Form 6-K Docebo Inc. For: Sep 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2021

Commission File Number 001-39750

DOCEBO INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name)

366 Adelaide St. West

Suite 701

Toronto, Ontario, Canada M5V 1R7

(800) 681-4601

(Address and telephone number of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | ☐ | Form 40-F | ☒ | |||||||||||

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

INCORPORATION BY REFERENCE

Exhibits 99.1, 99.2, 99.3, 99.4 and 99.5 of this Form 6-K is incorporated by reference as an additional exhibit to the registrant's Registration Statement on Form F-10 (File No. 333-251046).

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| Exhibit | |||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| 99.4 | |||||

| 99.5 | |||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Docebo Inc. | ||||||||||||||||||||

| Date: | September 20, 2021 | By: | /s/ Sukaran Mehta | |||||||||||||||||

| Name: | Sukaran Mehta | |||||||||||||||||||

| Title: | Interim Chief Financial Officer | |||||||||||||||||||

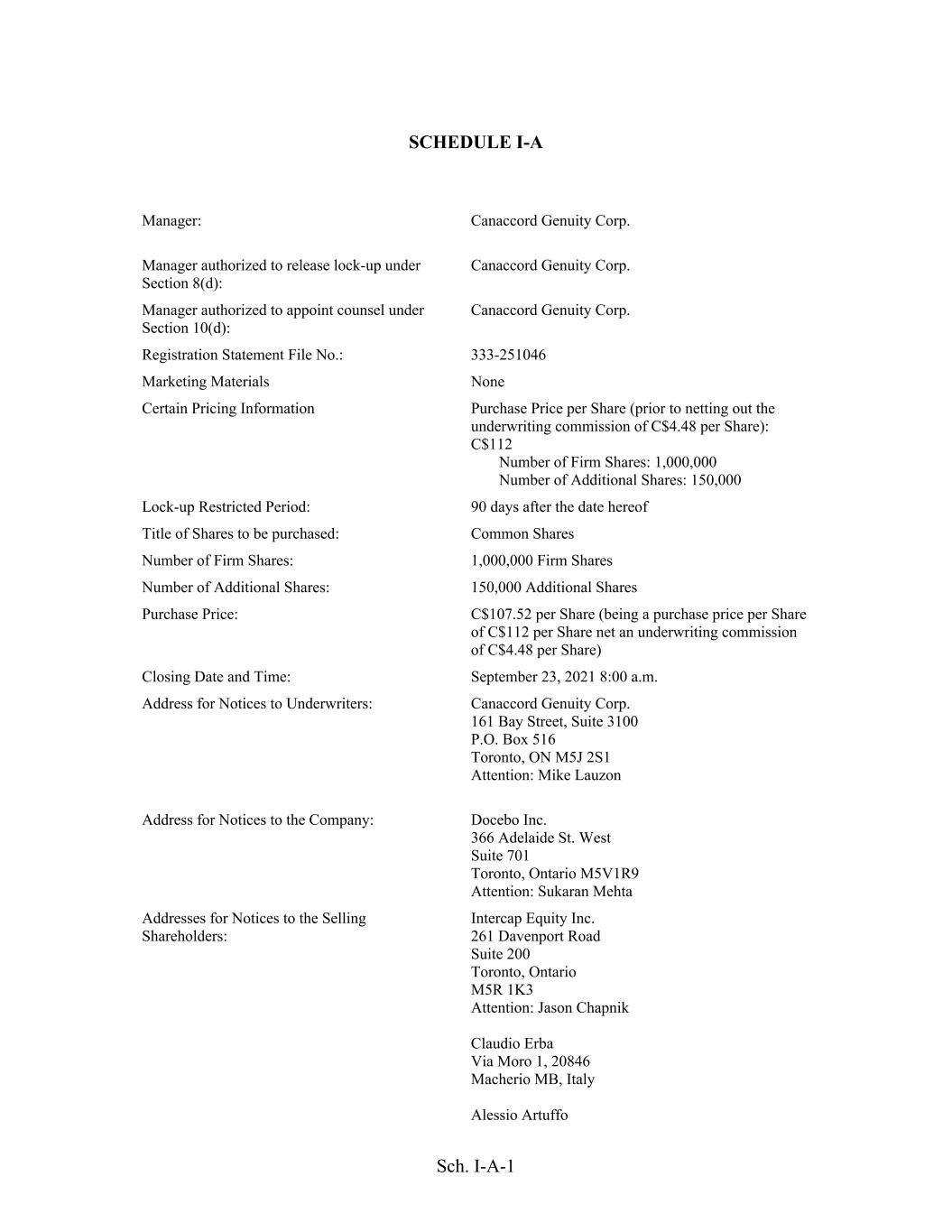

CONFORMED VERSION DOCEBO INC. Common Shares UNDERWRITING AGREEMENT September 20, 2021 To the Manager named in Schedule I-A hereto for the Underwriters named in Schedule II hereto Ladies and Gentlemen: Certain shareholders named in Schedule I-B hereto (the “Selling Shareholders”) of Docebo Inc. (the “Company”), a corporation incorporated under the Business Corporations Act (Ontario), propose, severally, to sell to the several underwriters named in Schedule II hereto (the “Underwriters”), for whom you are acting as manager (the “Manager”), the respective number of the Company’s common shares set forth opposite such Selling Shareholders’ names in Schedule I-B hereto (the “Firm Shares”). The Selling Shareholders also propose, severally, to sell to the several Underwriters not more than the respective additional number of the common shares set forth opposite such Selling Shareholders’ names in Schedule I-B hereto (the “Additional Shares”), if and to the extent that you, as Manager of this offering (the “Offering”), shall have determined to exercise, on behalf of the Underwriters, the right to purchase such common shares granted to the Underwriters in Section 3 of this Underwriting Agreement (the “Agreement”). If the Underwriters elect to purchase less than all of the Additional Shares, the number of Additional Shares sold by each Selling Shareholder will be adjusted proportionally based on its or his number of Firm Shares to be sold. The Firm Shares and the Additional Shares are hereinafter collectively referred to as the “Shares.” The common shares of the Company to be outstanding after giving effect to the sales contemplated hereby are hereinafter referred to as the “Common Shares.” If the firm or firms listed in Schedule II hereto include only the Manager listed in Schedule I-A hereto, then the terms “Underwriters” and “Manager” as used herein shall each be deemed to refer to such firm or firms. The Company meets the requirements under the Securities Act (Ontario) and the securities legislation applicable in each of the other provinces and territories of Canada (collectively, the “Canadian Qualifying Jurisdictions”), and the rules, regulations and national, multi- jurisdictional or local instruments, policy statements, published policies, notices, blanket rulings and orders of the Canadian Securities Commissions (as defined below), and all discretionary rulings and orders applicable to the Company, if any, of the Canadian Securities Commissions (collectively, the “Canadian Securities Laws”), including the rules and procedures established pursuant to National Instrument 44-101 – Short Form Prospectus Distributions and National Instrument 44-102 – Shelf Distributions (together, the “Canadian Shelf Procedures”) for the distribution of securities in the Canadian Qualifying Jurisdictions pursuant to a final short form base shelf prospectus. The Company has filed (i) a preliminary short form base shelf prospectus, dated October 15, 2020 and (ii) a final short form base shelf prospectus, dated October 22, 2020, in both the English and French languages unless the context indicates otherwise, together with all documents incorporated by reference (the “Canadian Base Prospectus”), in respect of up to C$750,000,000 aggregate principal amount of common shares, preferred shares, debt securities,

