Form 6-K Electra Battery Material For: Mar 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

| For the month of | May | 2022 | |

| Commission File Number | 001-41356 |

| Electra Battery Materials Corporation |

| (Translation of registrant’s name into English) |

|

133 Richmond Street West, Suite 602 Toronto, Ontario, Canada M5H 2L3 (416) 900-3891 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | ¨ | Form 40-F | x |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 to this Form 6-K of Electra Battery Materials Corporation (the “Company”) are hereby incorporated by reference as exhibits to the Registration Statements on Form F-10 (File No. 333-264982) and Form S-8 (File No. 333-264589) of the Company, as amended or supplemented.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Electra Battery Materials Corporation | ||||||

| (Registrant) | ||||||

| Date: | May 26, 2022 | By: | /s/ Trent Mell | |||

| Name: | Trent Mell | |||||

| Title: | Chief Executive Officer and Director | |||||

3

Exhibit 99.1

| ELECTRA BATTERY MATERIALS CORPORATION |

| (FORMERLY FIRST COBALT CORP.) |

| CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021 |

| (EXPRESSED IN THOUSANDS OF CANADIAN DOLLARS) |

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| Approved on behalf of the Board of Directors and authorized for issue on May 26, 2022 | ||

| /s/ Susan Uthayakumar | /s/ Trent Mell | |

| Susan Uthayakumar, Director | Trent Mell, Director | |

Page 2 of 22

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Page 3 of 22

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Page 4 of 22

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Page 5 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| 1. | Nature of Operations |

Electra Battery Materials Corporation (the “Company”, “Electra”) was incorporated on July 13, 2011 under the Business Corporations Act of British Columbia (the “Act”). On September 4, 2018, the Company filed a Certificate of Continuance into Canada and adopted Articles of Continuance as a Federal Company under the Canada Business Corporations Act (the “CBCA”). On December 6, 2021, the Company changed its corporate name from First Cobalt Corp. to Electra Battery Materials Corporation. The Company is in the business of producing battery materials for the electric vehicle supply chain. The Company is focused on building an ethical supply of cobalt, nickel and recycled battery materials.

Electra is a public company which is listed on the Toronto Venture Stock Exchange (TSX-V) (under the symbol ELBM). On April 27, 2022, the Company began trading on the NASDAQ (under the symbol ELBM). The Company’s registered office is Suite 2400, Bay-Adelaide Centre, 333 Bay Street, Toronto, Ontario, M5H 2T6 and the corporate head office is located at 133 Richmond Street W, Suite 602, Toronto, Ontario, M5H 2L3.

The Company is focused on building a North American integrated battery materials complex for the electric vehicle supply chain. The Company is in the process of constructing its expanded hydrometallurgical refinery (the “Refinery”) and exploring and developing its mineral properties. On September 2, 2021, the Company completed a Refinery construction financing package comprising convertible notes and an offering of common shares for total gross proceeds of US$45 million. With the completion of this financing, a full restart decision was made, and the project entered the full development phase.

With the completion of financing activities in 2021 and committed government funding, the Company currently has substantially all the liquidity required to cover the estimated Refinery project construction capital costs to reach commissioning. To achieve further Company initiatives such as advancing its battery recycling strategy, completing exploration drilling at Iron Creek, and providing an additional working capital buffer as the refinery enters its operating phase, additional funding will be required. The Company may elect to utilize its existing at-the-market equity program (the “2022 ATM Program”) to raise funds for these purposes. There can be no assurances that the Company will be successful in obtaining other sources of funding; failure to obtain additional capital could result in the delay or indefinite postponement of further advancement of the Company’s assets.

In addition, the Company continues to explore its Idaho mineral properties as a potential future source of North American cobalt and copper. The recoverability of the amounts shown for mineral properties is dependent upon the existence of economically recoverable reserves, successful permitting, the ability of the Company to obtain necessary financing to complete exploration and development, and upon future profitable production or proceeds from disposition of each mineral property. Furthermore, the acquisition of title to mineral properties is a complicated and uncertain process, and while the Company has taken steps in accordance with normal industry standards to verify its title to the mineral properties in which it has an interest, there can be no assurance that such title will ultimately be secured. The carrying amounts of exploration and evaluation assets are based on their acquisition costs, and do not necessarily represent present or future values.

Page 6 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| 2. | Significant Accounting Policies and Basis of Preparation |

Basis of Presentation and Statement of Compliance

The Company prepares its annual consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). These condensed interim consolidated financial statements have been prepared in accordance with IAS 34, Interim Financial Reporting (“IAS 34”). These condensed interim consolidated financial statements should be read in conjunction with our most recent annual financial statements. These condensed interim consolidated financial statements follow the same accounting policies and methods of application as our most recent annual financial statements except for the accounting standard disclosed in Note 2 below. On May 26, 2022, the Board of Directors authorized these financial statements for issuance.

Borrowing Costs

Borrowing costs are expensed as incurred except where they relate to the financing of construction or development of qualifying assets in which case they are capitalized as property, plant and equipment up to the date when the qualifying asset is ready for its intended use. Capitalized borrowing costs are recorded as financing activities in the consolidated statement of cash flows.

Comparative Information

All amounts on the condensed interim consolidated financial statements are presented in thousands of Canadian dollars unless otherwise stated.

| 3. | Recently Adopted and Issued Not Yet Effective Accounting Standards |

Property, Plant and Equipment

An amendment has been issued to IAS 16 – Property, Plant and Equipment, effective January 1, 2022, such that revenue earned prior to the time at which an asset has reached its intended use will be recognized as revenue, and not a reduction to the cost of property, plant and equipment. Any revenue earned prior to the Refinery achieving commercial production (the point at which it would be available for its intended use) will be recognized as revenue. There is no impact on previous reporting periods relating to this amendment.

Classification of liabilities as current or non-current

In January 2020, the IASB published narrow scope amendments to IAS 1 Presentation of financial statements. The narrow scope amendment clarifies that liabilities are classified as either current or non-current, depending on the rights that exist at the end of the reporting period. Classification is unaffected by the expectations of the entity or events after the reporting date. The amendments are effective for annual periods beginning on or after January 1, 2023 and applied retrospectively. The Company will adopt the narrow scope amendments on the date they become effective and is assessing the impact of these amendments on its consolidated financial statements.

Deferred tax related to assets and liabilities arising from a single transaction

In May 2021, the IASB published a narrow scope amendment to IAS 12 Income taxes. In September 2021, IAS 12 was revised to reflect this amendment. The amendment narrowed the scope of the recognition exemption so that it no longer applies to transactions that, on initial recognition, give rise to equal taxable and deductible temporary differences such as deferred taxes on leases and decommissioning obligations. The amendment is effective for annual periods beginning on or after January 1, 2023 and applied retrospectively. The Company will adopt the amendment on the date it becomes effective and is currently evaluating the impact of the amendment on its consolidated financial statements.

Page 7 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

As at March 31, 2022, there have been no other accounting pronouncements issued by the IASB that would materially affect the Company’s consolidated financial statements.

| 4. | Property, Plant and Equipment and Capital Long-Term Prepayments |

The majority of the Company’s property, plant, and equipment assets relate to the Refinery located near Temiskaming Shores, Ontario, Canada. The carrying value of property, plant, and equipment is $17,142 (December 31, 2021 - $10,446), all of which is pledged as security for the Convertible Notes issued on September 2, 2021 (Note 10).

