Form 6-K BANK OF NOVA SCOTIA For: Mar 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

| For the month of: March, 2022 |

Commission File Number: 002-09048 |

THE BANK OF NOVA SCOTIA

(Name of registrant)

44 King Street West, Scotia Plaza 8th floor, Toronto, Ontario, M5H 1H1

Attention: Secretary’s Department (Tel.: (416) 866-3672)

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

This report on Form 6-K shall be deemed to be incorporated by reference in The Bank of Nova Scotia’s registration statements on Form S-8 (File No. 333-199099) and Form F-3 (File No. 333-261476) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| THE BANK OF NOVA SCOTIA | ||||||

| Date: March 3, 2022 | By: | /s/ Nives Gaiotto | ||||

| Name: | Nives Gaiotto | |||||

| Title: | Assistant Corporate Secretary | |||||

EXHIBIT INDEX

| Exhibit | Description of Exhibit | |

| 99.1 | Notice of the 190th Annual Meeting of Shareholders and Management Proxy Circular | |

| 99.2 | Notice of Availability of Annual Shareholder Meeting Materials | |

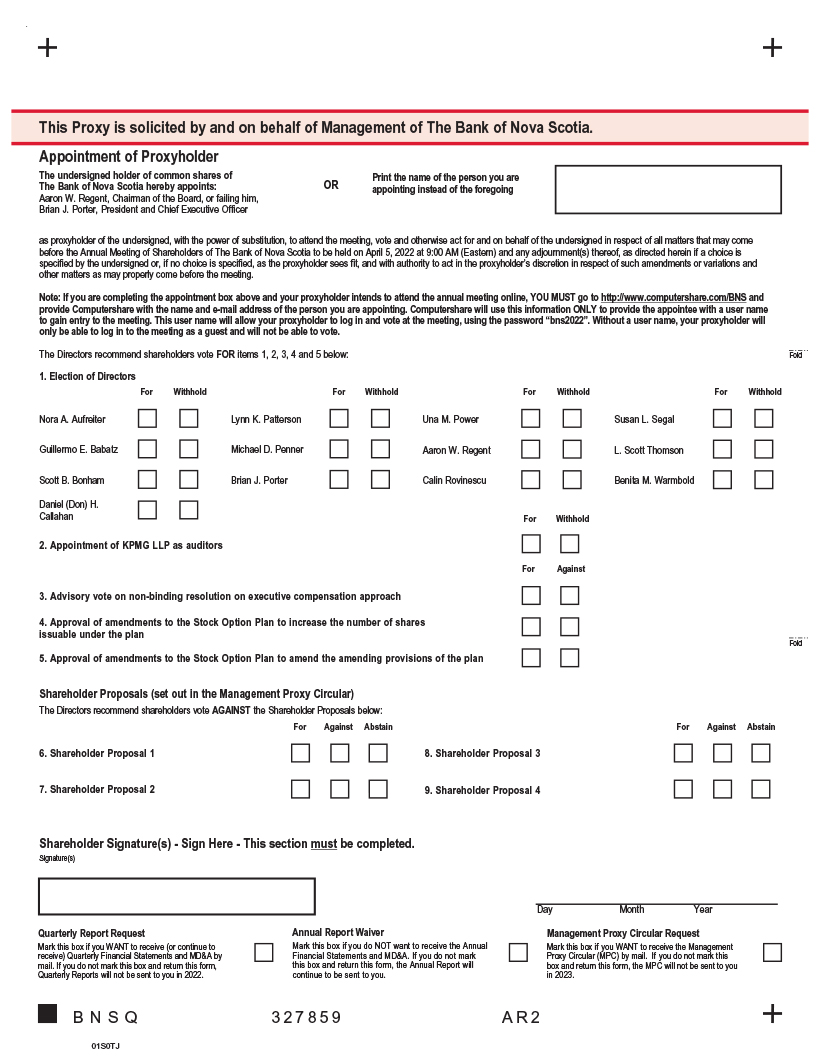

| 99.3 | Form of Proxy | |

| 99.4 | Mandate of the Board of Directors | |

Exhibit 99.1

MANAGEMENT PROXY CIRCULAR ANNUAL MEETING OF SHAREHOLDERS April 5, 2022 YOUR VOTE IS IMPORTANT Please take some time to read this management proxy circular for important information about the business of the meeting and to learn more about Scotiabank scotiabank.com/annualmeeting Scotiabank

Scotiabank is a leading bank in the Americas.

Guided by our purpose – for every futureTM – we help our customers, their families and their communities achieve success through a broad range of advice, products and services.

Notice of annual meeting of common shareholders of The Bank of Nova Scotia

| WHEN |

WHERE | LIVE WEBCAST | ||

| Tuesday, April 5, 2022 |

Scotiabank Centre | https://web.lumiagm.com/455617216 | ||

| 9:00 a.m. (Eastern) |

Scotia Plaza, 40 King Street West, 2nd floor |

|||

| Toronto, Ontario M5H 3Y2 | ||||

In order to ensure the safety of our employees, shareholders and guests, all current COVID-19 regulations and guidance in place at the time of the annual meeting will be in effect on site. Given the continued uncertainty surrounding the COVID-19 pandemic, we have taken the proactive step of obtaining a court order again this year that allows us to hold our annual meeting using electronic means as a contingency in the event that COVID-19 restrictions in place at the time of the meeting prevent us from holding an in-person event. Please visit scotiabank.com/annualmeeting regularly for updates.

A simultaneous webcast of the meeting will also be offered to allow shareholders to attend the meeting online, vote their shares and submit questions.

Please see page 10 for information about attending the meeting, voting and submitting questions.

AT THE MEETING YOU WILL BE ASKED TO:

| 1. | Receive our financial statements for the year ended October 31, 2021 and the auditors’ report on the statements |

| 2. | Elect directors |

| 3. | Appoint auditors |

| 4. | Vote on an advisory resolution on our approach to executive compensation |

| 5. | Vote on each of the amendments to the bank’s Stock Option Plan |

| 6. | Vote on the shareholder proposals |

| 7. | Consider any other business that may properly come before the meeting |

You can read about each item of business beginning on page 6 of the management proxy circular, which describes the meeting, who can vote and how to vote.

Holders of common shares on February 8, 2022, the record date, are eligible to vote at the meeting (subject to Bank Act (Canada) restrictions). There were 1,204,467,588 common shares outstanding on this date.

By order of the board,

Julie A. Walsh

Senior Vice President, Corporate Secretary and Chief Corporate Governance Officer

Toronto, Ontario, Canada

February 8, 2022

YOUR VOTE IS

IMPORTANT

As a Scotiabank shareholder, it is important to vote your shares at the upcoming meeting. Detailed voting instructions for registered and non-registered shareholders begin on page 10 of the management proxy circular.

If you cannot attend the meeting, you should complete, sign and return your proxy or voting instruction form to vote your shares. We encourage you to vote your shares prior to the annual meeting. Your vote must be received by our transfer agent, Computershare Trust Company of Canada, by 9 a.m. (Eastern) on April 1, 2022.

Welcome to our 190th annual meeting of shareholders

|

Aaron W. Regent Chairman of Scotiabank’s Board of Directors

Brian J. Porter President and Chief Executive Officer |

Dear fellow shareholders,

We are pleased to invite you to Scotiabank’s annual general meeting on April 5, 2022. We will be covering important items of business, so please review this management proxy circular and vote your shares.

We are optimistic that we will be returning to an in-person meeting after two years of meeting virtually and welcome you to join us at the Scotiabank Centre in downtown Toronto. In order to ensure the safety of the bank’s employees and shareholders, all COVID-19 regulations and guidance in place at the time of the meeting will be in effect on site. Given the continued uncertainty surrounding the COVID-19 pandemic, we have taken the proactive step of obtaining a court order again this year that allows us to hold our annual meeting using electronic means as a contingency in the event that COVID-19 restrictions in place at the time of the meeting prevent us from holding an in-person event. Please visit our website regularly for updates.

