Form 497K Voya PARTNERS INC

Summary Prospectus May 1, 2022, as supplemented January 27, 2023

Voya Index Solution 2025 Portfolio

|

Class/Ticker: Z/VSCBX

|

Before you invest, you may want to review the portfolio's Prospectus, which contains more information about the portfolio

and its risks. For free paper or electronic copies of the Prospectus and other portfolio information (including the Statement of Additional Information

and most recent financial report to shareholders), go to www.individuals.voya.com/literature; email a request to [email protected]; call 1-800-262-3862; or ask your salesperson, financial intermediary, or retirement plan administrator. The portfolio's Prospectus and Statement of Additional

Information, each dated May 1, 2022, as supplemented, and the audited financial statements on pages 18-55 of the portfolio’s shareholder report dated

December 31, 2021 are incorporated into this Summary Prospectus by reference and may be obtained free of charge at the website, phone number,

or e-mail address noted above.

Investment Objective

Until the day prior to its Target Date (defined below), the Portfolio seeks to provide total return consistent with an asset

allocation targeted at retirement in approximately 2025. On the Target Date, the Portfolio's investment objective will be

to seek to provide a combination of total return and stability of principal consistent with an asset allocation targeted to retirement.

Fees and Expenses of the Portfolio

The table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Portfolio. You may pay other fees and expenses such as fees and expenses imposed under your variable annuity contracts or variable life insurance

policies (“Variable Contract”) or a qualified pension or retirement plan (“Qualified Plan”), which are not reflected in the tables and examples below. If these fees or expenses were included in the table, the Portfolio’s expenses would be higher. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator.

Annual Portfolio Operating Expenses

Expenses you pay each year as a % of the value of your investment

Expenses you pay each year as a % of the value of your investment

|

Class

|

|

Z

|

|

Management Fees1

|

|

0.21%

|

|

Distribution and/or Shareholder Services (12b-1) Fees

|

|

None

|

|

Other Expenses

|

|

0.04%

|

|

Acquired Fund Fees and Expenses

|

|

0.15%

|

|

Total Annual Portfolio Operating Expenses2

|

|

0.40%

|

|

Waivers and Reimbursements3

|

|

(0.25)%

|

|

Total Annual Portfolio Operating Expenses after Waivers and

Reimbursements

|

|

0.15%

|

1

The Portfolio’s Management Fee structure is a “bifurcated fee” structure as follows: an annual rate of 0.20% of the Portfolio’s average daily net assets invested in Underlying Funds within the Voya family of funds, and 0.40% of the Portfolio’s average daily net assets invested

in direct investments.

2

Total Annual Portfolio Operating Expenses may be higher than the Portfolio's ratio of expenses to average net assets shown

in the Portfolio’s Financial Highlights, which reflects the operating expenses of the Portfolio and does not include Acquired Fund Fees and Expenses.

3

The adviser is contractually obligated to limit expenses to 0.00% for Class Z shares through May 1, 2024. The limitation does not extend to investment-related costs, extraordinary expenses, and Acquired Fund Fees and Expenses. Termination or modification of this obligation requires

approval by the Portfolio’s board.

Expense Example

The Example is intended to help you compare the cost of investing in shares of the Portfolio with the costs of investing in

other mutual funds. The Example does not reflect expenses and charges which are, or may be, imposed under your Variable Contract or Qualified Plan. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated. The

Example also assumes that your investment had a 5% return each year and that the Portfolio's operating expenses remain the same. The Example reflects applicable expense limitation agreements and/or waivers in effect, if any, for the one-year period and the first year of the three-, five-, and ten-year periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 of 10

|

Class

|

|

|

1 Yr

|

3 Yrs

|

5 Yrs

|

10 Yrs

|

|

|

|

|

|

|

|

Z

|

|

$

|

15

|

103

|

199

|

481

|

|

|

|

|

|

|

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in Annual Portfolio

Operating Expenses or in the Expense Example, affect the Portfolio's performance.

During the most recent fiscal year, the Portfolio's portfolio turnover rate was 40% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes)

in a combination of Underlying Funds which are passively managed index funds. The Portfolio will provide shareholders with

at least 60 days' prior written notice of any change in this investment policy. The Underlying Funds may or may not be advised

or subadvised by the Investment Adviser or an affiliate of the Investment Adviser. The Underlying Funds invest in U.S. stocks,

international stocks, U.S. bonds, and other fixed-income instruments and the Portfolio uses an asset allocation strategy designed

for investors expecting to retire around the year 2025. The Portfolio's current approximate target investment allocation (expressed

as a percentage of its net assets) (the “Target Allocation”) among the Underlying Funds is as follows: 45% in equity securities and 55% in fixed-income instruments. Although this is the Target Allocation, the actual allocation of the Portfolio's assets

may deviate from the percentages shown. In establishing the Portfolio’s exposure to fixed-income instruments, the Investment

Adviser will set target allocations to funding agreements with affiliated or unaffiliated (if available) insurance companies

(collectively, “Funding Agreements”), which will not exceed 10% in the case of contracts of any single issuer or 20% for all issuers combined. Because those are target allocations, the Portfolio’s actual allocations might exceed those percentages at times due to a

variety of factors, such as changes in the relative values of the Portfolio’s investments and cash flows into and out of the

Portfolio, and at those times the Portfolio will typically continue to invest new cash in accordance with those target allocations.

