Form 6-K Anheuser-Busch InBev For: Jul 30

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

July 30, 2021

Commission File No.: 001-37911

Anheuser-Busch InBev SA/NV

(Translation of registrant’s name into English)

Belgium

(Jurisdiction of Incorporation )

Brouwerijplein 1

3000 Leuven, Belgium

(Address of principal executive offices )

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ✓ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No ✓

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 99.1 | Press release issued 29 July 2021 regarding second quarter and half year results. | |

| 99.2 | Unaudited Interim Report for the six-month period ended 30 June 2021. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ANHEUSER-BUSCH INBEV SA/NV (Registrant) | ||||||

| Dated: July 30, 2021 | By: | /s/ Jan Vandermeersch | ||||

| Name: Jan Vandermeersch | ||||||

| Title: Global Legal Director Corporate | ||||||

Exhibit 99.1

| Regulated and inside information1 |

Brussels / 29 July 2021 / 7.00am CET |

Anheuser-Busch InBev Reports Second Quarter 2021 Results

Continued momentum in 2Q21 with top-line growth ahead of pre-pandemic levels

“The consistent execution of our commercial strategy – centered around winning brands, category development and digital transformation – delivered continued momentum in the second quarter with top-line growth 3.2% ahead of 2Q19 pre-pandemic levels, even in light of ongoing COVID-19 impacts. Looking forward, we will continue to build upon our customer- and consumer-first approach to drive growth and value creation.” - Michel Doukeris, CEO

| ab-inbev.com |

|

Press release – 29 July 2021 – 1 |

1The enclosed information constitutes inside information as defined in Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, and regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

MANAGEMENT COMMENTS

Continued momentum in 2Q21 with top-line growth ahead of pre-pandemic levels

Our business continued its momentum in the second quarter. We delivered top-line growth of 3.2% versus 2Q19, even in the context of ongoing impacts related to COVID-19. We remain focused on investing in and accelerating what is already working: category development, premiumization, health and wellness, beyond beer and our digital transformation initiatives.

On a year-over-year basis we grew top-line by 27.6%, comprised of 20.8% volume and 5.8% revenue per hl growth, yielding a 31.0% EBITDA increase. Positive brand mix, revenue management initiatives, operational leverage and ongoing cost discipline were partially offset by anticipated transactional FX and commodity headwinds. Additionally, our SG&A increased due to higher variable compensation accruals, which are recorded by quarter at the zone level depending on operational performance, and growth in sales and marketing investments to support our top-line momentum.

Winning customer- and consumer-centric commercial strategy:

| ● | Reaching more consumers on more occasions with our best-in-class portfolio: |

| o | Leading, premiumizing and accelerating growth in the beer category: |

| ◾ | Driving innovation to meet customer and consumer needs: Based on the success of Brahma Duplo Malte in Brazil, which continues to lead the core pure malt segment, we have leveraged our ‘prove and move’ strategy to scale the concept in five new markets. |

| ◾ | Our premium portfolio grew by 28% in 2Q21 with our global brands – Budweiser, Stella Artois and Corona – delivering 19.3% revenue growth outside their home markets, where they typically command a price premium. |

| ◾ | Connecting with consumers through award-winning creative content: At the 2021 Cannes Lions festival we achieved our best performance ever, winning 40 Lions including four won by our internal creative agency, draftLine. |

| o | Adding profitable growth in Beyond Beer globally: Our Beyond Beer business continues to accelerate, growing revenue by 45% in 2Q21, and delivering an average gross profit per hl 20% higher than our traditional beer business. |

| ● | Creating new value from our ecosystem using data and technology: |

| o | Digitizing our relationships with our more than 6 million global customers: In 2Q21, our proprietary B2B platform, BEES, captured over 4.5 billion USD in gross merchandise value (GMV), growing more than 50% from 1Q21. In June 2021, our monthly active user base (MAU) reached more than 1.8 million users, more than 20% above March 2021. In our 7 initial focus markets (Dominican Republic, Brazil, Mexico, Colombia, Ecuador, Peru and South Africa), BEES has now achieved significant adoption within our customer base with 60% to 90% of our revenue digital. More information can be found at www.bees.com. |

| o | Leading the way in e-commerce beer sales: In HY21, our owned direct-to-consumer (DTC) e-commerce platforms grew revenue by more than 2x compared to the same period last year. In Brazil, Zé Delivery continued its exponential growth, delivering over 15 million orders in 2Q21, with total orders in HY21 more than all of last year. Based on this success, we continue to scale our courier platforms which are now available in ten of our markets. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 2 |

Optimizing capital allocation to drive long-term value creation

Maximizing long-term value creation drives how we balance our capital allocation priorities. In HY21, we continued to invest behind the organic growth of our business with over 5.7 billion USD in capex and sales and marketing, led by our investments in customer- and consumer-centric capabilities, innovation and digital transformation. Deleveraging to our optimal capital structure of around 2x remains our commitment. Our net debt to normalized EBITDA decreased from 4.8x at 31 December 2020 to 4.4x for the 12-month period ending 30 June 2021. We reduced our gross debt from 98.6 billion USD as of 31 December 2020 to 90.6 billion USD, while maintaining a strong liquidity position of approximately 16.9 billion USD, consisting of 10.1 billion USD available under our Sustainable-Linked Loan Revolving Credit Facility (SLL RCF) and 6.8 billion USD of cash.

Advancing sustainability around the world

Sustainability is core to our business strategy and a key driver of innovation. The appointment of Ezgi Barcenas as our dedicated Chief Sustainability Officer, reporting directly to the CEO, builds on a strong track record and reinforces our commitment to further accelerate a broader ESG agenda.

In line with our commitment to Smart Agriculture, we continue to innovate to support farmers around the world to be skilled, connected and financially empowered. We recently expanded the blockchain-enabled supply chain platform BanQu to Latin America, following its success across several of our markets in Africa. BanQu gives farmers and recyclers improved security in the delivery and payment process and creates a digital economic identity allowing greater access to formal financial services. It also provides us better visibility across our value chain.

Confident about the future of our business and the beer category

We are confident in the future growth prospects for our business and the resilience of the beer category. We will continue to invest behind a customer and consumer-centric commercial strategy that is backed by a best-in-class brand portfolio, innovation capabilities, and digital transformation. Combined with our fundamental strengths, which include our people, leadership across the world’s largest beer profit pools, exposure to fast-growing emerging markets, operational excellence and a culture of ownership, we have an unmatched platform to drive long-term value creation.

| ab-inbev.com |

|

Press release – 29 July 2021 – 3 |

2021 OUTLOOK

| (i) | Overall Performance: We expect our EBITDA to grow between 8-12% and our revenue to grow ahead of EBITDA from a healthy combination of volume and price. The outlook for FY21 reflects our current assessment of the scale and magnitude of the COVID-19 pandemic, which is subject to change as we continue to monitor ongoing developments. |

| (ii) | Net Finance Costs: We expect the average gross debt coupon in FY21 to be approximately 4.0%. Net pension interest expenses and accretion expenses including IFRS 16 adjustments (lease reporting) are expected to be in the range of 140 to 160 million USD per quarter, depending on currency fluctuations. Net finance costs will continue to be impacted by any gains and losses related to the hedging of our share-based payment programs. |

| (iii) | Effective Tax Rates (ETR): We expect the normalized ETR in FY21 to be in the range of 28% to 30%, excluding any gains and losses relating to the hedging of our share-based payment programs. The increase versus 2020 is due to factors including the phasing out of temporary COVID-19 measures and changes to tax attributes in some key markets. The ETR outlook does not consider the impact of potential future changes in legislation. |

| (iv) | Net Capital Expenditure: We expect net capital expenditure of between 4.5 and 5.0 billion USD in FY21 as we are increasing investments in innovation and other consumer-centric initiatives to fuel our momentum. |

| (v) | Debt: Approximately 49% of our gross debt is denominated in currencies other than the US dollar, primarily the Euro. Our optimal capital structure remains a net debt to EBITDA ratio of around 2x. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 4 |

