Form 497K VALIC Co I

September 28, 2021 3:14 PM EDTSummary Prospectus

October 1, 2021

VALIC Company I

Global Strategy Fund

(Ticker: VGLSX)

The

Fund’s Statutory Prospectus and Statement of Additional Information, each dated October 1, 2021, as amended and

supplemented from time to time, and the most recent shareholder reports are incorporated into and made part of this Summary Prospectus

by reference. The Fund is offered only to registered and unregistered separate accounts of The Variable Annuity Life Insurance Company and its affiliates and to qualifying retirement plans and IRAs and is not intended for use by other

investors.

Before you invest, you may want to review

the Fund’s Statutory Prospectus, which contains more information about the Fund and its risks. You can find the Statutory Prospectus and the above-incorporated information online at

http://valic.onlineprospectus.net/VALIC/FundDocuments/index.html. You can also get this information at no cost by calling 800-448-2542 or by sending an e-mail request to [email protected].

The Securities and Exchange Commission has not approved or

disapproved these securities, nor has it determined that this Summary Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Objective

The Fund seeks high total return.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay

if you buy, hold and sell shares of the Fund. The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy (“Variable

Contracts”) in which the Fund is offered. If separate account fees were shown, the Fund’s annual operating expenses would be higher. Please see your Variable Contract prospectus for more details on the separate account fees.

Annual Fund

Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Management

Fees |

0.50% |

|

Other

Expenses |

0.22% |

|

Total Annual Fund Operating

Expenses |

0.72% |

|

Fee Waivers and/or Expense

Reimbursements1 |

0.02% |

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense

Reimbursements1 |

0.70% |

| 1 | The Fund’s investment adviser, The Variable Annuity Life Insurance Company (“VALIC”), has contractually agreed to waive its advisory fee until September 30, 2022, so that the advisory fee payable by the Fund to VALIC equals 0.48% on the first $500 million of the Fund’s average daily net assets and 0.44% on average daily net assets over $500 million. This agreement may be modified or discontinued prior |

| to such time only with the approval of the Board of Directors of VALIC Company I (“VC I”), including a majority of the directors who are not “interested persons” of VC I as defined in the Investment Company Act of 1940, as amended. |

Expense

Example

This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of those

periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses include fee waivers for one year. The Example does not reflect charges imposed by the Variable Contract. If the Variable

Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information on such charges. Although your actual costs may be higher or lower, based on these assumptions and the net expenses shown in the fee

table, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $72 | $228 | $399 | $893 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance.

- 1 -

VALIC Company I

Global Strategy Fund

During the most recent fiscal year, the Fund’s

portfolio turnover rate was 39% of the average value of its portfolio.

Principal Investment Strategies of the Fund

Under normal market conditions, the Fund invests in equity

securities of companies in any country, fixed income (debt) securities of companies and governments of any country, and in money market securities. There are no minimum or maximum percentage targets for each asset class, though under normal market

conditions, the Fund invests 50% to 80% of its assets in equity securities. Although the Fund seeks investments across a number of countries and sectors, from time to time, based on economic conditions, the Fund may have significant positions in

particular countries or sectors.

The equity

securities in which the Fund invests are primarily common stock of large- and mid-capitalization companies included in the Morgan Stanley Capital International All Country World Index (the “MSCI ACWI Index”) and depositary receipts

representing such stocks. As of August 31, 2021, the market capitalization range of the companies in the MSCI ACWI Index was approximately $76.81 million to $2.55 trillion. With respect to equity securities, the Fund seeks to achieve a lower level

of risk and higher risk-adjusted performance than the MSCI ACWI Index over the long term through a rules-based multi-factor selection process employed by the Fund’s subadviser.

