Form 6-K GREENPOWER MOTOR Co INC. For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2021

Commission File Number 001-39476

GreenPower Motor Company Inc.

(Translation of registrant's name into English)

#240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

| 99.1 | Statement of Executive Compensation for the Year Ended March 31, 2021 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GreenPower Motors Inc.

/s/ Michael Sieffert

____________________________________________

Michael Sieffert, Chief Financial Officer

Date: September 24, 2021

GREENPOWER MOTOR COMPANY INC.

(the "Issuer" or "GreenPower")

STATEMENT OF EXECUTIVE COMPENSATION

Form 51-102F6

Statement of Executive Compensation

YEAR ENDED MARCH 31, 2021

General

For the purpose of this Statement of Executive Compensation:

"CEO" means an individual who acted as chief executive officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

"CFO" means an individual who acted as chief financial officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

"closing market price" means the price at which the company's security was last sold, on the applicable date,

(a) in the security's principal marketplace in Canada, or

(b) if the security is not listed or quoted on a marketplace in Canada, in the security's principal marketplace;

"company" includes other types of business organizations such as partnerships, trusts and other unincorporated business entities;

"equity incentive plan" means an incentive plan, or portion of an incentive plan, under which awards are granted and that falls within the scope of IFRS 2 Share-based Payment;

"external management company" includes a subsidiary, affiliate or associate of the external management company;

"grant date" means a date determined for financial statement reporting purposes under IFRS 2 Share-based Payment;

"incentive plan" means any plan providing compensation that depends on achieving certain performance goals or similar conditions within a specified period;

"incentive plan award" means compensation awarded, earned, paid, or payable under an incentive plan;

"NEO" or "named executive officer" means each of the following individuals:

(a) a CEO;

(b) a CFO;

(c) each of the three most highly compensated executive officers of the company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than CDN$150,000, as determined in accordance with subsection 1.3(6), for that financial year; and

(d) each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year;

"non-equity incentive plan" means an incentive plan or portion of an incentive plan that is not an equity incentive plan;

"option-based award" means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights, and similar instruments that have option-like features;

"plan" includes any plan, contract, authorization, or arrangement, whether or not set out in any formal document, where cash, securities, similar instruments or any other property may be received, whether for one or more persons;

"replacement grant" means an option that a reasonable person would consider to be granted in relation to a prior or potential cancellation of an option;

"repricing" means, in relation to an option, adjusting or amending the exercise or base price of the option, but excludes any adjustment or amendment that equally affects all holders of the class of securities underlying the option and occurs through the operation of a formula or mechanism in, or applicable to, the option;

"share-based award" means an award under an equity incentive plan of equity-based instruments that do not have option-like features, including, for greater certainty, common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units, and stock.

For the purpose of this Statement of Executive Compensation, all amounts herein are reported in U.S. dollars unless stated otherwise.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis

The overall objective of the Issuer's compensation strategy is to offer short-term, medium-term and long- term compensation components to ensure that the Issuer has in place programs to attract, retain and develop management of the highest caliber and has in place a process to provide for the orderly succession of management, including receipt on an annual basis of any recommendations of the CEO, if any, in this regard. The Issuer currently has short-term, medium-term and long-term compensation components in place, and intends to further develop these compensation components. The objectives of the Issuer's compensation policies and procedures are to align the interests of the Issuer's employees with the interests of its shareholders.

The Issuer has a compensation committee (the "Compensation Committee") comprised of Malcolm Clay, Cathy McLay and David Richardson and a nominating committee (the "Nominating Committee") comprised of Malcolm Clay, Fraser Atkinson and Mark Achtemichuk. Cathy McLay is the chair of the Compensation Committee and Malcolm Clay is the chair of the Nominating Committee. All tasks related to developing and monitoring the Issuer's approach to the compensation of officers of the Issuer and to developing and monitoring the Issuer's approach to the nomination of directors to the board of directors of the Issuer (the "Board") are performed by the members of these committees in consultation with the Board. The compensation of the NEOs and the Issuer's employees are reviewed, recommended and approved by these committees in consultation with the Board.

Compensation to NEOs may include a base salary that constitutes the Issuer's short-term compensation component. Such salary takes into account his or her existing professional qualifications and experience. The NEOs' performances and salaries are to be reviewed periodically on the anniversary of their employment with the Issuer. Increases in salary are to be evaluated on an individual basis and are performance and market-based.

The Issuer may also grant incentive securities to NEOs to satisfy the long-term compensation component. The Board may also award bonuses to its NEOs. The amount and award of such bonuses is discretionary, depending on, among other factors, the financial performance of the Issuer and the position of a NEO. The objective of GreenPower's base salary and bonus compensation elements is to compensate NEO's at competitive market levels in order to attract and retain the best individuals for these positions in order to achieve the Issuer's long-term plans and objectives. In addition, the objective of the company's stock option compensation is to align each NEO's interests with the interests of GreenPower's shareholders. Depending on the NEO's position, the amount of the grant, and other factors, the vesting schedule of stock option grants is generally over a one year to a three-year period. This enables the stock option grant to provide both short-term and long-term incentive components to employees, which we believe better aligns the NEO's interests with those of GreenPower's shareholders, as it provides incentives for the NEO to consider the longer term business interests of the Issuer when fulfilling the duties of their role.