| Figure 1. Consolidated performance (million USD) | ||||||||||||

|

2Q20 |

2Q21 |

Organic |

||||||||||

| growth | ||||||||||||

| Total Volumes (thousand hls) |

119 895 | 144 845 | 20.8% | |||||||||

| AB InBev own beer |

106 858 | 128 625 | 20.5% | |||||||||

|

Non-beer volumes |

12 194 | 15 299 | 23.2% | |||||||||

| Third party products |

842 | 921 | 30.4% | |||||||||

| Revenue |

10 294 | 13 539 | 27.6% | |||||||||

| Gross profit |

5 770 | 7 819 | 31.1% | |||||||||

| Gross margin |

56.1% | 57.8% | 152 bps | |||||||||

| Normalized EBITDA |

3 414 | 4 846 | 31.0% | |||||||||

| Normalized EBITDA margin |

33.2% | 35.8% | 88 bps | |||||||||

| Normalized EBIT |

2 297 | 3 655 | 44.8% | |||||||||

| Normalized EBIT margin |

22.3% | 27.0% | 302 bps | |||||||||

| Profit from continuing operations attributable to equity holders of AB InBev |

-1 580 | 1 862 | ||||||||||

| Profit attributable to equity holders of AB InBev |

351 | 1 862 | ||||||||||

| Normalized profit attributable to equity holders of AB InBev |

921 | 1 911 | ||||||||||

| Underlying profit attributable to equity holders of AB InBev |

790 | 1 512 | ||||||||||

| Earnings per share (USD) |

0.18 | 0.93 | ||||||||||

| Normalized earnings per share (USD) |

0.46 | 0.95 | ||||||||||

| Underlying earnings per share (USD) |

0.40 | 0.75 | ||||||||||

| HY20 | HY21 | Organic | ||||||||||

| growth | ||||||||||||

| Total Volumes (thousand hls) |

239 577 | 280 398 | 17.0% | |||||||||

| AB InBev own beer |

210 294 | 247 635 | 17.7% | |||||||||

|

Non-beer volumes |

27 577 | 31 243 | 12.6% | |||||||||

| Third party products |

1 706 | 1 519 | 2.8% | |||||||||

| Revenue |

21 298 | 25 832 | 22.4% | |||||||||

| Gross profit |

12 201 | 14 869 | 22.7% | |||||||||

| Gross margin |

57.3% | 57.6% | 12 bps | |||||||||

| Normalized EBITDA |

7 363 | 9 114 | 22.1% | |||||||||

| Normalized EBITDA margin |

34.6% | 35.3% | -7 bps | |||||||||

| Normalized EBIT |

5 102 | 6 768 | 30.5% | |||||||||

| Normalized EBIT margin |

24.0% | 26.2% | 159 bps | |||||||||

| Profit from continuing operations attributable to equity holders of AB InBev |

-3 955 | 2 458 | ||||||||||

| Profit attributable to equity holders of AB InBev |

-1 900 | 2 458 | ||||||||||

| Normalized profit attributable to equity holders of AB InBev |

76 | 2 924 | ||||||||||

| Underlying profit attributable to equity holders of AB InBev |

1 805 | 2 606 | ||||||||||

| Earnings per share (USD) |

-0.95 | 1.23 | ||||||||||

| Normalized earnings per share (USD) |

0.04 | 1.46 | ||||||||||

| Underlying earnings per share (USD) |

0.90 | 1.30 | ||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 5 |

| Figure 2. Volumes (thousand hls) | ||||||||||||||||||||||||

| 2Q20 | Scope | Organic | 2Q21 | Organic growth | ||||||||||||||||||||

| growth | Total Volume | Own beer volume | ||||||||||||||||||||||

| North America |

27 594 | 4 | 517 | 28 115 | 1.9% | 1.2% | ||||||||||||||||||

| Middle Americas |

21 921 | - | 12 994 | 34 916 | 59.3% | 70.3% | ||||||||||||||||||

| South America |

28 523 | -83 | 5 026 | 33 465 | 17.7% | 15.4% | ||||||||||||||||||

| EMEA |

15 464 | -62 | 7 473 | 22 875 | 48.5% | 50.7% | ||||||||||||||||||

| Asia Pacific |

26 264 | - | -1 060 | 25 205 | -4.0% | -4.2% | ||||||||||||||||||

| Global Export and Holding Companies |

128 | 156 | -15 | 269 | -5.2% | -21.1% | ||||||||||||||||||

| AB InBev Worldwide |

119 895 | 14 | 24 936 | 144 845 | 20.8% | 20.5% | ||||||||||||||||||

| HY20 | Scope | Organic | HY21 | Organic growth | ||||||||||||||||||||

| growth | Total Volume | Own beer volume | ||||||||||||||||||||||

| North America |

51 977 | 56 | 1 219 | 53 252 | 2.4% | 1.5% | ||||||||||||||||||

| Middle Americas |

51 858 | - | 16 122 | 67 980 | 31.1% | 36.2% | ||||||||||||||||||

| South America |

62 782 | -25 | 9 171 | 71 929 | 14.6% | 15.3% | ||||||||||||||||||

| EMEA |

33 551 | -113 | 7 102 | 40 540 | 21.2% | 23.4% | ||||||||||||||||||

| Asia Pacific |

39 045 | - | 7 036 | 46 081 | 18.0% | 18.1% | ||||||||||||||||||

| Global Export and Holding Companies |

364 | 124 | 128 | 615 | 26.3% | 13.7% | ||||||||||||||||||

| AB InBev Worldwide |

239 577 | 41 | 40 779 | 280 398 | 17.0% | 17.7% | ||||||||||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 6 |

KEY MARKET PERFORMANCES

United States: Consistent execution of our commercial strategy driving top-line growth though bottom-line impacted by elevated costs

| ● | Operating performance: |

| o | 2Q21: Total revenue grew by 6.8%. Our sales-to-wholesalers (STWs) grew by 2.2% and revenue per hl grew by 4.6%, due to ongoing premiumization and revenue management initiatives. Our STRs declined 1.4%, estimated to be below industry growth. EBITDA declined by 0.6%, as we continue to absorb cost headwinds related to a tighter supply chain while prioritizing service levels to our customers and consumers. |

| o | HY21: Total revenue grew by 6.1%. Our STWs grew by 2.5%, with revenue per hl growth of 3.5%. Our STRs declined by 1.1%. EBITDA grew by 0.3%. |

| ● | Commercial highlights: We continue to strengthen and premiumize our portfolio, rebalancing toward faster growing above core segments. Michelob ULTRA and our craft brands grew by double-digits yet again in 2Q21. Our seltzer portfolio, led by Bud Light Seltzer, grew by 28%, which is 2.7x the growth of the segment according to IRI and our canned cocktail brand Cutwater is growing by triple digits. |

Mexico: Double-digit top-line growth vs 2019

| ● | Operating performance: |

| o | 2Q21: Our business in Mexico continued its momentum, with top-line growth of more than 10% versus the same period in 2019, from a healthy combination of volume and revenue per hl. Year-over-year, we delivered significant top and bottom-line growth, as we cycled a two-month nationwide lockdown in 2Q20. EBITDA more than doubled versus the prior year, as top-line growth and consistent cost discipline were partially offset by transactional FX and commodity headwinds. |

| o | HY21: Top-line and EBITDA grew by strong double-digits, led by volume growth of over 30%. |

| ● | Commercial highlights: We continue to see healthy growth across all segments of our portfolio. Our above core brands delivered strong double-digit growth versus 2Q19, led by Modelo, Michelob Ultra and Stella Artois and we continued to expand our portfolio offering through Beyond Beer innovations, such as Michelob Ultra Seltzer. We completed our sixth wave of expansion into OXXO, with our brands now available in nearly 10 000 stores. We continued expanding our DTC business, opening our 10 000th Modelorama store in June, while reaching more consumers through our ModeloramaNow e-commerce platform. The digital transformation of our business is progressing rapidly, with orders through our BEES platform now comprising over 60% of our revenue. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 7 |

Colombia: Volumes ahead of 2019

| ● | Operating performance: |

| o | 2Q21: Our business in Colombia continued its momentum, even in the context of on-going COVID-19 restrictions. Our volumes in 2Q21 grew by mid-single digits versus the same period in 2019. Compared to 2Q20, volumes grew by over 50%, leading to revenue growth of nearly 70%, supported by a favorable comparable. EBITDA grew by over 80%, driven by top-line growth and operational leverage, partially offset by transactional FX and commodity headwinds. |

| o | HY21: Top-line and EBITDA grew by over 40%, led by strong double-digit volume growth. |

| ● | Commercial highlights: Our core brands, Aguila and Poker, grew by strong double-digits, enhanced by our recent innovation, Poker Pura Malta. Our international premium brands grew by over 40%, led by Corona and Budweiser and the continued expansion of Michelob Ultra. We continue to transform our business through technology, with our BEES platform now representing nearly 80% of our revenue. |

Brazil: Continued top-line momentum, though bottom-line impacted by anticipated cost headwinds

| ● | Operating performance: |

| o | 2Q21: Our business in Brazil continued its top-line momentum, delivering revenue growth of 28.6%. Our beer volumes once again outperformed the industry according to our estimates, growing by double-digits both versus 2Q20 and 2Q19. Revenue per hl increased by 11.2%, primarily due to revenue management initiatives and favorable brand mix. Non-beer volumes increased by 25.6%, supported by the gradual recovery of mobility. EBITDA declined by 10.9%, as top-line growth was offset by a higher cost of sales, driven by anticipated transactional FX and commodity headwinds, coupled with higher distribution expenses and sales and marketing investments. |

| o | HY21: Our volumes grew by 13.7%, with beer volumes up by 14.3% and non-beer volumes up by 12.0%. Revenue increased by 25.9%, with a revenue per hl growth of 10.7%. EBITDA grew by 8.2%. |

| ● | Commercial highlights: Our above core portfolio outperformed this quarter, driven by the sustained growth of our core plus brands, led by Brahma Duplo Malte, and approximately 35% growth of our premium and super premium brands, with particularly strong growth of Corona, Original and Beck’s. Innovations represented more than 20% of our total revenue for the fourth quarter in a row. We continue to advance our digital transformation agenda with our B2B and DTC initiatives. BEES now covers more than 70% of our active customers across the country and our DTC platform, Zé Delivery, fulfilled more than 15 million orders in 2Q21. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 8 |

