Form 497K WILLIAM BLAIR FUNDS

Summary Prospectus May 1, 2022

Small Cap Value Fund

| Class N WBVNX | Class I ICSCX | Class R6 WBVRX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at williamblairfunds.com/prospectus. You can also get this information at no cost by calling 1-800-742-7272 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, each dated May 1, 2022, as supplemented, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE: The William Blair Small Cap Value Fund seeks long-term capital appreciation.

FEES AND EXPENSES: This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment):

| Class N | Class I | Class R6 | ||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases |

None | None | None | |||||||||

| Redemption Fee |

None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| Class N | Class I | Class R6 | ||||||||||

| Management Fee |

0.75% | 0.75% | 0.75% | |||||||||

| Distribution (Rule 12b-1) Fee |

0.25% | None | None | |||||||||

| Other Expenses |

0.26% | 0.07% | 0.03% | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Annual Fund Operating Expenses |

1.26% | 0.82% | 0.78% | |||||||||

| Fee Waiver and/or Expense Reimbursement* |

0.11% | N/A | N/A | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.15% | 0.82% | 0.78% | |||||||||

| * | William Blair Investment Management, LLC (the “Adviser”) has entered into a contractual agreement with the Fund to waive fees and/or reimburse expenses in order to limit the Fund’s operating expenses (excluding interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses on short sales, other investment-related costs and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of the Fund’s business) to 1.15% of average daily net assets for Class N shares until April 30, 2023. The |

1

| Adviser may not terminate this arrangement prior to April 30, 2023 without the approval of the Fund’s Board of Trustees. |

Example: This example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. The figures reflect the expense limitation for the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class N | $117 | $389 | $681 | $1,513 | ||||||||||||

| Class I | 84 | 262 | 455 | 1,014 | ||||||||||||

| Class R6 | 80 | 249 | 433 | 966 | ||||||||||||

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the fiscal year ended October 31, 2021, the Fund’s portfolio turnover rate was 35% of the average value of its portfolio. During the two months ended December 31, 2021, the Fund’s portfolio turnover rate was 7% of the average value of its portfolio. The portfolio turnover rates reflect both that of the ICM Small Company Portfolio (the “Predecessor Fund”) prior to July 16, 2021, the date the Fund acquired the assets and assumed the liabilities of the Predecessor Fund in a reorganization (the “Reorganization”) and the portfolio turnover of the Fund subsequent to such date.

PRINCIPAL INVESTMENT STRATEGIES: Under normal market conditions, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of small capitalized (“small cap”) companies. For purposes of the Fund, the Adviser considers a company to be a small cap company if it has a market capitalization no larger than the largest capitalized company included in the Russell 2000® Index at the time of the Fund’s investment. Securities of companies whose market capitalizations no longer meet this definition after purchase may continue to be held in the Fund. To a limited extent, the Fund may also purchase stocks of companies with business characteristics and value prospects similar to small cap companies, but that may have market capitalizations above the market capitalization of the largest member of the Russell 2000® Index. The Fund may invest in equity securities listed on a national securities exchange or traded in the over-the-counter markets. The Fund invests primarily in common stocks, but it may also invest in other types of equity securities, including real estate investment trusts (“REITs”) and American Depositary Receipts (“ADRs”).

The Russell 2000® Index is a widely recognized, unmanaged index of common stocks that measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The companies in the Russell 2000® Index are considered representative of small cap companies. The size of companies in the Russell 2000® Index may change with market conditions. In addition, changes to the composition of the Russell 2000® Index can change the market capitalization range of the companies included in the index. As of March 31, 2022, the Russell 2000® Index included securities issued by companies that ranged in size between $21.6 million and $14.2 billion. The Russell 2000® Value Index, the Fund’s benchmark, measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

In selecting investments for the Fund, the Adviser typically looks to invest in companies with leading market share positions, shareholder oriented managements, and strong balance sheet and cash flow ratios.

2

Usually, the shares of the companies the Adviser buys are selling at a price to earnings ratio below the average price to earnings ratio of the stocks that comprise the Russell 2000® Index. In addition, the companies selected by the Adviser usually have higher returns on equity and capital than the average company in the Russell 2000® Index. The Adviser screens the Fund’s universe of potential investments to identify potentially undervalued securities based on factors such as financial strength, earnings valuation, and earnings quality. The Adviser further narrows the list of potential investments through traditional fundamental security analysis, which may include interviews with company management and a review of the assessments and opinions of outside analysts and consultants. Securities are sold when the Adviser believes the shares have become relatively overvalued or it finds more attractive alternatives. The Adviser generally will not sell a security merely due to market appreciation outside the Fund’s target capitalization range if it believes the company has growth potential.

PRINCIPAL RISKS: The Fund’s returns will vary, and you could lose money by investing in the Fund. The following is a summary of the principal risks associated with an investment in the Fund.