The subadviser’s selection process is designed to

select stocks for the Fund that have favorable exposure to four investment style factors (commonly referred to as “smart beta”) – quality, value, momentum and low volatility. Factors are common characteristics that relate to a

group of issuers or securities that are important in explaining the returns and risks of those issuers’ securities. The “quality” factor incorporates measurements such as return on equity, earnings variability, cash return on

assets and leverage. The “value” factor incorporates measurements such as price to earnings, price to forward earnings, price to book value and dividend yield. The “momentum” factor incorporates measurements such as 6-month

risk adjusted price momentum and 12-month risk-adjusted price momentum. The “low volatility” factor incorporates measurements such as historical beta (i.e., a measure of the volatility of a

security relative to the total market).

Under normal

market conditions, the Fund will hold 600 to 900 of the common stocks in the MSCI ACWI Index. The subadviser will select such stocks on a semi-annual basis. The Fund employs a strategy to continue to hold stocks between its semi-annual selection of

stocks, even if there are adverse developments concerning a particular stock, an industry, the economy or the stock market generally.

The subadviser may reduce the position size of a stock or sell the stock

at the time of the semi-annual selection process if the stock no longer has favorable exposure to the four investment style factors. The size of the companies in the MSCI ACWI Index changes with market conditions and the composition of the MSCI ACWI

Index.

The debt obligations in which the Fund invests

are primarily foreign and domestic sovereign debt obligations of any maturity and duration and may include bonds, notes, bills and debentures. Although the Fund may buy bonds rated in any category, including bonds that are rated below investment

grade, it generally focuses on “investment grade” bonds. With respect to debt obligations and money market securities, the mix of investments will be adjusted in an effort to capitalize on the total return potential produced by changing

market, political and economic conditions throughout the world. For example, the subadviser may adjust the Fund’s investments as a result of its independent analysis of countries, interest rates and exchange rates, among other factors. The

subadviser may purchase a debt security when it believes the security is undervalued or will provide highly competitive rate yields. Conversely, the subadviser may consider selling a debt security when it believes the security has become fully

valued due to either its price appreciation or changes in the issuer’s fundamentals, or when the subadviser believes another security is a more attractive investment opportunity. The Fund may allocate a significant portion of its assets to

cash and cash equivalents to take advantage of investment opportunities as they arise, to manage volatility and for other portfolio management purposes.

Under normal market conditions, the Fund expects to invest

at least 40% of its net assets in foreign securities, including foreign equity securities and foreign sovereign debt securities. Although the Fund generally invests in securities of issuers located in developed countries, the Fund may invest up to

50% of its total assets in securities of issuers located in emerging markets.

The Fund regularly uses various currency related

transactions involving derivative instruments, including currency and cross currency forwards and currency and currency index futures contracts and currency options. The Fund may maintain significant positions in currency related derivative

instruments as a hedging technique or to implement a currency investment strategy, which could expose a large amount of the Fund’s assets to obligations under these instruments. The Fund may also enter into various other transactions involving

derivatives, including financial futures contracts (such as interest rate or bond futures) and swap agreements (which may include interest rate and credit default swaps). The use of these

VALIC Company I

- 2 -

Global Strategy

Fund

derivative transactions may allow the Fund to obtain net

long or net negative (short) exposure to selected currencies. The Fund may use a portion of its cash and cash equivalents as collateral for derivatives.

In order to generate additional income, the Fund may lend

portfolio securities to broker-dealers and other financial institutions provided that the value of the loaned securities does not exceed 30% of the Fund’s total assets. These loans earn income for the Fund and are collateralized by cash and

securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

Principal Risks of Investing in the Fund

As with any mutual fund, there can be no assurance that the

Fund’s investment objective will be met or that the net return on an investment in the Fund will exceed what could have been obtained through other investment or savings vehicles. Shares of the Fund are not bank deposits and are not guaranteed

or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Fund goes down, you could lose money.

The following is a summary of the principal risks of investing

in the Fund.

Management Risk. The investment style or strategy used by the Subadviser may fail to produce the intended result. The Subadviser’s assessment of a particular security or company may prove incorrect, resulting in losses or

underperformance.