To make its recommendations on the compensation of our NEO's, our compensation committee takes into account the types of compensation and the amounts paid to directors and officers of a peer group of companies listed on the Nasdaq stock exchange in the same or similar industry with market capitalizations under $2 billion. In a review conducted during the year ended March 31, 2021, companies included in this peer group are Workhorse Group, Inc. (Nasdaq: WKHS); Arcimoto (Nasdaq: FUV); Blink Charging Co. (Nasdaq:BLNK); Absolute Software (TSX: ABST, Nasdaq: ABST) and Kandi Technologies Group, Inc. (Nasdaq: KNDI). The Compensation Committee considers the peer group appropriate as these companies share GreenPower's listing exchange, are in the same or similar industry, and within a comparable market capitalization range.

In determining the amount of stock option grants to the CEO, CFO and President, the Compensation Committee considers market levels of grants to the peer group of comparable companies used to determine overall compensation levels. For grants to NEO's other than the CEO, CFO and President, the Compensation Committee considers recommendations from its senior executive officers, in addition to considering market levels of compensation for similar roles at comparable companies, and overall business performance.

Subsequent to the year ended March 31, 2021, GreenPower's Compensation Committee approved an increase to the base salary of its President of $25,000 per annum, and an increase to the base salary of the CFO of CDN$25,000 per annum. In addition, the Compensation Committee approved a bonus program for the CEO, the President and the CFO, with maximum payouts of $250,000, $137,500, and CDN$125,000 respectively. 60% of the potential bonus payout for each of these individuals will be based on achieving consolidated sales revenue, based on GreenPower's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated. The remaining 40% of the potential bonus payout to these three executives will be based on achieving a range of business objectives, the measurement of which is subjective, that are aligned with each executive's responsibilities, relating to areas including but not limited to production, supply chain, cost improvements, employees, financing, investor relations activities and regulatory filings and reporting.

The Issuer has not placed any restrictions on an NEO or a director's ability to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

Risks Associated with Compensation Policies and Practices

In fulfilling its duties for oversight and administration of the Issuer's executive compensation program, the Compensation Committee considers risks associated with the Issuer's compensation policies and practices. The potential risks of the Issuer's compensation policies and practices are considered on an annual basis as part of the evaluation of the NEO's performance and determination of the overall compensation for the coming year, and more frequently where required or where appropriate. The Compensation Committee mitigates the risk of an NEO taking excessive or inappropriate risks by structuring the overall compensation to include both short-term and long-term components as well as fixed and variable elements. The long-term compensation includes stock options with vesting profiles between one to three years, which helps align management's interests with those of the Issuer, and helps to manage risk by linking a portion of the NEO's overall compensation to the longer term performance of the Issuer.

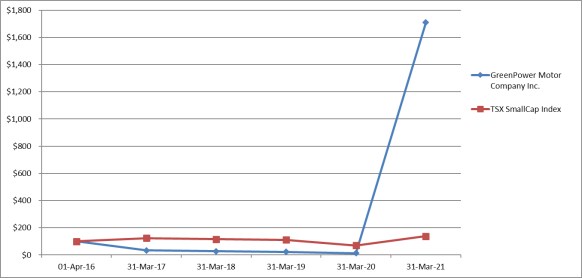

Performance Graph

The above graph compares the total shareholder return on a CDN$100 investment in the Issuer's common shares (the "Shares") to the same investment in the S&P/TSX Venture Composite Index over the same period. During the year ended March 31, 2021, the Shares outperformed the S&P/TSX Venture Composite Index by a significant margin. The above graph shows how a CDN$100 investment in the Issuer on April 1, 2016, with a closing stock price of $1.82 on such date, would have grown to CDN$1,709.34 on March 31, 2021, with a closing stock price of CDN$31.11 on such date.

As illustrated in the above chart, GreenPower's common shares have significantly outperformed the S&P/TSX Venture Composite Index over the past five years. The compensation to executive officers is set at levels that are comparable to similar roles at similar companies, and are comprised of base salary, bonuses, and option-based awards. The amount and award of bonuses is discretionary, depending on, among other factors, the financial performance of the Issuer and the position of a NEO.

Base salary and bonuses paid to NEO's has not been driven by share price performance, and rather are based on market factors. The positive share price performance in the year ended March 31, 2021 positively impacted the Black Scholes value of option based awards granted to the CEO, CFO and President, however these options vest over a three year period, as compared to the standard one year vesting period of the majority of options issued to the CEO, CFO and President in prior periods.

Share-based and Option-based Awards

The Issuer provides Option-based Awards to its employees and executive officers, and the Issuer does not offer Share-based Awards to executive officers, but may choose to do so in the future. Option-based Awards are generally granted to employees and executive officers on an annual basis based on the Issuer's performance, the Individual's role, and the Individual's performance based on the expectations of the role. In addition, option-based awards are typically granted to NEO's on their initial hire date as part of their long-term compensation. Previous grants are taken into account when considering new grants of options.