Capitalized development costs for the three months ended March 31, 2022 totaled $4,944 (December 31, 2021 - $2,789) and capitalized borrowing costs were $1,855 (December 31, 2021 - $2,218).

No depreciation has been recorded for the Refinery in the current quarter (December 31, 2021 - $nil) as the asset is not yet in service. The minor depreciation relates to mobile assets in use at Iron Creek.

Page 8 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Capital long-term prepayments relate to payments for long term capital contracts made for Refinery equipment that have not yet been received by the Company as of March 31, 2022, all of which are pledged as security for the Convertible Notes issued on September 2, 2021 (Note 10). The prepayments mainly relate to milestone payments to vendors for the cobalt crystallizer and the solvent extraction equipment being manufactured for the Refinery.

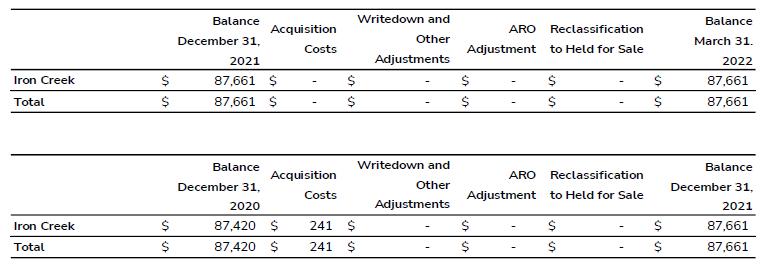

| 5. | Exploration and Evaluation Assets |

No exploration and evaluation assets were capitalized in the three months ended March 31, 2022. In the second quarter of 2021, the Company acquired the West Fork property directly west of the Iron Creek property. To acquire these mineral claims, the Company paid consideration of $50 in cash and 225,000 common shares (valued at $69). The Company also signed an earn-in arrangement that will allow it to ultimately control the Redcastle property to the east of Iron Creek if it elects to meet certain future conditions. To execute this arrangement, the Company paid $61 in cash and 200,000 common shares (valued at $61).

All of the Iron Creek mineral properties are pledged as security for the Convertible Notes issued on September 2, 2021 (Note 10). Upon successful commissioning of the Refinery, the Iron Creek mineral properties will be released from the Convertible Notes security package.

Page 9 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| 6. | Marketable Securities |

Marketable securities represent Kuya Silver Corp (“Kuya”) shares held by the Company. The Kuya shares were acquired via Kerr Assets sale on February 26, 2021. The total value of marketable securities at March 31, 2022 was $2,072 (December 31, 2021 - $1,768). These shares were marked-to-market at March 31, 2022 resulting in a gain of $458 being recorded during the three months ended March 31, 2022 (March 31, 2021 – loss of $144).

| 7. | Accounts Payable and Accrued Liabilities |

| March 31, 2022 | December 31, 2021 | |||||||

| Accounts Payable and Accrued Liabilities | $ | 5,555 | $ | 3,544 | ||||

| Accrued Interest | 484 | 1,164 | ||||||

| $ | 6,039 | $ | 4,708 | |||||

Accounts payable and accrued liabilities comprise primarily of trade payables incurred in the normal course of business and mainly relate to the development of the Refinery. Included in accounts payable and accrued liabilities are amounts totalling $90 (December 31, 2021 - $786) due to related parties (Note 18) related to compensation. The accrued interest relates to interest owing on the Convertible Notes, which is paid semi-annually in February and August each year.

| 8. | Asset Retirement Obligations |

| March 31, 2022 | December 31, 2021 | |||||||

| Refinery | $ | 1,234 | $ | 1,336 | ||||

| Ontario Mineral Properties | 338 | 338 | ||||||

| Long-term Asset Retirement Obligations | $ | 1,572 | $ | 1,674 | ||||

As at March 31, 2022, the Company has recorded its best estimate of the asset retirement obligations relating to its properties and assets. The Ontario Mineral Properties liability relates to the Keeley-Frontier patents, of which the Company owns a 50% stake. There has been no activity in relation to these properties in 2022.

Page 10 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

The full estimated closure cost in the new closure plan incorporated a number of new disturbances that have yet to take place, such as a new solvent extraction building, new chemicals on site, and a new tailings area. The new closure plan also included cost updates relating to remediating disturbances that existed at March 31, 2022. Based on the new closure plan and the infrastructure and disturbances that existed at March 31, 2022, the Company updated its estimate of the present value of reclamation activities for the Refinery. The following assumptions were used to calculate the asset retirement obligation:

| · | Undiscounted cash flows of $1,281 |

| · | Closure activities date of 2035 |

| · | Nominal discount rate of 2.43% |

| · | Long-term inflation rate of 2.1% |

During the three months ended March 31, 2022, the asset retirement obligation was decreased by $102 due to a revised estimate of closure costs for the Refinery and changes in estimates of discounted cash flows. The continuity of the asset retirement obligation at March 31, 2022 and December 31, 2021 is as follows:

| Total ARO | ||||

| Balance at January 1, 2021 | $ | 1,264 | ||

| Change in estimate of discounted cash flows | 410 | |||

| Balance at December 31, 2021 | 1,674 | |||

| Revised estimate and change in estimate of discounted cash flows | (102 | ) | ||

| Balance at March 31, 2022 | $ | 1,572 | ||

| 9. | Long-Term Government Loan Payable and Government Grant |

On November 24, 2020, the Company had entered into a contribution agreement with the Ministry of Economic Development and Official Languages as represented by the Federal Economic Development Agency for Northern Ontario (“FedNor”) for up to a maximum of $5,000 financing related to the recommissioning and expansion of the Refinery in Ontario. The contribution was to be in the form of debt bearing a 0% interest rate and funded in proportion to certain Refinery construction activities.

Once construction is completed, the cumulative balance borrowed will be repaid in 19 equal quarterly instalments starting on March 1, 2024. In November 2021, the Company received an initial $1,000 from FedNor. The Company received a further $1,579 on February 18, 2022, and $938 on March 9, 2022. The funding is provided pro rata with incurred Refinery construction costs, with all other conditions required for the funding having been met. The loan is discounted using a market rate of 7% with the resulting difference between the amortized cost and cash proceeds recognized as Government Grant.

As of March 31, 2022, the Company has recorded a balance of $2,639 (December 31, 2021 - $745) to Long-Term Government Loan Payable and $912 (December 31, 2021 - $264) to Government Grant. There were no transaction costs incurred in setting up the contribution agreement.

On November 30, 2020, the Company had entered into a separate contribution agreement with the Northern Ontario Heritage Fund Corporation (“NOHFC”) for up to a maximum of $5,000 financing related to recommissioning and expansion of the Refinery in Ontario. The contribution was to be in the form of a non-repayable grant. Contributions will be made as a reimbursement of a portion of the Refinery construction costs incurred. No NOHFC funding was received during the three months ended March 31, 2022 ($nil – December 31, 2021).

Page 11 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| 10. | Convertible Note Arrangement |

The Company closed a Convertible Note Arrangement (the “Notes”) on September 2, 2021 for gross proceeds of US$37,500 for Tranche #1. As the Notes include a conversion feature and other embedded derivates, its value was split between Financial Derivative Liability measured initially and subsequently at fair value through profit loss and Long-term Convertible Notes payable measured at fair value less transaction cost and subsequently at amortized cost.

The Notes bear interest at a fixed rate of 6.95%, with coupon payments due in February and August each year in cash. The maturity date is December 1, 2026 and all principal, if not converted, is due upon maturity.

