Form 6-K ANGLOGOLD ASHANTI LTD For: Dec 31

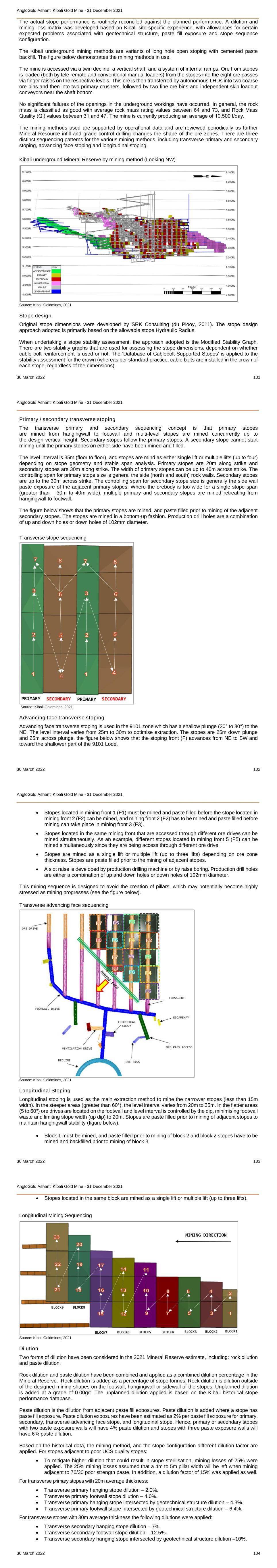

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 Report on Form 6-K dated March 30, 2022 Commission File Number: 001-14846 AngloGold Ashanti Limited (Name of registrant) 112 Oxford Road Houghton Estate, Johannesburg, 2198 (Private Bag X 20, Rosebank, 2196) South Africa (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F: ý Form 40-F: q Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes: q No: ý Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes: q No: ý | ||

EXPLANATORY NOTE

Exhibits containing the Technical Report Summaries for the mining properties of AngloGold Ashanti Limited (the “Company”) in the Africa region (pursuant to Subpart 1300 of Regulation S-K) are filed herewith in order to be incorporated by reference into the Company’s annual report on Form 20-F for the financial year ended 31 December 2021 which the Company plans to file with the Securities and Exchange Commission on 30 March 2022.

Exhibit Number | Description | Remarks | ||||||

Exhibit 96.1 | Filed herewith | |||||||

Exhibit 96.2 | Filed herewith | |||||||

Exhibit 96.3 | Filed herewith | |||||||

Exhibit 96.4 | Filed herewith | |||||||

Exhibit 96.5 | Filed herewith | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

AngloGold Ashanti Limited

Date: March 30, 2022

By: /s/ L MARWICK

Name: L Marwick

Title: Chief Legal Officer

AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 1 Technical Report Summary Geita Gold Mine A Life of Mine Summary Report Effective date: 31 December 2021 As required by § 229.601(b)(96) of Regulation S-K as an exhibit to AngloGold Ashanti's Annual Report on Form 20-F pursuant to Subpart 229.1300 of Regulation S-K - Disclosure by Registrants Engaged in Mining Operations (§ 229.1300 through § 229.1305). AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 2 Date and Signatures Page This report is effective as at 31 December 2021. Where the registrant (AngloGold Ashanti Limited) has relied on more than one Qualified Person to prepare the information and documentation supporting its disclosure of Mineral Resource or Mineral Reserve, the section(s) prepared by each qualified person has been clearly delineated. AngloGold Ashanti has recognised that in preparing this report, the Qualified Person(s) may have, when necessary, relied on information and input from others, including AngloGold Ashanti. As such, the table below lists the technical specialists who provided the relevant information and input, as necessary, to the Qualified Person to include in this Technical Report Summary. All information provided by AngloGold Ashanti has been identified in Section 25: Reliance on information provided by the registrant in this report. The registrant confirms it has obtained the written consent of each Qualified Person to the use of the person's name, or any quotation from, or summarisation of, the Technical Report summary in the relevant registration statement or report, and to the filing of the Technical Report Summary as an exhibit to the registration statement or report. The written consent only pertains to the particular section(s) of the Technical Report Summary prepared by each Qualified Person. The written consent has been filed together with the Technical Report Summary exhibit and will be retained for as long as AngloGold Ashanti relies on the Qualified Person’s information and supporting documentation for its current estimates regarding Mineral Resource or Mineral Reserve. MINERAL RESOURCE QUALIFIED PERSON Damon Elder Sections prepared: 1 - 11, 20 - 25 __________________ MINERAL RESERVE QUALIFIED PERSON Duan Campbell Sections prepared: 1, 12-19, 21 - 25 __________________ Responsibility Technical Specialist ESTIMATION Janet Luponelo EVALUATION QAQC Janet Luponelo EXPLORATION Mjinja Hatari GEOLOGICAL MODEL Mjinja Hatari GEOLOGY QAQC Mjinja Hatari GEOTECHNICAL ENGINEERING Samuel Banda HYDROGEOLOGY Gordon Maclear MINERAL RESOURCE CLASSIFICATION Janet Luponelo ENVIRONMENTAL AND PERMITTING Mhando Yusuph FINANCIAL MODEL Ikingo Gombo INFRASTRUCTURE Eliakimu Kagimbo LEGAL Elizabeth Karua METALLURGY Elibariki Andrew MINE PLANNING Duan Campbell MINERAL RESERVE CLASSIFICATION Duan Campbell /s/ Damon Elder /s/ Duan Campbell AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 3 Consent of Qualified Person I, Damon Elder, , in connection with the Technical Report Summary for “Geita Gold Mine, A Life of Mine Summary Report” dated 31 December 2021 (the “Technical Report Summary”) as required by Item 601(b)(96) of Regulation S-K and filed as an exhibit to AngloGold Ashanti Limited’s (“AngloGold Ashanti”) annual report on Form 20-F for the year ended 31 December 2021 and any amendments or supplements and/or exhibits thereto (collectively, the “Form 20-F”) pursuant to Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission (“1300 Regulation S-K”), consent to: • the public filing and use of the Technical Report Summary as an exhibit to the Form 20-F; • the use of and reference to my name, including my status as an expert or “Qualified Person” (as defined in 1300 Regulation S-K) in connection with the Form 20-F and Technical Report Summary; • any extracts from, or summary of, the Technical Report Summary in the Form 20-F and the use of any information derived, summarised, quoted or referenced from the Technical Report Summary, or portions thereof, that is included or incorporated by reference into the Form 20-F; and • the incorporation by reference of the above items as included in the Form 20-F into AngloGold Ashanti’s registration statements on Form F-3 (Registration No. 333-230651) and on Form S-8 (Registration No. 333-113789) (and any amendments or supplements thereto). I am responsible for authoring, and this consent pertains to, the Technical Report Summary. I certify that I have read the Form 20-F and that it fairly and accurately represents the information in the Technical Report Summary for which I am responsible. Date: 30 March 2022 Damon Elder /s/ Damon Elder AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 4 Consent of Qualified Person I, Duan Campbell, , in connection with the Technical Report Summary for “Geita Gold Mine, A Life of Mine Summary Report” dated 31 December 2021 (the “Technical Report Summary”) as required by Item 601(b)(96) of Regulation S-K and filed as an exhibit to AngloGold Ashanti Limited’s (“AngloGold Ashanti”) annual report on Form 20-F for the year ended 31 December 2021 and any amendments or supplements and/or exhibits thereto (collectively, the “Form 20-F”) pursuant to Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission (“1300 Regulation S-K”), consent to: • the public filing and use of the Technical Report Summary as an exhibit to the Form 20-F; • the use of and reference to my name, including my status as an expert or “Qualified Person” (as defined in 1300 Regulation S-K) in connection with the Form 20-F and Technical Report Summary; • any extracts from, or summary of, the Technical Report Summary in the Form 20-F and the use of any information derived, summarised, quoted or referenced from the Technical Report Summary, or portions thereof, that is included or incorporated by reference into the Form 20-F; and • the incorporation by reference of the above items as included in the Form 20-F into AngloGold Ashanti’s registration statements on Form F-3 (Registration No. 333-230651) and on Form S-8 (Registration No. 333-113789) (and any amendments or supplements thereto). I am responsible for authoring, and this consent pertains to, the Technical Report Summary. I certify that I have read the Form 20-F and that it fairly and accurately represents the information in the Technical Report Summary for which I am responsible. Date: 30 March 2022 Duan Campbell /s/ Duan Campbell

