Form 6-K CHINA LIFE INSURANCE CO For: Mar 25

Commission File Number 001-31914

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

March 25, 2022

China Life Insurance Company Limited

(Translation of registrant’s name into English)

16 Financial Street

Xicheng District

Beijing 100033, China

Tel: (86-10) 6363-3333

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ...X… Form 40-F ……

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):___________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ___________

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ..... No ...X..

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ___________

Commission File Number 001-31914

China Life Insurance Company Limited issued an announcement on March 24, 2022, a copy of which is attached as Exhibit 99.1 hereto.

Certain statements contained in this announcement may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2019 filed with the U.S. Securities and Exchange Commission, or SEC, on April 29, 2020 and in the Company’s other filings with the SEC. You should not place undue reliance on these forward-looking statements. All information provided in this announcement is as of the date of this announcement, unless otherwise stated, and we undertake no duty to update such information, except as required under applicable law. Unless otherwise indicated, the Chinese insurance market information set forth in this announcement is based on public information released by the China Banking and Insurance Regulatory Commission.

EXHIBIT LIST

| Exhibit | Description | |

| 99.1 | Announcement, dated March 24, 2022 | |

Commission File Number 001-31914

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| China Life Insurance Company Limited | ||||

| (Registrant) | ||||

|

By: |

/s/ Su Hengxuan

| |||

| (Signature) | ||||

| March 25, 2022 |

Name: |

Su Hengxuan | ||||

| Title: |

President and Executive Director |

EXHIBIT 99.1

Commission File Number 001-31914

China Life Insurance Company Limited

2021 Environmental, Social and Governance &

Social Responsibility Report

1

Contents

| About the Report |

3 | |||||

| Message from Management |

5 | |||||

| Performance highlights |

7 | |||||

| About Us |

8 | |||||

| Awards and Honors in 2021 |

9 | |||||

| Materiality Analysis |

12 | |||||

| Statement by the Board of Directors |

17 | |||||

| 1. |

Responsibilities of China Life | 19 | ||||

| 1.1. |

Serving National Strategies | 19 | ||||

| 1.2. |

Creating Premium-Quality Products | 24 | ||||

| 1.3. |

Drive Scientific and Technological Innovation | 29 | ||||

| 2. |

Warmth of China Life | 40 | ||||

| 2.1. |

Talent Culture | 40 | ||||

| 2.2. |

A Leader in Service | 48 | ||||

| 2.3. |

Social Guardian | 60 | ||||

| 2.4. |

Practicing on Low-carbon Development | 66 | ||||

| 3. |

Accumulation for China Life | 79 | ||||

| 3.1. |

Sound Governance | 79 | ||||

| 3.2. |

Sustainable Governance | 82 | ||||

| 3.3. |

Responsible Governance | 87 | ||||

| Table of KPI |

92 | |||||

| ESG Index |

97 | |||||

| Feedback Form |

102 | |||||

2

About the Report

This report is the 15th Environmental, Social and Governance Report of China Life Insurance Company Limited (hereinafter referred to as China Life). This report aims at responding to stakeholders expectations and demonstrating its concept, actions and performance related to the environment, society, corporate governance and sustainable development.

Organizations Covered by the Report

If not specified, all data and information disclosed in the report cover China Life. Its subsidiaries are excluded.

Notes on the Data of the Report

The key financial data of this report came from the audited 2021 Annual Report of China Life Insurance Company Limited and other data from the Company’s internal documents and related statistics.

Time Range of the Report

From January 1 to December 31st , 2021, with part of the content in excess thereof.

Basis for Report Preparation

The report is prepared in accordance with Environmental, Social and Governance Reporting Guide issued by HKEX, Notice on Strengthening Listed Companies Assumption of Social Responsibility and the Shanghai Stock Exchange Guidelines on Listed Companies Environmental Information Disclosure issued by Shanghai Stock Exchange and discloses information as per Global Reporting Initiative’s (GRI) Sustainability Reporting Guidelines.

Notes on Appellation

For the convenience of expression and reading, China Life Insurance Company Limited is hereinafter referred to as China Life the Company or we. If not specified, the amount is shown in RMB (yuan).

Reporting Period

This is an annual report.

3

How to Obtain the Report

The report is released in the online version. You can browse and download the Simplified Chinese, Traditional Chinese, and English versions of the report at the following website:

www.e-chinalife.com

The official website of the Company (www.e-chinalife.com)

www.sse.com.cn

The website of Shanghai Stock Exchange (www.sse.com.cn)

www.hkex.com.hk

The website of HKEX (www.hkex.com.hk)

4

Message from Management

2021 has been a milestone in the history of the Communist Party of China (CPC) and the country. Under the strong leadership of the Central CPC Committee with comrade Xi Jinping at its core, bearing in mind the upmost interests of the nation, China Life emerged from the rigorous international situation and the global health crisis at ease. We strengthened our presence in the insurance sector to facilitate new development paradigms and gained broad recognition with active corporate social responsibility endeavors. In 2021, China Life received the Golden Bauhinia Award and Award for Best Listed Company from China Securities, and Most Respected Company in Asia (Insurance Sector) from Institutional Investors.

Committed to high-quality development, China Life has been making solid contributions to the country. In 2021, we upheld our strategies to seek gradual and steady progress and deepen reform and innovation to promote transition and upgrading and achieve new successes in high-quality development. In 2021, China Life generated a premium income of RMB 618.327 billion and a net profit of RMB 50.921 billion, sustained at historically high levels, which marks a good start of the 14th Five-Year Development Plan.

We devote every effort to the key strategies of the nation to align our growth to the big picture. In 2021, to support rural revitalization, we stationed more than 1,100 employees in villages for poverty reduction. Our rural revitalization medical insurance paid out RMB520 million to 1.37 million policy holders. The poverty prevention insurance products covered 9.68 million people. To better facilitate real economy to improve quality and enhance efficiency, we invested more than RMB2.7 trillion in real economy. To fully support coordinated regional development, we increased our investment in core regions such as the Beijing-Tianjin-Hebei Region and countries in the Belt and Road Initiative (BRI), with a total strategic investment in regional development of more than RMB1.4 trillion. In addition, we played an integral role in promoting a multi-level social security system, diversifying product offerings, piloting commercial endowment insurance projects. To pursue technological self-reliance, we gave an overhaul to the infrastructure of our core systems, such as computing, storage, database, and applications, keeping abreast of cutting-edge technologies, and remarkably improving our elastic computing and real-time processing capabilities.

5

As a people-oriented company, China Life believes in developing ourselves and contributing to the success of others. In 2021, we followed the concepts of people orientation, high degree of integrity and ability and dare to take responsibility to protect the rights and interests of 100,000 plus employees and support their development. As a customer-centered company, we continued to offer accessible, thoughtful, and high-quality service to customers and maintained a high customer satisfaction rate. As a charitable company, we had more than 210 volunteer teams who launched nearly 1,000 charitable activities and events. In addition, we incorporated peaking carbon emissions and achieving carbon neutrality in our development philosophy and created a climate change mitigation scheme. We defined our overall environmental goal as protecting the environment and contributing to carbon neutrality and made action plans accordingly. We took targeted measures in green investment, green sales, green operation, and green office. In 2021, we concluded a total green investment of more than RMB300 billion, a four times year-on-year, to promote high-quality, sustainable economic growth.

We make diligent efforts to improve corporate governance and carry forward our legacies. In 2021, we focused on overall development and safety as we improved our corporate governance system, holding the line against systemic financial risks. China Life has remained Class A in comprehensive risk rating for 15 consecutive quarters. Taking a long view, we defined our strategic ESG goal as building a world-class, responsible life insurance company. We made systematic plans for ESG governance and established ESG risk management systems to build a responsible brand image with actions.

Boundless is the ocean where we sail with the wind. In 2022, we are ready to make solid efforts to take on new challenges. As China strives to accomplish the second centenary goal, we will undertake our historical mission and forge ahead. We believe that opening new grounds for reform and development is the best way to greet the opening of the 20th CPC National Congress.

6

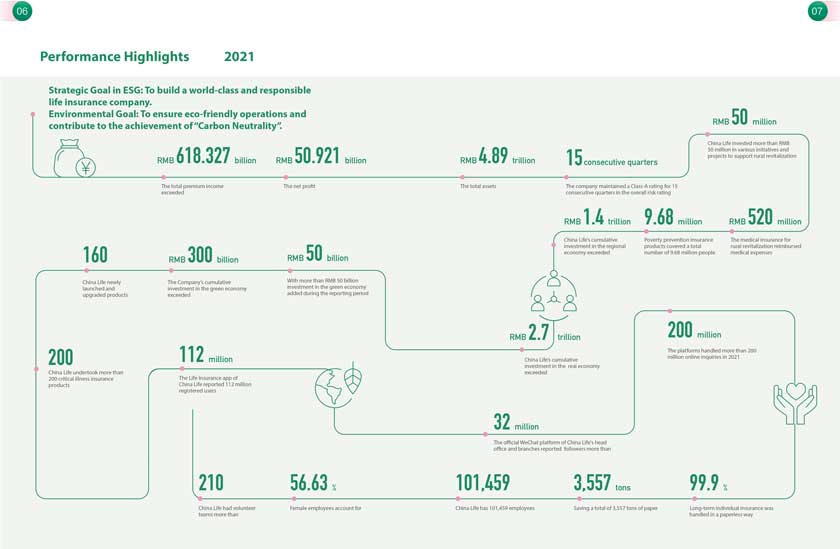

Performance Highlights 2021

Strategic Goal in ESG: To build a world-class and responsible life insurance company.