Dividend-paying Stocks Risk. There is no guarantee that the issuers of the stocks held by the Fund will declare dividends in the future or that, if dividends are declared, they will remain at their current levels or increase over time.

Dividend-paying stocks may not participate in a broad market advance to the same degree as other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend.

Emerging Markets Risk. In

addition to the risks associated with investments in foreign securities, emerging market securities are subject to additional risks, which cause these securities generally to be more volatile than securities of issuers located in developed

countries.

Foreign Investment Risk. Investment in foreign securities involves risks due to several factors, such as illiquidity, the lack of public information, changes in the exchange rates between foreign currencies and the U.S. dollar, unfavorable

political, social and legal

developments, or economic and financial instability. Foreign companies are

not subject to the U.S. accounting and financial reporting standards and may have riskier settlement procedures. U.S. investments that are denominated in foreign currencies or that are traded in foreign markets, or securities of U.S. companies that

have significant foreign operations may be subject to foreign investment risk.

Geographic Risk. If the

Fund invests a significant portion of its assets in issuers located in a single country, a limited number of countries, or a particular geographic region, it assumes the risk that economic, political and social conditions in those countries or that

region may have a significant impact on its investment performance.

Equity Securities Risk. The

Fund’s investments in equity securities are subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day-to-day and may decline significantly. The prices of individual

stocks may be negatively affected by poor company results or other factors affecting individual prices, as well as industry and/or economic trends and developments affecting industries or the securities market as a whole.

Depositary Receipts Risk.

Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Depositary receipts may or may not be jointly sponsored by the underlying issuer. The issuers of

unsponsored depositary receipts are not obligated to disclose information that is considered material in the United States. Therefore, there may be less information available regarding the issuers and there may not be a correlation between such

information and the market value of the depositary receipts. Certain depositary receipts are not listed on an exchange and therefore may be considered to be illiquid securities.

Factor-Based Investing

Risk. There can be no assurance that the multi-factor selection process employed by the subadviser will enhance performance. Exposure to investment style factors may detract from performance in some market

environments, which may continue for prolonged periods.

Disciplined Strategy Risk.

The Fund will not deviate from its equity strategy (except to the extent necessary to comply with federal tax laws or other applicable laws). If the Fund is committed to a strategy that is unsuccessful, the Fund will not meet its investment goal.

Because the Fund generally will not use certain techniques available to other mutual funds to reduce stock market exposure, the

VALIC Company I

- 3 -

Global Strategy

Fund

Fund may be more susceptible to general market declines than

other mutual funds.

Credit Risk. The issuer of a fixed income security owned by the Fund may be unable to make interest or principal payments.

Interest Rate Fluctuations Risk. Fixed income securities may be subject to volatility due to changes in interest rates. Duration is a measure of interest rate risk that indicates how price-sensitive a bond is to changes in interest rates. Longer-term

and lower coupon bonds tend to be more sensitive to changes in interest rates. Interest rates have been historically low, so the Fund faces a heightened risk that interest rates may rise. For example, a bond with a duration of three years will

decrease in value by approximately 3% if interest rates increase by 1%. Recent and potential future changes in monetary policy made by central banks and/or their governments are likely to affect the level of interest rates.

Currency Risk. Because the

Fund’s foreign investments are generally held in foreign currencies, the Fund could experience gains or losses based solely on changes in the exchange rate between foreign currencies and the U.S. dollar. Such gains or losses may be

substantial.

Derivatives Risk. The prices of derivatives may move in unexpected ways due to the use of leverage and other factors and may result in increased volatility or losses. The Fund may not be able to terminate or sell derivative positions,

and a liquid secondary market may not always exist for derivative positions. When currency forwards are used by the Fund for hedging purposes, there is a risk that due to imperfect correlations, the currency forwards will not fully hedge against

adverse changes in foreign currency values or, under extreme market conditions, will not provide any hedging benefit. The successful use of currency forwards for non-hedging purposes usually depends on the portfolio managers’ ability

to forecast movements in foreign currency values and may be speculative. Should these values move in unexpected ways, the Fund may not achieve the anticipated benefit from using currency forwards, and it may realize losses, which could be

significant.