Over the past few years, we have heard from many shareholders who value the opportunity to attend the meeting virtually and appreciate the enhancements we have made to increase shareholder participation via a live webcast. For this reason, shareholders can choose to attend either in-person or online and will be able to view the meeting, vote their shares and submit questions regardless of their method of participation for the first time this year.

Leading in the Americas

For nearly a decade, Scotiabank has been on a journey to simplify and diversify our business. We have been focused on gaining scale in the core markets and businesses where we can compete and win, and today we are a highly competitive player in each of our core markets, with optionality and multiple avenues of growth. The strategic decisions that we’ve made have provided us with the capital, the reputation, the partnerships and the team to realise our ambitions for the future. Our board is confident in the key strategic decisions we have made, and we continue to be grateful for your engagement and the confidence you’ve shown in the bank’s management team throughout this journey.

There will always be short-term factors that are outside of the bank’s control – a global pandemic, geopolitical tension and market volatility, to list a few examples – but the real measure of success is how the bank is positioned to win over the longer term. Despite these uncertain times, the bank has continued to generate sustainable dividends for our shareholders, as it has for almost two centuries.

Committed to Environmental, Social and Governance (ESG) Initiatives

ESG matters continue to be top of mind for both our shareholders and board of directors. Throughout 2021, we have brought an ESG focus to the forefront of our corporate governance policies. A discussion of relevant ESG issues is on the agenda of every board meeting and each of our board committees oversees various aspects of our ESG strategy, initiatives, risks and reporting.

In 2021, Scotiabank deepened its commitment to making investments that strengthen our communities today, and for generations to come. In January 2021, the bank launched ScotiaRISE – a 10-year, $500 million initiative to promote economic resilience among disadvantaged groups. Through ScotiaRISE, Scotiabank is supporting programs and partnering with organizations across our footprint to provide tools to improve education and employment prospects, adapt to changing circumstances, and increase the likelihood of financial success.

We have also made great strides towards our commitment to reach net-zero carbon emissions by 2050, including ongoing work to establish bank-wide, quantitative, time-bound targets for reducing greenhouse gas emissions associated with our lending activities, joining the Net-Zero Banking Alliance and launching our inaugural Net Zero Research Fund as part of our commitment to pursuing net-zero targets and pathways. The bank also closed a USD |

| Management proxy circular | 1 |

1 billion 3-year Sustainability Bond offering – the largest by a Canadian corporate or financial entity at the time of issue – with proceeds funding the financing or refinancing of green or social assets, businesses and projects. As of November 2021, the bank has mobilized $58 billion of its $100 billion commitment by 2025 to reduce the impacts of climate change.

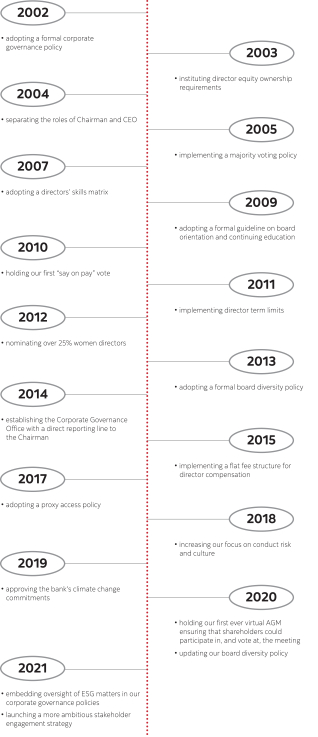

A leader in governance

Scotiabank continues to be a leader in corporate governance and was again named to the Dow Jones Sustainability Index North America for the fourth consecutive year, ranking in the top 8% of participating financial institutions from around the world for sustainability, and achieving an industry-best score for corporate governance. The Dow Jones Sustainability Index is considered the industry-standard for measuring ESG practices.

This year, our board has enhanced its approach to stakeholder engagement, with a focus on better understanding our various stakeholders’ priorities. We have engaged with a significant number of stakeholders throughout 2021, which has helped us in our commitment to continually enhancing our governance practices and disclosure, as well as moving forward on some of our ESG initiatives and creating sustainable value for our stakeholders. As part of our enhanced governance practices, we reported on our shareholder engagement since our 2021 annual meeting in a letter to our shareholders sent in October 2021.

Our board continues to focus on its own succession planning to ensure we have the right skills and experience around the boardroom table. We were pleased to welcome Don Callahan to our board in 2021. Don is a highly accomplished financial services executive, with impressive executive management, operations, technology and ESG experience, and we are very fortunate to have had him join the board.

Building for tomorrow

Though we are not through the pandemic yet, the bank has demonstrated considerable operational resilience and strength again over the past year. We are well diversified, with four strong business lines and a robust balance sheet that positions us well for sustainable growth over the long term. We have every confidence that the bank’s future is exceedingly bright.

Thank you for your continued support, and we look forward to speaking with you on April 5, 2022.

|

|

| 2 | Scotiabank |

What’s inside

| 1 | ||||

|

|

6 |

| ||

|

|

6 |

| ||

|

|

10 |

| ||

|

|

15 |

| ||

|

|

24 |

| ||

|

|

25 |

| ||

|

|

25 |

| ||

|

|

25 |

| ||

|

|

26 |

| ||

|

|

27 |

| ||

| 2 | ||||

|

|

28 |

| ||

|

|

32 |

| ||

|

|

32 |

| ||

|

|

33 |

| ||

|

|

33 |

| ||

|

|

34 |

| ||

|

|

35 |

| ||

|

|

35 |

| ||

|

|

39 |

| ||

|

|

42 |

| ||

|

|

43 |

| ||

|

|

43 |

| ||

|

|

45 |

| ||

|

|

50 |

| ||

|

|

50 |

| ||

|

|

50 |

| ||

|

|

50 |

| ||

|

|

51 |

| ||

|

|

52 |

| ||

|

|

52 |

| ||

|

|

52 |

| ||

|

|

53 |

| ||

|

|

53 |

| ||

|

|

54 |

| ||

|

|

54 |

| ||

|

|

55 |

| ||

|

|

58 |

| ||

|

|

59 |

| ||

| 3 | ||||

|

|

64 |

| ||

| Message from the chair of the human capital and compensation committee |

|

64 |

| |

|

|

74 |

| ||

|

|

74 |

| ||

|

|

81 |

| ||

|

|

85 |

| ||

|

|

88 |

| ||

|

|

94 |

| ||

|

|

107 |

| ||

|

|

108 |

| ||

|

|

108 |

| ||

|

|

110 |

| ||

|

|

114 |

| ||

|

|

117 |

| ||

| 4 | ||||

|

|

119 |

| ||

|

|

119 |

| ||

|

|

120 |

| ||

|

|

120 |

| ||

|

|

120 |

| ||

|

|

121 |

| ||

| 5 | ||||

|

|

122 |

| ||

|

|

136 |

| ||

| Management proxy circular | 3 |

| Management proxy circular

You have received this management proxy circular because you owned Scotiabank common shares as of the close of business on February 8, 2022 (the record date), and are entitled to vote at our annual meeting.

|

||||

| Management is soliciting your proxy for the annual meeting on April 5, 2022.

|

||||||

| This document tells you about the meeting, governance, executive compensation, other information and shareholder proposals at Scotiabank. We have organized it into five sections to make it easy to find what you are looking for and to help you vote with confidence.

We pay the cost of proxy solicitation for all registered and non-registered (beneficial) shareholders. We are soliciting proxies mainly by mail, but you may also be contacted by phone or in person by employees of Scotiabank, Computershare Trust Company of Canada (Computershare), our transfer agent, or Laurel Hill Advisory Group, our proxy solicitation firm. We have retained Laurel Hill Advisory Group to help us with this process at an estimated cost of $35,000.

Unless indicated otherwise, information in this management proxy circular (circular) is as of February 1, 2022 and all dollar amounts are in Canadian dollars.