2 subscription receipts, warrants and units of the Company (collectively, the “Shelf Securities”) with the Ontario Securities Commission (the “Reviewing Authority”) and the other Canadian securities regulators in the Canadian Qualifying Jurisdictions (together with the Reviewing Authority, the “Canadian Securities Commissions”); the Reviewing Authority has issued a receipt (collectively, the “Receipt”) pursuant to the procedures provided for under Multilateral Instrument 11-102 – Passport System (“MI 11-102”) and National Policy 11-202 – Process for Prospectus Reviews in Multiple Jurisdictions (collectively, the “Passport System”) in respect of each of the preliminary short form base shelf prospectus, dated October 15, 2020 and the Canadian Base Prospectus. The Canadian prospectus supplement relating to the Offering, which has been filed with the Canadian Securities Commissions on the date hereof, in both the English and French languages unless the context indicates otherwise, together with the Canadian Base Prospectus and including all documents incorporated therein by reference, is hereinafter referred to as the “Canadian Final Prospectus”. The Company meets the general eligibility requirements for use of Form F-10 under the U.S. Securities Act of 1933, as amended, and the rules and regulations of the U.S. Securities and Exchange Commission (the “Commission”) thereunder (collectively, the “Securities Act”). The Company has filed a registration statement on Form F-10 (File No. 333-251046) in respect of the Shelf Securities with the Commission on December 1, 2020 and has filed an appointment of agent for service of process upon the Company on Form F-X (the “Form F-X”) with the Commission in conjunction with the filing of such registration statement (such registration statement, as amended, including the Canadian Base Prospectus in the English language with such deletions therefrom and additions thereto as are permitted or required by Form F-10 and the applicable rules and regulations of the Commission and including the exhibits to such registration statement and all documents incorporated by reference in the prospectus contained therein are hereinafter referred to collectively as the “Registration Statement”); the base prospectus relating to the Shelf Securities contained in the Registration Statement at the time the registration statement on Form F-10 became effective, including all documents incorporated therein by reference, is hereinafter referred to as the “U.S. Base Prospectus”; the U.S. prospectus supplement, dated the date hereof, relating to the Offering (which consists of the Canadian Final Prospectus in the English language with such deletions therefrom and additions thereto as are permitted or required by Form F-10 and the applicable rules and regulations of the Commission), including all documents incorporated therein by reference, together with the U.S. Base Prospectus, is hereinafter referred to as the “U.S. Final Prospectus”. As used herein, “Base Prospectuses” shall mean, collectively, the Canadian Base Prospectus and the U.S. Base Prospectus; and “Prospectuses” shall mean, collectively, the Canadian Final Prospectus and the U.S. Final Prospectus. The terms “supplement,” “amendment,” and “amend” as used herein with respect to the Registration Statement, the Base Prospectuses, the Prospectuses or any free writing prospectus shall include all documents subsequently filed or furnished by the Company with or to the Canadian Securities Commissions or the Commission pursuant to Canadian Securities Laws or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as the case may be, that are deemed to be incorporated by reference therein. For purposes of this Agreement, “free writing prospectus” has the meaning set forth in Rule 405 under the Securities Act, “road show” means (except for purposes of Section 4 hereof or as otherwise described herein) a “road show” as defined in Rule 433(h) under the Securities Act that

3 has been made available without restriction to any person, “marketing materials” has the meaning ascribed to such term in National Instrument 41-101 – General Prospectus Requirements (“NI 41-101”), “provide”, in the context of sending or making available marketing materials to a potential investor, has the meaning ascribed to such term under Canadian Securities Laws; “template version” has the meaning ascribed to such term in NI 41-101 and includes any revised template version of marketing materials as contemplated by NI 41-101; and “misrepresentation” means a misrepresentation for the purposes of applicable Canadian Securities Laws or any of them. As used herein, the terms “Registration Statement”, “Canadian Final Prospectus” and “U.S. Final Prospectus” shall include the documents incorporated by reference therein from time to time. 1. Representations and Warranties of the Company. The Company represents and warrants to each of the Underwriters and to each Selling Shareholder as of the date hereof, as of the Closing Date and as of each day, if any, that Additional Shares are to be purchased (an “Option Closing Date”), and agrees with each of the Underwriters, that: (a) The Registration Statement has become effective pursuant to Rule 467(a) under the Securities Act; no stop order suspending the effectiveness of the Registration Statement is in effect, and no proceedings for such purpose or pursuant to Section 8A under the Securities Act are pending before or, to the knowledge of the Company, threatened by the Commission. The Receipt has been obtained under the Passport System from the Reviewing Authority in respect of the Canadian Base Prospectus and no order or action that would have the effect of ceasing or suspending the distribution of the Shares has been issued by any Canadian Securities Commission and no proceeding for that purpose has been initiated or, to the Company’s knowledge, threatened by any Canadian Securities Commission; and any request made to the Company on the part of any Canadian Securities Commission for additional information has been complied with. (b) (i) Each document, if any, filed or to be filed pursuant to the Exchange Act and incorporated by reference in the U.S. Final Prospectus complied or will comply when so filed in all material respects with the Exchange Act and the applicable rules and regulations of the Commission thereunder, and each document filed or to be filed with the Canadian Securities Commissions and incorporated by reference in the Canadian Final Prospectus, as amended or supplemented, if applicable, when such documents were or are filed with the Canadian Securities Commissions, conformed or will conform when so filed in all material respects with Canadian Securities Laws; (ii) the Registration Statement, when it became effective, did not contain, and as amended or supplemented, if applicable, will not contain, as of the date of such amendment or supplement, any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading, (iii) the Registration Statement as of the date hereof does not, and as of the Closing Date will not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading, (iv) the Canadian Final

4 Prospectus, as of the date of the Canadian Final Prospectus and any amendment or supplement thereto and at the Closing Date (as defined below), will not contain any misrepresentation or untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading, (v) the Registration Statement and the U.S. Final Prospectus comply, and as amended or supplemented, if applicable, will comply in all material respects with the Securities Act and the applicable rules and regulations of the Commission thereunder, (vi) the Canadian Final Prospectus and any amendment or supplement thereto, at the time of filing thereof, will comply, in all material respects with the applicable requirements of Canadian Securities Laws, (vii) each road show, if any, does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading, and (viii) as of its date and as of the Closing Date, the U.S. Final Prospectus does not contain and, as amended or supplemented, if applicable, will not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading, and the Canadian Final Prospectus and any amendment or supplement thereto, at the time of filing thereof and at the Closing Date, will constitute full, true and plain disclosure of all material facts relating to the Shares, except that the representations and warranties set forth in this paragraph do not apply to statements or omissions in the Registration Statement or the Prospectuses based upon (i) information relating to any Underwriter furnished to the Company in writing by such Underwriter through the Manager expressly for use therein, it being understood and agreed that the only such information furnished by any Underwriter consists of the information described as such in Section 10(c) hereof, or (ii) information relating to any Selling Shareholder furnished to the Company in writing by such Selling Shareholder expressly for use therein, it being understood that the only information so furnished by such Selling Shareholder consists of the name of such Selling Shareholder, the number of Common Shares beneficially owned by such Selling Shareholder before the Closing Date and immediately following the Closing Date and other information with respect to such Selling Shareholder (excluding percentages) that appear in the table (and corresponding footnotes) under the caption “Selling Shareholders” in the Prospectuses (the “Selling Shareholder Information”). The Form F-X conforms in all material respects with the requirements of the Securities Act and the rules and regulations of the Commission thereunder. (c) Any marketing material that the Company is required to file with or deliver to the Canadian Securities Commissions has been, or will be, filed with or delivered to the Canadian Securities Commissions in accordance with the requirements of Canadian Securities Laws. Each marketing material that the Company has filed or delivered, or is required to file or deliver, in connection with the Offering pursuant to Canadian Securities Laws or that was prepared by or on behalf of or used or referred to by the Company (i) does not and will not, at the time of any filing, delivery or use thereof in accordance with this Agreement, contain any misrepresentation or untrue statement of a material fact or omit to state a material

