Form 6-K BHP Group Ltd For: May 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May 19, 2022

BHP GROUP LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE, VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): n/a

NEWS RELEASE

| Release Time | IMMEDIATE | |

| Date | 19 May 2022 | |

| Release Number | 17/22 | |

BMO Global Farm to Market Conference

BHP CFO, David Lamont, will present at the BMO Global Farm to Market Conference today.

A copy of the presentation is attached.

This is also available on BHP’s website at: https://www.bhp.com/investor-centre/investor-presentations-and-briefings/

The webcast of the presentation will be available at: https://bmo.qumucloud.com/view/vuhYFQ8Xerh2zmjHmQzqRr

Authorised for lodgement by:

Stefanie Wilkinson

Group Company Secretary

| Media Relations | Investor Relations | |

| Email: [email protected] | Email: [email protected] | |

| Australia and Asia | Australia and Asia | |

| Gabrielle Notley Tel: +61 3 9609 3830 Mobile: +61 411 071 715 |

Dinesh Bishop Mobile: +61 407 033 909 | |

| Europe, Middle East and Africa | Europe, Middle East and Africa | |

| Neil Burrows Tel: +44 20 7802 7484 Mobile: +44 7786 661 683 |

James Bell Tel: +44 2078 027 144 Mobile: +44 7961 636 432 | |

| Americas | Americas | |

| Renata Fernandez | Sabrina Goulart | |

| Mobile: +56 9 8229 5357 |

Tel: +1 713 235 9744 7919 Mobile: +1 832 781 6698 | |

| BHP Group Limited ABN 49 004 028 077 LEI WZE1WSENV6JSZFK0JC28 Registered in Australia Registered Office: Level 18, 171 Collins Street Melbourne Victoria 3000 Australia Tel +61 1300 55 4757 Fax +61 3 9609 3015 |