DELIVERY OF MEETING MATERIALS

Notice and access

As permitted by the Canadian Securities Administrators and pursuant to an exemption |

In this document:

• we, us, our, the bank and Scotiabank mean The Bank of Nova Scotia • you and your mean holders of our common shares • common shares and shares mean the bank’s common shares • annual meeting and meeting mean the annual meeting of common shareholders of the bank

|

|||||

| from the proxy solicitation requirement received from the Office of the Superintendent of Financial Institutions (OSFI), we are using “notice and access” to deliver this circular to both our registered and beneficial shareholders. This means that this circular will be posted online for you to access instead of receiving a physical copy in the mail. Notice and access gives shareholders more choice, allows for faster access to this circular, reduces our printing and mailing costs, and is environmentally friendly as it reduces paper and energy consumption.

You will still receive a physical copy of the form of proxy if you are a registered shareholder or the voting instruction form if you are a beneficial shareholder in the mail so that you can vote your shares. However, instead of receiving a physical copy of the circular, you will receive a notice explaining how to access this circular electronically and how to request a physical copy. Physical copies of the circular will also be provided to shareholders who have standing instructions to receive physical copies of meeting materials.

How to access the circular electronically

This circular is available on the website of Computershare (www.envisionreports.com/scotiabank2022), on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov). |

||||||

| 4 | Scotiabank |

|

Delivery of the annual report

How we deliver our annual report to you depends on whether you are a registered shareholder or a beneficial shareholder.

You are a registered shareholder if the shares you own are registered directly in your name with Computershare. If this is the case, your name will appear on a share certificate or a statement from a direct registration system confirming your shareholdings. You are a beneficial shareholder if the shares you own are registered for you in the name of an intermediary such as a securities broker, trustee or financial institution.

Registered shareholders

Registered shareholders who have not opted out of receiving our annual report will receive a physical copy, unless they have consented to electronic delivery (e-delivery). Please refer to “Receiving shareholder materials by e-mail” under “Information about voting” for more information on signing up to receive shareholder materials by e-mail.

Beneficial shareholders

As permitted under securities laws, we are using notice and access to deliver our annual report to beneficial shareholders. You may access the annual report online in the same manner as described in “How to access the circular electronically”. Physical copies of the annual report will also be provided to shareholders who have standing instructions to receive physical copies of meeting materials.

How to request a physical copy of materials provided to you through notice and access

Shareholders may request a physical copy of this circular or our annual report, at no cost, up to one year from the date the circular was filed on SEDAR. If you would like to receive a physical copy prior to the meeting, please follow the instructions provided in the notice or contact Computershare at the contact information provided on the back cover of this circular. A copy of the requested documents will be sent to you within three business days of your request. If you request a physical copy of any materials, you will not receive a new form of proxy or voting instruction form, so you should keep the original form sent to you in order to vote.

Questions?

If you have questions about notice and access or to request a physical copy of this circular or our annual report after the meeting at no charge, you can contact Computershare at the contact information provided on the back cover of this circular. |

1 ABOUT THE MEETING Read about the items of to vote your shares

2 GOVERNANCE Learn about our practices

3 EXECUTIVE COMPENSATION Find out what we paid our

senior executives | |||

|

FOR MORE INFORMATION

You can find financial information about Scotiabank in our 2021 consolidated financial statements and management’s discussion and analysis (MD&A). Please see our caution regarding forward-looking statements on page 16 of our 2021 annual report. Financial information and other information about Scotiabank, including our annual information form (AIF) and quarterly financial statements are available on our website (www.scotiabank.com), SEDAR (www.sedar.com), or on the U.S. Securities and Exchange Commission (SEC) website (www.sec.gov).

Copies of these documents, this circular and any document incorporated by reference, are available for free by writing to:

Corporate Secretary of The Bank of Nova Scotia 44 King Street West Toronto, Ontario Canada M5H 1H1

You can also communicate with our board of directors by writing to the Chairman of the Board at [email protected]. |

4 OTHER INFORMATION Read additional disclosure about the bank

5 SHAREHOLDER PROPOSALS Read the proposals we received from shareholders and learn how and why we recommend voting in relation to each | |||

| Management proxy circular | 5 |

|

1

|

|

| 1. RECEIVE FINANCIAL STATEMENTS

Our consolidated financial statements and MD&A for the year ended October 31, 2021, together with the auditors’ report on those statements, will be presented at the meeting. You will find these documents in our annual report which is available on our website. |

||

| 2. ELECT DIRECTORS

Under our majority voting policy, you will elect 13 directors individually to serve on our board until the close of the next annual meeting or until their successors are elected or appointed. You can find information about the nominated directors beginning on page 15 and our majority voting policy on page 54. |

The board recommends you vote for each nominated director

The board recommends you vote for KPMG LLP as our independent auditors | |

| 3. APPOINT AUDITORS

You will vote on appointing the independent auditors. The board assessed the performance and independence of KPMG LLP (KPMG) and recommends that KPMG be re-appointed as the shareholders’ auditors until the close of the next annual meeting. KPMG has served continuously as one of our auditors since 1992, and as our sole auditor since March 2006. Last year, the vote was 98.25% for KPMG as auditors. A representative of KPMG will attend the meeting.

Auditors’ fees

The table below lists the services KPMG provides and the fees we paid to them for the fiscal years ended October 31, 2021 and 2020. The audit and conduct review committee can pre-approve services as long as they are within the scope of the policies and procedures approved by the committee. | ||

| $ millions | 2021 | 2020 | ||||||

| Audit services |

25.9 | 25.6 | ||||||

| Audit services generally relate to the statutory audits and review of financial statements, regulatory required attestation reports, as well as services associated with registration statements, prospectuses, periodic reports and other documents filed with securities regulatory bodies or other documents issued in connection with securities offerings. | ||||||||

| Audit-related services |

2.1 | 2.9 | ||||||

| Audit-related services include special attest services not directly linked to the financial statements, review of controls and procedures related to regulatory reporting, audits of employee benefit plans and consultation and training on accounting and financial reporting. | ||||||||

| Tax services outside of the audit scope |

– | – | ||||||

| Tax services outside of the audit scope relate primarily to specified review procedures required by local tax authorities, attestation on tax returns of certain subsidiaries as required by local tax authorities, and review to determine compliance with an agreement with the tax authorities. | ||||||||

| Other non-audit services |

0.4 | 0.3 | ||||||

| Other non-audit services are primarily for the review and translation of English language financial statements into other languages and other services. | ||||||||

| Total |

|

28.4 |

|

|

28.8 |

| ||

| 6 | Scotiabank |

ABOUT THE MEETING

|

4. ADVISORY VOTE ON OUR APPROACH TO EXECUTIVE COMPENSATION

You can have a “say on pay” by participating in an advisory vote on our approach to executive compensation.

Since 2010, we have held this annual advisory vote to give shareholders the opportunity to provide the board with important feedback. This vote does not diminish the role and responsibility of the board. Last year, the vote was 60.80% for our approach to executive compensation.

The human capital and compensation committee chair’s letter on page 64 describes our approach to executive compensation in 2021 and our response to the 2021 say-on-pay result, including our ambitious engagement strategy throughout 2021. Pursuant to our corporate governance policies regarding the say-on-pay vote (as described below), our chairman provided an update on our shareholder engagement since our 2021 annual meeting in his letter to our shareholders on October 29, 2021, that is available for review at scotiabank.com/annualmeeting. The human capital and compensation committee has also considered the concerns expressed by our shareholders on its decisions regarding executive compensation and in the explanation of these decisions as set out in Section 3 – Executive Compensation. Our executive compensation program supports our goal of delivering strong, consistent and predictable results to shareholders over the longer term. Our practices meet the model policy on “say on pay” for boards of directors developed by the Canadian Coalition for Good Governance (CCGG).

