Form 6-K Arco Platform Ltd. For: Nov 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2021

Commission File Number: 001-38673

Arco Platform Ltd.

(Exact name of registrant as specified in its charter)

Rua Augusta 2840, 9th floor, suite 91

Consolação, São Paulo – SP

01412-100, Brazil

+55 (11) 3047-2655

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F |

X |

Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No |

X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No |

X |

TABLE OF CONTENTS

| EXHIBIT | |

| 99.1 | Press Release dated November 29, 2021 – Arco Reports Third Quarter 2021 Results. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Arco Platform Ltd. | |||||

| By: | /s/ Ari de Sá Cavalcante Neto | ||||

| Name: | Ari de Sá Cavalcante Neto | ||||

| Title: | Chief Executive Officer | ||||

Date: November 29, 2021

Exhibit 99.1

Arco Reports Third Quarter 2021 Results

Quarterly operating results still reflecting dropouts caused by COVID-19, as expected, while efficiency initiatives start to show positive results and commercial cycle for 2022 points to a strong growth recovery

São Paulo, Brazil, November 29, 2021 – Arco Platform Limited, or Arco or Company (Nasdaq: ARCE), today reported financial and operating results for the third quarter ended September 30, 2021.

“Operating results for the 3Q21 conclude the 2021 commercial cycle and we leave behind a challenging period not only for us, but for our partner schools, teachers, parents and students. As we look ahead, we are excited about the positive results achieved for the 2022 commercial cycle as schools normalize their operations, students go back to school, and we evolve our product for all stakeholders to have the best learning experience. The organic growth for our Core solutions for the 2022 commercial cycle returned to pre-pandemic levels, while average retention remained at high levels and average price increase was slightly above expected inflation for 2022. We are confident this strong recovery was possible because of our client-centric culture, and we are proud to have that reflected in the 2021 NPS for our Core brands, which increased to 84 (from 82 in 2020), with a particular focus on the Positivo brands. Supplemental solutions also experienced a strong acceleration from 2020 levels as schools became increasingly more interested in complementing the learning journey beyond the cognitive. As a result, we expect our consolidated ACV to grow between 27% and 29% organically, or 38% to 42% including M&A, and we are confident we will recognize Revenues in line with, or above, pre-pandemic levels ACV in 2022, as we see potential upside to our ACV guidance as partner schools gradually see their operations return to full capacity. Arco is also undergoing an important transformation as we begin to integrate our processes, reduce operational complexity, and improve profitability, which in turn will allow us to free up cash to reinvest in growth, quality, and our people. We believe 2022 will be a year of strong growth and increased efficiency, placing Arco’s rule of 40 (the idea that a software/SaaS company's combined growth rate and profit margin should be greater than 40%) above the 60% level.” said Ari de Sá Neto, CEO and founder of Arco.

Third Quarter 2021 Results

| · | Net revenue of R$183.3 million; |

| · | Gross profit of R$138.5 million; |

| · | Adjusted EBITDA of R$15.8 million; and |

| · | Adjusted net loss of R$ -12.0 million. |

Nine-months ended September 30 2021 Results

| · | Net Revenue of R$771.2 million; |

| · | Gross Profit of R$571.2 million; |

| · | Adjusted EBITDA of R$206.5 million; and |

| · | Adjusted Net Income of R$85.5 million. |

Key Messages

| · | Net revenues for the quarter were R$183.3 million, a 12% decrease year-over-year, representing a 16% revenue recognition of ACV bookings, impacted by historically weaker seasonality for the 3Q and dropouts caused by the COVID-19 pandemic in the 2021 school year. Core solutions totaled R$150.0 million (-7% YoY versus 3Q20), while Supplemental solutions were R$33.3 million (-31% YoY versus 3Q20). For the 9 months of 2021, net revenues were 9% higher year-over-year, at R$771.2 million, with Core solutions totaling R$614.7 million and Supplemental solutions increasing 73% to R$156.5 million. Arco concluded the 2021 cycle with net revenues of R$1,062 million, or R$1,057 million excluding businesses acquired in 2021, representing a 9% shortfall from the R$1,163 million ACV Bookings provided at the beginning of the year. |

| · | As a result of a top line impacted by the COVID-19 pandemic and consequent higher discard of undelivered and/or books in the quarter, gross margin was 76% in 3Q21 (versus 79% in 3Q20), resulting in a 9M21 gross margin of 74% (versus 78% for 9M20). |

| · | Our cost and expenses base were impacted by new businesses acquired over the last twelve months and therefore not consolidated into our financial statements for the same period last year (Escola da Inteligência, WPensar, Geekie, Studos, Me Salva!, Eduqo, Edupass). |

| · | Higher 3Q and 9M G&A reflect (i) expenses related to the new businesses (Escola da Inteligência, WPensar, Geekie, Studos, Me Salva!, Eduqo, Edupass), (ii) non-recurring third-party services related to these new businesses and mainly COC/Dom Bosco, and (iii) a fair value update related to Geekie’s SOP3 (management’s stock option plan). Excluding the impact of new these businesses, G&A contracted 21% YoY in 3Q and 17% YoY in 9M21. Excluding RSU expenses, G&A contracted 19% YoY in 3Q and 10% YoY in 9M, reflecting initial efforts towards increased efficiency. |

| 1) | Excluding depreciation & amortization. |

| 2) | Businesses acquired in the last twelve months and therefore not consolidated in the comparable period of last year (EI, Geekie, W Pensar, Studos, Me Salva!, Eduqo, Edupass, COC and Dom Bosco). |

| 3) | When Arco acquired Geekie in 2016, as part of the deal Arco acquired Geekie’s management future stake in Geekie, resulting from the exercise of their existing SOP. The fair value of SOP is calculated using the same valuation method as the accounts payable to selling shareholders for the acquisition of the remaining interest, resulting in the final transaction price, which are updated quarterly for Geekie’s most recent fair value, until its effective settlement in 2022. As a result of Geekie’s recent strong commercial performance, its updated fair value impacted both SOP and accounts payable to selling shareholders. |

| · | Higher 3Q and 9M Selling expenses reflect (i) expenses related to the new businesses, and (ii) the resumption of traveling and marketing events, which are key to our commercial strategy. Reduction in allowance for doubtful accounts reflects improved cash collection performance. Excluding the impact of new businesses, Selling expenses contracted 3% YoY in 3Q and |

increased 9% YoY in 9M21. Excluding allowance for doubtful accounts, Selling expenses increased 11% YoY in 3Q and 17% YoY in 9M to support Arco’s strong 2022 commercial cycle.