At least 80% of the Portfolio’s assets will normally be invested in Underlying Funds, including exchange-traded funds (“ETFs”), advised or subadvised by the Investment Adviser or an affiliate of the Investment Adviser; this amount may include investments

in one or more Funding Agreements issued by Voya Retirement Insurance and Annuity Company (“VRIAC”). The sub-adviser (the “Sub-Adviser”) may in its discretion invest up to 20% of the Portfolio’s assets in Underlying Funds, including ETFs, that are not advised or subadvised by the Investment Adviser or an affiliate of the Investment Adviser and, potentially, in Funding

Agreements issued by insurance companies unaffiliated with the Investment Adviser, should they be available for investment

by the Portfolio.

The Target Allocation is measured with reference to the principal investment strategies of the Underlying Funds; actual exposure

to fixed-income instruments and equity securities will vary from the Target Allocation depending on the actual investments

held by the Underlying Funds. The Sub-Adviser may periodically cause the Portfolio to deviate from the Target Allocation based

on its assessment of current market conditions or other factors. Generally, the deviations fall within the range of +/- 10%

relative to the current Target Allocation. The Sub-Adviser may determine, in light of market conditions or other factors,

to deviate by a wider margin in order to protect the Portfolio, achieve its investment objective, or to take advantage of particular

opportunities.

The Underlying Funds provide exposure to a wide range of traditional asset classes which include stocks, bonds, and cash.

Equity securities in which the Underlying Funds invest include, but are not limited to, the following: domestic and international

large-, mid-, and small-capitalization stocks (which may be growth oriented, value oriented, or a blend); and emerging market

securities.

Fixed-income instruments in which the Underlying Funds invest include, but are not limited to, the following: domestic and

international long-, intermediate-, and short-term bonds; high-yield bonds commonly referred to as “junk-bonds”; floating rate loans; and Funding Agreements.

The Portfolio may also invest in derivatives, including futures and swaps (including interest rate swaps, total return swaps,

and credit default swaps), to make tactical allocations, as a substitute for taking a position in the underlying asset, to

minimize risk, and to assist in managing cash.

The Portfolio may also allocate to the following non-traditional asset classes (also known as alternative strategies) which

include, but are not limited to the following: domestic and international real estate-related securities, including real estate

investment trusts (“REITs”); natural resource/commodity securities; and U.S. Treasury Inflation-Protected Securities. There can be no assurance that these allocations will occur.

Summary Prospectus

2 of 10

Voya Index Solution 2025 Portfolio

The Portfolio is designed primarily for long-term investors in tax-advantaged accounts. The Portfolio is structured and managed

around a specific target retirement or financial goal date of 2025 (“Target Date”). The Target Date is the approximate year that an investor in the Portfolio would plan to make withdrawals from the Portfolio for retirement or other financial goals.

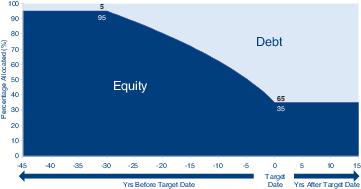

The chart below shows the glide path and illustrates how the target allocations to equity securities and debt instruments will

change over time. Generally, the Portfolio's glide path will transition to the target asset allocation illustrated below on

an annual basis and become more conservative as the Portfolio approaches the Target Date. As the Portfolio approaches its Target Date, the Portfolio's Target Allocation is anticipated to be the same as that of Voya Index Solution Income Portfolio,

which is equal to approximately 35% equity securities and 65% debt instruments.

As the Portfolio's Target Allocation migrates toward that of Voya Index Solution Income Portfolio by the Target Date, it is

anticipated that the Portfolio would be merged with and into the Voya Index Solution Income Portfolio. The Voya Index Solution

Income Portfolio is for those investors who are retired, nearing retirement or in need of making withdrawals from their portfolio

soon.

In summary, the Portfolio is designed for an investor who plans to withdraw the value of the investor's investments in the

Portfolio gradually on or after the Target Date. The mix of investments in the Portfolio's Target Allocation will change over

time and seek to reduce investment risk as the Portfolio approaches its Target Date.

The Portfolio will be rebalanced periodically to return to the Target Allocation. The Target Allocation may be changed at

any time by the Sub-Adviser.

Principal Risks

You could lose money on an investment in the Portfolio, even near, at, or after the Target Date. There is no guarantee that the Portfolio will provide adequate income at and through your retirement or for any of your financial goals. The value of

your investment in the Portfolio changes with the values of the Underlying Funds and their investments. The Portfolio is subject

to the following principal risks (either directly or through investments in one or more Underlying Funds). Any of these risks,

among others, could affect the Portfolio's or an Underlying Fund's performance or cause the Portfolio or an Underlying Fund

to lose money or to underperform market averages of other funds. The principal risks are presented in alphabetical order to

facilitate readability, and their order does not imply that the realization of one risk is more likely to occur or have a

greater adverse impact than another risk.

