 158,293.9 | 2.6% | 8.5% | ||||

| Interbank & overnight funds | 1,188.2 | 1,776.3 | 4,584.7 | 158.1% | 285.9% | ||||

| Total gross loans | 147,107.1 | 156,131.8 | 162,878.7 | 4.3% | 10.7% | ||||

Over the last twelve months, our retail products have driven our loan portfolio growth.

Commercial loans increased compared with pro forma figures by 5.9% over the year and grew 2.7% in the last quarter.

Consumer loans growth compared with pro forma figures over the last year and quarter was mainly driven by payrolls loans and personal loans. Consumer loans grew by 11.6% during the last twelve months and 2.4% between March 31st, 2022 and December 31st, 2021.

Mortgages loans increased by 15.1% versus pro forma 1Q21 and 2.2% versus pro forma 4Q21.

Reported commercial loans reached Ps 122,027.8 billion in December 31st, 2021 and Ps 114,497.6 billion in March 31st, 2021.

Reported consumer loans totaled Ps 76,889.1 billion in December 31st, 2021 and Ps 68.626.8 billion in March 31st, 2021.

Reported mortgages loans reached Ps 29,120.3 billion in December 31st, 2021 and Ps 26,030.9 billion in March 31st, 2021.

(1) Pro-forma gross loans and breakdown for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI's contribution to these numbers.

| 6 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

The following table shows the loans and receivables composition per entity. During the last twelve months, Banco de Occidente showed the highest growth rate within our banking operation in Colombia, driven by a strong performance in all types of loans with consumer loans growing 15.7%, commercial loans 14.9% and mortgages growing 13.3%.

| ∆ | |||||||||

| Gross loans / Bank ($) | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Banco de Bogotá | 79,074.7 | 81,901.8 | 83,017.5 | 1.4% | 5.0% | ||||

| Banco de Occidente | 33,145.2 | 36,599.2 | 38,124.3 | 4.2% | 15.0% | ||||

| Banco Popular | 21,766.2 | 22,617.6 | 23,509.7 | 3.9% | 8.0% | ||||

| Banco AV Villas | 11,977.9 | 13,114.5 | 13,627.7 | 3.9% | 13.8% | ||||

| Corficolombiana | 1,739.8 | 1,912.8 | 1,849.9 | -3.3% | 6.3% | ||||

| Eliminations | (1,784.8) | (1,790.4) | (1,835.2) | 2.5% | 2.8% | ||||

| Gross loans | 145,918.9 | 154,355.6 | 158,293.9 | 2.6% | 8.5% | ||||

| Interbank & overnight funds | 1,188.2 | 1,776.3 | 4,584.7 | 158.1% | 285.9% | ||||

| Total gross loans | 147,107.1 | 156,131.8 | 162,878.7 | 4.3% | 10.7% | ||||

| Gross loans / Bank (%) | Pro forma 1Q21(1) | Pro forma 4Q21(1) | 1Q22 | ||||

| Banco de Bogotá | 54.2% | 53.1% | 52.4% | ||||

| Banco de Occidente | 22.7% | 23.7% | 24.1% | ||||

| Banco Popular | 14.9% | 14.7% | 14.9% | ||||

| Banco AV Villas | 8.2% | 8.5% | 8.6% | ||||

| Corficolombiana | 1.2% | 1.2% | 1.2% | ||||

| Eliminations | -1.2% | -1.2% | -1.2% | ||||

| Gross loans | 100% | 100% | 100% |

Of the total gross loans, 91.6% are domestic and 8.4% are foreign. In terms of gross loans (excluding interbank and overnight funds), 91.4% are domestic and 8.6% are foreign (reflecting the Multi Financial Group operation).

The quality of our loan portfolio improved during the quarter.

Our 30 days PDL to total loans closed in 4.6% for 1Q22, 4.7% for pro forma 4Q21, and 5.5% in pro forma 1Q21. The ratio of 90 days PDL to total loans was 3.5% for 1Q22, 3.6% for pro forma 4Q21 and 4.1% for pro forma 1Q21.

Commercial loans 30 days PDL ratio was 4.5% for 1Q22, 4.6% for pro forma 4Q21 and 5.3% for pro forma 1Q21; 90 days PDL ratio was 4.0%, 4.0% and 4.7%, respectively. Consumer loans 30 days PDL ratio was 4.5% for 1Q22 and pro forma 4Q21, and 5.6% for pro forma 1Q21; 90 days PDL ratio was 2.7%, 3.0% and 3.2%, respectively. Mortgages’ 30 days PDL ratio was 5.5% for 1Q22, 4.9% for pro forma 4Q21 and 5.7% for pro forma 1Q21; 90 days PDL ratio was 3.3%, 3.2% and 3.4%, respectively.

| ∆ | |||||||||

| Total gross loans | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| ''A'' normal risk | 131,809.4 | 137,613.1 | 141,769.7 | 3.0% | 7.6% | ||||

| ''B'' acceptable risk | 3,742.5 | 4,032.8 | 3,965.2 | -1.7% | 5.9% | ||||

| ''C'' appreciable risk | 3,662.8 | 4,322.0 | 4,180.5 | -3.3% | 14.1% | ||||

| ''D'' significant risk | 3,675.4 | 4,663.5 | 4,501.9 | -3.5% | 22.5% | ||||

| ''E'' unrecoverable | 3,028.9 | 3,724.2 | 3,876.7 | 4.1% | 28.0% | ||||

| Gross loans | 145,918.9 | 154,355.6 | 158,293.9 | 2.6% | 8.5% | ||||

| Interbank and overnight funds | 1,188.2 | 1,776.3 | 4,584.7 | 158.1% | 285.9% | ||||

| Total gross loans | 147,107.1 | 156,131.8 | 162,878.7 | 4.3% | 10.7% | ||||

| CDE loans / gross loans (*) | 7.1% | 8.2% | 7.9% | ||||||

(1) Pro-forma gross loans, total gross loans and breakdown for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers. Pro-forma PDLs for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above.

| 7 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

| ∆ | |||||||||

| Past due loans | Pro forma 1Q21(1) | Pro forma 4Q21(1) | 1Q22 | 1Q22 vs. Pro forma 4Q21 |

1Q22 vs. Pro forma 1Q21 | ||||

| Performing | 81,380.4 | 84,527.7 | 86,882.8 | 2.8% | 6.8% | ||||

| Between 31 and 90 days past due | 534.0 | 528.9 | 476.5 | -9.9% | -10.8% | ||||

| +90 days past due | 4,010.2 | 3,534.5 | 3,647.4 | 3.2% | -9.0% | ||||

| Commercial loans | 85,924.5 | 88,591.1 | 91,006.7 | 2.7% | 5.9% | ||||

| Performing | 43,997.9 | 48,457.6 | 49,657.5 | 2.5% | 12.9% | ||||

| Between 31 and 90 days past due | 1,095.1 | 793.2 | 947.2 | 19.4% | -13.5% | ||||

| +90 days past due | 1,503.6 | 1,514.5 | 1,379.6 | -8.9% | -8.2% | ||||

| Consumer loans | 46,596.5 | 50,765.3 | 51,984.3 | 2.4% | 11.6% | ||||

| Performing | 12,297.8 | 13,968.7 | 14,190.7 | 1.6% | 15.4% | ||||

| Between 31 and 90 days past due | 303.3 | 242.2 | 329.8 | 36.2% | 8.8% | ||||

| +90 days past due | 438.1 | 470.5 | 489.8 | 4.1% | 11.8% | ||||

| Mortgages loans | 13,039.2 | 14,681.5 | 15,010.3 | 2.2% | 15.1% | ||||

| Performing | 260.3 | 217.3 | 209.0 | -3.8% | -19.7% | ||||

| Between 31 and 90 days past due | 29.6 | 13.5 | 10.3 | -24.1% | -65.2% | ||||

| +90 days past due | 68.9 | 86.9 | 73.3 | -15.7% | 6.3% | ||||

| Microcredit loans | 358.8 | 317.7 | 292.6 | -7.9% | -18.4% | ||||

| Gross loans | 145,918.9 | 154,355.6 | 158,293.9 | 2.6% | 8.5% | ||||

| Interbank & overnight funds | 1,188.2 | 1,776.3 | 4,584.7 | 158.1% | N.A. | ||||