Foreign Sovereign Debt Risk. Foreign sovereign debt securities are subject to the risk that a governmental entity may delay or refuse to pay interest or to repay principal on its sovereign debt, due, for example, to cash flow problems, insufficient

foreign currency reserves, political, social and economic considerations, the relative size of the governmental entity’s debt position in relation to the economy or the failure to put in place economic reforms required by the International

Monetary Fund or other

multilateral agencies. If a governmental entity defaults, it may ask for more

time in which to pay or for further loans.

Futures

Risk. A futures contract is considered a derivative because it derives its value from the price of the underlying currency, security or financial index. The prices of futures contracts can be volatile and

futures contracts may lack liquidity. In addition, there may be imperfect or even negative correlation between the price of a futures contract and the price of the underlying currency, security or financial index.

Credit Default Swap Risk. A

credit default swap is an agreement between two parties: a buyer of credit protection and a seller of credit protection. The buyer in a credit default swap agreement is obligated to pay the seller a periodic stream of payments over the term of the

swap agreement. If no default or other designated credit event occurs, the seller of credit protection will have received a fixed rate of income throughout the term of the swap agreement. If a default or designated credit event does occur, the

seller of credit protection must pay the buyer of credit protection the full value of the reference obligation. Credit default swaps increase counterparty risk when the Fund is the buyer. The absence of a central exchange or market for swap

transactions has led, in some instances, to difficulties in trading and valuation, especially in the event of market disruptions. Recent legislation requires most swaps to be executed through a centralized exchange or regulated facility and be

cleared through a regulated clearinghouse. The swap market could be disrupted or limited as a result of this legislation, which could adversely affect the Fund. Moreover, the establishment of a centralized exchange or market for swap transactions

may not result in swaps being easier to trade or value.

Junk Bond Risk. High

yielding, high risk fixed-income securities (often referred to as “junk bonds”) may involve significantly greater credit risk, market risk and interest rate risk compared to higher rated fixed-income securities. Issuers of junk bonds are

less secure financially and their securities are more sensitive to downturns in the economy. The market for junk bonds may not be as liquid as that for more highly rated securities.

Income Risk. Because the

Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds.

Counterparty Risk.

Counterparty risk is the risk that a counterparty to a security, loan or derivative held by the Fund becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties. The Fund may

VALIC Company I

- 4 -

Global Strategy

Fund

experience significant delays in obtaining any recovery in

a bankruptcy or other reorganization proceeding, and there may be no recovery or limited recovery in such circumstances.

Liquidity Risk. If the

active trading market for certain securities becomes limited or non-existent, it can become more difficult to sell the securities at or near their perceived value. This may cause the value of such securities and the Fund’s share price to fall

dramatically.

Market Risk. The Fund’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings or due to adverse political or economic developments here or abroad, changes in investor

psychology, or heavy institutional selling and other conditions or events (including, for example, military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). The prices of individual securities may fluctuate, sometimes

dramatically, from day to day. The prices of stocks and other equity securities tend to be more volatile than those of fixed-income securities.

The coronavirus pandemic and the related governmental and

public responses have had and may continue to have an impact on the Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities

and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and

component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such

diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Large-Cap Companies

Risk. Large-cap companies tend to go in and out of favor based on market and economic conditions and tend to be less volatile than companies with smaller market capitalizations. In exchange for this

potentially lower risk, the Fund’s value may not rise as much as the value of funds that emphasize smaller capitalization companies. Larger, more established companies may be unable to respond quickly to new competitive challenges, such as

changes in technology and consumer tastes. Larger companies also may not be able to attain the high growth rate of successful smaller

companies, particularly during extended periods of economic expansion.