Asset Allocation: Investment performance depends on the manager’s skill in allocating assets among the asset classes in which the Portfolio invests and in choosing investments within those asset classes. There is a risk that the manager may allocate assets or investments to or within an asset class that underperforms compared to other asset classes or investments.

Cash/Cash Equivalents: Investments in cash or cash equivalents may lower returns and result in potential lost opportunities to participate in market appreciation which could negatively impact the Portfolio’s performance and ability to achieve its

investment objective.

Company: The price of a company’s stock could decline or underperform for many reasons, including, among others, poor management, financial problems, reduced demand for the company’s goods or services, regulatory fines and judgments, or business challenges. If a company is unable to meet its financial obligations, declares bankruptcy, or becomes insolvent,

its stock could become worthless.

Credit: The Portfolio could lose money if the issuer or guarantor of a fixed-income instrument in which the Portfolio invests, or the counterparty to a derivative contract the Portfolio entered into, is unable or unwilling, or is perceived (whether

by market participants, rating agencies, pricing services, or otherwise) as unable or unwilling, to meet its financial obligations.

Summary Prospectus

3 of 10

Voya Index Solution 2025 Portfolio

Credit Default Swaps: The Portfolio may enter into credit default swaps, either as a buyer or a seller of the swap. A buyer of a credit default swap is generally obligated to pay the seller an upfront or a periodic stream of payments over the term of

the contract until a credit event, such as a default, on a reference obligation has occurred. If a credit event occurs, the seller

generally must pay the buyer the “par value” (full notional value) of the swap in exchange for an equal face amount of deliverable obligations of the reference entity described in the swap, or the seller may be required to deliver the related net cash amount

if the swap is cash settled. As a seller of a credit default swap, the Portfolio would effectively add leverage to its portfolio

because, in addition to its total net assets, the Portfolio would be subject to investment exposure on the full notional value

of the swap. Credit default swaps are particularly subject to counterparty, credit, valuation, liquidity, and leveraging risks

and the risk that the swap may not correlate with its reference obligation as expected. Certain standardized credit default swaps

are subject to mandatory central clearing. Central clearing is expected to reduce counterparty credit risk and increase liquidity;

however, there is no assurance that it will achieve that result, and, in the meantime, central clearing and related requirements

expose the Portfolio to new kinds of costs and risks. In addition, credit default swaps expose the Portfolio to the risk of

improper valuation.

Currency: To the extent that the Portfolio invests directly or indirectly in foreign (non-U.S.) currencies or in securities denominated

in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will

decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative

to the currency being hedged by the Portfolio through foreign currency exchange transactions.

Deflation: Deflation occurs when prices throughout the economy decline over time—the opposite of inflation. Unless repayment of the original bond principal upon maturity (as adjusted for inflation) is guaranteed, when there is deflation, the principal

and income of an inflation-protected bond will decline and could result in losses.

Derivative Instruments: Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying asset, reference rate, or index credit risk with respect to the counterparty, risk of loss due to

changes in market interest rates, liquidity risk, valuation risk, and volatility risk. The amounts required to purchase certain derivatives

may be small relative to the magnitude of exposure assumed by the Portfolio. Therefore, the purchase of certain derivatives

may have an economic leveraging effect on the Portfolio and exaggerate any increase or decrease in the net asset value. Derivatives may not perform as expected, so the Portfolio may not realize the intended benefits. When used for hedging purposes, the change in value of a derivative may not correlate as expected with the asset, reference rate, or index being

hedged. When used as an alternative or substitute for direct cash investment, the return provided by the derivative may not

provide the same return as direct cash investment.

Floating Rate Loans: In the event a borrower fails to pay scheduled interest or principal payments on a floating rate loan (which can include certain bank loans), the Portfolio will experience a reduction in its income and a decline in the market value

of such floating rate loan. If a floating rate loan is held by the Portfolio through another financial institution, or the Portfolio

relies upon another financial institution to administer the loan, the receipt of scheduled interest or principal payments

may be subject to the credit risk of such financial institution. Investors in floating rate loans may not be afforded the protections

of the anti-fraud provisions of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended,

because loans may not be considered “securities” under such laws. Additionally, the value of collateral, if any, securing a floating rate loan can decline or may be insufficient to meet the borrower’s obligations under the loan, and such collateral

may be difficult to liquidate. No active trading market may exist for many floating rate loans and many floating rate loans

are subject to restrictions on resale. Transactions in loans typically settle on a delayed basis and may take longer than 7 days

to settle. As a result, the Portfolio may not receive the proceeds from a sale of a floating rate loan for a significant period

of time. Delay in the receipts of settlement proceeds may impair the ability of the Portfolio to meet its redemption obligations,

and may limit the ability of the Portfolio to repay debt, pay dividends, or to take advantage of new investment opportunities.