| 1) | Excluding depreciation & amortization. |

| 2) | Businesses acquired in the last twelve months and therefore not consolidated in the comparable period of last year (EI, Geekie, W Pensar, Studos, Me Salva!, Eduqo, Edupass, COC and Dom Bosco). |

| · | The quality of Arco’s receivables' profile and strong credit and collection process reduced the allowance for doubtful accounts back to historical levels in 3Q21. Throughout the COVID-19 pandemic outbreak, Arco supported its partner schools through the extension of payment terms. Delinquency also dropped, to 6.1% in 9M21 from 8.4% in 9M20 and coverage index increased to 20% from 18%, or to 25% from 19%, excluding receivables from transactions with no credit risk such as direct sales to parents using credit cards. |

| Allowance for doubtful accounts (R$ MM) | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Allowance for doubtful accounts | (6.0) | (15.7) | -61.8% | (6.7) | -10.2% |

| % of Revenues | -3.3% | -7.5% | 4.2 p.p. | -2.6% | -0.7 p.p. |

| Allowance for doubtful accounts adjusted for COVID impact¹ | (6.0) | (14.8) | -59.4% | (6.7) | -10.0% |

| % of Revenues | -3.3% | -7.1% | 3.8 p.p. | -2.6% | -0.7 p.p. |

| 1) | Calculated excluding COVID-19 impact on allowance for doubtful accounts to better reflect a normalized level of this line. |

| · | Adjusted EBITDA was R$15.8 million in 3Q21, 73% lower versus 3Q20 when Arco presented an atypically high ACV recognition due to the COVID-related shift in the school year and, therefore, in the recognition of revenue, and significantly lower travelling expenses leading to higher than usual margins for the 3Q in 2020. In addition, our commercial activities in 2020 were predominantly held remotely, while in the 2H21 our sales force has intensified its visits to schools and commercial events, which had a direct impact to selling expenses. A lower revenue recognition due to the impact of the second wave of COVID-19, together with investments in product evolution and in sales & marketing, led to an adjusted EBITDA margin of 8.6% in the quarter versus 27.6% in 3Q20. For the 9M21, adjusted EBITDA was R$206.5 million, resulting in a margin of 26.8% versus 36.2% for 9M20. Excluding M&As concluded this year, which are therefore not included in the margin guidance, margin was 27.3% for 9M21. |

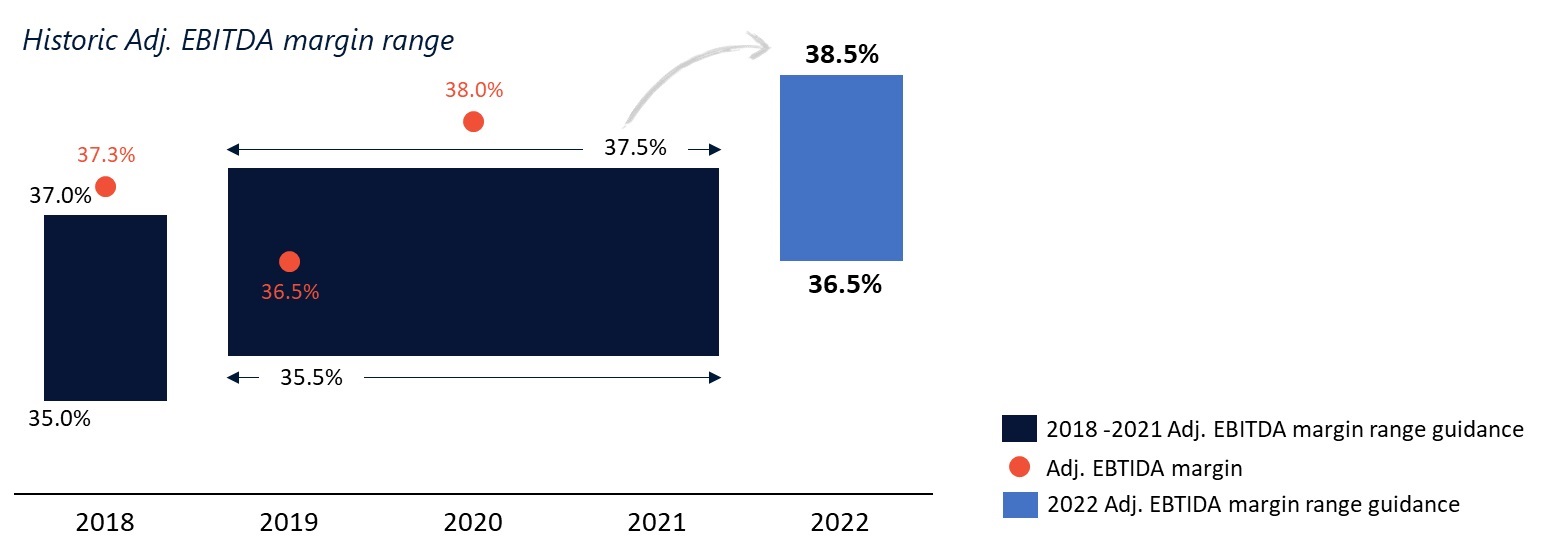

| · | As we approach the end of the year and gain more visibility in our P&L for the following months, we reinforce our adjusted EBITDA margin guidance for 2021 fiscal year of 35.5% to 37.5% and expect it to be closer to the bottom of the range, between 35.5% and 36.0%. Historically, Q4 is the best performing quarter for revenue recognition, delivering higher Adj. EBITDA margins. Additionally, 4Q21 will further benefit from initiatives that will deliver: (i) reduction in printing, freight & shipping costs as the new integrated logistics structure led to better terms negotiated with suppliers; (ii) revaluation of third party services in an integrated manner to increase synergies, and (iii) reduction in corporate personnel expenses as we start integrating some corporate areas of our solutions. |

| · | Free cash flow presented an 20% year-over-year increase to R$ 8.3 million in 3Q21, a significant improvement versus 3Q20, mainly due to the collection of trade receivables generated in previous quarters when we opted to assist our partner schools by extending payment terms. QoQ reduction follows historical seasonality, and the third quarter is historically the low point in cash collection from partner schools. |

| Free cash flow (R$ MM) | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Cash generated from operations | 74,137 | 68,934 | 8% | 113,157 | -34% |

| (-) Income tax paid | (19,167) | (26,392) | -27% | (4,529) | 323% |

| (-) Interest paid on lease liabilities | (918) | (476) | 93% | (743) | 24% |

| (-) Interest paid on investment acquisition | (1,031) | (47) | n/a | (70) | n/a |

| (-) Interest paid on loans and financing | (5,461) | (9,867) | -45% | (4,378) | 25% |

| (-) Payments for contingent consideration | - | - | n/a | (332) | n/a |

| Cash Flow from Operating Activities | 47,560 | 32,152 | 48% | 103,105 | -146% |

| (-) Acquisition of property, plant and equipment | (4,010) | (1,621) | 147% | (2,534) | 58% |

| (-) Acquisition of intangible assets | (35,190) | (23,589) | 49% | (36,842) | -4% |

| Free cash flow | 8,360 | 6,942 | 20% | 63,729 | -87% |

| · | The 20% sequential reduction in trade receivables reflects Arco’s business resilience and its capacity to collect from partner schools to whom we provided support through more flexible payment terms during the pandemic. |