||

| BHP Group is headquartered in Australia Follow us on social media |

||

|

||

2

BHP BMO Farm to Market Conference David Lamont Chief Financial Officer JANSEN

Disclaimer Forward-looking statements This presentation contains forward-looking statements, including statements regarding: trends in commodity prices and currency exchange rates; demand for commodities; production forecasts; plans, strategies and objectives of management; assumed long-term scenarios; potential global responses to climate change; the potential effect of possible future events on the value of the BHP portfolio; closure or divestment of certain assets, operations or facilities (including associated costs); anticipated production or construction commencement dates; capital costs and scheduling; operating costs and shortages of materials and skilled employees; anticipated productive lives of projects, mines and facilities; provisions and contingent liabilities; and tax and regulatory developments. Forward-looking statements may be identified by the use of terminology, including, but not limited to, ?intend?, ?aim?, ?project?, ?anticipate?, ?estimate?, ?plan?, ?believe?, ?expect?, ?may?, ?should?, ?will?, ?would?, ?continue?, ?annualised? or similar words. These statements discuss future expectations concerning the results of assets or financial conditions, or provide other forward-looking information. These forward-looking statements are based on the information available as at the date of this presentation and/or the date of the Group?s planning processes or scenario analysis processes. There are inherent limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed. Additionally, forward-looking statements are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contained in this presentation. BHP cautions against reliance on any forward-looking statements or guidance, particularly in light of the current economic climate and the significant volatility, uncertainty and disruption arising in connection with COVID-19. For example, our future revenues from our assets, projects or mines described in this release will be based, in part, upon the market price of the minerals, metals or petroleum produced, which may vary significantly from current levels. These variations, if materially adverse, may affect the timing or the feasibility of the development of a particular project, the expansion of certain facilities or mines, or the continuation of existing assets. Other factors that may affect the actual construction or production commencement dates, costs or production output and anticipated lives of assets, mines or facilities include our ability to profitably produce and transport the minerals, petroleum and/or metals extracted to applicable markets; the impact of foreign currency exchange rates on the market prices of the minerals, petroleum or metals we produce; activities of government authorities in the countries where we sell our products and in the countries where we are exploring or developing projects, facilities or mines, including increases in taxes; changes in environmental and other regulations; the duration and severity of the COVID-19 pandemic and its impact on our business; political uncertainty; labour unrest; and other factors identified in the risk factors discussed in BHP?s filings with the U.S. Securities and Exchange Commission (the ?SEC?) (including in Annual Reports on Form 20-F) which are available on the SEC?s website at www.sec.gov. Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any forward-looking statements, whether as a result of new information or future events. Past performance cannot be relied on as a guide to future performance. Presentation of data Numbers presented may not add up precisely to the totals provided due to rounding. No offer of securities Nothing in this presentation should be construed as either an offer or a solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, in any jurisdiction, or be treated or relied upon as a recommendation or advice by BHP. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Reliance on third party information The views expressed in this presentation contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. This presentation should not be relied upon as a recommendation or forecast by BHP. BHP and its subsidiaries In this presentation, the terms ?BHP?, the ?Company?, the ?Group?, ?our business?, ?organization?, ?Group?, ?we?, ?us? and ?our? refer to BHP Group Limited, BHP Group Plc and, except where the context otherwise requires, their respective subsidiaries set out in note 13 ?Related undertaking of the Group? in section 5.2 of BHP?s Annual Report and Form 20-F. Those terms do not include non-operated assets. This presentation includes references to BHP?s assets (including those under exploration, projects in development or execution phases, sites and closed operations) that have been wholly owned and/or operated by BHP and that have been owned as a joint venture operated by BHP (referred to as ?operated assets? or ?operations?) during the period from 1 July 2020 to 30 June 2021. Our functions are also included. BHP also holds interests in assets that are owned as a joint venture but not operated by BHP (referred to in this release as ?non-operated joint ventures? or ?non-operated assets?). Our non-operated assets include Antamina, Cerrej?n, Samarco, Atlantis, Mad Dog, Bass Strait and North West Shelf. Notwithstanding that this presentation may include production, financial and other information from non-operated assets, non-operated assets are not included in the Group and, as a result, statements regarding our operations, assets and values apply only to our operated assets unless otherwise stated. References in this presentation to a ?joint venture? are used for convenience to collectively describe assets that are not wholly owned by BHP. Such references are not intended to characterise the legal relationship between the owners of the asset. 19 May 2022 2 BMO Farm to Market

BHP: Sector leading assets across our commodities We are actively managing our portfolio for long-term value creation through the cycle 19 May 2022 3 BMO Farm to Market Demonstrated bulk logistics expertise Existing operations Port Western Australia Queensland BMA terminal Rail BHP Mitsubishi Alliance Western Australia Iron Ore *100% basis. Orebody 18 Newman Orebody 24/25 Yandi Mining Area C South Flank Mt Whaleback Orebody 29/30/35 Jimblebar Port Hedland ? Newman Rail Line Finucane Island Karratha South Hedland Nelson Point Port Hedland 100km Mackay Bowen Dalrymple Bay BMA Hay Point Coal Terminal Daunia Peak Downs Blackwater Blackwater Gladstone RG Tanna Saraji Broadmeadow Goonyella Riverside Caval Ridge Moranbah 75km FY21 material moved: 2,081 Mt* FY21 production: 64 Mt* ~50 years working with third party rail ~760 ships loaded/year FY21 material moved: 616 Mt* FY21 production: 284 Mt* >1,000 km rail ~1,500 ships loaded/year Iron ore Lowest cost major producer1 with expansion potential if market conditions warrant Metallurgical coal World-class operations producing higher quality steel-making coal Nickel Second largest nickel sulphide resource with ~90% of nickel metal sales to the electric vehicle supply chain Copper Largest resource endowment of any company globally, amongst the highest average grade Potash Significant expansion potential to support up to a century of production in the world?s best potash basin Increasing exposure to future facing commodities Maximising value