Foreign (Non-U.S.) Investments/Developing and Emerging Markets: Investing in foreign (non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S.

companies due, in part, to: smaller markets; differing reporting, accounting, auditing, and financial reporting standards

and practices; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage, or

replacement; potential for default on sovereign debt; and political changes or diplomatic developments, which may include the imposition

of economic sanctions or other measures by the U.S. or other governments and supranational organizations. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country,

or region may adversely impact investments or issuers in another market, country, or region. Foreign (non-U.S.) investment risks may be greater in developing and emerging markets than in developed markets.

Funding Agreements: A Portfolio may invest in Funding Agreements issued by insurance companies affiliated with the Investment Adviser and Sub-Adviser, such as VRIAC, and insurance companies unaffiliated with the Investment Adviser and Sub-Adviser.

A Funding Agreement has a stable principal value and typically pays interest at a relatively short-term rate, which is subject

Summary Prospectus

4 of 10

Voya Index Solution 2025 Portfolio

to change periodically. Investment in a Funding Agreement is subject to the credit risk of the insurer, and an insurer may

be unable to repay the entire amount of principal and interest due under a Funding Agreement. In a rising interest rate environment,

the interest rate provided by a Funding Agreement may not increase as quickly as the yields of other short-term investments,

adversely affecting the Portfolio’s performance. In the case of a Funding Agreement with VRIAC, there can be no guarantee

that the interest rate the Portfolio receives under such a Funding Agreement will be as favorable as the rate that might be

paid under a Funding Agreement with another, unaffiliated insurer or other short-term investments.

The Sub-Adviser’s decision to invest in a Funding Agreement issued by VRIAC presents conflicts of interest. VRIAC will typically

invest the proceeds of the Funding Agreement at a spread above what it agrees to pay the Portfolio, resulting in a financial

benefit to VRIAC, and the Sub-Adviser receives a management fee from VRIAC for managing the proceeds of the Funding Agreement (along with the proceeds of other funding agreements issued by VRIAC). In addition, an investment in a Funding Agreement may have the effect of reducing the Portfolio’s gross expenses, thereby also reducing the Investment Adviser’s obligations under fee waiver and expense limitation arrangements with the Portfolio. Any changes in the interest rate paid

by VRIAC on a Funding Agreement is determined by VRIAC, with prior notice to the Portfolio. The Sub-Adviser may have a financial

incentive to invest a greater percentage of the Portfolio’s assets in a Funding Agreement with VRIAC than the percentage of

the Portfolio’s assets it might invest in obligations of any other single issuer, including following a reduction in the interest

rate paid on the Funding Agreement. A Portfolio affiliation with VRIAC might delay or limit the Portfolio’s ability to recover

its investment in a Funding Agreement in the event of an insolvency of VRIAC. The Sub-Adviser is subject to a fiduciary duty to

the Portfolio in its decisions as to whether, and how much, the Portfolio should invest in a Funding Agreement with VRIAC

at any time. In addition, investments by the Portfolio in a Funding Agreement with VRIAC must comply with conditions set forth

in applicable exemptive relief provided by the SEC designed to mitigate the foregoing conflicts of interest, and in related

policies and procedures adopted by the Portfolio’s Board.

Growth Investing: Prices of growth-oriented stocks are more sensitive to investor perceptions of the issuer’s growth potential and may fall quickly and significantly if investors suspect that actual growth may be less than expected. There is a risk

that funds that invest in growth-oriented stocks may underperform other funds that invest more broadly. Growth-oriented stocks

tend to be more volatile than value-oriented stocks, and may underperform the market as a whole over any given time period.

High-Yield Securities: Lower-quality securities (including securities that have fallen below investment grade and are classified as “junk bonds” or “high-yield securities”) have greater credit risk and liquidity risk than higher-quality (investment grade) securities, and their issuers' long-term ability to make payments is considered speculative. Prices of lower-quality bonds

or other fixed-income instruments are also more volatile, are more sensitive to negative news about the economy or the issuer,

and have greater liquidity risk and price volatility.

Index Strategy (Portfolio): An Underlying Fund (or a portion of the Underlying Fund) that seeks to track an index’s performance and does not use defensive strategies or attempt to reduce its exposure to poor performing securities in an index may underperform

the overall market (each, an “Underlying Index Fund”). To the extent an Underlying Index Fund’s investments track its target index, such Underlying Index Fund may underperform other funds that invest more broadly. Errors in index data, index computations

or the construction of the index in accordance with its methodology may occur from time to time and may not be identified

and corrected by the index provider for a period of time or at all, which may have an adverse impact on the Portfolio. The

correlation between an Underlying Index Fund’s performance and index performance will be reduced by the Underlying Index Fund’s expenses and could be reduced by the timing of purchases and redemptions of the Underlying Index Fund’s shares. In addition, an Underlying Index Fund’s actual holdings might not match the index and an Underlying Index Fund’s effective

exposure to index securities at any given time may not precisely correlate. When deciding between Underlying Index Funds benchmarked to the same index, the manager may not select the Underlying Index Fund with the lowest expenses. In particular, when deciding between Underlying Index Funds benchmarked to the same index, the manager will generally select an affiliated