You will be asked to vote on the following advisory resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in this management proxy circular delivered in advance of the 2022 annual meeting of shareholders of the Bank. |

The board recommends you vote for our approach to executive compensation | |

| This is an advisory vote, which means the results are not binding on the board. The human capital and compensation committee and the board review the results after the meeting and as they consider future executive compensation decisions. If a significant number of shares are voted against the advisory resolution, the human capital and compensation committee will review our approach to executive compensation in the context of any specific shareholder concerns that have been identified and may make recommendations to the board. We will disclose the human capital and compensation committee’s review process and the outcome of its review within six months of the annual meeting.

|

||

|

The human capital and compensation committee and the board welcome questions and comments about executive compensation at Scotiabank. We maintain an open dialogue with shareholders and consider all feedback. See the back cover for our contact information. |

||

| 5. STOCK OPTION PLAN AMENDMENTS

In 1994, shareholder and regulatory approval was obtained to implement the bank’s stock option plan. The purpose of the stock option plan is to provide compensation opportunities to select employees that encourage share ownership, enhance the bank’s ability to attract and retain key employees and reward significant performance achievements. (See “About the stock option plan” beginning on page 112 for the general terms of the stock option plan).

Since its inception, shareholders have authorized the issuance of 129,000,000 common shares under the stock option plan. Shareholders last approved an increase in the number of shares issuable under the stock option plan in 2011, when an additional 15,000,000 common shares were approved for issuance. As of December 31, 2021, 119,522,087 options have been granted, excluding options which have been forfeited or cancelled. The exercise of options has resulted in the issuance of 10,760,132 common shares, representing 0.90% of the bank’s currently issued and outstanding common shares. Currently, options to issue 2,174,732 common shares remain available for grant. |

The board recommends you vote for the stock option plan amendments | |

| Management proxy circular | 7 |

| Approve the issuance of additional common shares

In December 2009, the bank eliminated granting stock options with a tandem stock appreciation right, which negatively impacted the bank’s ability to effectively manage the stock option plan inventory. Instead, to manage share dilution, only stand-alone stock appreciation rights (SARs) have thereafter been granted in select countries outside of Canada, where local laws may restrict the issuance of shares. Based on the current number of options available for grant, the current burn rate and the bank’s grant methodology, it is proposed to increase the number of common shares available for issuance under the stock option plan by an additional 12,000,000 in order to continue the stock option plan through the next number of years. This amendment to the stock option plan was approved by the board of directors on November 30, 2021, subject to shareholder approval and acceptance by the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE).

The table below shows the total number of common shares reserved for issuance under the stock option plan pursuant to outstanding grants and potential future grants, before and after the proposed issuance of additional common shares. |

| Securities issuable pursuant to outstanding grants |

Securities remaining for future issuance |

Total |

|||||||||||||||||||||||||||||||||

| # | % of outstanding common shares) |

# | % of outstanding common shares) |

# | % of outstanding common shares) |

||||||||||||||||||||||||||||||

| As at December 31, 2021 |

10,760,132 | 0.90 | % | 2,174,732 | 0.20 | % | 12,934,864 | 1.10 | % | ||||||||||||||||||||||||||

| To be approved at the annual meeting |

– | – | % | 12,000,000 | 1.00 | % | 12,000,000 | 1.00 | % | ||||||||||||||||||||||||||

| Pro forma total |

10,760,132 | 0.90 | % | 14,174,732 | 1.20 | % | 24,934,864 | 2.10 | % | ||||||||||||||||||||||||||

|

Housekeeping amendments to the amending provisions

In 2011, shareholders approved an amendment to the bank’s stock option plan to provide that any amendment to the amending provisions of the bank’s stock option plan shall require specific shareholder approval. In light of our proposed increase to the number of common shares under the stock option plan, we completed a thorough review of the stock option plan to address any further “housekeeping” changes as required. In that regard, to clarify the bank’s practice and current regulatory requirements and to be consistent with market practice, it is proposed that the amending provisions of the bank’s stock option plan be revised to: (i) clarify that such provisions apply to outstanding option or SAR agreements subject to the stock option plan in addition to the stock option plan itself; and (ii) also refer to SARs when referencing options throughout the amending provisions, as appropriate. Because these amendments are to the amending provisions of the stock option plan, shareholder approval is required despite the amendments being a consequence of “housekeeping” changes. See page 112 for further details of the stock option plan and the amending provisions. |

Application of amending provisions to option or SAR agreements

It is proposed that the amendment provisions be revised to specify that the board may suspend, terminate or amend an existing option or SAR agreement subject to the stock option plan (in addition to the stock option plan itself) as the board deems appropriate, subject to applicable laws, regulations, rules, by-laws or policies of applicable stock exchanges and other regulatory authorities; provided that (i) no amendment, suspension or termination of the option or SAR agreement shall, without the participant’s consent, impair any rights or obligations under any option or SAR previously granted except for adjustments made to the number of issuable shares or the exercise price of outstanding options or the base price of the outstanding SARs in accordance with the section of the stock option plan which provides for appropriate adjustments in respect of certain events. Such events include subdivision or consolidation of shares, payment of dividends in stock (other than dividends in the ordinary course), reclassification or conversion of the shares, recapitalization, reorganization or other events which necessitate adjustments to the outstanding options or SARs in proportion with adjustments to all common shares, and (ii) notice of the amendment is sent to holders of outstanding options or SARs previously granted if the amendment is applicable to such options or SARs.

| 8 | Scotiabank |

ABOUT THE MEETING

Reference to SARs throughout the amending provisions

It is further proposed that the amending provisions be amended to also refer to SARs when referencing options throughout the amending provisions, as appropriate, as follows:

| a) | when shareholders must approve changes to the plan including: (i) a reduction in the exercise price of outstanding options or the base price of the outstanding SARs; (ii) an extension of an option or SAR expiry date; (iii) certain expansions of classes of eligible recipients of options or SARs; and (iv) an expansion of the transferability of options or SARs; and |

| b) | when the board can make changes to the plan without shareholder approval including, but not limited to: (i) terms, conditions and mechanics of granting stock option awards or SARs awards; and (ii) changes to vesting, exercise or early expiry of options or SARS. |

Both of these amendments to the bank’s stock option plan were approved by the board of directors on November 30, 2021, subject to shareholder approval and acceptance by the TSX and the NYSE. For the full text of the stock option plan, including the amendments to be approved by our shareholders, please visit scotiabank.com/annualmeeting.

Resolutions

To be effective, each of the amendment to increase the number of shares issuable under the stock option plan and the amendments to the amending provisions must be approved by a resolution passed by a majority of the votes cast by shareholders at the meeting.

The resolutions to be presented for consideration by shareholders at the meeting are as follows:

“Resolved that the amendment to The Bank of Nova Scotia’s stock option plan to provide that the number of common shares of The Bank of Nova Scotia issuable pursuant to the exercise of options under the bank’s stock option plan be increased by an additional 12,000,000 common shares, from 129,000,000 common shares to 141,000,000 common shares, is hereby approved.”

AND

“Resolved that the amendments to The Bank of Nova Scotia’s stock option plan to amend the amending provisions to:

| (i) | provide that the board may suspend, terminate or amend an existing option or Stock Appreciation Right (SAR) agreement subject to The Bank of Nova Scotia’s stock option plan as the board deems appropriate, and subject to certain conditions, and |

| (ii) | refer to SARs when referencing options, as appropriate, |

as described in the Management Proxy Circular of The Bank of Nova Scotia dated February 1, 2022, are hereby approved.”

| 6. SHAREHOLDER PROPOSALS

This year you will be asked to consider four proposals. You can read the proposals and how and why the board recommends voting in relation to each proposal in Section 5.

|

The board recommends you vote against the proposals | |

|

The deadline for submitting proposals to be considered at next year’s annual meeting is November 9, 2022. Proposals should be sent to the Corporate Secretary of The Bank of Nova Scotia, 44 King Street West, Toronto, Ontario, Canada M5H 1H1 or [email protected].

|

||

|

SHAREHOLDER APPROVAL

Each item being put to a vote requires the approval of a majority of votes cast in person or by proxy at the meeting. Directors are subject to our majority voting policy (see page 54).

