Form 497K VALIC Co I

September 28, 2021 3:32 PM EDTSummary Prospectus

October 1, 2021

VALIC Company I

Small Cap Value Fund

(Ticker: VVSCX)

The

Fund’s Statutory Prospectus and Statement of Additional Information, each dated October 1, 2021, as amended and

supplemented from time to time, and the most recent shareholder reports are incorporated into and made part of this Summary Prospectus

by reference. The Fund is offered only to registered and unregistered separate accounts of The Variable Annuity Life Insurance Company and its affiliates and to qualifying retirement plans and IRAs and is not intended for use by other

investors.

Before you invest, you may want to review

the Fund’s Statutory Prospectus, which contains more information about the Fund and its risks. You can find the Statutory Prospectus and the above-incorporated information online at

http://valic.onlineprospectus.net/VALIC/FundDocuments/index.html. You can also get this information at no cost by calling 800-448-2542 or by sending an e-mail request to [email protected].

The Securities and Exchange Commission has not approved or

disapproved these securities, nor has it determined that this Summary Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Objective

The Fund seeks to provide maximum long-term return,

consistent with reasonable risk to principal, by investing primarily in securities of small-cap companies in terms of revenues and/or market capitalization.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay

if you buy, hold and sell shares of the Fund. The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy (“Variable

Contracts”) in which the Fund is offered. If separate account fees were shown, the Fund’s annual operating expenses would be higher. Please see your Variable Contract prospectus for more details on the separate account fees.

Annual Fund

Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Management

Fees |

0.66% |

|

Other

Expenses |

0.16% |

|

Total Annual Fund Operating

Expenses |

0.82% |

|

Fee Waivers and/or Expense

Reimbursements1 |

0.05% |

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense

Reimbursements1 |

0.77% |

| 1 | Pursuant to an Expense Limitation Agreement, The Variable Annuity Life Insurance Company (“VALIC”) has contractually agreed to reimburse the expenses of the Fund until September 30, 2022, so that the Fund’s Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements do not exceed 0.77%. For purposes of the Expense Limitation Agreement, “Total Annual Fund Operating Expenses” shall not include extraordinary expenses (i.e., expenses that are unusual in nature and infrequent in occurrence, such as litigation), or acquired fund fees and expenses, brokerage |

| commissions and other transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and governmental fees, and other expenses not incurred in the ordinary course of the Fund’s business. This agreement will be renewed annually for one-year terms unless terminated by the Board of Directors of VALIC Company I prior to any such renewal. |

Expense

Example

This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of those

periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses include expense reimbursements for year one. The Example does not reflect charges imposed by the Variable Contract. If the

Variable Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information on such charges. Although your actual costs may be higher or lower, based on these assumptions and the net expenses shown in

the fee table, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $79 | $257 | $450 | $1,009 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance.

As a result of a reorganization which occurred on May 24,

2021 (the “Reorganization”), the Fund acquired all of the assets and liabilities of the Small Cap Value Fund (the

- 1 -

VALIC Company I

Small Cap Value Fund

“Predecessor Fund”), a series of VALIC Company

II. During the fiscal year ended August 31, 2020, the portfolio turnover rate of the Predecessor Fund was 69% of the average value of its portfolio. During the fiscal period September 1, 2020 to May 31, 2021, the portfolio turnover rate of the

Predecessor Fund and the Fund was 55% (not annualized) of the average value of the portfolio.

Principal Investment Strategies of the Fund

The Fund invests, under normal circumstances, at least 80%

of its net assets in equity securities of small-cap companies.

A company will be considered a small-cap company if its

market capitalization, at time of purchase, is equal to or less than the largest company in the Russell 2000® Index during the most recent 12-month

period. As of May 7, 2021, the market capitalization range of the companies in the Russell 2000® Index was approximately $257.1 million to $7.3

billion.

The subadvisers use a value-oriented

approach. Companies will be selected based upon valuation characteristics such as price-to-cash flow ratios which are at a discount to market averages. Although the Fund primarily invests in domestic issuers, the Fund is authorized to invest up to

25% of its assets in the securities of foreign issuers.

In order to generate additional income, the Fund may lend

portfolio securities to broker-dealers and other financial institutions provided that the value of the loaned securities does not exceed 30% of the Fund’s total assets. These loans earn income for the Fund and are collateralized by cash and

securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

Investors will be given at least 60 days’ written

notice in advance of any change to the Fund’s 80% investment policy set forth above.