Underlying Index Fund, even when the affiliated Underlying Index Fund has higher expenses than an unaffiliated Underlying

Index Fund. When the Portfolio invests in an affiliated Underlying Index Fund with higher expenses, the Portfolio’s performance

will be lower than if the Portfolio had invested in an Underlying Index Fund with comparable performance but lower expenses

(although any expense limitation arrangements in place at the time might have the effect of limiting or eliminating the amount

of that underperformance). The manager may select an unaffiliated Underlying Index Fund, including an ETF, over an affiliated

Underlying Index Fund benchmarked to the same index when the manager believes making an investment in the affiliated Underlying Index Fund would be disadvantageous to the affiliated Underlying Index Fund, such as when the Portfolio is investing

on a short-term basis.

Inflation-Indexed Bonds: If the index measuring inflation falls, the principal value of inflation-indexed bonds will be adjusted downward, and consequently, the interest payable on these bonds (calculated with respect to a smaller principal amount) will

be reduced. In addition, inflation-indexed bonds are subject to the usual risks associated with fixed-income instruments,

such

Summary Prospectus

5 of 10

Voya Index Solution 2025 Portfolio

as interest rate and credit risk. Repayment of the original bond principal upon maturity (as adjusted for inflation) is guaranteed

in the case of U.S. Treasury inflation-indexed bonds. For bonds that do not provide a similar guarantee, the adjusted principal

value of the bond repaid at maturity may be less than the original principal.

Interest Rate: A rise in market interest rates generally results in a fall in the value of bonds and other fixed-income instruments; conversely, values generally rise as market interest rates fall. The higher the credit quality of the instrument, and the

longer its maturity or duration, the more sensitive it is to changes in market interest rates. Duration is a measure of sensitivity

of the price of a fixed-income instrument to a change in interest rate. As of the date of this Prospectus, the United States

is experiencing a rising market interest rate environment, which may increase the Portfolio’s exposure to risks associated with

rising market interest rates. Rising market interest rates have unpredictable effects on the markets and may expose fixed-income

and related markets to heightened volatility. To the extent that the Portfolio invests in fixed-income instruments, an increase

in market interest rates may lead to increased redemptions and increased portfolio turnover, which could reduce liquidity

for certain investments, adversely affect values, and increase costs. Increased redemptions may cause the Portfolio to liquidate

portfolio positions when it may not be advantageous to do so and may lower returns. If dealer capacity in fixed-income markets

is insufficient for market conditions, it may further inhibit liquidity and increase volatility in the fixed-income markets.

Further, recent and potential future changes in government policy may affect interest rates. Negative or very low interest rates could

magnify the risks associated with changes in interest rates. In general, changing interest rates, including rates that fall

below zero, could have unpredictable effects on markets and may expose fixed-income and related markets to heightened volatility.

Changes to monetary policy by the Federal Reserve Board or other regulatory actions could expose fixed-income and related

markets to heightened volatility, interest rate sensitivity, and reduced liquidity, which may impact the Portfolio’s operations

and return potential.

Investing through Stock Connect: Shares in mainland China-based companies that trade on Chinese stock exchanges such as the Shanghai Stock Exchange and the Shenzhen Stock Exchange (“China A-Shares”) may be purchased directly or indirectly through the Shanghai-Hong Kong Stock Connect (“Stock Connect”), a mutual market access program designed to, among other things, enable foreign investment in the People’s Republic of China (“PRC”) via brokers in Hong Kong. There are significant risks inherent in investing in China A-Shares through Stock Connect. The underdeveloped state of PRC’s investment and banking systems subjects the settlement, clearing, and registration of China A-Shares transactions to heightened risks. Stock

Connect can only operate when both PRC and Hong Kong markets are open for trading and when banking services are available

in both markets on the corresponding settlement days. As such, if either or both markets are closed on a U.S. trading day,

the Portfolio may not be able to dispose of its China A-Shares in a timely manner, which could adversely affect the Portfolio’s

performance.

The Chinese economy is generally considered an emerging and volatile market. Significant portions of the Chinese securities

markets may become rapidly illiquid because Chinese issuers have the ability to suspend the trading of their equity securities

under certain circumstances, and have shown a willingness to exercise that option in response to market volatility, epidemics,

pandemics, adverse economic, market or political events, and other events. In addition, there may be restrictions on investments

in Chinese companies. For example, on November 12, 2020, the President of the United States of America signed an Executive

Order prohibiting U.S. persons from purchasing or investing in publicly-traded securities of companies identified by the U.S.

government as “Communist Chinese military companies.” The list of such companies can change from time to time, and as a result of forced selling or inability to participate in an investment the Investment Adviser otherwise believes is attractive,

the Portfolio may incur losses.