The Notes were convertible into common shares of Electra, at the option of the Noteholders, at an initial Conversion Rate of 4,058.24 common shares per US$1 principal amount of Notes. As a result of the 18:1 share consolidation that took effect that occurred subsequent to period-end (Note 19), the new Conversion Rate is 225.46 per US$1 principal amount of Notes.

After the third anniversary of the issue of the Notes, the Company may mandate the conversion of the Notes at its option in the event the trading price of the Company’s common shares exceeds 150% of the Conversion Price for at least 20 trading days, whether consecutive or not, during any consecutive 30 day trading period.

Converting Noteholders will be entitled to an interest make-whole payment, equal to two years of coupon payment or the remaining coupon payment until maturity, whichever is less. In the event of a fundamental change, namely a change of control, the conversion rate may be adjusted, in line with a prescribed table in the Note Indenture.

The Notes are secured by a first priority security interest (subject to permitted liens) in substantially all of the Company’s assets. Security against the Company’s Iron Creek Project in Idaho will be released upon achieving certain Refinery commissioning thresholds. The Notes are subject to customary events of default and basic positive and negative covenants. The Company is required to maintain a minimum liquidity balance of US$7,500 under the terms of the Notes, which can be satisfied with a future working capital facility.

The total value recorded to the host debt portion of Tranche #1 at inception was $23,488. Transaction costs of $1,473 were recorded as a reduction in the initial debt balance, leading to a net host debt value of $22,015 on the September 2, 2021 initial recognition date. Transaction costs allocated to the derivative liability and expensed were $1,493. The total transaction costs were $2,966.

Holders of the Notes also had the option to require the Company to issue to the Noteholders an aggregate additional US$7,500 principal amount of Notes, issued at par and on the same terms as noted above, prior to October 22, 2021. The Noteholders exercised this option in full, and US$7,500 of additional Notes were issued on October 22, 2021 as Tranche #2. The total value recorded to the host debt portion at inception was $2,306. Transaction costs of $110 were recorded as a reduction in the initial debt balance, leading to a net host debt value of $2,196. Transaction costs allocated to the derivative liability and expensed were $333. The total transaction costs were $443.

Page 12 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

During the three months ended March 31, 2022, US$500 (December 31, 2021 - US$5,500) of principal value of notes were converted by noteholders which resulted in the Company issuing a total of 2,029,120 (December 31, 2021 - 22,320,320) common shares. The Company also made interest make-whole payments to the noteholders upon conversion totaling US$89 (December 31, 2021 – US$756). There were no significant transaction costs incurred in relation to the conversions. During the three months ended March 31, 2022, the Company had also made an interest payment of $1,577 (December 31, 2021 - $nil).

The following table sets out the details of the Company’s long-term debt relating to the host debt portion of the Notes as of March 31, 2021.

| March 31, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Convertible notes payable – beginning of year | $ | 22,541 | $ | - | ||||

| Tranche #1 issuance | - | 22,015 | ||||||

| Tranche #2 issuance | - | 2,196 | ||||||

| Effective interest | 1,921 | 2,308 | ||||||

| Foreign exchange (gain)/loss | 538 | 269 | ||||||

| Interest payment | (1,569 | ) | - | |||||

| Portion derecognized due to conversions | (316 | ) | (3,083 | ) | ||||

| Convertible notes payable – end of period | $ | 23,115 | $ | 23,705 | ||||

| Less: current portion recorded as accrued interest | (484 | ) | (1,164 | ) | ||||

| Non-current portion | $ | 22,631 | $ | 22,541 | ||||

The effective interest associated with the convertible notes payable is capitalized to the associated Refinery assets. The foreign exchange movement is recorded as a gain or loss in the Statement of (Income) Loss and Other Comprehensive (Income) Loss.

The Convertible Note Arrangement contains certain features that are embedded derivatives that are separated from the host debt contract relating to the noteholders option to convert principal into common shares, the Company’s option to force a mandatory conversion and the interest make-whole payment.

For the three months ended March 31, 2022, the embedded derivatives were fair valued using the finite difference valuation method with the following key assumptions:

| · | The conversion rate, interest rate, and make-whole interest requirements, and maturity date terms from the Convertible Note Indenture as outlined above; |

| · | Risk free rates of 2.6% at March 31, 2022 period end date based on US dollar zero curve; |

| · | Equity volatility of 56% at March 31, 2022 based on an assessment of the Company’s historical volatility and the estimated maximum a third party investor would be willing to pay for; |

| · | An Electra share price of $0.295 at March 31, 2022 reflecting the quoted market prices; and |

| · | An estimated credit spread of 26.1% at March 31, 2022 |

Page 13 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

The following table sets out the details of the Company’s financial derivative liability related to embedded derivatives in the Notes as of March 31, 2022

| Financial Derivative Liability – January 1, 2022 | $ | 37,715 | ||

| Loss (Gain) on fair value derivative revaluation | (3,980 | ) | ||

| Portion derecognized due to conversion | (432 | ) | ||

| Financial Derivative Liability – end of period | $ | 33,303 |

| 11. | Shareholder’s Equity |

| (a) | Authorized Share Capital |

The Company is authorized to issue an unlimited number of common shares without par value. As at March 31, 2021, the Company had 562,324,189 (December 31, 2021: 557,547,436) common shares outstanding.

| (b) | Issued Share Capital |

During the three months ended March 31, 2022, the Company issued common shares as follows:

| · | 83,333 common shares resulting from the exercise of options, deferred share units and restricted share units. The total proceeds from the option exercises were $nil at an exercise price at $0.145. |

| · | 2,664,300 common shares at an average price of $0.30 per share for gross proceeds of approximately $790 under its ATM Program. The transaction costs associated with these issuances were $20, which reflect commissions paid to CIBC Capital Markets. |

| · | US$500 of convertible notes were converted by noteholders which resulted in the Company issuing a total of 2,029,120 common shares. The Company also made interest make-whole payments to the noteholders upon conversion totaling US$89. There were no significant transaction costs incurred in relation to the conversions. |

| 12. | Share based payments |

The Company adopted a new long-term incentive plan on December 2, 2021 (the “Plan”) whereby it can grant stock options, restricted share units (“RSUs”), Deferred Share Units (“DSUs”), and Performance Share Units (“PSUs”) to directors, officers, employees, and consultants of the Company.

Stock options generally vest in equal tranches over a three-year period. The grant date fair value is determined using the Black-Scholes Option Pricing Model and this value is recognized as an expense over the vesting period. DSUs vest immediately but cannot be exercised until the holder ceases to be a Director or Officer of Electra. DSUs are valued based on the market price of the Company’s common shares on the grant date, with the full value expensed immediately. PSUs generally vest over an 18-24 month period if certain performance metrics have been achieved. They are valued based on the market price of the Company’s shares on the grant date and this value is expensed over the vesting period. RSUs generally vest over a 24-36 month period. They are valued based on the market price of the Company’s shares on the grant date and this value is expensed over the vesting period.