Potash and Jansen fit our strategy Modern, long-life, expandable will support long-term value and returns 19 May 2022 4 BMO Farm to Market Attractive future facing commodity Reliable base demand leveraged by population growth and higher living standards Low emission, biosphere friendly and positively leveraged to decarbonisation Strong fundamentals and mature existing asset base offers an attractive entry opportunity World class asset Increases diversification of commodity, customer base and operating footprint for BHP Long-life asset in a stable mining jurisdiction Provides a platform for growth via potential capital efficient expansions Operational excellence; leadership on Social Value and sustainability Utilisation of latest design and technology First Nations agreements, and targeting 20% indigenous employment2 Aspirational goal for a gender balanced workforce Low water footprint and emissions embedded in design

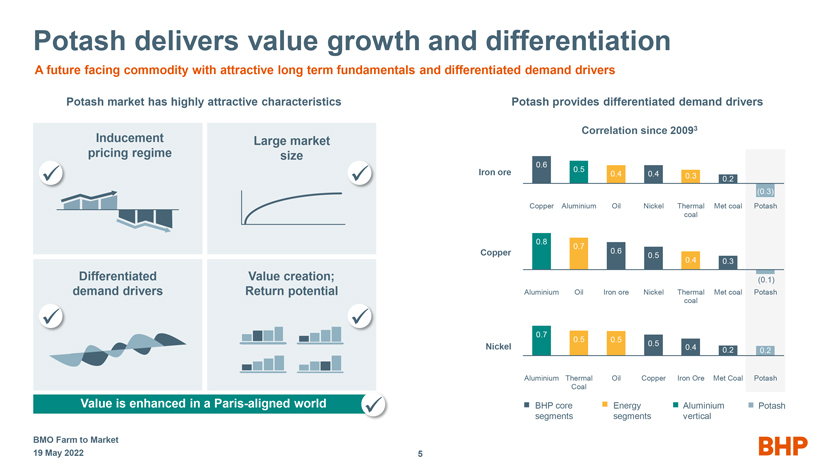

Potash delivers value growth and differentiation 5 A future facing commodity with attractive long term fundamentals and differentiated demand drivers 19 May 2022 BMO Farm to Market Potash market has highly attractive characteristics Differentiated demand drivers Inducement pricing regime Large market size Value creation; Return potential Value is enhanced in a Paris-aligned world Potash provides differentiated demand drivers Correlation since 20093 0.8 0.7 0.6 0.5 0.4 0.3 (0.1) Aluminium Oil Iron ore Nickel Thermal coal Met coal Potash 0.7 0.5 0.5 0.5 0.4 0.2 0.2 Aluminium Thermal Coal Oil Copper Iron Ore Met Coal Potash 0.6 0.5 0.4 0.4 0.3 0.2 (0.3) Copper Aluminium Oil Nickel Thermal coal Met coal Potash Iron ore Copper Nickel Energy segments BHP core segments Aluminium Potash Vertical

Risks and opportunities on the road to entry 19 May 2022 6 BMO Farm to Market Near term consumption impacted by shipping constraints Firm demand from food exporters/potash importers Food security concerns to influence sovereign behaviour Earlier than anticipated draw in latent capacity Project pipeline is the key unknown for the medium to longer term Supply response to scarcity price? Pre-invasion, market was expected to reach a balance in late 2020s High conviction that long run pricing will reflect the cost of developing new greenfield supply LRMC5 estimates of the market may move upwards, reflecting industry inflation and cost of capital Impact on the window of concern to Jansen? Overall market changes are positive for Jansen S1 economics 16% 18% 20% 15% 12% 4% 15% Europe Brazil USA China SE Asia India Other CY21 Demand ~70Mt4 38% 33% 9% 6% 6% 8% Russia & Belarus Canada China Europe Israel Other CY21 Supply ~70Mt4 Source: CRU Source: CRU Demand response to scarcity price?