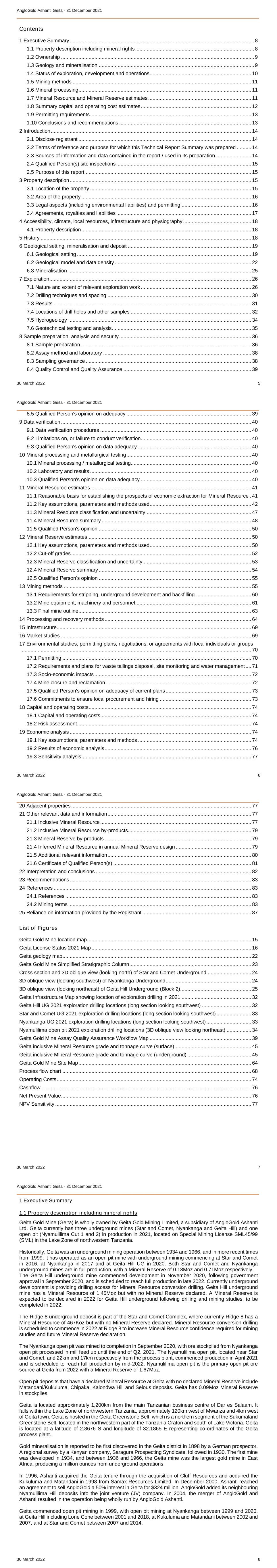

AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 5 Contents 1 Executive Summary ............................................................................................................................... 8 1.1 Property description including mineral rights .................................................................................. 8 1.2 Ownership ..................................................................................................................................... 9 1.3 Geology and mineralisation ........................................................................................................... 9 1.4 Status of exploration, development and operations ...................................................................... 10 1.5 Mining methods ........................................................................................................................... 11 1.6 Mineral processing ....................................................................................................................... 11 1.7 Mineral Resource and Mineral Reserve estimates ....................................................................... 11 1.8 Summary capital and operating cost estimates ............................................................................ 12 1.9 Permitting requirements ............................................................................................................... 13 1.10 Conclusions and recommendations ........................................................................................... 13 2 Introduction .......................................................................................................................................... 14 2.1 Disclose registrant ....................................................................................................................... 14 2.2 Terms of reference and purpose for which this Technical Report Summary was prepared .......... 14 2.3 Sources of information and data contained in the report / used in its preparation ......................... 14 2.4 Qualified Person(s) site inspections ............................................................................................. 15 2.5 Purpose of this report................................................................................................................... 15 3 Property description ............................................................................................................................. 15 3.1 Location of the property ............................................................................................................... 15 3.2 Area of the property ..................................................................................................................... 16 3.3 Legal aspects (including environmental liabilities) and permitting ................................................ 16 3.4 Agreements, royalties and liabilities ............................................................................................. 17 4 Accessibility, climate, local resources, infrastructure and physiography ............................................... 18 4.1 Property description ..................................................................................................................... 18 5 History ................................................................................................................................................. 18 6 Geological setting, mineralisation and deposit ..................................................................................... 19 6.1 Geological setting ........................................................................................................................ 19 6.2 Geological model and data density .............................................................................................. 22 6.3 Mineralisation .............................................................................................................................. 25 7 Exploration ........................................................................................................................................... 26 7.1 Nature and extent of relevant exploration work ............................................................................ 26 7.2 Drilling techniques and spacing ................................................................................................... 30 7.3 Results ........................................................................................................................................ 31 7.4 Locations of drill holes and other samples ................................................................................... 32 7.5 Hydrogeology .............................................................................................................................. 34 7.6 Geotechnical testing and analysis ................................................................................................ 35 8 Sample preparation, analysis and security ........................................................................................... 36 8.1 Sample preparation ..................................................................................................................... 36 8.2 Assay method and laboratory ...................................................................................................... 38 8.3 Sampling governance .................................................................................................................. 38 8.4 Quality Control and Quality Assurance ........................................................................................ 39 AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 6 8.5 Qualified Person's opinion on adequacy ...................................................................................... 39 9 Data verification ................................................................................................................................... 40 9.1 Data verification procedures ........................................................................................................ 40 9.2 Limitations on, or failure to conduct verification ............................................................................ 40 9.3 Qualified Person's opinion on data adequacy .............................................................................. 40 10 Mineral processing and metallurgical testing ...................................................................................... 40 10.1 Mineral processing / metallurgical testing ................................................................................... 40 10.2 Laboratory and results ............................................................................................................... 40 10.3 Qualified Person's opinion on data adequacy ............................................................................ 40 11 Mineral Resource estimates ............................................................................................................... 41 11.1 Reasonable basis for establishing the prospects of economic extraction for Mineral Resource . 41 11.2 Key assumptions, parameters and methods used ...................................................................... 42 11.3 Mineral Resource classification and uncertainty ......................................................................... 47 11.4 Mineral Resource summary ....................................................................................................... 48 11.5 Qualified Person's opinion ......................................................................................................... 50 12 Mineral Reserve estimates ................................................................................................................. 50 12.1 Key assumptions, parameters and methods used ...................................................................... 50 12.2 Cut-off grades ............................................................................................................................ 52 12.3 Mineral Reserve classification and uncertainty........................................................................... 53 12.4 Mineral Reserve summary ......................................................................................................... 54 12.5 Qualified Person’s opinion ......................................................................................................... 55 13 Mining methods ................................................................................................................................. 55 13.1 Requirements for stripping, underground development and backfilling ...................................... 60 13.2 Mine equipment, machinery and personnel ................................................................................ 61 13.3 Final mine outline ....................................................................................................................... 63 14 Processing and recovery methods ..................................................................................................... 64 15 Infrastructure ...................................................................................................................................... 69 16 Market studies ................................................................................................................................... 69 17 Environmental studies, permitting plans, negotiations, or agreements with local individuals or groups ............................................................................................................................................................... 70 17.1 Permitting .................................................................................................................................. 70 17.2 Requirements and plans for waste tailings disposal, site monitoring and water management .... 71 17.3 Socio-economic impacts ............................................................................................................ 72 17.4 Mine closure and reclamation .................................................................................................... 72 17.5 Qualified Person's opinion on adequacy of current plans ........................................................... 73 17.6 Commitments to ensure local procurement and hiring ............................................................... 73 18 Capital and operating costs ................................................................................................................ 74 18.1 Capital and operating costs ........................................................................................................ 74 18.2 Risk assessment ........................................................................................................................ 74 19 Economic analysis ............................................................................................................................. 74 19.1 Key assumptions, parameters and methods .............................................................................. 74 19.2 Results of economic analysis ..................................................................................................... 76 19.3 Sensitivity analysis ..................................................................................................................... 77 AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 7 20 Adjacent properties ............................................................................................................................ 77 21 Other relevant data and information ................................................................................................... 77 21.1 Inclusive Mineral Resource ........................................................................................................ 77 21.2 Inclusive Mineral Resource by-products..................................................................................... 79 21.3 Mineral Reserve by-products ..................................................................................................... 79 21.4 Inferred Mineral Resource in annual Mineral Reserve design .................................................... 79 21.5 Additional relevant information ................................................................................................... 80 21.6 Certificate of Qualified Person(s) ............................................................................................... 81 22 Interpretation and conclusions ........................................................................................................... 82 23 Recommendations ............................................................................................................................. 83 24 References ........................................................................................................................................ 83 24.1 References ................................................................................................................................ 83 24.2 Mining terms .............................................................................................................................. 83 25 Reliance on information provided by the Registrant ........................................................................... 87 List of Figures Geita Gold Mine location map. ................................................................................................................ 15 Geita License Status 2021 Map .............................................................................................................. 16 Geita geology map .................................................................................................................................. 22 Geita Gold Mine Simplified Stratigraphic Column .................................................................................... 23 Cross section and 3D oblique view (looking north) of Star and Comet Underground .............................. 24 3D oblique view (looking southwest) of Nyankanga Underground ........................................................... 24 3D oblique view (looking northeast) of Geita Hill Underground (Block 2)................................................. 25 Geita Infrastructure Map showing location of exploration drilling in 2021 ................................................ 32 Geita Hill UG 2021 exploration drilling locations (long section looking southwest) .................................. 32 Star and Comet UG 2021 exploration drilling locations (long section looking southwest) ........................ 33 Nyankanga UG 2021 exploration drilling locations (long section looking southwest) ............................... 33 Nyamulilima open pit 2021 exploration drilling locations (3D oblique view looking northeast) ................. 34 Geita Gold Mine Assay Quality Assurance Workflow Map ...................................................................... 39 Geita inclusive Mineral Resource grade and tonnage curve (surface) ..................................................... 45 Geita inclusive Mineral Resource grade and tonnage curve (underground) ............................................ 45 Geita Gold Mine Site Map ....................................................................................................................... 64 Process flow chart .................................................................................................................................. 68 Operating Costs ...................................................................................................................................... 74 Cashflow ................................................................................................................................................. 76 Net Present Value ................................................................................................................................... 76 NPV Sensitivity ....................................................................................................................................... 77 AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 8 1 Executive Summary 1.1 Property description including mineral rights Geita Gold Mine (Geita) is wholly owned by Geita Gold Mining Limited, a subsidiary of AngloGold Ashanti Ltd. Geita currently has three underground mines (Star and Comet, Nyankanga and Geita Hill) and one open pit (Nyamulilima Cut 1 and 2) in production in 2021, located on Special Mining License SML45/99 (SML) in the Lake Zone of northwestern Tanzania. Historically, Geita was an underground mining operation between 1934 and 1966, and in more recent times from 1999, it has operated as an open pit mine with underground mining commencing at Star and Comet in 2016, at Nyankanga in 2017 and at Geita Hill UG in 2020. Both Star and Comet and Nyankanga underground mines are in full production, with a Mineral Reserve of 0.18Moz and 0.71Moz respectively. The Geita Hill underground mine commenced development in November 2020, following government approval in September 2020, and is scheduled to reach full production in late 2022. Currently underground development is providing drilling access for Mineral Resource conversion drilling. Geita Hill underground mine has a Mineral Resource of 1.45Moz but with no Mineral Reserve declared. A Mineral Reserve is expected to be declared in 2022 for Geita Hill underground following drilling and mining studies, to be completed in 2022. The Ridge 8 underground deposit is part of the Star and Comet Complex, where currently Ridge 8 has a Mineral Resource of 467Koz but with no Mineral Reserve declared. Mineral Resource conversion drilling is scheduled to commence in 2022 at Ridge 8 to increase Mineral Resource confidence required for mining studies and future Mineral Reserve declaration. The Nyankanga open pit was mined to completion in September 2020, with ore stockpiled from Nyankanga open pit processed in mill feed up until the end of Q2, 2021. The Nyamulilima open pit, located near Star and Comet, and 22km and 17km respectively from the process plant, commenced production in April 2021 and is scheduled to reach full production by mid-2022. Nyamulilima open pit is the primary open pit ore source at Geita from 2022 with a Mineral Reserve of 1.67Moz. Open pit deposits that have a declared Mineral Resource at Geita with no declared Mineral Reserve include Matandani/Kukuluma, Chipaka, Kalondwa Hill and Selous deposits. Geita has 0.09Moz Mineral Reserve in stockpiles. Geita is located approximately 1,200km from the main Tanzanian business centre of Dar es Salaam. It falls within the Lake Zone of northwestern Tanzania, approximately 120km west of Mwanza and 4km west of Geita town. Geita is hosted in the Geita Greenstone Belt, which is a northern segment of the Sukumaland Greenstone Belt, located in the northwestern part of the Tanzania Craton and south of Lake Victoria. Geita is located at a latitude of 2.8676 S and longitude of 32.1865 E representing co-ordinates of the Geita process plant. Gold mineralisation is reported to be first discovered in the Geita district in 1898 by a German prospector. A regional survey by a Kenyan company, Saragura Prospecting Syndicate, followed in 1930. The first mine was developed in 1934, and between 1936 and 1966, the Geita mine was the largest gold mine in East Africa, producing a million ounces from underground operations. In 1996, Ashanti acquired the Geita tenure through the acquisition of Cluff Resources and acquired the Kukuluma and Matandani in 1998 from Samax Resources Limited. In December 2000, Ashanti reached an agreement to sell AngloGold a 50% interest in Geita for $324 million. AngloGold added its neighbouring Nyamulilima Hill deposits into the joint venture (JV) company. In 2004, the merger of AngloGold and Ashanti resulted in the operation being wholly run by AngloGold Ashanti. Geita commenced open pit mining in 1999, with open pit mining at Nyankanga between 1999 and 2020, at Geita Hill including Lone Cone between 2001 and 2018, at Kukuluma and Matandani between 2002 and 2007, and at Star and Comet between 2007 and 2014.