| Trade Receivables - Aging (R$ MM) | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Neither past due nor impaired | 246.7 | 191.7 | 29% | 357.2 | -31% |

| 1 to 60 days | 34.8 | 42.7 | -19% | 36.9 | -6% |

| 61 to 90 days | 13.0 | 17.9 | -28% | 9.3 | 39% |

| 91 to 120 days | 10.7 | 14.0 | -23% | 7.1 | 52% |

| 121 to 180 days | 14.5 | 18.5 | -22% | 7.9 | 84% |

| More than 180 days | 62.7 | 33.6 | 87% | 59.3 | 6% |

| Trade receivables | 382.3 | 318.3 | 20% | 477.7 | -20% |

| Days of sales outstanding | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Trade receivables (R$ MM) | 382.3 | 318.3 | 20% | 477.7 | -20% |

| (-) Allowance for doubtful accounts | (77.1) | (57.8) | 34% | (71.3) | 8% |

| Trade receivables, net (R$ MM) | 305.1 | 260.6 | 17% | 406.4 | -25% |

| Net revenue LTM pro-forma1 | 1,073.2 | 1,078.5 | -1% | 1,122.7 | -4% |

| Adjusted DSO | 104 | 88 | 18% | 132 | -22% |

| 1) | Calculated as net revenues for the last twelve months added to the pro forma revenues from businesses acquired in the period to accurately reflect the Company’s operations. |

| · | The CAPEX observed in the 3Q21, reaching R$39.0 million, was mainly due to the increase of our content development capex, due to the final sprint to conclude 2022 content as deliveries begin in 4Q. Year-to-date, CAPEX represents 14.8% of net revenues, slightly above historical levels. |

| CAPEX (R$ MM)¹ | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Acquisition of intangible assets | 35.0 | 23.6 | 48% | 36.8 | -5% |

| Educational platform - content development | 13.4 | 11.2 | 20% | 8.1 | 66% |

| Educational platform - platforms and educational technology | 8.5 | 4.5 | 91% | 13.0 | -34% |

| Software | 10.5 | 5.4 | 96% | 13.7 | -23% |

| Copyrights and others | 2.5 | 2.6 | -2% | 2.1 | 21% |

| Acquisition of property, plant and equipment | 4.0 | 1.6 | 147% | 2.53 | 58% |

| TOTAL | 39.0 | 25.2 | 55% | 39.4 | -1% |

| 1) | Excluding the effect of business combinations. |

| · | Arco’s corporate restructuring is ongoing. On October 1st, we concluded the incorporation of Nave a Vela. We expect to incorporate the recently acquired COC/Dom Bosco (2022), followed by Escola em Movimento (2022), Pleno (2022) and Studos (2022). As we keep incorporating other businesses into CBE (Companhia Brasileira de Educação e Sistemas de Ensino, our wholly owned entity incorporating acquired businesses) we will be able to capture additional tax benefits and therefore further reduce our effective tax rate, currently at 17.3% for 9M21 (versus 27.6% for 9M20). |

| Intangible assets - net balances (R$ MM) | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Business Combination | 2,334.6 | 1,708.9 | 214% | 2,374.1 | 0% |

| Trademarks | 437.3 | 333.1 | 31% | 443.0 | -1% |

| Customer relationships | 261.4 | 176.1 | 48% | 266.8 | -2% |

| Educational system | 209.6 | 214.9 | -3% | 216.4 | -4% |

| Softwares | 11.4 | 6.8 | 51% | 7.3 | 42% |

| Educational platform | 5.7 | 13.2 | -47% | 6.0 | 18% |

| Others¹ | 16.4 | 15.9 | -4% | 15.9 | -4% |

| Goodwill | 1,392.8 | 948.9 | 47% | 1,418.7 | 2% |

| Operational | 206.5 | 122.1 | 69% | 193.0 | 7% |

| Educational platform² | 141.7 | 86.2 | 64% | 136.0 | 4% |

| Softwares | 53.0 | 25.2 | 110% | 45.3 | 17% |

| Copyrights | 11.8 | 10.5 | 13% | 11.7 | 1% |

| Customer relationships | 0.1 | 0.2 | -38% | 0.1 | -14% |

| TOTAL | 2,541.2 | 1,831.0 | 39% | 2,567.1 | 0% |

| Amortization of intangible assets (R$ MM) | 3Q21 | 3Q20 | YoY | 2Q21 | QoQ |

| Business Combination | (55.7) | (18.5) | 202% | (55.0) | 1% |

| Trademarks | (6.5) | (4.6) | 39% | (6.4) | 1% |

| Customer relationships | (8.6) | (6.1) | 40% | (8.5) | 1% |

| Educational system | (8.1) | (6.6) | 21% | (8.1) | 0% |

| Softwares | (0.9) | (0.5) | 81% | (0.6) | 42% |

| Educational platform | (0.3) | (0.2) | 104% | (0.2) | 74% |

| Others¹ | (1.3) | (0.4) | 216% | (1.2) | 18% |

| Goodwill | (30.1) | 0.0 | n/a | (30.1) | 0% |

| Operational | (22.8) | (12.0) | 90% | (20.6) | 23% |

| Educational platform² | (16.3) | (8.7) | 87% | (15.2) | 19% |

| Softwares | (4.5) | (1.5) | 194% | (3.4) | 54% |

| Copyrights | (2.0) | (1.7) | 17% | (2.1) | 0% |

| Customer relationships | (0.0) | (0.0) | 100% | (0.0) | 100% |

| TOTAL | (78.5) | (30.4) | 158% | (75.7) | 7% |

| 1) | Non-compete agreements and rights on contracts. |

| 2) | Includes content development in progress. |

Amortization of intangible assets (R$ MM) |

Impacts P&L |

Originates tax benefit | Amortizations with tax benefit in 3Q212 | ||

| Amortization | Tax benefit | Impact on net income | |||

| Business Combination | (45.7) | 15.5 | (30.1) | ||

| Trademarks | Yes | Yes² | (4.2) | 1.4 | (2.7) |

| Customer relationships | Yes | Yes² | (5.3) | 1.8 | (3.5) |

| Educational system | Yes | Yes² | (5.4) | 1.8 | (3.5) |

| Educational platform | Yes | Yes² | (0.2) | 0.1 | (0.1) |

| Others¹ | Yes | Yes² | (0.5) | 0.2 | (0.3) |

| Goodwill | No | Yes² | (30.1) | 10.2 | (19.9) |

| Operational | Yes | Yes | (22.8) | 7.8 | (15.1) |

| TOTAL | (68.5) | 23.3 | (45.2) | ||

| 1) | Non-compete agreements and rights on contracts. |

| 2) | Amortizations are tax deductible only after the incorporation of the acquired business. In 3Q21, 28% of the balance of the intangible assets from business combinations generates tax benefits. |

| Amortization of intangible assets from business combination that generate tax benefit - schedule (R$ MM) |