You (or your proxyholder) can vote as you (or your proxyholder) wish on any other items of business properly brought before the meeting (or a reconvened meeting if there is an adjournment). As of the date of this circular, we are not aware of other matters that will be brought before the meeting.

Management does not contemplate that any nominated director will be unable to serve as a director. If, however, this does occur for any reason during or prior to the meeting, the individuals named in your proxy form or voting instruction form as your proxyholder can vote for another nominee at their discretion.

| ||

| Management proxy circular | 9 |

WHO CAN VOTE

| You are entitled to one vote per common share held on February 8, 2022, the record date.

Shares beneficially owned by the following entities and persons cannot be voted (except in circumstances approved by the Minister of Finance): • the Government of Canada or any of its agencies • the government of a province or any of its agencies • the government of a foreign country or any political subdivision of a foreign country or any of its agencies • any person who has acquired more than 10% of any class of shares of the bank.

Also, if a person, or an entity controlled by a person, beneficially owns shares that in total are more than 20% of the eligible votes that may be cast, that person or entity may not vote any of the shares (unless permitted by the Minister of Finance).

Our directors and officers are not aware of any person or entity who beneficially owns, directly or indirectly, or exercises control or direction over, more than 10% of any class of our outstanding shares, as of the record date.

HOW TO VOTE

You can vote in advance of the annual meeting, during the meeting or you can appoint someone to attend the meeting and vote your shares for you (called voting by proxy). How you vote depends on whether you are a registered or a beneficial shareholder. You are a beneficial shareholder if the shares you own are registered for you in the name of an intermediary such as a securities broker, trustee or financial institution. You are a registered shareholder if the shares you own are registered directly in your name with Computershare. If this is the case, your name will appear on a share certificate or a statement from a direct registration system confirming your shareholdings.

|

Outstanding

1,204,394,204 on

1,204,467,588 on

| |

| Beneficial shareholders |

Registered shareholders | |||||

|

|

Your intermediary has sent you a voting instruction form with this package. We may not have records of your shareholdings as a beneficial shareholder, so you must follow the instructions from your intermediary to vote.

|

|

We have sent you a proxy form with this package. A proxy is a document that can authorize someone else to attend the meeting and vote for you. | |||

|

Voting in advance of the annual meeting |

Complete the voting instruction form and return it to your intermediary.

Your intermediary may also allow you to do this online or by telephone.

You can either mark your voting instructions on the voting instruction form or you can appoint another person (called a proxyholder) to attend the annual meeting and vote your shares for you.

|

|

To vote online, follow the instructions on the proxy form.

Alternatively, you may complete the paper proxy form and return it to Computershare.

You can either mark your voting instructions on the proxy form or you can appoint another person (called a proxyholder) to attend the annual meeting and vote your shares for you. | |||

|

Voting at the annual meeting |

Beneficial shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the meeting in person or online, as applicable, but will be able to participate as a guest. This is because we and Computershare do not have a record of the beneficial shareholders of the bank, and, as a result, will have no knowledge of your shareholdings or entitlement to vote unless you appoint yourself as proxyholder.

If you are a beneficial shareholder and wish to vote at the meeting, you MUST appoint yourself as proxyholder by inserting your own name in the space provided on the voting instruction form sent to you and you MUST follow all the applicable instructions, including the deadline, provided by your intermediary. See “Appointment of a third party as proxy” and “How to attend the meeting” below. |

|

Registered shareholders may vote in person or online, as applicable, during the meeting, as further described below under “How to attend the meeting”.

Do not complete and return the proxy form in advance. | |||

| 10 | Scotiabank |

ABOUT THE MEETING

| Beneficial shareholders |

Registered shareholders | |||||

|

Returning the form |

The voting instruction form tells you how to return it to your intermediary.

Remember that your intermediary must receive your voting instructions in sufficient time to act on them, generally one day before the proxy deadline below.

Computershare must receive your voting instructions from your intermediary by no later than the proxy deadline, which is 9 a.m. (Eastern) on April 1, 2022. |

|

The enclosed proxy form tells you how to submit your voting instructions.

Computershare must receive your proxy, including any amended proxy, by no later than the proxy deadline which is 9 a.m. (Eastern) on April 1, 2022.

You may return your proxy in one of the following ways: • by mail, in the envelope provided • using the internet. Go to www.investorvote.com and follow the instructions online. | |||

|

Changing your vote |

If you have provided voting instructions to your intermediary and change your mind about how you want to vote, or you decide to attend and vote at the annual meeting, contact your intermediary to find out what to do.

If your intermediary gives you the option of using the internet to provide your voting instructions, you can also use the internet to change your instructions, as long as your intermediary receives the new instructions in enough time to act on them before the proxy deadline. Contact your intermediary to confirm the deadline. |

|

If you want to revoke your proxy, you must deliver a signed written notice specifying your instructions to one of the following: • our Corporate Secretary, by 5 p.m. (Eastern) on the last business day before the meeting (or any adjourned meeting reconvenes). Deliver to: The Bank of Nova Scotia Executive Offices, 44 King Street West, Toronto, Ontario, Canada M5H 1H1 Attention: Julie Walsh, Senior Vice President, Corporate Secretary and Chief Corporate Governance Officer, E-mail: [email protected] • David Noel, Regional Senior Vice President, Atlantic Region, by 5 p.m. (Eastern) on the last business day before the meeting (or any adjourned meeting reconvenes). Deliver to: The Bank of Nova Scotia Head Office, 1709 Hollis Street, Halifax, Nova Scotia, Canada B3J 1W1 • the Chairman of the meeting, before the meeting starts or any adjourned meeting reconvenes.

You can also revoke your proxy in any other way permitted by law. You can change your voting instructions by voting again using the internet. Your voting instructions must be received by Computershare by the proxy deadline noted above, or by voting at the meeting. | |||

| Management proxy circular | 11 |

| APPOINTMENT OF A THIRD PARTY AS PROXY

Your form of proxy or voting instruction form names Aaron Regent and Brian Porter, each a director of the bank, as your proxyholder. You may appoint anyone as your proxyholder to represent you at the meeting. Your proxyholder does not have to be a shareholder of the bank. Your proxyholder must attend the meeting and vote for you. Beneficial shareholders who wish to attend the meeting in person or online MUST appoint themselves as proxyholder.

Additional information for appointing a third party as proxy if attending the meeting online

Shareholders who wish to appoint someone other than the Scotiabank proxyholders as their proxyholder to attend and participate at the meeting online and vote their shares MUST submit their form of proxy or voting instruction form, as applicable, appointing that person as proxyholder AND register that proxyholder as described below. This includes beneficial shareholders who wish to appoint themselves as proxyholder to attend, participate or vote at the meeting. Registering your proxyholder is an additional step to be completed AFTER you have submitted your form of proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a user name that is required to vote at the meeting online.

Step 1: Submit your form of proxy or voting instruction form: To appoint someone other than the Scotiabank proxyholders as your proxyholder, insert that person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed before registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form.

If you are a beneficial shareholder and wish to vote during the meeting online, you MUST insert your own name in the space provided on the voting instruction form sent to you by your intermediary, follow all the applicable instructions provided by your intermediary AND register yourself as your proxyholder, as described below. By doing so, you are instructing your intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your intermediary. Please also see further instructions below under the heading “How to attend the meeting.”

If you are a beneficial shareholder located in the United States and wish to vote during the meeting online or, if permitted, appoint a third party as your proxyholder, in addition to the steps described below under “How to attend the meeting”, you MUST obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting instruction form sent to you or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Computershare. Requests for registration from beneficial shareholders located in the United States that wish to vote at the meeting online or, if permitted, appoint a third party as their proxyholder must be sent by e-mail or by courier to: [email protected] (if by e-mail), or Computershare, Attention: Proxy Dept., 8th Floor, 100 University Avenue, Toronto, ON M5J 2Y1, Canada (if by courier), and in both cases, must be labeled “Legal Proxy” and received no later than the voting deadline of 9 a.m. (Eastern) on April 1, 2022.