| Total gross loans | 147,107.1 | 156,131.8 | 162,878.7 | 4.3% | 10.7% | ||||

| 30 Days PDL / gross loans (*) | 5.5% | 4.7% | 4.6% | ||||||

| 90 Days PDL / gross loans (*) | 4.1% | 3.6% | 3.5% | ||||||

| Loans by stages (%) | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | ||||

| Loans classified as Stage 2 / gross loans | 12.8% | 11.3% | 10.5% | ||||

| Loans classified as Stage 3 / gross loans | 6.9% | 7.1% | 6.9% | ||||

| Loans classified as Stage 2 and 3 / gross loans | 19.7% | 18.3% | 17.4% | ||||

| Allowance for Stage 1 loans / Stage 1 loans | 1.1% | 0.9% | 0.9% | ||||

| Allowance for Stage 2 loans / Stage 2 loans | 11.3% | 9.9% | 10.5% | ||||

| Allowance for Stage 3 loans / Stage 3 loans | 52.1% | 53.1% | 53.5% | ||||

| Allowance for Stage 2 y 3 loans / Stage 2 y 3 loans | 25.6% | 26.6% | 27.5% |

Grupo Aval’s coverage over its 90 days PDL was 1.6x for 1Q22 and pro forma 4Q21, and 1.4x for pro forma 1Q21. Allowance to CDE Loans was 0.7x for 1Q22 and pro forma 4Q21, and 0.8x for pro forma 1Q21, allowance to 30 days PDL was 1.2x in 1Q22 and pro forma 4Q21, and 1.1x for pro forma 1Q21. Impairment loss, net of recoveries of charged off assets to average gross loans was 1.7% in pro forma 1Q22 and pro forma 4Q21, and 2.3% in pro forma 1Q21. Charge-offs to average gross loans was 2.0% in pro forma 1Q22, 2.2% in pro forma 4Q21, and 2.9% in pro forma 1Q21.

| Total gross loans | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22(2) | |||

| Allowance for impairment / CDE loans | 0.8 | 0.7 | 0.7 | |||

| Allowance for impairment / 30 days PDL | 1.1 | 1.2 | 1.2 | |||

| Allowance for impairment / 90 days PDL | 1.4 | 1.6 | 1.6 | |||

| Allowance for impairment / gross loans (*) | 5.9% | 5.6% | 5.6% | |||

| Impairment loss / CDE loans | 0.4 | 0.2 | 0.3 | |||

| Impairment loss / 30 days PDL | 0.5 | 0.4 | 0.4 | |||

| Impairment loss / 90 days PDL | 0.6 | 0.6 | 0.6 | |||

| Impairment loss / average gross loans (*) | 2.6% | 2.1% | 2.1%(1) | |||

| Impairment loss, net of recoveries of charged-off assets / average gross loans (*) | 2.3% | 1.7% | 1.7%(1) | |||

| Charge-offs / average gross loans (*) | 2.9% | 2.2% | 2.0%(1) |

(*) Gross loans exclude interbank and overnight funds. 30 days past due and 90 days past due are calculated on a capital plus interest accounts receivable basis.

(1) Pro-forma past due loans, loans by stages and total gross loans and breakdown for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers. Pro-forma ratios for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above.

(2) Pro-forma ratios for 1Q22 are based on reported revenues and expenses, associated to each ratio; however, the denominators averages used to calculate these ratios contain pro-forma figures from previous quarters.

| 8 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

1.2 Investment securities and trading assets (1)

Total investment securities and trading assets increased 0.7% to Ps 41,397.0 billion between March 31st, 2022 and pro forma March 31st, 2021 and decreased 5.8% versus pro forma December 31st, 2021.

Ps 33,423.8 billion of our total portfolio is invested in debt securities, which decreased by 1.9% between March 31st, 2022 and pro forma March 31st, 2021 and by 8.1% since pro forma December 31st, 2021. Ps 6,628.4 billion of our total investment securities is invested in equity securities, which increased by 7.1% between March 31st, 2022 and pro forma March 31st, 2021 and by 3.1% versus pro forma December 31st, 2021.

Reported investment securities and trading assets as of March 31st, 2021 and December 31st, 2021 were Ps 52,184.2 billion and Ps 55,651.1 billion, respectively.

| ∆ | |||||||||

| Investment and trading assets | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Debt securities | 5,697.6 | 4,601.5 | 3,247.3 | -29.4% | -43.0% | ||||

| Equity securities | 4,669.9 | 5,032.2 | 5,254.7 | 4.4% | 12.5% | ||||

| Derivative assets | 835.3 | 1,162.8 | 1,344.8 | 15.7% | 61.0% | ||||

| Trading assets | 11,202.7 | 10,796.4 | 9,846.7 | -8.8% | -12.1% | ||||

| Investments in debt securities at FVTPL (non compliant with SPPI test) | 6.6 | - | - | N.A | N.A | ||||

| Debt securities at FVOCI | 20,942.3 | 23,931.2 | 22,591.1 | -5.6% | 7.9% | ||||

| Equity securities at FVOCI | 1,520.2 | 1,393.9 | 1,373.8 | -1.4% | -9.6% | ||||

| Investments in securities at FVOCI | 22,462.5 | 25,325.0 | 23,964.9 | -5.4% | 6.7% | ||||

| Investments in debt securities at AC | 7,439.8 | 7,819.6 | 7,585.4 | -3.0% | 2.0% | ||||

| Investment and trading assets | 41,111.7 | 43,941.0 | 41,397.0 | -5.8% | 0.7% | ||||

The average yield on our debt and equity investment securities (trading assets, investments in debt securities at FVTPL, investments in securities at FVOCI and investments in debt securities at AC) was 3.6% for pro forma 1Q22, 2.9% for pro forma 4Q21 and 0.8% for pro forma 1Q21.

1.3 Cash and Cash Equivalents (1)

As of March 31st, 2022 cash and cash equivalents had a balance of Ps 16,407.1 billion showing a decrease of 8.2% versus pro forma March 31st, 2021 and 7.6% versus pro forma December 31st, 2021.

The ratio of cash and cash equivalents to customer deposits was 10.7% at March 31st, 2022, 12.0% at pro forma December 31st, 2021, and 12.2% at pro forma March 31st, 2021.

Reported cash and cash equivalents as of March 31st, 2021 and December 31st, 2021 were Ps 35,132.0 billion and Ps 36,642.8 billion, respectively.

(1) Pro-forma investment and trading assets and cash and cash equivalents for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

| 9 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

1.4 Goodwill and Other Intangibles (1)

Goodwill and other intangibles as of March 31st, 2022 reached Ps 15,246.5 billion, increasing by 14.1% versus pro forma March 31st, 2021 and 1.6% versus pro forma December 31st, 2021.

Goodwill as of March 31st, 2022 was Ps 2,220.5 billion, decreasing by 4.6% versus pro forma March 31st, 2021 and 0.4% versus pro forma December 31st, 2021.

Other intangibles, which include “concession arrangement rights” and other intangibles, mainly reflect the value of road concessions recorded for the most part at Corficolombiana. Other intangibles as of March 31st, 2022 reached Ps 13,026.0 billion and grew by 18.1% versus pro forma March 31st, 2021 and 2.0% versus pro forma December 31st, 2021.