Principal Risks of Investing in the Fund

As with any mutual fund, there can be no assurance that the

Fund’s investment objective will be met or that the net return on an investment in the Fund will exceed what could have been obtained through other investment or savings vehicles. Shares of the Fund are not bank deposits and are not guaranteed

or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Fund goes down, you could lose money.

The following is a summary of the principal risks of investing

in the Fund.

Management Risk. The investment style or

strategy used by the Fund may fail to produce the intended result. A subadviser’s assessment of a particular security or company may prove incorrect, resulting in losses or underperformance.

Equity Securities Risk. The

Fund’s investments in equity securities are subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day-to-day and may decline significantly. The prices of individual

stocks may be negatively affected by poor company results or other factors affecting individual prices, as well as industry and/or economic trends and developments affecting industries or the securities market as a whole.

Market Risk. The

Fund’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings or due to adverse political or economic developments here or abroad, changes in investor psychology, or heavy institutional

selling and other conditions or events (including, for example, military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). The prices of individual securities may fluctuate, sometimes dramatically, from day to day. The prices

of stocks and other equity securities tend to be more volatile than those of fixed-income securities.

The coronavirus pandemic and the related governmental and

public responses have had and may continue to have an impact on the Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities

and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and

component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such

diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Securities Lending Risk.

Engaging in securities lending could increase the market and credit risk for Fund investments. The Fund may lose money if it does not recover borrowed securities, the value of the collateral falls, or the value of investments made with cash

collateral declines. The Fund’s loans will be collateralized by

VALIC Company I

- 2 -

Small Cap Value

Fund

securities issued or guaranteed by the U.S. Government or

its agencies and instrumentalities, which subjects the Fund to the credit risk of the U.S. Government or the issuing federal agency or instrumentality. If the value of either the cash collateral or the Fund’s investments of the cash collateral

falls below the amount owed to a borrower, the Fund also may incur losses that exceed the amount it earned on lending the security. Securities lending also involves the risks of delay in receiving additional collateral or possible loss of rights in

the collateral if the borrower fails. Another risk of securities lending is the risk that the loaned portfolio securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a

desirable price.

Small-Cap Company Risk. Investing in small-cap companies carries the risk that due to current market conditions these companies may be out of favor with investors. Small companies often are in the early stages of development with limited

product lines, markets, or financial resources and managements lacking depth and experience, which may cause their stock prices to be more volatile than those of larger companies. Small company stocks may be less liquid yet subject to abrupt or

erratic price movements. It may take a substantial period of time before the Fund realizes a gain on an investment in a small-cap company, if it realizes any gain at all.

Value Style Risk.

Generally, “value” stocks are stocks of companies that a subadviser believes are currently undervalued in the marketplace. A subadviser’s judgment that a particular security is undervalued in relation to the company’s

fundamental economic value may prove incorrect and the price of the company’s stock may fall or may not approach the value the subadviser has placed on it.

Performance Information

The returns presented for the Fund reflect the performance

of the Predecessor Fund. The Fund adopted the performance of the Predecessor Fund as a result of the Reorganization on May 24, 2021. The Fund had not yet commenced operations prior to the Reorganization. The performance information below is based on

the performance of the Predecessor Fund for periods prior to the date of the Reorganization. The Fund and the Predecessor Fund had the same investment objectives, strategies and portfolio management team on the date of the Reorganization.

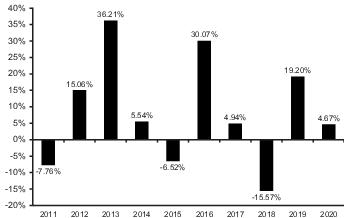

The following Risk/Return Bar Chart and Table illustrate

the risks of investing in the Fund by showing changes in

the Predecessor Fund’s performance from calendar year to calendar

year and comparing the Predecessor Fund’s average annual returns to those of the Russell 2000® Value Index. Fees and expenses incurred at the

contract level are not reflected in the bar chart or table. If these amounts were reflected, returns would be less than those shown. Of course, past performance of the Predecessor Fund is not necessarily an indication of how the Fund will perform in

the future.

J.P. Morgan Investment Management Inc.

(“JPMIM”) (and its predecessors) assumed management of the Predecessor Fund on January 1, 2002. SunAmerica Asset Management, LLC was a co-subadviser of the Predecessor Fund from February 28, 2010 to December 14, 2012. From February 8,

2010 to October 28, 2016, Wells Capital Management Incorporated (f/k/a Metropolitan West Capital Management, LLC) was a co-subadviser of the Predecessor Fund. On October 29, 2016, JPMIM became the Predecessor Fund’s sole subadviser.