Step 2: Register your proxyholder: To register a third party proxyholder to attend the meeting online, shareholders must visit http://www.computershare.com/BNS by 9:00 a.m. (Eastern) on April 1, 2022 and provide Computershare with the required proxyholder contact information OR follow the instructions provided by your intermediary on your voting instruction form so that Computershare may provide the proxyholder with a user name via e-mail. Without a user name, proxyholders will not be able to vote at the meeting but will be able to participate as a guest.

Shareholders who wish to appoint a proxyholder to attend the meeting in person on their behalf are not required to complete this additional registration process.

HOW TO ATTEND THE MEETING

Scotiabank is holding the meeting at the Scotiabank Centre in downtown Toronto and offering a simultaneous live webcast of the event. Shareholders and their proxyholders will be able to choose to attend the meeting either in person or online. |

| 12 | Scotiabank |

ABOUT THE MEETING

|

Attending in person

The meeting will take place at the Scotiabank Centre on the second floor of Scotia Plaza at 40 King Street West in Toronto. In order to ensure the safety of the bank’s employees, shareholders and guests, all current COVID-19 regulations and guidance in place at the time of the meeting will be in effect on site. Please visit scotiabank.com/annualmeeting regularly for updates.

Attending online

A simultaneous webcast of the meeting will also be offered to allow shareholders to attend the meeting online, vote their shares and submit questions.

To join the webcast, log in online at https://web.lumiagm.com/455617216. You may log in up to one hour before the meeting starts. • Registered shareholders and duly appointed proxyholders should click “Login” and then enter their control number/user name (see below) and the password “bns2022” (case sensitive). OR • Guests, including beneficial shareholders who have not duly appointed themselves as proxyholder and who do not have a user name, click “Guest” and complete the online form. |

| Duly appointed proxyholders |

Registered shareholders | |||||

|

Control number/user name |

Computershare will provide the proxyholder with a user name by e-mail after the proxy voting deadline has passed and the proxyholder has been duly appointed AND registered as described previously in “Additional information for appointing a third party as proxy if attending the meeting online”. |

The control number located on the form of proxy or in the e-mail notification you received is your control number. | ||||

| If you attend the annual meeting online, it is important that you are connected to the internet at all times during the meeting in order to vote at the designated times. It is your responsibility to ensure connectivity for the duration of the meeting. You should allow ample time to check into the annual meeting and complete the related procedure. For additional information about attending the meeting online: • refer to our AGM user guide which will be available at scotiabank.com/annualmeeting • visit lumiglobal.com/faq, which provides frequently asked questions along with access to a live chat for technical support in the event of difficulties accessing the meeting online • contact Computershare at 1-877-982-8767 (Toll Free) or (514) 982-7555 (International) for general proxy matters or additional shareholder information and questions.

In the event of technical malfunction or other significant problem that disrupts the live webcast of the meeting, the Chairman of the meeting will continue the meeting in person, so long as a quorum of shareholders is represented at the meeting.

Although we are planning on also conducting the meeting in-person, the virtual meeting will be used as the sole method of participation in the event that COVID-19 restrictions in place at the time of the meeting prevent us from holding an in-person event. |

||

| VOTING AT THE MEETING Registered shareholders and duly appointed proxyholders can vote at the appropriate times during the meeting if they have not done so in advance of the meeting. Please see “Voting at the annual meeting” set out in the chart in the preceding section “How to vote” for details on how to vote at the meeting. Guests in attendance will not be able to vote at the meeting. |

||

| SUBMITTING QUESTIONS AT THE MEETING As in years past, the board and senior management will be available for questions from shareholders and duly appointed proxyholders. As part of our ongoing stakeholder engagement, questions may be submitted in advance of the meeting by contacting the Corporate Secretary by e-mail or mail at the contact information provided on the back cover. Questions submitted in advance must be received by 9:00 a.m. (Eastern) on April 4, 2022 to be included in the meeting.

Questions may also be asked by shareholders and duly appointed proxyholders at the meeting. It is recommended that shareholders and duly appointed proxyholders attending the meeting online submit their questions as soon as possible during the meeting so they can be addressed at the appropriate time. Shareholders and duly appointed proxyholders attending the meeting in person will also have the opportunity to ask questions.

As this is a shareholders’ meeting, only shareholders and duly appointed proxyholders may ask a question during the question period.

The board and senior management will answer questions relating to matters to be voted on before a vote is held on each matter, if applicable. General questions will be addressed at the end of the meeting during the question period. |

||

| Management proxy circular | 13 |

| To answer as many questions as possible, shareholders and duly appointed proxyholders are asked to be brief and concise and to address only one topic per question. Questions dealing with similar topics or issues may be grouped, summarized and addressed with one response. | ||

|

Shareholders who have submitted proposals for the meeting will have the opportunity to present their proposals at the appropriate time during the meeting.

The Chairman of the meeting reserves the right to refuse questions he deems irrelevant to the business of the meeting or otherwise inappropriate. The Chairman has broad authority to conduct the meeting in a manner that is fair to all shareholders and may exercise discretion in the order in which questions are asked and the amount of time devoted to any one question. Any questions that cannot be answered during the meeting and that have been properly put before the annual meeting will be posted online as soon as practical after the meeting and answered at scotiabank.com/annualmeeting. |

||

| HOW YOUR PROXYHOLDER WILL VOTE Your proxyholder must vote according to the instructions you provide on your proxy form or voting instruction form. For directors and the appointment of auditors, you may either vote for or withhold. For the advisory resolution on our approach to executive compensation you may vote for or against. For the amendments to the bank’s stock option plan, you may vote for or against. For shareholder proposals, you may vote for, against or abstain. If you do not specify how you want to vote, your proxyholder can vote your shares as they wish. Your proxyholder will also decide how to vote on any amendment or variation to any item of business in the notice of meeting or any new matters that are properly brought before the meeting, or any postponement or adjournment. |

||

| If you properly complete and return your proxy form or voting instruction form, but do not appoint a different proxyholder, and do not specify how you want to vote, Aaron Regent or Brian Porter will vote for you as follows: • for the election of the nominated directors to the board • for the appointment of the shareholders’ auditors • for the advisory resolution on our approach to executive compensation • for each of the amendments to the bank’s stock option plan • against the shareholder proposals.

CONFIDENTIALITY

To keep voting confidential, Computershare counts all proxies. Computershare only discusses proxies with us when legally necessary, when a shareholder clearly intends to communicate with management, or when there is a proxy contest.

QUORUM

A minimum of 25% of all eligible votes must be represented at the meeting for it to take place.

VOTING RESULTS

We will post the voting results (including details about the percentage of support received for each item of business) on our website and file them with securities regulators after the meeting.

RECEIVING SHAREHOLDER MATERIALS BY E-MAIL

Shareholders may sign up to receive shareholder materials by e-mail, including this circular, as follows: • Beneficial owners may go to www.proxyvote.com, use the control number provided on the voting instruction form and click on ‘Delivery Settings’ to enroll • Registered shareholders who hold share certificates or receive statements from a direct registration system may go to www.investorcentre.com and click on ‘Receive Documents Electronically’ to enroll.

QUESTIONS?

Please contact Computershare with any questions. See the back cover for their contact information. |

||

| 14 | Scotiabank |

ABOUT THE MEETING

| This year 13 directors are proposed for election to our board.

They each bring a range of skills, experience and knowledge to the table. As a group, they have been selected based on their integrity, collective skills and ability to contribute to the broad range of issues the board considers when overseeing our business and affairs. You can learn more about our expectations for directors and how the board functions beginning on page 28.