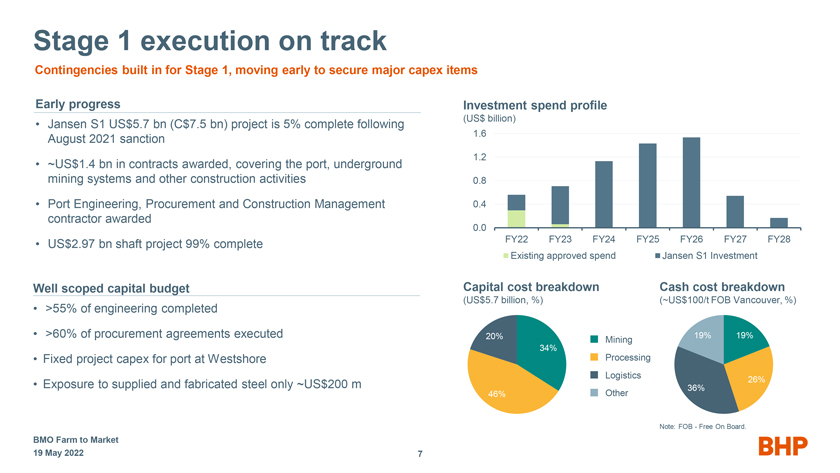

Early progress Jansen S1 US$5.7 bn (C$7.5 bn) project is 5% complete following August 2021 sanction ~US$1.4 bn in contracts awarded, covering the port, underground mining systems and other construction activities Port Engineering, Procurement and Construction Management contractor awarded US$2.97 bn shaft project 99% complete Stage 1 execution on track Contingencies built in for Stage 1, moving early to secure major capex items Investment spend profile (US$ billion) 0.0 0.4 0.8 1.2 1.6 FY22 FY23 FY24 FY25 FY26 FY27 FY28 Existing approved spend Jansen S1 Investment Capital cost breakdown (US$5.7 billion, %) 34% 46% 20% Well scoped capital budget >55% of engineering completed >60% of procurement agreements executed Fixed project capex for port at Westshore Exposure to supplied and fabricated steel only ~US$200 m 19 May 2022 7 BMO Farm to Market 19% 26% 36% 19% Cash cost breakdown (~US$100/t FOB Vancouver, %) Note: FOB—Free On Board. Mining Processing Logistics Other

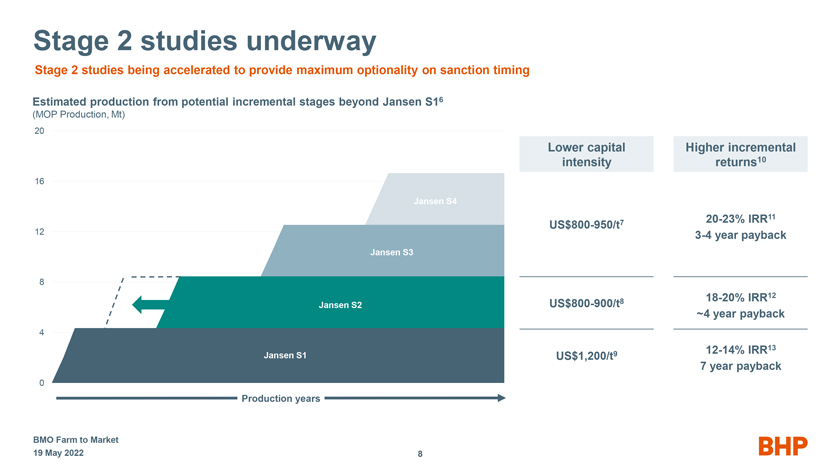

0 4 8 12 16 20 Stage 2 studies underway 19 May 2022 8 BMO Farm to Market Stage 2 studies being accelerated to provide maximum optionality on sanction timing Estimated production from potential incremental stages beyond Jansen S16 (MOP Production, Mt) Jansen S1 Jansen S2 Jansen S3 Production years Jansen S4 Lower capital intensity Higher incremental returns10 US$800-950/t7 20-23% IRR11 3-4 year payback US$800-900/t8 18-20% IRR12 ~4 year payback US$1,200/t9 12-14% IRR13 7 year payback