Environmental Goal: To ensure eco-friendly operations and contribute to the achievement of “Carbon Neutrality”.

|

The total premium income exceeded RMB 618.327 billion, the net profit RMB 50.921 billion and the total assets RMB 4.89 trillion.

|

|

The company maintained a Class-A rating for 15 consecutive quarters in the overall risk rating.

|

|

China Life invested more than RMB 50 million in various initiatives and projects to support rural revitalization. The medical insurance for rural revitalization reimbursed medical expenses of RMB 520 million. Poverty prevention insurance products covered a total number of 9.68 million people.

|

|

China Life’s cumulative investment in the regional economy and real economy exceeded RMB 1.4 trillion and RMB 2.7 trillion respectively. The Companys cumulative investment in the green economy exceeded RMB 300 billion, with more than RMB 50 billion added during the reporting period.

|

|

China Life newly launched and upgraded 160 products.

|

|

China Life undertook more than 200 critical illness insurance products.

|

|

The Life Insurance app of China Life reported 112 million registered users. The official WeChat platform of China Lifes head office and branches reported more than 32 million followers. The platforms handled more than 200 million online inquiries in 2021.

|

|

99.9% of long-term individual insurance was handled in a paperless way, saving a total of 3,557 tons of paper.

|

|

China Life has 101,459 employees. Female employees account for 56.63 percent.

|

|

China Life had more than 210 volunteer teams.

|

7

About Us

China Life, headquartered in Beijing, is an industry leader in Chinas life insurance industry, with a registered capital of RMB 28.265 billion. As a core member of China Life Insurance (Group) Company, the company is one of the Fortune Global 500 companies and the Worlds 500 Most Influential Brands. The company has won the trust of the society with its long history, strong strength, professional expertise, competitive advantage and a world-famous brand. It has been a pacesetter in Chinas life insurance market and is known as the mainstay of Chinas insurance industry. The predecessor of China Life was the same age as that of the People’s Republic of China.

Established in October 1949 and approved by the central government, it is one of the earliest insurance companies in China and shoulders the important responsibility as an explorer and pioneer of China’s life insurance industry. During the long-term development course, the company has fostered a stable professional management team, accumulated rich management experience, and is well versed in the domestic life insurance market. On December 17 and 18, 2003, China Life was listed in New York and Hong Kong respectively. On January 9, 2007, China Life returned to the A-share market. Since then, the company has become the first financial insurance company to be listed in New York, Hong Kong and Shanghai.

In 2021, China Life registered a premium income of RMB 618.327 billion. During the year, it comprised more than 19 thousand branches1 across the country and employed over 100 thousand persons and 890 thousand sales staff in various channels. We are the leading supplier of individual and group life insurance products and annuity products, accident insurance and health insurance in China. As of December 31st , 2021, the Companys total assets reached RMB 4.89 trillion. In the year, we provided various insurance coverage with 323 million valid, long-term individual and group life insurance policies, annuity contracts, long-term health insurance and long-term accident insurance policies, in addition to individual and group accident insurance and short-term health insurance policies and services.

1 Note: As of December 31st, 2021, the Company has more than 19 thousand branches across the country, including head office, provincial company, municipal company (central branch), branch company, business department and marketing service department.

8

Corporate culture

Awards and Honors in 2021

| Forbes |

Ranked 49th on the Forbes list of Global 2,000 Listed Companies in 2021

| |

|

Fortune |

Ranked 8th on Fortunes China 500 list for 2021

| |

|

21st Century Business Herald

|

Best Life Insurance Company of Asia in 2021

| |

|

Hong Kong Ta Kung Wen Wei Media Group, Beijing Association of Listed Companies, Hong Kong Chinese Enterprises Association, Hong Kong China Finance Association, Hong Kong Chinese Securities Association, Hong Kong Corporate Governance Association, and Hong Kong Securities and Investment Institute 2021 China Securities Golden Bauhinia Awards

|

Best Listed Company

Most Investment-Worthy Listed Company during the 14th Five-Year Plan | |

9

|

Securities Time

2021 Ark Awards for Insurance Companies |

2021 Ark Award for High-Quality Development Insurance Company

2021 Ark Award for Golden Insurance Service

2021 Ark Award for Science and Technology Progress in the Insurance Sector

| |

|

Financial Times

Gold Medal Award for Chinese Financial Institutions

|

Golden Dragon Award for Best Listed Life Insurance Company in 2021 | |

|

National Business Daily

2021 China Golden Tripod Awards

|

Outstanding Life Insurance Company of the Year | |

|

New Fortune

3rd Best Listed Companies Awards

|

New Fortune Best Listed Company | |

|

China Securities Journal

2021 Golden Bull Awards for Investment of Insurance Companies

|

Golden Bull Award for Investment of Insurance Companies | |

|

Shanghai Securities News

12th Golden Wealth Management Awards

|

Top Award for Insurance Coverage Brand | |

|

Hexun.com

19th Chinas Financial Champion Awards |

Influential Insurance Company of the Year

Green Award for Sustainability | |

|

Caijing Magazine

2021 Evergreen Awards |

Corporate Social Responsibility Award in 2011

| |

10

|

Shanghai United Media Group & Jiemian News

Top 60 ESG Pioneers in 2021

|

Excellent Corporate Social Responsibility Award in 2011 | |

|

Sina Finance

ESG Golden Awards for Chinese Enterprises in 2021

|

Sustainability Award in 2011 | |

|

Point Finance - China Investment Network

|

2021 ESG Green Star

|

11

Materiality Analysis

China Life places close importance on the demands and recommendations of stakeholders and incorporates such to improve its management systems. The Company collects the expectations and appeals of stakeholders through regular communication in order to provide targeted responses.

|

Stakeholders

|

Expectations & Appeals

|

Mode of Communications

| ||||

| Government and Regulators |

● Operate in compliance with laws and regulations

● Pay taxes according to laws

● Create job opportunities

● Serve the national strategy

● Prevent risks

|

● Work report and communication

● Participate in meetings and major activities

● Documents and special reports

● Accept supervision |

||||

| Shareholders and Investors |

● Create stable returns

● Improve corporate governance

● Strengthen investor relationship management

● Disclosure information in a timely, accurate and complete manner

|

● Shareholders meeting

● Regular announcements and roadshows

● Press conference

● Meeting of analysts

● Arrange investors and analysts to survey branches and subsidiaries

|

||||

| Customers |

● Good faith and quality services

● Satisfactory customer experience

● Rich insurance products

● Protect legitimate rights and interests

|

● Smart service processes

● Survey of customers demand/satisfaction

● Service hotline

● Handling of customer complaints

● Characteristic customer activities and value-added services

|

||||

| Partners |

● Fair competition

● Good faith and mutual benefit |

● Daily informal communication

● Sign cooperation agreements

● Morning sessions and symposiums of sales agents

● Special surveys and lectures

● Survey of related parties

|

||||

12

| Employees |

● Safeguard basic rights and interests

● Assurance for salary and benefits

● Occupational health and safety

● Career advancement and development

● Care for employees |

● Pay wages in full and on time

● Congress of workers and staff

● Employees symposiums

● Training of employees

● Help needy employees

● Presidents letter box

● Investigate the needs and satisfaction of employees

|

||||

| Community & Public |

● Promote local employment

● Take part in public welfare programs

● Drive community economy

● Rural revitalization

● Serve peoples livelihood |

● Community communications and surveys

● Carry out public welfare activities

● Volunteer services

● Disaster relief

● Insurance for poverty alleviation, e-commerce poverty alleviation, donations for medical care