Compensation Governance

The Issuer Compensation Committee consists of Malcolm Clay, Cathy McLay and David Richardson. Cathy McLay is the chair of the Committee. Each of the members of the Compensation Committee are independent. All tasks related to developing and monitoring the Issuer's approach to the compensation of officers of the Issuer and to developing and monitoring the Issuer's approach to the nomination of directors to the Board are performed by the members of these committees in consultation with the Board. The compensation of the NEOs and the Issuer's employees are reviewed, recommended and approved by these committees in consultation with the Board.

Ms. McLay worked at TransLink from September 2008 to March 2018, most recently as the Chief Financial Officer and Executive Vice President Finance and Corporate Services. Previously, Ms. McLay worked in the forest sector in several senior executive roles at Canfor and Howe Sound Pulp and Paper. Ms. McLay currently serves on the boards of Vancouver Fraser Port Authority, Insurance Corporation of British Columbia and Coast Mountain Bus Company. She has previously served on the boards of Providence Health Care, Transportation Property & Casualty Company Inc., British Columbia Rapid Transit Company Inc, Vancouver Coastal Health and Canfor Asia Corporation. Ms. McLay is an International Certified Business Coach, a fellow of the Chartered Professional Accountants of British Columbia and a graduate of the Institute of Corporate Directors Education Program.

Mr. Clay holds a Bachelor of Arts degree from the University of British Columbia (1965) and his designation as a CPA, CA from the Chartered Professional Accountants, British Columbia (1969), and an FCA from the Chartered Professional Accountants, British Columbia (1992). Mr. Clay is currently retired, and since retirement has been active as a financial consultant and corporate director. He was a Partner with KPMG LLP from September 1975 to September 2002. Mr. Clay has been a director of Minco Capital Corporation since 2007, and between 2007 and 2012 he was a director of Zongshen PEM Power Systems Inc., a large manufacturer of motorcycles and battery powered scooters based in China.

Mr. Richardson has been the President and Chief Executive Officer of Octaform Systems Inc. since May 1997. Mr. Richardson is Director Emeritus of Ducks Unlimited Canada following 20 years of service on the board. Mr. Richardson was a founding member and director of the Asia Pacific Foundation and a leader on various government trade missions to Asia. In addition, he was a director of the Canada China Trade Council and Chairman of the Agriculture Committee. Mr. Richardson has served on a number of public and private boards throughout his career and continues to hold several other directorship positions. Mr. Richardson has received the ICD.D designation from the Institute of Corporate Directors.

We adopted a formal Compensation Committee Charter on August 23, 2020. Our compensation committee, in consultation with the Board, conducts reviews with regards to the compensation of our officers and directors once a year. Neither the board of directors nor the compensation committee has retained a compensation consultant during the year ended March 31, 2021, or between March 31, 2021 and the filing date of this Statement of Executive Compensation.

SUMMARY COMPENSATION TABLE

Summary Compensation Table

The following table sets out information concerning compensation earned by, paid to, or awarded to each NEO in the fiscal year ended March 31, 2021 for each of the Issuer's three most recently completed financial years (1):

|

|

Non-equity |

|

|||||||

|

Name and |

Fiscal Year |

Salary |

Share- |

Option- |

Annual |

Long- |

Pension |

All other |

Total |

|

Fraser Atkinson(5) |

2021 |

Nil |

N/A |

1,097,124 |

N/A |

N/A |

N/A |

213,750(6) |

1,310,874 |

|

Brendan Riley(7) President and director |

2021 |

231,875 |

N/A |

1,097,124 |

N/A |

N/A |

N/A |

63,425 |

1,392,424 |

|

Michael Sieffert(8) |

2021 |

159,408(9) |

N/A |

1,097,124 |

N/A |

N/A |

N/A |

22,928 |

1,279,460 |

|

Ryne Shetterly(10), |

2021 |

152,450 |

N/A |

15,629 |

N/A |

N/A |

N/A |

27,300 |

195,379 |

|

Henry Caouette(11) |

2021 |

132,000 |

N/A |

7,814 |

N/A |

N/A |

N/A |

200 |

140,014 |

(1) All values in the table are expressed in US$.

(2) During the three fiscal years ending March 31, 2021, none of the NEOs were granted share based awards, nor did they receive non-equity incentive plan compensation, and the Issuer did not offer NEOs a pension plan.

(3) Option-based awards were calculated at the fair market value at the time of grant under the Black-Scholes method. The value of options with an exercise price denominated in CDN$ was converted to US$ at exchange rates of $0.76, $0.75, and $0.75 in the years ended March 31, 2021, March 31, 2020, and March 31, 2019 respectively, and these exchange rates were the average exchange rates used for financial reporting purposes for the respective years.

(4) None of the NEOs are entitled to perquisites or other personal benefits which, in the aggregate, are worth over CDN$50,000 or over 10% of their base salary. Other compensation comprised of benefits and discretionary bonus.