Businesses with current tax benefit (already incorporated) |

Undefined¹ | ||||

| 2021 | 2022 | 2023 | 2024 | 2025 + | ||

| Trademarks | 6.5 | 26.0 | 26.0 | 25.9 | 350.1 | 15.6 |

| Customer relationships | 8.6 | 33.2 | 32.9 | 32.8 | 153.9 | 26.6 |

| Educational system | 8.3 | 33.2 | 30.8 | 30.2 | 108.1 | 21.2 |

| Software | 1.7 | 6.8 | 5.7 | 4.3 | 6.9 | 16.9 |

| Others | 1.0 | 4.6 | 4.6 | 4.3 | 0.9 | 1.9 |

| Goodwill | 30.1 | 120.5 | 120.5 | 114.6 | 341.2 | 513.6 |

| Total | 56.2 | 223.2 | 220.6 | 212.0 | 961.2 | 595.8 |

| Maximum tax benefit | 19.1 | 75.9 | 75.0 | 72.1 | 326.8 | 202.6 |

| 1) | Businesses with future tax benefit (to be incorporated). |

| · | Arco raised R$900 million through the issuance of Debentures in August, with a 2-year term and bearing interest per annum at the CDI rate +1.7%. Arco’s cash and cash equivalent plus financial investments position of R$1,656 million is adequate to meet the obligations for the year of R$763 million in debt and accounts payable to selling shareholders. |

| 1) | Sum of cash and cash equivalents and short-term financial investment. |

| 2) | Accounts payable to selling shareholders do not include acquisitions announced still pending anti-trust approval or acquisitions closed after September 30, 2021. |

| · | We had a positive commercial cycle outcome for the 2022 school year, with a clear acceleration in the pace of organic growth versus 2020, because of the significant improvement in the COVID-19 pandemic scenario in Brazil. We are providing a 2022 ACV guidance range of R$1,475 million to R$1,515 million, which represents 38%-42% growth versus 2021 pro forma net revenues of R$1,069 million (2021 cycle net revenues of R$1,057 million plus annualized revenues of businesses acquired in 2021 of R$12 million), or 27%-29% organic growth. We are confident we will recognize Revenues in line with, or above, pre-pandemic levels ACV in 2022, as we see |

potential upside to our ACV guidance as partner schools gradually see their operations return to full capacity. This ACV guidance reflects (i) new student intake and upsell for Core and Supplemental solutions show strong growth YoY; (ii) Strong first year of structured cross-sell initiatives, increasing by 31% the number of schools in our core base that use at least one Supplemental solution; (iii) retention rates consistent with historical trends; (iv) once again healthy average price increase dynamics despite the macro; and (v) continuous focus on client satisfaction, translating into best-in-class NPS for our Core solutions (84 in 2021 versus 82 in 2020 and 71 in 2019), with a specific focus on the strong improvement of the Positivo brands.

* Percentage growth rates in chart represent the mid-point of the guidance rage.

| · | We are also providing an adjusted EBITDA margin range guidance for 2022 fiscal year of 36.5% to 38.5%, above the range provided for the past 3 years, reflecting Arco’s integration initiatives and corporate restructuring in place as Arco paves the way to become a portfolio hub of education solutions and a more efficient company in the years to come. Margin expansion drivers include (i) strategic sourcing, (ii) supply chain: printing costs & freight, (iii) IT systems optimization, (iv) corporate reorganization, (v) supplemental synergies, (vi) sales & operations planning, (vii) increased cooperation among core units, and (viii) technology integration. Our guidance includes all recently acquired businesses to date. When excluding operations still in their early cycle of maturation, such as Me Salva!, Eduqo, Edupass, which carry negative margins but higher growth (~260% YoY), our Adj. EBITDA margin for 2022 would be ~180bps higher. |

| · | Arco announced on November 18th, 2021, an US$150 million investment from Dragoneer and General Atlantic, through the purchase of convertible senior notes, subject to customary closing conditions (for transaction details please access https://investor.arcoplatform.com/press_releases/arco-announces-a-us150-million-investment-from-dragoneer-and-general-atlantic/). We believe this announcement reinforces Arco’s strategic growth plan for the coming years. In October, Arco finalized the acquisition of COC and Dom Bosco from Pearson, brands which serve over 800 partner schools and 210 thousand students. COC and Dom Bosco complement Arco’s existing portfolio in geography and price-point and expand their market leading position in K-12 core learning systems. Arco intends to use the proceeds from Dragoneer’s and General Atlantic’s investments to fund its growth strategy, including an emphasis on cross-selling portfolio brands and making accretive acquisitions in existing and new verticals. |

Conference Call Information

Arco will discuss its third quarter 2021 results today, November 29, 2021, via a conference call at 5 p.m. Eastern Time (7 p.m. Brasilia Time). To access the call, please dial: +1 (412) 717-9627, +1 (844) 204-8942, +55 (11) 4090-1621 or +55 (11) 4210-1803. An audio replay of the call will be available through December 5, 2021, by dialing +55 (11) 3193-1012 and entering access code 1608874#. A live and archived webcast of the call will be available on the Investor Relations section of the Company’s website at https://investor.arcoplatform.com/.

Information related to COVID-19 pandemic

As of September 30, 2021, there was a total net impact of R$1,419 thousand on the Company's condensed consolidated financial statements related to the COVID-19 pandemic mainly related to: (i) additional expenses of R$1,646 thousand related to health care in food and emotional health programs provided to the Company’s employees, and (ii) savings on rent concessions, in connection with leased buildings, as a direct consequence of the COVID-19 pandemic, amounting to R$217 thousand.

The Company assessed the existence of potential impairment indicators and the possible impacts on the key assumptions and projections caused by the pandemic on the recoverability of long-lived assets and concluded that there are no indications that demonstrate the need to recognize a provision for impairment of long-lived assets in the consolidated financial statements.

The future impact of the COVID-19 pandemic on an ongoing basis is still uncertain, and the Company’s management team will continue to closely monitor and assess the potential impacts it may have on the Company’s business, its financial performance and position.

For full disclosure regarding the COVID-19 discussion, please refer to the September 30, 2021, condensed consolidated financial statements submitted to the Securities and Exchange Commission on Form 6-K.

About Arco Platform Limited (Nasdaq: ARCE)

Arco has empowered hundreds of thousands of students to rewrite their futures through education. Our data-driven learning methodology, proprietary adaptable curriculum, interactive hybrid content, and high-quality pedagogical services allow students to personalize their learning experience while enabling schools to thrive.

Forward-Looking Statements

This press release contains forward-looking statements as pertains to Arco Platform Limited (the “Company”) within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, the Company’s expectations or predictions of future financial or business performance conditions. The achievement or success of the matters covered by statements herein involves substantial known and unknown risks, uncertainties, and assumptions, including with respect to the COVID-19 pandemic. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the Company’s results could differ materially from the results expressed or implied by the statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward looking statements are made based on the Company’s current expectations and projections relating to its financial conditions, result of operations, plans, objectives, future performance and business, and these statements are not guarantees of future performance.