● Develop health insurance and inclusive medical care

|

||||

| Environment |

● Climatic changes

● Energy saving and emission reduction

● Integrated utilization of resources

● Green offices |

● Publicity about environmental protection

● Disclosure of environmental information

● Public welfare activities of environmental protection

● Green buildings

● Electronic service process

|

||||

13

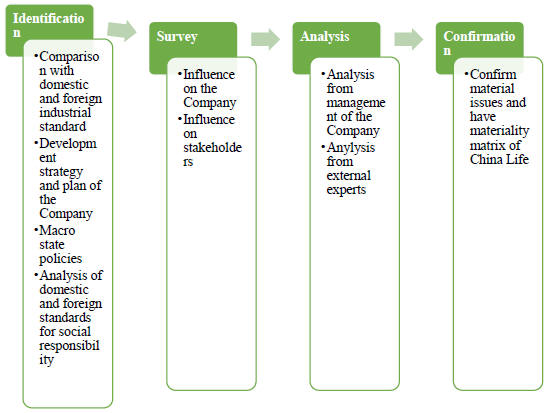

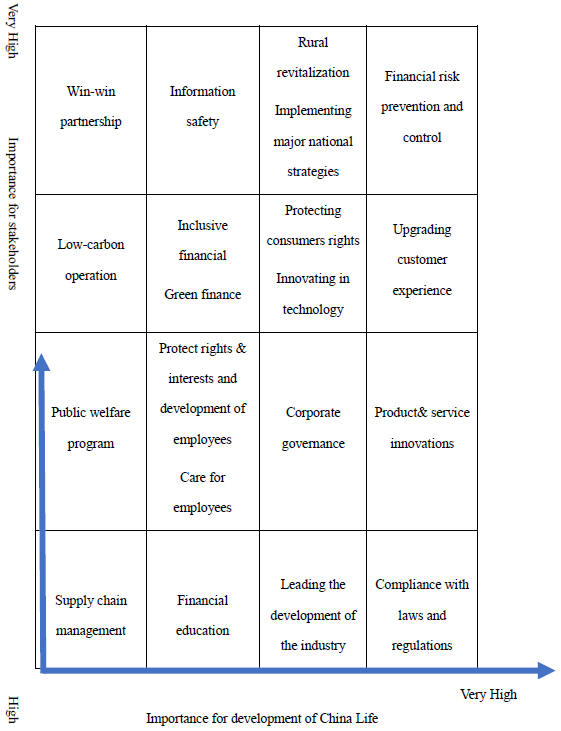

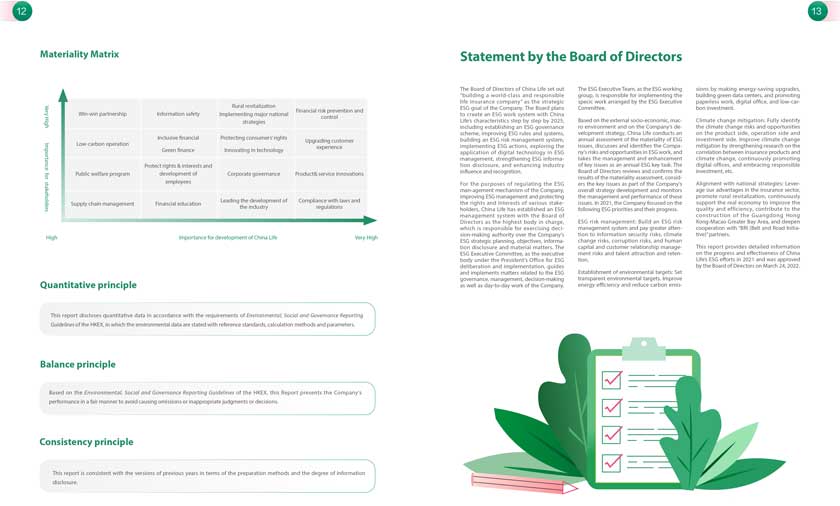

Materiality principle

China Life has implemented the ESG materiality identification and assessment procedures in accordance with the requirements of HKEXs Environmental, Social and Governance Reporting Guidelines in order to understand the concerns, expectations and appeals of stakeholders on sustainable development. Through research on national macro policies, analysis of domestic and international social responsibility standards, actual corporate development strategies and plans, benchmarking performance in the industry and stakeholders interviews, China Life has identified a total of 20 ESG material issues, and assessed the 20 material issues in terms of their impact on the sustainable development of the Company and its stakeholders, before finally completing the Companys ESG materiality matrix for 2021.

Materiality Identification Process

14

Materiality Matrix

15

Quantitative principle

This report discloses quantitative data in accordance with the requirements of Environmental, Social and Governance Reporting Guidelines of the HKEX, in which the environmental data are stated with reference standards, calculation methods and parameters.

Balance principle

Based on the Environmental, Social and Governance Reporting Guidelines of the HKEX, this Report presents the Company’s performance in a fair manner to avoid causing omissions or inappropriate judgments or decisions.

Consistency principle

This report is consistent with the versions of previous years in terms of the preparation methods and the degree of information disclosure.

16

Statement by the Board of Directors

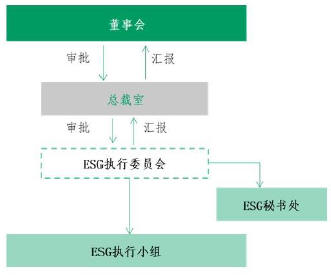

The Board of Directors of China Life set out “building a world-class and responsible life insurance company” as the strategic ESG goal of the Company. The Board plans to create an ESG work system with China Life’s characteristics step by step by 2025, including establishing an ESG governance scheme, improving ESG rules and systems, building an ESG risk management system, implementing ESG actions, exploring the application of digital technology in ESG management, strengthening ESG information disclosure, and enhancing industry influence and recognition.

For the purposes of regulating the ESG management mechanism of the Company, improving ESG management and protecting the rights and interests of various stakeholders, China Life has established an ESG management system with the Board of Directors as the highest body in charge, which is responsible for exercising decision-making authority over the Companys ESG strategic planning, objectives, information disclosure and material matters. The ESG Executive Committee, as the executive body under the Presidents Office for ESG deliberation and implementation, guides and implements matters related to the ESG governance, management, decision-making as well as day-to-day work of the Company. The ESG Executive Team, as the ESG working group, is responsible for implementing the specic work arranged by the ESG Executive Committee.

Based on the external socio-economic, macro environment and on the Companys development strategy, China Life conducts an annual assessment of the materiality of ESG issues, discusses and identifies the Companys risks and opportunities in ESG work, and takes the management and enhancement of key issues as an annual ESG key task. The Board of Directors reviews and confirms the results of the materiality assessment, considers the key issues as part of the Companys overall strategy development and monitors the management and performance of these issues. In 2021, the Company focused on the following ESG priorities and their progress.

ESG risk management: Build an ESG risk management system and pay greater attention to information security risks, climate change risks, corruption risks, and human capital and customer relationship management risks and talent attraction and retention.

17

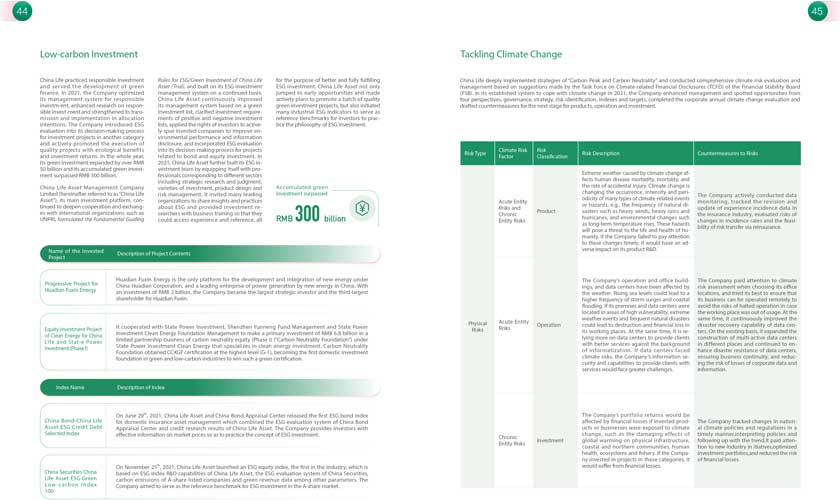

Establishment of environmental targets: Set transparent environmental targets. Improve energy efficiency and reduce carbon emissions by making energy-saving upgrades, building green data centers, and promoting paperless work, digital office, and low-carbon investment.

Climate change mitigation: Fully identify the climate change risks and opportunities on the product side, operation side and investment side. Improve climate change mitigation by strengthening research on the correlation between insurance products and climate change, continuously promoting digital offices, and embracing responsible investment, etc.

Alignment with national strategies: Leverage our advantages in the insurance sector, promote rural revitalization, continuously support the real economy to improve the quality and efficiency, contribute to the construction of the Guangdong Hong Kong-Macao Greater Bay Area, and deepen cooperation with BRI (Belt and Road Initiative) partners.

This report provides detailed information on the progress and effectiveness of China Lifes ESG efforts in 2021 and was approved by the Board of Directors on March 24, 2022.

18

1. Responsibilities of China Life

1.1. Serving National Strategies

China Life makes active moves to align its operations with the general interests of the country, fulfilling its mission in the current era. The Company leverages its advantages in the insurance sector to promote rural revitalization, and is determined to put people first and serve the real economy.

1.1.1 Promoting rural revitalization

China Life fully implemented the decisions and arrangements of the Central CPC Committee and the State Council to effectively align poverty reduction with rural revitalization. The Company coordinates resources and leverages the strength in insurance services to prevent poverty and consolidate the countrys poverty alleviation progress in a sustainable way.