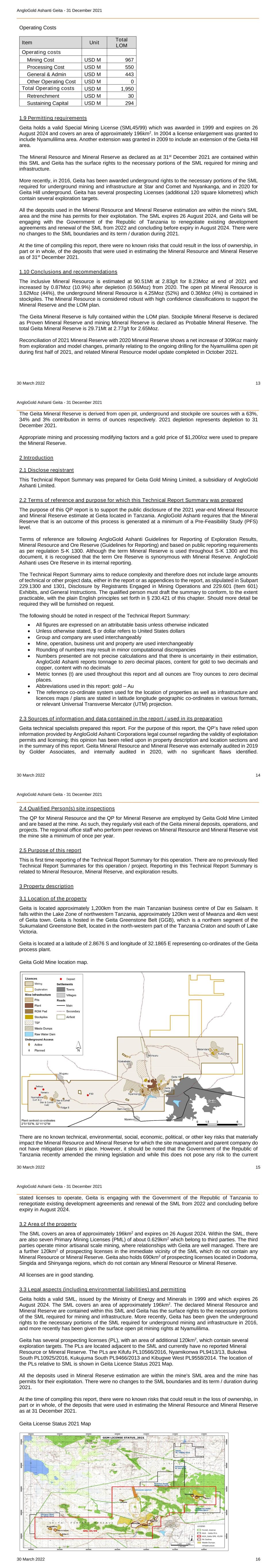

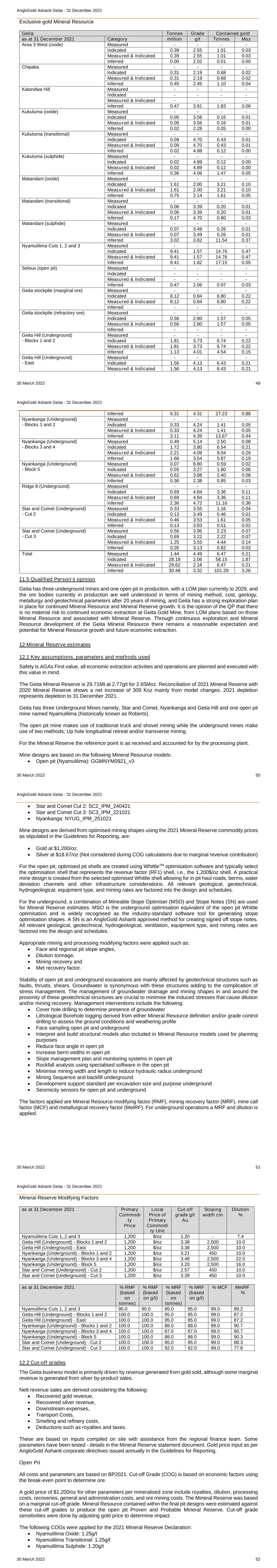

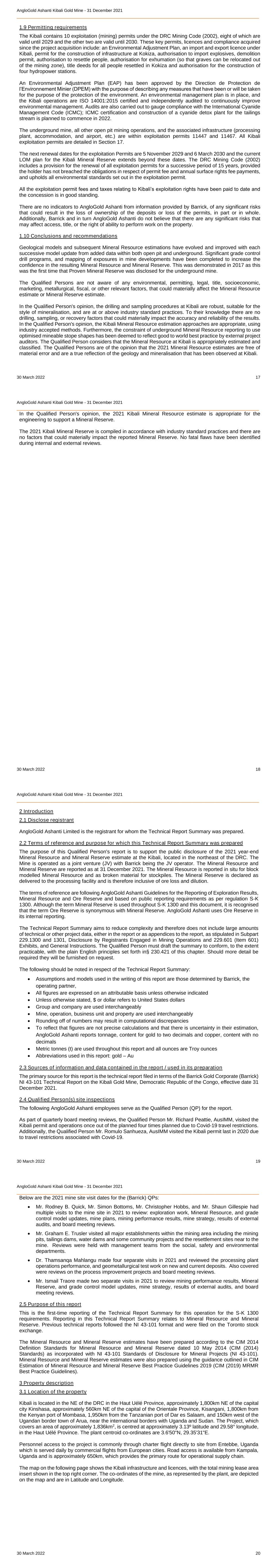

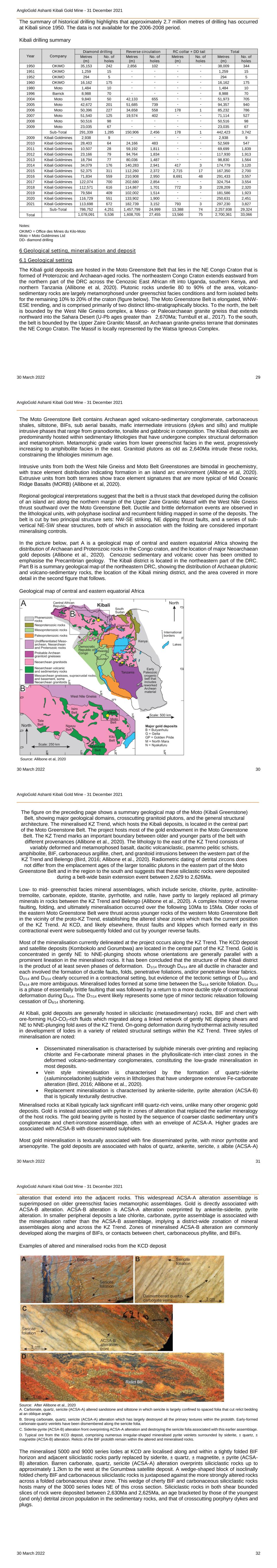

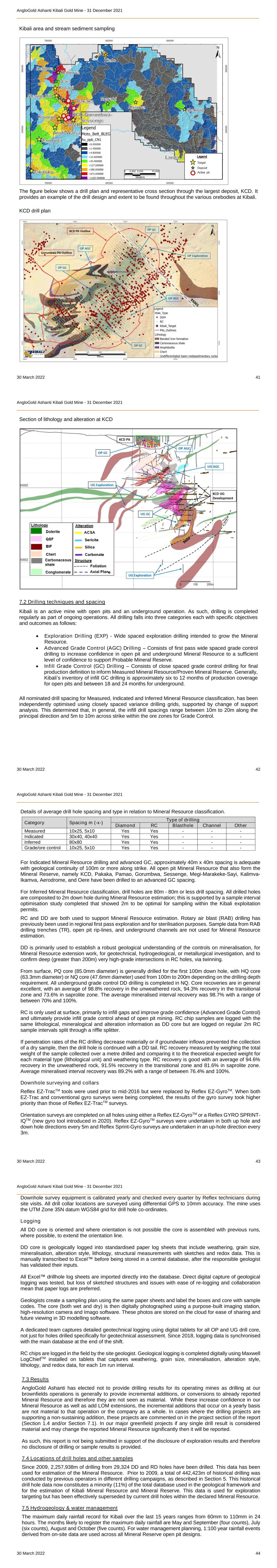

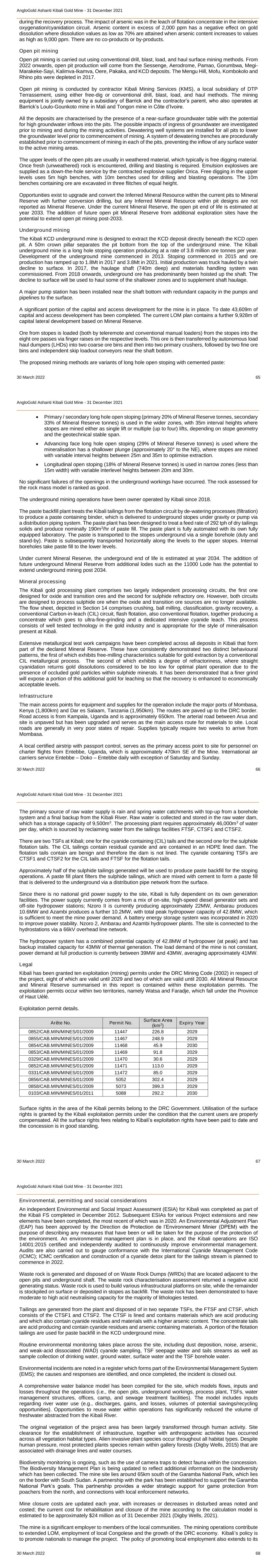

AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 9 In 2015, a decision was taken to go underground at Star and Comet and the underground development started in 2016. In 2017 the Nyankanga underground operation commenced and in 2020 the Geita Hill underground operation commenced and is scheduled to ramp-up to full production by end of 2022. In 2020, the Nyankanga open pit, the only remaining operating pit at the time, was mined to completion in September 2020. In April 2021, the Nyamulilima open pit (1.67Moz) commenced operations. The Special Mining License SML45/99 (SML) is 100% attributable to Geita Gold Mining Limited and covers an area of approximately 196km2 and expires on 26 August 2024. Within the SML there are also seven Primary Mining Licenses (PML) of about 0.629km2 which belong to third parties. There are a further 120km2 of Prospecting Licenses (PL), held by Geita Gold Mine Limited, in the immediate vicinity to the special mining license which do not contain any Mineral Reserve. Geita Gold Mining Limited also holds 690km2 of Prospecting Licenses located in Dodoma, Singida and Shinyanga regions, which do not contain any Mineral Reserve. All licenses are in good standing. The Geita process plant is crushing and milling approximately 5.2Mtpa and forecast to produce approximately 0.5Moz per annum over the next five plus years. The current operations are supported by a LOM plan to 2029, with an annually updated, five-year exploration strategy in place for Mineral Resource growth and to replace and grow Mineral Reserve at a rate of greater than depletion (greater than 0.5Moz per annum). The exploration strategy is aligned with the Geita business plan and seeks to extend the LOM beyond 2029, with exploration drilling targeting Mineral Resource conversion in the underground mines securing near-term ounces, in conjunction with exploration targeting underground extension for Mineral Resource growth, and surface exploration of key prospects exploring for potential future open pit and underground mining opportunities. 1.2 Ownership Geita Gold Mine Limited is the 100% owner and operator of Geita and is a subsidiary of AngloGold Ashanti Limited. 1.3 Geology and mineralisation Geita is hosted in the Geita Greenstone Belt (GGB), which is a northern segment of the Sukumaland Greenstone Belt, located in the northwestern part of the Tanzania Craton and south of Lake Victoria. This Archaean sequence strikes almost east-west, extending for about 80km long and is up to 20km wide. The GGB sits dominantly within the Nyanzian Supergroup stratigraphy that is sub-divided into the Lower Nyanzian and the Upper Nyanzian groups. The Lower Nyanzian Group is composed of mafic volcanic units (basalts, pillow basalt, minor gabbro, and dolerites). This group of rocks within the GGB is collectively termed the Kiziba Formation. The Upper Nyanzian Group consists of black shales, banded iron formation, clastic sedimentary rock, tuffs, agglomerates and felsic volcaniclastics. The entire package (Nyanzian stratigraphy) is intruded by a variety of mafic to felsic rocks. The supra-crustal package shows variable thickness and is estimated to be more than 500m thick in places, mostly underlain by intrusive complexes. A simplified stratigraphy of the main igneous rocks in the Geita area is summarised as: Archaean Gabbro, Basalts, and intermediate to acid volcanoclastic sediments > Diorites > Tonalites-Granodiorites > Granites > Proterozoic Gabbro dykes. Across the Archaean-Proterozoic rocks there is a property-wide paleo-drainage system, which likely flowed towards Lake Victoria. These late sediments likely represent the remnants of a much thicker package that might have covered all the hills exposed today. Both the Archaean-Proterozoic rocks and paleo-alluvials are covered by ferricrete at different levels of induration and evolution, up to 15m thick. The region hosts several world-class shear-hosted Archaean lode gold deposits and forms the northern portion of the regional Sukumaland Greenstone Belt, itself one of several belts that comprise the Lake AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 10 Victoria goldfields. Other gold mines hosted in the Lake Victoria Goldfields include Golden Pride (Resolute Mining Limited), Bulyanhulu, Tulawaka, Buzwagi and North Mara (all owned by Barrick Gold Corporation). The Geita gold deposits are shear hosted, Archaean orogenic gold deposits. Within Geita leases the GGB is subdivided into three major mineralised trends: (i) Geita Central Trend, hosting the Nyankanga, Geita Hill, and Lone Cone deposits, (ii) Nyamulilima Trend in the west, hosting Star and Comet, Ridge 8 and Nyamulilima deposits, and (iii) Matandani-Kukuluma Trend to the northeast, hosting Matandani and Kukuluma deposits. The Geita Central Trend contains three major gold deposits occurring along a NE-SW mineralised trend. These are from northeast to southwest: Geita Hill, Lone Cone and Nyankanga. Other prospects occur singly: Chipaka in the centre of the greenstone belt, and Kalondwa Hill, P30, Fukiri-Jumanne along an NW- SE trending ironstone ridge. Geita Hill, Lone Cone and Nyankanga occur along a moderately NW dipping system of reverse faults that have been multiply reactivated during subsequent deformation events. The mineralisation is mainly related to diorite and banded iron formation contacts exploited by the shear system. The alteration is restricted within the ore zone and consists of secondary sulphide (mainly pyrite), silica, carbonate and moderate potassic alteration. The Nyamulilima Trend contains three major gold deposits on an approximately NW-SE mineralised trend. These are from SE to NW: Ridge 8, Star and Comet and Nyamulilima open pit (historically named Roberts). Individual deposits occur along a series of N-S trending, steeply dipping, left stepping en-echelon fault zones that cut across the ironstone-rich sediments and granite-granodiorite-tonalite intrusions. Mineralisation is preferentially localised along fault zones where they cut the ironstone-granitoid contacts. The mineralisation is associated with secondary pyrite and minor pyrrhotite, silica, carbonate and actinolite alteration. The Kukuluma Trend contains five gold deposits distributed along an approximately E-W mineralised trend. These are from east to west: Area 3 South, Area 3 Central, Area 3 West, Kukuluma and Matandani. The mineralisation is steeply dipping along the contacts of intermediate fine-grained intrusions and magnetite rich chert and ironstone showing a general en-echelon, left stepping geometry. The gold is associated with secondary pyrite, arsenopyrite and minor pyrrhotite. magnetite, silica, carbonate, and amphibole alteration are variably present within the mineralised zone. Deformation in the GGB comprises of early stages of ductile shearing and folding (D1 to D5), with periodic emplacement of large diorite intrusive complexes, sills, and dykes. Later stages of deformation (D6 to D8) involved development of brittle-ductile shear zones, with faults developed in the later stages of deformation, with late emplacement felsic porphyry dykes within the greenstone belt, and granitic intrusions located on the margins of the greenstone belt. Gold mineralisation occurred late in the tectonic history of the greenstone belt, synchronous with the development of brittle-ductile shear zones (D6). Mineralisation is dominantly sulphide replacement of magnetite-rich layers in ironstone, with local replacement of ferromagnesian phases and magnetite in the diorite intrusions. Primary gold mineralisation is associated with the intersection of the brittle-ductile shear zones and pre-existing fold hinges, with higher grade concentrations associated with banded iron formation lithologies and with diorite dyke and sill contacts. The mineralisation in GGB is preferentially hosted within deformation zones developed along the contact of banded iron formation and porphyries of various compositions and associated with major shear systems. The structures associated with the mineralised system are well defined, the alteration zone is restricted to the mineralised zone, quartz veins are rare or missing although silicification is common. 