Europe: Strength of our premium brands and gradual on-premise recovery driving top- and bottom-line growth

| ● | Operating performance: |

| o | 2Q21: Our business in Europe grew top-line by high teens with a healthy combination of low-teens volume growth and mid-single digit revenue per hl growth. The recovery was supported by the gradual re-opening of the on-premise and continued strength of the off-premise. Top-line momentum, along with improving channel mix and strong performance of our premium and super premium brands, drove a double-digit EBITDA increase. |

| o | HY21: Our revenue grew by high-single digits with mid-single digit volume growth powered by continued strong commercial performance of our premium and super premium brands. EBITDA increased by mid-teens. |

| ● | Commercial highlights: We are driving premiumization across Europe with our premium and super premium portfolio now making up over 50% of our revenue. Our Global brand portfolio continued to outperform and grew by mid-single digits in the quarter and HY21, with particularly strong performance of Corona and Stella Artois. We are supporting the on-premise channel and welcomed its reopening with the “Stella Tips” campaign in the UK and “Merci Horeca” campaign in Belgium. |

South Africa: Underlying consumer demand for our brands remains strong, though industry impacted by another alcohol ban

| ● | Operating performance: |

| o | 2Q21: Our business delivered significant top- and bottom-line growth as we cycled a favorable comparable from a government-mandated ban on alcohol sales through much of 2Q20. When allowed to trade, we have seen strong underlying consumer demand for our brands and we continue to adapt our business to navigate the challenging operating environment. However, a new alcohol ban was instituted on 28 June 2021 and lasted until 25 July 2021, impacting the last selling week of 2Q21 and the first month of 3Q21. |

| o | HY21: Volumes, revenue and EBITDA grew by strong double-digits. |

| ● | Commercial highlights: Our diverse portfolio of brands spanning styles and price points serves various consumer needs across different occasions. Strong demand and the power of our brands continues to benefit our core portfolio, particularly Carling Black Label. In the premium segment, we see ongoing healthy performance from our global brands, Corona and Stella Artois, and our flavored alcohol beverages, Brutal Fruit and Flying Fish. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 9 |

China: Ongoing premiumization driving top- and bottom-line growth

| ● | Operating performance: |

| o | 2Q21: Revenue grew by 4.7% with revenue per hl growth of 9.7%, driven by premiumization and supported by a favorable comparable. Our volumes outperformed the industry according to our estimates, declining by 4.6% as the category cycled a challenging comparable from the easing of COVID-19 restrictions in 2Q20. EBITDA grew by 5.9%. |

| o | HY21: Our volumes grew by 21.6% and revenue per hl grew by 9.6%, leading to total revenue growth of 33.3%. EBITDA grew by 55.1%. |

| ● | Commercial highlights: Our premium and super premium brands grew by double-digits in both volume and revenue, led by Budweiser. Innovations further accelerated our momentum in premiumization, including the expansion of Budweiser Supreme and successful launch of ME-X exclusively in the e-commerce channel. |

Highlights from our other markets

| ● | Canada: We grew revenue in 2Q21, driven by our premiumization strategy. Our above core beer brands and our Beyond Beer portfolio gained share, led by the double-digit growth of Bud Light Seltzer. We estimate our performance was in line with the industry, which had a volume decline in the quarter due to continued on-premise restrictions. |

| ● | Peru: Our business continues to recover, with volume and revenue growth of triple-digits, supported by a favorable comparable. We remain focused on strengthening our portfolio through premiumization and innovation and advancing the digital transformation of our business. Our global and local premium brands grew by strong double-digits and triple-digits, respectively. Our BEES platform is expanding, now making up close to 70% of our revenue. |

| ● | Ecuador: We delivered volume and revenue growth of strong double-digits, supported by a favorable comparable. As restrictions began to ease in June, we delivered our best monthly volume performance in the last 5 years, supported by enhancements to our portfolio and digital transformation, with over 90% of our revenue coming through BEES. |

| ● | Argentina: Our business in 2Q21 continued its commercial momentum. We grew both volume and net revenue per hl by double-digits, driven by the ongoing premiumization of our portfolio and revenue management initiatives in a highly inflationary environment. We continue to see our core plus and premium brands outperforming the overall portfolio both in 2Q21 and HY21. |

| ● | Africa excluding South Africa: Underlying consumer demand for our brands remains resilient in many of our markets, though the operating environment remains challenging due to ongoing COVID-19 related restrictions. We grew top-line ahead of pre-pandemic levels in the majority of our key markets, with double-digit beer volume growth versus 2Q19 in Nigeria, Mozambique and Zambia. |

| ● | South Korea: Led by the success of our recent innovations including ‘All New Cass’ and our new classic lager, HANMAC, we estimate our volumes outperformed the industry. Volumes declined by low single digits in 2Q21, impacted by ongoing COVID-19 restrictions. Revenue per hl grew low-single digits driven by positive brand and package mix. We achieved double-digit growth in the premium segment, led by Budweiser and Hoegaarden. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 10 |

CONSOLIDATED INCOME STATEMENT

| Figure 3. Consolidated income statement (million USD) | ||||||||||||

| 2Q20 | 2Q21 | Organic growth |

||||||||||

| Revenue |

10 294 | 13 539 | 27.6% | |||||||||

| Cost of sales |

-4 524 | -5 720 | -23.2% | |||||||||

| Gross profit |

5 770 | 7 819 | 31.1% | |||||||||

| SG&A |

-3 536 | -4 511 | -23.2% | |||||||||

| Other operating income/(expenses) |

63 | 347 | 85.5% | |||||||||

| Normalized profit from operations (normalized EBIT) |

2 297 | 3 655 | 44.8% | |||||||||

| Non-underlying items above EBIT |

-2 751 | -150 | ||||||||||

| Net finance income/(cost) |

-1 044 | -755 | ||||||||||

| Non-underlying net finance income/(cost) |

174 | 64 | ||||||||||

| Share of results of associates |

20 | 69 | ||||||||||

| Income tax expense |

-174 | -702 | ||||||||||

| Profit from continuing operations |

-1 478 | 2 182 | ||||||||||

| Discontinued operations results (underlying and non-underlying) |

1 930 | - | ||||||||||

| Profit |

452 | 2 182 | ||||||||||

| Profit attributable to non-controlling interest |

102 | 319 | ||||||||||

| Profit attributable to equity holders of AB InBev |

351 | 1 862 | ||||||||||

|

|

||||||||||||

| Normalized EBITDA |

3 414 | 4 846 | 31.0% | |||||||||

| Normalized profit attributable to equity holders of AB InBev |

921 | 1 911 | ||||||||||

| HY20 | HY21 | Organic growth |

||||||||||

| Revenue |

21 298 | 25 832 | 22.4% | |||||||||

| Cost of sales |

-9 097 | -10 963 | -22.0% | |||||||||

| Gross profit |

12 201 | 14 869 | 22.7% | |||||||||

| SG&A |

-7 257 | -8 571 | -17.8% | |||||||||

| Other operating income/(expenses) |

158 | 470 | 54.0% | |||||||||

| Normalized profit from operations (normalized EBIT) |

5 102 | 6 768 | 30.5% | |||||||||

| Non-underlying items above EBIT |

-2 796 | -217 | ||||||||||

| Net finance income/(cost) |

-4 204 | -2 047 | ||||||||||

| Non-underlying net finance income/(cost) |

-1 388 | -299 | ||||||||||

| Share of results of associates |

33 | 100 | ||||||||||

| Income tax expense |

-492 | -1 231 | ||||||||||

| Profit from continuing operations |

-3 744 | 3 074 | ||||||||||

| Discontinued operations results (underlying and non-underlying) |

2 055 | - | ||||||||||

| Profit |

-1 688 | 3 074 | ||||||||||

| Profit attributable to non-controlling interest |

211 | 616 | ||||||||||

| Profit attributable to equity holders of AB InBev |

-1 900 | 2 458 | ||||||||||

|

|

||||||||||||

| Normalized EBITDA |

7 363 | 9 114 | 22.1% | |||||||||

| Normalized profit attributable to equity holders of AB InBev |

76 | 2 924 | ||||||||||

Consolidated other operating income/(expenses) in the first six months of 2021 increased by 54.0% primarily driven by government grants in Brazil and China and lower other operating expenses in Europe. In the second quarter of 2021, Ambev recognized 226 million USD income in other operating income related to tax credits following a favorable decision from the Brazilian Supreme Court. The impact is presented as a scope change.

| ab-inbev.com |

|

Press release – 29 July 2021 – 11 |

Non-underlying items above EBIT

| Figure 4. Non-underlying items above EBIT from continuing and discontinued operations (million USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| COVID-19 costs |

-66 | -31 | -78 | -54 | ||||||||||||

| Restructuring |

-35 | -64 | -60 | -97 | ||||||||||||

| Business and asset disposal (including impairment losses) |

-149 | 24 | -154 | 14 | ||||||||||||

| Acquisition costs / Business combinations |

-2 | -6 | -4 | -6 | ||||||||||||

| SAB Zenzele Kabili costs |

- | -73 | - | -73 | ||||||||||||

| Impairment of Goodwill |

-2 500 | - | -2 500 | - | ||||||||||||

| Non-underlying in profit from operations |

-2 751 | -150 | -2 796 | -217 | ||||||||||||

| Gain on disposal of Australia (in discontinued operations results) |

1 919 | - | 1 919 | - | ||||||||||||

| Total non-underlying items in EBIT |

-832 | -150 | -877 | -217 | ||||||||||||

EBIT excludes negative non-underlying items of 150 million USD in 2Q21 and 217 million USD in HY21. This includes negative non-underlying items of 31 million USD in 2Q21 and 54 million USD in HY21 related to costs associated with COVID-19. These costs are mainly related to personal protective equipment for our colleagues and charitable donations.