In 2021, to meet the four requirements of sustainable poverty reduction, we upheld Party building to enhance our sense of mission and drive our efforts. Focusing on the five rejuvenations, we upgraded the Poverty Alleviation Insurance Program in a comprehensive way. We leveraged our strengths in the insurance sector to help establish a sustainable scheme for poverty reduction, and improved the long-term effective assistance system with one theme, two pillars, five measures, and six guarantees. The Guiding Opinions on Upgrading thePoverty Alleviation Insurance Program and Promoting Rural Revitalization (Trial) and Work Plan of China Life Insurance Company on Promoting Rural Revitalization in 2021 were developed to define key measures and long-term goals. In 2021, the whole Company assisted more than 1,000 sites for rural revitalization, making a total contribution of more than RMB 50 million. We also monitored and facilitated the completion of 116 key projects that started in 2020. For example, we donated RMB 3.66 million to Daliuhao County, Ulanqab City, Inner Mongolia Autonomous Region to fund the renovation of the e-commerce center and the maize deep processing project in Chayouhou Qi.

Drawing on our strengths in the insurance sector, we developed insurance products and services that are affordable, assessable, and useful to those who are lifted out of poverty. As of December 31, 2021, in terms of community insurance for poverty reduction, our poverty prevention products covered 9.68 million people, with total insurance coverage of RMB 0.92 trillion. As to health insurance for poverty reduction, our critical illness products paid out RMB 2.6 billion of medical expenses to 1.67 million cases. The rural revitalization-dedicated medical insurance paid out RMB 520 million to 1.37 million cases.

19

2022 Rural Revitalization Plan

| ➣ | Continuously upgrading the Poverty Alleviation Insurance program. Enhancing financial well-being monitoring and assistance mechanisms for those who are lifted out of poverty. Identifying those who are likely to return to poverty and offer early intervention and early assistance. |

| ➣ | Drawing on our advantages in the insurance sector to improve the quality and expand the coverage of the critical illness insurance + commercial insurance package. |

| ➣ | Continuously designing targeted insurance products for rural revitalization and special groups who are lifted out of poverty. Vigorously developing rural life insurance, and rural endowment and health insurance. Expanding the coverage of inclusive insurance. |

| ➣ | Vigorously promoting high-quality economic development in counties. Promoting the development of counties and villages with high-quality financial services. Satisfying the insurance needs of rural residents and farmers. Contributing to socioeconomic development in counties and the improvement of people’s livelihood. |

| ➣ | Focusing on the “three autonomous regions and three autonomous prefectures”, Daliuhao Town in Ulanqab, Inner Mongolia, and other key areas needing poverty reduction, to carry out charitable programs and projects. Continuously supporting poverty reduction and education in these key areas. |

To better contribute to the rural revitalization strategy, China Life continues to implement the “Beautiful County, Happy Village” program. The Company initiated the “County Brand Communication Program”, “County Workplace Upgrade Program”, County Awareness Incentives Program to support high-quality and high-efficiency county development, create an enjoyable workplace, and better reward our employees. These efforts will not only improve the brand image of China Life but also provide our employees with a better workplace and higher income.

20

|

Releasing the Beautiful County, Happy Village PR videos |

PR videos titled Beauty of Grandness, Beauty of Love, and Beauty Technology were released to showcase how China Life improved efficiency with technology and inspired customers with service in various scenarios. The videos were intended to spur more people to contribute to rural development and fulfill social responsibility. | |

|

Continuing with the China Life Best Insurance Model Villages and Towns |

Guiding sub-branches in villages and towns to utilize insurance to contribute to local social security systems, public welfare, rural revitalization, socio-economic development, and the standard of living of the people. | |

|

Building model sub-branches in rural areas |

To further improve brand image and service quality, China Life initiated a workplace standardization plan for county-level operations, especially sub-branches in villages and towns, to better equip grass-roots sub-branches to serve rural residents and promote rural revitalization. | |

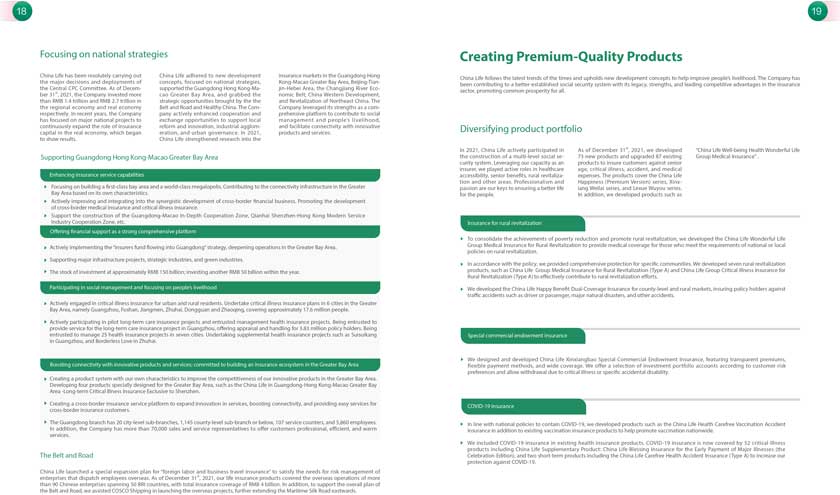

1.1.2 Focusing on national strategies

China Life has been resolutely carrying out the major decisions and deployments of the Central CPC Committee. As of December 31, 2021, the Company invested more than RMB 1.4 trillion and RMB 2.7 trillion in the regional economy and real economy respectively. In recent years, the Company has focused on major national projects to continuously expand the role of insurance capital in the real economy, which began to show results.

China Life adhered to new development concepts, focused on national strategies, supported the Guangdong Hong Kong-Macao Greater Bay Area, and grabbed the strategic opportunities brought by the the Belt and Road and Healthy China. The Company actively enhanced cooperation and exchange opportunities to support local reform and innovation, industrial agglomeration, and urban governance. In 2021, China Life strengthened research into the insurance markets in the Guangdong Hong Kong-Macao Greater Bay Area, Beijing-Tianjin-Hebei Area, the Changjiang River Economic Belt, China Western Development, and Revitalization of Northeast China. The Company leveraged its strengths as a comprehensive platform to contribute to social management and peoples livelihood, and facilitate connectivity with innovative products and services.

21

Supporting Guangdong Hong Kong-Macao Greater Bay Area

|

Enhancing insurance service capabilities |

● Focusing on building a first-class bay area and a world-class megalopolis. Contributing to the connectivity infrastructure in the Greater Bay Area based on its own characteristics.

● Actively improving and integrating into the synergistic development of cross-border financial business. Promoting the development of cross-border medical insurance and critical illness insurance.

● Support the construction of the Guangdong-Macao In-Depth Cooperation Zone, Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone, etc.

| |

|

Offering financial support as a strong comprehensive platform |

● Actively implementing the insurers fund flowing into Guangdong strategy, deepening operations in the Greater Bay Area.

● Supporting major infrastructure projects, strategic industries, and green industries.

● The stock of investment at approximately RMB 150 billion; investing another RMB 50 billion within the year.

| |

|

Participating in social management and focusing on people’s livelihood |

● Actively engaged in critical illness insurance for urban and rural residents. Undertake critical illness insurance plans in 6 cities in the Greater Bay Area, namely Guangzhou, Foshan, Jiangmen, Zhuhai, Dongguan and Zhaoqing, covering approximately 17.6 million people.

● Actively participating in pilot long-term care insurance projects and entrusted management health insurance projects. Being entrusted to provide service for the long-term care insurance project in Guangzhou, offering appraisal and handling for 3.83 million policy holders. Being entrusted to manage 25 health insurance projects in seven cities. Undertaking supplemental health insurance projects such as Suisuikang in Guangzhou, and Borderless Love in Zhuhai.

| |

22

|

Boosting connectivity with innovative products and services; committed to building an insurance ecosystem in the Greater Bay Area |

● Creating a product system with our own characteristics to improve the competitiveness of our innovative products in the Greater Bay Area. Developing four products specially designed for the Greater Bay Area, such as the China Life in Guangdong-Hong Kong-Macao Greater Bay Area -Long-term Critical Illness Insurance Exclusive to Shenzhen.

● Creating a cross-border insurance service platform to expand innovation in services, boosting connectivity, and providing easy services for cross-border insurance customers.

● The Guangdong branch has 20 city-level sub-branches, 1,145 county-level sub-branch or below, 107 service counters, and 5,860 employees. In addition, the Company has more than 70,000 sales and service representatives to offer customers professional, efficient, and warm services.

| |

The Belt and Road

China Life launched a special expansion plan for foreign labor and business travel insurance to satisfy the needs for risk management of enterprises that dispatch employees overseas. As of December 31, 2021, our life insurance products covered the overseas operations of more than 90 Chinese enterprises spanning 50 BRI countries, with total insurance coverage of RMB 4 billion. In addition, to support the overall plan of the Belt and Road, we assisted COSCO Shipping in launching the overseas projects, further extending the Maritime Silk Road eastwards.

23

1.2. Creating Premium-Quality Products

China Life follows the latest trends of the times and upholds new development concepts to help improve peoples livelihood. The Company has been contributing to a better-established social security system with its legacy, strengths, and leading competitive advantages in the insurance sector, promoting common prosperity for all.

1.2.1 Diversifying product portfolio

In 2021, China Life actively participated in the construction of a multi-level social security system. Leveraging our capacity as an insurer, we played active roles in healthcare accessibility, senior benefits, rural revitalization and other areas. Professionalism and passion are our keys to ensuring a better life for the people.

