Form 6-K CHINA SOUTHERN AIRLINES For: Mar 31

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

March 31, 2022

CHINA SOUTHERN AIRLINES COMPANY LIMITED

68 Qi Xin Road

Guangzhou, 510403

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

China Southern Airlines Company Limited (the “Company”) published the following announcements on March 30, 2022 on the Hong Kong Stock Exchange’s website at:

https://www1.hkexnews.hk/listedco/listconews/sehk/2022/0330/2022033002952.pdf, in relation to the annual results for the year ended December 31, 2021;

https://www1.hkexnews.hk/listedco/listconews/sehk/2022/0330/2022033003008.pdf, in relation to the 2021 corporate social responsibility report of the Company;

https://www1.hkexnews.hk/listedco/listconews/sehk/2022/0330/2022033003246.pdf, in relation to the provision for impairment of the Company; and

https://www1.hkexnews.hk/listedco/listconews/sehk/2022/0330/2022033003188.pdf, in relation to the resolutions of the board of directors and the supervisory committee of the Company.

The announcements in English are included as exhibits to this Form 6-K.

Certain statements contained in these announcements may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements. All information provided in this announcement is as of the date of this announcement, unless otherwise stated, and we undertake no duty to update such information, except as required under applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CHINA SOUTHERN AIRLINES COMPANY LIMITED

| By: | /s/ Xie Bing | |

| Name: | Xie Bing | |

| Title: | Company Secretary | |

| Date: March 31, 2022 | ||

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

(a joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 1055)

2021 ANNUAL RESULTS

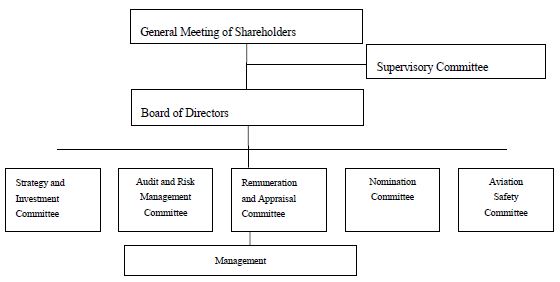

The board of directors (the “Board”) of China Southern Airlines Company Limited (the “Company”) hereby announces the results of the Company and its subsidiaries (the “Group”) for the year ended 31 December 2021 together with the comparative figures for 2020, which have been derived from the Group’s audited consolidated financial statements for the year ended 31 December 2021.

FINANCIAL RESULTS

| A. | PREPARED IN ACCORDANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS (“IFRSs”) |

CONSOLIDATED INCOME STATEMENTS

For the year ended 31 December 2021

| Note | 2021 RMB million |

2020 RMB million |

||||||||||

| Operating revenue |

||||||||||||

| Traffic revenue |

95,279 | 87,027 | ||||||||||

| Other operating revenue |

6,365 | 5,534 | ||||||||||

|

|

|

|

|

|||||||||

| Total operating revenue |

4 | 101,644 | 92,561 | |||||||||

|

|

|

|

|

|||||||||

| Operating expenses |

||||||||||||

| Flight operation expenses |

5 | 45,569 | 37,545 | |||||||||

| Maintenance expenses |

12,162 | 13,375 | ||||||||||

| Aircraft and transportation service expenses |

21,147 | 18,743 | ||||||||||

| Promotion and selling expenses |

4,705 | 5,007 | ||||||||||

| General and administrative expenses |

3,663 | 4,088 | ||||||||||

| Depreciation and amortisation |

6 | 24,241 | 24,590 | |||||||||

| Impairment losses on property, plant and equipment, right-of-use assets and other assets |

2,597 | 3,961 | ||||||||||

| Others |

2,256 | 1,802 | ||||||||||

|

|

|

|

|

|||||||||

| Note | 2021 RMB million |

2020 RMB million |

||||||||||

| Total operating expenses |

116,340 | 109,111 | ||||||||||

|

|

|

|

|

|||||||||

| Other net income |

7 | 4,767 | 4,686 | |||||||||

|

|

|

|

|

|||||||||

| Operating losses |

(9,929 | ) | (11,864 | ) | ||||||||

|

|

|

|

|

|||||||||

| Interest income |

675 | 322 | ||||||||||

| Interest expense |

8 | (6,202 | ) | (6,716 | ) | |||||||

| Exchange gain, net |

20 | 1,575 | 3,485 | |||||||||

| Share of associates’ results |

9 | (776 | ) | |||||||||

| Share of joint ventures’ results |

271 | 309 | ||||||||||

| Changes in fair value of financial assets/liabilities |

(309 | ) | 53 | |||||||||

| Loss on disposal of a subsidiary |

— | (8 | ) | |||||||||

|

|

|

|

|

|||||||||

| Loss before income tax |

(13,910 | ) | (15,195 | ) | ||||||||

| Income tax |

9 | 2,894 | 3,368 | |||||||||

|

|

|

|

|

|||||||||

| Loss for the year |

(11,016 | ) | (11,827 | ) | ||||||||

|

|

|

|

|

|||||||||

| Loss attributable to: |

||||||||||||

| Equity shareholders of the Company |

(12,106 | ) | (10,847 | ) | ||||||||

| Non-controlling interests |

1,090 | (980 | ) | |||||||||

|

|

|

|

|

|||||||||

| Loss for the year |

(11,016 | ) | (11,827 | ) | ||||||||

|

|

|

|

|

|||||||||

| Loss per share |

||||||||||||

| Basic and diluted |

10 | RMB(0.75 | ) | RMB(0.77 | ) | |||||||

|

|

|

|

|

|||||||||

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

| 2021 RMB million |

2020 RMB million |

|||||||

| Loss for the year |

(11,016 | ) | (11,827 | ) | ||||

|

|

|

|

|

|||||

| Other comprehensive income: |

||||||||

| Items that will not be reclassified to profit or loss |

||||||||

| – Equity investments at fair value through other comprehensive income – net movement in fair value reserve (non-recycling) |

(236 | ) | (250 | ) | ||||

| – Share of other comprehensive income of an associate |

(2 | ) | (2 | ) | ||||

| – Income tax effect of the above items |

60 | 63 | ||||||

| Items that may be reclassified subsequently to profit or loss |

||||||||

| – Cash flow hedge: fair value movement of derivative financial instrument |

42 | (45 | ) | |||||

| – Differences resulting from the translation of foreign currency financial statements |