Statements which herein address activities, events, conditions or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. You can generally identify forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “evaluate,” “expect,” “explore,” “forecast,” “guidance,” “intend,” “likely,” “may,” “might,” “outlook,” “plan,” “potential,” “predict,” “probable,” “project,” “seek,” “should,” “view,” or “will,” or the negative thereof or other variations thereon or comparable terminology. All statements other than statements of historical fact could be deemed forward looking, including risks and uncertainties related to statements about our competition; our ability to attract, upsell and retain customers; our ability to increase the price of our solutions; our ability to expand our sales and marketing capabilities; general market, political, economic, and business conditions in Brazil or abroad; and our financial targets which include revenue, share count and other IFRS measures, as well as non-IFRS financial measures including Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss), Adjusted Net Income (Loss) Margin, Taxable Income Reconciliation and Free Cash Flow.

Forward-looking statements represent the Company management’s beliefs and assumptions only as of the date such statements are made, and the Company undertakes no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

Further information on these and other factors that could affect the Company’s financial results is included in filings the Company makes with the Securities and Exchange Commission from time to time, including the section titled “Risk Factors” in the Company’s most recent Forms 20-F and 6-K. These documents are available on the SEC Filings section of the Investor Relations section of the Company’s website at: https://investor.arcoplatform.com/

Key Business Metrics

ACV Bookings: we define ACV Bookings as the revenue we would contractually expect to recognize from a partner school in each school year pursuant to the terms of our contract with such partner school, assuming no further additions or reductions in the number of enrolled students that will access our content at such partner school in such school year (we define “school year” for purposes of calculation of ACV Bookings as the twelve-month period starting in October of the previous year to September of the mentioned current year). We calculate ACV Bookings by multiplying the number of enrolled students at each partner school with the average ticket per student per year; the related number of enrolled students and average ticket per student per year are each calculated in accordance with the terms of each contract with the related partner school.

Non-GAAP Financial Measures

To supplement the Company's condensed consolidated financial statements, which are prepared and presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board—IASB, we use Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Net Income Margin, Free Cash Flow and Taxable Income Reconciliation which are non-GAAP financial measures.

We calculate Adjusted EBITDA as profit (loss) for the year (or period) plus/minus income taxes, plus/minus finance result, plus depreciation and amortization, plus/minus share of (profit) loss of equity-accounted investees, plus share-based compensation plan, restricted stock units and provision for payroll taxes (restricted stock units), plus M&A expenses, plus non-recurring expenses and plus effects related to COVID-19 pandemic. We calculate Adjusted EBITDA Margin as Adjusted EBITDA divided by Net Revenue.

We calculate Adjusted Net Income as profit (loss) for the year (or period), plus share-based compensation plan, restricted stock units and provision for payroll taxes (restricted stock units), plus amortization of intangible assets from business combinations (which refers to the amortization of the following intangible assets from business combinations: (i) rights on contracts, (ii) customer relationships, (iii) educational system, (iv) trademarks, (v) non-compete agreement (vi) software and (vii) educational platform resulting from acquisitions), plus/minus changes in fair value of derivative instruments (which refers to (i) changes in fair value of derivative instruments—finance income, and plus (ii) changes in fair value of derivative instruments—finance costs), plus/minus changes in accounts payable to selling shareholders, plus/minus share of (profit) loss of equity-accounted investees, plus/minus changes in current and deferred tax recognized in statements of income applied to all adjustments to net income, plus/minus foreign exchange gains/loss on cash and cash equivalents, plus interest expenses, net, plus M&A expenses, plus non-recurring expenses and plus effects related to COVID-19 pandemic. We calculate Adjusted Net Income Margin as Adjusted Net Income divided by Net Revenue.

We calculate Free Cash Flow as Net Cash Flows from Operating activities, less acquisition of property and equipment, less acquisition of intangible assets. We consider Free Cash Flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by operating activities and cash used for investments in property and equipment required to maintain and grow our business.

We calculate Taxable Income Reconciliation as profit (loss) for the year (or period) adjusted for permanent and temporary additions and exclusions (for example, adjustments to provisions and amortizations in the period) and for all tax benefits that Arco is entitled to (for example, goodwill). The effective tax rate will be the current taxes for the period divided by the taxable income. In Brazil, taxes are charged based on the taxable income, not the accounting income, which means companies can have an accounting loss and a taxable profit. Additionally, Arco owns several companies and taxes are calculated individually.

We understand that, although Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Net Income Margin, Free Cash Flow and Taxable Income Reconciliation are used by investors and securities analysts in their evaluation of companies, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under IFRS. Additionally, our calculations of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Net Income Margin, Free Cash Flow and Taxable Income Reconciliation may be different from the calculation used by other companies, including our competitors in the education services industry, and therefore, our measures may not be comparable to those of other companies.

Investor Relations Contact:

Arco Platform Limited

| Arco Platform Limited | ||||||||

| Consolidated Statements of Financial Position | ||||||||

| September 30, | December 31, | |||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | ||||||

| Assets | (unaudited) | |||||||

| Current assets | ||||||||

| Cash and cash equivalents | 1,322,334 | 424,410 | ||||||

| Financial investments | 333,166 | 712,645 | ||||||

| Trade receivables | 305,149 | 415,282 | ||||||

| Inventories | 99,692 | 74,076 | ||||||

| Recoverable taxes | 44,591 | 19,304 | ||||||

| Related parties | 4,481 | 9,970 | ||||||

| Other assets | 35,622 | 24,073 | ||||||

| Total current assets | 2,145,035 | 1,679,760 | ||||||

| Non-current assets | ||||||||

| Deferred income tax | 322,305 | 236,903 | ||||||

| Recoverable taxes | 1,122 | 1,121 | ||||||

| Financial investments | 38,434 | 10,349 | ||||||

| Related parties | 6,733 | 10,508 | ||||||

| Other assets | 41,365 | 22,239 | ||||||

| Investments and interests in other entities | 128,202 | 9,654 | ||||||

| Property and equipment | 27,335 | 26,087 | ||||||

| Right-of-use assets | 36,748 | 30,022 | ||||||

| Intangible assets | 2,541,254 | 2,549,637 | ||||||

| Total non-current assets | 3,143,498 | 2,896,520 | ||||||

| Total assets | 5,288,533 | 4,576,280 | ||||||

| September 30, | December 31, | |||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | ||||||