1.4 Status of exploration, development and operations Geita has an aggressive, annually updated five-year exploration plan in place, with approximately 20 drill rigs operating and forecast to drill approximately 180km in 2022. The exploration strategy targets Mineral Resource and Mineral Reserve growth ahead of annual depletion in the Life of Mine (LOM) plan, where surface drilling is targeting new open pit and underground opportunities, and underground drilling is targeting Mineral Resource conversion to allow Mineral Reserve growth via engineering and extension of underground operations down-dip and along strike. AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 11 1.5 Mining methods Mining at Geita is by both open pit and underground mining methods. Open pit mining at Nyankanga Cut 8 was completed in 2020. The Nyamulilima open pit commenced production in April 2021 and is scheduled to reach full production during 2022. This mining is done utilising a truck and shovel operated by Geita with a contractor providing drill and blast support. Underground mining commenced at Star and Comet in 2016 and subsequently at Nyankanga in 2017 and most recently Geita Hill in 2020. Star and Comet underground has successfully transitioned to owner mining and the mining contractor African Underground Mining Services (AUMS) is used at Nyankanga and Geita Hill for underground development and stoping. The underground mining method is a combination of longitudinal and transverse open stoping. Cement Aggregate Fill (CAF) is used at Nyankanga to fill the primary stopes and allows for mining of secondary stopes. Ore is hauled from the Star and Comet and Nyankanga underground operations to the central run of mine (ROM) pad by the Geita processing plant. 1.6 Mineral processing Geita ore processing method is via conventional carbon-in-leach (CIL) process with a throughput capacity of 5.2Mtpa. The circuit contains a primary gyratory crusher, secondary and tertiary crushers, a semi- autogenous mill, a ball mill and 12 leach tanks. This is coupled with a gravity circuit using two Knelson concentrators. In planning the plant feed blend material, hardness grade, oxide and sulphide content are considered to optimise throughput and recovery. Power to the mine is self-generated using diesel generators but planned construction of 33kV Hydropower Station (TANESCO National Grid Substation) is underway. 1.7 Mineral Resource and Mineral Reserve estimates As per AngloGold Ashanti’s Guidelines for Reporting of Exploration Results, Mineral Resource and Ore Reserve, 2021 (Guidelines for Reporting), the exclusive Mineral Resource is defined as the inclusive Mineral Resource less the Mineral Reserve before dilution and other factors are applied, all entities are reported from the equivalent Mineral Resource Model. The exclusive Mineral Resource consists of the following components: Portion 1: Open Pit: The Mineral Resource that lies within the Mineral Resource model between the LOM design shell and the Mineral Resource shell optimised at the Mineral Resource cut-off grade and quoted at the Mineral Resource cut-off grade. Underground: The Mineral Resource that lies outside an underground design but within shapes defined at the Mineral Resource price and quoted at 0g/t cut-off Common: Note that an exploration anomaly that is considered to be a Mineral Resource, but not a Mineral Reserve is a subset of this category. Portion 2: Material within the LOM design shell that lies between the Mineral Resource and Mineral Reserve cut-offs as reported from the Mineral Resource model but not reported as Mineral Reserve. There is no underground equivalent. Portion 3: Open Pit: All Inferred Mineral Resource, including Inferred Mineral Resource within the LOM design shell that lies above the Mineral Resource cut-off. Underground: All Inferred Mineral Resource, including Inferred Mineral Resource within the Mineral Reserve designs. Portion 4: Mineral Resource where the technical studies to engineer a Mineral Reserve have not yet been completed. Portion 5: Stockpiles that qualify as a Mineral Resource, but not as a Mineral Reserve. AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 12 The exclusive Mineral Resource = Portion 1 + Portion 2 + Portion 3 + Portion 4 + Portion 5. The total Geita exclusive Mineral Resource is estimated at 60.1Mt at 2.76g/t for 5.33Moz, where the open pit exclusive Mineral Resource is 1.85Moz (35%), the underground exclusive Mineral Resource is 3.21Moz (54%) and 0.27Moz (1%) in stockpiles. A significant portion of the open pit exclusive Mineral Resource is informed by Nyamulilima open pit (1.03Moz), being Inferred Mineral Resource inside the final pit design (less than 5%), and all Mineral Resource outside the final pit design and inside the $1500/oz 2021 Mineral Resource price optimisation shell. The Kukuluma / Matandani Mineral Resource is 0.68Moz and several small open pit Mineral Resource total 0.15Moz (Kalondwa Hill, Chipaka, Selous) and which have no Mineral Reserve declared. The underground exclusive Mineral Resource is informed by Geita Hill UG 1.45Moz (no Mineral Reserve declared), Nyankanga UG 1.07Moz, Ridge 8 0.47Moz (no Mineral Reserve declared), and Star and Comet UG 0.27Moz, all relating to Mineral Resource not in Mineral Reserve and in pillars not recovered. Stockpiles of 0.27Moz below Mineral Reserve cut-off and above Mineral Resource cut-off are exclusive, made up of low-grade (0.29Moz) and refractory ore (0.05Moz) stockpiles. Exclusive gold Mineral Resource Geita Tonnes Grade Contained gold as at 31 December 2021 Category million g/t tonnes Moz Measured 1.44 4.49 6.47 0.21 Indicated 28.18 2.06 58.15 1.87 Measured & Indicated 29.62 2.18 64.63 2.08 Inferred 30.48 3.32 101.29 3.26 The total Geita Mineral Reserve is 29.71Mt at 2.77g/t for 2.65Moz. This represents a net increase of 13.2% year to year was achieved, and an increase of 35% after depletion. Gold Mineral Reserve Geita Tonnes Grade Contained gold as at 31 December 2021 Category million g/t tonnes Moz Proven 2.19 1.30 2.84 0.09 Probable 27.52 2.89 79.45 2.55 Total 29.71 2.77 82.29 2.65 1.8 Summary capital and operating cost estimates Stay in Business (SIB) and capital expenditure (CAPEX) was estimated on a zero-based basis from the Geita’s BP2022 9+3 LOM mining schedule and is estimated at $294M for the LOM plan. The CAPEX relates to relates to Mineral Reserve development (ORD), surface and underground infrastructure and related development, mining fleet replacement, process infrastructure upgrades and other site SIB projects. Operating expenditure (OPEX) is estimated by a first principles budget process, applying known unit costs from mine contracts to physicals, and is estimated at $1,950M for the LOM plan. The average All in Costs (AIC) over the Mineral Reserve derived LOM plan equates to $1,113/oz. The total Mine Closure liability is included in the Processing Costs. The total liability is estimated in Q4 2021 at $69M. Decommissioning cost of infrastructures that have potential post-mining uses (re- usable infrastructures) is estimated at $13.8M. Hence, total liability excluding re-usable infrastructure is $55.2M.

AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 13 Operating Costs Item Unit Total LOM Operating costs Mining Cost USD M 967 Processing Cost USD M 550 General & Admin USD M 443 Other Operating Cost USD M 0 Total Operating costs USD M 1,950 Retrenchment USD M 30 Sustaining Capital USD M 294 1.9 Permitting requirements Geita holds a valid Special Mining License (SML45/99) which was awarded in 1999 and expires on 26 August 2024 and covers an area of approximately 196km2. In 2004 a license enlargement was granted to include Nyamulilima area. Another extension was granted in 2009 to include an extension of the Geita Hill area. The Mineral Resource and Mineral Reserve as declared as at 31st December 2021 are contained within this SML and Geita has the surface rights to the necessary portions of the SML required for mining and infrastructure. More recently, in 2016, Geita has been awarded underground rights to the necessary portions of the SML required for underground mining and infrastructure at Star and Comet and Nyankanga, and in 2020 for Geita Hill underground. Geita has several prospecting Licenses (additional 120 square kilometres) which contain several exploration targets. All the deposits used in the Mineral Resource and Mineral Reserve estimation are within the mine's SML area and the mine has permits for their exploitation. The SML expires 26 August 2024, and Geita will be engaging with the Government of the Republic of Tanzania to renegotiate existing development agreements and renewal of the SML from 2022 and concluding before expiry in August 2024. There were no changes to the SML boundaries and its term / duration during 2021. At the time of compiling this report, there were no known risks that could result in the loss of ownership, in part or in whole, of the deposits that were used in estimating the Mineral Resource and Mineral Reserve as of 31st December 2021. 1.10 Conclusions and recommendations The inclusive Mineral Resource is estimated at 90.51Mt at 2.83g/t for 8.23Moz at end of 2021 and increased by 0.87Moz (10.9%) after depletion (0.56Moz) from 2020. The open pit Mineral Resource is 3.62Moz (44%), the underground Mineral Resource is 4.25Moz (52%) and 0.36Moz (4%) is contained in stockpiles. The Mineral Resource is considered robust with high confidence classifications to support the Mineral Reserve and the LOM plan. The Geita Mineral Reserve is fully contained within the LOM plan. Stockpile Mineral Reserve is declared as Proven Mineral Reserve and mining Mineral Reserve is declared as Probable Mineral Reserve. The total Geita Mineral Reserve is 29.71Mt at 2.77g/t for 2.65Moz. Reconciliation of 2021 Mineral Reserve with 2020 Mineral Reserve shows a net increase of 309Koz mainly from exploration and model changes, primarily relating to the ongoing drilling for the Nyamulilima open pit during first half of 2021, and related Mineral Resource model update completed in October 2021. AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 14 The Geita Mineral Reserve is derived from open pit, underground and stockpile ore sources with a 63%, 34% and 3% contribution in terms of ounces respectively. 2021 depletion represents depletion to 31 December 2021. Appropriate mining and processing modifying factors and a gold price of $1,200/oz were used to prepare the Mineral Reserve. 2 Introduction 2.1 Disclose registrant This Technical Report Summary was prepared for Geita Gold Mining Limited, a subsidiary of AngloGold Ashanti Limited. 2.2 Terms of reference and purpose for which this Technical Report Summary was prepared The purpose of this QP report is to support the public disclosure of the 2021 year-end Mineral Resource and Mineral Reserve estimate at Geita located in Tanzania. AngloGold Ashanti requires that the Mineral Reserve that is an outcome of this process is generated at a minimum of a Pre-Feasibility Study (PFS) level. Terms of reference are following AngloGold Ashanti Guidelines for Reporting of Exploration Results, Mineral Resource and Ore Reserve (Guidelines for Reporting) and based on public reporting requirements as per regulation S-K 1300. Although the term Mineral Reserve is used throughout S-K 1300 and this document, it is recognised that the term Ore Reserve is synonymous with Mineral Reserve. AngloGold Ashanti uses Ore Reserve in its internal reporting. The Technical Report Summary aims to reduce complexity and therefore does not include large amounts of technical or other project data, either in the report or as appendices to the report, as stipulated in Subpart 229.1300 and 1301, Disclosure by Registrants Engaged in Mining Operations and 229.601 (Item 601) Exhibits, and General Instructions. The qualified person must draft the summary to conform, to the extent practicable, with the plain English principles set forth in § 230.421 of this chapter. Should more detail be required they will be furnished on request. The following should be noted in respect of the Technical Report Summary: • All figures are expressed on an attributable basis unless otherwise indicated • Unless otherwise stated, $ or dollar refers to United States dollars • Group and company are used interchangeably • Mine, operation, business unit and property are used interchangeably • Rounding of numbers may result in minor computational discrepancies • Numbers presented are not precise calculations and that there is uncertainty in their estimation, AngloGold Ashanti reports tonnage to zero decimal places, content for gold to two decimals and copper, content with no decimals • Metric tonnes (t) are used throughout this report and all ounces are Troy ounces to zero decimal places. • Abbreviations used in this report: gold – Au • The reference co-ordinate system used for the location of properties as well as infrastructure and licences maps / plans are stated in latitude longitude geographic co-ordinates in various formats, or relevant Universal Transverse Mercator (UTM) projection. 2.3 Sources of information and data contained in the report / used in its preparation Geita technical specialists prepared this report. For the purpose of this report, the QP’s have relied upon information provided by AngloGold Ashanti Corporations legal counsel regarding the validity of exploitation permits and licensing; this opinion has been relied upon in property description and location sections and in the summary of this report. Geita Mineral Resource and Mineral Reserve was externally audited in 2019 by Golder Associates, and internally audited in 2020, with no significant flaws identified. AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 15 2.4 Qualified Person(s) site inspections The QP for Mineral Resource and the QP for Mineral Reserve are employed by Geita Gold Mine Limited and are based at the mine. As such, they regularly visit each of the Geita mineral deposits, operations, and projects. The regional office staff who perform peer reviews on Mineral Resource and Mineral Reserve visit the mine site a minimum of once per year. 2.5 Purpose of this report This is first time reporting of the Technical Report Summary for this operation. There are no previously filed Technical Report Summaries for this operation / project. Reporting in this Technical Report Summary is related to Mineral Resource, Mineral Reserve, and exploration results. 3 Property description 3.1 Location of the property Geita is located approximately 1,200km from the main Tanzanian business centre of Dar es Salaam. It falls within the Lake Zone of northwestern Tanzania, approximately 120km west of Mwanza and 4km west of Geita town. Geita is hosted in the Geita Greenstone Belt (GGB), which is a northern segment of the Sukumaland Greenstone Belt, located in the north-western part of the Tanzania Craton and south of Lake Victoria. Geita is located at a latitude of 2.8676 S and longitude of 32.1865 E representing co-ordinates of the Geita process plant. Geita Gold Mine location map. There are no known technical, environmental, social, economic, political, or other key risks that materially impact the Mineral Resource and Mineral Reserve for which the site management and parent company do not have mitigation plans in place. However, it should be noted that the Government of the Republic of Tanzania recently amended the mining legislation and while this does not pose any risk to the current AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 16 stated licenses to operate, Geita is engaging with the Government of the Republic of Tanzania to renegotiate existing development agreements and renewal of the SML from 2022 and concluding before expiry in August 2024. 3.2 Area of the property The SML covers an area of approximately 196km2 and expires on 26 August 2024. Within the SML, there are also seven Primary Mining Licenses (PML) of about 0.629km2 which belong to third parties. The third parties operate minor artisanal scale mining, where relationships with Geita are well managed. There are a further 120km2 of prospecting licenses in the immediate vicinity of the SML which do not contain any Mineral Resource or Mineral Reserve. Geita also holds 690km2 of prospecting licenses located in Dodoma, Singida and Shinyanga regions, which do not contain any Mineral Resource or Mineral Reserve. All licenses are in good standing. 3.3 Legal aspects (including environmental liabilities) and permitting Geita holds a valid SML, issued by the Ministry of Energy and Minerals in 1999 and which expires 26 August 2024. The SML covers an area of approximately 196km2. The declared Mineral Resource and Mineral Reserve are contained within this SML and Geita has the surface rights to the necessary portions of the SML required for mining and infrastructure. More recently, Geita has been given the underground rights to the necessary portions of the SML required for underground mining and infrastructure in 2016, and more recently has been given the surface open pit mining rights at Nyamulilima. Geita has several prospecting licenses (PL), with an area of additional 120km2, which contain several exploration targets. The PLs are located adjacent to the SML and currently have no reported Mineral Resource or Mineral Reserve. The PLs are Kifufu PL10566/2016, Nyamikonwa PL9413/13, Bukolwa South PL10925/2016, Kukujuma South PL9466/2013 and Kibugwe West PL9558/2014. The location of the PLs relative to SML is shown in Geita Licence Status 2021 Map. All the deposits used in Mineral Reserve estimation are within the mine's SML area and the mine has permits for their exploitation. There were no changes to the SML boundaries and its term / duration during 2021. At the time of compiling this report, there were no known risks that could result in the loss of ownership, in part or in whole, of the deposits that were used in estimating the Mineral Resource and Mineral Reserve as at 31 December 2021. Geita License Status 2021 Map