(5) Mr. Atkinson was appointed as CEO on June 12, 2019.

(6) This consulting fee was paid to Koko Financial Services Ltd., a private company owned by Mr. Atkinson, as compensation for Mr. Atkinson's provision of services of Koko Financial Services Ltd. fulfilling the duties of CEO of GreenPower Motor Company Inc. Neither Mr. Atkinson nor Koko Financial Services Ltd. received additional compensation for Mr. Atkinson's services as a director of the Issuer. Pursuant to the amended management services agreement between the Issuer and Koko Financial Services Ltd. dated February 26, 2020, GreenPower agreed to pay Koko Financial Services Ltd. a base fee of $225,000 per annum (plus GST) payable monthly commencing January 1, 2020. In addition, we agreed to pay Koko Financial Services Ltd. a retroactive payment of $57,500 (plus GST) in instalments to reflect the appointment of Fraser Atkinson to be the Issuer's CEO on June 12, 2019.

(7) Brendan Riley was appointed President of the Issuer on September 19, 2016 and was appointed as a director of the Issuer on July 3, 2019.

(8) Michael Sieffert was appointed as the CFO and secretary of the Issuer on December 1, 2018.

(9) Salary paid to Michael Sieffert was converted from CDN$ to US$ at exchange rates of $0.76, $0.76, and $0.75 in the years ended March 31, 2021, March 31, 2020, and March 31, 2019 respectively, and these exchange rates were the average exchange rates used for financial reporting purposes for the respective years.

(10) Ryne Shetterly was appointed as the Vice President of Sales and Marketing the Issuer on December 26, 2017.

(11) Henry Caouette was appointed as the Director of Product Development of the Issuer on April 19, 2018.

Narrative Discussion

Employment, Consulting and Management Agreements

Fraser Atkinson

On February 26, 2020, the Issuer entered into a management services agreement with Koko Financial Services Inc. which was effective starting June 12, 2019 for a term of one year, however if neither party has provided the other party with a notice of termination then the agreement automatically renews on a month to month basis. Pursuant to this agreement, Koko Financial Services Inc. accepted the appointment with the designated personnel Fraser Atkinson acting as the CEO of the Issuer and all of the Issuer's subsidiary companies. Mr. Atkinson's current duties are to lead in conjunction with the Board, in the development of the Issuer's strategy, and to oversee the implementation of the strategy; to ensure the Issuer is appropriately staffed and organized, to assess business risks and ensure effective controls and systems are in place; to work with the management team to execute on the strategic direction of the Issuer, including overseeing the material undertakings and activities of the Issuer and ensure that the directors are properly informed so they can form appropriate judgments. So long as this management services agreement remains in effect, the Issuer agreed to pay Koko Financial Services Inc. a base fee of $18,750 per month (plus applicable taxes) for carrying out the services payable on the last day of each month. The base fee does not include any bonuses that might be paid to Koko Financial Services Inc. for carrying out the services. During November 2020 Mr. Atkinson received a grant of 100,000 stock options that are exercisable at a price of $20.00, have a term of five years, and vest over a three-year period. Subsequent to the year ended March 31, 2021, GreenPower's Compensation Committee approved a bonus program for Mr. Atkinson with a maximum payout of $250,000. 60% of the potential bonus payout will be based on achieving consolidated sales revenue, based on GreenPower's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated, and the remaining 40% of the potential bonus payout be based on achieving a range of business objectives aligned with Mr. Atkinson's responsibilities, the measurement of which is subjective.

Brendan Riley

On September 19, 2016, the Issuer entered into an employment agreement with Brendan Riley. Pursuant to this agreement, Mr. Riley agreed to be employed as the President of the Issuer and agreed to fulfil any and all duties, roles and responsibilities relevant to this position as set out in the employment agreement. Mr. Riley's employment commenced on November 1, 2016 at a base salary of $225,000 plus bonuses and sales commission. Effective October 1, 2020 Mr. Riley's base compensation was increased to $250,000 per annum and during November 2020 Mr. Riley received a one time bonus of $50,000, and a grant of 100,000 stock options that are exercisable at a price of $20.00, have a term of five years, and vest over a three-year period. Subsequent to the year ended March 31, 2021, GreenPower's Compensation Committee approved an increase to the base salary of Mr. Riley to $275,000 per annum. In addition, subsequent to the year ended March 31, 2021, the Compensation Committee approved a bonus program for Mr. Riley with a maximum payout of $137,500. 60% of the potential bonus payout will be based on achieving consolidated sales revenue, based on GreenPower's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated, and the remaining 40% of the potential bonus payout be based on achieving a range of business objectives aligned with Mr. Riley's responsibilities, the measurement of which is subjective.