Jansen has structural competitive advantages 9 Modern, large scale conventional mine with modern design providing platform for future growth Modern plant design delivers high recoveries, lower emissions and water use Leading equipment and material handling systems Full life of mine planning of resource leveraging 3D seismic technology Larger borers make a unique, integrated mining system Large capacity supports low capital intensity expansion options Upfront geological information ~60% less equipment delivers lower costs Shaft design ~20-50% larger than competitors Efficient path to market with significant expansion potential Continuous, automated loading system Geology & Resource Mining system Hoisting Processing Outbound logistics Our approach to social value and environmental stewardship underpin Jansen?s development 19 May 2022 BMO Farm to Market

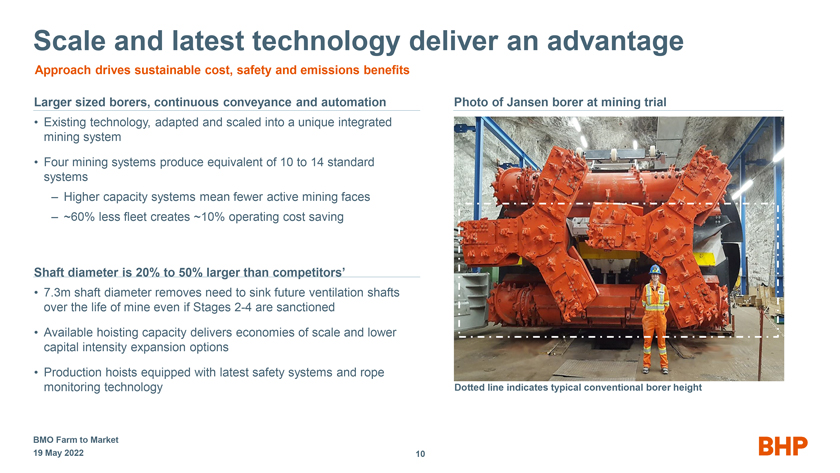

Scale and latest technology deliver an advantage Larger sized borers, continuous conveyance and automation Existing technology, adapted and scaled into a unique integrated mining system Four mining systems produce equivalent of 10 to 14 standard systems ? Higher capacity systems mean fewer active mining faces ? ~60% less fleet creates ~10% operating cost saving Shaft diameter is 20% to 50% larger than competitors? 7.3m shaft diameter removes need to sink future ventilation shafts over the life of mine even if Stages 2-4 are sanctioned Available hoisting capacity delivers economies of scale and lower capital intensity expansion options Production hoists equipped with latest safety systems and rope monitoring technology Approach drives sustainable cost, safety and emissions benefits Photo of Jansen borer at mining trial 10 Dotted line indicates typical conventional borer height 19 May 2022 BMO Farm to Market