Reported goodwill and other intangibles as of March 31st, 2021 and December 31st, 2021 were Ps 19,355.3 billion and Ps 21,470.7 billion, respectively.

2. Liabilities

As of March 31st, 2022 Total Funding represented 93.1% of total liabilities and other liabilities represented 6.9%.

2.1 Funding (1)

Total Funding (Total financial liabilities at amortized cost) which includes (i) Customer deposits, (ii) Interbank borrowings and overnight funds, (iii) Borrowings from banks and others, (iv) Bonds issued, and (v) Borrowing from development entities had a balance of Ps 215,487.1 billion as of March 31st, 2022 showing an increase of 7.4% versus pro forma March 31st, 2021 and 2.1% versus pro forma December 31st, 2021. Total customer deposits represented 70.9% of total funding as of 1Q22, 70.1% for pro forma 4Q21, and 72.7% for pro forma 1Q21.

Average cost of funds was 3.2% for pro forma 1Q22, 2.5% for pro forma 4Q21 and 2.2% for pro forma 1Q21.

Reported total funding as of March 31st, 2021 and December 31st, 2021 were Ps 284,170.7 billion and Ps 307.752.7 billion, respectively.

2.1.1 Customer deposits

| ∆ | |||||||||

| Customer deposits | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 |

1Q22 vs. Pro forma 1Q21 | ||||

| Checking accounts | 18,349.6 | 20,087.1 | 19,617.1 | -2.3% | 6.9% | ||||

| Other deposits | 247.2 | 273.3 | 302.9 | 10.8% | 22.5% | ||||

| Non-interest bearing | 18,596.9 | 20,360.4 | 19,920.0 | -2.2% | 7.1% | ||||

| Checking accounts | 8,205.8 | 6,110.9 | 8,599.8 | 40.7% | 4.8% | ||||

| Time deposits | 54,511.1 | 52,428.7 | 53,221.1 | 1.5% | -2.4% | ||||

| Savings deposits | 64,600.0 | 69,198.4 | 70,967.2 | 2.6% | 9.9% | ||||

| Interest bearing | 127,316.9 | 127,738.1 | 132,788.1 | 4.0% | 4.3% | ||||

| Customer deposits | 145,913.7 | 148,098.5 | 152,708.1 | 3.1% | 4.7% | ||||

(1) Pro-forma goodwill and other intangibles, funding and deposits for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

| 10 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Of our total customer deposits as of March 31st, 2022 checking accounts represented 18.5%, time deposits 34.9%, savings accounts 46.5%, and other deposits 0.2%.

The following table shows the customer deposits composition by bank. During the last twelve months, Banco Popular showed the highest growth rate in customer deposits within our banking operation in Colombia.

| Deposits / Bank ($) | Pro forma 1Q21(1) | Pro forma 4Q21(1) | 1Q22 | ∆ | |||||

| 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||||||

| Banco de Bogotá | 77,836.4 | 76,452.9 | 77,045.3 | 0.8% | -1.0% | ||||

| Banco de Occidente | 34,117.7 | 36,340.3 | 37,561.3 | 3.4% | 10.1% | ||||

| Banco Popular | 20,570.5 | 20,868.6 | 23,068.5 | 10.5% | 12.1% | ||||

| Banco AV Villas | 13,036.5 | 13,408.9 | 13,557.0 | 1.1% | 4.0% | ||||

| Corficolombiana | 4,934.3 | 5,330.9 | 5,440.7 | 2.1% | 10.3% | ||||

| Eliminations | (4,581.7) | (4,302.9) | (3,964.7) | -7.9% | -13.5% | ||||

| Total Grupo Aval | 145,913.7 | 148,098.5 | 152,708.1 | 3.1% | 4.7% | ||||

| Deposits / Bank (%) | Pro forma 1Q21(1) | Pro forma 4Q21(1) | 1Q22 | ||||

| Banco de Bogotá | 53.3% | 51.6% | 50.5% | ||||

| Banco de Occidente | 23.4% | 24.5% | 24.6% | ||||

| Banco Popular | 14.1% | 14.1% | 15.1% | ||||

| Banco AV Villas | 8.9% | 9.1% | 8.9% | ||||

| Corficolombiana | 3.4% | 3.6% | 3.6% | ||||

| Eliminations | -3.1% | -2.9% | -2.6% | ||||

| Total Grupo Aval | 100.0% | 100.0% | 100.0% |

Reported customer deposits as of March 31st, 2021 and December 31st, 2021 were Ps 222,077.7 billion and Ps 234.470.4 billion, respectively.

2.1.2 Borrowings from Banks and Other (includes borrowings from development entities) (1)

As of March 31st, 2022 borrowings from banks and other totaled Ps 21,207.9 billion, increasing 24.2% versus pro forma March 31st, 2021 and decreasing 0.3% versus pro forma December 31st, 2021.

Reported borrowings from banks and others as of March 31st, 2021 and December 31st, 2021 were Ps 23,001.3 billion and Ps 30,352.0 billion, respectively.

2.1.3 Bonds issued (1)

Total bonds issued as of March 31st, 2022 totaled Ps 30,414.2 billion and increased 5.2% versus pro forma March 31st, 2021 and decreased 3.5% versus pro forma December 31st, 2021.

(1) Pro-forma deposits, borrowings from banks and other and bond issued for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

| 11 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

3. Non-controlling Interest

Non-controlling Interest in Grupo Aval reflects the minority stakes that third party shareholders hold in each of its direct consolidated subsidiaries (Banco de Bogotá, Banco de Occidente, Banco Popular, Banco AV Villas, Corficolombiana and Porvenir).

As of March 31st, 2022 non-controlling interest was Ps 13,370.3 billion which decreased by 9.8% versus March 31st, 2021 and 18.8% versus December 31st, 2021. Total non-controlling interest represents 45.2% of total equity as of 1Q22, compared to 41.7% in 4Q21 and 42.1% in 1Q21.

Total non-controlling interest derives from the sum of the combined minority interests of our banks and of Grupo Aval, applying eliminations associated with the consolidation process of Grupo Aval.

| ∆ | |||||||||

| Percentage consolidated by Aval | 1Q21 | 4Q21 | 1Q22 | 1Q22 vs. 4Q21 | 1Q22 vs. 1Q21 | ||||

| Banco de Bogotá | 68.7% | 68.7% | 68.7% | - | - | ||||

| Banco de Occidente | 72.3% | 72.3% | 72.3% | - | - | ||||

| Banco Popular | 93.7% | 93.7% | 93.7% | - | - | ||||

| Banco AV Villas | 79.9% | 79.9% | 79.9% | - | - | ||||

| Porvenir (1) | 75.7% | 75.7% | 75.7% | - | 0 | ||||

| Corficolombiana | 39.6% | 40.0% | 40.0% | - | 40 | ||||

(1) Grupo Aval is the direct controlling entity of Porvenir.