Michael Sieffert

On November 15, 2018, the Issuer entered into an employment agreement with Michael Sieffert. Pursuant to this agreement, Mr. Sieffert agreed to be employed as the CFO of the Issuer and agreed to fulfil any and all duties, roles and responsibilities relevant to this position as set out in the employment agreement. Mr. Sieffert's employment commenced on November 20, 2018, and for the first three months of his employment we agreed to pay Mr. Sieffert a base salary of CDN$200,000 per year (subject to applicable income tax withholdings) for carrying out the services, and after three months of employment, his base salary increased to CDN$225,000 per year. The base salary does not include any bonuses that might be paid to Mr. Sieffert for carrying out the services. Mr. Sieffert received performance bonuses of $22,928 and $41,210 for the years ended March 31, 2021, and March 31, 2020 respectively. Subsequent to the year ended March 31, 2021, GreenPower's Compensation Committee approved an increase to the base salary of Mr. Sieffert to CDN$250,000 per annum. In addition, subsequent to the year ended March 31, 2021, the Compensation Committee approved a bonus program for Mr. Sieffert with a maximum payout of CDN$125,000. 60% of the potential bonus payout will be based on achieving consolidated sales revenue, based on GreenPower's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated, and the remaining 40% of the potential bonus payout be based on achieving a range of business objectives aligned with Mr. Sieffert's responsibilities, the measurement of which is subjective.

Ryne Shetterly

On December 26, 2017, the Issuer entered into an employment agreement with Ryne Shetterly. Pursuant to this agreement, Mr. Shetterly agreed to be employed as the Vice President of Sales and Marketing for School Buses of the Issuer and agreed to fulfil any and all duties, roles and responsibilities relevant to this position as set out in the employment agreement. Mr. Shetterly's employment commenced on January 2, 2018. Pursuant to the employment agreement, the Issuer agreed to pay Mr. Shetterly an annual base salary of $150,000, plus a car allowance of $500 per month and commissions based on sales or leases of buses. Mr. Shetterly is also eligible for stock option grants from the Issuer's stock option plan. Mr. Shetterly received sales commissions of $27,300 for the period ended March 31, 2021, and a performance bonus of $56,000 for the period ended March 31, 2020.

Henry Caouette

On April 19, 2018, the Issuer entered into an employment agreement with Henry Caouette. Pursuant to this agreement, Mr. Caouette is employed as the Director of Product Development for the Issuer and agreed to fulfil any and all duties, roles and responsibilities relevant to this position as set out in the employment agreement. Mr. Caouette's employment commenced on April 24, 2018. Pursuant to the employment agreement, the Issuer agreed to pay Mr. Caouette an annual base salary of $132,000, and Mr. Caouette is eligible for bonuses and for stock option grants from the Issuer's stock option plan.

INCENTIVE PLAN AWARDS

Outstanding Share-based Awards and Option-based Awards

The following table sets out information concerning the option-based and share-based awards held by our NEOs as at March 31, 2021:

|

|

Option-based Awards |

Share-based Awards(1) |

|||||

|

Name |

Number of (#) |

Option (CDN$) |

Option |

Value of (CDN$) |

Number (#) |

Market ($) |

Market or ($) |

|

Fraser Atkinson |

14,286 |

5.25 |

February 2, 2022 |

369,435 |

Nil |

N/A |

N/A |

|

85,713 |

5.25 |

May 26, 2022 |

2,216,538 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

May 4, 2023 |

394,436 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

February 12, 2024 |

394,436 |

Nil |

N/A |

N/A |

|

|

28,571 |

2.59 |

January 30, 2025 |

814,485 |

Nil |

N/A |

N/A |

|

|

100,000 |

20.00(3) |

November 19, 2025 |

479,421(2, 3) |

Nil |

N/A |

N/A |

|

|

Brendan Riley |

71,429 |

4.34 |

October 27, 2021 |

1,912,154 |

Nil |

N/A |

N/A |

|

14,286 |

3.15 |

December 18, 2022 |

399,437 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

February 12, 2024 |

394,436 |

Nil |

N/A |

N/A |

|

|

35,714 |

2.59 |

January 30, 2025 |

1,018,563 |

Nil |

N/A |

N/A |

|

|

100,000 |

20.00(3) |

November 19, 2025 |

479,421(2, 3) |

Nil |

N/A |

N/A |

|

|

Michael Sieffert |

50,000 |

3.01 |

November 30, 2023 |

1,405,000 |

Nil |

N/A |

N/A |

|

28,571 |

2.59 |

January 30, 2025 |

814,845 |

Nil |

N/A |

N/A |

|

|

100,000 |

20.00(3) |

November 19, 2025 |

479,421(2, 3) |

Nil |

N/A |

N/A |

|

|

Ryne Shetterly |

1,786 |

3.50 |

May 4, 2023 |

49,311 |

Nil |

N/A |

N/A |

|

13,393 |

2.59 |

January 30, 2025 |

381,968 |

Nil |

N/A |

N/A |

|

|

5,357 |

4.90 |

July 3, 2025 |

140,407 |

Nil |

N/A |

N/A |

|

|

Henry Caouette |

7,143 |

3.50 |

May 4, 2023 |

197,218 |

Nil |

N/A |

N/A |

|

7,143 |

2.59 |

January 30, 2025 |

203,718 |

Nil |

N/A |

N/A |

|

|

3,571 |

4.90 |

July 3, 2025 |

93,596 |

Nil |

N/A |

N/A |

(1) Our NEO's were not granted share-based awards during the year ended March 31, 2021.