Equity Funds General. Because the Fund invests substantially all of its assets in equity securities of U.S. small cap value companies, the primary risk is that the value of the equity securities it holds might decrease in response to the activities of an individual company or in response to general market, business and economic conditions. If this occurs, the Fund’s share price may also decrease. In addition, there is the risk that individual securities may not perform as expected or a strategy used by the Adviser may fail to produce its intended result.

Market Risk. The value of the Fund’s investments may go up or down, sometimes rapidly or unpredictably. The value of an investment may decline due to factors affecting securities markets generally or particular industries represented in the securities markets. The value of an investment may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Events such as war, acts of terrorism, social unrest, natural disasters, the spread of infectious illness or other public health threats could also significantly impact the Fund and its investments. The value of an investment may also decline due to factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. During a general downturn in the securities markets, multiple asset classes may decline in value simultaneously. Geopolitical and other events may also disrupt securities markets and adversely affect global economies and markets and thereby decrease the value of the Fund’s investments.

Small and Micro Cap Company Risk. Stocks of small and micro cap companies involve greater risk than those of larger, more established companies. This is because small and micro cap companies may be in earlier stages of development, may be dependent on a small number of products or services, may lack substantial capital reserves and/or do not have proven track records. Small and micro cap companies may be traded in low volumes. This can increase volatility and increase the risk that the Fund will not be able to sell a security on short notice at a reasonable price. The securities of small and micro cap companies may be more volatile and less liquid than securities of large capitalized companies. For purposes of the Fund, micro cap companies are companies with market capitalizations of $500 million or less at the time of the Fund’s investment.

REIT Risk. REITs are pooled investment vehicles that own, and usually operate, income-producing real estate. REITs are susceptible to the risks associated with direct ownership of real estate, such as the following: declines in property values; increases in property taxes, operating expenses, interest rates or competition; overbuilding; zoning changes; and losses from casualty or condemnation. REITs typically incur fees that are separate from those of the Fund. Accordingly, the Fund’s shareholders will indirectly bear a proportionate share of the REITs’ operating expenses, in addition to paying Fund expenses. REIT operating expenses are not reflected in the fee table and example in this Prospectus.

3

Foreign Securities Risk. The Fund’s investments in ADRs are subject to foreign securities risk. ADRs are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and traded on U.S. exchanges. Although ADRs are alternatives to directly purchasing the underlying foreign securities in their national markets and currencies, they continue to be subject to many of the risks associated with investing directly in foreign securities.

Share Ownership Concentration Risk. To the extent that a significant portion of the Fund’s shares is held by a limited number of shareholders or their affiliates, there is a risk that the share trading activities of these shareholders could disrupt the Fund’s investment strategies, which could have adverse consequences for the Fund and other shareholders (e.g., by requiring the Fund to sell investments at inopportune times or causing the Fund to maintain larger-than-expected cash positions pending acquisition of investments).

Style Risk. Different investment styles (e.g., growth vs. value, quality bias, market capitalization focus) tend to shift in and out of favor depending on market conditions and investor sentiment, and at times when the value investment style used by the Adviser for the Fund is out of favor, the Fund may underperform other equity funds that use different investment styles.

Portfolio Turnover Rate Risk. Higher portfolio turnover rates involve correspondingly higher transaction costs, which are borne directly by the Fund. In addition, the Fund may realize significant short-term and long-term capital gains if portfolio turnover rate is high, which will result in taxable distributions to investors that may be greater than those made by other funds with lower portfolio turnover rates.

Focus Risk. To the extent that the Fund focuses its investments in particular industries, asset classes or sectors of the economy, any market changes affecting companies in those industries, asset classes or sectors may impact the Fund’s performance.

Operational and Technology Risk. Cyber-attacks, disruptions, or failures that affect the Fund’s service providers, counterparties, market participants, or issuers of securities held by the Fund may adversely affect the Fund and its shareholders, including by causing losses for the Fund or impairing Fund operations.

The Fund is not intended to be a complete investment program. The Fund is designed for long-term investors.

The Fund involves a high level of risk and may not be appropriate for everyone. You should only consider it for the aggressive portion of your portfolio.