5 fact necessary to make the statements therein, in the light of the circumstances under which they were made not misleading, and (ii) complies or will comply in all material respects with the applicable requirements of Canadian Securities Laws. Except for the marketing materials, if any, identified in Schedule I-A hereto that have been, or will be, filed with or delivered to the Canadian Securities Commission in accordance with the requirements of Canadian Securities Laws, each furnished to you before first use, the Company has not prepared, used or referred to, and will not, without your prior consent, prepare, use or refer to, any marketing materials. (d) The Company is not an “ineligible issuer” in connection with the Offering pursuant to Rules 164, 405 and 433 under the Securities Act. Any free writing prospectus that the Company is required to file pursuant to Rule 433(d) under the Securities Act has been, or will be, filed with the Commission in accordance with the requirements of the Securities Act and the applicable rules and regulations of the Commission thereunder. Each free writing prospectus that the Company has filed, or is required to file, in connection with the Offering pursuant to Rule 433(d) under the Securities Act or that was prepared by or on behalf of or used or referred to by the Company complies or will comply in all material respects with the requirements of the Securities Act and the applicable rules and regulations of the Commission thereunder. The Company has not prepared, used or referred to, and will not, without your prior consent, prepare, use or refer to, any free writing prospectus. (e) Since the respective dates as of which information is given in the Prospectuses, and except as otherwise disclosed in the Prospectuses: (i) there has been no material adverse change, or any development involving a prospective material adverse change, in the business, affairs, operations, assets, liabilities (contingent or otherwise) or capital of the Company and each of Docebo NA, Inc., Docebo UK Limited, Docebo S.p.A., Docebo EMEA FZ-LLC, Docebo France Société par Actions Simplifiée, Docebo DACH GmbH and any subsidiaries formed after the date hereof and prior to the Closing Date (collectively, the “Subsidiaries”), taken as a whole and as a going concern (“Condition of the Company”); (ii) there have been no transactions entered into by the Company or any of the Subsidiaries, other than those in the ordinary course of business, which are material with respect to the Company and the Subsidiaries taken as a whole; and (iii) there has been no dividend or distribution of any kind declared, paid or made by the Company on any class of its shares. (f) The Company and each of its Subsidiaries is a valid and subsisting corporation, duly incorporated, continued or amalgamated and in good standing under the laws of their respective jurisdictions of formation, incorporation, continuation or amalgamation and have all requisite power, capacity and authority to carry on their business as now conducted or contemplated to be conducted and to own, lease and operate their property and assets and, in the case of the Company, to execute, deliver and perform its obligations hereunder; and, no proceedings have been taken or authorized by the Company or its shareholders or to the knowledge of the Company, any other person, with respect to the bankruptcy, insolvency, liquidation, dissolution or winding up of the Company.

6 (g) All of the outstanding Common Shares of the Company have been duly authorized and are validly issued, fully paid and non-assessable. (h) All of the issued and outstanding shares of, or other equity interests in, the Subsidiaries have been duly and validly authorized and issued, are fully paid and non-assessable, and are free and clear of any mortgage, charge, pledge, hypothec, claim, security interest, assignment, lien (statutory or otherwise), restriction on transfer, or other encumbrance of any nature, including any arrangement or condition which, in substance, secures payment or performance of an obligation (“Lien”), whatsoever. (i) The execution, delivery and performance by the Company of this Agreement has been duly authorized by all necessary corporate action on the part of the Company and does not require the consent, approval, authorization, registration or qualification of or with any court, governmental entity or other third party, except: (a) those which have been obtained (or will be obtained prior to the Closing Date), or (b) those as may be required (and will be obtained prior to the Closing Date) under applicable Canadian Securities Laws. (j) Except for the investor rights agreement entered into on October 8, 2019 among the Company and certain of its shareholders and supplemented pursuant to a letter agreement dated November 30, 2020 (as further amended or supplemented from time to time, the “Investor Rights Agreement”), and contracts, agreements or understandings expired in accordance with their terms prior to the date of this Agreement, there are no contracts, agreements or understandings between the Company and any person granting such person the right to require the Company to file a registration statement under the Securities Act or to file a prospectus under Canadian Securities Laws with respect to any securities of the Company owned or to be owned by such person or to require the Company to include such securities in the Offering to which the Prospectuses relate. (k) In connection with the Offering, the Company will have complied as of the Closing Date with all requirements applicable to it, and obtained all consents and waivers required to be obtained by it, on or prior to the Closing Date as may be required under Canadian Securities Laws, U.S. federal and state securities laws, the rules of the Nasdaq Global Select Market (“Nasdaq”) and the rules and regulations of the Toronto Stock Exchange (the “TSX”). (l) This Agreement has been duly authorized, executed and delivered by the Company and constitutes a valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (a) as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the rights of creditors generally, (b) as limited by the application of equitable principles when equitable remedies are sought, (c) that rights to indemnity and contribution may be limited under applicable law, and (d) that provisions that attempt to sever any provision which is prohibited or unenforceable under

7 applicable law without affecting the enforceability or validity of the remainder of the agreement would be determined only in the discretion of the court. (m) Neither the Company nor any of its Subsidiaries is in violation or default of, nor will the execution and delivery of this Agreement, and the performance by the Company of its obligations hereunder, result in a breach or violation of, or be in conflict with, or constitute a default under, or create a state of facts which after notice or lapse of time, or both, would constitute a default under, or result in the imposition of any Lien upon any property or assets of the Company or its Subsidiaries pursuant to: (i) any of the terms, conditions or provisions of the articles or by-laws of the Company or any of its Subsidiaries, or any resolution of their respective directors or shareholders; (ii) any law applicable to the Company or its Subsidiaries; (iii) any judgement, decree, order or award of any court, governmental entity or arbitrator having jurisdiction over any of the Company or its Subsidiaries, of which the Company or its Subsidiaries are aware; or (iv) any agreement, license, authorization or permit necessary for the conduct of their businesses, to which any of the Company or its Subsidiaries is party or bound or to which any of the business, operations, property or assets of the Company or its Subsidiaries is subject; which violation or default would, individually or in the aggregate: (i) result in a material adverse effect on the Condition of the Company or (ii) materially impair the ability of the Company to perform its obligations under this Agreement. (n) The authorized and issued share capital of the Company conforms to the description thereof contained in the Prospectuses. (o) Except for the Investor Rights Agreement, no person (except for the Underwriters hereunder) has an agreement (oral or written) or option, right or privilege (whether pre-emptive or contractual) capable of becoming an agreement for the subscription or issuance by Company of any unissued shares of the Company, or for the purchase or acquisition, outside of the ordinary course of business, of any material assets or material property of any kind of the Company or any of its Subsidiaries. Other than the Company or any of its Subsidiaries pursuant to inter-company arrangements, no person has an agreement (oral or written) or option, right or privilege (whether pre-emptive or contractual) capable of becoming an agreement for the subscription or issuance by any Subsidiary of any unissued shares of the Subsidiary. (p) Neither the Company nor any of its Subsidiaries is in violation of any laws, other than violations which would not individually or in the aggregate reasonably be expected to have a material adverse effect on the Condition of the Company.