INDEPENDENCE

Twelve of our 13 (92%) directors are independent and have never served as an executive of the bank. Having an independent board is one of the ways we make sure the board is able to operate independently of management and make decisions in the best interests of Scotiabank. Brian Porter is the only non-independent director as the bank’s President and Chief Executive Officer (President and CEO).

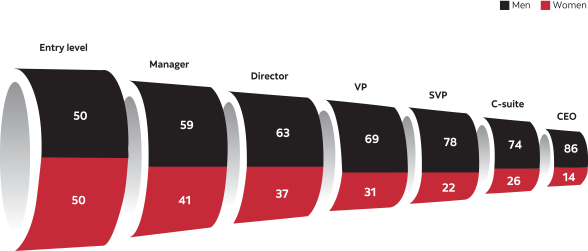

DIVERSITY

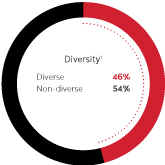

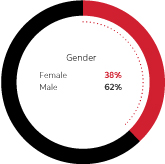

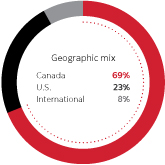

Each director has a wealth of experience in leadership and strategy development. We believe that an important part of board effectiveness includes the unique perspectives of our directors resulting from the combination and diversity of their experience, perspectives, gender/gender identity, age, sexual orientation, ethnicity, geographic background, and personal characteristics, along with membership within “designated groups” as defined in the Employment Equity Act (Canada), including women, visible minorities, Aboriginal peoples and persons with disabilities (read about our board diversity policy on page 50 and how our directors’ skills and experience are represented starting on page 16).

Key skills and experience

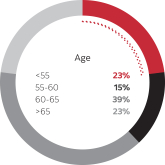

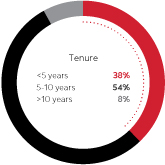

TENURE AND TERM LIMITS

Balancing the combination of longer serving directors with newer directors allows the board to have the insight of experience while also being exposed to fresh perspectives. Our average board tenure is 5 years (you can read more about tenure and term limits on page 53).

1 Diverse directors include those who have identified as women, members of visible minorities, Aboriginal peoples and persons with disabilities. Five of the nominated directors identify as women and one identifies as a member of a visible minority. |

|

| Management proxy circular | 15 |

DIRECTOR PROFILES

| Each director has provided the information about the Scotiabank shares they own or exercise control or direction over. This information and the details about the director deferred share units (DDSUs) they hold are as of October 29, 2021. The value of common shares and DDSUs is calculated using $81.14 (the closing price of our common shares on the TSX on October 29, 2021) for 2021 and $55.35 (the closing price of our common shares on the TSX on October 30, 2020) for 2020. The equity ownership requirement is five times the equity portion of the annual retainer ($725,000 for directors and $850,000 for the Chairman for both 2020 and 2021) and directors have five years to meet this requirement.

The attendance figures reflect the number of board and committee meetings held in fiscal 2021 and each nominee’s attendance for the time they served as a director or committee member. |

We have strengthened our director equity ownership requirements for fiscal

| |

Aaron W. Regent

Toronto, Ontario, Canada Age 56 | Director since Independent

2021 votes for: 92.4%

Not eligible for re-election in April 2028 |

Aaron Regent is Chairman of the Board of Scotiabank. He is the Founder, Chairman and Chief Executive Officer of Magris Performance Materials Inc., a leading North American based industrial minerals company. He was President and Chief Executive Officer of Barrick Gold Corporation from January 2009 to June 2012. Previously, Mr. Regent was Senior Managing Partner of Brookfield Asset Management and Co-Chief Executive Officer of the Brookfield Infrastructure Group, an asset management company, and President and Chief Executive Officer of Falconbridge Limited. Mr. Regent holds a B.A. from the University of Western Ontario and is a chartered accountant and a Fellow of CPA Ontario. |

| ||||||||||||||||||||||||||||||||||

|

KEY SKILLS & EXPERIENCE |

|

|||||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Environmental, social and governance (ESG) matters | Human resources and executive compensation | Risk management |

| |||||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 37 of 37/100% |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

Meeting attendance |

|

|

|

Committees | Meeting attendance | |||||||||||||||||||||||||||

|

Board |

|

11 of 11 / 100% |

|

|

Audit and conduct review |

|

|

5 of 5 / 100% |

| |||||||||||||||||||||||||||

| Corporate governance |

8 of 8 / 100% | |||||||||||||||||||||||||||||||||||

| Human capital and compensation |

7 of 7 / 100% | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Risk |

6 of 6 / 100% | ||||||||||||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||

| Year | |

Common shares |

|

DDSUs |

|

|

| |||||||||||||||||||||||||||||

|

|

2021 |

|

62,522 |

|

|

44,710 |

|

|

107,232 |

|

|

$3,627,769 |

|

|

$8,700,804 |

|

|

10.2 |

| |||||||||||||||||

|

|

2020 |

62,522 | 36,951 |

|

|

|

99,473 | $2,045,238 | $5,505,831 | 6.5 | ||||||||||||||||||||||||||

|

|

Change |

0 | 7,759 |

|

|

|

7,759 | $1,582,531 | $3,194,973 |

|

|

| ||||||||||||||||||||||||

|

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | |||||||||||||||||||||||||||||||||

|

|

Nutrien Ltd. (2018 – present) |

|

|

Audit | Human resources and compensation |

| |||||||||||||||||||||||||||||||

|

|

Potash Corporation of Saskatchewan Inc. (2015 – 2018) |

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

| 16 | Scotiabank |

ABOUT THE MEETING

|

Nora A. Aufreiter

Toronto, Ontario, Canada Age 62 | Director since 2014 Independent

2021 votes for: 92.6%

Not eligible for re-election in April 2030 |

Nora Aufreiter is a corporate director and a former senior partner of McKinsey and Company, an international consulting firm. Throughout her 27 year career at McKinsey, she held multiple leadership roles including Managing Director of McKinsey’s Toronto office, leader of the North American Digital and Omni Channel service line and was a member of the firm’s global personnel committees. She has worked extensively in Canada, the United States and internationally serving her clients in consumer-facing industries including retail, consumer and financial services, energy and the public sector. Ms. Aufreiter holds a B.A. (Honours) in business administration from the Ivey Business School at the University of Western Ontario and an M.B.A. from Harvard Business School. She was recognized in 2011 as one of “Canada’s Most Powerful Women: Top 100”. In June 2018, Ms. Aufreiter was awarded an Honorary Doctor of Laws at the University of Western Ontario. |

| ||||||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Environmental, social and governance (ESG) matters | Financial services | Human resources and executive compensation | Retail/consumer | Technology |

| |||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 26 of 26 / 100% |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

Meeting attendance |

|

|

|

Committees | Meeting attendance | |||||||||||||||||||||||||

|

Board |

|

|

11 of 11 / 100% |

|

|

|

|

|

Corporate governance (chair) |

|

|

8 of 8 / 100% 7 of 7 / 100% |

| |||||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||

| Year | |

Common shares |

|

DDSUs |

|

|

| |||||||||||||||||||||||||||

|

2021 |

|

3,200 |

|

|

21,953 |

|

|

25,153 |

|

|

$1,781,266 |

|

|

$2,040,914 |

|

|

2.8 |

| ||||||||||||||||

| 2020 |

3,200 | 17,647 |

|

|

|

20,847 | $976,761 | $1,153,881 | 1.6 | |||||||||||||||||||||||||

| Change |

0 | 4,306 |

|

|

|

4,306 | $804,505 | $877,033 |

|

|

| |||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

|

|

|

Current board committee memberships | |||||||||||||||||||||||||||||

|

MYT Netherlands Parent B.V. (Chair) |

|

|

Audit | Nominating, governance and compensation |

| ||||||||||||||||||||||||||||||

|

The Kroger Co. (2014 – present) |

|

|

|

|

|

Financial policy | Public responsibilities (chair) |

| |||||||||||||||||||||||||||

|

Guillermo E. Babatz

Mexico City, Mexico Age 53 | Director since 2014 Independent

2021 votes for: 93.0%

Not eligible for re-election in April 2029 |

Guillermo Babatz is the Managing Partner of Atik Capital, S.C., an advisory firm that specializes in structuring financial solutions for its clients. Previously, he was the Executive Chairman of Comisión Nacional Bancaria y de Valores in Mexico from July 2007 to December 2012. Mr. Babatz holds a B.A. (in economics) from the Instituto Tecnologico Autonomo de Mexico (ITAM) in Mexico City, and a Ph.D. (in economics) from Harvard University. |

| ||||||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Financial services | Public policy | Risk management |

| |||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 24 of 24 / 100% |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