Mid-Cap Company Risk.

Investing in mid-cap companies carries the risk that due to current market conditions these companies may be out of favor with investors. Stocks of mid-cap companies may be more volatile than those of larger

companies due to, among other reasons, narrower product lines, more limited financial resources and fewer experienced managers.

Risk of Investing in Money Market Securities. An investment in the Fund is subject to the risk that the value of its investments may be subject to changes in interest rates, changes in the rating of any money market security and in the ability of an issuer to make

payments of interest and principal.

Securities

Lending Risk. Engaging in securities lending could increase the market and credit risk for Fund investments. The Fund may lose money if it does not recover borrowed securities, the value of the collateral falls, or

the value of investments made with cash collateral declines. The Fund’s loans will be collateralized by securities issued or guaranteed by the U.S. Government or its agencies and instrumentalities, which subjects the Fund to the credit risk of

the U.S. Government or the issuing federal agency or instrumentality. If the value of either the cash collateral or the Fund’s investments of the cash collateral falls below the amount owed to a borrower, the Fund also may incur losses that

exceed the amount it earned on lending the security. Securities lending also involves the risks of delay in receiving additional collateral or possible loss of rights in the collateral if the borrower fails. Another risk of securities lending is the

risk that the loaned portfolio securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price.

Currency Management Strategies Risk. Currency management strategies may substantially change the Fund’s exposure to currency exchange rates and could result in losses to the Fund if currencies do not perform as the subadviser expects. In addition,

currency management strategies, to the extent that they reduce the Fund’s exposure to currency risks, may also reduce the Fund’s ability to benefit from favorable changes in currency exchange rates. Using currency management strategies

for purposes other than hedging further increases the Fund’s exposure to foreign investment losses. Currency markets generally are not as regulated as securities markets. In addition, currency rates may fluctuate significantly over short

periods of time, and can reduce returns.

VALIC Company I

- 5 -

Global Strategy

Fund

Performance Information

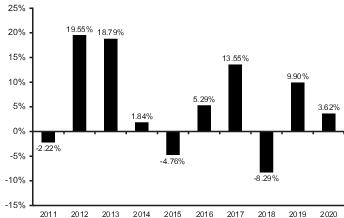

The following Risk/Return Bar Chart and Table illustrate

the risks of investing in the Fund by showing changes in the Fund’s performance from calendar year to calendar year and comparing the Fund’s average annual returns to those of the MSCI ACWI Index (net) and a blended index and each of its

components. The blended index is composed of the J.P. Morgan GBI Global Index (unhedged) (40%) and the MSCI ACWI Index (net) (60%). Fund management believes the blended index provides additional comparative performance information and

represents the Fund’s overall investment strategies and portfolio composition. Fees and expenses incurred at the contract level are not reflected in the bar chart or table. If these amounts were reflected, returns would be less than those

shown. Of course, past performance of the Fund is not necessarily an indication of how the Fund will perform in the future.

Effective January 29, 2020, Franklin Advisers, Inc.

(“Franklin Advisers”) manages all of the assets of the Fund. Prior to January 29, 2020, Templeton Investment Counsel, LLC managed the equity assets of the Fund and Franklin Advisers managed the fixed income assets of the Fund.

During the period shown

in the bar chart:

| Highest

Quarterly Return: |

March 31, 2012 | 9.17% |

| Lowest

Quarterly Return: |

March 31, 2020 | -14.67% |

| Year

to Date Most Recent Quarter: |

June 30, 2021 | 6.59% |

Average Annual Total Returns (For the periods

ended December 31, 2020)

| 1

Year |

5

Years |

10

Years | |||

|

Fund |

3.62% | 4.54% | 5.34% | ||

|

Blended

Index |

14.40% | 9.46% | 6.68% | ||

|

JPM GBI Global (unhedged) (reflects no deduction for fees, expenses or

taxes) |

9.68% | 4.62% | 2.46% | ||

|

MSCI ACWI (net) (reflects no deduction for fees or

expenses) |

16.25% | 12.26% | 9.13% |

Investment Adviser

The Fund’s investment adviser is VALIC.