8 (q) The Company and its Subsidiaries possess all licenses, permits, franchises, certificates, registrations and authorizations necessary to conduct their business and own their property and assets and are not in default or breach of any of the foregoing, except for failure to possess, defaults or breaches which would not individually or in the aggregate reasonably be expected to have a material adverse effect on the Condition of the Company. (r) Except those that would not reasonably be expected to have a material adverse effect on the Condition of the Company, neither the Company nor any of its Subsidiaries is in breach of, conflict with, or default under, and no event or omission has occurred which after notice or lapse of time or both, would constitute a breach of, conflict with, or default under, or would result in the acceleration or maturity of any material indebtedness or other material liabilities or obligations under any mortgage, hypothec, note, indenture, contract, agreement (written or oral), instrument, lease, license or other document to which it is a party or is subject or by which it is bound. (s) There is no action, suit or proceeding before or by any governmental entity now pending or, to the knowledge of the Company, threatened against the Company, its Subsidiaries or any of their properties or assets (collectively, “Proceedings”) that is required to be disclosed in the Prospectuses or that would reasonably be expected to have a material adverse effect on the Condition of the Company or the consummation of the transactions contemplated in this Agreement, and the aggregate of all pending Proceedings, including routine litigation, would not reasonably be expected to have a material adverse effect on the Condition of the Company if determined unfavorably. (t) The currently issued and outstanding Common Shares are listed and posted for trading on the TSX and Nasdaq and no governmental entity has issued any order preventing or suspending the trading of the Company’s securities, the use of the Prospectuses or the distribution of the Shares and the Company is not aware of any investigation, order, inquiry or proceeding which has been commenced or which is pending, contemplated or threatened by any such authority. (u) Except as disclosed in the Prospectuses, there are no off-balance sheet transactions, arrangements, obligations (including contingent obligations) or other relationships of the Company with unconsolidated entities or other persons that may have a material current or future effect on the financial condition, changes in financial condition, results of operations, earnings, cash flow, liquidity, capital expenditures, capital resources, or significant components of revenues or expenses of the Company or that would reasonably be expected to be material to an investor in making a decision to purchase the Shares. (v) Except as disclosed in the Prospectuses, neither the Company nor any of its Subsidiaries has outstanding any debentures, notes, mortgages or other indebtedness that is material to the Company and its Subsidiaries, taken as a whole.

9 (w) Except as disclosed in the Prospectuses, the Company does not have any contingent liabilities that would be required to be disclosed under IFRS, in excess of the liabilities that are either reflected or reserved against in the Company’s financial statements which would reasonably be expected to be material to the Condition of the Company. (x) Except with respect to matters which would not reasonably be expected to have a material adverse effect on the Condition of the Company: (a) all income tax returns of the Company and its Subsidiaries required by law to be filed in any jurisdiction have been filed, all such returns are complete and accurate and all taxes shown on such returns or otherwise assessed which are due and payable have been paid, except tax assessments against which appeals have been or will be promptly taken and as to which adequate reserves have been provided; (b) all other tax returns of the Company and its Subsidiaries required to be filed pursuant to any applicable law have been filed, all such returns are complete and accurate and all taxes shown on such returns or otherwise assessed which are due and payable have been paid, except for such taxes, if any, as are being contested in good faith and as to which adequate reserves have been provided; (c) the Company has made installments of taxes as and when required; and (d) the Company has duly and timely withheld from any amount paid or credited by it to or for the account or benefit of any person, including any employee, officer, director, or non-resident person, the amount of all taxes and other deductions required by applicable law to be withheld and has duly and timely remitted the withheld amount to the appropriate taxing or other authority and has duly and timely issued tax reporting slips or returns in respect of any amount so paid or credited by it as required by applicable law. (y) The Prospectuses disclose, to the extent required by applicable Canadian Securities Laws and U.S. federal and state securities laws, each material plan for retirement, bonus, stock purchase, profit sharing, stock option, deferred compensation, severance or termination pay, insurance, medical, hospital, dental, vision care, drug, sick leave, disability, salary continuation, legal benefits, unemployment benefits, vacation, incentive or otherwise contributed to or required to be contributed to, by the Company for the benefit of any current or former director, officer, employee or consultant of the Company. (z) The Company has no pension, retirement or similar plans relating to current or former employees, officers or directors of the Company or any of its Subsidiaries, whether written or oral. (aa) Except as would not, individually or in the aggregate, reasonably be expected to result in a material adverse effect on the Condition of the Company, (a) each of the Company and its Subsidiaries is in compliance with the provisions of applicable federal, provincial, state, local and foreign laws and regulations respecting employment; (b) no labour dispute (including any strike, lock-out or work slow- down or stoppage) with the current or former employees of the Company of any of its Subsidiaries exists or is pending or, to the knowledge of the Company is threatened or imminent, and the Company has no knowledge of any existing or

10 imminent labour disturbance by the employees of the Company’s or the Subsidiaries’ principal suppliers, value-added resellers or agents that would impact the Company; (c) the labour relations of the Company and its Subsidiaries are satisfactory; and (d) no union has been accredited or otherwise designated to represent any employees of the Company or its Subsidiaries and, to the knowledge of the Company, no accreditation request or other representation question is pending with respect to the employees of the Company or its Subsidiaries and no collective agreement or collective bargaining agreement or modification thereof has expired or is in effect in any of the premises of the Company or its Subsidiaries and none is currently being negotiated by the Company or its Subsidiaries. (bb) Except for Company IP (as defined below), which is addressed separately, the Company and its Subsidiaries have good and marketable title to the material property and assets owned by them and hold valid leases in all material property leased by them, in each case, free and clear of all Liens other than those which would not individually or in the aggregate reasonably be expected to have a material adverse effect on the Condition of the Company. (cc) Except as disclosed in the Prospectuses, neither the Company nor any of its Subsidiaries owns any real property and none has entered into any agreement to acquire any real property. (dd) The Company has not received any notice or other communication from the owner or manager of any of its leased material properties that the Company or any of its Subsidiaries is not in compliance with any material term or condition of its lease, and to the knowledge of the Company, no such notice or other communication is pending or has been threatened. (ee) All material tangible assets of the Company and its Subsidiaries are in good working condition and repair except as would not individually or in the aggregate reasonably be expected to have a material adverse effect on the Condition of the Company. (ff) The Company and its Subsidiaries maintain insurance policies with reputable insurers against risks of loss of or damage to their properties, assets and business of such types and in such amounts as are customary in the case of entities engaged in the same or similar businesses and the Company and its Subsidiaries are not in default in any material respect under any such policies. (gg) Except as would not individually or in the aggregate reasonably be expected to have a material adverse effect on the Condition of the Company: (a) neither the Company nor any of its Subsidiaries is in violation of any applicable law relating to pollution or occupational health and safety, the environment (including ambient air, surface water, groundwater, land surface or subsurface strata) or wildlife, including laws relating to the release or threatened release of chemicals, pollutants, contaminants, wastes, toxic substances, hazardous substances, petroleum or petroleum products (collectively, “Hazardous Materials”) or to the manufacture, processing,