— | 8 | ||||||

| – Share of other comprehensive income of an associate |

3 | (3 | ) | |||||

| – Income tax effect of the above items |

(10 | ) | 11 | |||||

|

|

|

|

|

|||||

| Other comprehensive income for the year |

(143 | ) | (218 | ) | ||||

|

|

|

|

|

|||||

| Total comprehensive income for the year |

(11,159 | ) | (12,045 | ) | ||||

|

|

|

|

|

|||||

| Total comprehensive income attributable to: |

||||||||

| Equity shareholders of the Company |

(12,189 | ) | (11,011 | ) | ||||

| Non-controlling interests |

1,030 | (1,034 | ) | |||||

|

|

|

|

|

|||||

| Total comprehensive income for the year |

(11,159 | ) | (12,045 | ) | ||||

|

|

|

|

|

|||||

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 December 2021

| Note | 31 December 2021 RMB million |

31 December 2020 RMB million |

||||||||||

| Non-current assets |

||||||||||||

| Property, plant and equipment, net |

12 | 91,186 | 86,146 | |||||||||

| Construction in progress |

13 | 31,847 | 32,407 | |||||||||

| Right-of-use assets |

14 | 138,439 | 151,065 | |||||||||

| Goodwill |

237 | 237 | ||||||||||

| Interest in associates |

2,637 | 2,449 | ||||||||||

| Interest in joint ventures |

3,341 | 3,225 | ||||||||||

| Aircraft lease deposits |

321 | 362 | ||||||||||

| Other equity instrument investments |

563 | 799 | ||||||||||

| Other non-current financial assets |

589 | 92 | ||||||||||

| Amounts due from related companies |

151 | — | ||||||||||

| Deferred tax assets |

15 | 12,823 | 7,739 | |||||||||

| Other assets |

3,211 | 2,877 | ||||||||||

|

|

|

|

|

|||||||||

| 285,345 | 287,398 | |||||||||||

|

|

|

|

|

|||||||||

| Current assets |

||||||||||||

| Inventories |

1,652 | 1,760 | ||||||||||

| Trade receivables |

16 | 2,858 | 2,525 | |||||||||

| Other receivables |

17 | 9,599 | 8,347 | |||||||||

| Cash and cash equivalents |

21,456 | 25,419 | ||||||||||

| Assets held for sale |

1,292 | — | ||||||||||

| Restricted bank deposits |

158 | 117 | ||||||||||

| Prepaid expenses and other current assets |

736 | 732 | ||||||||||

| Amounts due from related companies |

115 | 85 | ||||||||||

|

|

|

|

|

|||||||||

| 37,866 | 38,985 | |||||||||||

|

|

|

|

|

|||||||||

| Note | 31 December 2021 RMB million |

31 December 2020 RMB million |

||||||||||

| Current liabilities |

||||||||||||

| Derivative financial liabilities |

18 | 1,222 | 3,148 | |||||||||

| Borrowings |

19 | 57,913 | 40,099 | |||||||||

| Lease liabilities |

20 | 20,805 | 20,930 | |||||||||

| Trade payables |

21 | 1,328 | 1,782 | |||||||||

| Contract liabilities |

1,542 | 1,513 | ||||||||||

| Sales in advance of carriage |

3,716 | 3,997 | ||||||||||

| Current income tax |

844 | 462 | ||||||||||

| Amounts due to related companies |

363 | 357 | ||||||||||

| Accrued expenses |

15,479 | 15,920 | ||||||||||

| Other liabilities |

7,778 | 7,473 | ||||||||||

|

|

|

|

|

|||||||||

| 110,990 | 95,681 | |||||||||||

|

|

|

|

|

|||||||||

| Net current liabilities |

(73,124 | ) | (56,696 | ) | ||||||||

|

|

|

|

|

|||||||||

| Total assets less current liabilities |

212,221 | 230,702 | ||||||||||

|

|

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||

| Borrowings |

19 | 38,354 | 38,134 | |||||||||

| Lease liabilities |

20 | 81,944 | 100,283 | |||||||||

| Derivative financial liabilities |

20 | 53 | ||||||||||

| Other non-current liabilities |

1,824 | 2,036 | ||||||||||

| Provision for major overhauls |

4,820 | 4,216 | ||||||||||

| Deferred benefits and gains |

725 | 769 | ||||||||||

| Deferred tax liabilities |

26 | 80 | ||||||||||

|

|

|

|

|

|||||||||

| 127,713 | 145,571 | |||||||||||

|

|

|

|

|

|||||||||

| Net assets |

84,508 | 85,131 | ||||||||||

|

|

|

|

|

|||||||||

| Capital and reserves |

||||||||||||

| Share capital |

16,948 | 15,329 | ||||||||||

| Reserves |

50,903 | 54,255 | ||||||||||

|

|

|

|

|

|||||||||

| Total equity attributable to equity shareholders of the Company |

67,851 | 69,584 | ||||||||||

| Non-controlling interests |

16,657 | 15,547 | ||||||||||

|

|

|

|

|

|||||||||

| Total equity |

84,508 | 85,131 | ||||||||||

|

|

|

|

|

|||||||||

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021

| Attributable to equity shareholders of the Company | ||||||||||||||||||||||||||||||||||||

| Share capital | Share premium |

Fair value reserve (recycling) |

Fair value reserve (non- recycling) |

Other reserves |

Retained Earnings/(acc umulated losses) |

Total | Non- controlling interests |

Total equity | ||||||||||||||||||||||||||||

| RMB million | RMB million | RMB million | RMB Million | RMB million | RMB million | RMB million | RMB million | RMB million | ||||||||||||||||||||||||||||

| Balance at 1 January 2020 |

12,267 | 25,652 | 2 | 409 | 2,844 | 22,932 | 64,106 | 13,223 | 77,329 | |||||||||||||||||||||||||||

| Changes in equity for 2020 |

||||||||||||||||||||||||||||||||||||

| Loss for the year |

— | — | — | — | — | (10,847 | ) | (10,847 | ) | (980 | ) | (11,827 | ) | |||||||||||||||||||||||

| Other comprehensive income |

— | — | (37 | ) | (135 | ) | 8 | — | (164 | ) | (54 | ) | (218 | ) | ||||||||||||||||||||||

| Total comprehensive income |

— | — | (37 | ) | (135 | ) | 8 | (10,847 | ) | (11,011 | ) | (1,034 | ) | (12,045 | ) | |||||||||||||||||||||

| Issuance of shares |

3,062 | 12,889 | — | — | — | — | 15,951 | — | 15,951 | |||||||||||||||||||||||||||

| Acquisition of non-controlling interests in a subsidiary |

— | — | — | — | (155 | ) | — | (155 | ) | (105 | ) | (260 | ) | |||||||||||||||||||||||

| Capital injection from non-controlling interests |

— | — | — | — | 700 | — | 700 | 3,521 | 4,221 | |||||||||||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | — | — | (57 | ) | (57 | ) | |||||||||||||||||||||||||

| Decrease in non-controlling interests as a result of loss of control of a subsidiary |

— | — | — | — | — | — | — | (1 | ) | (1 | ) | |||||||||||||||||||||||||

| Change in other reserves |

— | — | — | — | (7 | ) | — | (7 | ) | — | (7 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance at 31 December 2020 |

15,329 | 38,541 | (35 | ) | 274 | 3,390 | 12,085 | 69,584 | 15,547 | 85,131 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Changes in equity for 2021: |

||||||||||||||||||||||||||||||||||||

| Loss for the year |

— | — | — | — | — | (12,106 | ) | (12,106 | ) | 1,090 | (11,016 | ) | ||||||||||||||||||||||||

| Other comprehensive income |

— | — | 35 | (118 | ) | — | — | (83 | ) | (60 | ) | (143 | ) | |||||||||||||||||||||||

| Total comprehensive income |

— | — | 35 | (118 | ) | — | (12,106 | ) | (12,189 | ) | 1,030 | (11,159 | ) | |||||||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | — | — | (659 | ) | (659 | ) | |||||||||||||||||||||||||

| Conversion of convertible bonds to ordinary shares |

1,619 | 8,837 | — | — | — | — | 10,456 | — | 10,456 | |||||||||||||||||||||||||||

| Capital injection from non-controlling interests |

— | — | — | — | — | — | — | 810 | 810 | |||||||||||||||||||||||||||

| Decrease in non-controlling interests as a result of liquidation of a subsidiary |

— | — | — | — | — | — | — | (71 | ) | (71 | ) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance at 31 December 2021 |

16,948 | 47,378 | — | 156 | 3,390 | (21 | ) | 67,851 | 16,657 | 84,508 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Notes to the financial information prepared in accordance with IFRSs:

| 1. | CORPORATE INFORMATION |

China Southern Airlines Company Limited (the “Company”), a joint stock limited company, was incorporated in the People’s Republic of China (the “PRC”) on 25 March 1995. The address of the Company’s registered office is Unit 301, 3/F, Office Tower, Guanhao Science Park Phase I, 12 Yuyan Street, Huangpu District, Guangzhou, Guangdong Province, the PRC. The Company and its subsidiaries (the “Group”) are principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services.

The Company’s majority interest is owned by China Southern Air Holding Company Limited (“CSAH”), a state-owned enterprise incorporated in the PRC.