| Liabilities | (unaudited) | |||||||

| Current liabilities | ||||||||

| Trade payables | 70,674 | 40,925 | ||||||

| Labor and social obligations | 167,783 | 85,069 | ||||||

| Taxes and contributions payable | 3,974 | 9,676 | ||||||

| Income taxes payable | 33,274 | 44,731 | ||||||

| Advances from customers | 6,850 | 23,080 | ||||||

| Lease liabilities | 16,052 | 12,742 | ||||||

| Loans and financing | 305,305 | 107,706 | ||||||

| Accounts payable to selling shareholders | 775,464 | 656,014 | ||||||

| Other liabilities | 4,363 | 331 | ||||||

| Total current liabilities | 1,383,739 | 980,274 | ||||||

| Non-current liabilities | ||||||||

| Labor and social obligations | 346 | 36,570 | ||||||

| Lease liabilities | 27,502 | 22,478 | ||||||

| Loans and financing | 900,902 | 203,413 | ||||||

| Provision for legal proceedings | 2,066 | 1,366 | ||||||

| Accounts payable to selling shareholders | 1,033,318 | 1,130,501 | ||||||

| Other liabilities | 1,134 | 794 | ||||||

| Total non-current liabilities | 1,965,268 | 1,395,122 | ||||||

| Equity | ||||||||

| Share capital | 11 | 11 | ||||||

| Capital reserve | 2,203,167 | 2,200,645 | ||||||

| Treasury shares | (132,929 | ) | - | |||||

| Share-based compensation reserve | 102,134 | 80,817 | ||||||

| Accumulated losses | (232,857 | ) | (80,589 | ) | ||||

| Total equity | 1,939,526 | 2,200,884 | ||||||

| Total liabilities and equity | 5,288,533 | 4,576,280 | ||||||

| Arco Platform Limited | ||||||||||||||||

| Interim Condensed Consolidated Statements of Income | ||||||||||||||||

| Three months period ended September 30, | Nine months period ended September 30, | |||||||||||||||

| (In thousands of Brazilian reais, except earnings per share) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Net revenue | 183,267 | 208,730 | 771,240 | 705,173 | ||||||||||||

| Cost of sales | (44,766 | ) | (44,485 | ) | (199,994 | ) | (154,825 | ) | ||||||||

| Gross profit | 138,501 | 164,245 | 571,246 | 550,348 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling expenses | (114,982 | ) | (98,612 | ) | (353,367 | ) | (274,582 | ) | ||||||||

| General and administrative expenses | (109,867 | ) | (72,108 | ) | (246,161 | ) | (199,030 | ) | ||||||||

| Other income (expenses), net | 413 | 3,234 | 2,913 | 3,993 | ||||||||||||

| Operating profit (loss) | (85,935 | ) | (3,241 | ) | (25,369 | ) | 80,729 | |||||||||

| Finance income | 20,353 | 13,418 | 42,407 | 35,597 | ||||||||||||

| Finance costs | (124,947 | ) | (44,812 | ) | (209,239 | ) | (113,903 | ) | ||||||||

| Finance result | (104,594 | ) | (31,394 | ) | (166,832 | ) | (78,306 | ) | ||||||||

| Share of loss of equity-accounted investees | (5,575 | ) | (4,042 | ) | (8,326 | ) | (8,041 | ) | ||||||||

| Loss before income taxes | (196,104 | ) | (38,677 | ) | (200,527 | ) | (5,618 | ) | ||||||||

| Income taxes - income (expense) | ||||||||||||||||

| Current | (1,246 | ) | (14,218 | ) | (37,143 | ) | (68,841 | ) | ||||||||

| Deferred | 53,290 | 25,407 | 85,402 | 67,036 | ||||||||||||

| Total income taxes – income (expense) | 52,044 | 11,189 | 48,259 | (1,805 | ) | |||||||||||

| Loss for the period | (144,060 | ) | (27,488 | ) | (152,268 | ) | (7,423 | ) | ||||||||

| Basic earnings per share – in Brazilian reais | ||||||||||||||||

| Class A | (2.53 | ) | (0.49 | ) | (2.67 | ) | (0.13 | ) | ||||||||

| Class B | (2.53 | ) | (0.49 | ) | (2.67 | ) | (0.13 | ) | ||||||||

| Diluted earnings per share – in Brazilian reais | ||||||||||||||||

| Class A | (2.53 | ) | (0.49 | ) | (2.67 | ) | (0.13 | ) | ||||||||

| Class B | (2.53 | ) | (0.49 | ) | (2.67 | ) | (0.13 | ) | ||||||||

| Weighted-average shares used to compute net (loss) profit per share: | ||||||||||||||||

| Basic | 56,902 | 55,545 | 57,109 | 55,144 | ||||||||||||

| Diluted | 57,122 | 55,737 | 57,329 | 55,336 | ||||||||||||

| Arco Platform Limited | ||||||||||||||||

| Interim Condensed Consolidated Statements of Cash Flows | ||||||||||||||||

| Three months period ended September 30, | Nine months period ended September 30, | |||||||||||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Operating activities | ||||||||||||||||

| Loss before income taxes | (196,104 | ) | (38,677 | ) | (200,527 | ) | (5,618 | ) | ||||||||

| Adjustments to reconcile loss before income taxes | ||||||||||||||||

| Depreciation and amortization | 42,605 | 29,715 | 136,080 | 89,763 | ||||||||||||

| Inventory reserves | 5,579 | (305 | ) | 12,965 | 3,339 | |||||||||||

| Allowance for doubtful accounts | 5,987 | 15,679 | 16,486 | 28,233 | ||||||||||||

| Loss on sale/disposal of property and equipment and intangible assets disposed | 87 | 72 | 222 | 1,524 | ||||||||||||

| Fair value change in financial instruments from acquisition interests | - | 421 | - | (438 | ) | |||||||||||

| Changes in accounts payable to selling shareholders | 74,664 | 12,978 | 75,153 | 19,872 | ||||||||||||

| Share of loss of equity-accounted investees | 5,575 | 4,042 | 8,326 | 8,041 | ||||||||||||

| Share-based compensation plan | 41,760 | (2,339 | ) | 57,315 | 15,309 | |||||||||||

| Accrued interest | 11,705 | 9,077 | 20,610 | 16,052 | ||||||||||||

| Interest accretion on acquisition liability | 30,802 | 13,013 | 84,826 | 49,990 | ||||||||||||

| Income non-cash equivalents | (6,421 | ) | (4,200 | ) | (14,916 | ) | (9,856 | ) | ||||||||

| Interest on lease liabilities | 1,204 | 641 | 3,361 | 2,060 | ||||||||||||

| Provision for legal proceedings | 248 | - | 37 | 594 | ||||||||||||

| Provision for payroll taxes (restricted stock units) | 1,259 | (10,212 | ) | 2,686 | (1,166 | ) | ||||||||||

| Foreign exchange income | (1,945 | ) | (551 | ) | 2,147 | (371 | ) | |||||||||

| Changes in fair value of step acquisitions | - | (3,248 | ) | - | (3,248 | ) | ||||||||||

| Other financial cost/revenue, net | 1,792 | (811 | ) | (706 | ) | (1,849 | ) | |||||||||