11 distribution, use, treatment, storage, disposal, transport or handling of Hazardous Materials (collectively, “Environmental Laws”), (b) to the knowledge of the Company, there are no pending or threatened administrative, regulatory or judicial actions, suits, demands, demand letters, claims, Liens, notices of non-compliance or violation, investigation or proceedings relating to any Environmental Laws against the Company or any of its Subsidiaries and (c) to the knowledge of the Company, there are no events or circumstances that would reasonably be expected to form the basis of an order for clean-up or remediation, or an action, suit or proceeding by any private party or governmental body or agency, against or affecting the Company or any of its Subsidiaries relating to Hazardous Materials or any Environmental Laws. (hh) (a) None of the Company or its Subsidiaries or affiliates, or any director, officer, or employee thereof, or, to the Company’s knowledge, any agent or representative of the Company or of any of its Subsidiaries or affiliates, has taken or will take any action in furtherance of an offer, payment, promise to pay, or authorization or approval of the payment, giving or receipt of money, property, gifts or anything else of value, directly or indirectly, to any government official (including any officer or employee of a government or government-owned or controlled entity or of a public international organization, or any person acting in an official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate for political office) (“Government Official”) in order to influence official action, or to any person in violation of any applicable anti-corruption statute or regulation; (b) the Company and its Subsidiaries and affiliates have conducted their businesses in compliance with applicable anti-corruption statutes and regulations and have instituted and maintained and will continue to maintain policies and procedures reasonably designed to promote and achieve compliance with such laws and with the representations and warranties contained herein; and (iii) neither the Company nor its Subsidiaries will use, directly or indirectly, the proceeds of the offering in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any person in violation of any applicable anti-corruption laws. (ii) The operations of the Company and its Subsidiaries are and have been conducted at all times in material compliance with all applicable financial recordkeeping and reporting requirements, including those of the Bank Secrecy Act, as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), and the applicable anti-money laundering statutes of jurisdictions where the Company and its Subsidiaries conduct business, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Anti- Money Laundering Laws”), and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any of its Subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the knowledge of the Company, threatened.

12 (jj) (a) None of the Company, any of its Subsidiaries, or any director, officer, or employee thereof, or, to the Company’s knowledge, any agent, affiliate or representative of the Company or any of its Subsidiaries, is an individual or entity (“Person”) that is, or is owned or controlled by one or more Persons that are: (A) the subject of any sanctions administered or enforced by the U.S. Department of Treasury’s Office of Foreign Assets Control (“OFAC”), the United Nations Security Council (“UNSC”), the European Union (“EU”), Her Majesty’s Treasury (“HMT”), or other relevant sanctions authority (collectively, “Sanctions”), or (B) located, organized or resident in a country or territory that is the subject of Sanctions (including, without limitation, Crimea, Cuba, Iran, North Korea and Syria). (b) The Company will not, directly or indirectly, use the proceeds of the offering, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person: (A) to fund or facilitate any activities or business of or with any Person or in any country or territory that, at the time of such funding or facilitation, is the subject of Sanctions; or (B) in any other manner that will result in a violation of Sanctions by any Person (including any Person participating in the offering, whether as underwriter, advisor, investor or otherwise). (c) The Company and its subsidiaries have not knowingly engaged in, are not now knowingly engaged in, and will not engage in, any dealings or transactions with any Person, or in any country or territory, that at the time of the dealing or transaction is or was the subject of Sanctions. For the past five years, the Company and each of its subsidiaries have not knowingly engaged in, are not now knowingly engaged in, and will not engage in, any dealings or transactions with any Person, or in any country or territory, that at the time of the dealing or transaction is or was the subject of Sanctions. (kk) Neither the Company nor any of its Subsidiaries nor, to the Company’s knowledge, any employee or agent of the Company or any subsidiary, has made any contribution or other payment to any official of, or candidate for, any federal, provincial, state or foreign office in violation of any law or of the character required to be disclosed in the Prospectuses, or any related amendment thereto. (ll) The Company or its Subsidiaries, as the case may be, is the legal and beneficial owner of, has good and marketable title to, the right to use and exploit, and owns all rights, title and interest in all Company IP free and clear of all Liens except for covenants, conditions, options to purchase and restriction, except where the failure to so own, use or exploit would not result in a material adverse effect on the Condition of the Company. “Company IP” means the following intellectual

13 property that is owned by the Company or its Subsidiaries, whether through development, creation, conception or acquisition: (a) trademarks, including brand names, business names, trade names, registered and unregistered trademarks, service marks, certification marks, distinguishing guises, trade dress, get-up, logos and other indications of origin; (b) patents, including patents, patent rights (including design patents and industrial designs) and related applications; (c) copyrights, writings and other copyrightable works of authorship, including computer programs, data bases and related documentation, maskworks and integrated circuit topographies; and (d) trade secrets (proprietary and non-public business information) including know-how, inventions, discoveries, improvements, concepts, ideas, methods, processes, designs, formulae, technical data, drawings, specifications, research and development information, customer lists, and business plans and marketing plans. (mm) Except as would not reasonably be expected to have a material adverse effect on the Condition of the Company: (a) no action, suit, proceeding or claim is pending, nor have the Company or its Subsidiaries received any notice or claim (whether written, oral or otherwise), challenging the ownership, validity or right to use any of the Company IP or suggesting that any other person has any claim of legal or beneficial ownership or other claim or interest with respect to Company IP; (b) to the knowledge of the Company, there is no Company IP being used or enforced by the Company or any of its Subsidiaries in a manner that would result in its abandonment, cancellation or unenforceability; and (c) to the knowledge of the Company, no person is infringing upon, violating or misappropriating any material Company IP and neither the Company nor any of its Subsidiaries is a party to any action or proceeding that alleges that any person has infringed, violated or misappropriated any Company IP. (nn) Except in each case as would not reasonably be expected to have a material adverse effect on the Condition of the Company, and except in relation to open source software or commercially available off-the-shelf software: (a) each of the Company and its Subsidiaries, as applicable, have entered into valid and enforceable written agreements in respect of their licensed intellectual property; (b) the Company or its Subsidiaries has been granted licenses and permission to use, reproduce, sub- license, sell, modify, update, enhance or otherwise exploit the licensed intellectual property to the extent required to conduct the business of the Company and its Subsidiaries (including, if required, the right to incorporate such licensed intellectual property into the Company IP); and (c) all license agreements in respect to any licensed intellectual property that is material to the business of the Company are in full force and effect and none of the Company or its Subsidiaries is in default of any of their material obligations thereunder. (oo) Except in each case as would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the Condition of the Company: (a) to the extent any Company IP was invented, developed, modified, created, conceived, supported or reduced to practice, in whole or in part, by current or past employees or independent contractors of the Company or any of its Subsidiaries, the Company