In May 2021, we set up a new broad-based black economic empowerment (“B-BBEE”) scheme (the “Zenzele Kabili scheme”) and reported 73 million USD in non-underlying items mainly representing the IFRS 2 cost related to the grant of shares to qualifying retailers and employees participating to the Zenzele Kabili scheme.

Net finance income/(cost)

| Figure 5. Net finance income/(cost) (million USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Net interest expense |

-1 017 | -908 | -1 911 | -1 817 | ||||||||||||

| Net interest on net defined benefit liabilities |

-20 | -19 | -41 | -37 | ||||||||||||

| Accretion expense |

-133 | -142 | -291 | -265 | ||||||||||||

|

Mark-to-market |

131 | 441 | -1 724 | 348 | ||||||||||||

| Net interest income on Brazilian tax credits |

13 | 76 | 13 | 76 | ||||||||||||

| Other financial results |

-18 | -204 | -250 | -353 | ||||||||||||

| Net finance income/(cost) |

-1 044 | -755 | -4 204 | -2 047 | ||||||||||||

Net finance costs in HY21 were positively impacted by the mark-to-market gains on the hedging of our share-based payment programs. The number of shares covered by the hedging of our share-based payment programs, and the opening and closing share prices, are shown in figure 6 below.

| Figure 6. Share-based payment hedge | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Share price at the start of the period (Euro) |

40.47 | 53.75 | 72.71 | 57.01 | ||||||||||||

| Share price at the end of the period (Euro) |

43.87 | 60.81 | 43.87 | 60.81 | ||||||||||||

| Number of equity derivative instruments at the end of the period (millions) |

55.0 | 55.0 | 55.0 | 55.0 | ||||||||||||

Additionally, in 2Q21 our subsidiary Ambev recognized 76 million USD interest income following a favorable decision from the Brazilian Supreme Court related to tax credits.

| ab-inbev.com |

|

Press release – 29 July 2021 – 12 |

Non-underlying net finance income/(cost)

| Figure 7. Non-underlying net finance income/(cost) (million USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

|

Mark-to-market (Grupo Modelo deferred share instrument) |

62 | 183 | -729 | 144 | ||||||||||||

| Other mark-to-market |

61 | 177 | -709 | 139 | ||||||||||||

| Early termination fee of Bonds and Other |

51 | -295 | 50 | -582 | ||||||||||||

| Non-underlying net finance income/(cost) |

174 | 64 | -1 388 | -299 | ||||||||||||

Non-underlying net finance cost in HY21 includes mark-to-market gains on derivative instruments entered into to hedge the shares issued in relation to the Grupo Modelo and SAB combinations.

The number of shares covered by the hedging of the deferred share instrument and the restricted shares are shown in figure 8, together with the opening and closing share prices.

| Figure 8. Non-underlying equity derivative instruments | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Share price at the start of the period (Euro) |

40.47 | 53.75 | 72.71 | 57.01 | ||||||||||||

| Share price at the end of the period (Euro) |

43.87 | 60.81 | 43.87 | 60.81 | ||||||||||||

| Number of equity derivative instruments at the end of the period (millions) |

45.5 | 45.5 | 45.5 | 45.5 | ||||||||||||

Income tax expense

| Figure 9. Income tax expense (million USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Income tax expense |

174 | 702 | 492 | 1 231 | ||||||||||||

| Effective tax rate |

-13.1% | 24.9% | -15.0% | 29.3% | ||||||||||||

| Normalized effective tax rate |

16.8% | 25.6% | 66.6% | 27.3% | ||||||||||||

| Normalized effective tax rate before MTM |

18.8% | 30.2% | 22.8% | 29.5% | ||||||||||||

The increase in our normalized ETR excluding mark-to-market gains and losses linked to the hedging of our share-based payment programs in both 2Q21 and HY21 is primarily driven by country mix and reduced benefits of tax attributes.

| Figure 10. Normalized Profit attributable to equity holders of AB InBev (million USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Profit attributable to equity holders of AB InBev |

351 | 1 862 | -1 900 | 2 458 | ||||||||||||

| Non-underlying items, before taxes |

2 751 | 150 | 2 796 | 217 | ||||||||||||

| Non-underlying finance (income)/cost, before taxes |

-174 | -64 | 1 388 | 299 | ||||||||||||

| Non-underlying taxes |

-37 | -32 | -107 | -42 | ||||||||||||

| Non-underlying non-controlling interest |

-41 | -4 | -46 | -7 | ||||||||||||

| Profit from discontinued operations (underlying and non-underlying) |

-1 930 | - | -2 055 | - | ||||||||||||

| Normalized profit attributable to equity holders of AB InBev |

921 | 1 911 | 76 | 2 924 | ||||||||||||

| Underlying profit attributable to equity holders of AB InBev |

790 | 1 512 | 1 805 | 2 606 | ||||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 13 |

Basic, normalized and underlying EPS

| Figure 11. Earnings per share (USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Basic earnings per share |

0.18 | 0.93 | -0.95 | 1.23 | ||||||||||||

| Non-underlying items, before taxes |

1.38 | 0.07 | 1.40 | 0.11 | ||||||||||||

| Non-underlying finance (income)/cost, before taxes |

-0.09 | -0.03 | 0.70 | 0.15 | ||||||||||||

| Non-underlying taxes |

-0.02 | -0.02 | -0.05 | -0.02 | ||||||||||||

| Non-underlying non-controlling interest |

-0.02 | - | -0.02 | - | ||||||||||||

| Profit from discontinued operations (underlying and non-underlying) |

-0.97 | - | -1.03 | - | ||||||||||||

| Normalized earnings per share |

0.46 | 0.95 | 0.04 | 1.46 | ||||||||||||

| Underlying earnings per share |

0.40 | 0.75 | 0.90 | 1.30 | ||||||||||||

| Weighted average number of ordinary and restricted shares (million) |

1 995 | 2 004 | 1 995 | 2 004 | ||||||||||||

| Figure 12. Key components - Normalized Earnings per share in USD | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Normalized EBIT before hyperinflation |

1.16 | 1.82 | 2.58 | 3.39 | ||||||||||||

| Hyperinflation impacts in normalized EBIT |

-0.01 | - | -0.02 | -0.01 | ||||||||||||

| Normalized EBIT |

1.15 | 1.82 | 2.56 | 3.38 | ||||||||||||

|

Mark-to-market (share-based payment programs) |

0.07 | 0.22 | -0.86 | 0.17 | ||||||||||||

| Net finance cost |

-0.59 | -0.60 | -1.24 | -1.20 | ||||||||||||

| Income tax expense |

-0.11 | -0.37 | -0.30 | -0.64 | ||||||||||||

| Associates & non-controlling interest |

-0.06 | -0.13 | -0.11 | -0.26 | ||||||||||||

| Normalized EPS |

0.46 | 0.95 | 0.04 | 1.46 | ||||||||||||

|

Mark-to-market (share-based payment programs) |

-0.07 | -0.22 | 0.86 | -0.17 | ||||||||||||

| Hyperinflation impacts in EPS |

- | 0.02 | - | 0.02 | ||||||||||||

| Underlying EPS |

0.40 | 0.75 | 0.90 | 1.30 | ||||||||||||

| Weighted average number of ordinary and restricted shares (million) |

1 995 | 2 004 | 1 995 | 2 004 | ||||||||||||

Underlying profit attributable to equity holders and underlying EPS are positively impacted by 123 million USD after tax and non-controlling interest related to Ambev’s tax credits.

Reconciliation between profit attributable to equity holders and normalized EBITDA

| Figure 13. Reconciliation of normalized EBITDA to profit attributable to equity holders of AB InBev (million USD) | ||||||||||||||||

| 2Q20 | 2Q21 | HY20 | HY21 | |||||||||||||

| Profit attributable to equity holders of AB InBev |

351 | 1 862 | -1 900 | 2 458 | ||||||||||||

| Non-controlling interests |

102 | 319 | 211 | 616 | ||||||||||||

| Profit |

452 | 2 182 | -1 688 | 3 074 | ||||||||||||

| Discontinued operations results (underlying and non-underlying) |

-1 930 | - | -2 055 | - | ||||||||||||

| Profit from continuing operations |

-1 478 | 2 182 | -3 744 | 3 074 | ||||||||||||

| Income tax expense |

174 | 702 | 492 | 1 231 | ||||||||||||

| Share of result of associates |

-20 | -69 | -33 | -100 | ||||||||||||

| Net finance (income)/cost |

1 044 | 755 | 4 204 | 2 047 | ||||||||||||

| Non-underlying net finance (income)/cost |

-174 | -64 | 1 388 | 299 | ||||||||||||

| Non-underlying items above EBIT (incl. non-underlying impairment) |

2 751 | 150 | 2 796 | 217 | ||||||||||||

| Normalized EBIT |

2 297 | 3 655 | 5 102 | 6 768 | ||||||||||||

| Depreciation, amortization and impairment |

1 117 | 1 191 | 2 261 | 2 345 | ||||||||||||

| Normalized EBITDA |

3 414 | 4 846 | 7 363 | 9 114 | ||||||||||||

Normalized EBITDA and normalized EBIT are measures utilized by AB InBev to demonstrate the company’s underlying performance.

| ab-inbev.com |

|

Press release – 29 July 2021 – 14 |

Normalized EBITDA is calculated excluding the following effects from profit attributable to equity holders of AB InBev: (i) non-controlling interest; (ii) discontinued operations results; (iii) income tax expense; (iv) share of results of associates; (v) net finance cost; (vi) non-underlying net finance cost; (vii) non-underlying items above EBIT (including non-underlying impairment); and (viii) depreciation, amortization and impairment.