Liquidity: If a security is illiquid, the Portfolio might be unable to sell the security at a time when the Portfolio’s manager might

wish to sell, or at all, which could cause the Portfolio to lose money. Further, the lack of an established secondary market

may make it more difficult to value illiquid securities, exposing the Portfolio to the risk that the prices at which it sells

illiquid securities will be less than the prices at which they were valued when held by the Portfolio. The prices of illiquid securities

may be more volatile than more liquid securities, and the risks associated with illiquid securities may be greater in times

of financial stress.

London Inter-Bank Offered Rate: The obligations of the parties under many financial arrangements, such as fixed-income instruments (including senior loans) and derivatives, may be determined based, in whole or in part, on the London Inter-Bank Offered Rate

(“LIBOR”). In 2017, the UK Financial Conduct Authority announced its intention to cease compelling banks to provide the quotations needed to sustain LIBOR after 2021. ICE Benchmark Administration, the administrator of LIBOR, ceased publication

of most LIBOR settings on a representative basis at the end of 2021 and is expected to cease publication of a majority of

U.S. dollar LIBOR settings on a representative basis after June 30, 2023. In addition, global regulators have announced that,

with limited exceptions, no new LIBOR-based contracts should be entered into after 2021. Actions by regulators have resulted

in the establishment of alternative reference rates to LIBOR in many major currencies, including for example, the Secured

Overnight Funding Rate (“SOFR”) for U.S. dollar LIBOR. SOFR is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement market. SOFR is published in various forms, including

Summary Prospectus

6 of 10

Voya Index Solution 2025 Portfolio

as a daily, compounded, and forward-looking term rate. The discontinuance of LIBOR and the adoption/implementation of alternative rates pose a number of risks, including, among others, whether any substitute rate will experience the market

participation and liquidity necessary to provide a workable substitute for LIBOR; the effect on parties’ existing contractual

arrangements, hedging transactions, and investment strategies generally from a conversion from LIBOR to alternative rates;

the effect on the Portfolio’s existing investments, including the possibility that some of those investments may terminate

or their terms may be adjusted to the disadvantage of the Portfolio; and the risk of general market disruption during the transition

period. Markets relying on alternative rates are developing slowly and may offer limited liquidity. The general unavailability

of LIBOR and the transition away from LIBOR to alternative rates could have a substantial adverse impact on the performance of the Portfolio.

Market: The market values of securities will fluctuate, sometimes sharply and unpredictably, based on overall economic conditions,

governmental actions or intervention, market disruptions caused by trade disputes or other factors, political developments,

and other factors. Prices of equity securities tend to rise and fall more dramatically than those of fixed-income instruments.

Additionally, legislative, regulatory, or tax policies or developments may adversely impact the investment techniques available

to a manager, add to costs and impair the ability of the Portfolio to achieve its investment objectives.

Market Capitalization: Stocks fall into three broad market capitalization categories: large, mid, and small. Investing primarily in one category carries the risk that, due to current market conditions, that category may be out of favor with investors.

If valuations of large-capitalization companies appear to be greatly out of proportion to the valuations of mid- or small-capitalization

companies, investors may migrate to the stocks of mid- and small-capitalization companies causing a fund that invests in these companies to increase in value more rapidly than a fund that invests in large-capitalization companies. Investing in

mid- and small-capitalization companies may be subject to special risks associated with narrower product lines, more limited financial

resources, smaller management groups, more limited publicly available information, and a more limited trading market for their stocks as compared with large-capitalization companies. As a result, stocks of mid- and small-capitalization companies

may be more volatile and may decline significantly in market downturns.

Market Disruption and Geopolitical: The Portfolio is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and markets. Due to the increasing interdependence among global economies and markets, conditions in one country, market, or region might adversely impact markets, issuers and/or foreign exchange rates

in other countries, including the United States Wars, terrorism, global health crises and pandemics, and other geopolitical

events that have led, and may continue to lead, to increased market volatility and may have adverse short- or long-term effects

on U.S., and global economies and markets, generally. For example, the COVID-19 pandemic has resulted, and may continue to result, in significant market volatility, exchange suspensions and closures, declines in global financial markets, higher

default rates, supply chain disruptions, and a substantial economic downturn in economies throughout the world. Natural and

environmental disasters and systemic market dislocations are also highly disruptive to economies and markets. In addition,

military action by Russia in Ukraine has, and may continue to, adversely affect global energy and financial markets and therefore

could affect the value of the Portfolio’s investments, including beyond the Portfolio’s direct exposure to Russian issuers

or nearby geographic regions. The extent and duration of the military action, sanctions, and resulting market disruptions are

impossible to predict and could be substantial. Those events as well as other changes in foreign (non-U.S.) and domestic economic, social, and political conditions also could adversely affect individual issuers or related groups of issuers, securities

markets, interest rates, credit ratings, inflation, investor sentiment, and other factors affecting the value of the Portfolio’s

investments. Any of these occurrences could disrupt the operations of the Portfolio and of the Portfolio’s service providers.