The Company’s shares are traded on the Shanghai Stock Exchange, The Stock Exchange of Hong Kong Limited and the New York Stock Exchange.

| 2. | BASIS OF PREPARATION |

The consolidated financial statements have been prepared in accordance with all applicable International Financial Reporting Standards (“IFRSs”), which collective term includes all applicable individual IFRSs, International Accounting Standards (“IASs”) and Interpretations issued by the International Accounting Standards Board (the “IASB”). The consolidated financial statements also comply with the applicable disclosure requirements of the Hong Kong Companies Ordinance and the applicable disclosure provisions of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

The IASB has issued certain amendments to IFRSs that are first effective or available for early adoption for the current accounting period of the Group. Note 3 provides information on any changes in accounting policies resulting from initial application of these developments to the extent that they are relevant to the Group for the current accounting period reflected in these consolidated financial statements.

The consolidated financial statements for the year ended 31 December 2021 comprise the Group and the Group’s interest in associates and joint ventures.

The measurement basis used in the preparation of the consolidated financial statements is the historical cost basis except that the following assets and liabilities are stated at their fair value:

| • | other equity instrument investments; |

| • | other non-current financial assets (FVPL); and |

| • | derivative financial assets/liabilities. |

Non-current assets (or disposal groups) held for sale are stated at the lower of carrying amount and fair value less costs to sell.

| 3. | CHANGES IN ACCOUNTING POLICIES |

The Group has applied the following amendments to IFRSs issued by the IASB to these financial statements for the current accounting period:

| • | Amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16, Interest rate benchmark reform – phase 2 |

| • | Amendment to IFRS 16, Covid-19-related rent concessions beyond 30 June 2021 |

Other than the amendment to IFRS 16, the Group has not applied any new standard or interpretation that is not yet effective for the current accounting period. Impacts of the adoption of the amended IFRSs are discussed below:

Amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16, Interest rate benchmark reform – phase 2

The amendments provide targeted reliefs from (i) accounting for changes in the basis for determining contractual cash flows of financial assets, financial liabilities and lease liabilities as modifications, and (ii) discontinuing hedge accounting when an interest rate benchmark is replaced by an alternative benchmark rate as a result of the reform of interbank offered rates (“IBOR reform”). The adoption of the amendments does not have any material impact on the financial position and the financial result of the Group.

Amendment to IFRS 16, Covid-19-related rent concessions beyond 30 June 2021 (“2021 amendment”)

The Group previously applied the practical expedient in IFRS 16 to all leases except for aircraft and engine leases such that as lessee it was not required to assess whether rent concessions occurring as a direct consequence of the COVID-19 pandemic were lease modifications, if the eligibility conditions are met. One of these conditions requires the reduction in lease payments affect only payments originally due on or before a specified time limit. The 2021 amendment extends this time limit from 30 June 2021 to 30 June 2022.

The Group has early adopted the 2021 amendment in this financial year. The adoption of 2021 amendment does not have any material impact on the financial position and the financial result of the Group.

| 4. | REVENUE AND SEGMENT INFORMATION |

| a. | Operating revenue |

The Group is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery, and other extended transportation services.

| (i) | Disaggregation of revenue |

Disaggregation of revenue from contracts with customers by major service lines is as follows:

| 2021 RMB million |

2020 RMB million |

|||||||

| Revenue from contracts with customers within the scope of IFRS 15: |

||||||||

| Disaggregated by service lines |

||||||||

| – Traffic revenue |

||||||||

| – Passenger |

75,392 | 70,534 | ||||||

| – Cargo and mail |

19,887 | 16,493 | ||||||

| – Commission income |

2,677 | 2,771 | ||||||

| – General aviation income |

572 | 508 | ||||||

| – Cargo handling income |

864 | 507 | ||||||

| – Hotel and tour operation income |

538 | 390 | ||||||

| – Ground services income |

326 | 210 | ||||||

| – Air catering service income |

271 | 273 | ||||||

| – Others |

885 | 689 | ||||||

|

|

|

|

|

|||||

| 101,412 | 92,375 | |||||||

| Revenue from other sources: |

||||||||

| – Rental income |

232 | 186 | ||||||

|

|

|

|

|

|||||

| 101,644 | 92,561 | |||||||

|

|

|

|

|

|||||

Disaggregation of revenue from contracts with customers by the timing of revenue recognition and by geographic markets is disclosed in Notes 4(b) and 4(c) respectively.

| (ii) | Revenue expected to be recognised in the future arising from contracts with customers in existence at the reporting date |

As at 31 December 2021, the aggregated amount of the transaction price allocated to the remaining performance obligation, which is the unredeemed credits under the frequent flyer award programmes, amounted to RMB3,061 million (31 December 2020: RMB3,196 million). This amount represents revenue expected to be recognised in the future when the customers obtain control of the goods or services.

| b. | Business segments |

The Group has two reportable operating segments “airline transportation operations” and “other segments”, according to internal organisation structure, managerial needs and internal reporting system. “Airline transportation operations” comprises the Group’s passenger and cargo and mail operations. “Other segments” includes cargo handling, hotel and tour operation, ground services, air catering services and other miscellaneous services.

For the purposes of assessing segment performance and allocating resources between segments, the Group’s chief operating decision maker (“CODM”) monitors the results, assets and liabilities attributable to each reportable segment based on financial results prepared under the People’s Republic of China Accounting Standards for Business Enterprises (“PRC GAAP”). As such, the amount of each material reconciling item from the Group’s reportable segment loss before taxation, assets and liabilities which arises from different accounting policies, are set out in Note 4(d).

Inter-segment sales and transfers are transacted with reference to the selling prices used for sales made to third parties at the then prevailing market prices.

Information regarding the Group’s reportable segments as provided to the Group’s CODM for the purposes of resource allocation and assessment of segment performance is set out below.

The segment results of the Group for the year ended 31 December 2021 are as follows:

| Airline transportation operations |

Other segments | Elimination | Unallocated* | Total | ||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | ||||||||||||||||

| Disaggregated by timing of revenue recognition |

||||||||||||||||||||

| Point in time |

2,763 | 1,418 | (1,171 | ) | — | 3,010 | ||||||||||||||

| Over time |

98,206 | 3,257 | (2,829 | ) | — | 98,634 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenue from external customers |

100,419 | 1,225 | — | — | 101,644 | |||||||||||||||

| Inter-segment sales |

550 | 3,450 | (4,000 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reportable segment revenue |

100,969 | 4,675 | (4,000 | ) | — | 101,644 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reportable segment loss before taxation |

(13,769 | ) | (111 | ) | 2 | (25 | ) | (13,903 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reportable segment loss after taxation |

(10,998 | ) | (67 | ) | 2 | 52 | (11,011 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other segment information |

||||||||||||||||||||

| Income tax |

(2,771 | ) | (44 | ) | — | (77 | ) | (2,892 | ) | |||||||||||

| Interest income |

763 | 15 | (103 | ) | — | 675 | ||||||||||||||

| Interest expense |

6,291 | 26 | (115 | ) | — | 6,202 | ||||||||||||||

| Depreciation and amortisation |

23,854 | 380 | — | — | 24,234 | |||||||||||||||

| Impairment loss |

2,596 | 18 | — | — | 2,614 | |||||||||||||||

| Credit losses |

1 | (2 | ) | — | — | (1 | ) | |||||||||||||

| Share of associates’ results |

— | — | — | 9 | 9 | |||||||||||||||

| Share of joint ventures’ results |

— | — | — | 271 | 271 | |||||||||||||||

| Change in fair value of financial assets/liabilities |

— | — | — | (309 | ) | (309 | ) | |||||||||||||

| Non-current assets additions during the year# |

21,457 | 905 | (359 | ) | — | 22,003 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The segment results of the Group for the year ended 31 December 2020 are as follows:

| Airline transportation operations |

Other segments | Elimination | Unallocated* | Total | ||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | ||||||||||||||||

| Disaggregated by timing of revenue recognition |

||||||||||||||||||||

| Point in time |

2,856 | 1,727 | (1,483 | ) | — | 3,100 | ||||||||||||||

| Over time |

89,196 | 2,448 | (2,183 | ) | — | 89,461 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenue from external customers |