| 18,797 | 25,295 | 204,065 | 212,231 | |||||||||||||

| Changes in assets and liabilities | ||||||||||||||||

| Trade receivables | 95,594 | 22,354 | 95,979 | 40,821 | ||||||||||||

| Inventories | (6,372 | ) | (489 | ) | (18,339 | ) | (8,052 | ) | ||||||||

| Recoverable taxes | (5,463 | ) | (514 | ) | (2,996 | ) | (4,818 | ) | ||||||||

| Other assets | (12,776 | ) | 11,582 | (21,231 | ) | (7,319 | ) | |||||||||

| Trade payables | 21,809 | (76 | ) | 29,034 | (3,791 | ) | ||||||||||

| Labor and social obligations | 1,069 | 29,210 | 11,325 | 44,832 | ||||||||||||

| Taxes and contributions payable | (1,388 | ) | 12,576 | (6,471 | ) | 9,797 | ||||||||||

| Advances from customers | (36,559 | ) | (31,099 | ) | (16,574 | ) | (20,273 | ) | ||||||||

| Other liabilities | (574 | ) | 95 | 1,730 | (887 | ) | ||||||||||

| Cash generated from operations | 74,137 | 68,934 | 276,522 | 262,541 | ||||||||||||

| Income taxes paid | (19,167 | ) | (26,392 | ) | (70,684 | ) | (90,412 | ) | ||||||||

| Interest paid on lease liabilities | (918 | ) | (476 | ) | (2,521 | ) | (1,186 | ) | ||||||||

| Interest paid on accounts payable to selling shareholders | (1,031 | ) | (47 | ) | (5,254 | ) | (47 | ) | ||||||||

| Interest paid on loans and financing | (5,461 | ) | (9,867 | ) | (13,406 | ) | (9,867 | ) | ||||||||

| Payments for contingent consideration | - | - | (332 | ) | (3,696 | ) | ||||||||||

| Net cash flows from operating activities | 47,560 | 32,152 | 184,325 | 157,333 | ||||||||||||

| Investing activities | ||||||||||||||||

| Acquisition of property and equipment | (4,010 | ) | (1,621 | ) | (9,542 | ) | (5,663 | ) | ||||||||

| Investments in unconsolidated entities | (53,538 | ) | (19,953 | ) | (126,760 | ) | (32,628 | ) | ||||||||

| Acquisition of subsidiaries, net of cash acquired | (15,839 | ) | (22,002 | ) | (31,056 | ) | (22,002 | ) | ||||||||

| Payment of accounts payable to selling shareholders | (8,449 | ) | - | (101,285 | ) | - | ||||||||||

| Acquisition of intangible assets | (35,190 | ) | (23,589 | ) | (104,733 | ) | (63,069 | ) | ||||||||

| Sale (purchase) of financial investments | 213,374 | (199,739 | ) | 366,309 | (322,141 | ) | ||||||||||

| Net cash flows used in investing activities | 96,348 | (266,904 | ) | (7,067 | ) | (445,503 | ) | |||||||||

| Financing activities | ||||||||||||||||

| Purchase of treasury shares | (25,069 | ) | - | (134,806 | ) | - | ||||||||||

| Capital increase proceeds from public offering | - | 591,898 | - | 591,898 | ||||||||||||

| Share issuance costs | - | (17,531 | ) | - | (17,531 | ) | ||||||||||

| Payment of lease liabilities | (4,245 | ) | (1,949 | ) | (10,599 | ) | (5,728 | ) | ||||||||

| Long term payments of accounts payable to selling shareholders | (13 | ) | 47 | (19,455 | ) | (954 | ) | |||||||||

| Loans and financing | 899,666 | 198,611 | 896,223 | 198,611 | ||||||||||||

| Loans and financing transaction costs | (8,550 | ) | (198,925 | ) | (8,550 | ) | (553 | ) | ||||||||

| Net cash flows from financing activities | 861,789 | 572,151 | 722,813 | 765,743 | ||||||||||||

| Foreign exchange effects on cash and cash equivalents | 1,945 | 551 | (2,147 | ) | 371 | |||||||||||

| Increase in cash and cash equivalents | 1,007,642 | 337,950 | 897,924 | 477,944 | ||||||||||||

| Cash and cash equivalents at the beginning of the period | 314,692 | 188,894 | 424,410 | 48,900 | ||||||||||||

| Cash and cash equivalents at the end of the period | 1,322,334 | 526,844 | 1,322,334 | 526,844 | ||||||||||||

| Increase in cash and cash equivalents | 1,007,642 | 337,950 | 897,924 | 477,944 |

| Arco Platform Limited | ||||||||||||||||

| Reconciliation of Non-GAAP Measures | ||||||||||||||||

| Three months period ended September 30, | Nine months period ended September 30, | |||||||||||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| Adjusted EBITDA Reconciliation | (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||

| Loss for the period | (144,060 | ) | (27,488 | ) | (152,268 | ) | (7,423 | ) | ||||||||

| (+/-) Income taxes | (52,044 | ) | (11,189 | ) | (48,259 | ) | 1,805 | |||||||||

| (+/-) Finance result | 104,594 | 31,394 | 166,832 | 78,306 | ||||||||||||

| (+) Depreciation and amortization | 42,605 | 29,715 | 136,080 | 89,763 | ||||||||||||

| (+) Share of loss of equity-accounted investees | 5,575 | 4,042 | 8,326 | 8,041 | ||||||||||||

| EBITDA | (43,330 | ) | 26,474 | 110,711 | 170,492 | |||||||||||

| (+) Share-based compensation plan, restricted stock units and provision for payroll taxes (restricted stock units). | 42,993 | 19,840 | 64,041 | 51,280 | ||||||||||||

| (+) M&A expenses | 14,353 | 1,697 | 22,203 | 5,688 | ||||||||||||

| (+) Non-recurring expenses | 1,242 | 6,694 | 7,800 | 16,752 | ||||||||||||

| (+) Effects related to Covid-19 pandemic | 544 | 2,922 | 1,696 | 10,915 | ||||||||||||

| Adjusted EBITDA | 15,802 | 57,627 | 206,451 | 255,127 | ||||||||||||

| Net Revenue | 183,267 | 208,730 | 771,240 | 705,173 | ||||||||||||

| EBITDA Margin | -23.6 | % | 12.7 | % | 14.4 | % | 24.2 | % | ||||||||

| Adjusted EBITDA Margin | 8.6 | % | 27.6 | % | 26.8 | % | 36.2 | % | ||||||||

| Three months period ended September 30, | Nine months period ended September 30, | |||||||||||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| Adjusted Net Income (Loss) Reconciliation | (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||

| Loss for the period | (144,060 | ) | (27,488 | ) | (152,268 | ) | (7,423 | ) | ||||||||

| (+) Share-based compensation plan, restricted stock units and provision for payroll taxes (restricted stock units). | 42,993 | 19,840 | 64,041 | 51,280 | ||||||||||||