4. Attributable Shareholders’ Equity

Attributable shareholders’ equity as of March 31st, 2022 was Ps 16,230.3 billion, showing a decrease of 20.3% versus March 31st, 2021 and 29.5% versus December 31st, 2021.

| 12 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Income Statement Analysis

Our net income attributable to the owners of the parent company for 1Q22 of Ps 1,729.7 billion showed a 118.5% increase versus 1Q21 and a 122.7% increase versus 4Q21.

| ∆ | |||||||||

| Consolidated Statement of Income Continued operations |

Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Interest income | 3,111.8 | 3,320.4 | 3,759.8 | 13.2% | 20.8% | ||||

| Interest expense | 1,085.6 | 1,312.8 | 1,679.2 | 27.9% | 54.7% | ||||

| Net interest income | 2,026.2 | 2,007.5 | 2,080.6 | 3.6% | 2.7% | ||||

| Loans and other accounts receivable | 929.8 | 793.7 | 807.3 | 1.7% | -13.2% | ||||

| Other financial assets | 0.7 | (0.2) | 18.9 | N.A | N.A. | ||||

| Recovery of charged-off financial assets | (91.7) | (148.1) | (130.8) | -11.6% | 42.7% | ||||

| Net impairment loss on financial assets | 838.7 | 645.4 | 695.4 | 7.8% | -17.1% | ||||

| Net income from commissions and fees | 756.2 | 805.0 | 710.0 | -11.8% | -6.1% | ||||

| Gross profit from sales of goods and services | 770.7 | 676.6 | 1,020.6 | 50.8% | 32.4% | ||||

| Net trading income | 189.6 | 230.7 | (287.3) | N.A | N.A | ||||

| Net income from other financial instruments mandatory at FVTPL | 81.6 | 62.8 | 73.9 | 17.7% | -9.5% | ||||

| Total other income | 140.2 | 52.9 | 1,845.9 | N.A. | N.A. | ||||

| Total other expenses | 1,548.1 | 1,963.7 | 1,679.5 | -14.5% | 8.5% | ||||

| Net income before income tax expense | 1,577.7 | 1,226.4 | 3,068.8 | 150.2% | 94.5% | ||||

| Income tax expense | 491.9 | 379.4 | 633.0 | 66.8% | 28.7% | ||||

| Net income for the period of continued operations | 1,085.8 | 847.0 | 2,435.9 | 187.6% | 124.3% | ||||

| Net income for the period of discontinued operations | 365.8 | 444.6 | 544.9 | 22.6% | 49.0% | ||||

| Net income for the period | 1,451.6 | 1,291.6 | 2,980.8 | 130.8% | 105.3% | ||||

| Non-controlling interest | 659.8 | 514.9 | 1,251.1 | 143.0% | 89.6% | ||||

| Net income attributable to owners of the parent | 791.8 | 776.8 | 1,729.7 | 122.7% | 118.5% | ||||

1. Net Interest Income (1)

| ∆ | |||||||||

| Net interest income | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Interest income | |||||||||

| Commercial | 1,160.6 | 1,227.6 | 1,456.9 | 18.7% | 25.5% | ||||

| Interbank and overnight funds | 39.9 | 42.2 | 68.6 | 62.7% | 71.8% | ||||

| Consumer | 1,437.8 | 1,517.7 | 1,559.8 | 2.8% | 8.5% | ||||

| Mortgages and housing leases | 257.8 | 283.1 | 278.0 | -1.8% | 7.8% | ||||

| Microcredit | 21.8 | 17.3 | 16.6 | -3.7% | -23.6% | ||||

| Loan portfolio | 2,917.9 | 3,087.8 | 3,379.8 | 9.5% | 15.8% | ||||

| Interests on investments in debt securities | 193.9 | 232.5 | 380.0 | 63.4% | 95.9% | ||||

| Total interest income | 3,111.8 | 3,320.4 | 3,759.8 | 13.2% | 20.8% | ||||

| Interest expense | |||||||||

| Checking accounts | 16.4 | 15.9 | 29.9 | 88.0% | 82.8% | ||||

| Time deposits | 429.1 | 452.2 | 544.2 | 20.4% | 26.8% | ||||

| Savings deposits | 203.7 | 259.5 | 407.9 | 57.2% | 100.3% | ||||

| Total interest expenses on deposits | 649.1 | 727.5 | 982.0 | 35.0% | 51.3% | ||||

| Interbank borrowings and overnight funds | 24.1 | 61.1 | 76.5 | 25.2% | N.A. | ||||

| Borrowings from banks and others | 93.5 | 108.9 | 124.5 | 14.3% | 33.1% | ||||

| Bonds issued | 295.6 | 391.4 | 466.9 | 19.3% | 57.9% | ||||

| Borrowings from development entities | 23.3 | 23.9 | 29.3 | 22.9% | 25.8% | ||||

| Total interest expenses on financial obligations | 436.5 | 585.3 | 697.1 | 19.1% | 59.7% | ||||

| Total interest expense | 1,085.6 | 1,312.8 | 1,679.2 | 27.9% | 54.7% | ||||

| Net interest income | 2,026.2 | 2,007.5 | 2,080.6 | 3.6% | 2.7% | ||||

(1) Pro-forma figures for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

| 13 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Our net interest income increased by 2.7% to Ps 2,080.6 billion for 1Q22 versus pro forma 1Q21 and by 3.6% versus pro forma 4Q21. The increase versus pro forma 1Q21 was derived mainly from a 20.8% increase in total interest income and a 54.7% increase in total interest expense.

Our Net Interest Margin(*) was 4.1%(1) (2) for pro forma 1Q22 and for pro forma 1Q21, and 4.2%(1) in pro forma 4Q21. Net Interest Margin on Loans was 5.1%(2) for pro forma 1Q22, 5.3%(1) for pro forma 4Q21, and 5.6%(1) in pro forma 1Q21. On the other hand, our Net Investments Margin was 0.6%(2) for pro forma 1Q22, 0.5%(1) for pro forma 4Q21 and -1.2%(1) for pro forma 1Q21.

Reported Net Interest Margin was 4.8% for 4Q21, 4.6% in 1Q21. Net Interest Margin on Loans was 5.7% for 4Q21 and 5.8% for 1Q21. On the other hand, our Net Investments Margin was 1.0% for 4Q21, -0.4% in 1Q21.

2. Impairment loss on financial assets, net (1)

Our impairment loss on financial assets, net decreased by 17.1% to Ps 695.4 billion for 1Q22 versus pro forma 1Q21 and increased by 7.8% versus pro forma 4Q21.

| ∆ | |||||||||

| Net impairment loss on financial assets | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Loans and other accounts receivable | 929.8 | 793.7 | 807.3 | 1.7% | -13.2% | ||||

| Other financial assets | 0.7 | (0.2) | 18.9 | N.A | N.A. | ||||

| Recovery of charged-off financial assets | (91.7) | (148.1) | (130.8) | -11.6% | 42.7% | ||||

| Net impairment loss on financial assets | 838.7 | 645.4 | 695.4 | 7.8% | -17.1% | ||||

Our annualized gross cost of risk was 2.1% for pro forma 1Q22 and for pro forma 4Q21, and 2.6% for pro forma 1Q21. Net of recoveries of charged-off assets our ratio was 1.7% for pro forma 1Q22 and for pro forma 4Q21, and 2.3% for pro forma 1Q21.

Reported annualized gross cost of risk as reported was 2.1% for 4Q21, 2.4% for 1Q21. Net of recoveries of charged-off assets our ratio was 1.8% for 4Q21, 2.2% for 1Q21.

(*) Grupo Aval’s NIM without income from trading securities and investment in debt securities designated at fair value through profit and loss (non compliant with SPPI test) was 4.4% for 1Q22, 4.3% for pro forma 4Q21, and 4.7% for pro forma1Q21.

(1) Pro-forma NIM, NIM on loans and NIM on Investments and Net impairment loss on financial assets for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers. Pro-forma ratios for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above.