91,722 | 839 | — | — | 92,561 | |||||||||||||||

| Inter-segment sales |

330 | 3,336 | (3,666 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reportable segment revenue |

92,052 | 4,175 | (3,666 | ) | — | 92,561 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reportable segment loss before taxation |

(14,727 | ) | (112 | ) | 1 | (348 | ) | (15,186 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reportable segment loss after taxation |

(11,388 | ) | (61 | ) | 1 | (372 | ) | (11,820 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other segment information |

||||||||||||||||||||

| Income tax |

(3,339 | ) | (51 | ) | — | 24 | (3,366 | ) | ||||||||||||

| Interest income |

328 | 26 | (32 | ) | — | 322 | ||||||||||||||

| Interest expense |

6,739 | 11 | (34 | ) | — | 6,716 | ||||||||||||||

| Depreciation and amortisation |

24,438 | 143 | — | — | 24,581 | |||||||||||||||

| Impairment loss |

4,015 | 2 | — | — | 4,017 | |||||||||||||||

| Credit losses |

153 | 11 | — | — | 164 | |||||||||||||||

| Share of associates’ results |

— | — | — | (776 | ) | (776 | ) | |||||||||||||

| Share of joint ventures’ results |

— | — | — | 309 | 309 | |||||||||||||||

| Change in fair value of financial assets/liabilities |

— | — | — | 53 | 53 | |||||||||||||||

| Non-current assets additions during the year# |

24,039 | 547 | (49 | ) | — | 24,537 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The segment assets and liabilities of the Group as at 31 December 2021 and 31 December 2020 are as follows:

| Airline transportation operations |

Other segments | Elimination | Unallocated* | Total | ||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | ||||||||||||||||

| As at 31 December 2021 |

||||||||||||||||||||

| Reportable segment assets |

312,020 | 5,909 | (1,616 | ) | 6,635 | 322,948 | ||||||||||||||

| Reportable segment liabilities |

236,428 | 2,640 | (1,607 | ) | 1,242 | 238,703 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| As at 31 December 2020 |

||||||||||||||||||||

| Reportable segment assets |

317,741 | 6,019 | (4,209 | ) | 6,564 | 326,115 | ||||||||||||||

| Reportable segment liabilities |

239,968 | 2,237 | (4,154 | ) | 3,201 | 241,252 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| * | Unallocated assets primarily include interest in associates and joint ventures, derivative financial assets and equity securities. Unallocated liabilities primarily include derivative financial liabilities. Unallocated results primarily include the share of results of associates and joint ventures, dividend income from equity securities, and the fair value movement of financial instruments recognised through profit or loss. |

| # | The additions of non-current assets do not include interests in associates and joint ventures, other equity instrument investments, other non-current financial assets, derivative financial assets and deferred tax assets. |

| c. | Geographical information |

The Group’s business segments operate in three main geographical areas, even though they are managed on a worldwide basis.

The Group’s revenue by geographical segment are analysed based on the following criteria:

| (1) | Traffic revenue from services of both origin and destination within the PRC (excluding Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan (“Hong Kong, Macau and Taiwan”)), is classified as domestic revenue. Traffic revenue with origin and destination among PRC, Hong Kong, Macau and Taiwan is classified as Hong Kong, Macau and Taiwan revenue; while that with origin from or destination to other overseas markets is classified as international revenue. |

| (2) | Revenue from commission income, general aviation, cargo handling, hotel and tour operation, ground services, air catering services and other miscellaneous services are classified on the basis of where the services are performed. |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Domestic |

76,517 | 65,137 | ||||||

| International |

24,739 | 27,090 | ||||||

| Hong Kong, Macau and Taiwan |

388 | 334 | ||||||

|

|

|

|

|

|||||

| 101,644 | 92,561 | |||||||

|

|

|

|

|

|||||

The major revenue earning assets of the Group are its aircraft fleet which is registered in the PRC and is deployed across its worldwide route network. Majority of the Group’s other assets are located in the PRC. CODM considers that there is no suitable basis for allocating such assets and related liabilities to geographical locations. Accordingly, geographical segment assets and liabilities are not disclosed.

| d. | Reconciliation of reportable segment loss before income tax, assets and liabilities to the consolidated figures as reported in the consolidated financial statements |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Loss before income tax |

||||||||

| Reportable segment loss before taxation |

(13,903 | ) | (15,186 | ) | ||||

| Capitalisation of exchange difference of specific loans |

(8 | ) | (9 | ) | ||||

| Government grants |

1 | — | ||||||

|

|

|

|

|

|||||

| Consolidated loss before income tax |

(13,910 | ) | (15,195 | ) | ||||

|

|

|

|

|

|||||

| 31 December 2021 |

31 December 2020 |

|||||||

| RMB million | RMB million | |||||||

| Assets |

||||||||

| Reportable segment assets |

322,948 | 326,115 | ||||||

| Capitalisation of exchange difference of specific loans |

39 | 47 | ||||||

| Government grants |

(5 | ) | (6 | ) | ||||

| Adjustments arising from business combinations under common control |

237 | 237 | ||||||

| Others |

(8 | ) | (10 | ) | ||||

|

|

|

|

|

|||||

| Consolidated total assets |

323,211 | 326,383 | ||||||

|

|

|

|

|

|||||

Liabilities

As at 31 December 2021 and 2020, the amount of reportable segment liabilities is the same as the amount of consolidated total liabilities.

| 5 | FLIGHT OPERATION EXPENSES |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Jet fuel costs |

25,505 | 18,797 | ||||||

| Flight personnel payroll and welfare |

10,763 | 10,232 | ||||||

| Air catering expenses |

1,577 | 1,765 | ||||||

| Civil Aviation Development Fund |

1,059 | — | ||||||

| Aircraft operating lease charges |

920 | 977 | ||||||

| Training expenses |

690 | 857 | ||||||

| Aircraft insurance |

184 | 191 | ||||||

| Others |

4,871 | 4,726 | ||||||

|

|

|

|

|

|||||

| 45,569 | 37,545 | |||||||

|

|

|

|

|

|||||

| 6 | DEPRECIATION AND AMORTISATION |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Depreciation of property, plant and equipment |

8,835 | 8,824 | ||||||

| Depreciation of right-of-use assets |

14,888 | 15,388 | ||||||

| Other amortisation |

518 | 378 | ||||||

|

|

|

|

|

|||||

| 24,241 | 24,590 | |||||||

|

|

|

|

|

|||||

| 7 | OTHER NET INCOME |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Government grants |

4,040 | 4,209 | ||||||

| Gains/(loss) on disposal of property, plant and equipment, net |

||||||||

| – Aircraft and spare engines |

149 | (18 | ) | |||||

| – Other property, plant and equipment and right-of-use assets |

214 | 75 | ||||||

| Others |

364 | 420 | ||||||

|

|

|

|

|

|||||

| 4,767 | 4,686 | |||||||

|

|

|

|

|

|||||

| 8 | INTEREST EXPENSE |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Interest on borrowings |

2,448 | 1,914 | ||||||

| Interest relating to leases liabilities |

4,434 | 5,180 | ||||||

|

|

|

|

|

|||||

| Total interest expense on financial liabilities not at fair value through profit or loss |

6,882 | 7,094 | ||||||

| Less: interest expense capitalised (Note) |

(701 | ) | (363 | ) | ||||

|

|

|

|

|

|||||

| 6,181 | 6,731 | |||||||

| Interest rate swaps: cash flow hedge, reclassified from equity |

21 | (15 | ) | |||||

|

|

|

|

|

|||||

| 6,202 | 6,716 | |||||||

|

|

|

|

|

|||||

| Note: | The weighted average interest rate used for interest capitalisation was 2.61% per annum in 2021 (2020: 2.51%). |

| 9 | INCOME TAX |

| (a) | Income tax credit in the consolidated income statement |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| PRC income tax |

||||||||

| – Provision for the year |

2,159 | 1,716 | ||||||

| – Under-provision in prior year |

35 | 48 | ||||||

|

|

|

|

|

|||||

| 2,194 | 1,764 | |||||||

| Deferred tax |

||||||||

| Origination and reversal of temporary differences |

(5,088 | ) | (5,132 | ) | ||||

|

|

|

|

|

|||||

| Income tax credit |

(2,894 | ) | (3,368 | ) | ||||

|

|

|

|

|

|||||

In respect of a majority of the Group’s airlines operation outside mainland China, the Group has either obtained exemptions from overseas taxation pursuant to the bilateral aviation agreements between the overseas governments and the PRC government, or has sustained tax losses in those overseas jurisdictions. Accordingly, no provision for overseas income tax has been made for overseas airlines operation in the current and prior years.