(2) Based on CDN$31.11, being the closing price of the Shares on the TSX Venture Exchange on March 31, 2021. Value of unexercised in the money options are expressed in CDN$, and options with an exercise price in US$ have been converted to CDN$ at an exchange rate of $0.76. This exchange rate is the average exchange rates used for financial reporting purposes for the twelve months ended March 31, 2021.

(3) Exercise price in US$.

Incentive Plan Awards - Value vested or Earned During the Year

The following table indicates, for each of our NEOs, a summary of the value of the option-based and share-based awards vested in accordance with their terms during the year ended March 31, 2021:

|

|

(CDN$) |

($) |

Non-equity incentive plan ($) |

|

Fraser Atkinson |

$934,700 |

N/A |

N/A |

|

Brendan Riley |

$1,238,264 |

N/A |

N/A |

|

Michael Sieffert |

$1,285,950 |

N/A |

N/A |

|

Ryne Shetterly |

$350,778 |

N/A |

N/A |

|

Henry Caouette |

$221,361 |

N/A |

N/A |

(1) Calculated using the closing share price on the TSX Venture Exchange on March 31, 2021, being CDN$31.11, less the exercise price, multiplied by the number of shares vested during the year.

(2) Our NEO's did not receive share-based awards or non-equity incentive plan compensation during the year.

Narrative Discussion

The Issuer's current stock option plan is the 2019 Rolling Stock Option Plan (the "2019 Plan"). The following information is intended as a brief description of the 2019 Plan and is qualified in its entirety by the full text of the 2019 Plan.

Purpose

The purpose of the 2019 Plan is to: (i) enable the Issuer and any affiliate of the Issuer to attract and retain the types of employees, consultants, directors and such other persons as the plan administrator may select who will contribute to the Issuer's long range success; (ii) provide incentives that align the interests of employees, consultants, directors and such other persons as the plan administrator may select with those of the Issuer's shareholders; and (iii) promote the success of the Issuer's business.

Description of the 2019 Plan

On May 14, 2019, our board of directors adopted the 2019 Rolling Stock Option Plan, which is a "rolling" stock option plan, whereby the aggregate number of common shares of our company reserved for issuance, together with any other common shares of our company reserved for issuance under any other plan or agreement of our company, must not exceed 10% of the total number of issued common shares of our company (calculated on a non-diluted basis) at the time a stock option is granted.

We will not grant any additional stock options under our 2016 Fixed Stock Option Plan and all new stock options will be granted under our 2019 Rolling Stock Option Plan.

The following information is a brief description of our 2019 Rolling Stock Option Plan:

1. Our board of directors must establish the exercise price at the time each stock option is granted, subject to the following conditions:

(a) if our common shares are listed on the TSX Venture Exchange, the exercise price must not be less than the minimum prevailing price permitted by the policies of the TSX Venture Exchange;

(b) if our common shares are not listed, posted and trading on any stock exchange or bulletin board, then the exercise price will be determined by our board of directors at the time of granting;

(c) if a stock option is granted within 90 days of a distribution by a prospectus by our company, the exercise price must not be less than the price that is the greater of the minimum prevailing price permitted by the policies of the TSX Venture Exchange and the per share price paid by public investors for our common shares acquired under the distribution by the prospectus, with the 90 day period beginning on the date a final receipt is issued for the prospectus; and

(d) in all other cases, the exercise price must be determined in accordance with the rules and regulations of any applicable regulatory bodies.

2. Upon expiry of a stock option, or in the event a stock option is otherwise terminated for any reason, without having been exercised in full, the number of our common shares in respect of the expired or terminated stock option will again be available for a grant under our 2019 Rolling Stock Option Plan.

3. No stock option granted under our 2019 Rolling Stock Option Plan may have an expiry date exceeding 10 years from the date on which the stock option is granted (unless automatically extended as a result of a blackout period as described below).

4. The expiry date of each stock option will be automatically extended if the expiry date falls within a period during which we prohibit optionees from exercising their stock options, provided that: (a) the blackout period has been formally imposed by our company pursuant to our internal trading policies as a result of the bona fide existence of undisclosed Material Information (as defined in the policies of the TSX Venture Exchange). For greater certainty, in the absence of our company formally imposing a blackout period, the expiry date of any stock options will not be automatically extended in any circumstances; (b) the blackout period expires upon the general disclosure of the undisclosed Material Information and the expiry date of the affected stock options is extended to no later than ten business days after the expiry of the blackout period; and (c) the automatic extension will not be permitted where the optionee or our company is subject to a cease trade order (or similar order under applicable securities laws) in respect of our securities.

5. Stock options granted to any one individual in any 12-month period cannot exceed more than 5% of the issued common shares of our company, unless we have obtained disinterested shareholder approval.

6. Stock options granted to any one consultant in any 12-month period cannot exceed more than 2% of the issued common shares of our company, without the prior consent of the TSX Venture Exchange.