(2) Pro-forma ratios for 1Q22 are based on reported revenues and expenses, associated to each ratio; however, the denominators averages used to calculate these ratios contain pro-forma figures from previous quarters.

| 14 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

3. Non-interest income (1)

| ∆ | |||||||||

| Total non-interest income | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Income from commissions and fees | |||||||||

| Banking fees(1) | 504.0 | 574.1 | 564.6 | -1.7% | 12.0% | ||||

| Trust activities | 88.6 | 81.3 | 83.9 | 3.1% | -5.3% | ||||

| Pension and severance fund management | 303.3 | 302.9 | 303.7 | 0.3% | 0.1% | ||||

| Bonded warehouse services | 38.0 | 47.6 | 43.0 | -9.8% | 13.0% | ||||

| Total income from commissions and fees | 933.9 | 1,006.0 | 995.1 | -1.1% | 6.6% | ||||

| Expenses from commissions and fees | 177.6 | 201.0 | 285.0 | 41.8% | 60.5% | ||||

| Net income from commissions and fees | 756.2 | 805.0 | 710.0 | -11.8% | -6.1% | ||||

| Income from sales of goods and services | 2,373.5 | 2,888.3 | 2,667.9 | -7.6% | 12.4% | ||||

| Costs and expenses from sales of goods and services | 1,602.8 | 2,211.7 | 1,647.3 | -25.5% | 2.8% | ||||

| Gross profit from sales of goods and services | 770.7 | 676.6 | 1,020.6 | 50.8% | 32.4% | ||||

| Net trading income | 189.6 | 230.7 | (287.3) | N.A | N.A | ||||

| Net income from other financial instruments mandatory at FVTPL | 81.6 | 62.8 | 73.9 | 17.7% | -9.5% | ||||

| Other income | |||||||||

| Foreign exchange gains (losses), net | (167.4) | (116.9) | 369.2 | N.A | N.A | ||||

| Net gain on sale of investments and OCI realization | 71.0 | (4.0) | (2.6) | -36.7% | -103.6% | ||||

| Gain on the sale of non-current assets held for sale | 3.9 | 1.2 | 3.9 | N.A. | -0.4% | ||||

| Income from non-consolidated investments(2) | 162.5 | 78.7 | 203.3 | 158.3% | 25.1% | ||||

| Net gains on asset valuations | 2.0 | 13.2 | 0.3 | -97.9% | -85.9% | ||||

| Gains from loss of control in subsidiaries | - | - | 1,052.6 | N.A | N.A | ||||

| Other income from operations | 68.1 | 80.7 | 219.2 | 171.5% | N.A. | ||||

| Total other income | 140.2 | 52.9 | 1,845.9 | N.A. | N.A. | ||||

| Total non-interest income | 1,938.4 | 1,827.9 | 3,363.1 | 84.0% | 73.5% | ||||

(1) Includes commissions on banking services, office network services, credit and debit card fees, fees on drafts, checks and checkbooks and other fees

(2) Includes share of profit of equity accounted investees, net of tax, and dividend income.

3.1 Net income from commissions and fees(1)

Net income from commissions and fees for 1Q22 totaled Ps 710.0 billion and decreased by 6.1% versus pro forma 1Q21 and by 11.8% versus pro forma 4Q21. Income from commissions and fees increased by 6.6% to Ps 995.1 billion in 1Q22 versus pro forma 1Q21 and decreased 1.1% versus pro forma 4Q21.

Reported net income from commissions and fees for 4Q21 totaled Ps 1,540.0 billion and for 1Q21 totaled Ps 1,346.8 billion. Reported income from commissions and fees for 4Q21 totaled Ps 1,772.6 billion and for 1Q21 totaled Ps 1,550.9 billion.

3.2 Gross profit from sales of goods and services

Gross profit from sales of goods and services (non-financial sector) increased by 50.8% to Ps 1,020.6 billion for 1Q22 versus 4Q21 and 32.4% annually, due to a strong contribution from energy & gas and infrastructure sectors.

(1) Pro-forma non-interest income, net income from commissions and fees for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

| 15 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

3.3 Net trading income (1)

| ∆ | |||||||||

| Net trading income | Pro forma 1Q21(1) |

Pro forma 4Q21(1) |

1Q22 | 1Q22 vs. Pro forma 4Q21 | 1Q22 vs. Pro forma 1Q21 | ||||

| Trading investment income | (119.9) | 62.5 | (18.3) | -129.2% | -84.8% | ||||

| Net income (loss) on financial derivatives | 284.2 | 151.2 | (301.7) | N.A | N.A | ||||

| Other trading income on derivatives | 25.3 | 17.0 | 32.6 | 91.9% | 29.1% | ||||

| Net trading income | 189.6 | 230.7 | (287.3) | N.A | N.A | ||||

Net trading income for Grupo Aval should be analyzed in conjunction with the foreign exchange gains (losses).

3.4 Other income (1)

Total other income for 1Q22 totaled Ps 1,845.9 billion, the increase was related to the gains from loss of control of BAC Holding International, this gain accounted for Ps 1,052.6 billion.

Reported total other income for 4Q21 totaled Ps 325.6 billion and for 1Q21 reached Ps 327.9 billion.

4. Other expenses (1)

Total other expenses for 1Q22 totaled Ps 1,679.5 billion and increased by 8.5% versus pro forma 1Q21 and decreased by 14.5% versus pro forma 4Q21. Our efficiency ratio measured as total other expenses to total income was 30.9% in 1Q22, 51.2%(1) for pro forma 4Q21 and 39.0%(1) for pro forma 1Q21. The ratio of annualized total other expenses as a percentage of average total assets was 2.6%(2) in pro forma 1Q22, 3.1%(1) for pro forma 4Q21, and 2.7%(1) for pro forma 1Q21.

Reported total other expenses for 4Q21 totaled Ps 3,243.2 billion and for 1Q21 reached Ps 2,581.1 billion.

5. Non-controlling Interest

Non-controlling interest in Grupo Aval mainly reflects the minority stakes that third party shareholders hold in each of its direct consolidated subsidiaries (Banco de Bogotá, Banco de Occidente, Banco Popular, Banco AV Villas, Corficolombiana and Porvenir).

Banco de Bogotá and Grupo Aval shareholders acquired the status of direct shareholders of the 75% of BAC Holding International Corp, as a result 1Q22 includes a one-time gain due to the realization of OCI accounts related to the spin-off. As a result of this transaction, non-controlling interest in the income statement increased to Ps 1,251.1 billion, showing a 89.6% increase versus 1Q21 and a 143.0% increase versus 4Q21. In addition, the ratio of non-controlling interest to income before non-controlling interest was 42.0% in 1Q22, 39.9% in 4Q21 and 45.5% in 1Q21.

(1) Pro-forma net trading income, total other income and total other expenses for 1Q21 and 4Q21 are calculated based on the reported consolidated figures excluding BHI’s contribution to these numbers.

Pro-forma ratios for 1Q21 and 4Q21 are calculated based on the pro-forma figures explained above.

(2) Pro-forma ratios for 1Q22 are based on reported revenues and expenses, associated to each ratio; however, the denominators averages used to calculate these ratios contain pro-forma figures from previous quarters.

| 16 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Information related to Grupo Aval Acciones y Valores S.A. (Holding Company) and Grupo Aval Limited

The holding company recorded a total gross indebtedness of Ps 1,666.9 billion (Ps 532.8 billion of bank debt and Ps 1,134.1 billion of bonds denominated in Colombian pesos) as of March 31st 2022. It also guarantees irrevocably and unconditionally Grupo Aval Limited’s (144A / Reg S) 2022 (USD 1.0 billion) bonds and Grupo Aval Limited’s (144A / Reg S) 2030 (USD 1.0 billion) bonds under its respective indentures. As of March 31st 2022 the total amount outstanding (including interests payable) of such bonds was USD 2.0 billion, or Ps 7,509.8 billion when translated into pesos.