For the year of 2021, the Company and its branches and subsidiaries in mainland China are subject to income tax rates ranging from 15% to 25% (2020: 15% to 25%), and certain subsidiaries of the Company in Hong Kong are subject to income tax at 16.5% (2020: 16.5%).

| (b) | Reconciliation between actual income tax credit and calculated tax based on accounting loss at applicable income tax rates |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Loss before income tax |

(13,910 | ) | (15,195 | ) | ||||

|

|

|

|

|

|||||

| Notional tax on loss before taxation, calculated at the rates applicable to loss in the tax jurisdictions concerned |

(3,380 | ) | (3,667 | ) | ||||

| Adjustments for tax effect of: |

||||||||

| Non-deductible expenses |

96 | 102 | ||||||

| Share of results of associates and joint ventures and other non-taxable income |

(70 | ) | 111 | |||||

| Unused tax losses and deductible temporary differences for which no deferred tax assets were recognised |

489 | 80 | ||||||

| Utilisation of unused tax losses and deductible temporary differences for which no deferred tax assets were recognised in prior years |

(32 | ) | (8 | ) | ||||

| Under-provision in prior year |

35 | 48 | ||||||

| Super deduction of research and development expenses |

(32 | ) | (34 | ) | ||||

|

|

|

|

|

|||||

| Income tax credit |

(2,894 | ) | (3,368 | ) | ||||

|

|

|

|

|

|||||

| 10 | LOSS PER SHARE |

The calculation of basic loss per share for the year ended 31 December 2021 is based on the loss attributable to equity shareholders of the Company of RMB12,106 million (2020: RMB10,847 million) and the weighted average of 16,201,129,384 shares in issue during the year (2020: 14,056,887,174 shares).

| 2021 | 2020 | |||||||

| million | million | |||||||

| Issued ordinary shares at 1 January |

15,329 | 12,267 | ||||||

| Effect of issuance of shares |

872 | 1,790 | ||||||

|

|

|

|

|

|||||

| Weighted average number of ordinary shares at 31 December |

16,201 | 14,057 | ||||||

|

|

|

|

|

|||||

The amount of diluted loss per share is the same as basic loss per share as the effect of convertible bonds is anti-dilutive for the year ended 31 December 2021 and for the year ended 31 December 2020.

| 11 | DIVIDENDS |

The directors did not recommend any final dividend in respect of the years ended 31 December 2021 and 2020.

| 12 | PROPERTY, PLANT AND EQUIPMENT, NET |

| Investment properties |

Buildings | Aircraft | Other flight equipment including |

Machinery, equipment and vehicles |

Total | |||||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | RMB million | |||||||||||||||||||

| Cost: |

||||||||||||||||||||||||

| At 1 January 2020 |

470 | 16,046 | 113,276 | 24,385 | 8,253 | 162,430 | ||||||||||||||||||

| Additions |

— | 12 | 1,435 | 542 | 935 | 2,924 | ||||||||||||||||||

| Transferred from construction in progress |

— | 5,720 | 3,719 | 497 | 1,340 | 11,276 | ||||||||||||||||||

| Reclassification on change of holding intention: |

||||||||||||||||||||||||

| – transferred from other property, plant and equipment, net |

52 | (52 | ) | — | — | — | — | |||||||||||||||||

| Transferred from right-of-use assets on exercise of purchase option (Note 14) |

— | — | 2,780 | — | — | 2,780 | ||||||||||||||||||

| Disposals |

||||||||||||||||||||||||

| – disposals |

— | (152 | ) | (6,830 | ) | (399 | ) | (558 | ) | (7,939 | ) | |||||||||||||

| – disposal of a subsidiary |

— | (99 | ) | — | – | (34 | ) | (133 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 31 December 2020 |

522 | 21,475 | 114,380 | 25,025 | 9,936 | 171,338 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 1 January 2021 |

522 | 21,475 | 114,380 | 25,025 | 9,936 | 171,338 | ||||||||||||||||||

| Additions |

— | 66 | 2,855 | 487 | 668 | 4,076 | ||||||||||||||||||

| Transferred from construction in progress |

— | 2,097 | 8,796 | 434 | 486 | 11,813 | ||||||||||||||||||

| Reclassification on change of holding intention: |

||||||||||||||||||||||||

| – transferred to other property, plant and equipment, net |

(32 | ) | 32 | — | — | — | — | |||||||||||||||||

| – transferred from other property, plant and equipment, net |

50 | (50 | ) | — | — | — | — | |||||||||||||||||

| Transfer to assets held for sale |

— | — | (6,309 | ) | (152 | ) | — | (6,461 | ) | |||||||||||||||

| Transferred from right-of-use assets on exercise of purchase option (Note 14) |

— | — | 2,761 | — | — | 2,761 | ||||||||||||||||||

| Others |

9 | — | — | — | — | 9 | ||||||||||||||||||

| Disposals |

(8 | ) | (115 | ) | (6,393 | ) | (441 | ) | (556 | ) | (7,513 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 31 December 2021 |

541 | 23,505 | 116,090 | 25,353 | 10,534 | 176,023 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Investment properties |

Buildings | Aircraft | Other flight equipment including rotables |

Machinery, equipment |

Total | |||||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | RMB million | |||||||||||||||||||

| Accumulated depreciation and impairment losses: |

||||||||||||||||||||||||

| At 1 January 2020 |

166 | 4,917 | 54,177 | 13,119 | 5,263 | 77,642 | ||||||||||||||||||

| Depreciation charge for the year |

23 | 618 | 5,744 | 1,493 | 946 | 8,824 | ||||||||||||||||||

| Reclassification on change of holding intention: |

||||||||||||||||||||||||

| – transferred from other property, plant and equipment, net |

21 | (21 | ) | — | — | — | — | |||||||||||||||||

| Transferred from right-of-use assets on exercise of purchase option (Note 14) |

— | — | 982 | — | — | 982 | ||||||||||||||||||

| Disposals |

||||||||||||||||||||||||

| – disposals |

— | (59 | ) | (4,588 | ) | (372 | ) | (483 | ) | (5,502 | ) | |||||||||||||

| – disposal of a subsidiary |

— | (15 | ) | — | — | (11 | ) | (26 | ) | |||||||||||||||

| Provision for impairment losses |

— | — | 3,202 | 75 | 2 | 3,279 | ||||||||||||||||||

| Impairment losses written off on disposals |

— | — | — | (7 | ) | — | (7 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 31 December 2020 |

210 | 5,440 | 59,517 | 14,308 | 5,717 | 85,192 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 1 January 2021 |

210 | 5,440 | 59,517 | 14,308 | 5,717 | 85,192 | ||||||||||||||||||

| Depreciation charge for the year |

16 | 712 | 5,673 | 1,394 | 1,040 | 8,835 | ||||||||||||||||||

| Reclassification on change of holding intention: |

||||||||||||||||||||||||

| – transferred to other property, plant and equipment, net |

(19 | ) | 19 | — | — | — | — | |||||||||||||||||

| – transferred from other property, plant and equipment, net |

35 | (35 | ) | — | — | — | — | |||||||||||||||||

| Transfer to assets held for sale |

— | — | (2,746 | ) | (66 | ) | — | (2,812 | ) | |||||||||||||||

| Transferred from right-of-use assets on exercise of purchase option (Note 14) |