7. Stock options granted to all persons, in aggregate, conducting investor relations activities in any 12 month period cannot exceed more than 2% of the issued common shares of our company, without the prior consent of the TSX Venture Exchange.

8. Stock options issued to optionees performing investor relations activities must vest in stages over 12-months with no more than one quarter of the stock options vesting in any three month period.

9. If a director, employee or consultant of our company is terminated for cause, then any stock option granted to the option holder will terminate immediately upon the option holder ceasing to be a director, employee, or consultant of our company by reason of termination for cause.

10. If an option holder ceases to be a director, employee or consultant of our company (other than by reason of death, disability or termination of services for cause), or if an optionee resigns, as the case may be, then any stock option granted to the holder that had vested and was exercisable on the date of termination will expire on the earlier of the expiry date and the date that is 90 days following the date that the holder ceases to be a director, employee or service provider of our company.

11. If the engagement of an option holder engaged in investor relations activities as a consultant is terminated for any reason other than cause, disability or death, any stock option granted to such holder that was exercisable and had vested on the date of termination will be exercisable until the earlier of the expiry date and the date that is 30 days after the effective date of the holder ceasing to be a consultant.

12. If an option holder dies, the holder's lawful personal representatives, heirs or executors may exercise any stock option granted to the holder that had vested and was exercisable on the date of death until the earlier of the expiry date and one year after the date of death of the holder.

13. If an option holder ceases to be a director, employee or consultant of our company as a result of a disability, the holder may exercise any stock option granted to the holder that had vested and was exercisable on the date of disability until the earlier of the expiry date and one year after the date of disability.

14. If an option holder ceases to be one type of eligible person but concurrently is or becomes one or more other type of eligible person, the stock option will not terminate but will continue in full force and effect and the option holder may exercise the stock option until the earlier of (a) the expiry date, and (b) the applicable date where the option holder ceases to be any type of eligible person. If the option holder is an employee, the stock option will not be affected by any change of the option holder's employment where the option holder continues to be employed by our company or an affiliate of our company.

15. Stock options granted to directors, employees or consultants will vest when granted unless determined by our board of directors on a case by case basis, other than stock options granted to consultants performing investor relations activities, which will vest in stages over 12 months with no more than one quarter of the stock options vesting in any three month period.

16. Our 2019 Rolling Stock Option Plan is administered by our board of directors who has the full authority and sole discretion to grant stock options under our 2019 Rolling Stock Option Plan to any eligible party, including themselves.

17. Stock options granted under our 2019 Rolling Stock Option Plan are not assignable or transferable by an option holder.

18. Our board of directors may from time to time, subject to regulatory or shareholder approval, amend or revise the terms of our 2019 Rolling Stock Option Plan.

PENSION PLAN BENEFITS

The Issuer does not have any pension plans that provide for payments or benefits to the NEOs at, following, or in connection with retirement, including any defined benefits plan or any defined contribution plan. The Issuer does not have a deferred compensation plan with respect to any NEO.

TERMINATION AND CHANGE OF CONTROL BENEFITS

We have no contract, agreement, plan or arrangement, whether written or unwritten, that provides for payments to our directors or members of our management at, following or in connection with any termination whether voluntary, involuntary or constructive, resignation, retirement, a change in control of the Issuer or a change in their responsibilities.

In the event of a change of control, as defined in the 2019 Plan, then all outstanding stock options, whether fully vested and exercisable or remaining subject to vesting provisions or other limitations on exercise, will be exercisable in full to enable the Shares subject to such stock options to be issued and tendered to such bid.

DIRECTOR COMPENSATION

Director Compensation Table

The following table sets out information concerning compensation earned by, paid to, or awarded to the non-executive directors of the Issuer for their service as members of the Board and, if applicable, as members of any committee of the Board for the year ended March 31, 2021:

|

Name |

Fees |

Share- |

Option- |

Non-equity |

Pension |

All other |

Total |

|

Mark Achtemichuk |

8,099 |

N/A |

68,285 |

N/A |

N/A |

Nil |

76,384 |

|

Malcolm Clay |

11,339 |

N/A |

68,285 |

N/A |

N/A |

Nil |

79,624 |

|

David Richardson |

8,099 |

N/A |

68,285 |

N/A |

N/A |

Nil |

76,384 |

|

Cathy McLay |

9,719 |

N/A |

68,285 |

N/A |

N/A |

Nil |

78,004 |

(1) Fees earned by directors expressed in CDN$ and were converted from amounts paid in US$ using an exchange rate of $0.76 US per CDN$, which is the average exchange rate for the year ended March 31, 2021, used for financial reporting purposes.

(2) The Issuer's directors did not receive share-based awards, non-equity incentive plan compensation, or pension benefits during the year ended March 31, 2021.

(3) Option-based awards calculated at the fair market value at the time of grant under the Black-Scholes method.