14 and its Subsidiaries have obtained written agreements providing for confidentiality, non-disclosure and assignment of inventions executed by all of such employees and independent contractors; and (b) the Company and Subsidiaries treat their software products, including all source code therein, as confidential and proprietary business information and have taken commercially reasonable steps to protect the source code as trade secrets. (pp) Except in each case as would not reasonably be expected to have a material adverse effect on the Condition of the Company: (i) neither the Company nor any of its Subsidiaries is a party to any action or proceeding; and (ii) to the knowledge of the Company, there are no actions or proceedings threatened, in each case that allege that the Company or its Subsidiaries has infringed, violated or misappropriated any intellectual property of any person. (qq) Except in each case as would not reasonably be expected to have a material adverse effect on the Condition of the Company, the Company and its Subsidiaries’ information technology assets and equipment, computers, systems, networks, hardware, software, websites, applications, and databases (collectively, “IT Systems”) are adequate for, and operate and perform as required in connection with the operation of the business of the Company and its Subsidiaries as currently conducted. The Company and its Subsidiaries have implemented and maintained commercially reasonable controls, policies, procedures, and safeguards to control risks and to maintain and protect their material confidential information and the integrity, continuous operation, redundancy and security of all IT Systems and data (including all personal, personally identifiable, sensitive, confidential or regulated data (“Personal Data”)) used in connection with their businesses, and there have been no breaches, violations, outages or unauthorized uses of or accesses to same, except for those that have been remedied without material cost or liability, and there are no material incidents under internal review or investigations relating to the same. Except as would not reasonably be expected to have a material adverse effect on the Condition of the Company, the Company and its Subsidiaries presently comply, and have complied at all times, with all applicable laws, statutes, and industry standards, and all judgments, orders, rules and regulations of any court or arbitrator or governmental or regulatory authority (including, but not limited to, the European Union General Data Protection Regulation, the Canadian Personal Information Protection and Electronic Documents Act, and the Payment Card Industry Data Security Standard, where applicable), and internal policies and contractual obligations relating to the privacy and security of IT Systems and Personal Data and to the protection of such IT Systems and Personal Data from unauthorized use, access, misappropriation or modification. The Company and its Subsidiaries have entered into data processing agreements compliant in all material respects with all applicable laws relating to the privacy and security of IT Systems and Personal Data with each of its subscribers, and the Company has implemented compliance measures to ensure that its subscribers are in material compliance with the terms of such data processing agreements. (rr) Except for the transactions contemplated by this Agreement, since June 30, 2021:

15 (i) there has not been any material change (actual, anticipated, contemplated or threatened, whether financial or otherwise) in the Condition of the Company; (ii) there has not been any material change in the capital stock or long-term or short-term debt of the Company determined on a consolidated basis; and (iii) there has been no transaction out of the ordinary course of business that is material to the Company and its Subsidiaries taken as a whole. (ss) Except as disclosed in the Prospectuses, to the knowledge of the Company, none of the directors or officers or employees of the Company or any of its Subsidiaries, any person who owns or exercises control over, directly or indirectly, more than 10% of the Common Shares, or any associate or affiliate of any of the foregoing, has, or has had within the last three years, any material interest, direct or indirect, in any transaction, or in any proposed transaction (within the meaning of Item 11 of Form 51-102F5 – Information Circular), that has materially affected or will materially affect the Company or its Subsidiaries. (tt) To the knowledge of the Company, none of the Company’s directors or officers is now, or has ever been, subject to an order or ruling of any securities regulatory authority or stock exchange prohibiting such individual from acting as a director or officer of a public company or of a company listed on any stock exchange. (uu) The minute books and corporate records of the Company and its Subsidiaries made available to Stikeman Elliott LLP, Canadian counsel to the Underwriters, and Skadden, Arps, Slate, Meagher & Flom LLP, U.S. counsel to the Underwriters, for the periods from their respective dates of incorporation, continuance or amalgamation, as the case may be, to the date of examination thereof are the original minute books and records of the Company and its Subsidiaries and contain, in all material respects, all proceedings of the shareholders, the board of directors and all committees of the board of directors of the Company and its Subsidiaries. (vv) Other than the Underwriters and any such dealer or broker other than the Underwriters, with which the Underwriters have a contractual relationship in respect of the distribution of the Shares, there is no person acting or purporting to act at the request of the Company, who is entitled to any commission, finder’s fee, advisory fee, underwriting fee or agency fee in connection with or as a result of the sale of the Shares. (ww) The Company’s former auditors, PricewaterhouseCoopers LLP (“PwC”) were during the period they served as the Company’s auditors, and the Company’s current auditors KPMG LLP (“KPMG”) are, independent public accountants as required under Canadian Securities Laws and are an independent registered public accounting firm within the meaning of the Securities Act and the applicable rules and regulations thereunder adopted by the Commission and the Public Company Accounting Oversight Board (United States), and there has not been any

16 disagreement (within the meaning of National Instrument 51-102 – Continuous Disclosure Obligations) with the present or any former auditors of the Company. (xx) No acquisition has been made by the Company or its Subsidiaries during the three most recently completed financial years of the Company that would be a significant acquisition for the purposes of Canadian Securities Laws, and no proposed acquisition by the Company or its Subsidiaries has progressed to a state where a reasonable person would believe that the likelihood of the Company or its Subsidiaries completing the acquisition is high and that, if completed by the Company or its Subsidiaries at the date of the Prospectuses, as applicable, would be a significant acquisition for the purposes of Canadian Securities Laws, in each case, that would require the prescribed disclosure in the Prospectuses, as applicable, pursuant to such laws. (yy) The Company has a reasonable basis for disclosing any forward-looking information contained in the Prospectuses and is not, as of the date hereof, required to update such forward-looking information pursuant to National Instrument 51- 102 – Continuous Disclosure Obligations. (zz) There are no reports or information that, in accordance with the requirements of the Canadian Securities Regulators and Canadian Securities Laws and the Commission and U.S. securities laws, must be made publicly available in connection with the Offering of the Shares that have not been made publicly available as required; there are no documents required to be filed with any Canadian Securities Regulators or the Commission in connection with the Prospectuses, as applicable, that have not been filed, or will be filed on or before the Closing Date, as required by applicable Canadian Securities Laws and U.S. securities laws; and there are no contracts or documents which are required by Canadian Securities Laws or U.S. securities laws to be described as material contracts in the Prospectuses which have not been so described. (aaa) TSX Trust Company is the duly appointed Canadian registrar and transfer agent for the Shares, and Continental Stock Transfer & Trust is the duly appointed U.S. co- registrar and transfer agent for the Shares. (bbb) The Company is qualified under National Instrument 44-101 – Short Form Prospectus Distributions to file a prospectus in the form of a short form prospectus in each of the Canadian Qualifying Jurisdictions. (ccc) The Company is a reporting issuer or the equivalent in good standing in all of the Canadian Qualifying Jurisdictions under the Canadian Securities Laws and the Company is in compliance, in all material respects, with all of its applicable continuous disclosure obligations and timely disclosure obligations under the Canadian Securities Laws and the rules and regulations of the TSX. (ddd) (i) The audited financial statements included in the Registration Statement and the Prospectuses have been prepared in conformity with International Financial

17 Reporting Standards applied on a consistent basis throughout the periods involved, except as may be expressly stated in the related notes thereto, and present fairly in all material respects the consolidated financial position of the Company as at December 31, 2020 and 2019 and the consolidated results of operations and comprehensive income, changes in shareholders’ equity and cash flows of the Company for the years ended December 31, 2020 and 2019; and (B) the interim financial statements included in the Registration Statement and the Prospectuses have been prepared in conformity with International Financial Reporting Standards applied on a consistent basis throughout the periods involved, except as may be expressly stated in the related notes thereto, and present fairly in all material respects the consolidated financial position of the Company as at June 30, 2021 and the consolidated results of operations and comprehensive income (loss), changes in equity and cash flows of the Company for the six month period ended June 30, 2021 and 2020. (eee) The Company has established and maintains a system of “disclosure controls and procedures” and “internal control over financial reporting” as required by Rule 13a- 15(e) under the Exchange Act, NI 52-109 and Canadian Securities Laws (and subject to applicable exemptions therefrom), which are effective in all material respects to perform the functions for which they were established. Based on the most recent evaluation of its internal controls over financial reporting, the Company is not aware, and has not been advised by its auditors, of any “material weakness”. (fff) Neither the Company nor any of its Subsidiaries has taken, and the Company and its Subsidiaries will not take, any action which constitutes stabilization or manipulation of the price of the Shares or any “reference security” (as defined in Rule 100 of Regulation M under the Exchange Act) of the Company. (ggg) The Company is, and has been since the time of the initial filing of the Registration Statement with the Commission, in compliance in all material respects with all applicable provisions of the Sarbanes-Oxley Act of 2002, as amended, and all applicable rules and regulations promulgated thereunder or implementing provisions thereof (the “Sarbanes-Oxley Act”). (hhh) Neither the Company nor any of its Subsidiaries is (a) required to register as an “investment company” or a company “controlled” by an “investment company” within the meaning of the Investment Company Act of 1940, as amended (the “Investment Company Act”), and the rules and regulations of the Commission thereunder, or (b) a “business development company” (as defined in Section 2(a)(48) of the Investment Company Act). (iii) Except as would not reasonably be expected to result in a material adverse change to the Condition of the Company, (a) the Company and each of its Subsidiaries are in compliance with all presently applicable provisions of the Employee Retirement Income Security Act of 1974, as amended, including the regulations and published interpretations thereunder (“ERISA”); (b) no “reportable event” (as defined in ERISA) has occurred with respect to any “pension plan” (as defined in ERISA) for