Meeting attendance |

|

|

|

Committees | Meeting attendance | |||||||||||||||||||||||||

|

Board |

|

|

11 of 11 / 100% |

|

|

Human capital and compensation |

|

|

7 of 7 / 100% |

| ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Risk (chair) |

6 of 6 / 100% | |||||||||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||

| Year | |

Common shares |

|

DDSUs |

|

|

| |||||||||||||||||||||||||||

|

2021 |

|

2,500 |

|

|

18,935 |

|

|

21,435 |

|

|

$1,536,386 |

|

|

$1,739,236 |

|

|

2.4 |

| ||||||||||||||||

| 2020 |

2,500 | 15,403 |

|

|

|

17,903 | $852,556 | $990,931 | 1.4 | |||||||||||||||||||||||||

| Change |

0 | 3,532 |

|

|

|

3,532 | $683,830 | $748,305 |

|

|

| |||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

|

Fibra MTY, S.A.P.I. de C.V. (2015 – present) |

|

|

Corporate practices | Investment |

| ||||||||||||||||||||||||||||||

| Management proxy circular | 17 |

|

Scott B. Bonham

Atherton, California, U.S.A. Age 60 | Director since 2016 Independent

2021 votes for: 99.3%

Not eligible for re-election in April 2028

|

Scott Bonham is a corporate director and the co-founder of Intentional Capital, a privately-held real estate asset management company. From 2000 to 2015, he was co-founder of GGV Capital, an expansion stage venture capital firm with investments in the U.S. and China. Prior to GGV Capital, he served as Vice President of the Capital Group Companies, where he managed technology investments across several mutual funds from 1996 to 2000. Mr. Bonham has a B.Sc. (in electrical engineering) from Queen’s University and an M.B.A. from Harvard Business School. |

| ||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Environmental, social and governance (ESG) matters | Risk management | Technology |

| |||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 24 of 24/ 100% |

||||||||||||||||||||||||||||||

|

|

|

|

|

Meeting attendance |

|

|

|

Committees | Meeting attendance | |||||||||||||||||||||

|

Board |

|

|

11 of 11 / 100% |

|

|

|

|

|

Audit and conduct review |

|

5 of 5 / 100% 8 of 8 / 100% |

| ||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

Value of common shares and DDSUs | |

Total value as a multiple of equity ownership target |

| |||||||||||||

| Year | |

Common shares |

|

DDSUs |

|

|

| |||||||||||||||||||||||

|

2021 |

|

1,500 |

|

|

21,260 |

|

|

22,760 |

|

|

$1,725,036 |

|

$1,846,746 |

|

2.5 |

| ||||||||||||||

| 2020 |

1,500 | 17,430 |

|

|

|

18,930 | $964,751 | $1,047,776 | 1.4 | |||||||||||||||||||||

| Change |

0 | 3,830 |

|

|

|

3,830 | $760,285 | $798,970 |

|

|

| |||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

|

|

|

Current board committee memberships | |||||||||||||||||||||||||

|

Loblaw Companies Limited (2016 – present) |

|

|

|

|

|

Audit | Risk and compliance |

| |||||||||||||||||||||||

|

Magna International Inc. (2012 – 2021) |

|

|

|

|

|

|

| |||||||||||||||||||||||

|

Daniel (Don) H. Callahan

Fairfield, Connecticut, U.S.A. Age 65 | Director since June 2021 Independent

Not eligible for re-election in April 2034

Appointed to the board after the 2021 annual meeting |

Don Callahan is the Executive Chairman of TIME USA LLC, and a corporate director. From 2007 until his retirement in December 2018, Mr. Callahan held several officer roles at Citigroup, including most recently as Citigroup’s Chief Administrative Officer and Global Head of Operations, Technology and Shared Services. Prior to joining Citigroup, Mr. Callahan held various senior executive positions at Morgan Stanley and Credit Suisse. Earlier in his career, he spent 12 years at IBM, where he held a number of management positions, including Director of Strategy for IBM Japan. Mr. Callahan holds a Bachelor of Arts degree in history from Manhattanville College, where he serves as Trustee Chair Emeritus. | |||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

||||||||||||||||||||||||||

| Environmental, social and governance (ESG) matters | Financial services | Human resources and executive compensation | Risk management | Technology | ||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 9 of 9/ 100% |

||||||||||||||||||||||||||

|

|

|

|

|

Meeting attendance |

|

Committees | Meeting attendance | |||||||||||||||||||

|

Board |

|

|

4 of 4 / 100% |

|

|

|

Corporate governance |

3 of 3 / 100% 2 of 2 / 100% | ||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

Value of common shares and DDSUs | Total value as a multiple of equity ownership target | |||||||||||||

| Year |

|

Common shares |

|

DDSUs |

| |||||||||||||||||||||

|

2021 |

|

1,000 |

|

|

1,045 |

|

|

|

2,045 |

|

|

$84,791 |

|

$165,931 |

0.2 | |||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||

|

Tata Consultancy Services (2019 – present) |

|

|

|

|

|

|

|

|

Audit | Risk management | |||||||||||||||||

|

WEX Inc. (2019 – present) |

|

|

Leadership development and compensation (chair) | Technology | |||||||||||||||||||||||

|

Effective June 15, 2021, Mr. Callahan joined the corporate governance committee and the risk committee.

Mr. Callahan has until 2026 to meet his equity holding requirement. | ||||||||||||||||||||||||||

| 18 | Scotiabank |

ABOUT THE MEETING

|

Lynn K. Patterson

Toronto, Ontario, Canada Age 60 | Director since September 2020 Independent

2021 votes for: 99.8%

Not eligible for re-election in April 2033 |

Lynn Patterson is a corporate director and served as Deputy Governor of the Bank of Canada (“BoC”) from May 2014 until her retirement from the BoC in July 2019. In this capacity, she was one of two deputy governors responsible for overseeing the BoC’s analysis and activities promoting a stable and efficient financial system. Prior to this, Ms. Patterson served as Special Adviser to the Governor and Senior Representative (Financial Markets) at the BoC’s Toronto Regional Office. Previous to her time at the BoC, Ms. Patterson was President and Country Head for Bank of America Merrill Lynch Canada. She is a recipient of the Diamond Jubilee Medal as a builder and innovator in Canada’s investment industry. Ms. Patterson received an honours degree in Business Administration from the University of Western Ontario and is a Chartered Financial Analyst. |

| ||||||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

| |||||||||||||||||||||||||||||||||

| Capital markets | Financial services | Public policy | Risk management | Technology |

| |||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 22 of 22 / 100% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

11 of 11 / 100% | Audit and conduct review |

5 of 5 / 100% | |||||||||||||||||||||||||||||||

| Risk |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2021 |

10,659 | 3,719 | 14,378 | $301,760 | $1,166,631 | 1.6 | ||||||||||||||||||||||||||||

| 2020 |

4,364 | 691 | 5,055 | $38,247 | $279,794 | 0.4 | ||||||||||||||||||||||||||||

| Change |

|

6,295 |

|

|

3,028 |

|

|

9,323 |

|

|

$263,513 |

|

|

$886,837 |

|

|||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|