The debt at Grupo Aval Limited is serviced with interest income on loans to subsidiaries and cash & cash equivalents. Grupo Aval Limited has not required, to this date, cash from Grupo Aval Acciones y Valores S.A. to fulfill its obligations. The main sources of cash to pay the debt and debt service at Grupo Aval Acciones y Valores S.A. have been the dividend income from its subsidiaries and the returns on its cash & cash equivalents.

When combined, Grupo Aval Acciones y Valores S.A. and Grupo Aval Ltd. had Ps 3,097.5 billion of total liquid assets (including callable senior loans to subsidiaries), a total gross indebtedness of Ps 9,176.8 billion and a net indebtedness of Ps 6,079.3 billion as of March 31st 2022. In addition to liquid assets, Grupo Aval Ltd. has Ps 2,064.0 billion in other loans to subsidiaries and investments in AT1 instruments of Ps 1,943.6 billion.

| Total liquid assets as of March 31, 2022 |  | |

| Cash and cash equivalents | 1,827.8 | |

| Fixed income investments | 296.8 | |

| Callable Senior loans to subsidiaries | 972.8 | |

| Total liquid assets | 3,097.5 | |

As of March 31st, 2022 our combined double leverage (calculated as investments in subsidiaries at book value, subordinated loans to subsidiaries, AT1 investments, and goodwill as a percentage of shareholders' equity) was 1.22x. Finally, we present an evolution of our key ratios on a combined basis:

| ∆ | |||||||||

| Debt service coverage and leverage ratios | 1Q21 | 4Q21 | 1Q22 | 1Q22 vs. 4Q21 | 1Q22 vs. 1Q21 | ||||

| Double leverage (1) | 1.19x | 1.18x | 1.22x | 0.04 | 0.03 | ||||

| Net debt / Core earnings (2)(3) | 3.5x | 3.1x | 4.6x | 1.53 | 1.14 | ||||

| Net debt / Cash dividends (2)(3) | 4.7x | 4.5x | 6.2x | 1.67 | 1.54 | ||||

| Core Earnings / Interest Expense (2) | 4.6x | 5.0x | 3.1x | -1.92 | -1.49 | ||||

(1) Double leverage is calculated as investments in subsidiaries at book value (excluding revaluations), subordinated loans to subsidiaries and goodwill as a percentage of shareholders' equity;

(2) Core earnings are defined as annualized recurring cash flow from dividends, investments and net operating income;

(3) Net debt is calculated as total gross debt minus cash and cash equivalents and fixed income investments

| 17 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

ABOUT GRUPO AVAL

Grupo Aval, leading financial conglomerate in Colombia, operates through: four commercial banks in Colombia (Banco de Bogotá, Banco de Occidente, Banco Popular and Banco AV Villas), the largest private pension and severance fund manager in Colombia (Porvenir), and the largest financial corporation in Colombia (Corficolombiana). Additionally, it operates in Central America through Multi Financial Holding Group in Panama and has a 25% investment in BAC Holding International Corporation (BHI) through Banco de Bogota

Investor Relations Contact

Andrea Arevalo

Strategic Planning and Investor Relations Manager

Tel: +571 743 32 22 x 23422

E-mail: [email protected]

| 18 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Grupo Aval Acciones y Valores S.A.

Consolidated Financial Statements

Supplemental unaudited pro forma financial information

Information in Ps. Billions

| ∆ | |||||||||||

| Consolidated Statement of Financial Position | 1Q21 | BHI 1Q21 (1) |

Pro forma 1Q21 |

1Q22 | 1Q22 vs. 1Q21 | 1Q22 vs. Pro forma 1Q21 | |||||

| Cash and cash equivalents | 35,132.0 | (17,262.5) | 17,869.6 | 16,407.1 | -53.3% | -8.2% | |||||

| Investment and trading assets | |||||||||||

| Debt securities | 5,844.5 | (146.9) | 5,697.6 | 3,247.3 | -44.4% | -43.0% | |||||

| Equity securities | 4,713.7 | (43.8) | 4,669.9 | 5,254.7 | 11.5% | 12.5% | |||||

| Derivative assets | 835.4 | (0.1) | 835.3 | 1,344.8 | 61.0% | 61.0% | |||||

| Trading assets | 11,393.6 | (190.8) | 11,202.7 | 9,846.7 | -13.6% | -12.1% | |||||

| Investments in debt securities at FVTPL (non compliant with SPPI test) | 6.6 | - | 6.6 | - | -100.0% | -100.0% | |||||

| Investments in securities at FVOCI | 35,089.0 | (12,626.5) | 22,462.5 | 23,964.9 | -31.7% | 6.7% | |||||

| Investments in debt securities at AC | 5,695.0 | 1,744.8 | 7,439.8 | 7,585.4 | 33.2% | 2.0% | |||||

| Investment securities | 40,790.6 | (10,881.7) | 29,908.9 | 31,550.3 | -22.7% | 5.5% | |||||

| Hedging derivatives assets | 29.5 | - | 29.5 | 53.8 | 82.1% | 82.1% | |||||

| Gross loans | |||||||||||

| Commercial loans | 117,059.5 | (29,946.7) | 87,112.7 | 95,591.4 | -18.3% | 9.7% | |||||

| Commercial loans | 114,497.6 | (28,573.0) | 85,924.5 | 91,006.7 | -20.5% | 5.9% | |||||

| Interbank & overnight funds | 2,561.9 | (1,373.7) | 1,188.2 | 4,584.7 | 79.0% | N.A. | |||||

| Consumer loans | 68,626.8 | (22,030.4) | 46,596.5 | 51,984.3 | -24.3% | 11.6% | |||||

| Mortgages loans | 26,030.9 | (12,991.7) | 13,039.2 | 15,010.3 | -42.3% | 15.1% | |||||

| Microcredit loans | 358.8 | - | 358.8 | 292.6 | -18.4% | -18.4% | |||||

| Total gross loans | 212,076.0 | (64,968.9) | 147,107.1 | 162,878.7 | -23.2% | 10.7% | |||||

| Loss allowance | (11,059.2) | 2,433.0 | (8,626.2) | (8,824.2) | -20.2% | 2.3% | |||||

| Total loans, net | 201,016.7 | (62,535.9) | 138,480.9 | 154,054.5 | -23.4% | 11.2% | |||||

| Other accounts receivable, net | 16,310.0 | (929.9) | 15,380.0 | 19,587.4 | 20.1% | 27.4% | |||||

| Non-current assets held for sale | 250.6 | (22.5) | 228.1 | 147.2 | -41.2% | -35.4% | |||||

| Investments in associates and joint ventures | 969.8 | (0.6) | 969.2 | 4,356.9 | N.A. | N.A. | |||||

| Own-use property, plant and equipment for own-use and given in operating lease, net | 6,022.6 | (1,312.4) | 4,710.2 | 4,593.0 | -23.7% | -2.5% | |||||

| Right-of-use assets | 2,031.4 | (662.4) | 1,369.0 | 1,362.0 | -33.0% | -0.5% | |||||

| Investment properties | 827.5 | - | 827.5 | 894.5 | 8.1% | 8.1% | |||||

| Biological assets | 124.5 | - | 124.5 | 153.8 | 23.6% | 23.6% | |||||

| Tangible assets | 9,006.0 | (1,974.8) | 7,031.2 | 7,003.4 | -22.2% | -0.4% | |||||

| Goodwill | 8,109.6 | (5,781.0) | 2,328.6 | 2,220.5 | -72.6% | -4.6% | |||||

| Concession arrangement rights | 9,540.9 | - | 9,540.9 | 11,338.9 | 18.8% | 18.8% | |||||

| Other intangible assets | 1,704.8 | (212.5) | 1,492.3 | 1,687.2 | -1.0% | 13.1% | |||||

| Intangible assets | 19,355.3 | (5,993.4) | 13,361.8 | 15,246.5 | -21.2% | 14.1% | |||||