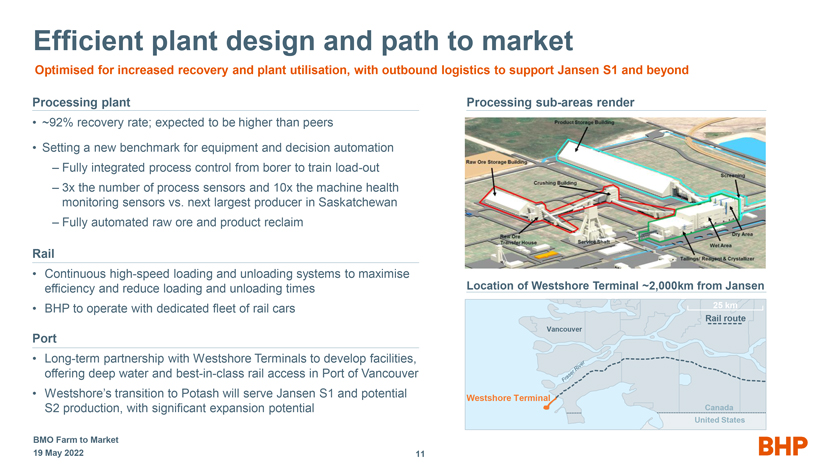

Rail Continuous high-speed loading and unloading systems to maximise efficiency and reduce loading and unloading times BHP to operate with dedicated fleet of rail cars Processing plant ~92% recovery rate; expected to be higher than peers Setting a new benchmark for equipment and decision automation ? Fully integrated process control from borer to train load-out ? 3x the number of process sensors and 10x the machine health monitoring sensors vs. next largest producer in Saskatchewan ? Fully automated raw ore and product reclaim Optimised for increased recovery and plant utilisation, with outbound logistics to support Jansen S1 and beyond Processing sub-areas render 11 Port Long-term partnership with Westshore Terminals to develop facilities, offering deep water and best-in-class rail access in Port of Vancouver Westshore?s transition to Potash will serve Jansen S1 and potential S2 production, with significant expansion potential Westshore Terminal Vancouver Canada United States Rail route 25 km Location of Westshore Terminal ~2,000km from Jansen 19 May 2022 BMO Farm to Market Efficient plant design and path to market

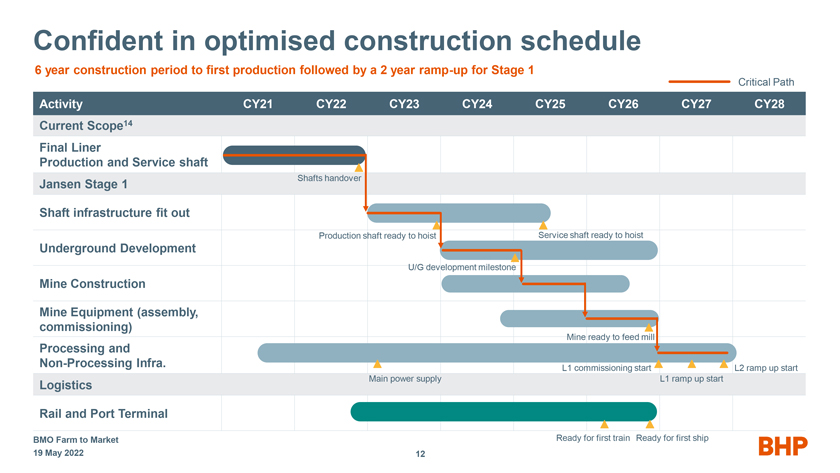

Confident in optimised construction schedule 6 year construction period to first production followed by a 2 year ramp-up for Stage 1 Activity CY21 CY22 CY23 CY24 CY25 CY26 CY27 CY28 Current Scope14 Final Liner Production and Service shaft Jansen Stage 1 Shaft infrastructure fit out Underground Development Mine Construction Mine Equipment (assembly, commissioning) Processing and Non-Processing Infra. Logistics Rail and Port Terminal Shafts handover L2 ramp up start Production shaft ready to hoist Service shaft ready to hoist Main power supply L1 ramp up start Ready for first train Ready for first ship 12 Critical Path U/G development milestone Mine ready to feed mill L1 commissioning start 19 May 2022 BMO Farm to Market