Natural Resources/Commodity Securities: The operations and financial performance of companies in natural resources industries may be directly affected by commodity prices. This risk is exacerbated for those natural resources companies that own the

underlying commodity.

Prepayment and Extension: Many types of fixed-income instruments are subject to prepayment and extension risk. Prepayment risk is the risk that the issuer of a fixed-income instrument will pay back the principal earlier than expected. This risk

is heightened in a falling market interest rate environment. Prepayment may expose the Portfolio to a lower rate of return upon reinvestment

of principal. Also, if a fixed-income instrument subject to prepayment has been purchased at a premium, the value of the premium would be lost in the event of prepayment. Extension risk is the risk that the issuer of a fixed-income instrument

will pay back the principal later than expected. This risk is heightened in a rising market interest rate environment. This may

negatively affect performance, as the value of the fixed-income instrument decreases when principal payments are made later than expected. Additionally, the Portfolio may be prevented from investing proceeds it would have received at a given

time at the higher prevailing interest rates.

Real Estate Companies and Real Estate Investment Trusts: Investing in real estate companies and REITs may subject the Portfolio to risks similar to those associated with the direct ownership of real estate, including losses from casualty or condemnation,

changes in local and general economic conditions, supply and demand, market interest rates, zoning laws, regulatory limitations

Summary Prospectus

7 of 10

Voya Index Solution 2025 Portfolio

on rents, property taxes, environmental problems, overbuilding, high foreclosure rates, and operating expenses in addition

to terrorist attacks, wars, or other acts that destroy real property. In addition, REITs may also be affected by tax and regulatory

requirements in that a REIT may not qualify for favorable tax treatment or regulatory exemptions. Investments in REITs are

affected by the management skill of the REIT’s sponsor. The Portfolio will indirectly bear its proportionate share of expenses,

including management fees, paid by each REIT in which it invests.

Underlying Funds: Because the Portfolio invests primarily in Underlying Funds, the investment performance of the Portfolio is directly related to the investment performance of the Underlying Funds in which it invests. When the Portfolio invests in

an Underlying Fund, it is exposed indirectly to the risks of a direct investment in the Underlying Fund. If the Portfolio invests

a significant portion of its assets in a single Underlying Fund, it may be more susceptible to risks associated with that Underlying

Fund and its investments than if it invested in a broader range of Underlying Funds. It is possible that more than one Underlying

Fund will hold securities of the same issuers, thereby increasing the Portfolio’s indirect exposure to those issuers. It also

is possible that one Underlying Fund may be selling a particular security when another is buying it, producing little or no change

in exposure but generating transaction costs and/or resulting in realization of gains with no economic benefit. There can

be no assurance that the investment objective of any Underlying Fund will be achieved. In addition, the Portfolio’s shareholders

will indirectly bear their proportionate share of the Underlying Funds’ fees and expenses, in addition to the fees and expenses

of the Portfolio itself.

Value Investing: Securities that appear to be undervalued may never appreciate to the extent expected. Further, because the prices of value-oriented securities tend to correlate more closely with economic cycles than growth-oriented securities, they

generally are more sensitive to changing economic conditions, such as changes in market interest rates, corporate earnings

and industrial production. The manager may be wrong in its assessment of a company’s value and the securities the Portfolio

holds may not reach their full values. Risks associated with value investing include that a security that is perceived by

the manager to be undervalued may actually be appropriately priced and, thus, may not appreciate and provide anticipated capital

growth. The market may not favor value-oriented securities and may not favor equities at all. During those periods, the Portfolio’s

relative performance may suffer. There is a risk that funds that invest in value-oriented securities may underperform other

funds that invest more broadly.

Voya-related Underlying Funds: The Sub-Adviser’s selection of Underlying Funds presents conflicts of interest. The net management fee revenue received or costs incurred by the Sub-Adviser and its affiliates will vary depending on the Underlying Funds it

selects for the Portfolio, and the Sub-Adviser will have an incentive to select the Underlying Funds (whether or not affiliated

with the Sub-Adviser) that will result in the greatest net management fee revenue or lowest costs to the Sub-Adviser and its

affiliates, even if that results in increased expenses and potentially less favorable investment performance for the Portfolio.

In many cases, investments in Underlying Funds advised or subadvised by the Investment Adviser or an affiliate (“Voya-related Underlying Funds”) will afford the manager greater net management fee revenue (including Underlying Fund advisory or subadvisory fees) than would investments in other Underlying Funds. In addition, the Sub-Adviser may prefer to invest in a Voya-related

Underlying Fund over another Underlying Fund because the investment may be beneficial to the Sub-Adviser in managing the Voya-related Underlying Fund by helping the Voya-related Underlying Fund achieve economies of scale or by enhancing cash flows to the Voya-related Underlying Fund. For similar reasons, the Sub-Adviser may have an incentive to delay or decide against

the sale of interests held by the Portfolio in Voya-related Underlying Funds, and the Sub-Adviser may implement changes in

the Portfolio’s holdings of Underlying Funds in a manner intended to minimize the disruptive effects and added costs of those

changes to Voya-related Underlying Funds. Although the Portfolio may invest a portion of its assets in Underlying Funds not

advised or subadvised by the Investment Adviser or an affiliate, there is no assurance that it will do so even in cases where

those Underlying Funds incur lower fees or have achieved better historical investment performance than the comparable Voya-related

Underlying Funds.

An investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation,

the Federal Reserve Board or any other government agency.

Performance Information

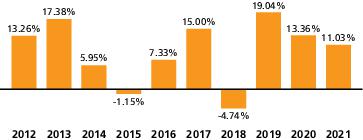

The following information is intended to help you understand the risks of investing in the Portfolio. The following bar chart shows the changes in the Portfolio's performance from year to year, and the table compares the Portfolio's performance to

the performance of a broad-based securities market index/indices with investment characteristics similar to those of the Portfolio for the same period. The Portfolio's performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. The Class Z shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns

would be different.

Class I shares commenced operations on March 10, 2008.

Summary Prospectus

8 of 10

Voya Index Solution 2025 Portfolio

Performance shown in the bar chart and in the Average Annual Total Returns table does not include insurance-related charges

imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance

would be lower. Thus, you should not compare the Portfolio's performance directly with the performance information of other

investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract

or Qualified Plan. The Portfolio's past performance is no guarantee of future results.

Calendar Year Total Returns Class Z

(as of December 31 of each year)

(as of December 31 of each year)

|

Best quarter:

|

2nd Quarter 2020

|

12.65%

|

|

Worst quarter:

|

1st Quarter 2020

|

-12.22%

|

Average Annual Total Returns %

(for the periods ended December 31, 2021)

(for the periods ended December 31, 2021)

|

|

|

1 Yr

|

5 Yrs

|

10 Yrs

|

Since

Inception

|

Inception

Date

|

|

Class Z

|

%

|

11.03

|

10.42

|

9.39

|

N/A

|

05/01/15

|

|

S&P Target Date 2025 Index1

|

%

|

10.67

|

9.65

|

9.01

|

N/A

|

|

1

The index returns include the reinvestment of dividends and distributions net of withholding taxes, but do not reflect fees,

brokerage commissions, or other expenses.

Portfolio Management

|

Investment Adviser

|

Sub-Adviser

|

|

Voya Investments, LLC

|

Voya Investment Management Co. LLC

|

|

Portfolio Managers

|

|

|

Barbara Reinhard, CFA

Portfolio Manager (since 09/19)

|

Paul Zemsky, CFA

Portfolio Manager (since 03/08)

|

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are not offered directly to the public. Purchase and sale of shares may be made only by separate accounts of insurance companies serving as investment options under Variable Contracts or by Qualified Plans, custodian accounts, and certain investment advisers and their affiliates, other investment companies, or permitted investors. Please

refer to the prospectus for the appropriate insurance company separate account, investment company, or your plan documents

for information on how to direct investments in, or sale from, an investment option corresponding to the Portfolio and any

fees that may apply. Participating insurance companies and certain other designated organizations are authorized to receive

purchase orders on the Portfolio's behalf.

Tax Information

Distributions made by the Portfolio to a Variable Contract or Qualified Plan, and exchanges and redemptions of Portfolio shares

made by a Variable Contract or Qualified Plan, ordinarily do not cause the corresponding contract holder or plan participant

to recognize income or gain for federal income tax purposes. See the contract prospectus or the governing documents of your

Qualified Plan for information regarding the federal income tax treatment of the distributions to your Variable Contract or

Qualified Plan and the holders of the contracts or plan participants.

Payments to Broker-Dealers and Other Financial Intermediaries

If you invest in the Portfolio through a Variable Contract issued by an insurance company or through a Qualified Plan that,

in turn, was purchased or serviced through an insurance company, broker-dealer or other financial intermediary, the Portfolio

and its adviser or distributor or their affiliates may: (1) make payments to the insurance company issuer of the Variable

Contract or to the company servicing the Qualified Plan; and (2) make payments to the insurance company, broker-dealer or other financial intermediary. These payments may create a conflict of interest by: (1) influencing the insurance company or the

Summary Prospectus

9 of 10

Voya Index Solution 2025 Portfolio

company servicing the Qualified Plan to make the Portfolio available as an investment option for the Variable Contract or

the Qualified Plan; or (2) by influencing the broker-dealer or other intermediary and your salesperson to recommend the Variable

Contract or the pension servicing agent and/or the Portfolio over other options. Ask your salesperson or Qualified Plan administrator

or visit your financial intermediary's website for more information.

Summary Prospectus

10 of 10

Voya Index Solution 2025 Portfolio

(This page intentionally left blank.)

Summary Prospectus

SPRO-47115417 (0123-012723)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Safir Injury & Criminal Defense Law Provides Legal Services for Criminal Charges in St. Petersburg, FL

- Superior Plus Announces Timing of 2024 First Quarter Results Conference Call and Webcast

- Mobivity Announces Fourth Quarter and Full Year 2023 Financial Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share