Normalized EBITDA and normalized EBIT are not accounting measures under IFRS accounting and should not be considered as an alternative to profit attributable to equity holders as a measure of operational performance, or an alternative to cash flow as a measure of liquidity. Normalized EBITDA and normalized EBIT do not have a standard calculation method and AB InBev’s definition of normalized EBITDA and normalized EBIT may not be comparable to that of other companies.

| ab-inbev.com |

|

Press release – 29 July 2021 – 15 |

Financial position

| Figure 14. Cash Flow Statement (million USD) | ||||||||

| HY20 | HY21 | |||||||

| Operating activities |

||||||||

| Profit from continuing operations |

-3 744 | 3 074 | ||||||

| Interest, taxes and non-cash items included in profit |

11 164 | 6 062 | ||||||

| Cash flow from operating activities before changes in working capital and use of provisions |

7 420 | 9 134 | ||||||

| Change in working capital |

-2 700 | -1 327 | ||||||

| Pension contributions and use of provisions |

-327 | -258 | ||||||

| Interest and taxes (paid)/received |

-3 388 | -3 696 | ||||||

| Dividends received |

30 | 86 | ||||||

| Cash flow from operating activities on Australia discontinued operations |

84 | - | ||||||

| Cash flow from operating activities |

1 119 | 3 939 | ||||||

| Investing activities |

||||||||

| Net capex |

-1 524 | -2 104 | ||||||

| Acquisition and sale of subsidiaries, net of cash acquired/disposed of |

-204 | -203 | ||||||

| Net proceeds from sale/(acquisition) of other assets |

-30 | 98 | ||||||

| Proceeds from Australia divestiture |

10 838 | - | ||||||

| Cash flow from investing activities on Australia discontinued operations |

-13 | - | ||||||

| Cash flow from investing activities |

9 067 | -2 209 | ||||||

| Financing activities |

||||||||

| Dividends paid |

-1 219 | -1 382 | ||||||

| Net (payments on)/proceeds from borrowings |

10 194 | -7 999 | ||||||

| Payment of lease liabilities |

-280 | -256 | ||||||

| Sale/(purchase) of non-controlling interests and other |

-457 | -470 | ||||||

| Cash flow from financing activities on Australia discontinued operations |

-6 | - | ||||||

| Cash flow from financing activities |

8 231 | -10 107 | ||||||

| Net increase/(decrease) in cash and cash equivalents |

18 416 | -8 377 | ||||||

HY21 recorded a decrease in cash and cash equivalents of (8 377) million USD compared to an increase of 18 416 million USD in HY20, with the following movements:

| • | Our cash flow from operating activities reached 3 939 million USD in HY21 compared to 1 119 million USD in HY20. The increase primarily results from higher profit and lower changes in working capital for the first six months of 2021 compared to the same period last year as our results for the first half of 2020 were negatively impacted by the COVID-19 pandemic. Changes in working capital in the first half of 2021 and 2020 reflect higher working capital levels at the end of June than at year-end as a result of seasonality. |

| • | Our cash outflow from investing activities was 2 209 million USD in HY21 compared to a cash inflow of 9 067 million USD in HY20. The decrease in the cash flow from investing activities was mainly due to the exceptional 10 838 million USD proceeds from the divestiture of the Australian business reported in the first six months of 2020 and higher net capital expenditures in the first six months of 2021 compared to the same period last year. |

| • | Our cash outflow from financing activities amounted to 10 107 million USD in HY21, as compared to a cash inflow of 8 231 million USD in HY20, mainly driven by lower proceeds from borrowings coupled with increased repayments of borrowing compared to the same period last year as we took significant actions in 2020 to maintain a strong liquidity position in light of the COVID-19 pandemic. |

| ab-inbev.com |

|

Press release – 29 July 2021 – 16 |

Our net debt increased to 83.4 billion USD as of 30 June 2021 from 82.7 billion USD at 31 December 2020.

Our net debt to normalized EBITDA ratio was 4.4x as of 30 June 2021. Our optimal capital structure is a net debt to normalized EBITDA ratio of around 2x. Deleveraging to around this level remains our commitment and we will prioritize debt repayment in order to meet this objective.

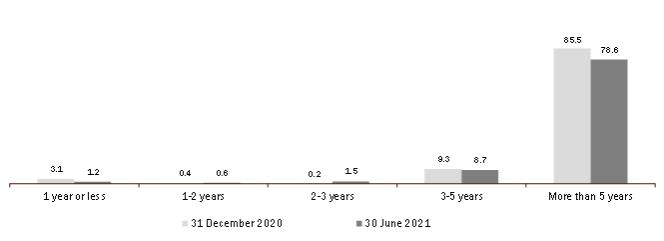

We will continue to proactively manage our debt portfolio. After redemptions in January and June 2021, 95% of our bond portfolio holds a fixed-interest rate, 49% is denominated in currencies other than USD and maturities are well-distributed across the next several years.

In addition to a very comfortable debt maturity profile and strong cash flow generation, as of 30 June 2021, we had total liquidity of 16.9 billion USD, which consisted of 10.1 billion USD available under committed long-term credit facilities and 6.8 billion USD of cash, cash equivalents and short-term investments in debt securities less bank overdrafts.

| Figure 15. Terms and debt repayment schedule as of 30 June 2021 (billion USD) |

| ab-inbev.com |

|

Press release – 29 July 2021 – 17 |

NOTES

To facilitate the understanding of AB InBev’s underlying performance, the analyses of growth, including all comments in this press release, unless otherwise indicated, are based on organic growth and normalized numbers. In other words, financials are analyzed eliminating the impact of changes in currencies on translation of foreign operations, and scope changes. Scope changes represent the impact of acquisitions and divestitures, the start or termination of activities or the transfer of activities between segments, curtailment gains and losses and year over year changes in accounting estimates and other assumptions that management does not consider as part of the underlying performance of the business. AB InBev has restated its 2019 results following the announcement of the agreement to divest Carlton & United Breweries (“the Australian operations”), its Australian subsidiary, to Asahi Group Holdings, Ltd. AB InBev is presenting the Australian operations prior to their disposal on 1 June 2020 as discontinued operations in a separate line of the consolidated income statement “profit from discontinued operations” in line with IFRS rules. As a result, all the presentations of AB InBev’s underlying performance and organic growth figures do not reflect the results of the Australian operations. All references per hectoliter (per hl) exclude US non-beer activities. References to the High End Company refer to a business unit made up of a portfolio of global, specialty and craft brands across more than 30 countries. Whenever presented in this document, all performance measures (EBITDA, EBIT, profit, tax rate, EPS) are presented on a “normalized” basis, which means they are presented before non-underlying items and discontinued operations. Non-underlying items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature. Normalized measures are additional measures used by management and should not replace the measures determined in accordance with IFRS as an indicator of the Company’s performance. We are reporting the results from Argentina applying hyperinflation accounting, starting from the 3Q18 results release in which we accounted for the hyperinflation impact for the first nine months of 2018. The IFRS rules (IAS 29) require us to restate the year-to-date results for the change in the general purchasing power of the local currency, using official indices before converting the local amounts at the closing rate of the period. These impacts are excluded from organic calculations and are identified separately in the annexes within the column labeled “Hyperinflation restatement”. In HY21, we reported a positive impact on the profit attributable to equity holders of AB InBev of 30 million USD or 0.02 USD normalized EPS in 2Q21 or HY21.Values in the figures and annexes may not add up, due to rounding. 2Q21 and HY21 EPS is based upon a weighted average of 2 004 million shares compared to a weighted average of 1 995 million shares for 2Q20 and HY20. Following a report on European Union (EU) issuers’ use of Alternative Performance Measures (i.e. non-IFRS measures, or “APMs”), issued by the European Securities and Markets Authority (ESMA) in December 2019, the company relabeled effective with the results announcement of the first quarter of 2021 in its disclosures “non-recurring” items to “non-underlying” items.