Page 14 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

The maximum number of shares that may be reserved for issuance under the Plan is limited to 42,000,000 shares.

| (a) | Stock Options |

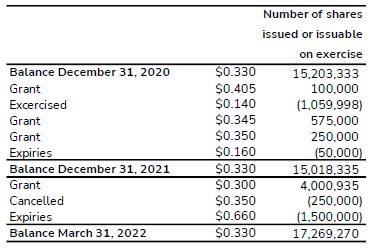

The changes in incentive share options outstanding are summarized as follows:

During the three months ended March 31, 2022:

| · | The Company granted 4,000,935 stock options to new employees under its long-term incentive plan. The options may be exercised within 5 years from the date of the grant at a price of $0.30 per share. The fair value of the options at the date of the grant was $529 using the Black-Scholes Option Pricing Model, assuming a risk-free rate of 1.24% per year, an expected life of 2.5 years, an expected volatility in the range of 69.89%, an expected forfeiture rate of 0%, no expected dividends and a share price of $0.305. |

| · | 250,000 options with an exercise price of $0.35 had been cancelled. |

| · | 1,500,000 options with an exercise price of $0.66 had expired. |

Page 15 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Incentive share options outstanding and exercisable (vested) at March 31, 2022 are summarized as follows:

During the three months ended March 31, 2022, the Company has expensed $94 (March 31, 2022 - $69) for options valued at share prices in the range of $0.14 to $0.41, as shared-based payment expense.

| (b) | DSUs, RSUs and PSUs |

Restricted Share Units

The Company’s RSU plan transactions during three months ended March 31, 2022 and 2021 were as follows:

| Number of Units | 2022 | 2021 | ||||||

| Balance - January 1 | 1,146,791 | 1,300,000 | ||||||

| Granted | 205,000 | 148,456 | ||||||

| Exercised | (83,333 | ) | - | |||||

| Balance, March 31 | 1,268,458 | 1,448,456 | ||||||

Page 16 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Performance Share Units

The Company’s PSU plan transactions during the three months ended March 31, 2022 and 2021:

| Number of Units | 2022 | 2021 | ||||||

| Balance, January 1 | 1,575,000 | - | ||||||

| Granted | 325,000 | - | ||||||

| Balance, March 31 | 1,900,000 | - | ||||||

Deferred Shares Units

The Company’s DSU plan transactions during three months ended March 31, 2022 and 2021 were as follows:

| Number of Units | 2022 | 2021 | ||||||

| Balance, January 1 | 3,173,949 | 3,120,505 | ||||||

| Granted | 639,959 | 30,864 | ||||||

| Balance, December 31 | 3,813,908 | 3,151,369 | ||||||

During the three months ended March 31, 2022, the Company has expensed $6 (March 31, 2021 - $13) for DSUs, $115 (March 31, 2021 - $nil) for PSUs, and $36 (March 31, 2021 - $26) for RSUs as shared-based payment expense.

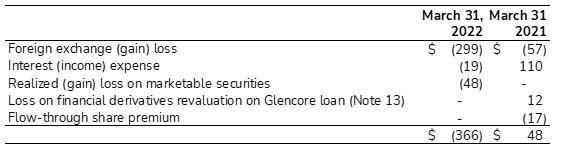

| 13. | Other Non-Operating (Income) Expense |

The Company’s Other Non-Operating (Income) Expense comprises the following for the three months ended March 31, 2022 and March 31, 2021:

Page 17 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| 14. | (Income) Loss Per Share |

Basic and diluted earnings per share for the current and comparative period have been adjusted to reflect the share consolidation that occurred subsequent to period-end (Note 19). The following table sets forth the computation of basic and diluted loss per share for the three months ended March 31, 2022 and 2021:

| March 31,

2022 |

March 31,

2021 |

|||||||

| Numerator | ||||||||

| Net (Income) loss for the period – basic | $ | (2,330 | ) | $ | 2,510 | |||

| Net (Income) loss for the period – diluted | $ | 1,649 | $ | 2,510 | ||||

| Denominator | ||||||||

| Basic – weighted average number of shares outstanding | 31,032,166 | 25,238,459 | ||||||

| Effect of dilutive securities | 8,792,853 | - | ||||||

| Diluted – adjusted weighted average number of shares outstanding | 39,825,019 | 25,238,459 | ||||||

| (Income) Loss Per Share – Basic | $ | (0.08 | ) | $ | 0.10 | |||

| Loss Per Share – Diluted | $ | 0.04 | $ | 0.10 | ||||

The basic (income) loss per share is computed by dividing the net (income) loss by the weighted average number of common shares outstanding during the year.

The diluted loss per share reflects the potential dilution of common share equivalents such as the conversion of convertible debt on the net (income) loss for the period and the weighted average number of common shares outstanding during the period.

Share purchase warrants, stock options, DSUs, PSUs, and RSUs were excluded from the calculation of diluted weighted average number of common shares outstanding during the three months ended March 31, 2022 and 2021 as these equity instruments were anti-dilutive since the Company was in a loss position after the diluted effect from the convertible notes.

| 15. | Fair Value Measurements |

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. All assets and liabilities for which fair value is measured or disclosed in the consolidated financial statements are categorized within the fair value hierarchy, described, as follows, based on the lowest-level input that is significant to the fair value measurement as a whole:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Page 18 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Level 2 — Quoted prices in markets that are not active or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3 — Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). The fair value hierarchy gives the highest priority to Level 1 inputs and the lowest priority to Level 3 inputs.

Assets and Liabilities Measured at Fair Value

The Company’s fair values of financial assets and liabilities were as follows:

| Carrying Value | March 31, 2022 | ||||||||||||||||||||||

| Fair value through profit or loss | Amortized cost | Level 1 | Level 2 | Level 3 | Total Fair Value | ||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Cash and Cash Equivalents | $ | - | $ | 51,896 | $ | - | $ | - | $ | - | $ | 51,896 | |||||||||||

| Restricted cash | - | 938 | - | - | - | 938 | |||||||||||||||||

| Restricted deposits | - | 821 | - | - | - | 821 | |||||||||||||||||

| Receivables | - | 1,332 | - | - | - | 1,332 | |||||||||||||||||

| Marketable securities | 2,072 | - | 2,072 | - | - | 2,072 | |||||||||||||||||

| $ | 2,072 | $ | 54,987 | $ | 2,072 | $ | - | $ | - | $ | 57,059 | ||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | - | $ | 6,039 | $ | - | $ | - | $ | - | $ | 6,039 | |||||||||||

| Long-term Government Loan payable | - | 2,639 | - | - | - | 2,639 | |||||||||||||||||

| Long-term convertible notes payable | - | 22,631 | - | - | - | 45,147 | |||||||||||||||||

| Financial Derivative Liability | 33,303 | - | - | - | 33,303 | 33,303 | |||||||||||||||||

| $ | 33,303 | $ | 31,309 | $ | - | $ | - | $ | 33,303 | $ | 87,128 | ||||||||||||

Valuation techniques

A) Marketable securities

Marketable securities are included in Level 1 as these assets are quoted on active markets.

B) Financial Derivative Liability

The fair value of the embedded derivative (Note 10) as at March 31, 2022 was $33,303 and is accounted for at FVTPL. The valuation is derived by a finite difference method, whereby the convertible debt as a whole is viewed as a hybrid instrument consisting of two components, a financial derivative liability (i.e., the conversion option) and a debt component, each with different risk. These two aforementioned risks result in a pair of coupled partial differential equations and are solved simultaneously to calculate the value of the debt and financial derivative liability components of the convertible bond. The key inputs in the valuation include risk-free rates, share price, equity volatility, and credit spread. As there are significant unobservable inputs used in the valuation, the financial derivative liability is included in Level 3.

Page 19 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

Methodologies and procedures regarding Level 3 fair value measurements are determined by the Company’s management. Calculation of Level 3 fair values is generated based on underlying contractual data as well as observable and unobservable inputs. Development of unobservable inputs requires the use of significant judgment. To ensure reasonability, Level 3 fair value measurements are reviewed and validated by the Company’s management. Review occurs formally on a quarterly basis or more frequently if review and monitoring procedures identify unexpected changes to fair value.