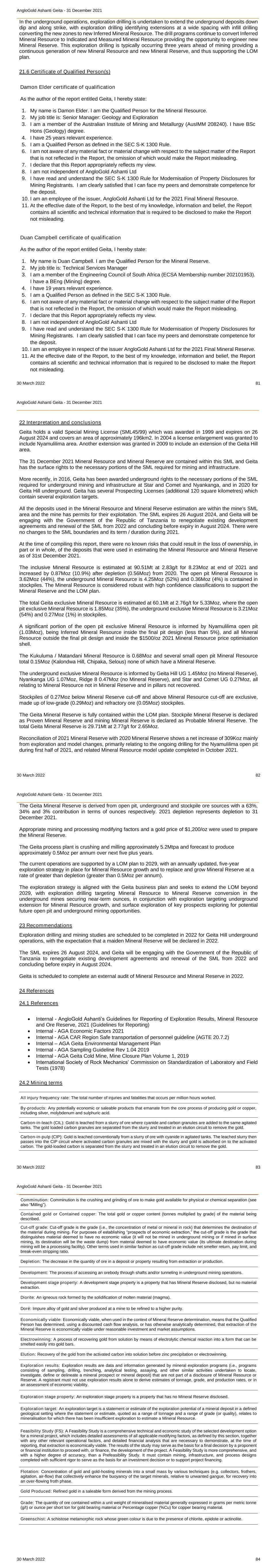

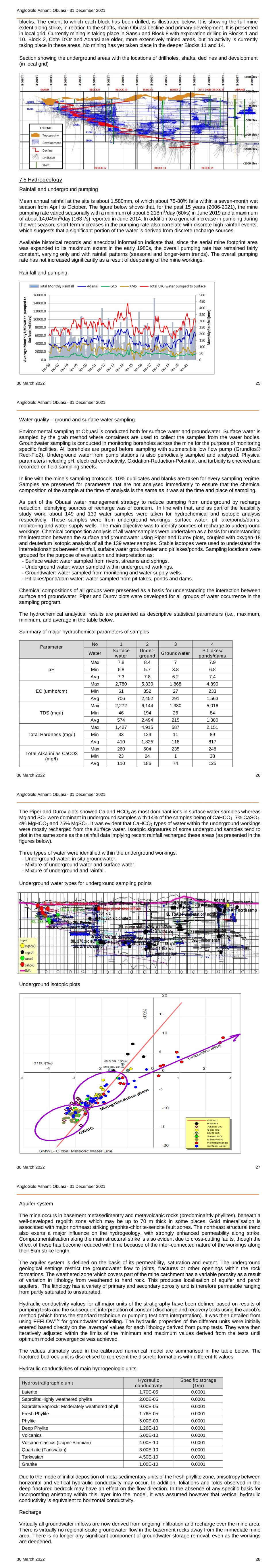

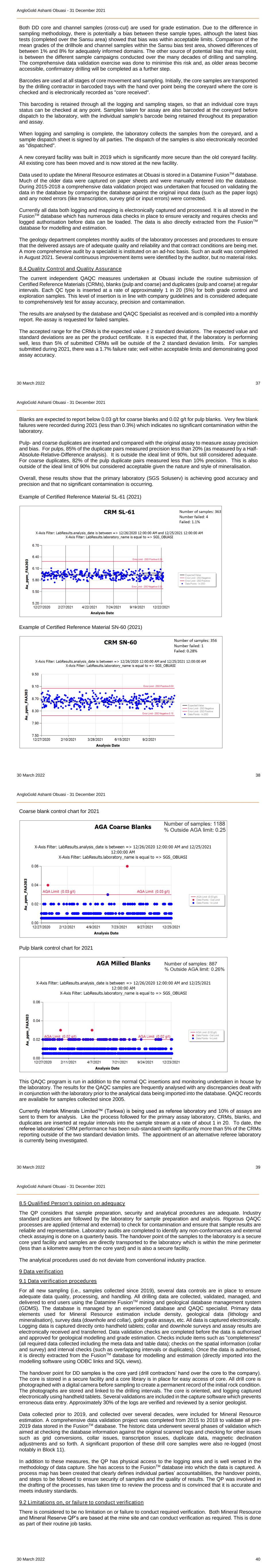

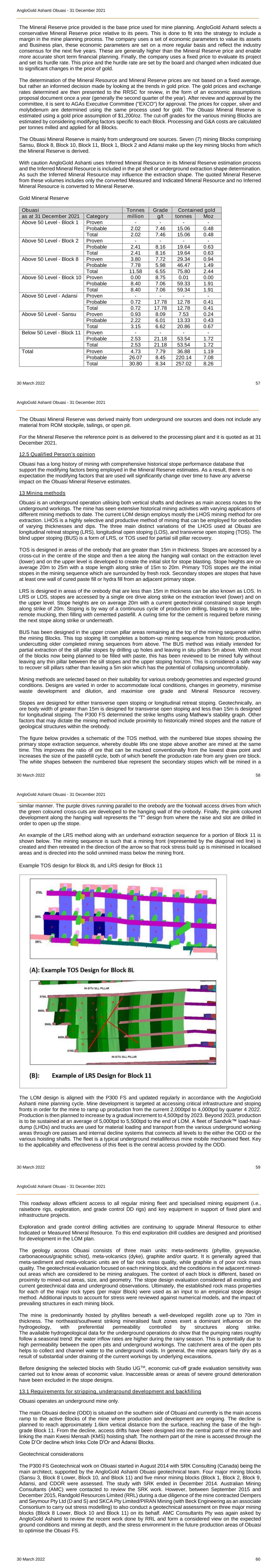

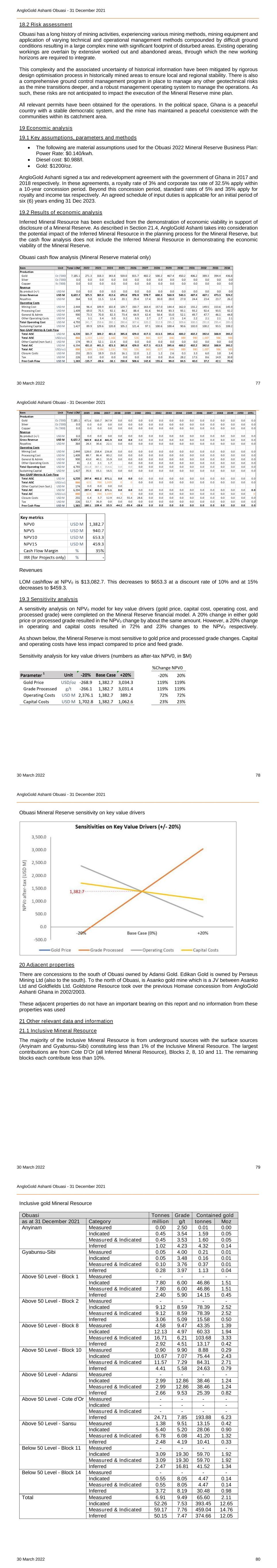

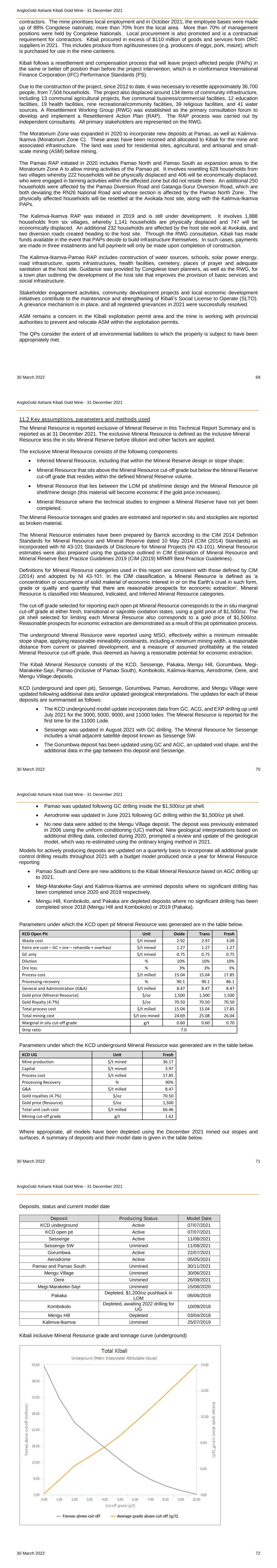

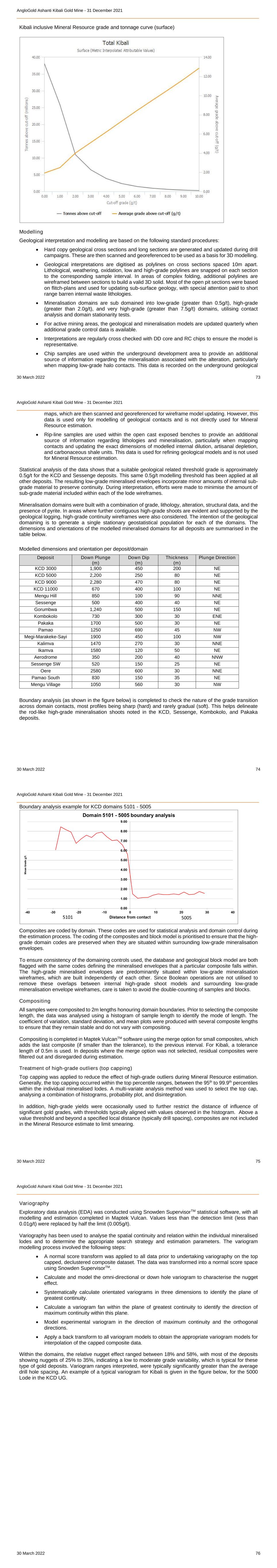

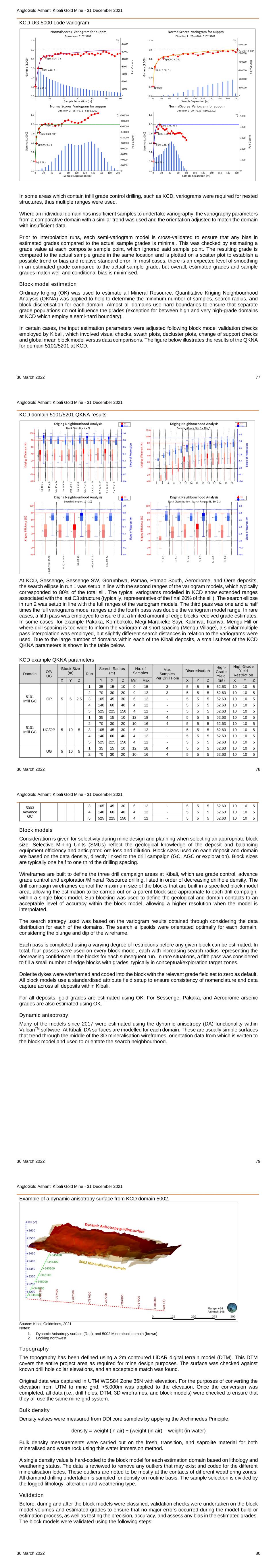

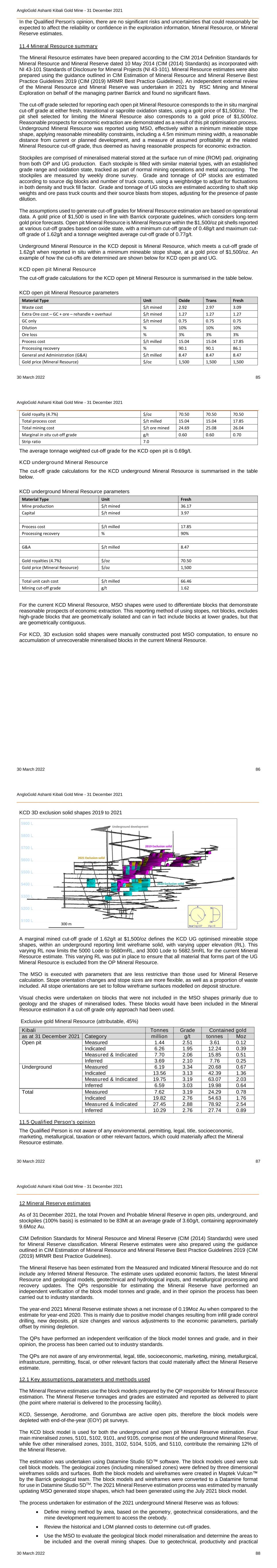

AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 17 Approximately 77% of the mine lease falls within the Geita Forest Reserve which is typically dominated by Miombo woodland with minor area of grasses and shrubs. In addition to the SML the following permits and licenses are in place: • The mine has a permit # FD/RES/GEITA/44 of 1999 to mine in the forest reserve. • Environment Impact Assessment (EIA) were conducted and approved prior to the commencement of operations at Nyankanga (1998), Kukuluma (1998), Geita Hill (2005). • The underground EIA Certificate No. for Geita Hill West and Nyankanga, as well as the new replacement power plant is: 6020/EC/EIA/2874, and valid for the duration of the specific project. This is dated January 2017. • The underground EIA Certificate No. for Star and Comet is: 5397/EC/EIA/2336, and valid for the duration of the specific project. This is dated March 2016. • In relation to SML 45/99; approval of changing of mining method for underground mining was granted in 2016 for Star and Comet and Nyankanga underground operations. • Geita Hill UG mine approval granted in September 2020. • The open pit EIA was granted for Nyamulilima in January 2021 and is valid for the duration of the project. • The open pit mining approval was granted for Nyamulilima in February 2021 and is valid for the duration of the project. Permits or agreements that were needed to be obtained with respect to the current Mineral Resource and Mineral Reserve declaration for Nyamulilima relate to an approval from the Ministry of Minerals to commence open pit mining at Nyamulilima. The approval was obtained in February 2021 and required for commencement of open pit mining in April 2021. At the time of compiling this report, there were no known impediments related to the security of tenure and the right to operate with respect to the current Mineral Resource and Mineral Reserve declaration. Geita takes account of the environmental legal requirements through its certified Environmental Management System for better management of environmental aspects such as Tailings Storage Facilities (TSF), waste disposal facilities (landfill, bio farms etc.), waste rock dumps, power generation, source pits and other wastewater impoundments. Monitoring programs are periodically undertaken as detailed in the approved AngloGold Ashanti’s Geita Environmental Management Plan which is subject to annual audits by the National Environmental Management Council and the Tanzania Mineral Audit Agency. There are currently no legal proceedings or claims that influence the rights to mine and further explore the Geita SML and associated PL’s. Site Management is working with the Resident Mines Office and other relevant government entities ensure the area remains clear of illegal mining activities. The mine is permitted to extract water by pumping of approximately 25,000m3 of raw water from Lake Victoria per day. In addition, there is sustainable use of raw water through recycling of the process water. 3.4 Agreements, royalties and liabilities Royalty is legislated at 6% of gross revenue with an additional 1% inspection fee of the gross revenue from gold exports is charged from 2017 (7% of gross revenue). Geita Gold Mine Limited is the 100% owner and operator of Geita SML and is a subsidiary of AngloGold Ashanti Limited. Rehabilitation liability is included in the mine closure costs which is taken into consideration when defining the cut-off grade for Mineral Resource and Mineral Reserve estimates. AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 18 4 Accessibility, climate, local resources, infrastructure and physiography 4.1 Property description Geita is surrounded by several natural hills and valleys extending from the eastern to western parts of the SML, issued by the Ministry of Energy and Minerals in 1999. Approximately 77% of the mine lease falls within the Geita forest reserve which is typically dominated by Miombo woodland with minor areas of grasses and shrubs. The mine is located approximately 4km west of Geita Town and approximately 25km upstream of the Lake Victoria water basin. Geita is situated at the headwaters of the Mtakuja River which drains directly into the Lake Victoria. Apart from Mtakuja river, there are other streams that drain straight to the lake such as Mabubi river, Kukuluma and Matandani streams that form part of the Lake Victoria basin. The mine can be accessed through a well-sealed tarmac road from Mwanza in the east. The area is a bimodal rainfall region that generally receives rainfalls from Mid-October to December and from March to mid-May of the year. However, changes in weather patterns have been experienced in recent times; this includes, but is not limited to, prolonged drought and storm events that lead to flood, siltation and sedimentation of rivers or channels. Changes in weather patterns are suspected to be contributed to by global climate change. The Geita population is approximately 1.7 million people with varying economic activities including small scale and artisanal mining works, animal husbandry and subsistence farming. Recently, the surrounding community has put high pressure on natural resources and highly impacted the natural forest due to demand for timber extraction, small and illegal mining workings and charcoal burning. 