Legal disclaimer

This release contains “forward-looking statements”. These statements are based on the current expectations and views of future events and developments of the management of AB InBev and are naturally subject to uncertainty and changes in circumstances. The forward-looking statements contained in this release include, statements other than historical facts and include statements typically containing words such as “will”, “may”, “should”, “believe”, “intends”, “expects”, “anticipates”, “targets”, “estimates”, “likely”, “foresees” and words of similar import. All statements other than statements of historical facts are forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect the current views of the management of AB InBev, are subject to numerous risks and uncertainties about AB InBev and are dependent on many factors, some of which are outside of AB InBev’s control. There are important factors, risks and uncertainties that could cause actual outcomes and results to be materially different, including, but not limited to, the effects of the COVID-19 pandemic and uncertainties about its impact and duration and the risks and uncertainties relating to AB InBev described under Item 3.D of AB InBev’s Annual Report on Form 20-F filed with the SEC on 19 March 2021. Many of these risks and uncertainties are, and will be, exacerbated by the COVID-19 pandemic and any worsening of the global business and economic environment as a result. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements should be read in conjunction with the other cautionary statements that are included elsewhere, including AB InBev’s most recent Form 20-F and other reports furnished on Form 6-K, and any other documents that AB InBev has made public. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements and there can be no assurance that the actual results or developments anticipated by AB InBev will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, AB InBev or its business or operations. Except as required by law, AB InBev undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The second quarter 2021 (2Q21) and half year 2021 (HY21) financial data set out in Figure 1 (except for the volume information), Figures 3 to 5, 7, 9, 10 and 13 and 14 of this press release have been extracted from the group’s unaudited condensed consolidated interim financial statements as of and for the six months ended 30 June 2021, which have been reviewed by our statutory auditors PwC Réviseurs d’Entreprises SRL / PwC Bedrijfsrevisoren BV in accordance with the standards of the Public Company Accounting Oversight Board (United States). Financial data included in Figures 6, 8 11, 12 and 15 have been extracted from the underlying accounting records as of and for the six months ended 30 June 2021 (except for the volume information). References in this document to materials on our websites, such as www.bees.com, are included as an aid to their location and are not incorporated by reference into this document.

| ab-inbev.com |

|

Press release – 29 July 2021 – 18 |

CONFERENCE CALL AND WEBCAST

Investor Conference call and webcast on Thursday, 29 July 2021:

3.00pm Brussels / 2.00pm London / 9.00am New York

Registration details:

Webcast (listen-only mode):

AB InBev 2Q & HY21 Results Webcast

To join by phone, please use one of the following two phone numbers:

Toll-Free: 877-407-8029

Toll: 201-689-8029

| Investors | Media | |

| Shaun Fullalove | Ingvild Van Lysebetten | |

| Tel: +1 212 573 9287 |

Tel: +32 16 276 608 | |

| E-mail: [email protected] |

E-mail: [email protected] | |

| Maria Glukhova | Fallon Buckelew | |

| Tel: +32 16 276 888 |

Tel: +1 310 592 6319 | |

| E-mail: [email protected] |

E-mail: [email protected] | |

| Jency John | ||

| Tel: +1 646 746 9673 | ||

| E-mail: [email protected] | ||

About Anheuser-Busch InBev

Anheuser-Busch InBev is a publicly traded company (Euronext: ABI) based in Leuven, Belgium, with secondary listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH) stock exchanges and with American Depositary Receipts on the New York Stock Exchange (NYSE: BUD). Our Dream is to bring people together for a better world. Beer, the original social network, has been bringing people together for thousands of years. We are committed to building great brands that stand the test of time and to brewing the best beers using the finest natural ingredients. Our diverse portfolio of well over 500 beer brands includes global brands Budweiser®, Corona® and Stella Artois®; multi-country brands Beck’s®, Hoegaarden®, Leffe® and Michelob ULTRA®; and local champions such as Aguila®, Antarctica®, Bud Light®, Brahma®, Cass®, Castle®, Castle Lite®, Cristal®, Harbin®, Jupiler®, Modelo Especial®, Quilmes®, Victoria®, Sedrin®, and Skol®. Our brewing heritage dates back more than 600 years, spanning continents and generations. From our European roots at the Den Hoorn brewery in Leuven, Belgium. To the pioneering spirit of the Anheuser & Co brewery in St. Louis, US. To the creation of the Castle Brewery in South Africa during the Johannesburg gold rush. To Bohemia, the first brewery in Brazil. Geographically diversified with a balanced exposure to developed and developing markets, we leverage the collective strengths of approximately 164,000 colleagues based in nearly 50 countries worldwide. For 2020, AB InBev’s reported revenue was 46.9 billion USD (excluding JVs and associates).

| ab-inbev.com |

|

Press release – 29 July 2021 – 19 |

Annex 1

| AB InBev Worldwide | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

119 895 | 14 | - | - | 24 936 | 144 845 | 20.8% | |||||||||||||||||||||

| of which AB InBev own beer |

106 858 | -76 | - | - | 21 843 | 128 625 | 20.5% | |||||||||||||||||||||

| Revenue |

10 294 | -29 | 414 | 32 | 2 828 | 13 539 | 27.6% | |||||||||||||||||||||

| Cost of sales |

-4 524 | 18 | -159 | -11 | -1 042 | -5 720 | -23.2% | |||||||||||||||||||||

| Gross profit |

5 770 | -12 | 255 | 21 | 1 785 | 7 819 | 31.1% | |||||||||||||||||||||

| SG&A |

-3 536 | -3 | -148 | -8 | -815 | -4 511 | -23.2% | |||||||||||||||||||||

| Other operating income/(expenses) |

63 | 226 | 5 | -4 | 56 | 347 | 85.5% | |||||||||||||||||||||

| Normalized EBIT |

2 297 | 211 | 112 | 9 | 1 026 | 3 655 | 44.8% | |||||||||||||||||||||

| Normalized EBITDA |

3 414 | 213 | 154 | 9 | 1 056 | 4 846 | 31.0% | |||||||||||||||||||||

| Normalized EBITDA margin |

33.2% | 35.8% | 88 bps | |||||||||||||||||||||||||

| North America | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

27 594 | 4 | - | - | 517 | 28 115 | 1.9% | |||||||||||||||||||||

| Revenue |

3 979 | -11 | 68 | - | 252 | 4 289 | 6.4% | |||||||||||||||||||||

| Cost of sales |

-1 488 | 18 | -23 | - | -135 | -1 628 | -9.3% | |||||||||||||||||||||

| Gross profit |

2 491 | 7 | 45 | - | 117 | 2 661 | 4.7% | |||||||||||||||||||||

| SG&A |

-1 072 | -26 | -23 | - | -137 | -1 257 | -12.7% | |||||||||||||||||||||

| Other operating income/(expenses) |

-3 | - | - | - | 12 | 9 | 385.0% | |||||||||||||||||||||

| Normalized EBIT |

1 416 | -18 | 22 | - | -8 | 1 413 | -0.6% | |||||||||||||||||||||

| Normalized EBITDA |

1 616 | -16 | 26 | - | -15 | 1 611 | -0.9% | |||||||||||||||||||||

| Normalized EBITDA margin |

40.6% | 37.6% | -281 bps | |||||||||||||||||||||||||

| Middle Americas | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

21 921 | - | - | - | 12 994 | 34 916 | 59.3% | |||||||||||||||||||||

| Revenue |

1 664 | - | 59 | - | 1 330 | 3 053 | 79.9% | |||||||||||||||||||||

| Cost of sales |

-632 | - | -23 | - | -419 | -1 074 | -66.4% | |||||||||||||||||||||

| Gross profit |

1 032 | - | 37 | - | 911 | 1 979 | 88.2% | |||||||||||||||||||||

| SG&A |

-557 | -1 | -20 | - | -231 | -809 | -41.4% | |||||||||||||||||||||

| Other operating income/(expenses) |

-2 | - | - | - | 3 | 1 | 118.9% | |||||||||||||||||||||

| Normalized EBIT |

472 | - | 17 | - | 682 | 1 171 | 144.5% | |||||||||||||||||||||

| Normalized EBITDA |

712 | - | 27 | - | 716 | 1 454 | 100.6% | |||||||||||||||||||||

| Normalized EBITDA margin |

42.8% | 47.6% | 490 bps | |||||||||||||||||||||||||

| South America | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

28 523 | -83 | - | - | 5 026 | 33 465 | 17.7% | |||||||||||||||||||||

| Revenue |

1 428 | -25 | -109 | 32 | 573 | 1 898 | 40.6% | |||||||||||||||||||||

| Cost of sales |

-760 | 4 | 61 | -11 | -308 | -1 013 | -40.5% | |||||||||||||||||||||

| Gross profit |

669 | -22 | -48 | 21 | 266 | 885 | 40.8% | |||||||||||||||||||||

| SG&A |

-512 | 25 | 49 | -8 | -192 | -638 | -39.2% | |||||||||||||||||||||

| Other operating income/(expenses) |

16 | 225 | - | -4 | 16 | 254 | 93.9% | |||||||||||||||||||||

| Normalized EBIT |

172 | 229 | 1 | 9 | 90 | 501 | 50.4% | |||||||||||||||||||||

| Normalized EBITDA |

366 | 228 | -13 | 9 | 93 | 684 | 24.8% | |||||||||||||||||||||

| Normalized EBITDA margin |

25.6% | 36.0% | -294 bps | |||||||||||||||||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 20 |