As of December 31, 2021, we developed 73 new products and upgraded 87 existing products to insure customers against senior age, critical illness, accident, and medical expenses. The products cover the China Life Happiness (Premium Version) series, Xinxiang Weilai series, and Lexue Wuyou series. In addition, we developed products such as “China Life Well-being Health Wonderful Life Group Medical Insurance” to help promote policy-based health insurance.

| Insurance for rural revitalization |

• To consolidate the achievements of poverty reduction and promote rural revitalization, we developed the China Life Wonderful Life Group Medical Insurance for Rural Revitalization to provide medical coverage for those who meet the requirements of national or local policies on rural revitalization.

• In accordance with the policy, we provided comprehensive protection for specific communities. We developed seven rural revitalization products, such as China Life Group Medical Insurance for Rural Revitalization (Type A) and China Life Group Critical Illness Insurance for Rural Revitalization (Type A) to effectively contribute to rural revitalization efforts.

| |

24

|

• We developed the China Life Happy Benefit Dual-Coverage Insurance for county-level and rural markets, insuring policy holders against traffic accidents such as driver or passenger, major natural disasters, and other accidents.

| ||

| Special commercial endowment insurance |

• We designed and developed China Life Xinxiangbao Special Commercial Endowment Insurance, featuring transparent premiums, flexible payment methods, and wide coverage. We offer a selection of investment portfolio accounts according to customer risk preferences and allow withdrawal due to critical illness or specific accidental disability.

| |

|

COVID-19 insurance |

• In line with national policies to contain COVID-19, we developed products such as the China Life Health Carefree Vaccination Accident Insurance in addition to existing vaccination insurance products to help promote vaccination nationwide.

• We included COVID-19 insurance in existing health insurance products. COVID-19 insurance is now covered by 52 critical illness products including China Life Supplementary Product: China Life Blessing Insurance for the Early Payment of Major Illnesses (the Celebration Edition), and two short-term products including the China Life Carefree Health Accident Insurance (Type A) to increase our protection against COVID-19.

| |

|

Case: Launching Ceremony of Integrated Financial Ecosystem New Products

In December 2021, China Life held the launching ceremony of new integrated financial products titled New Ecosystem, New Momentum, New Life, bringing three new products to customers, namely, integrated product, Xinchebao car insurance, and insurance trust. As we strive to meet the diverse needs of customers, we follow an integrated operation strategy to help improve the quality of life of the people.

|

25

1.2.2 Contributing to a Healthy China

China Life implements the requirements of the Opinions of the CPC Central Committee and State Council on Deepening the Reform of the Medical Security System and insists on the principles of operation based on law and regulations, government-leading role, break-even with small interests and professional management as well as insurance + health to support the construction of a Healthy China.

As one of the first critical illness insurers in this industry, China Life is always dedicated to expanding insurance coverage. As of December 31, 2021, the Company has undertaken more than 200 critical illness insurance projects, covering over 350 million rural and urban residents with a cumulative compensation of nearly RMB 140 billion. It has provided an important supplement to basic medical insurance. In the 14th Five-Year Plan period, the Company will continue to actively develop critical illness insurance, urban custom insurance and other inclusive services to help all people get insured and facilitate governments in different areas to develop a tightly woven net to secure and improve living standards.

26

The Company emphasizes the integrated development of health services and the major business, insurance to enrich the Massive Health platform services, improve the platform functions and user experience. In 2021, the Massive Health platform of the Company saw new registrations exceeding 7.3 million throughout the year and the cumulative registrations have exceeded 26 million as the platform has served more than ten million person-times.

| Critical illness insurance |

• The Company has covered more than 350 million urban and rural residents with more than 200 critical illness insurance products. In 2021, medical expenses of more than RMB 25 billion were paid out to 14 million cases.

| |

| City-specific commercial medical insurance |

• The Suisuikang project in Guangzhou was the only city-specific medical insurance product selected by the China Health Journal. The Boundless Love project in Zhuhai project won local awards for insurance reform and financial innovation and was included in the China Health Insurance Development Report (2021) published by the Chinese Academy of Social Sciences. West Lake Yilianbao in Hangzhou received extensive recognition from the community and the industry. In the “Excellent Cases of Comprehensive Innovation in Multi-level Medical Insurance” selection sponsored by the People’s Daily Health app and Health Times, five out of eight awardees were our products.

• As of December 31, 2011, the Company has launched city-specific commercial medical insurance projects in 54 cities across 15 provinces and municipalities, covering more than 10 million people in total.

| |

| Products available to substandard applicants |

• The Company developed Xinwuyou, a surgery insurance product available to substandard applicants to relieve their financial pressure.

| |

27

| Inclusive insurance |

• Leveraging our advantages in insurance services and brand effect, we work closely with local governments to develop inclusive insurance products such as pension insurance, family planning insurance, and women’s insurance.

• Pension insurance: As of December 31, 2021, the Company insured more than 50 million senior citizens with total insurance coverage of RMB 2.96 trillion.

• Family planning insurance: As of December 31, 2021, the Company insured more than 31 million people that comply with family planning regulations with total insurance coverage of RMB 1.77 trillion.

• Womens insurance: As of December 31, 2021, the Company insured more than 10 million women in collaboration with the All-China Women’s Federation, with total insurance coverage of nearly RMB 1 trillion.

| |

28

1.3. Drive Scientific and Technological Innovation

China Life continues to advance service innovation, accelerates transformation and upgrading, keeps enhancing the autonomous control of core technologies, strengthening intellectual property management and protection, insisting on science and technology self-reliance and moving towards the technology-based China Life.

1.3.1 Building an Intelligent China Life

China Life enhances constantly its digital drive as the core of the development, spares all efforts to strengthen its scientific and technological development foundation, actively promotes the digital transformation of the company and empowers high-quality development. In 2021, the Company fully innovated its scientific and technological structure and provided diversified technical support by means of available cloud services; actively constructed an integrated corporate collaboration framework, improved the data management mechanism and perfected whole-scenario customer service experience to fully promote the intelligent upgrading of operation and risk control, enabled value creation in a deep-going way and further deepened digital transformation.

The Company embraces constant technological upgrades to improve customer experience and adapt to the market. We take a customer-centric approach to accelerate innovation in online service content, quickly enhancing our digital processing capability.

|

• Sales

China Life Internet of Things (IoT) covers all branch offices nationwide and creates the online digital twin of the physical workplace to realize centralized control of 240,000 electronic devices under 12 categories. The flat supply of scientific and technological resources and smooth flow of information to all national frontline workplaces help to build a corporate online collaboration system, drive the sales team to interact with customers online and create all-around social application scenarios for sales consultants.

|

29

|

• Service

The direct payment of benefits is available at more than 20,000 medical institutions, serving over 6 million person-times. The Company also deepens the customer-centered swift agile product delivery mechanism, with an average of more than 40 times of technology product iteration and optimization in a day to quickly satisfy customer requirements.

|

|

• Operation

The Company launched five intelligent model and built an intelligent claim settlement model for health insurances covering 19 key risk types under 5 categories to make the claim settlement more efficient and easier.

|

The Company took the following five actions to keep deepening digital transformation and enhance online platform service capability.

|

• Development of China Life Massive Health Platform

|

|

We continuously enrich service items, improve platform functions, and enhance user experience at the Massive Health platform, with a focus on the integrated development of healthcare and insurance. In 2021, the Massive Health platform had over 7.3 million new registrations and accumulated over 26 million registrations as the platform has served more than 10 million people. |

|

• Upgrading service at China Life Insurance App

|

|

An online service matrix consisting of the China Life Insurance App, WeChat official account and the mini-program has become the most important service channel of the Company, truly realizing one-time authentication for any platform and one-step login to all platforms. For this reason, customers can enjoy convenient and efficient online services. The life insurance APP features stronger marketing capability, better health services and more complete business functions, so it can provide customers with an accurate, readable, easy and trustworthy service experience. In 2021, the China Life Insurance App provided 160+ services with cumulatively more than 112 million registered users. It has served more than 200 million people and the monthly active users exceed 8 million.

|

30

|

The Company also looks at the needs of senior users and the difficulties they experience with online services. We were the first in the industry to launch a senior mode in China Life Insurance App. This is to facilitate elder customers to read and hear services, easily select what they need and be quickly familiar with the App. As of the end of 2021, customers using the services in the version for the elderly have exceeded 7 million person-times. The degree of praise from elder customers for the online services is better than the average and the version for the elderly of the China Life Insurance App has been approved by the relevant regulator. |

|

• Further upgrading smart teller machines |

|

The smart teller machines at the counter of the Company are able to provide 39 frequently used self-services under 5 categories for massive customers. Customers may easily use the teller machine to securely and conveniently handle services with scanning or touching. The large font and easy operation are highly favored by elder customers. In 2021, the teller machines served person-times with a nearly 3 times growth on a year-on-year basis. |

|

• Establishing V Life value-added service platform |

|

V Life, our value-added service platform, supports a variety of operations on a regular basis, helping sales consultants build up connections with customers and provide a fund of value-added services for customers. |

|

• A digital platform to empower the financial ecosystem |

|

Based on the double-core double-focus strategic core, the Company has implemented an integrated online/offline EAC digital platform, which aggregates ecological resources, empowers production units, effectively connects enterprises, sales teams and customers to gradually establish a colorful insurance ecology. An open and win-win ecosphere based on the digital platform has enabled 3,256 standard services cumulatively, rising by 92% compared with that at the end of 2020 and accessed nearly a thousand ecological applications. Nearly 400,000 services and activities have been provided for various partners and the digital ecological services are gradually enriched. |