— | — | 1,202 | — | — | 1,202 | ||||||||||||||||||

| Disposals |

(6 | ) | (28 | ) | (4,270 | ) | (406 | ) | (414 | ) | (5,124 | ) | ||||||||||||

| Provision for impairment losses (a) |

— | — | 914 | 80 | — | 994 | ||||||||||||||||||

| Impairment losses transfer to assets held for sale |

— | — | (2,581 | ) | (60 | ) | — | (2,641 | ) | |||||||||||||||

| Impairment losses written off on disposals |

— | — | (809 | ) | — | — | (809 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 31 December 2021 |

236 | 6,108 | 56,900 | 15,250 | 6,343 | 84,837 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net book value: |

||||||||||||||||||||||||

| At 31 December 2021 |

305 | 17,397 | 59,190 | 10,103 | 4,191 | 91,186 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At 31 December 2020 |

312 | 16,035 | 54,863 | 10,717 | 4,219 | 86,146 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | As at 31 December 2021, the Group reported aircraft and related equipment in the amount of RMB199,407 million. For the year ended 31 December 2021, the Group made impairment provision of RMB2,579 million in aggregate towards certain aged or market value declined aircraft and related equipment based on its fleet disposal plans. Among which, the impairment provision for owned aircraft and related equipment were RMB994 million, and the impairment provision for leased aircraft and related equipment were RMB1,585 million (Note 14). Provision were made when asset’s carrying amount exceed its recoverable amount. The estimated recoverable amounts of above aircraft and related equipment with impairment indications were based on the fair value less cost to sell, which was determined by reference to the recent observable market prices for those aircraft and related equipment or appraisal results valued by external appraisal expert based on the cost method. |

| 13. | CONSTRUCTION IN PROGRESS |

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Advance payment for aircraft and flight equipment |

30,122 | 29,342 | ||||||

| Others |

1,725 | 3,065 | ||||||

|

|

|

|

|

|||||

| 31,847 | 32,407 | |||||||

|

|

|

|

|

|||||

| 14 | RIGHT-OF-USE ASSETS |

| Aircraft and engines |

Land use rights | Buildings | Others | Total | ||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | ||||||||||||||||

| Cost: |

||||||||||||||||||||

| At 1 January 2020 |

215,381 | 4,022 | 2,790 | 392 | 222,585 | |||||||||||||||

| Additions |

6,526 | 45 | 412 | 190 | 7,173 | |||||||||||||||

| Transfer from construction in progress |

5,993 | 2,440 | — | 226 | 8,659 | |||||||||||||||

| Transferred to property, plant and equipment on exercise of purchase option (Note 12) |

(2,780 | ) | — | — | — | (2,780 | ) | |||||||||||||

| Disposals |

||||||||||||||||||||

| – disposals |

(4,419 | ) | — | (180 | ) | — | (4,599 | ) | ||||||||||||

| – disposal of a subsidiary |

— | (26 | ) | — | (43 | ) | (69 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 31 December 2020 |

220,701 | 6,481 | 3,022 | 765 | 230,969 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 1 January 2021 |

220,701 | 6,481 | 3,022 | 765 | 230,969 | |||||||||||||||

| Additions |

3,493 | 343 | 1,194 | 243 | 5,273 | |||||||||||||||

| Transfer from construction in progress |

302 | 61 | — | 152 | 515 | |||||||||||||||

| Transferred to property, plant and equipment on exercise of purchase option (Note 12) |

(2,761 | ) | — | — | — | (2,761 | ) | |||||||||||||

| Transferred to assets held for sale |

(1,582 | ) | — | — | — | (1,582 | ) | |||||||||||||

| Disposals |

(5,959 | ) | (75 | ) | (931 | ) | (26 | ) | (6,991 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 31 December 2021 |

214,194 | 6,810 | 3,285 | 1,134 | 225,423 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Aircraft and engines |

Land use rights | Buildings | Others | Total | ||||||||||||||||

| RMB million | RMB million | RMB million | RMB million | RMB million | ||||||||||||||||

| Accumulated amortization and impairment losses: |

||||||||||||||||||||

| At 1 January 2020 |

67,890 | 813 | 637 | 34 | 69,374 | |||||||||||||||

| Amortisation charge for the year |

14,167 | 134 | 997 | 90 | 15,388 | |||||||||||||||

| Transferred to property, plant and equipment on exercise of purchase option (Note 12) |

(982 | ) | — | — | — | (982 | ) | |||||||||||||

| Disposals |

||||||||||||||||||||

| – disposals |

(4,419 | ) | — | (132 | ) | — | (4,551 | ) | ||||||||||||

| – disposal of a subsidiary |

— | — | — | (7 | ) | (7 | ) | |||||||||||||

| Provision for impairment losses |

682 | — | — | — | 682 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 31 December 2020 |

77,338 | 947 | 1,502 | 117 | 79,904 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 1 January 2021 |

77,338 | 947 | 1,502 | 117 | 79,904 | |||||||||||||||

| Amortisation charge for the year |

13,616 | 140 | 954 | 178 | 14,888 | |||||||||||||||

| Transferred to property, plant and equipment on exercise of purchase option (Note 12) |

(1,202 | ) | — | — | — | (1,202 | ) | |||||||||||||

| Transferred to assets held for sale |

(616 | ) | — | — | — | (616 | ) | |||||||||||||

| Disposals |

(5,959 | ) | — | (913 | ) | (21 | ) | (6,893 | ) | |||||||||||

| Provision for impairment losses (Note 12(a)) |

1,585 | — | — | — | 1,585 | |||||||||||||||

| Impairment losses transfer to assets held for sale |

(682 | ) | — | — | — | (682 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 31 December 2021 |

84,080 | 1,087 | 1,543 | 274 | 86,984 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net book value: |

||||||||||||||||||||

| At 31 December 2021 |

130,114 | 5,723 | 1,742 | 860 | 138,439 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| At 31 December 2020 |

143,363 | 5,534 | 1,520 | 648 | 151,065 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 15 | DEFERRED TAX ASSETS |

Deferred tax assets arise from deductible temporary differences and unused tax losses are recognised to the extent that it is probable that future taxable profits will be available against which the related tax benefit can be utilised. The Group’s tax losses in the PRC are available for carrying forward to set off future assessable income for a maximum period of five or eight years (According to the Notice of the Ministry of Finance on the Taxation Policy for supporting the prevention of pandemic of Covid-19 (No. 8, 2020), the carry over period for tax losses of enterprises in certain difficult industries suffering from the epidemic in 2020 will be extended from 5 years to 8 years). Therefore, the Group’s tax losses occurred in 2020 can be carried forward for 5-8 years, and the Group’s tax losses occurred in other years can be carried forward for 5 years.

| 16 | TRADE RECEIVABLES |

Credit terms granted by the Group to sales agents and other customers generally range from one to three months. Ageing analysis of trade receivables based on transaction date is set out below:

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Within 1 month |

2,337 | 1,972 | ||||||

| More than 1 month but less than 3 months |

273 | 307 | ||||||

| More than 3 months but less than 12 months |

236 | 231 | ||||||

| More than 1 year |

51 | 58 | ||||||

|

|

|

|

|

|||||

| 2,897 | 2,568 | |||||||

| Less: loss allowance |

(39 | ) | (43 | ) | ||||

|

|

|

|

|

|||||

| 2,858 | 2,525 | |||||||

|

|

|

|

|

|||||

| 17 | OTHER RECEIVABLES |

| 2021 | 2020 | |||||||

| RMB million | RMB million |

|||||||

| VAT recoverable |

7,854 | 6,072 | ||||||

| Government grants receivables |

474 | 523 | ||||||

| Rebate receivables on aircraft acquisitions |

302 | 497 | ||||||

| Other deposits |

155 | 170 | ||||||

| Others |

972 | 1,244 | ||||||

|

|

|

|

|

|||||

| 9,757 | 8,506 | |||||||

| Less: loss allowance |

(158 | ) | (159 | ) | ||||

|

|

|

|

|

|||||

| 9,599 | 8,347 | |||||||

|

|

|

|

|

|||||

| 18 | DERIVATIVE FINANCIAL LIABILITIES |

In October 2020, the Group issued a total of 160,000,000 A share convertible bonds with par value of RMB100 each at par. The convertible bonds have a term of six years from the date of the issuance and the convertible bonds bear interest at the annual rate of 0.2% in the first year, 0.4% in the second year, 0.6% in the third year, 0.8% in the fourth year, 1.5% in the fifth year and 2.0% in the sixth year. Interest is paid once a year. Conversion rights are exercisable from 21 April 2021 to 14 October 2026 at an initial conversion price of RMB6.24 per share, subject to clauses of adjustment and downward revision of conversion price, redemption and sell-back. Convertible bonds, which conversion rights have not been exercised in five transaction days after maturity, will be redeemed at 106.5% of par value (including the interest for the sixth year).