While the Company considers its fair value measurements to be appropriate, the use of reasonably alternative assumptions could result in different fair values. On a given valuation date, it is possible that other market participants could measure a same financial instrument at a different fair value, with the valuation techniques and inputs used by these market participants still meeting the definition of fair value. The fact that different fair value measurements exist reflects the judgment, estimates and assumptions applied as well as the uncertainty involved in determining the fair value of these financial instruments.

The fair value of the embedded derivative (Note 10) has been estimated as at March 31, 2022 based on significant unobservable inputs which are equity volatility and credit spread. The Company used an equity volatility of 56%. If the Company had used an equity volatility that was higher or lower by 10%, the potential effect would be an increase of $1,760 or a decrease of $1,897 to the fair value of the embedded derivative. The Company used a credit spread of 26.1%. If the Company had used a credit spread that was higher or lower by 5%, the potential effect would be an increase of $1,224 or a decrease of $1,487 to the fair value of embedded derivative (Note 10).

C) Long-term convertible notes

The fair value of the long-term convertible notes payable has been estimated at March 31, 2022 as $45,147. The Company utilized the discounted cash flow valuation method, and an interest rate of 9%.

| 16. | Commitments |

As at March 31, 2022, the Company’s commitments relate to purchase and services commitments for work programs relating to Refinery expansion and payments under financing arrangements. The Company had the following commitments as of March 31, 2022:

| 2022 | 2023 | 2024 | 2025 | Thereafter | Total | |||||||||||||||||||

| Purchase commitments | $ | 26,773 | $ | - | $ | - | $ | - | $ | - | $ | 26,773 | ||||||||||||

| Convertible notes payments | 1,582 | 3,430 | 3,440 | 3,430 | 53,257 | 65,139 | ||||||||||||||||||

| Government loan payments | - | - | 740 | 740 | 2,071 | 3,551 | ||||||||||||||||||

| Total | $ | 28,355 | $ | 3,430 | $ | 4,180 | $ | 4,170 | $ | 55,328 | $ | 95,463 | ||||||||||||

Page 20 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| 17. | Segmented Information |

The Company’s exploration and evaluation activities are located in the province of Ontario, Canada and Idaho, USA, with its head office function in Canada. All of the Company’s capital assets, including property and equipment, and exploration and evaluation assets are located in Canada and USA.

The Company’s Chief Operating Decision Maker (CODM) is its Chief Executive Officer. The CODM reviews the results of Company’s refinery business as a discrete business unit, separate from the rest of the Company’s activities which are reviewed on an aggregate basis.

| 18. | Related Party Transactions |

The Company’s related parties include key management personnel and companies related by way of directors or shareholders in common.

| (a) | Key Management Personnel Compensation |

During the three months ended March 31, 2022 and 2021, the Company paid and/or accrued the following fees to management personnel and directors:

| March 31, 2022 |

March 31, 2021 |

|||||||

| Management | $ | 310 | $ | 319 | ||||

| Directors | 62 | 48 | ||||||

| $ | 372 | $ | 367 | |||||

During the three months ended March 31, 2022, the Company had share-based payments made to management and directors of $256 (March 31, 2021 - $65).

Page 21 of 22

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 (UNAUDITED)

| (expressed in thousands of Canadian dollars) |

| (b) | Due to Related Parties |

As at March 31, 2022 and December 31, 2021, the Company had the following amounts due to related parties:

| March 31, 2022 | December 31, 2021 | |||||||

| Accounts payable and accrued liabilities | $ | 90 | $ | 786 | ||||

| $ | 90 | $ | 786 | |||||

As at March 31, 2022, the accrued liabilities balance for related parties was $90 (December 31, 2021 - $786), which relates mainly to quarter-end compensation accruals.

| 19. | Subsequent Events |

Subsequent to March 31, 2022:

| (a) | On April 5, 2022, the Company announced a share consolidation on the basis of one new post-consolidation common share for every 18 pre-consolidation common shares issued and outstanding on the effective date of the consolidation. The share consolidation completed on April 13, 2022, after approval by the TSX Venture Exchange, and resulted in the number of issued and outstanding common shares being reduced from approximately 562 million to approximately 31 million, on a non-diluted basis. On April 13, 2022, the exercise price and number of common shares issuable upon the exercise of outstanding stock options, warrants and other outstanding convertible securities were proportionately adjusted to reflect the Share Consolidation in accordance with the terms of such securities for the holders of such instruments. EPS have been retrospectively updated to reflect the share consolidation (Note 14). |

| (b) | For the period from April 1, 2022 to May 26, 2022, the Company received conversion notices for US$3,000 of principal for its outstanding convertible notes. In line with the conversion terms in the Note Indenture, a total of 676,376 post-consolidation commons shares were issued and cash make-whole interest payments of US$416 were made. |

| (c) | On April 27, 2022, the Company commenced trading common shares on the Nasdaq Capital Market (“Nasdaq”) under the ticket symbol “ELBM”. The Company’s common shares will continue to trade on the TSX Venture Exchange under the symbol “ELBM”. |

| (d) | On May 17, 2022, the Company announced it updated its at-the-market equity program (the “ATM Program”) to issue up to C$20,000 (or its equivalent in US$) of common shares (“Common Shares”) in the United States and Canada from time to time, at the Company’s discretion. The update is to permit sales of Common Shares under the ATM Program into the United States following Electra’s listing on the Nasdaq Capital Market (“Nasdaq”) on April 27, 2022. |

Page 22 of 22

Exhibit 99.2

|

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

(EXPRESSED IN THOUSANDS OF CANADIAN DOLLARS)

|

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

General

This Management’s Discussion and Analysis of Electra Battery Materials Corporation (“Electra” or the “Company”) (“MD&A”) was prepared on May 26, 2022 and provides analysis of the Company’s financial results for the three months ended March 31, 2022 and 2021. The following information should be read in conjunction with the accompanying condensed interim consolidated financial statements for the three months ended March 31, 2022 and 2021 with accompanying notes which have been prepared in accordance with IAS 34, Interim Financial Reporting (“IAS 34”). All dollar figures are expressed in thousands of Canadian dollars unless otherwise stated. Financial Statements are available at www.sedar.com and the Company’s website www.electrabmc.com.

Company Overview

Electra was incorporated on July 13, 2011 under the Business Corporations Act of British Columbia and on September 4, 2018, the Company filed a Certificate of Continuance into Canada and adopted Articles of Continuance as a Federal Company under the Canada Business Corporations Act (the “CBCA”). On December 6, 2021, the Company changed its name from First Cobalt Corp. to Electra Battery Materials Corporation to better align with its strategic vision. The Company is focused on building a North American integrated battery materials complex for the electric vehicle supply chain. In addition, the Company continues to explore its Idaho mineral properties as a potential future source of North American cobalt and copper.

Electra is a public company listed on the TSX Venture Exchange (TSX-V) (under the symbol ELBM). On April 27, 2022, the Company began trading on the Nasdaq Capital Market (Nasdaq) (under the symbol ELBM). The Company’s registered and records office is Suite 2400, Bay-Adelaide Centre, 333 Bay Street, Toronto, Ontario, M5H 2T6. The Company’s head office is located at 133 Richmond Street W, Suite 602, Toronto, Ontario, M5H 2L3.