31

| Case: Deepening service grid construction for a technology-based China Life |

|

The service grid independently built by China Life is an important IT infrastructure and has greatly compelled science and technology self-reliance. Nowadays, the service grid has been deeply applied in various services of China Life and stably supports the transaction call in dozens of key systems including core business, customer service and sales system to provide more stable, convenient, efficient and safer services. |

|

The service grid replaces the centralized management style with the distributed direct-connect infrastructure mode so as to realize the distributed isolation on infrastructure. This product can effectively prevent corporate service risks due to mass communication among numerous corporate services, support hundreds of millions of concurrent service calls and ensure stable and reliable services for users. It also addresses the performance bottleneck in centralized service governance essentially. In addition, the product can encrypt the private cloud and public cloud communication information of the Company, greatly improve communication security, and realize one-button encryption and secure access to the cloud server.

|

|

|

|

Structure Chart of the Service Grid and the Uniform Management and Control View

Interface |

32

China Life actively practices science and technology self-reliance, closely follows the frontier technologies, and realizes the comprehensive architecture innovation of all core systems from the calculation, storage, database, middleware to applications, successfully reducing costs and carbon emissions. Moreover, the elastic computing and real-time processing capability have been greatly improved. Three cases of the Company were awarded the 2021 Excellent Practice Case in integration and innovative application of digital technologies by the Ministry of Industry and Information Technology.

1.3.2 Protect customers privacy and data security

China Life highlights the information security and private data protection of users and clarifies the information security management work mechanism and requirements to ensure that the data use is legal and conforms to regulations. The Company has established the cyber security and IT application commission, four specialized committees and an information security working group. It conducts a special internal information technology audit every two years for relevant risk warnings and conducts traceability audits in the event of exceptions to ensure the secure and stable operation of various technological products of the Company.

33

The Company always abides by the legal red line and the bottom-line value in privacy protection. In 2021, the Company revised and printed the User Information Authorization and Personal Information Protection Policy of China Life Insurance Co., Ltd., Childrens Personal Information Protection Rules of China Life Insurance Co., Ltd., Information Security Regulations of China Life Insurance Co., Ltd. and other management systems related to information security, customers privacy protection and emergency response, which are applicable to all services of the Company based on the Information Security Event Management Measures of China Life Insurance Co., Ltd. and Information Security Specifications for Employees of China Life Insurance Co., Ltd. The Company has also built and improved the defensive line of information security systems and standardized the handling procedures of information security events. If necessary, we can entrust associated companies and third-party partners (third-party service providers, agents, advertising partners, application developers, etc.) to handle users relevant information according to the description and series information protection policies of China Life and other relevant confidentiality and security measures to collect, store and use customer information in a reasonable, legal and compliant way, ensuring the security of the company’s business operating environment and user information.

China Life fully respects and protects users rights to know, select and control personal information. Users have the right to independently access, correct and delete personal information. The Company will not lease, sell or provide individuals data without the prior written consent of the user and users information is used in a reasonable and transparent way only with the consent of the user. When a user cancels his/her account and the statutory retention period expires, the Company will delete or process the users personal information anonymously and make users truly feel their information protected and willing respected. In addition, the Company has passed the information security management system certification, conducted the 3-level security and protection assessment of the information system for all services and obtained the certificate of ISO27001 information security management system and level III certificate of secure service qualification to guarantee information security by various means and in an all-around way.

|

Throughout 2021, there was no major information security event at China Life. |

34

Information Security Certificates of China Life

|

• Establishing a regular security mechanism |

|

The Company customized regular security matters in key fields and conducted risk monitoring, vulnerability discovery, analysis and judgment, verification and rating, rectification and implementation without interruption with ECC as the carrier. It kept optimizing and implementing the “peacetime and wartime combining” secure operation classification standards, secure operation field duty and regular monitoring and processing of security events to guarantee information security of the Company in 24 hours. |

|

• Creating a three-dimensional endogenous security protection system |

|

Based on the regular information security operating mechanism, the Company has established “three defensive lines” in information security management and technologies, optimized and deepened the defensive system, formed a three-dimensional cyber security prevention and control system featuring equal attention to technologies and management, defense-in-depth and continuous optimization and realized the global security management from the operating environment, technological products to people. |

Technical enhancement

To further upgrade customer information management and user privacy protection and improve information security protection capability, China Life implemented an overall layout of “big background and small front-end” at the technology level, realized an information security management mechanism featuring data unity, centralized storage, deployment and processing. The collection, storage, circulation and use of all applications, software and data are required to be conducted inside the data center to narrow information security exposures. It is also specified that production data required in work and data necessary for development, testing and other jobs must be approved, filed and filtered for sensitive information before use. These actions are to further enhance the technical defense line in information security and continuously enhance the information security control strength.

35

|

• Formulating the pre-event, in-process and post-event information security response and protection measures | ||||||

|

Guaranteeing users data security through the information security response and protection measures in three stages: pre-event prevention, in-process response and post-event processing.

Pre-event, In-process and Post-event Information Security Response and

Protection Measures

| ||||||

|

|

Pre-event prevention |

Strictly controlling the quality of technological products, conducting quality inspection and security tests before the products are launched and improving the security and robustness of technological products;

Enhancing routine monitoring, guaranteeing that the operating conditions of technological products can be monitored and timely discovering exceptions and generating warnings.

|

||||

|

In-process response |

Timely triggering the emergency response process in the event of exceptions, starting the linkage mechanism, ensuring that the relevant personnel can efficiently dispose of risks and timely prevent information security risk events from spreading.

|

| ||||

| Post-event processing |

Conducting a comprehensive evaluation of the cause, impact and emergency measures for exceptional events, timely detecting and closing the loophole and further improving the information security management mechanism. |

|||||

|

• Applying the security situation sensing platform | ||||||

36

|

The security situation sensing platform can collectively analyze and conduct linkage disposal of various security risks and improve the quick response capability of the Company for security risks. The Company carries on research based on the hybrid cloud security governance system, effectively protects customers information and ensures their privacy data security from the perspectives of physics, network, host and application and enhances the data security protection capability of the Company.

|

|

• Introducing the adaptive security, deception defense and attack traceability systems of the host |

|

The adaptive security, deception defense and attack traceability systems of the host can improve the in-depth defensive system and realize the transition from passive defense to active security, front asset-driven to data-driven. |

|

• Implementing whole chain security management technologies |

|

The Company adopts relevant technologies for the whole chain security management including background data, data transmission, front-end access and data traceability, and applies the access control technology and the encryption and de-identification technology to improve the data security of the Company. The Company uses the uniform identity management technology to realize uniform authorization, authentication, account and audit, ensuring the background data operation and maintenance security; uses the digital watermarking technology to realize the data leakage and tracking prevention; uses encryption and de-identification technology to provide remote access to office and business handling, keep the data within the system, improve the back-end data security, and implements desensitization treatment of customers sensitive information. The Company also applies for virtual numbers in customer service, surveys and other links and strictly prevents data leakage in the data transmission process.

|

Consolidating awareness

China Life puts forward the contingency plans for information system, basic platform and basic environment, and carries out the risk assessment for network security and contingency plan exercise for information security on a regular basis, in a bid to improve the defense line of information security awareness.

37

The Company organizes information security training on a regular basis to intensify the information security awareness of all employees. The network security awareness training is carried out regularly every year for all employees, and a variety of professional and technical training is organized, for example, the information security training for senior management, thematic technology sharing, and network security practical protection training. Besides, the personnel in the relevant post are regularly organized to participate in the training of certified information security professionals. Meanwhile, the Company also requires the third-party cooperating organizations to conduct information security training for relevant service personnel, so as to comprehensively consolidate and enhance the information security awareness, quality, and skills of third party service personnel.

|

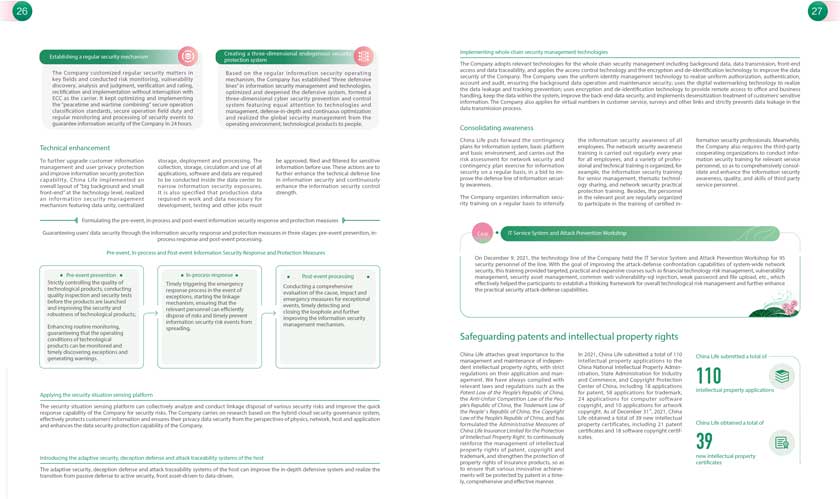

Case: IT Service System and Attack Prevention Workshop

|

| |

|

On December 9, 2021, the technology line of the Company held the IT Service System and Attack Prevention Workshop for 95 security personnel of the line. With the goal of improving the attack-defense confrontation capabilities of system-wide network security, this training provided targeted, practical and expansive courses such as financial technology risk management, vulnerability management, security asset management, common web vulnerability-sql injection, weak password and file upload, etc., which effectively helped the participants to establish a thinking framework for overall technological risk management and further enhance the practical security attack-defense capabilities.