FUND PERFORMANCE HISTORY: The information below provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the periods indicated compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. On July 16, 2021, the Fund acquired the assets and assumed the liabilities of the Predecessor Fund, a series of The Advisors’ Inner Circle Fund. In the Reorganization, former shareholders of the Predecessor Fund received Class I shares of the Fund. The Predecessor Fund was advised by Investment Counselors of Maryland, LLC, which was acquired by the Adviser. The Predecessor Fund’s (Institutional Class shares) performance and financial history has been adopted by Class I shares of the Fund following the Reorganization and will be used going forward from the date of the Reorganization. The performance of Class I shares of the Fund therefore reflects the performance of the Predecessor Fund prior to the Reorganization. The performance of the Predecessor Fund has not been restated to reflect the annual operating expenses of Class I shares of the Fund, which were different than those of the Predecessor Fund. Because the Fund had different fees and expenses than

4

the Predecessor Fund, the Predecessor Fund would therefore have had different performance results if it was subject to the Fund’s fees and expenses. The Fund’s past performance (including the performance of the Predecessor Fund), before and after taxes, is not necessarily an indication of how the Fund will perform in the future and does not guarantee future results. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

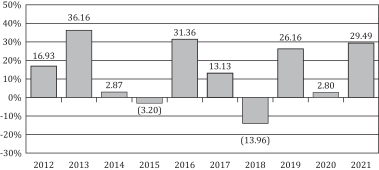

Annual Total Returns. The bar chart below provides an illustration of how the Fund’s performance has varied in each of the last ten calendar years for Class I shares.

|

Highest Quarterly 29.75% (4Q20) |

Lowest Quarterly (35.02)% (1Q20) |

Average Annual Total Returns (For the periods ended December 31, 2021). The table below shows returns on a before-tax and after-tax basis for Class I shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Because the Predecessor Fund did not offer share classes other than Institutional Class shares, no performance information is shown for Class R6 or Class N shares of the Fund. Performance information for those classes will be provided after a full calendar year of performance history following the Reorganization is available.

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class I Shares |

||||||||||||

| Return Before Taxes |

29.49% | 10.33% | 13.03% | |||||||||

| Return After Taxes on Distributions |

24.71% | 7.96% | 10.50% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

19.14% | 7.52% | 10.01% | |||||||||

| Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) |

28.27% | 9.07% | 12.03% | |||||||||

MANAGEMENT:

Investment Adviser. William Blair Investment Management, LLC is the investment adviser of the Fund.

Portfolio Manager(s). William V. Heaphy, CFA, an Associate of the Adviser, and Gary J. Merwitz, an Associate of the Adviser, co-manage the Fund. Mr. Heaphy and Mr. Merwitz have each co-managed the Fund since 2021 (and managed the Predecessor Fund since 1999 and 2004, respectively).

5

PURCHASE AND SALE OF FUND SHARES:

Class N Share Purchase. The minimum initial investment for an account generally is $2,500. The minimum subsequent investment generally is $1,000. Certain exceptions to the minimum initial and subsequent investment amounts may apply. See “Your Account—Class N Shares” for additional information on eligibility requirements applicable to purchasing Class N shares.

Class I Share Purchase. The minimum initial investment for an account generally is $500,000 (or any lesser amount if, in William Blair’s opinion, the investor has adequate intent and availability of funds to reach a future level of investment of $500,000). There is no minimum for subsequent purchases. There is no minimum initial investment for qualified retirement plans, including, but not limited to, 401(k) plans, 457 plans, employer-sponsored 403(b) plans, defined benefit plans and other similar accounts, or plans whereby Class I shares are held through omnibus accounts (either at the plan level or the level of the plan administrator) and certain other accounts. William Blair may make certain additional exceptions to the minimum initial investment amount in its discretion. Class I shares are only available to certain investors. See “Your Account—Class I Shares” for additional information on the eligibility requirements and investment minimums applicable to purchasing Class I shares.

Class R6 Share Purchase. The minimum initial investment for an account is $1 million (or any lesser amount if, in William Blair’s opinion, the investor has adequate intent and availability of funds to reach a future level of investment of $1 million). There is no minimum for subsequent purchases. There is no minimum initial investment for qualified retirement plans, including, but not limited to, 401(k) plans, 457 plans, employer-sponsored 403(b) plans, defined benefit plans and other similar accounts, or plans whereby Class R6 shares are held through omnibus accounts (either at the plan level or the level of the plan administrator) and certain other accounts. William Blair may make certain additional exceptions to the minimum initial investment amount in its discretion. Class R6 shares are only available to certain investors. See “Your Account—Class R6 Shares” for additional information on eligibility requirements and investment minimums applicable to purchasing Class R6 shares.

Sale. Shares of the Fund are redeemable on any day the New York Stock Exchange is open for business by mail, wire or telephone, depending on the elections you make in the account application.

TAX INFORMATION: The Fund intends to make distributions that may be taxed as ordinary income or capital gains, unless you are investing through a tax-advantaged investment plan. If you are investing through a tax-advantaged investment plan, withdrawals from the tax-advantaged investment plan may be subject to taxes.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- William Blair on Sage Therapeutics (SAGE): 'we have difficulty envisioning what additional data could be generated to support a resubmission'

- William Blair Starts On Holding AG (ONON) at Outperform, 'e see a path to three-year revenue growth above 25%'

- APi Group Corporation (APG) Prices 11M Share Offering at $37.50/sh

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

William BlairSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share