Any excess of proceeds over the fair value amount initially recognised as the derivative component is recognised as the host liability component. Transaction costs related to the issuance of the convertible bonds are allocated to the host liability and are recognised initially as part of the liability. The derivative component is subsequently remeasured at fair value while the host liability component is subsequently carried at amortised cost using the effective interest method.

For the year ended 31 December 2021, 101,034,070 convertible bonds were converted to A shares at the conversion price of RMB6.24 per share, RMB1,619 million was credited to share capital. As at 31 December 2021, the carrying amount of liability component of the remaining 58,965,930 A share convertible bonds was RMB4,992 million (31 December 2020: 160,000,000 A share convertible bonds with a carrying amount of RMB12,833 million), and the fair value of the derivative component of remaining 58,965,930 A share convertible bonds was RMB1,222 million (31 December 2020: 160,000,000 A share convertible bonds with fair value of RMB3,092 million). For the year ended 31 December 2021, the loss on the changes in fair value of the derivative component amounted to RMB269 million was recognised (31 December 2020: gain on the changes in fair value amounted to RMB201 million).

| 19 | BORROWINGS |

Borrowings are analysed as follows:

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Non-current |

||||||||

| Long-term borrowings |

15,389 | 8,811 | ||||||

| Corporate bonds |

1,000 | 7,500 | ||||||

| Convertible bonds |

4,984 | 12,833 | ||||||

| Medium-term notes |

16,981 | 8,990 | ||||||

|

|

|

|

|

|||||

| 38,354 | 38,134 | |||||||

|

|

|

|

|

|||||

| Current |

||||||||

| Current portion of long-term borrowings |

169 | 67 | ||||||

| Short-term borrowings |

25,116 | 25,286 | ||||||

| Ultra-short-term financing bills |

24,710 | 10,999 | ||||||

| Current portion of corporate bonds and medium-term notes |

7,910 | 3,747 | ||||||

| Current portion of convertible bonds |

8 | — | ||||||

|

|

|

|

|

|||||

| 57,913 | 40,099 | |||||||

|

|

|

|

|

|||||

| Total borrowings |

96,267 | 78,233 | ||||||

|

|

|

|

|

|||||

| The borrowings are repayable: |

||||||||

| Within one year |

57,913 | 40,099 | ||||||

| In the second year |

18,611 | 7,662 | ||||||

| In the third to fifth year |

16,747 | 14,394 | ||||||

| After the fifth year |

2,996 | 16,078 | ||||||

|

|

|

|

|

|||||

| Total borrowings |

96,267 | 78,233 | ||||||

|

|

|

|

|

|||||

| 20 | LEASE LIABILITIES |

At 31 December 2021, the leases liabilities were payable as follows:

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Within 1 year |

20,805 | 20,930 | ||||||

| After 1 year but within 2 years |

19,229 | 20,045 | ||||||

| After 2 years but within 5 years |

38,950 | 47,164 | ||||||

| After 5 years |

23,765 | 33,074 | ||||||

|

|

|

|

|

|||||

| 102,749 | 121,213 | |||||||

|

|

|

|

|

|||||

The Group has significant lease liabilities which are denominated in USD as at 31 December 2021. The net exchange gain of RMB1,575 million for the year ended 31 December 2021 (2020: net exchange gain of RMB3,485 million) was mainly attributable to the translation of balances of lease liabilities which are denominated in USD.

| 21 | TRADE PAYABLES |

Ageing analysis of trade payables based on transaction date is set out below:

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Within 1 month |

403 | 431 | ||||||

| More than 1 month but less than 3 months |

221 | 473 | ||||||

| More than 3 months but less than 6 months |

221 | 313 | ||||||

| More than 6 months but less than 1 year |

268 | 329 | ||||||

| More than 1 year |

215 | 236 | ||||||

|

|

|

|

|

|||||

| 1,328 | 1,782 | |||||||

|

|

|

|

|

|||||

| B. | PREPARED IN ACCORDANCE WITH THE PRC GAAP |

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2021

| 2021 | 2020 | |||||||

| RMB million | RMB million | |||||||

| Revenue |

101,644 | 92,561 | ||||||

| Less: Operating costs |

104,229 | 94,903 | ||||||

| Taxes and surcharges |

365 | 330 | ||||||

| Selling and distribution expenses |

4,993 | 5,248 | ||||||

| General and administrative expenses |

3,678 | 3,989 | ||||||

| Research and development expenses |

381 | 367 | ||||||

| Finance expenses |

4,025 | 2,993 | ||||||

| Including: Interest expense |

6,202 | 6,716 | ||||||

| Interest income |

675 | 322 | ||||||

| Add: Other income |

3,964 | 4,179 | ||||||

| Investment income/(loss) |

284 | (401 | ) | |||||

| Including: in come/(loss) from investment in associates and joint ventures |

280 | (467 | ) | |||||

| (Loss)/gain on fair value movement |

(309 | ) | 53 | |||||

| Credit losses |

1 | (164 | ) | |||||

| Impairment loss |

(2,614 | ) | (4,017 | ) | ||||

| Gain/(loss) on assets disposals |

399 | (22 | ) | |||||

|

|

|

|

|

|||||

| Operating loss |

(14,302 | ) | (15,641 | ) | ||||

| Add: Non-operating income |

660 | 652 | ||||||

| Less: Non-operating expenses |

261 | 197 | ||||||

|

|

|

|

|

|||||

| Loss before income tax |

(13,903 | ) | (15,186 | ) | ||||

| Less: Income tax |

(2,892 | ) | (3,366 | ) | ||||

|

|

|

|

|

|||||

| Net loss for the year |

(11,011 | ) | (11,820 | ) | ||||

|

|

|

|

|

|||||

| (1) Net loss classified by continuity of operations: |

||||||||

| 1. Net loss from continuing operations |

(11,011 | ) | (11,820 | ) | ||||

| 2. Net loss from discontinued operations |

— | — | ||||||

| (2) Net loss classified by ownership: |

||||||||

| 1. Shareholders of the Company |

(12,103 | ) | (10,842 | ) | ||||

| 2. Non-controlling interests |

1,092 | (978 | ) | |||||

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 December 2021

| 31 December 2021 |

31 December 2020 |

|||||||

| RMB million | RMB million | |||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash at bank and on hand |