|

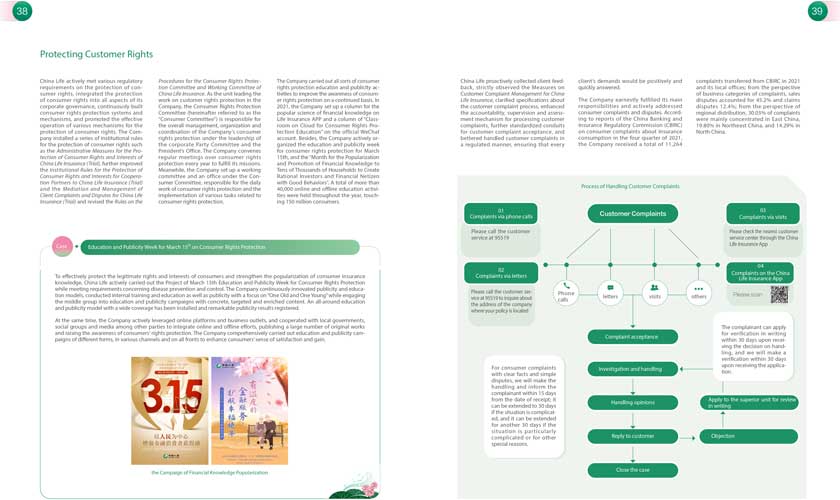

1.3.3 Safeguarding patents and intellectual property rights

China Life attaches great importance to the management and maintenance of independent intellectual property rights, with strict regulations on their application and management. We have always complied with relevant laws and regulations such as the Patent Law of the Peoples Republic of China, the Anti-Unfair Competition Law of the Peoples Republic of China, the Trademark Law of the People s Republic of China, the Copyright Law of the Peoples Republic of China, and has formulated the Administrative Measures of China Life Insurance Limited for the Protection of Intellectual Property Right to continuously reinforce the management of intellectual property rights of patent, copyright and trademark, and strengthen the protection of property rights of insurance products, so as to ensure that various innovative achievements will be protected by patent in a timely, comprehensive and effective manner.

38

In 2021, China Life submitted a total of 110 intellectual property applications to the China National Intellectual Property Administration, State Administration for Industry and Commerce, and Copyright Protection Center of China, including 18 applications for patent, 58 applications for trademark, 24 applications for computer software copyright, and 10 applications for artwork copyright. As of December 31, 2021, China Life obtained a total of 39 new intellectual property certificates, including 21 patent certificates and 18 software copyright certificates.

39

2. Warmth of China Life

2.1. Talent Culture

China Life takes a human-oriented approach to protect the rights and interests of employees, provides diverse training and exchange opportunities for employees, and creates a healthy and safe workplace to bring practical care to employees, thereby improving their enthusiasm and cohesiveness.

2.1.1 Protecting employee rights and benefits

China Life strictly abides by the laws and regulations such as the Labor Law of the Peoples Republic of China and the Labor Contract Law of the Peoples Republic of China and strictly implements the systems such as the Administrative Measures for Employee Recruitment in the Branches of China Life Insurance Co., Ltd. and the Measures for Employee Management in the Branches of China Life Insurance Co., Ltd. to enter into labor contracts with employees according to law and based on the principle of fair employment, as well as to protect the legitimate rights and interests of employees. Besides, China Life strives to eliminate the discrimination regarding gender, ethnicity, religion, age, etc. in all forms with respect to talent recruitment, salary and benefits, employee training, and career development, insisting on equal pay for equal work, and opposing child labor and forced labor, thus guaranteeing labor diversification. As of December 31st, 2021, China Life had 101,459 employees with labor contracts, among which female employees accounted for 56.63%, and minority employees accounted for 6.39%.

Democratic management

The trade unions at all levels of China Life continuously strengthen the role of employee congresses, and actively implement the democratic management and supervision of employees, in a bid to comprehensively protect employees’ democratic rights. In 2021, China Life held the fourth, fifth and sixth temporary employee congresses of the third session of the whole system in online mode, and held the ninth employee congresses of the head office of the second session on the spot to take concrete steps to advance the democratic management of enterprises. As of December 31st, 2021, the employee congress of China Life covered 100% of the employees.

40

Protecting the rights and interests of female employees

Under the organization and leadership of the female employee committees of trade unions at all levels of the system, and following the principle of enhancing the happiness of female employees, the Company has made all efforts to improve the protection of the rights and interests of female employees, coordinate the allocation of special funds for female employees, and enrich the construction of the cultural life of female employees. In 2021, the Company continuously promoted the signing of special collective contracts for female employees, and coordinated the joint construction of “Female Employees’ Home” of financial trade unions and Group trade unions; the Company completed more than 300 files of female employees with difficulties, and organized the warm activities for female employees, thereby comprehensively raising the service guarantee level of female employees.

| Case: Care for female employees throughout the year | ||

| In 2021, the headquarters carried out fruits picking activities on Womens Day among female employees, distributing gifts to 501 female employees; the headquarters worked with China Guangfa Bank to organize the flower arrangement activity of “fragrant flowers in flower basket for the Party in the anniversary of the founding of the Communist Party of China” for female employees; the headquarters organized the wool weaving and donation activity of Everlasting Love Campaign; besides, the headquarters cooperated with Women of China in the public welfare project to complete the renovation of the nursing room for female workers. |

||

|

Branches across the country also organized a variety of colorful activities for female employees, such as the female employee birthday party in Beijing Branch, the “Embracing the grassland” long walk activity for female employees in Xinjiang Branch, the photo contest for female employees in Hebei Branch, skillful knitting competition for female employees in Shanghai Branch, etc.

|

||

41

2.1.2 Supporting employee development

With emphasis on talent development, China Life revised the Administrative Measures for Job Grade System in Headquarters of China Life Insurance Co., Ltd. and Administrative Measures for Investment Job Grade of China Life Insurance Co., Ltd. (Trial) as well as other systems to ensure the career development channel for employees.

China Life adopts a market-based compensation mechanism to provide employees with competitive compensation in the industry. The Company implements hierarchical and classified management and differentiated performance appraisal policies for personnel at all levels of branches according to the Administrative Measures for Employee Performance in Branches of China Life Insurance Co., Ltd., in order to realize the reasonable salary distribution for employees. Meanwhile, the Company sets performance appraisal objectives linked to variable salaries for all employees/non-sales front-line employees and management, as well as makes differentiated payments according to the achievement of performance appraisal objectives.

| Case: China Life actively carried out various online learning activities |

|

In 2021, China Lifes’ all business lines as well as branches closely cooperated and widely carried out various thematic education activities under the help of China Life E-learning, E-School (mobile learning system) and external training resources including China E-learning Academy for Leadership and Insurance Online University: or organizing reading activities of Case, Emergency Management System and Capacity Building Cadre Reader and 100 Years of Organizational Construction for the Communist Party of China in the whole system; establishing an online column of Training for Party Construction with 8 sub-columns and 105 courses released; releasing 5 online training classes including Online Thematic Class for “Learning and Implementing the Guiding Principles of the Fifth Plenary Session of the 19th Central Committee of the CPC”, Online Training Class for Thematic Education in Learning Partys History, Online Course Learning for Secrecy Publicity and Education, and so on; releasing 14 required courses for learning, such as Knowledge of Internal Control Standards, Knowledge Training for Anti-money Laundering, Knowledge Training for Preventing Illegal Fundraising and so on; holding 8 lectures for China Life, so as to timely provide various training support for the staff in the whole system, such as interpretation of hot topics, research and judgement of development trends, as well as practical skills, with more than 50,000 people learning in each lecture on average.

|

42

In accordance with several related systems including Management Measures for Staff Education and Training of China Life Insurance Co., Ltd., Management Regulations on the Annual Staff Training Plan of China Life Insurance Co., Ltd., Management Measures for Staff Education and Training Expenses of China Life Insurance Co., Ltd. (Trial) and so on, the Company established a talent training system consisting of basic theory, skill training, professional post-training and professional qualification training to constantly improve the staffs qualities and abilities.