The Fund is subadvised by Franklin Advisers.

Portfolio

Managers

| Name and Title | Portfolio

Manager of the Fund Since | |

|

Michael Hasenstab, Ph.D. Executive Vice President, Portfolio Manager, and Lead Portfolio

Manager |

2005 | |

|

Christine Yuhui Zhu Senior Vice President, Portfolio Manager, and Primary Backup Portfolio

Manager |

2014 | |

|

Chandra Seethamraju, Ph.D. Senior Vice President, Co-Head of Systematic Strategies Portfolio Management, and Portfolio

Manager |

2020 | |

|

Sundaram Chettiappan, CFA Vice President, Portfolio Manager, and Portfolio

Manager |

2020 |

Purchases and Sales of Fund

Shares

Shares of the Funds may only be purchased or redeemed

through Variable Contracts offered by the separate accounts of VALIC or other participating life insurance companies and through qualifying retirement plans (“Plans”) and IRAs. Shares of each Fund may be purchased and redeemed each day

the New York Stock Exchange is open, at the Fund’s net asset value determined after receipt of a request in good order.

VALIC Company I

- 6 -

Global Strategy

Fund

The Funds do not have any initial or subsequent investment

minimums. However, your insurance company may impose investment or account value minimums. The prospectus (or other offering document) for your Variable Contract contains additional information about purchases and redemptions of the Funds’

shares.

Tax Information

A Fund will not be subject to U.S. federal income tax so

long as it qualifies as a regulated investment company and distributes its income and gains each year to its shareholders. However, contractholders may be subject to federal income tax (and a federal Medicare tax of 3.8% that applies to net income,

including taxable annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the prospectus (or other offering document) for the Variable Contract for additional information regarding taxation.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

The Funds are not sold directly to the general public but

instead are offered to registered and unregistered separate accounts of VALIC and its affiliates and to Plans and IRAs. The Funds and their related companies may make payments to the sponsoring insurance company or its affiliates for recordkeeping

and distribution. These payments may create a conflict of interest as they may be a factor that the insurance company considers in including the Funds as underlying investment options in a variable contract. Visit your sponsoring insurance

company’s website for more information.

VALIC Company I

- 7 -

- 8 -

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/25/2024

- Wall St loses over 1% amid fading rate-cut hopes

- Q1 US GDP shows surprise slowing and uncomfortable inflation

- Meta shares dip on softer Q2 revenue guidance, elevated AI spending plans

- Oil steadies as US fuel demand concerns face Middle East supply risks

- Dollar sags after US GDP and inflation surprise, except against yen

- IBM tumbles on soft Q1 revenue; announces HashiCorp $6.4bn acquisition

- Hasbro (HAS) brand strength sees earnings top expectations

- Meta Platforms (META) Tops Q1 EPS by 39c, Offers Guidance

- Seagate Technology (STX) Enters $600M Asset Purchase Agreement with Avago

- Rubrik (RBRK) Prices Upsized 23.5M Share IPO at $32/sh

- Midday movers: Meta, IBM, Caterpillar fall; Chipotle rises

- After-hours movers: Meta, Ford, IBM, ServiceNow and more

- Midday movers: Tesla, Boeing rise; Uber, Old Dominion Freight fall

- After-hours movers: Tesla, Texas Instruments, Seagate, Visa and more

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AIG (AIG) Announces Retirement of David McElroy

- Natural Grocers® Pledges Portion of Opening-Day Sales at New Location in Warr Acres, Oklahoma, to Natural Grocers Heroes in Aprons Fund

- IDC Names Expel a Leader in 2024 MarketScape for Worldwide Emerging MDR Services

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share