Q1 2022 Highlights and Recent Events

On April 5, 2022 the Company announced that it was undertaking a consolidation of its outstanding common share capital on an 18-to-1 basis, thereby reducing the number of shares outstanding from 564,443,309 to 31,357,959. The share consolidation was completed to support a listing application for Electra’s shares on the Nasdaq, which required a share price of at least US$3.00 at the time of the application. Approval was subsequently received and the Company commenced trading on Nasdaq on April 27, 2022 under the ticker symbol “ELBM”.

On January 13, 2022 the Company established an at-the-market equity program (“ATM Program”) to allow the Company to issue up to $20,000 of common shares from treasury to the public from time to time, at the Company’s discretion. The ATM Program was amended on May 17, 2022 to extend the program to the Nasdaq.

On April 11, Electra announced the appointment of Renata Cardoso as Vice-President, Sustainability and Low Carbon. Renata will have overall responsibility for the Company’s mission to exceed global ESG norms in the industry, in line with Electra’s business objective to be the partner of choice in the EV market. On April 21, 2022, the Company announced the departure of its Chief Financial Officer, Ryan Snyder, who was recruited by a senior precious metals producer. Michael Insulan has been appointed Interim Chief Financial Officer until a successor is in place. On May 25, 2022, Electra announced the appointment of Joe Racanelli as Vice President, Investor Relations, responsible for the Company’s engagement with the investment community.

During the three months ended March 31, 2022, US$500 of principal value of notes were converted by noteholders which resulted in the Company issuing a total of 112,729 post-consolidation common shares. The Company also made interest make-whole payments to the noteholders upon conversion totaling US$89. As of March 31, 2022, a total of US$6,000 of principal value of notes were converted by noteholders which resulted in the Company issuing a total of 1,352,747 post-consolidation common shares. Subsequent to March 31, 2022, a further US$3,000 of principal value of notes were converted by noteholders, bringing the total principal of value of notes converted to US$9,000 since inception.

Page 2 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

During the three months ended March 31, 2022, the Company was in a net income position of $2,330 or $0.08 earnings per share. This was primarily driven by a $3,980 gain on the fair value of the embedded derivative liability portion of the convertible debt. The Company’s costs associated with the refinery expansion were capitalized, as a result operating expenses were reduced, thus producing an income position.

Battery Materials Park

In early March, Electra commenced a battery materials park study in partnership with the Government of Canada, the Government of Ontario, Glencore plc and Talon Metals. The consortium is collaborating on a $900 study of the engineering, permitting, socio-economic, ESG and costs associated with the construction of a nickel sulfate plant as well as a battery precursor cathode active materials (PCAM) plant adjacent to Electra’s cobalt refinery and recycling plant. The realization of this vision would result in the creation an integrated, localized and environmentally sustainable battery materials park for the North American electric vehicle market.

The cobalt refinery construction project continued to advance on schedule. On February 10, Electra announced the receipt of its Industrial Sewage Works permit and the filing of its final Closure Plan, two significant milestones in the permitting process. The closure plan was approved on March 7, allowing the Company to commence concrete work for a solvent extraction plant. All long lead equipment orders were placed by the end of the first quarter and management continued to expand the owner’s team to ensure proper oversight over contractors.

On April 6, the Company provided an update on battery recycling, Phase 2 of the Battery Materials Park project. A battery recycling demonstration plant is expected to be commissioned in Q3, using existing equipment at a cost of $3,000. Once the recycling facility achieves expected commercial production in the second half of 2023, nickel and cobalt will be sold to Glencore until the end of 2024 on market-based terms.

Iron Creek Cobalt-Copper Project

On March 14, the Company released drill results to the west of its Iron Creek cobalt-copper project, which extended mineralization by 130 metres along strike and by 110 metres at depth. Broad widths of copper mineralization were intercepted along with high grade cobalt intercepts. Results to the east of the current deposit were released May 9, highlighting new cobalt intercepts and extending mineralization by an additional 180 metres as well as down dip from the eastern edge of the resource zone. The Iron Creek strike extent now extends over more than one kilometer and is open along strike and at depth.

Amendment to Base Shelf Prospectus and At-the-Market Equity Program

On November 30, 2021, the Company announced that it had filed an amendment to its base shelf prospectus to increase the total offering price of the securities of the Company that may be offered from time to time under the Prospectus from $20,000 to $70,000. The original $20,000 capacity had been fully utilized, and this amendment provided an additional $50,000 of flexibility to consider future financing opportunities under favourable market conditions to advance its battery materials park and other growth plans to increase shareholder value.

Page 3 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

On January 13, 2022, the Company announced it had established an at-the-market equity program (the “2022 ATM Program”), as a supplement to the amended base shelf prospectus, that allows the Company to issue up to $20,000 of common shares from treasury to the public from time to time, at the Company’s discretion. Distributions of common shares through the 2022 ATM Program will be made pursuant to the terms of an equity distribution agreement between the Company and CIBC Capital Markets. The volume and timing of distributions under the ATM Program will be determined at the Company’s sole discretion, and the ATM program is effective until the earlier of the issuance of all common shares issuable under the ATM Program and December 26, 2022. As of the date of this MD&A, May 26, 2022, the Company has issued a total of 448,517 common shares under the 2022 ATM Program at an average price of $5.65 per shares, providing gross proceeds of $2,532. A commission of $63 was paid to CIBC Capital Markets in relation to these distributions.

COVID-19 Impacts

Market volatility and economic uncertainty due to the COVID-19 pandemic have cast uncertainty over global economic activity levels. Despite pandemic-related market instability, the electric vehicle (EV) market continues to strengthen in North America, Europe and around the world. The Company continues to advance its plans for the refinery and has not encountered any adverse effects relating to COVID-19 to date. Best practice protocols have been developed and implemented for on-site activity to ensure the health and safety of all personnel. Where possible, the Company has procured equipment and materials for the refinery expansion from North American sources to attempt to mitigate any impacts from global supply chain constraints.

Notwithstanding the forgoing, global uncertainty related to the pandemic may present other challenges that are not known at the current time beyond new supply chain interruptions, cost impacts, or alteration of business plans by the Company’s strategic partners.

Outlook and Overview of Current Programs

The Company’s vision is to provide sustainable battery materials to the electric vehicle industry. The Company owns two main assets – the Refinery located in Ontario, Canada and the Iron Creek cobalt-copper project located in Idaho, United States. It also controls a number of properties in Ontario known as the Cobalt Camp.

The Company has been progressing plans to create an integrated battery materials park in Ontario, Canada. The first phase of this plan involves recommissioning and expanding the Refinery with a view to becoming the only refiner of battery grade cobalt sulfate in North America. Electra’s primary focus for 2022 is advancing the Refinery along its construction schedule and commencing commissioning in late 2022. The second phase of the Company’s strategic plan involves the introduction of recycled battery materials (known as black mass) as additional feedstock for the refinery, with commercial, metallurgical, and engineering activities on potential incorporation of black mass into the refinery being conducted in parallel with the phase one expansion project. The Company has also increased exploration activity in Idaho.

As part of the Company’s strategic plan, it is committed to industry leading Environment, Social and Governance (ESG) principles and expects to have the greenest source of battery materials when in production. The Company has already released results of an independent life cycle assessment (LCA) that compares projected carbon emissions, water consumption and other environmental outputs against operating facilities in China. The Company’s hydroelectric-powered Refinery scored very favourably on the key environmental metrics. In 2022, the Company intends to join the Responsible Minerals Initiative and develop and report metrics that demonstrate its path to a low carbon facility.