During the period shown

in the bar chart:

| Highest

Quarterly Return: |

December 31, 2020 | 33.74% |

| Lowest

Quarterly Return: |

March 31, 2020 | -36.20% |

| Year

to Date Most Recent Quarter: |

June 30, 2021 | 28.12% |

Average Annual Total Returns (For the periods ended December 31, 2020)

| 1

Year |

5

Years |

10

Years | |||

|

Fund |

4.67% | 7.53% | 7.45% | ||

|

Russell 2000® Value Index (reflects no deduction for fees, expenses or

taxes) |

4.63% | 9.65% | 8.66% |

VALIC Company I

- 3 -

Small Cap Value

Fund

Investment Adviser

The Fund’s investment adviser is VALIC.

The Fund is subadvised by JPMIM.

Portfolio

Managers

| Name and Title | Portfolio

Manager of the Fund Since | |

|

Phillip Hart, CFA Managing Director, Head of U.S. Structured Equity Small and Mid Cap Team and Co-Lead

Manager |

2012* | |

|

Wonseok Choi Managing Director, Head of U.S. Structured Equity Quantitative Research and Co-Lead

Manager |

2019* | |

|

Jonathan Tse Executive Director, Quantitative Research and Co-Lead

Manager |

2019* | |

|

Akash Gupta Executive Director, Fundamental Research and Co-Lead

Manager |

2019* |

* Includes management of the

Predecessor Fund.

Purchases and Sales of Fund

Shares

Shares of the Funds may only be purchased or redeemed

through Variable Contracts offered by the separate accounts of VALIC or other participating life insurance companies and through qualifying retirement plans (“Plans”) and IRAs. Shares of each Fund may be purchased and redeemed each day

the New York Stock Exchange is open, at the Fund’s net asset value determined after receipt of a request in good order.

The Funds do not have any initial or subsequent investment minimums.

However, your insurance company may impose investment or account value minimums. The prospectus (or other offering document) for your Variable Contract contains additional information about purchases and redemptions of the Funds’ shares.

Tax Information

A Fund will not be subject to U.S. federal income tax so

long as it qualifies as a regulated investment company and distributes its income and gains each year to its shareholders. However, contractholders may be subject to federal income tax (and a federal Medicare tax of 3.8% that applies to net income,

including taxable annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the prospectus (or other offering document) for the Variable Contract for additional information regarding taxation.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

The Funds are not sold directly to the general public but

instead are offered to registered and unregistered separate accounts of VALIC and its affiliates and to Plans and IRAs. The Funds and their related companies may make payments to the sponsoring insurance company or its affiliates for recordkeeping

and distribution. These payments may create a conflict of interest as they may be a factor that the insurance company considers in including the Funds as underlying investment options in a variable contract. Visit your sponsoring insurance

company’s website for more information.

VALIC Company I

- 4 -

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/25/2024

- Futures falter as Meta Platforms weighs on megacaps

- Meta shares dip on softer Q2 revenue guidance, elevated AI spending plans

- Oil steady as US demand concerns balance Middle East conflict risks

- Yen at multi-decade lows, dollar drops before US data

- IBM tumbles on soft Q1 revenue; announces HashiCorp $6.4bn acquisition

- IBM tumbles on soft Q1 revenue; announces HashiCorp $6.4bn acquisition

- Hasbro (HAS) brand strength sees earnings top expectations

- Meta Platforms (META) Tops Q1 EPS by 39c, Offers Guidance

- Seagate Technology (STX) Enters $600M Asset Purchase Agreement with Avago

- Crude Inventory Declined 6.4 Million Barrels Last Week

- Meta Platforms, IBM, Caterpillar fall premarket; American Airlines, Chipotle rise

- After-hours movers: Meta, Ford, IBM, ServiceNow and more

- Midday movers: Tesla, Boeing rise; Uber, Old Dominion Freight fall

- After-hours movers: Tesla, Texas Instruments, Seagate, Visa and more

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AIG (AIG) Announces Retirement of David McElroy

- Alfa Laval AB (publ) Interim report January 1 - March 31, 2024

- TriCo Bancshares Reports First Quarter 2024 Net Income of $27.7 Million, Diluted EPS of $0.83

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share