21,841 | 25,823 | ||||||

| Bills receivable |

4 | 12 | ||||||

| Accounts receivable |

2,894 | 2,544 | ||||||

| Prepayments |

736 | 732 | ||||||

| Other receivables |

1,275 | 1,955 | ||||||

| Inventories |

1,652 | 1,760 | ||||||

| Assets held for sale |

1,292 | — | ||||||

| Non-current assets due within one year |

138 | — | ||||||

| Other current assets |

8,034 | 6,159 | ||||||

|

|

|

|

|

|||||

| Total current assets |

37,866 | 38,985 | ||||||

|

|

|

|

|

|||||

| Non-current assets |

||||||||

| Long-term equity investments |

5,977 | 5,673 | ||||||

| Other equity instrument investment |

563 | 799 | ||||||

| Other non-current financial assets |

95 | 92 | ||||||

| Investment properties |

305 | 312 | ||||||

| Fixed assets |

90,817 | 85,754 | ||||||

| Construction in progress |

31,869 | 32,438 | ||||||

| Right-of-use assets |

132,725 | 145,540 | ||||||

| Intangible assets |

6,564 | 6,155 | ||||||

| Long-term receivables |

645 | — | ||||||

| Aircraft lease deposits |

321 | 362 | ||||||

| Long-term deferred expenses |

768 | 887 | ||||||

| Deferred tax assets |

12,831 | 7,749 | ||||||

| Other non-current assets |

1,602 | 1,369 | ||||||

|

|

|

|

|

|||||

| Total non-current assets |

285,082 | 287,130 | ||||||

|

|

|

|

|

|||||

| Total assets |

322,948 | 326,115 | ||||||

|

|

|

|

|

|||||

| 31 December 2021 |

31 December 2020 |

|||||||

| RMB million | RMB million | |||||||

| Liabilities and shareholders’ equity |

||||||||

| Current liabilities |

||||||||

| Short-term bank borrowings |

25,116 | 25,286 | ||||||

| Derivative financial liabilities |

1,222 | 3,148 | ||||||

| Bills payable |

— | 278 | ||||||

| Accounts payable |

12,183 | 11,974 | ||||||

| Contract liabilities |

1,542 | 1,513 | ||||||

| Sales in advance of carriage |

3,716 | 3,997 | ||||||

| Employee benefits payable |

4,457 | 4,328 | ||||||

| Taxes payable |

1,140 | 680 | ||||||

| Other payables |

7,914 | 8,640 | ||||||

| Non-current liabilities due within one year |

28,990 | 24,838 | ||||||

| Other current liabilities |

24,710 | 10,999 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

110,990 | 95,681 | ||||||

|

|

|

|

|

|||||

| Non-current liabilities |

||||||||

| Long-term bank borrowings |

15,389 | 8,811 | ||||||

| Bonds payable |

22,965 | 29,323 | ||||||

| Derivative financial liabilities |

20 | 11 | ||||||

| Hedging instrument |

— | 42 | ||||||

| Lease liabilities |

81,944 | 100,283 | ||||||

| Long-term payables |

193 | 291 | ||||||

| Provision for major overhauls |

4,820 | 4,216 | ||||||

| Deferred benefits and gains |

725 | 769 | ||||||

| Deferred tax liabilities |

26 | 80 | ||||||

| Other non-current liabilities |

1,631 | 1,745 | ||||||

|

|

|

|

|

|||||

| Total non-current liabilities |

127,713 | 145,571 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

238,703 | 241,252 | ||||||

|

|

|

|

|

|||||

| 31 December 2021 |

31 December 2020 |

|||||||

| RMB million | RMB million | |||||||

| Net assets |

||||||||

| Share capital |

16,948 | 15,329 | ||||||

| Capital reserve |

47,887 | 39,050 | ||||||

| Other comprehensive income |

159 | 242 | ||||||

| Surplus reserve |

2,579 | 2,579 | ||||||

| Retained earnings |

43 | 12,146 | ||||||

|

|

|

|

|

|||||

| Total equity attributable to equity shareholders of the Company |

67,616 | 69,346 | ||||||

| Non-controlling interests |

16,629 | 15,517 | ||||||

|

|

|

|

|

|||||

| Total equity |

84,245 | 84,863 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

322,948 | 326,115 | ||||||

|

|

|

|

|

|||||

| C. | RECONCILIATION OF DIFFERENCES IN FINANCIAL STATEMENTS PREPARED UNDER PRC GAAP AND IFRSs |

Difference in loss and equity attributable to equity shareholders of the Company under consolidated financial information in financial statements between IFRSs and PRC GAAP

| Loss attributable to equity Company |

Equity attributable to equity shareholders of the |

|||||||||||||||

| 2021 | 2020 | 31 December 2021 |

31 December 2020 |

|||||||||||||

| RMB million | RMB million | RMB million | RMB million | |||||||||||||

| Amounts under PRC GAAP |

(12,103 | ) | (10,842 | ) | 67,616 | 69,346 | ||||||||||

| Adjustments: |

||||||||||||||||

| Capitalisation of exchange difference of specific loans |

(8 | ) | (9 | ) | 39 | 47 | ||||||||||

| Government grants |

1 | — | (5 | ) | (6 | ) | ||||||||||

| Adjustment arising from the Company’s business combination under common control |

— | — | 237 | 237 | ||||||||||||

| Income tax effect of the above adjustments |

2 | 2 | (8 | ) | (10 | ) | ||||||||||

| Effect of the above adjustments on non-controlling interests |

2 | 2 | (28 | ) | (30 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Amounts under IFRSs |

(12,106 | ) | (10,847 | ) | 67,851 | 69,584 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

BUSINESS REVIEW

In 2021, the global economy rebounded significantly from the low base in 2020. According to the World Economic Outlook issued by the International Monetary Fund, the global economy experienced a growth of 5.9% in 2021. China’s economic development and pandemic prevention and control maintained a leading position in the world. Its construction of a new development paradigm moved a new step and high quality development made new progress. The economy of China grew at 8.1% for the whole year, the economy growth rate ranked at the leading position among major economies, and the GDP exceeded RMB110 trillion.

In 2021, the global aviation industry presented a recovery momentum, and travellers were more confident and willing to travel around. However, as affected by COVID-19 pandemic (the “pandemic”), the passenger transportation and cargo transportation of the global aviation continued to differentiate, with passenger transportation maintaining weak recovery and cargo transportation maintaining high growth. Under the repeated impact of the pandemic, China’s aviation industry showed the trend of gradual recovery and improvement. During the year, the total traffic turnover volume, passenger traffic volume, and cargo and mail transportation volume recorded 85.7 billion ton-kilometers, 440 million passengers and 7.32 million tonnes, respectively, representing a year-on-year increase of 7.3, 5.5 and 8.2 percentage points, respectively. The Group continued to improve pandemic prevention and control mechanism, gave top priority to aviation safety, actively responded to the operation challenges, accumulated new drivers for high quality development. During the reporting period, with the joint efforts of the management and all staff, the Group achieved 2.11 million hours of safe flight, served approximately 98.50 million passengers, and made a new record in operating results of cargo transportation. The “Green Flight” of the Company was awarded the first “Golden Key” Champion by the Ministry of Commerce, and the Company was awarded the First Brand in Aviation Service Industry by the Ministry of Industry and Information Technology in China Brand Power Research for 11 consecutive years.

1. Pandemic Prevention and Control

During the reporting period, the Group resolutely implemented the responsibilities for pandemic prevention and control, and continued to improve the pandemic prevention and control working mechanism. With reference to the national pandemic prevention and control policies, we updated and improved the Company’s pandemic prevention system and measures in a timely manner; we put a premium on the prevention of imported pandemic from overseas, advanced the pandemic prevention check points, ensured the pandemic prevention management and control for inbound tourists, formulated guidelines for the whole-process pandemic prevention for international flight crew; we actively coordinated with national pandemic prevention and control measures, promoted full coverage of vaccination and 100% completion of booster injection for international flight crew and personnel in high-risk positions. During the reporting period, the Group actively coped with the pandemic challenge, protected and quarantined approximately 50,000 crew members, organized the pandemic prevention training to all staff and organized to conduct more than 1.90 million nucleic acid tests. The Company’s special flight for COVID-19 vaccine transported more than 130 million doses of COVID-19 vaccines within and across the borders.

2. Safety Management

During the reporting period, the Group continued to enhance safety quality, commenced special work for safety system improvement, work style construction and rectification, and safety risk management and control. We further carried out a three-year campaign of rectification special work for safety production, pushed forward the construction of seven safety systems, formulated and improved safety management system; we utilized digitalised concept to constantly enhance safety management level, promoted and applied professional system for safety management; we conducted work style rectification special work and promoted the obviousness of work style issues by using technical means.

3. Management Response