The outlook for Electra’s North American assets is discussed below:

| 1. | The Refinery |

The Company is working towards restarting its wholly owned Refinery in Ontario, Canada as the first phase in a multi-phase strategy to create an integrated battery materials park in North America. In 2020, the Company announced the results of an engineering study on the expansion of the Refinery that demonstrated that the facility could become a significant, globally competitive producer of cobalt sulfate for the electric vehicle market. The engineering study determined the Refinery could produce 25,000 tonnes of battery grade cobalt sulfate annually (equating to 5,000 tonnes of contained cobalt), which would represent 5% of the total refined cobalt market and 100% of North American cobalt sulfate supply. The study indicated strong operating margins at the asset level.

Page 4 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

The Company notes that the engineering study and the associated update were prepared by Ausenco Engineering under the definitions of an Association for the Advancement of Cost Engineering (AACE) Class 3 Feasibility Study. The report does not constitute a feasibility study within the definition employed by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), as it relates to a standalone industrial project and does not concern a mineral project of Electra. As a result, disclosure standards prescribed by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) are not applicable to the scientific and technical disclosure in the report. Any references to scoping study, prefeasibility study, or feasibility study by the Company, in relation to the Refinery, are not the same as terms defined by the CIM Definition Standards and used in NI 43-101.

Subsequent to this study, the Company replaced Ausenco with a strong, experienced owner’s team, with support from leading engineering firms, notably EXP, Hatch and Metso-Outotec. The owner’s team conducted additional metallurgical testing, engineering work, flow-sheet optimization and market analysis before ordering major equipment and entering the development phase of the Refinery expansion project.

In response to strong customer demand, the Company has invested in increased capacity for its cobalt crystallizer, which can result in installed capacity of 6,500 tonnes of annual contained cobalt production, a 30% increase from the engineering study design of 5,000 tonnes. Future permit amendments will be sought to permit this increased output level. The Company has also been reviewing opportunities to utilize black mass from recycled lithium-ion batteries as supplemental refinery feedstock, with an on-site demonstration plant during 2022.

The Company’s outlook in relation to the production phase of the Refinery reflect approximate spot pricing for cobalt inputs and outputs, and operating costs and recoveries (both of which are commercially sensitive), in line with the latest internal technical estimates. Operating cost estimates are based on consumption levels of key consumables such as sodium hydroxide, sulfuric acid, quicklime, natural gas, and cyanex based on the current refinery flow sheet and current market pricing for such consumables. Estimates of labour costs and power costs also form a key component of the Refinery’s operating costs. The required volume and market pricing of these items is subject to change. Recoveries reflect management’s best estimates based on metallurgical lab tests of representative feedstock from contracted providers. Total recovery could vary in the future due to variations in feedstock and operating conditions.

Page 5 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

The Company utilized the following key market assumptions when estimating its outlook:

| · | Cobalt sulfate price of US$41.50 per pound |

| · | Cobalt metal price of US$38.50 per pound |

| · | Cobalt hydroxide payability of 89% |

| · | USD to CAD foreign exchange rate of 1.25 for 2023 and future years |

The Company’s cobalt production and EBITDA outlooks for phase one of its Refinery are as follows:

Quarter-ended March 31, 2022 | Year-ended December 31, | Year-ended December 31, | Year-ended December 31, | |||||||||||||

| Cobalt production (tonnes) | - | 4,375 | 5,750 | 6,500 | ||||||||||||

| EBITDA(1) | $ | 2,350 | $ | 27,000-31,000 | $ | 39,000-44,000 | $ | 45,000-51,000 | ||||||||

Key milestones on its development path for the Refinery, including:

The construction remains on schedule to commence commissioning of the expanded refinery in December 2022 and initially ramp-up to 5,000 tonnes of contained cobalt production per year, with steady state production achieved by mid-2023. Subject to future permits and market conditions, the Company plans to increase production capacity to a 6,5000 tonne per annum run rate by mid-2024.

Ground excavation and concrete foundations has been completed for the solvent extraction facility. Structural steel and solvent extraction tanks have begun to arrive on site and key equipment contracts have been awarded.

Despite global supply chain disruptions, the owner’s team has successfully kept the project on schedule to commence dry commissioning in December. However, cost pressures have emerged from systemic inflation, constrained global supply chains and the sanctions on trade with Russia, increasing the average cost of project inputs, such as steel, copper, nickel and freight rates have put the original budget at risk. Labour and contractor rates are also higher as a number of concurrent development projects in the region has created a very competitive market for experienced trades. With approximately 66% of the initial capital budget costs now under contract, the $4,824 (US$3,800) contingency amount had been utilized and the balance of the budget implies a cost overrun of approximately $2,500 over the Company’s original guidance of $83,774 (US$67,020). In addition, and based on trends in the market, management believes that the capital budget could be exceeded by approximately 5 to 10%. The Company’s early decision to create an experienced owner’s team has helped mitigate some of these impacts and management believes the Company is better positioned than its peers to navigate a more complex landscape.

Given the uncertainty around supply chain constraints and inflationary price pressures on certain inputs, the Company believes it would be prudent to review capital budget considerations and provide a more precise capital estimate once it has greater visibility and certainty on remaining key inputs.

(1) Non-GAAP financial measure. See discussion under “Non-GAAP Financial Measures”

Page 6 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

The project capital table is provided below:

Subject to the uncertainty noted above, cash requirements for the Refinery expansion from today through to commissioning are estimated at $60,391. The total cash spend to date is approximately $23,381, with incurred costs to date totalling $25,031. The Company will also require a working capital arrangement to fund inventory purchases through to the sale of final cobalt sulfate and is in discussions with various parties on alternatives.

The Company continues to make progress towards achieving its objective of providing the world’s most sustainable battery materials for the electric vehicle market. The Company continues to work with engineering firms, its commercial partners, process experts and financial advisers to finalize and execute on the plans for its phase one recommissioning and expansion of the Refinery.

| 2. | The Iron Creek Project |

Following the acquisition of US Cobalt in June of 2018, the Company commenced an extensive drill program at Iron Creek. In October 2018, the Company filed a technical report supporting the maiden resource estimate for the Iron Creek Project in Idaho. A second phase drill campaign was initiated to conduct infill drilling to upgrade a portion of the inferred resources to the indicated category for mine planning and to improve the confidence for future engineering studies. As a secondary priority, this campaign increased the resource along strike and at depth. However, as the cobalt price declined in 2018, the Company elected to suspend step-out drilling until market conditions improved. During 2019, the Company completed assaying work and further geological modeling to support a resource update, with a new technical report filed in early 2020.

The 2020 technical report includes a new mineral resource estimate based on infill drilling and limited step-out drilling which includes the conversion of 49% of resources from the Inferred category to the Indicated category while also increasing the overall tonnage. The indicated resource is 2.2 million tonnes grading 0.32% cobalt equivalent (0.26% cobalt and 0.61% copper) containing 12.3 million pounds of cobalt and 29.1 million pounds of copper. The inferred mineral resource is 2.7 million tonnes grading 0.28% cobalt equivalent (0.22% cobalt and 0.68% copper) for an additional 12.7 million pounds of cobalt and 39.9 million pounds of copper.

The mineralization remains open along strike and downdip. Management believes that there is potential to continue to expand the size of the Iron Creek resource. In 2020, the Company completed a new geophysics program at the property which identified several new drill targets.

Page 7 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

During 2021, the Company completed a 2,500-metre drill program, targeting extensions to the resource along strike to the cobalt-rich east and copper-rich west, as shown in Figure 1.