| EMEA | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

15 464 | -62 | - | - | 7 473 | 22 875 | 48.5% | |||||||||||||||||||||

| Revenue |

1 429 | -56 | 216 | - | 607 | 2 196 | 44.2% | |||||||||||||||||||||

| Cost of sales |

-788 | 37 | -94 | - | -162 | -1 007 | -21.6% | |||||||||||||||||||||

| Gross profit |

641 | -18 | 121 | - | 444 | 1 188 | 71.4% | |||||||||||||||||||||

| SG&A |

-642 | 19 | -87 | - | -129 | -838 | -20.7% | |||||||||||||||||||||

| Other operating income/(expenses) |

11 | - | 4 | - | 29 | 44 | 266.6% | |||||||||||||||||||||

| Normalized EBIT |

10 | 1 | 39 | - | 345 | 395 | 3 041.6% | |||||||||||||||||||||

| Normalized EBITDA |

251 | 1 | 60 | - | 346 | 658 | 137.8% | |||||||||||||||||||||

| Normalized EBITDA margin |

17.5% | 29.9% | 1189 bps | |||||||||||||||||||||||||

| Asia Pacific | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

26 264 | - | - | - | -1 060 | 25 205 | -4.0% | |||||||||||||||||||||

| Revenue |

1 653 | -21 | 169 | - | 64 | 1 864 | 3.9% | |||||||||||||||||||||

| Cost of sales |

-704 | - | -72 | - | -33 | -810 | -4.7% | |||||||||||||||||||||

| Gross profit |

949 | -22 | 96 | - | 31 | 1 055 | 3.3% | |||||||||||||||||||||

| SG&A |

-544 | 21 | -53 | - | -16 | -591 | -3.0% | |||||||||||||||||||||

| Other operating income/(expenses) |

23 | - | 3 | - | 8 | 35 | 35.1% | |||||||||||||||||||||

| Normalized EBIT |

429 | - | 46 | - | 23 | 498 | 5.4% | |||||||||||||||||||||

| Normalized EBITDA |

584 | - | 62 | - | 26 | 672 | 4.5% | |||||||||||||||||||||

| Normalized EBITDA margin |

35.3% | 36.0% | 18 bps | |||||||||||||||||||||||||

| Global Export and Holding Companies | 2Q20 | Scope | Currency Translation |

Hyperinflation restatement |

Organic Growth |

2Q21 | Organic Growth |

|||||||||||||||||||||

| Total volumes (thousand hls) |

128 | 156 | - | - | -15 | 269 | -5.2% | |||||||||||||||||||||

| Revenue |

142 | 83 | 12 | - | 1 | 238 | 0.5% | |||||||||||||||||||||

| Cost of sales |

-153 | -42 | -8 | - | 15 | -187 | 7.9% | |||||||||||||||||||||

| Gross profit |

-11 | 42 | 4 | - | 16 | 51 | 56.8% | |||||||||||||||||||||

| SG&A |

-210 | -42 | -15 | - | -110 | -377 | -43.7% | |||||||||||||||||||||

| Other operating income/(expenses) |

18 | - | -2 | - | -13 | 4 | -67.9% | |||||||||||||||||||||

| Normalized EBIT |

-203 | - | -13 | - | -106 | -322 | -52.0% | |||||||||||||||||||||

| Normalized EBITDA |

-114 | - | -8 | - | -110 | -232 | -95.4% | |||||||||||||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 21 |

Annex 2

| AB InBev Worldwide | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

239 577 | 41 | - | 40 779 | 280 398 | 17.0% | ||||||||||||||||||

| of which AB InBev own beer |

210 294 | 96 | - | 37 246 | 247 635 | 17.7% | ||||||||||||||||||

| Revenue |

21 298 | -42 | -169 | 4 745 | 25 832 | 22.4% | ||||||||||||||||||

| Cost of sales |

-9 097 | 34 | 91 | -1 991 | -10 963 | -22.0% | ||||||||||||||||||

| Gross profit |

12 201 | -8 | -78 | 2 754 | 14 869 | 22.7% | ||||||||||||||||||

| SG&A |

-7 257 | -12 | -13 | -1 288 | -8 571 | -17.8% | ||||||||||||||||||

| Other operating income/(expenses) |

158 | 226 | - | 86 | 470 | 54.0% | ||||||||||||||||||

| Normalized EBIT |

5 102 | 206 | -91 | 1 551 | 6 768 | 30.5% | ||||||||||||||||||

| Normalized EBITDA |

7 363 | 211 | -87 | 1 627 | 9 114 | 22.1% | ||||||||||||||||||

| Normalized EBITDA margin |

34.6% | 35.3% | -7 bps | |||||||||||||||||||||

| North America | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

51 977 | 56 | - | 1 219 | 53 252 | 2.4% | ||||||||||||||||||

| Revenue |

7 536 | -8 | 83 | 428 | 8 040 | 5.7% | ||||||||||||||||||

| Cost of sales |

-2 842 | 28 | -28 | -237 | -3 080 | -8.5% | ||||||||||||||||||

| Gross profit |

4 694 | 20 | 55 | 191 | 4 960 | 4.1% | ||||||||||||||||||

| SG&A |

-2 104 | -44 | -28 | -173 | -2 350 | -8.2% | ||||||||||||||||||

| Other operating income/(expenses) |

-10 | - | - | 25 | 15 | 257.6% | ||||||||||||||||||

| Normalized EBIT |

2 579 | -24 | 27 | 43 | 2 625 | 1.7% | ||||||||||||||||||

| Normalized EBITDA |

2 986 | -18 | 31 | 16 | 3 014 | 0.5% | ||||||||||||||||||

| Normalized EBITDA margin |

39.6% | 37.5% | -196 bps | |||||||||||||||||||||

| Middle Americas | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

51 858 | - | - | 16 122 | 67 980 | 31.1% | ||||||||||||||||||

| Revenue |

4 246 | - | -96 | 1 743 | 5 893 | 41.0% | ||||||||||||||||||

| Cost of sales |

-1 454 | - | 29 | -630 | -2 055 | -43.4% | ||||||||||||||||||

| Gross profit |

2 792 | - | -67 | 1 113 | 3 838 | 39.8% | ||||||||||||||||||

| SG&A |

-1 258 | - | 20 | -339 | -1 577 | -26.9% | ||||||||||||||||||

| Other operating income/(expenses) |

- | - | - | 4 | 5 | 908.3% | ||||||||||||||||||

| Normalized EBIT |

1 535 | - | -46 | 778 | 2 266 | 50.7% | ||||||||||||||||||

| Normalized EBITDA |

2 021 | - | -52 | 855 | 2 824 | 42.3% | ||||||||||||||||||

| Normalized EBITDA margin |

47.6% | 47.9% | 42 bps | |||||||||||||||||||||

| South America | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

62 782 | -25 | - | 9 171 | 71 929 | 14.6% | ||||||||||||||||||

| Revenue |

3 613 | -23 | -683 | 1 239 | 4 146 | 34.5% | ||||||||||||||||||

| Cost of sales |

-1 727 | 3 | 328 | -694 | -2 091 | -40.3% | ||||||||||||||||||

| Gross profit |

1 886 | -20 | -356 | 545 | 2 055 | 29.2% | ||||||||||||||||||

| SG&A |

-1 205 | 25 | 211 | -285 | -1 254 | -24.1% | ||||||||||||||||||

| Other operating income/(expenses) |

54 | 225 | -9 | 16 | 287 | 30.0% | ||||||||||||||||||

| Normalized EBIT |

736 | 230 | -154 | 276 | 1 088 | 37.3% | ||||||||||||||||||

| Normalized EBITDA |

1 146 | 230 | -214 | 284 | 1 447 | 24.7% | ||||||||||||||||||

| Normalized EBITDA margin |

31.7% | 34.9% | -234 bps | |||||||||||||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 22 |