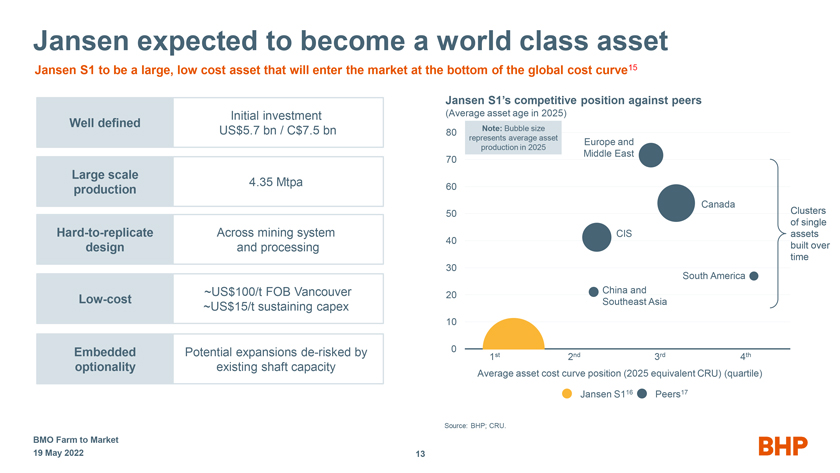

Jansen expected to become a world class asset 13 Jansen S1 to be a large, low cost asset that will enter the market at the bottom of the global cost curve15 Clusters of single assets built over time Initial investment US$5.7 bn / C$7.5 bn Well defined 4.35 Mtpa Large scale production ~US$100/t FOB Vancouver ~US$15/t sustaining capex Low-cost Potential expansions de-risked by existing shaft capacity Embedded optionality 0 10 20 30 40 50 60 70 80 Canada Jansen S1?s competitive position against peers (Average asset age in 2025) Note: Bubble size represents average asset production in 2025 Jansen S116 Peers17 Europe and Middle East CIS China and Southeast Asia South America Across mining system and processing Hard-to-replicate design Average asset cost curve position (2025 equivalent CRU) (quartile) 1st 2nd 3rd 4th Source: BHP; CRU. 19 May 2022 BMO Farm to Market

BHP Appendix

Footnotes 19 May 2022 15 BMO Farm to Market 1. Slide 3: Based on published unit costs by major iron ore producers, as reported at 31 December 2021. 2. Slide 4: Aiming to achieve Indigenous workforce participation of 20% by the end of FY27. 3. Slide 5: Correlation based on changes in average quarterly prices from Q2 2009 to Q1 2022. 4. Slide 6: CY21 MOP supply and demand sourced from CRU. 5. Slide 6: LRMC refers to long run marginal cost. 6. Slide 8: Production target for Stage 1 is based on reported Ore Reserves. Potential incremental stages 2-4 are based on Measured Resources. Mineral Resources and Ore Reserves are included in the news release published on 17th August 2021, available to view at www.bhp.com. The execution of future stages would be subject to our review of supply and demand fundamentals and successful competition for capital under our Capital Allocation Framework. 7. Slide 8: Expected Capital Intensity Jansen S3-4, US$/product tonne, Real 1 July 2021. 8. Slide 8: Expected Capital Intensity Jansen S2, US$/product tonne, Real 1 July 2021. Values do not reflect an accelerated Jansen S2 case. 9. Slide 8: Expected Capital Intensity Jansen S1, US$/product tonne, Real 1 July 2021. 10. Slide 8: Based on the yearly average of forecast December 2021 (Argus) and February 2022 (CRU) consensus prices. Long-run Argus and CRU consensus prices are US$350/tonne and US$505/tonne, respectively. 11. Slide 8: Expected Jansen S3-S4 IRR of investment decision across ~100 year mine life analysis was conducted using December 2021 (Argus) and February 2022 (CRU) consensus prices. Jansen S3-S4 IRR is post tax and nominal. 12. Slide 8: Expected Jansen S2 IRR of investment decision across ~100 year mine life analysis was conducted using December 2021 (Argus) and February 2022 (CRU) consensus prices. Jansen S2 IRR is post tax and nominal. Values do not reflect an accelerated Jansen S2 case. 13. Slide 8: Expected Jansen S1 IRR of investment decision across ~100 year mine life analysis was conducted using December 2021 (Argus) and February 2022 (CRU) consensus prices. Jansen S1 IRR is post tax and nominal, and excludes remaining funded investment of ~US$0.35 billion (as at September 2021) for completion of the shafts and installation of essential service infrastructure and utilities. 14. Slide 12: Project scope includes finishing the excavation and lining of the production and service shafts, and continuing the installation of essential surface infrastructure and utilities. 15. Slide 13: Figures on this slide refers to Jansen S1; Jansen S1 sustaining capex +/-20% on any given year. 16. Slide 13: Jansen S1 production begins in CY27. Jansen S1 forecast to be first quartile when it reaches full production. 17. Slide 13: Canada excludes Jansen.