Figure 1. Long section of the Iron Creek Deposit showing 2021 drill holes. Inclined section cut at 340 degrees azimuth dipping 70 degrees to the northeast with a 125m cutting thickness.

Drill results have been received for the 6 holes completed during the 2021 drill program, which extended mineralization along strike to the east and to the west. The Company’s objective over the next two years is to meaningfully increase the resource size at Iron Creek and advance the asset towards a development decision.

| 3. | The Cobalt Camp |

Electra holds an interest in a significant land package in the historic silver-cobalt mining camp of Cobalt, Ontario.

In 2021, the Company completed a transaction with Kuya Silver Corporation (“Kuya”) to sell a portion of these properties outright and to potentially form a joint venture on the remaining mineral assets in the Canadian Cobalt Camp.

Electra retains a right of first offer to refine base metal concentrates produced at Electra’s Refinery as well as a back-in right for any discovery of a primary cobalt deposit on the Remaining Assets.

EXPLORATION AND EVALUATION ASSETS

The Company is focused on building a North American cobalt supply chain. The Company’s Iron Creek Project in Idaho, U.S. is its flagship mineral property and a new, upgraded resource estimate was published in January 2020. The Iron Creek property includes patented and unpatented claims totalling approximately 2,400 hectares as well as 600 metres of underground drifting from three adits. Other cobalt-copper targets exist on the Company’s property away from the Iron Creek resource. While not a major focus of the Company’s exploration efforts in recent years, the Cobalt Camp properties are shown separately below due to their different geographic location.

Page 8 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

SUMMARY OF QUARTERLY RESULTS

Key financial information for the three months ended March 31, 2022, as well as the quarters spanning the most recently preceding fiscal years, are summarized as follows, reported in thousands of Canadian dollars except for per share amounts.

Page 9 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED MARCH 31, 2022

The following are highlights from the Company’s results of operations for the three months ended March 31, 2022 and 2021:

| · | Exploration and evaluation expenditures were $394 for the three months ended March 31, 2022, compared to $146 for the three months ended March 31, 2021. The increase was mainly driven by the drill program conducted at Iron Creek. |

| · | Refinery, engineering and metallurgical studies costs were $93 for the three months ended March 31, 2022, compared to $730 for the three months ended March 31, 2021. The decrease is related to the Company capitalizing most refinery related costs with only black mass studies related costs expensed compared to the prior period. |

| · | Salary and benefits were $624 for the three months ended March 31, 2022, compared to $417 for the three months ended March 31, 2021. The increase is a result of the Company expanding its workforce and increased management compensation during the three months ended March 31, 2022. |

| · | Consulting and professional fees were $586 for the three months ended March 31, 2022, compared to $468 incurred during the three months ended March 31, 2021 due to professional and filing fees related to the Nasdaq listing the Company underwent throughout the three months ended March 31, 2022. |

| · | Refinery, permitting and environmental expenses were $28 for the three months ended March 31, 2022, compared to $257 for the three months ended March 31, 2021. These costs have decreased due to the Company using internal personnel for environmental activities rather than external consultants. Most work related to support permit applications were completed in the three month period ended March 31, 2021. |

Page 10 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

CAPITAL STRUCTURE

On April 13, 2022, the Company entered into a share consolidation on the basis of one (1) new post-consolidation common share for every eighteen (18) pre-consolidation common shares issued. The consolidation was undertaken in preparation of the NASDAQ listing. This has reduced the number of issued and outstanding common shares from approximately 562 million to approximately 31 million, on a non-diluted basis (refer to subsequent events note in the condensed interim consolidation financial statements for the three months ended March 31, 2022 and 2021, Note 19). As of the date of this MD&A, the Company has 32,339,519 common shares issued and outstanding. In addition, there are outstanding share purchase warrants and stock options for a further 1,260,896 and 923,293 common shares, respectively. The Company currently has 211,884 Deferred Share Units (DSUs), 60,776 Restricted Share Units (RSUs) and 85,417 Performance Share Units (PSUs) issued under its Long-Term Incentive Plan.

The following warrants were outstanding at the date of this MD&A:

| Grant Date | Expiry Date | Number of warrants outstanding |

Weighted Average Exercise Price |

|||||||

| August 27, 2020 | August 27, 2022 | 279,869 | $ | 3.78 | ||||||

| January 22, 2021 | January 22, 2023 | 875,917 | 9.00 | |||||||

| January 22, 2021 | January 22, 2023 | 105,110 | 5.58 | |||||||

| 1,260,896 | $ | 7.56 | ||||||||

Page 11 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

The following incentive stock options were outstanding and exercisable at the date of this MD&A:

The following units were outstanding at the date of this MD&A:

| Type | Outstanding | |||

| Deferred Share Units | 211,884 | |||

| Restricted Share Units | 60,776 | |||

| Performance Share Units | 85,417 | |||

CAPITAL RESOURCES

The Company manages its capital structure to maximize its financial flexibility, making adjustments to it in response to changes in economic conditions and the risk characteristics of the underlying assets and business opportunities. The Company does not presently utilize any quantitative measures to monitor its capital, but rather relies on the expertise of the Company’s management to sustain the future development of the business. Management reviews its capital management approach on an ongoing basis and believes that this, given the relative size of the Company, is appropriate.

Page 12 of 22

ELECTRA BATTERY MATERIALS CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

(expressed in thousands of Canadian dollars)

The Company will continue to adjust its capital structure based on Management’s assessment of the best capital mix to effectively advance its assets. With the closing of the Notes on September 2, 2021 and the associated Additional Notes issued on October 22, 2021, the Company now has added a debt component to its capital structure.

In addition to its cash on hand, the Company also has executed contribution agreements with the Government of Ontario and Government of Canada for aggregate funding towards the refinery construction of $10,000, of which $3,517 has been received to date. The company expects receipt of the balance $6,483 throughout the first phase of the refinery expansion. With the completion of the Note Offering (inclusive of the Additional Notes) and Equity Offering, the Company’s current working capital on hand, in aggregate with the government investments, will provide the funding required to substantially finance the estimated construction costs of the refinery. The Company will still require a working capital facility to cover the feedstock purchase cycle through to the sale of final cobalt sulfate and to meet minimum liquidity requirements under the Note Offering. The minimum liquidity requirement is US$7,500. The Company is in discussions with working capital finance providers.

LIQUIDITY

The Company’s objective in managing liquidity risk is to maintain sufficient liquidity in order to meet operational and asset advancement requirements. The company has financed its Refinery construction project with a combination of debt instruments and the sale of share capital. During the year ended 2021, the Company issued convertible notes for total net proceeds of $54,986 and issued equity for total net proceeds of $18,266.

At March 31, 2022, the Company had cash of $51,896 (December 31, 2021 - $58,626). This figure does not include the remaining $6,483 (of the original committed $10,000) of Government investments not yet received.

To maintain liquidity, the Company issued common shares for cash proceeds during the three months ended March 31, 2022 as follows:

| · | 148,016 common shares at an average price of $5.40 per share were issued for gross proceeds of approximately $790 under its ATM program. The transaction costs associated with these issuances were $20, which reflect commissions paid to CIBC Capital Markets. |

During the three months ended March 31, 2022, US$500 of convertible notes were converted by noteholders which resulted in the Company issuing a total of 112,729 common shares. The Company also made interest make-whole payments to the noteholders upon conversion totaling US$89. There were no significant transaction costs incurred in relation to the conversions