| EMEA | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

33 551 | -113 | - | 7 102 | 40 540 | 21.2% | ||||||||||||||||||

| Revenue |

3 007 | -88 | 243 | 600 | 3 763 | 20.6% | ||||||||||||||||||

| Cost of sales |

-1 555 | 65 | -106 | -200 | -1 796 | -13.4% | ||||||||||||||||||

| Gross profit |

1 452 | -23 | 137 | 400 | 1 966 | 28.0% | ||||||||||||||||||

| SG&A |

-1 263 | 33 | -113 | -152 | -1 496 | -12.3% | ||||||||||||||||||

| Other operating income/(expenses) |

55 | - | 6 | 31 | 92 | 57.2% | ||||||||||||||||||

| Normalized EBIT |

243 | 10 | 30 | 280 | 563 | 110.5% | ||||||||||||||||||

| Normalized EBITDA |

713 | 9 | 58 | 280 | 1 060 | 38.8% | ||||||||||||||||||

| Normalized EBITDA margin |

23.7% | 28.2% | 374 bps | |||||||||||||||||||||

| Asia Pacific | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

39 045 | - | - | 7 036 | 46 081 | 18.0% | ||||||||||||||||||

| Revenue |

2 609 | -31 | 272 | 649 | 3 500 | 25.2% | ||||||||||||||||||

| Cost of sales |

-1 217 | -1 | -118 | -220 | -1 555 | -18.1% | ||||||||||||||||||

| Gross profit |

1 393 | -31 | 154 | 429 | 1 944 | 31.5% | ||||||||||||||||||

| SG&A |

-961 | 31 | -86 | -110 | -1 126 | -11.8% | ||||||||||||||||||

| Other operating income/(expenses) |

40 | - | 5 | 19 | 64 | 46.5% | ||||||||||||||||||

| Normalized EBIT |

472 | -1 | 74 | 337 | 882 | 71.6% | ||||||||||||||||||

| Normalized EBITDA |

783 | -1 | 102 | 358 | 1 242 | 45.7% | ||||||||||||||||||

| Normalized EBITDA margin |

30.0% | 35.5% | 498 bps | |||||||||||||||||||||

| Global Export and Holding Companies | HY20 | Scope | Currency Translation |

Organic Growth |

HY21 | Organic Growth |

||||||||||||||||||

| Total volumes (thousand hls) |

364 | 124 | - | 128 | 615 | 26.3% | ||||||||||||||||||

| Revenue |

287 | 106 | 12 | 86 | 491 | 22.1% | ||||||||||||||||||

| Cost of sales |

-302 | -60 | -14 | -9 | -385 | -2.4% | ||||||||||||||||||

| Gross profit |

-15 | 46 | -2 | 77 | 106 | 269.8% | ||||||||||||||||||

| SG&A |

-466 | -56 | -17 | -230 | -769 | -44.0% | ||||||||||||||||||

| Other operating income/(expenses) |

19 | - | -2 | -9 | 7 | -49.8% | ||||||||||||||||||

| Normalized EBIT |

-462 | -10 | -21 | -162 | -656 | -34.1% | ||||||||||||||||||

| Normalized EBITDA | -287 | -9 | -12 | -165 | -473 | -55.3% | ||||||||||||||||||

| ab-inbev.com |

|

Press release – 29 July 2021 – 23 |

Exhibit 99.2

Unaudited Interim Report

for the six-month period ended

30 June 2021

Management report

Anheuser-Busch InBev is a publicly traded company (Euronext: ABI) based in Leuven, Belgium, with secondary listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH) stock exchanges and with American Depositary Receipts on the New York Stock Exchange (NYSE: BUD). Our Dream is to bring people together for a better world. Beer, the original social network, has been bringing people together for thousands of years. We are committed to building great brands that stand the test of time and to brewing the best beers using the finest natural ingredients. Our diverse portfolio of well over 500 beer brands includes global brands Budweiser®, Corona® and Stella Artois®; multi-country brands Beck’s®, Hoegaarden®, Leffe® and Michelob Ultra®; and local champions such as Aguila®, Antarctica®, Bud Light®, Brahma®, Cass®, Castle®, Castle Lite®, Cristal®, Harbin®, Jupiler®, Modelo Especial®, Quilmes®, Victoria®, Sedrin® and Skol®. Our brewing heritage dates back more than 600 years, spanning continents and generations. From our European roots at the Den Hoorn brewery in Leuven, Belgium. To the pioneering spirit of the Anheuser & Co brewery in St. Louis, US. To the creation of the Castle Brewery in South Africa during the Johannesburg gold rush. To Bohemia, the first brewery in Brazil. Geographically diversified with a balanced exposure to developed and developing markets, we leverage the collective strengths of approximately 164 000 employees based in nearly 50 countries worldwide. For 2020, our reported revenue was 46.9 billion US dollar (excluding joint ventures and associates).

The following management report should be read in conjunction with Anheuser-Busch InBev’s 2020 audited consolidated financial statements and with the unaudited condensed consolidated interim financial statements as at 30 June 2021.

In the rest of this document we refer to Anheuser-Busch InBev as “AB InBev”, “the company”, “we”, “us” or “our”.

Recent events

On 28 May 2021, upon maturity of the previous broad-based black economic empowerment (“B-BBEE”) scheme in South Africa (“Zenzele scheme”), we implemented a new scheme through the listing of a special purpose company called SAB Zenzele Kabili Holdings Limited (“Zenzele Kabili”), on the Johannesburg Stock Exchange. At the same date, we settled the remaining obligations of the Zenzele scheme to SAB retailers. The settlement of the balance of the SAB retailers entitlement and the set-up of the new B-BBEE scheme required 5.8 billion ZAR (0.4 billion US dollar). 5.1 million AB InBev Treasury shares were used in the transaction. The IFRS 2 cost of 73m US dollar related to the grant of shares to qualifying SAB retailers and employees participating in the Zenzele Kabili scheme was reported in non-underlying items.

Selected financial figures

To facilitate the understanding of our underlying performance, the comments in this management report, unless otherwise indicated, are based on organic and normalized numbers. “Organic” means the financials are analyzed eliminating the impact of changes in currencies on translation of foreign operations, and scopes. Scopes represent the impact of acquisitions and divestitures, the start-up or termination of activities or the transfer of activities between segments, curtailment gains and losses and year-over-year changes in accounting estimates and other assumptions that management does not consider part of the underlying performance of the business.

The tables in this management report provide the segment information per region for the period ended 30 June 2021 and 2020 in the format up to Normalized EBIT level that is used by management to monitor performance.

Whenever used in this report, the term “normalized” refers to performance measures (EBITDA, EBIT, Profit, EPS, effective tax rate) before non-underlying items and discontinued operations. Non-underlying items are either income or expenses which do not occur regularly as part of the normal activities of the company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the company due to their size or nature. Normalized measures are additional measures used by management and should not replace the measures determined in accordance with IFRS as an indicator of the company’s performance, but rather should be used in conjunction with the most directly comparable IFRS measures.

2

The tables below set out the components of our operating income and operating expenses, as well as the key cash flow figures.

| For the six-month period ended 30 June | ||||||||||||||||

| Million US dollar | 2021 | % | 2020 | % | ||||||||||||

| Revenue¹ |

25 832 | 100% | 21 298 | 100% | ||||||||||||

| Cost of sales |

(10 963) | 42% | (9 097) | 43% | ||||||||||||

| Gross profit |

14 869 | 58% | 12 201 | 57% | ||||||||||||

| SG&A |

(8 571) | 33% | (7 257) | 34% | ||||||||||||

| Other operating income/(expenses) |

470 | 2% | 158 | 1% | ||||||||||||

| Normalized profit from operations (Normalized EBIT) |

6 768 | 26% | 5 102 | 24% | ||||||||||||

| Non-underlying items |

(217) | 1% | (2 796) | 13% | ||||||||||||

| Profit from operations (EBIT) |

6 551 | 25% | 2 306 | 11% | ||||||||||||

| Depreciation, amortization and impairment |

2 345 | 9% | 2 261 | 11% | ||||||||||||

| Non-underlying impairment |

24 | 0% | 2 650 | 12% | ||||||||||||

| Normalized EBITDA |

9 114 | 35% | 7 363 | 35% | ||||||||||||

| EBITDA |

8 920 | 35% | 7 217 | 34% | ||||||||||||

| Normalized profit attributable to equity holders of AB InBev |

2 924 | 11% | 76 | - | ||||||||||||

| Profit from continuing operations attributable to equity holders of AB InBev |

2 458 | 10% | (3 955) | 19% | ||||||||||||

| Profit from discontinued operations attributable to equity holders of AB InBev |

- | 0% | 2 055 | 10% | ||||||||||||

| Profit attributable to equity holders of AB InBev |

2 458 | 10% | (1 900) | 9% | ||||||||||||

| For the six-month period ended 30 June | ||||||||

| Million US dollar | 2021 | 2020 | ||||||

| Operating activities |

||||||||

| Profit from continuing operations |

3 074 | (3 744 | ) | |||||

| Interest, taxes and non-cash items included in profit |

6 062 | 11 164 | ||||||

| Cash flow from operating activities before changes in working capital and use of provisions |

9 134 | 7 420 | ||||||

| Change in working capital |

(1 327 | ) | (2 700 | ) | ||||

| Pension contributions and use of provisions |

(258 | ) | (327 | ) | ||||

| Interest and taxes (paid)/received |

(3 696 | ) | (3 388 | ) | ||||

| Dividends received |

86 | 30 | ||||||

| Cash flow from operating activities on Australia discontinued operations |

- | 84 | ||||||

| Cash flow from operating activities |

3 939 | 1 119 | ||||||

| Investing activities |

||||||||

| Net capex |

(2 104 | ) | (1 524 | ) | ||||

| Acquisition and sale of subsidiaries, net of cash acquired/disposed of |

(203 | ) | (204 | ) | ||||

| Net proceeds from sale/(acquisition) of other assets |

98 | (30 | ) | |||||

| Proceeds from Australia divestiture |

- | 10 838 | ||||||

| Cash flow from investing activities on Australia discontinued operations |

- | (13 | ) | |||||

| Cash flow from investing activities |

(2 209 | ) | 9 067 | |||||

| Financing activities |

||||||||

| Dividends paid |

(1 382 | ) | (1 219 | ) | ||||

| Net (payments on)/proceeds from borrowings |

(7 999 | ) | 10 194 | |||||

| Payment of lease liabilities |

(256 | ) | (280 | ) | ||||

| Sale/(purchase) of non-controlling interests and other |