| Current | 992.5 | (29.8) | 962.7 | 983.7 | -0.9% | 2.2% | |||||

| Deferred | 1,166.8 | (210.7) | 956.1 | 1,406.4 | 20.5% | 47.1% | |||||

| Income tax assets | 2,159.3 | (240.4) | 1,918.8 | 2,390.1 | 10.7% | 24.6% | |||||

| Other assets | 498.3 | (161.0) | 337.2 | 480.1 | -3.6% | 42.4% | |||||

| Activos escindidos de BHI | - | 100,193.6 | 100,193.6 | - | N.A | -100.0% | |||||

| Total assets | 336,911.6 | - | 336,911.6 | 261,124.1 | -22.5% | -22.5% | |||||

| Trading liabilities | 825.8 | (0.1) | 825.7 | 1,360.4 | 64.7% | 64.8% | |||||

| Hedging derivatives liabilities | 74.0 | 74.0 | 52.6 | -29.0% | -29.0% | ||||||

| Customer deposits | 222,077.7 | (76,164.0) | 145,913.7 | 152,708.1 | -31.2% | 4.7% | |||||

| Checking accounts | 55,289.6 | (28,734.2) | 26,555.4 | 28,216.9 | -49.0% | 6.3% | |||||

| Time deposits | 85,597.1 | (31,086.0) | 54,511.1 | 53,221.1 | -37.8% | -2.4% | |||||

| Savings deposits | 80,761.0 | (16,161.1) | 64,600.0 | 70,967.2 | -12.1% | 9.9% | |||||

| Other deposits | 430.0 | (182.7) | 247.2 | 302.9 | -29.5% | 22.5% | |||||

| Financial obligations | 62,093.0 | (7,364.7) | 54,728.3 | 62,778.9 | 1.1% | 14.7% | |||||

| Interbank borrowings and overnight funds | 9,363.1 | (623.3) | 8,739.8 | 11,156.8 | 19.2% | 27.7% | |||||

| Borrowings from banks and others | 19,122.9 | (5,927.2) | 13,195.7 | 17,937.9 | -6.2% | 35.9% | |||||

| Bonds issued | 29,728.6 | (814.3) | 28,914.3 | 30,414.2 | 2.3% | 5.2% | |||||

| Borrowings from development entities | 3,878.4 | - | 3,878.4 | 3,270.0 | -15.7% | -15.7% | |||||

| Total financial liabilities at amortized cost | 284,170.7 | (83,528.7) | 200,642.0 | 215,487.1 | -24.2% | 7.4% | |||||

| Legal related | 256.2 | (1.2) | 255.0 | 252.0 | -1.7% | -1.2% | |||||

| Other provisions | 653.2 | (33.8) | 619.4 | 844.4 | 29.3% | 36.3% | |||||

| Provisions | 909.4 | (35.0) | 874.4 | 1,096.4 | 20.6% | 25.4% | |||||

| Current | 378.7 | (134.7) | 244.0 | 245.6 | -35.1% | 0.7% | |||||

| Deferred | 3,336.5 | (268.8) | 3,067.7 | 4,186.6 | 25.5% | 36.5% | |||||

| Income tax liabilities | 3,715.2 | (403.5) | 3,311.7 | 4,432.2 | 19.3% | 33.8% | |||||

| Employee benefits | 1,212.2 | (205.7) | 1,006.5 | 950.6 | -21.6% | -5.6% | |||||

| Other liabilities | 10,809.3 | (1,530.2) | 9,279.2 | 8,144.3 | -24.7% | -12.2% | |||||

| Spun-off liabilities from BHI | - | 85,703.1 | 85,703.1 | - | N.A | -100.0% | |||||

| Total liabilities | 301,716.6 | - | 301,716.6 | 231,523.5 | -23.3% | -23.3% | |||||

| Equity attributable to owners of the parent | 20,376.0 | - | 20,376.0 | 16,230.3 | -20.3% | -20.3% | |||||

| Non-controlling interest | 14,818.9 | - | 14,818.9 | 13,370.3 | -9.8% | -9.8% | |||||

| Total equity | 35,195.0 | - | 35,195.0 | 29,600.6 | -15.9% | -15.9% | |||||

| Total liabilities and equity | 336,911.6 | - | 336,911.6 | 261,124.1 | -22.5% | -22.5% | |||||

(1) BHI’s contribution to previously reported consolidated figures.

| 19 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Grupo Aval Acciones y Valores S.A.

Consolidated Financial Statements

Supplemental unaudited pro forma financial information

Information in Ps. Billions

| ∆ | |||||||||||

| Consolidated Statement of Income | 1Q21 | BHI 1Q21 (1) |

Pro forma 1Q21 |

1Q22 | 1Q22 vs. 1Q21 | 1Q22 vs. Pro forma 1Q21 | |||||

| Interest income | |||||||||||

| Loan portfolio | 4,349.2 | (1,431.3) | 2,917.9 | 3,379.8 | -22.3% | 15.8% | |||||

| Interests on investments in debt securities | 353.2 | (159.3) | 193.9 | 380.0 | 7.6% | 95.9% | |||||

| Total interest income | 4,702.4 | (1,590.6) | 3,111.8 | 3,759.8 | -20.0% | 20.8% | |||||

| Interest expense | |||||||||||

| Checking accounts | 71.2 | (54.8) | 16.4 | 29.9 | -58.0% | 82.8% | |||||

| Time deposits | 770.9 | (341.8) | 429.1 | 544.2 | -29.4% | 26.8% | |||||

| Savings deposits | 244.6 | (40.9) | 203.7 | 407.9 | 66.8% | 100.3% | |||||

| Total interest expenses on deposits | 1,086.7 | (437.6) | 649.1 | 982.0 | -9.6% | 51.3% | |||||

| Interbank borrowings and overnight funds | 24.4 | (0.3) | 24.1 | 76.5 | N.A. | N.A. | |||||

| Borrowings from banks and others | 160.1 | (66.6) | 93.5 | 124.5 | -22.3% | 33.1% | |||||

| Bonds issued | 362.5 | (66.9) | 295.6 | 466.9 | 28.8% | 57.9% | |||||

| Borrowings from development entities | 23.3 | - | 23.3 | 29.3 | 25.8% | 25.8% | |||||

| Total interest expenses on financial obligations | 570.4 | (133.8) | 436.5 | 697.1 | 22.2% | 59.7% | |||||

| Total interest expense | 1,657.0 | (571.4) | 1,085.6 | 1,679.2 | 1.3% | 54.7% | |||||

| Net interest income | 3,045.4 | (1,019.2) | 2,026.2 | 2,080.6 | -31.7% | 2.7% | |||||

| Impairment losses (recoveries) on financial assets | |||||||||||

| Loans and other accounts receivable | 1,233.3 | (303.5) | 929.8 | 807.3 | -34.5% | -13.2% | |||||

| Other financial assets | 15.6 | (15.0) | 0.7 | 18.9 | 21.1% | N.A. | |||||

| Recovery of charged-off financial assets | (91.7) | - | (91.7) | (130.8) | 42.7% | 42.7% | |||||

| Net impairment loss on financial assets | 1,157.2 | (318.5) | 838.7 | 695.4 | -39.9% | -17.1% | |||||

| Net interest income, after impairment losses | 1,888.2 | (700.8) | 1,187.4 | 1,385.2 | -26.6% | 16.7% | |||||

| Income from commissions and fees | |||||||||||

| Banking fees(2) | 1,108.4 | (604.5) | 504.0 | 564.6 | -49.1% | 12.0% | |||||

| Trust activities | 88.6 | - | 88.6 | 83.9 | -5.3% | -5.3% | |||||

| Pension and severance fund management | 315.9 | (12.6) | 303.3 | 303.7 | -3.9% | 0.1% | |||||