| (+) Amortization of intangible assets from business combinations | 25,598 | 18,483 | 75,350 | 54,718 | ||||||||||||

| (+/-) Changes in fair value of derivative instruments | - | 421 | - | (438 | ) | |||||||||||

| (+/-) Changes in accounts payable to selling shareholders | 74,664 | 12,978 | 75,153 | 19,872 | ||||||||||||

| (+/-) Share of loss of equity-accounted investees | 5,575 | 4,042 | 8,326 | 8,041 | ||||||||||||

| (+/-) Tax effects | (61,738 | ) | (12,768 | ) | (103,793 | ) | (55,192 | ) | ||||||||

| (+/-) Foreign exchange on cash and cash equivalents | (1,945 | ) | (551 | ) | 2,147 | (371 | ) | |||||||||

| (+) Interest on acquisition of investments, net (linked to a fixed rate)¹ | 16,395 | 4,507 | 30,847 | 20,763 | ||||||||||||

| (+) Interest on acquisition of investments, net (adjusted by fair value)² | 14,407 | 8,006 | 53,979 | 28,246 | ||||||||||||

| (+) M&A expenses | 14,353 | 1,697 | 22,203 | 5,688 | ||||||||||||

| (+) Non-recurring expenses | 1,242 | 6,694 | 7,800 | 16,752 | ||||||||||||

| (+) Effects related to Covid-19 pandemic | 544 | 2,922 | 1,696 | 10,915 | ||||||||||||

| Adjusted Net Income (Loss) | (11,972 | ) | 38,783 | 85,481 | 152,851 | |||||||||||

| Net Revenue | 183,267 | 208,730 | 771,240 | 705,173 | ||||||||||||

| Adjusted Net Income (Loss) Margin | -6.5 | % | 18.6 | % | 11.1 | % | 21.7 | % | ||||||||

| 1) | Refer to interest expenses on liabilities related to business combinations and investments in associates that are linked to a fixed rate (CDI or SELIC). |

| 2) | Refer to interest expense on liabilities related to business combinations and investments in associates that are adjusted by the fair value of the acquired business. |

| Three months period ended September 30, | Nine months period ended September 30, | |||||||||||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| Free Cash Flow Reconciliation | (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||

| Cash generated from operations | 74,137 | 68,934 | 276,522 | 262,541 | ||||||||||||

| (-) Income tax paid | (19,167 | ) | (26,392 | ) | (70,684 | ) | (90,412 | ) | ||||||||

| (-) Interest paid on lease liabilities | (918 | ) | (476 | ) | (2,521 | ) | (1,186 | ) | ||||||||

| (-) Interest paid on investment acquisition | (1,031 | ) | (47 | ) | (5,254 | ) | (47 | ) | ||||||||

| (-) Interest paid on loans and financing | (5,461 | ) | (9,867 | ) | (13,406 | ) | (9,867 | ) | ||||||||

| (-) Payments for contingent consideration | - | - | (332 | ) | (3,696 | ) | ||||||||||

| Cash Flow from Operating Activities | 47,560 | 32,152 | 184,325 | 157,333 | ||||||||||||

| (-) Acquisition of property and equipment | (4,010 | ) | (1,621 | ) | (9,542 | ) | (5,663 | ) | ||||||||

| (-) Acquisition of intangible assets | (35,190 | ) | (23,589 | ) | (104,733 | ) | (63,069 | ) | ||||||||

| Free Cash Flow | 8,360 | 6,942 | 70,050 | 88,601 | ||||||||||||

| Three months period ended September 30, | Nine months period ended September 30, | |||||||||||||||

| (In thousands of Brazilian reais) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| Taxable Income Reconciliation | (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||

| Loss before income taxes | (196,104 | ) | (38,677 | ) | (200,527 | ) | (5,618 | ) | ||||||||

| (+) Share-based compensation plan, RSU and provision for payroll taxes¹ | 44,929 | (3,897 | ) | 53,965 | 21,879 | |||||||||||

| (+) Amortization of intangible assets from business combinations before incorporation¹ | 725 | (5,344 | ) | 10,485 | 34,205 | |||||||||||

| (+/-) Changes in accounts payable to selling shareholders¹ | 92,173 | 21,297 | 131,584 | 54,180 | ||||||||||||

| (+/-) Share of loss of equity-accounted investees | (1,896 | ) | (1,374 | ) | (2,831 | ) | (2,734 | ) | ||||||||

| (+) Net income from Arco Platform (Cayman) | 2,971 | 6,839 | 16,771 | 12,118 | ||||||||||||

| (+) Fiscal loss without deferred | 4,168 | 1,780 | 8,935 | 4,243 | ||||||||||||

| (+/-) Provisions booked in the period | (3,546 | ) | 16,427 | 9,781 | 41,025 | |||||||||||

| (+) Tax loss carryforward | 77,673 | 66,396 | 169,039 | 83,672 | ||||||||||||

| (+) Others | 9,349 | (1,405 | ) | 17,868 | 6,426 | |||||||||||

| Taxable income | 30,442 | 62,042 | 215,070 | 249,396 | ||||||||||||

| Current income tax under actual profit method | (10,350 | ) | (21,094 | ) | (73,123 | ) | (84,794 | ) | ||||||||

| % Tax rate under actual profit method | 34.0 | % | 34.0 | % | 34.0 | % | 34.0 | % | ||||||||

| (+) Effect of presumed profit benefit | - | (254 | ) | 3,266 | 4,675 | |||||||||||

| Effective current income tax | (10,350 | ) | (21,348 | ) | (69,857 | ) | (80,119 | ) | ||||||||

| % Effective tax rate | 34.0 | % | 34.4 | % | 32.5 | % | 32.1 | % | ||||||||

| (+) Recognition of tax-deductible amortization of goodwill and added value² | 10,867 | 7,434 | 32,802 | 9,279 | ||||||||||||

| (+/-) Other additions (exclusions) | (1,763 | ) | (304 | ) | (88 | ) | 1,999 | |||||||||

| Effective current income tax accounted for goodwill benefit | (1,246 | ) | (14,218 | ) | (37,143 | ) | (68,841 | ) | ||||||||

| % Effective tax rate accounting for goodwill benefit | 4.1 | % | 22.9 | % | 17.3 | % | 27.6 | % | ||||||||

| 1) | Temporary differences between the carrying amount of an asset or liability in the balance sheet and its tax base that will yield amounts that can be deducted in the future when determining taxable profit or loss, |

| 2) | Added value refers to the fair value of intangible assets from business combinations, |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 420 with CNW — Study Enumerates Therapeutic Effects, Quality of Life Benefits of Medical Cannabis

- Pinetree Capital Ltd Announces Unaudited Financial Results for the Period Ended March 31, 2024

- Blackwell 3D Acquires Operating Dubai LLC, Inches Closer to Project Readiness

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share