5 History Gold mineralisation is reported to be first discovered in the Geita district in 1898 by a German prospector. A regional survey by a Kenyan company, Saragura Prospecting Syndicate, followed in 1930. The first mine was developed in 1934, and between 1936 and 1966, the Geita mine was the largest gold mine in East Africa, producing a million ounces from underground operations. In 1996, Ashanti acquired the Geita tenure through the acquisition of Cluff Resources and acquired the Kukuluma and Matandani in 1998 from Samax Resources Limited. In December 2000, Ashanti reached an agreement to sell AngloGold a 50% interest in Geita for $324 million. AngloGold added its neighbouring Nyamulilima deposits into the joint venture (JV) company. In 2004, the merger of AngloGold and Ashanti resulted in the operation being wholly run by AngloGold Ashanti. Geita commenced open pit mining in 1999, with open pit mining at Nyankanga between 1999 and 2020, at Geita Hill including Lone Cone between 2001 and 2018, at Kukuluma and Matandani between 2002 and 2007, and at Star and Comet between 2007 and 2014. In 2015, a decision was taken to go underground at Star and Comet and the underground development started in 2016. In 2017 the Nyankanga underground operation commenced and in 2020 the Geita Hill underground operation commenced and is scheduled to ramp-up to full production by end of 2022. In 2020, the Nyankanga open pit, the only remaining operating pit at the time, was mined to completion in September 2020. In April 2021, the Nyamulilima open pit (1.67Moz) commenced operations. Geita an operating mine with a significant Mineral Resource (8.23Moz) and Mineral Reserve (2.65Moz) inventory. Based on past 20 years of production performance, and a current LOM plan forecasting production through to 2029 is considered to be a Tier 1 asset for AngloGold Ashanti. Gold production in excess of 0.5Moz per annum was achieved over the period 2017 to 2020, with 0.486Moz produced in 2021. Forecast gold production for 2022 is estimated between 480Koz and 492Koz. Currently plans are in place to increase production back to these levels (greater than 0.5Moz) in 2023, during the transition from completing the Nyankanga open pit in September 2020, and commencement of the new Nyamulilima open pit in April 2021, and commencement of the third underground operation at Geita Hill AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 19 underground mine in November 2020. Both Nyamulilima open pit and Geita Hill UG are scheduled to reach full production be end of 2022. The current operations are supported by a LOM plan to 2029, with an annually updated, five-year exploration strategy in place for Mineral Resource growth and to replace and grow Mineral Reserve at a rate of greater than depletion (greater than 0.5Moz per annum). The exploration strategy is aligned with the Geita business plan and seeks to extend the LOM beyond 2029, with exploration drilling targeting Mineral Resource conversion allowing for engineering of an increased Mineral Reserve in the underground mines securing near-term ounces, in conjunction with exploration targeting underground extension for Mineral Resource growth, and surface exploration of key prospects exploring for potential future open pit and underground mining opportunities. Geita been in operation since 2000, and the Mineral Resource to Reserve to production reconciliation is monitored and shows reliable performance between Mineral Resource/Mineral Reserve and mine production. Infill drilling plans ensure that the two-year production window is drilled to Indicated and Measured Mineral Resource confidence status. The Mineral Resource to Mineral Reserve to production reconciliation shows a steady improvement since 2009 when this infill drilling strategy was initiated for open pit mining. This strategy was then extended to underground operations in 2016 when Star and Comet started. Currently the underground Mineral Resource confidence is upgraded to Measured confidence levels 18 to 24 months ahead of mining through underground grade control drilling programs. The existing historical Mineral Resource estimates and performance statistics on actual production are presented below Year Reconciliation Entity 2018 2019 2020 2021 Mineral Resource Model (oz) 461,227 511,310 627,356 301,146 Grade Control Model (oz) 604,210 608,493 741,355 298,094 Percentage (%) 131 119 118 99 Year Reconciliation Entity 2018 2019 2020 2021 Mining Feed (oz) 682,241 651,041 711,042 489,753 Plant Accounted (oz) 642,997 665,840 680,915 530,830 Percentage (%) 94 102 96 108 Mining feed as obtained from the grade control models performs well against the plant accounted gold. Geita is reporting open pit, underground and stockpiled Mineral Reserve. Open pit Mineral Reserve is reported from Nyamulilima (maiden Mineral Reserve of 0.99Moz declared in 2020, increasing to 1.67Moz in 2021) and underground Mineral Reserve is reported from Nyankanga and Star and Comet (totalling 0.89Moz). Programs of exploration drilling are in progress with a Mineral Reserve expected to be declared for Geita Hill underground in 2022. 