| Bonded warehouse services | 38.0 | - | 38.0 | 43.0 | 13.0% | 13.0% | |||||

| Total income from commissions and fees | 1,550.9 | (617.1) | 933.9 | 995.1 | -35.8% | 6.6% | |||||

| Expenses from commissions and fees | 204.2 | (26.5) | 177.6 | 285.0 | 39.6% | 60.5% | |||||

| Net income from commissions and fees | 1,346.8 | (590.5) | 756.2 | 710.0 | -47.3% | -6.1% | |||||

| Income from sales of goods and services | 2,373.5 | - | 2,373.5 | 2,667.9 | 12.4% | 12.4% | |||||

| Costs and expenses from sales of goods and services | 1,602.8 | - | 1,602.8 | 1,647.3 | 2.8% | 2.8% | |||||

| Gross profit from sales of goods and services | 770.7 | - | 770.7 | 1,020.6 | 32.4% | 32.4% | |||||

| Net trading income | 197.6 | (8.0) | 189.6 | (287.3) | N.A | N.A | |||||

| Net income from other financial instruments mandatory at FVTPL | 81.6 | - | 81.6 | 73.9 | -9.5% | -9.5% | |||||

| Gains from loss of control in subsidiaries | 1,052.6 | N.A | N.A | ||||||||

| Other income | |||||||||||

| Foreign exchange gains (losses), net | (70.4) | (97.0) | (167.4) | 369.2 | N.A | N.A | |||||

| Net gain on sale of investments and OCI realization | 129.1 | (58.1) | 71.0 | (2.6) | -102.0% | -103.6% | |||||

| Gain on the sale of non-current assets held for sale | 8.7 | (4.8) | 3.9 | 3.9 | -54.9% | -0.4% | |||||

| Income from non-consolidated investments(3) | 164.0 | (1.5) | 162.5 | 203.3 | 23.9% | 25.1% | |||||

| Net gains on asset valuations | 2.0 | - | 2.0 | 0.3 | -85.9% | -85.9% | |||||

| Other income from operations | 94.4 | (26.3) | 68.1 | 219.2 | 132.1% | N.A. | |||||

| Total other income | 327.9 | (187.7) | 140.2 | 793.3 | 142.0% | N.A. | |||||

| Loss on the sale of non-current assets held for sale | 0.6 | (0.1) | 0.5 | 0.3 | -39.6% | -25.8% | |||||

| Personnel expenses | 1,071.0 | (438.4) | 632.5 | 680.0 | -36.5% | 7.5% | |||||

| General and administrative expenses | 1,200.9 | (460.1) | 740.8 | 797.9 | -33.6% | 7.7% | |||||

| Depreciation and amortization | 254.0 | (104.2) | 149.8 | 155.5 | -38.8% | 3.9% | |||||

| Impairment loss on other assets | 5.2 | (0.1) | 5.1 | 10.5 | 102.9% | 105.4% | |||||

| Other operating expenses | 49.4 | (30.0) | 19.5 | 35.2 | -28.8% | 80.8% | |||||

| Total other expenses | 2,581.1 | (1,032.9) | 1,548.1 | 1,679.5 | -34.9% | 8.5% | |||||

| Net income before income tax expense | 2,031.7 | (454.1) | 1,577.7 | 3,068.8 | 51.0% | 94.5% | |||||

| Income tax expense | 580.1 | (88.2) | 491.9 | 633.0 | 9.1% | 28.7% | |||||

| Net income for the period of continued operations | 1,451.6 | (365.8) | 1,085.8 | 2,435.9 | 67.8% | 124.3% | |||||

| Net income for the period of discontinued operations | - | 365.8 | 365.8 | 544.9 | N.A | 49.0% | |||||

| Net income for the period | 1,451.6 | (0.0) | 1,451.6 | 2,980.8 | 105.3% | 105.3% | |||||

| Net income attributable to owners of the parent | |||||||||||

| From discontinued operations | - | - | 251.5 | 374.5 | N.A | 49.0% | |||||

| From continued operations | - | - | 540.3 | 1,355.2 | N.A | 150.8% | |||||

| Net income attributable to owners of the parent | 791.8 | - | 791.8 | 1,729.7 | 118.5% | 118.5% | |||||

| Net income attibutable to non-controlling interest | |||||||||||

| From discontinued operations | - | - | 114.4 | 170.4 | N.A | 49.0% | |||||

| From continued operations | - | - | 545.5 | 1,080.7 | N.A | 98.1% | |||||

| Non-controlling interest | 659.8 | - | 659.8 | 1,251.1 | 89.6% | 89.6% | |||||

| Net income for the period | 1,451.6 | - | 1,451.6 | 2,980.8 | 105.3% | 105.3% | |||||

(1) BHI’s contribution to previously reported consolidated figures.

(2) Includes commissions on banking services, office network services, credit and debit card fees, fees on drafts, checks and checkbooks and other fees

(3) Includes share of profit of equity accounted investees, net of tax, and dividend income.

| 20 |  |

|

Report of 1Q2022 consolidated results Information reported in Ps billions |

Grupo Aval Acciones y Valores S.A.

Consolidated Financial Statements

Supplemental unaudited pro forma financial information

Information in Ps. Billions

| ∆ | |||||||||||

| Consolidated Statement of Financial Position | 4Q21 | BHI 4Q21 (1) |

Pro forma 4Q21 |

1Q22 | 1Q22 vs. 4Q21 | 1Q22 vs. Pro forma 4Q21 | |||||

| Cash and cash equivalents | 36,642.8 | (18,890.7) | 17,752.1 | 16,407.1 | -55.2% | -7.6% | |||||

| Investment and trading assets | |||||||||||

| Debt securities | 4,741.3 | (139.8) | 4,601.5 | 3,247.3 | -31.5% | -29.4% | |||||

| Equity securities | 5,082.6 | (50.4) | 5,032.2 | 5,254.7 | 3.4% | 4.4% | |||||

| Derivative assets | 1,162.9 | (0.2) | 1,162.8 | 1,344.8 | 15.6% | 15.7% | |||||

| Trading assets | 10,986.8 | (190.3) | 10,796.4 | 9,846.7 | -10.4% | -8.8% | |||||

| Investments in debt securities at FVTPL (non compliant with SPPI test) | - | - | - | - | N.A | N.A | |||||

| Investments in securities at FVOCI | 38,900.0 | (13,575.0) | 25,325.0 | 23,964.9 | -38.4% | -5.4% | |||||

| Investments in debt securities at AC | 5,764.4 | 2,055.2 | 7,819.6 | 7,585.4 | 31.6% | -3.0% | |||||

| Investment securities | 44,664.4 | (11,519.8) | 33,144.6 | 31,550.3 | -29.4% | -4.8% | |||||

| Hedging derivatives assets | 44.2 | - | 44.2 | 53.8 | 21.5% | 21.5% | |||||

| Gross loans | |||||||||||

| Commercial loans | 125,246.2 | (34,878.9) | 90,367.3 | 95,591.4 | -23.7% | 5.8% | |||||

| Commercial loans | 122,027.8 | (33,436.7) | 88,591.1 | 91,006.7 | -25.4% | 2.7% | |||||

| Interbank & overnight funds | 3,218.4 | (1,442.2) | 1,776.3 | 4,584.7 | 42.5% | 158.1% | |||||

| Consumer loans | 76,889.1 | (26,123.8) | 50,765.3 | 51,984.3 | -32.4% | 2.4% | |||||

| Mortgages loans | 29,120.3 | (14,438.9) | 14,681.5 | 15,010.3 | -48.5% | 2.2% | |||||