China Life strengthened training for leaders and cadres on a continuous basis and established a training course system for management according to title levels, formulating and implementing Thematic Education and Training Program on Party Spirit for “Top Leaders” in the Whole System to strengthen the thematic education on Party spirit for leadership. The Company formulated and implemented the Cadre Education and Training System of China Life Insurance Co., Ltd. to systematically carry out the pre-job and on-job training for cadres at all levels. The training for young cadres was vigorously developed to jointly promote the work in base platform training and other aspects, comprehensively assist in the development and improvement of leadership skills for the Companys cadres, strengthen enterprise governance skills, and improve the operation level. In 2021, more than 10,000 people in the whole system participated in various training activities for the leadership of China Life.

The Company deepened and implemented the guiding principles of the Central Talent Working Conference, continuously strengthening the echelon construction of cadres and gradually improving the talent training system. Several talent training programs were organized and carried out normally, such as Base Platform, Fiery Talent, Spark Program, Spreading Wings Program and so on. Practical abilities of cadres at all levels, especially young cadres, were trained in the way of cross-level, cross-company and cross-institution secondment, so as to develop and consolidate the foundation of cadres for the Company.

43

China Life constantly strengthened the foundation construction of staff training and improved the education and training system, comprehensively promoting the business skills of the staff. The Company developed online and offline training assessment tools, actively promoting and applying them to improve the ability and quality assessment system. It carried out online autonomic learning activities with diversified themes to meet the learning needs of the staff at all business lines. Moreover, the Company strictly implemented the requirements of learning-time assessment while monthly following up and supervising the completion to ensure that the staff could complete all learning activities on time. As of December 31st, 2021, 99.8% of the staff in the headquarters of China Life reached the standard of learning-time assessment while 95.3% of the staff in the whole system reached the standard of learning-time assessment.

The Company cooperated with professional external training providers to strengthen its team of part-time lecturers while preparing and releasing the primary training course system for part-time lecturers by holding a primary licensing class for part-time lecturers of the staff as well as training 49 licensed lecturers for the branches. As of December 31st, 2021, the Company organized a total of 68 primary training sessions for primary part-time lecturers with 3,345 people trained.

44

|

Case: Primary licensing training for part-time lecturers of the staff |

|

For the purpose of further strengthening the system construction of part-time lecturer training for the staff, strictly controlling the lecturer recruitment and effectively improving the professional standards for the part-time lecturer team of the staff, the Company cooperated with an external professional organization, GROWAY, to hold the Primary Licensing Training Class for Part-time Lecturers of the Staff and cultivate lecturers as well as teachers for companies at all levels. |

|

Several ways were adopted for the training, such as practice in class, comments and feedbacks from lecturers, licensing review and certification, and so on, to ensure that people who participated in the training could truly master and skillfully apply what they had learned.

|

|

2.1.3 Continuous care for employees

China Life respects and attaches importance to the lawful rights and interests of all staff, striving to protect their rights and interests and provide them with due benefits. The Company has established a basic welfare and security system consisting of basic endowment insurance, basic medical insurance, unemployment insurance, work-related injury insurance, maternity insurance and housing provident fund, providing all staff with supplementary medical security and old-age security (supplementary pension) to ensure the implementation of all benefits.

45

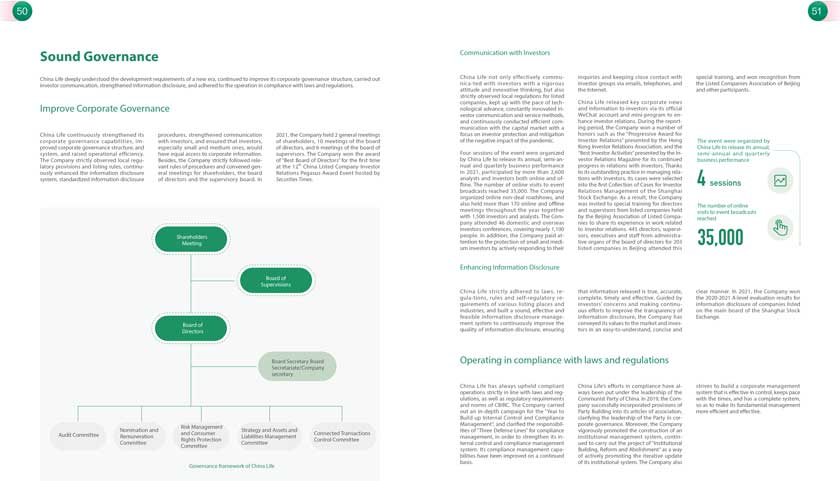

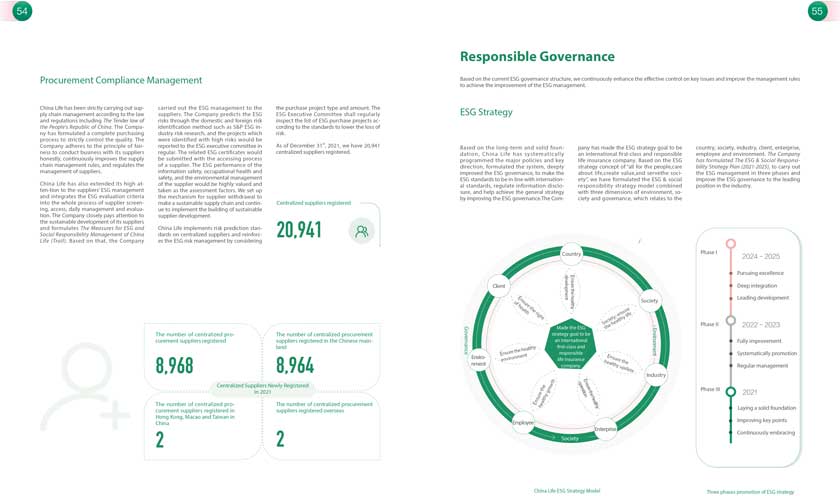

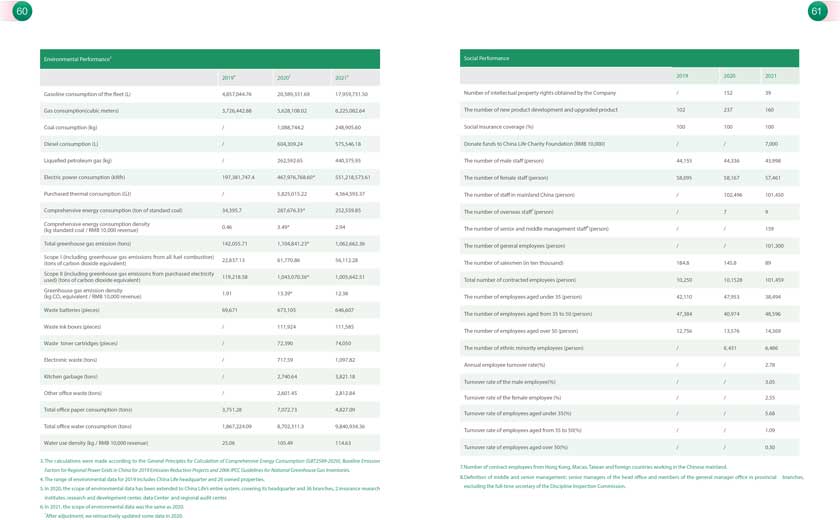

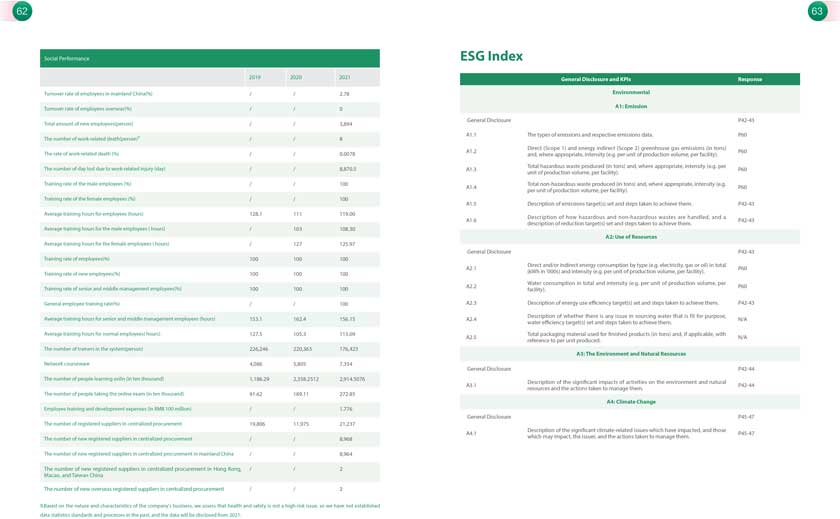

The Company attaches importance to the occupational health rights and interests of employees, strictly abides by the Labor Law of the Peoples’ Republic of China, Regulation on Work-Related Injury Insurances, and provides physical examination for employees on a regular basis. During the pandemic period, the Company regularly distributed pandemic prevention articles to employees and encouraged employees to exercise so as to ensure the health of all employees. In order to comprehensively improve the physical health of employees, the Company conducted various activities regarding fun games, long walk, table tennis and badminton in all branches of the Company and held the sports events “Passionate China Life” series. By the time of December 31st, 2021, 12 events have been successfully held in the headquarters throughout the year, with a total of 4,810 participants and several hundred thousand participants in various activities of the Company.