6 Geological setting, mineralisation and deposit 6.1 Geological setting The Geita deposit is hosted in the Geita Greenstone Belt (GGB), which is a northern segment of the Sukumaland Greenstone Belt, located in the north-western part of the Tanzania Craton and south of Lake Victoria. This Archaean sequence strikes almost east west, extending for about 80km long and up to 20km wide. The GGB sits dominantly within the Nyanzian Supergroup stratigraphy that is sub-divided into the Lower Nyanzian and the Upper Nyanzian groups. The Lower Nyanzian group is composed of mafic volcanic units (basalts, pillow basalt, minor gabbro, and dolerites). This group of rocks within the GGB is collectively termed the Kiziba Formation. The Upper Nyanzian group consists of black shales, banded iron formation, clastic sedimentary rock, tuffs, agglomerates and felsic volcaniclastics. The entire package (Nyanzian stratigraphy) is intruded by a variety of mafic to felsic rocks. The supra-crustal package shows AngloGold Ashanti Geita - 31 December 2021 _____________________________________________________________________________________ 30 March 2022 20 variable thickness and is estimated to be more than 500m thick in places, mostly underlain by intrusive complexes. A simplified stratigraphy of the main igneous rocks in the Geita area are summarised as: Archaean Gabbro, Basalts, and intermediate to acid volcanoclastic sediments > Diorites > Tonalites-Granodiorites > Granites > Proterozoic Gabbro dykes. Across the Archaean-Proterozoic rocks there is a property-wide paleo-drainage system, which likely flowed towards Lake Victoria. These late sediments likely represent the remnants of a much thicker package that might have covered all the hills exposed today. Both the Archaean-Proterozoic rocks and paleo-alluvials are covered by ferricrete at different levels of induration and evolution, up to 15m thick. The region hosts several world-class shear-hosted Archaean lode gold deposits and forms the northern portion of the regional Sukumaland Greenstone Belt, itself one of several belts that comprise the Lake Victoria goldfields. Other gold mines hosted in the Lake Victoria Goldfields include Golden Pride, Bulyanhulu, Tulawaka, Buzwagi and North Mara. The GGB has been through a protracted history of deformation, which resulted in a large scale syn-formal configuration in the region, with west-northwest trending limbs connected by a northeast trending hinge zone. Eight deformation phases (D1 to D8) and four folding phases (F1 to F4) are identified at Geita, where deformation in the GGB comprises of early stages of ductile shearing and folding (D1 to D5), with periodic emplacement of large diorite intrusive complexes, sills, and dykes. Later stages of deformation (D6 to D8) involved development of brittle-ductile shear zones, with faults developed in the later stages of deformation, with late emplacement felsic porphyry dykes within the greenstone belt, and granitic intrusions located on the margins of the greenstone belt. Gold mineralisation occurred late in the tectonic history of the greenstone belt, synchronous with the development of brittle-ductile shear zones (D6). The mineralisation in GGB is preferentially hosted within deformation zones (both ductile and dominant brittle deformation) developed along the contact of banded iron formation and porphyries of various compositions and associated with major shear systems. The shear systems preferentially exploit fold axial planes as well as the contacts between the supra-crustal and intrusive rocks. The structures associated with the mineralised system are well defined, the alteration zone is restricted to the mineralised zone, quartz veins are rare or missing although silicification is common. Mineralisation is dominantly sulphide replacement of magnetite-rich layers in banded iron formation, with local replacement of ferromagnesian phases and magnetite in the diorite intrusions. Primary gold mineralisation is associated with the intersection of the brittle-ductile shear zones and pre-existing fold hinges, with higher grade concentrations associated with banded iron formation and with diorite dyke and sill contacts. The Geita gold deposits are shear hosted, Archaean orogenic gold deposits, and within the leases the GGB is subdivided into three major mineralised trends: (i) Geita Central Trend, hosting Nyankanga, Geita Hill, and Lone Cone deposits, (ii) Nyamulilima Trend in the west, hosting Star and Comet, Ridge 8 and Nyamulilima deposits; and (iii) Matandani-Kukuluma Trend to the northeast, hosting Matandani and Kukuluma deposits. The Geita Central Trend contains three major gold deposits occurring along a NE-SW mineralised trend. These are from northeast to southwest: Geita Hill, Lone Cone and Nyankanga. Other prospects occur singly: Chipaka in the centre of the greenstone belt, and Kalondwa Hill, P30, Fukiri- Jumanne along an NW-SE trending banded iron formation ridge. The deposits of the Central Trend are mainly located within the relatively low-strain hinge zone, where the Geita Hill, Lone Cone and Nyankanga deposits occur along a moderately NW dipping system of reverse faults that have been frequently reactivated during subsequent deformation events. At Geita Hill (and Lone Cone), dioritic rocks are present as sills and dykes intruded into a supra-crustal sequence that has been subject to extensive polyphase folding. The mineralisation is controlled by a