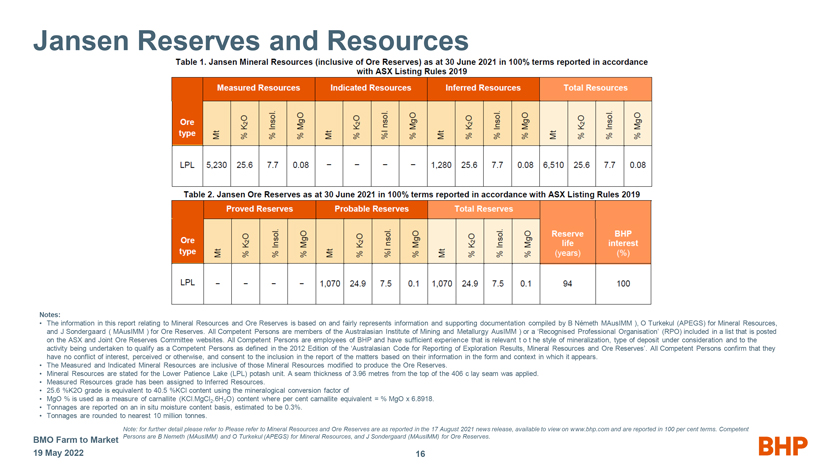

Table 1. jansen mineral resources (inclusive of ore reserves) as at 30 June 2021 in 100% terms reported in accordance with asx listing rules 2019 Jansen Reserves and Resources measured resources mt 5,230 lpl % k2o 25.6 % insol. 7.7 % mgo 0.08 mt % k2o %i nsol. % mgo mt. 1,280 % k2o 25.6 %insol. 7.7 % mgo 0.08 mt 6,510 % k2o 25.6 % insol 7.7 % mgo ORE type Table 2. Jansen ore reserves as at 30 june 2021 in 100% terms reported in accordance with asx listing rules 2019 ore type mt % k2o % insol. % mgo mt 1,070 % k2o 24.9 %i insol 7.5 % mgo 0.1 reserve life (years) 94 BHP interest (%) 100 Notes: The information in this report relating to Mineral Resources and Ore Reserves is based on and fairly represents information and supporting documentation compiled by B N?meth MAusIMM ), O Turkekul (APEGS) for Mineral Resources, and J Sondergaard ( MAusIMM ) for Ore Reserves. All Competent Persons are members of the Australasian Institute of Mining and Metallurgy AusIMM ) or a ?Recognised Professional Organisation? (RPO) included in a list that is posted on the ASX and Joint Ore Reserves Committee websites. All Competent Persons are employees of BHP and have sufficient experience that is relevant t o t he style of mineralization, type of deposit under consideration and to the activity being undertaken to qualify as a Competent Persons as defined in the 2012 Edition of the ?Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves?. All Competent Persons confirm that they have no conflict of interest, perceived or otherwise, and consent to the inclusion in the report of the matters based on their information in the form and context in which it appears. The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to produce the Ore Reserves. Mineral Resources are stated for the Lower Patience Lake (LPL) potash unit. A seam thickness of 3.96 metres from the top of the 406 c lay seam was applied. Measured Resources grade has been assigned to Inferred Resources. 25.6 %K2O grade is equivalent to 40.5 %KCl content using the mineralogical conversion factor of MgO % is used as a measure of carnallite (KCl.MgCl2.6H2O) content where per cent carnallite equivalent = % MgO x 6.8918. Tonnages are reported on an in situ moisture content basis, estimated to be 0.3%. Tonnages are rounded to nearest 10 million tonnes. 16 Note: for further detail please refer to Please refer to Mineral Resources and Ore Reserves are as reported in the 17 August 2021 news release, available to view on www.bhp.com and are reported in 100 per cent terms. Competent Persons are B Nemeth (MAusIMM) and O Turkekul (APEGS) for Mineral Resources, and J Sondergaard (MAusIMM) for Ore Reserves. 19 May 2022 BMO Farm to Market

BHP

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BHP Group Limited | ||||||

| Date: May 19, 2022 | By: | /s/ Stefanie Wilkinson | ||||

| Name: | Stefanie Wilkinson | |||||

| Title: | Group Company Secretary | |||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BHP Group (BHP) 30-day option implied volatility near low end of range

- Montauk Renewables Schedules First Quarter 2024 Conference Call for Thursday, May 9, 2024, at 5:00 p.m. ET

- AGBA Stands Firm: The AGBA-Triller Merger is Value-Enhancing to All Stakeholders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share