Narrative Description

GreenPower's non-executive directors are eligible for stock options pursuant to the 2019 Plan which are typically granted on an annual basis and are based on business performance, personal performance, and are granted at a level that is consistent with director stock option grants of comparable public companies. GreenPower's non-executive directors did not receive share-based awards, non-equity incentive plan compensation or a pension in the year ended March 31, 2021. On December 4, 2020 the board of directors of GreenPower agreed to set director's fees for each non-executive director of GreenPower at $25,000 per annum plus an additional $5,000 per annum for each committee chair. Between December 4, 2020 and the date of this report, Malcolm Clay was the chair of the Audit Committee and the chair of the Nomination Committee and Cathy McLay was the chair of the Compensation Committee. On December 4, 2020, GreenPower's board of directors granted 5,000 stock options exercisable at $20.00 per share to each of the Issuer's non-executive directors. The stock options have a term of five years, and vest 25% three months after the grant date, 25% six months after the grant date, 25% nine months after the grant date, and 25% twelve months after the grant date.

Share-based Awards, Option-based Awards and Non-equity Incentive Plan Compensation

The following table sets out information concerning the option-based and share-based awards held by our non-executive directors as at March 31, 2021:

|

|

Option-based Awards |

Share-based Awards(1) |

|||||

|

Name |

Number of (#) |

(CDN$) |

Option |

Value of (CDN$)(2) |

(#) |

Market ($) |

Market or ($) |

|

Mark Achtemichuk |

14,286 |

5.25 |

February 2, 2022 |

369,436 |

Nil |

N/A |

N/A |

|

5,357 |

5.25 |

May 26, 2022 |

138,532 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

May 4, 2023 |

394,436 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

February 12, 2024 |

394,436 |

Nil |

N/A |

N/A |

|

|

42,857 |

2.59 |

January 30, 2025 |

1,222,282 |

Nil |

N/A |

N/A |

|

|

5,000 |

20.00(3) |

December 4, 2025 |

23,971 |

Nil |

N/A |

N/A |

|

|

Malcolm Clay |

14,286 |

5.25 |

February 2, 2022 |

369,436 |

Nil |

N/A |

N/A |

|

57,143 |

5.25 |

May 26, 2022 |

1,477,718 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

May 4, 2023 |

394,436 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

February 12, 2024 |

394,436 |

Nil |

N/A |

N/A |

|

|

28,571 |

2.59 |

January 30, 2025 |

814,845 |

Nil |

N/A |

N/A |

|

|

5,000 |

20.00(3) |

December 4, 2025 |

23,971 |

Nil |

N/A |

N/A |

|

|

David Richardson |

14,285 |

5.25 |

February 2, 2022 |

369,410 |

Nil |

N/A |

N/A |

|

14,286 |

3.50 |

May 4, 2023 |

394,436 |

Nil |

N/A |

N/A |

|

|

14,286 |

3.50 |

February 12, 2024 |

394,436 |

Nil |

N/A |

N/A |

|

|

28,571 |

2.59 |

January 30, 2025 |

814,845 |

Nil |

N/A |

N/A |

|

|

5,000 |

20.00(3) |

December 4, 2025 |

23,971 |

Nil |

N/A |

N/A |

|

|

Cathy McLay |

42,857 |

2.59 |

January 30, 2025 |

1,222,282 |

Nil |

N/A |

N/A |

|

5,000 |

20.00(3) |

December 4, 2025 |

23,971 |

Nil |

N/A |

N/A |

(1) Our director's were not granted share-based awards during the year ended March 31, 2021.

(2) Based on CDN$31.11, being the closing price of the Shares on the TSX Venture Exchange on March 31, 2021. Value of unexercised in the money options are expressed in CDN$, and options with an exercise price in US$ have been converted to CDN$ at an exchange rate of $0.76. This exchange rate is the average exchange rates used for financial reporting purposes for the twelve months ended March 31, 2021.

(3) Exercise price in US$.

Incentive Plan Awards - Value vested or Earned During the Year

The following table indicates, for each of our non-executive directors, a summary of the value of the option-based and share-based awards vested in accordance with their terms during the year ended March 31, 2021:

|

|

Option-based awards - (CDN$) |

Share-based awards - ($) |

Non-equity incentive plan ($) |

|

Mark Achtemichuk |

$1,228,274 |

N/A |

N/A |

|

Malcolm Clay |

$820,838 |

N/A |

N/A |

|

David Richardson |

$820,838 |

N/A |

N/A |

|

Cathy McLay |

$1,228,274 |

N/A |

N/A |

(1) Calculated using the closing share price of the shares on the TSX Venture Exchange on March 31, 2021, being CDN $31.11, less the exercise price.

(2) Our director's did not receive share-based awards or non-equity incentive plan compensation during the year.

Narrative Description

The options granted to GreenPower's non-executive directors on January 30, 2020 vested in their entirety during the year ended March 31, 2021, and 25% of the options granted to GreenPower's non-executive directors on December 4, 2020 vested during the year ended March 31, 2021.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- GreenPower Motor Co. (GP) Appoints Paul Start as VP of Sales for the Company's School Bus Group

- Timberland Bancorp Reports Second Fiscal Quarter Net Income of $5.71 Million

- Cantaloupe, Inc. to Report Third Quarter Fiscal Year 2024 Results on May 9, 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share