18 which the Company would have any liability; (c) the Company has not incurred and does not expect to incur liability under (A) Title IV of ERISA with respect to termination of, or withdrawal from, any “pension plan” or (B) Sections 412 or 4971 of the Internal Revenue Code of 1986, as amended, including the regulations and published interpretations thereunder (the “Code”); and (d) each “pension plan” for which the Company would have any liability that is intended to be qualified under Section 401(a) of the Code is so qualified and nothing has occurred, whether by action or by failure to act, which would cause the loss of such qualification. (jjj) With the exception of withholding tax levied under the Income Tax Act (Canada), under the current laws and regulations of Canada and the Province of Ontario all dividends and other distributions declared and payable on the Shares in cash may be freely remitted out of Canada and may be paid in, or freely converted into, United States dollars, in each case without there being required any consent, approval, authorization or order of, or qualification with, any court or governmental agency or body in Canada; and except as disclosed in the Prospectuses, all such dividends and other distributions paid by the Company will not be subject to withholding under the laws and regulations of Canada. (kkk) No stamp, documentary, issuance, registration, transfer or other similar taxes or duties are payable by or on behalf of the Underwriters, the Company or any of its Subsidiaries under the laws of Canada in connection with (i) the execution, delivery or consummation of this Agreement, (ii) the sale and delivery of the Shares to the Underwriters or purchasers procured by the Underwriters, or (iii) the resale and delivery of the Shares by the Underwriters in the manner contemplated herein. (lll) Subject to the qualifications, limitations, exceptions and assumptions set forth in the Prospectuses, the Company does not believe that it was a passive foreign investment company, as defined in section 1297 of the Internal Revenue Code of 1986, as amended, for its taxable year ending December 31, 2019. (mmm)The Company is a “foreign private issuer” as defined in Rule 405 of the Securities Act. (nnn) The Company (a) has not alone engaged in any Testing-the-Waters Communication and (b) has not authorized anyone to engage in Testing-the-Waters Communications. The Company has not distributed any Written Testing-the- Waters Communications. “Testing-the-Waters Communication” means any oral or written communication with potential investors undertaken in reliance on Section 5(d) of the Securities Act. “Written Testing-the-Waters Communication” means any Testing-the-Waters Communication that is a written communication within the meaning of Rule 405 under the Securities Act. (ooo) As of the time of each sale of the Shares in connection with the Offering, no free writing prospectus included, includes or will include a misrepresentation or an untrue statement of material fact or omitted, omits or will omit to state a material

19 fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. 2. Representations and Warranties of the Selling Shareholders. Each of the Selling Shareholders severally and not jointly represents and warrants to each of the Underwriters, with respect to itself and not with respect to any other Selling Shareholder, as of the date hereof, as of the Closing Date and as of any Option Closing Date, and agrees with each of the Underwriters, that: (a) The Selling Shareholder is an individual or a valid and subsisting entity duly formed or incorporated and in good standing under the laws of its formation or jurisdiction of incorporation and has all requisite power, capacity and authority to carry on its business as currently conducted and to own, lease and operate its property and assets and to execute, deliver and perform its obligations hereunder. (b) All consents, approvals, authorizations and orders necessary for the execution and delivery by the Selling Shareholder of this Agreement, and for the sale and delivery of the Firm Shares and, if applicable, any Additional Shares (collectively, the “Total Shares”), to be sold by the Selling Shareholder hereunder, have been obtained, and such Selling Shareholder has full right, power and authority to enter into this Agreement and to sell, assign, transfer and deliver the Total Shares to be sold by such Selling Shareholder hereunder. (c) The sale of the Total Shares to be sold by such Selling Shareholder hereunder, and the compliance by such Selling Shareholder with this Agreement and the consummation of the transactions herein contemplated will not: (i) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, any statute, indenture, mortgage, hypothec, deed of trust, loan agreement, lease or other agreement or instrument to which such Selling Shareholder is a party or by which such Selling Shareholder is bound or to which any of the property or assets of such Selling Shareholder is subject; (ii) result in any violation of the provisions of the organizational documents of such Selling Shareholder if such Selling Shareholder is a corporation, or the partnership agreement of such Selling Shareholder if such Selling Shareholder is a partnership; or (iii) result in any violation of any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction over such Selling Shareholder or any of its subsidiaries or any property or assets of such Selling Shareholder, except, in the case of (i) and (iii), where such violations would not, individually or in the aggregate, have a material adverse effect on the Selling Shareholder’s ability to perform its obligations hereunder. (d) There is no action, suit, investigation or proceeding, at law or in equity, by any person, nor any arbitration, administrative or other proceeding by or before any governmental authority pending or, to such Selling Shareholder’s knowledge, threatened against or affecting such Selling Shareholder which invalidates the sale and delivery of the Total Shares being sold by such Selling Shareholder or the

20 validity of any action taken or to be taken by such Selling Shareholder pursuant to or in connection with this Agreement. (e) The Selling Shareholder has good and valid title to the Total Shares to be sold by such Selling Shareholder, free and clear of all mortgages, Liens, charges, pledges, security interests, encumbrances, claims and demands or rights of any other person whatsoever. Such Selling Shareholder will transfer to the Underwriters good and marketable title to such Total Shares free and clear of all mortgages, Liens, charges, pledges, security interests, encumbrances, claims and demands or rights of any other person whatsoever. (f) Such Selling Shareholder has, and on the Closing Date will have, valid title to, or a valid “security entitlement” within the meaning of Section 8-501 of the New York Uniform Commercial Code in respect of, the Shares to be sold by such Selling Shareholder free and clear of all security interests, claims, liens, equities or other encumbrances and the legal right and power, and all authorization and approval required by law, to enter into this Agreement and to sell, transfer and deliver the Shares to be sold by such Selling Shareholder or a security entitlement in respect of such Shares. (g) At or prior to the Closing Date: (a) the Selling Shareholders shall duly deliver the Firm Shares in the form of an electronic deposit pursuant to the NCI System maintained by CDS Clearing and Depository Services Inc. (“CDS”) registered in the name of “CDS & Co.”, or in the form of a definitive certificate in such other name or names as the Manager, on behalf of the Underwriters, may notify the Selling Shareholders in writing not less than 48 hours prior to the Closing Date; and (c) the Manager, on behalf of the Underwriters, shall deliver to the Company, on behalf of the Selling Shareholders, the Purchase Price net of applicable fees and expenses, by wire transfer of immediately available funds. (h) If applicable, at the Option Closing Date, the Selling Shareholders shall duly deliver the Additional Shares to the Underwriters in the form of an electronic deposit pursuant to the NCI System registered in the name of “CDS & Co.”, or in the form of a definitive certificate in such other name or names as the Manager, on behalf of the Underwriters, may notify the Selling Shareholders in writing not less than 48 hours prior to the Option Closing Date. Payment for the Additional Shares (if any), net of applicable fees and expenses, shall be made by the Manager, on behalf of the Underwriters, to the Company, on behalf of the Selling Shareholders, by wire transfer of immediately available funds against delivery of such Additional Shares for the respective accounts of the Underwriters at the Option Closing Date. (i) Such Selling Shareholder has delivered to the Manager an executed lock-up agreement in substantially the form attached hereto as Exhibit A (the “lock-up agreement”).

21 (j) No person has any right, agreement or option, present or future, contingent or absolute, or any right capable of becoming a right, agreement or option, for the purchase of any Total Shares held by such Selling Shareholder. (k) The Agreement has been duly executed and delivered by the Selling Shareholder and constitutes a valid and binding obligation of such Selling Shareholder enforceable against such Selling Shareholder in accordance with its terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium and other laws relating to or affecting the rights of creditors generally and except as limited by the application of equitable principles when equitable remedies are sought, and by the fact that rights to indemnity, contribution and waiver, and the ability to sever unenforceable terms, may be limited by applicable law. (l) Neither such Selling Shareholder, nor any affiliate of such Selling Shareholder, has taken and will take, directly or indirectly, any action that is designed to or that has constituted or might reasonably be expected to cause or result in stabilization or manipulation of the price of any security of the Company for the purpose of facilitating the sale or resale of the Total Shares. (m) (a) The Registration Statement, when it became effective, did not contain and, as amended or supplemented, if applicable, will not contain, as of the date of such amendment or supplement, any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading, (b) the Canadian Final Prospectus as of the date of the Canadian Final Prospectus and any amendment or supplement thereto and at the Closing Date (as defined below), will not, contain any untrue statement of a material fact or omit to state a material fact that is required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading, and (c) each of the Prospectuses does not contain and, as amended or supplemented, if applicable, will not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading, and the Canadian Final Prospectus and any amendment or supplement thereto, at the time of filing thereof and at the Closing Date, will constitute, full, true and plain disclosure of all material facts relating to the Shares, provided that the representations and warranties set forth in this paragraph 2(m) are limited to statements or omissions made in reliance upon Selling Shareholder Information furnished to the Company in writing by such Selling Shareholder expressly for use in the Registration Statement, the Prospectuses or any amendments or supplements thereto. (n) The Selling Shareholder is not prompted by any information concerning the Company or its Subsidiaries which is not set forth in the Registration Statement or the Prospectuses to sell its Shares pursuant to this Agreement.

22 (o) (a) None of such Selling Shareholder or, if applicable, its subsidiaries, or, to the knowledge of such Selling Shareholder, any director, officer, employee, agent, representative, or affiliate thereof has taken or will take any action in furtherance of an offer, payment, promise to pay, or authorization or approval of the payment giving or receipt of money, property, gifts or anything else of value, directly or indirectly, to any Government Official in order to influence official action, or to any person in violation of any applicable anti-corruption laws; (b) such Selling Shareholder and, if applicable, its subsidiaries have conducted their businesses in compliance with applicable anti-corruption laws and, if the Selling Shareholder is not an individual, have instituted and maintained and will continue to maintain policies and procedures as reasonably required and reasonably designed to promote and achieve compliance with such laws and with the representations and warranties contained herein; and (c) neither the Selling Shareholder nor, if applicable, any of its subsidiaries will use, directly or indirectly, the proceeds of the offering in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any person in violation of any applicable anti-corruption laws. (p) If the Selling Shareholder is not an individual, the operations of such Selling Shareholder and, if applicable, its subsidiaries are and have been conducted at all times in material compliance with all applicable Anti-Money Laundering Laws, and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving such Selling Shareholder or any of its subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the best knowledge of the Selling Shareholder, threatened. (q) (a) None of such Selling Shareholder or, if applicable, any of its subsidiaries, or, to the knowledge of such Selling Shareholder, any director, officer, employee, agent, representative, or affiliate thereof, is a Person that is, or is owned or controlled by one or more Persons that are: (A) the subject of any Sanctions, or (B) located, organized or resident in a country or territory that is the subject of Sanctions (including, without limitation, Crimea, Cuba, Iran, North Korea and Syria). (b) Such Selling Shareholder will not, directly or indirectly, use the proceeds of the offering, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person: (C) to fund or facilitate any activities or business of or with any Person or in any country or territory that, at the time of such funding or facilitation, is the subject of Sanctions; or

23 (D) in any other manner that will result in a violation of Sanctions by any Person (including any Person participating in the offering, whether as underwriter, advisor, investor or otherwise). (c) Such Selling Shareholder has not knowingly engaged in, is not now knowingly engaged in, and will not knowingly engage in, any dealings or transactions with any Person, or in any country or territory, that at the time of the dealing or transaction is or was the subject of Sanctions. (r) If the Selling Shareholder is not an individual, such Selling Shareholder represents and warrants that it is not (i) an employee benefit plan subject to Title I of ERISA, (ii) a plan or account subject to Section 4975 of the Internal Revenue Code of 1986, as amended or (iii) an entity deemed to hold “plan assets” of any such plan or account under Section 3(42) of ERISA, 29 C.F.R. 2510.3-101, or otherwise. (s) No stamp, documentary, issuance, registration, transfer or other similar taxes or duties are payable by or on behalf of the Underwriters, the Company, any of its Subsidiaries or the Selling Shareholders under the laws of Canada in connection with (i) the execution, delivery or consummation of this Agreement and (ii) the sale and delivery of the Total Shares to the Underwriters or purchasers procured by the Underwriters, or (iii) the resale and delivery of the Total Shares by the Underwriters in the manner contemplated herein. 3. Agreements to Sell and Purchase. Each Selling Shareholder, severally and not jointly, hereby agrees to sell to the several Underwriters, and each Underwriter, upon the basis of the representations and warranties herein contained, but subject to the conditions hereinafter stated, agrees, severally and not jointly, to purchase from the Selling Shareholders at the purchase price set forth in Schedule I-A hereto (the “Purchase Price”) the respective numbers of Firm Shares set forth in Schedule II hereto opposite the name of such Underwriter bears to the total number of Firm Shares. On the basis of the representations and warranties contained in this Agreement, and subject to its terms and conditions, each Selling Shareholder agrees, severally and not jointly, to sell to the Underwriters the Additional Shares, and the Underwriters shall have the right to purchase, severally and not jointly, up to the number of Additional Shares set forth, as applicable, in Schedule I-B at the Purchase Price, provided, however, that the amount paid by the Underwriters for any Additional Shares shall be reduced by an amount per share equal to any dividends declared by the Company and payable on the Firm Shares but not payable on such Additional Shares. Any such election to purchase Additional Shares shall be made in proportion to the maximum number of Additional Shares to be sold by each Selling Shareholder as set forth in Schedule I-B hereto. You may exercise this right on behalf of the Underwriters in whole or from time to time in part by giving written notice not later than 30 days after the date of the Closing Date. Any exercise notice shall specify the number of Additional Shares to be purchased by the Underwriters and the date on which such shares are to be purchased. Each purchase date must be at least two business days after the written notice is given and may not be earlier than the Closing Date for the Firm Shares nor later than ten business days after the date of such notice. Additional Shares may