Form 497K VALIC Co I

September 28, 2021 3:00 PM EDTSummary Prospectus

October 1, 2021

VALIC Company I

Capital Appreciation Fund

(Ticker: VAPPX)

The

Fund’s Statutory Prospectus and Statement of Additional Information, each dated October 1, 2021, as amended and

supplemented from time to time, and the most recent shareholder reports are incorporated into and made part of this Summary Prospectus

by reference. The Fund is offered only to registered and unregistered separate accounts of The Variable Annuity Life Insurance Company and its affiliates and to qualifying retirement plans and IRAs and is not intended for use by other

investors.

Before you invest, you may want to review

the Fund’s Statutory Prospectus, which contains more information about the Fund and its risks. You can find the Statutory Prospectus and the above-incorporated information online at

http://valic.onlineprospectus.net/VALIC/FundDocuments/index.html. You can also get this information at no cost by calling 800-448-2542 or by sending an e-mail request to [email protected].

The Securities and Exchange Commission has not approved or

disapproved these securities, nor has it determined that this Summary Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Objective

The Fund seeks long-term capital appreciation by investing

primarily in a broadly diversified portfolio of stocks and other equity securities of U.S. companies.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay

if you buy, hold and sell shares of the Fund. The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy (“Variable

Contracts”) in which the Fund is offered. If separate account fees were shown, the Fund’s annual operating expenses would be higher. Please see your Variable Contract prospectus for more details on the separate account fees.

Annual Fund

Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Management

Fees |

0.55% |

|

Other

Expenses |

0.20% |

|

Total Annual Fund Operating

Expenses |

0.75% |

|

Fee Waivers and/or Expense

Reimbursements1 |

0.15% |

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense

Reimbursements1 |

0.60% |

| 1 | Pursuant to an Expense Limitation Agreement, The Variable Annuity Life Insurance Company (“VALIC”) has contractually agreed to reimburse the expenses of the Fund until September 30, 2022, so that the Fund’s Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements do not exceed 0.60%. For purposes of the Expense Limitation Agreement, “Total Annual Fund Operating Expenses” shall not include extraordinary expenses (i.e., expenses that are unusual in nature and infrequent in occurrence, such as litigation), or acquired fund fees and expenses, brokerage commissions and other transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and |

| governmental fees, and other expenses not incurred in the ordinary course of the Fund’s business. This agreement will be renewed annually for one-year terms unless terminated by the Board of Directors of VALIC Company I prior to any such renewal. |

Expense

Example

This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of those

periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses include expense reimbursements for year one. The Example does not reflect charges imposed by the Variable Contract. If the

Variable Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information on such charges. Although your actual costs may be higher or lower, based on these assumptions and the net expenses shown in

the fee table, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $61 | $225 | $402 | $916 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance.

As a result of a reorganization which occurred on May 24,

2021 (the “Reorganization”), the Fund acquired all of the assets and liabilities of the Capital Appreciation Fund (the “Predecessor Fund”), a series of VALIC Company II. During the fiscal year ended August 31, 2020, the

portfolio

- 1 -

VALIC Company I

Capital Appreciation Fund

turnover rate of the Predecessor Fund was 62% of the

average value of its portfolio. During the fiscal period September 1, 2020 to May 31, 2021, the portfolio turnover rate of the Predecessor Fund and the Fund was 27% (not annualized) of the average value of the portfolio.

Principal Investment Strategies of the Fund

The Fund invests in equity securities of large-sized U.S.

companies similar in size, at the time of purchase, to those within the Russell 1000® Growth Index. As of May 7, 2021, the largest stock by market

capitalization in the Russell 1000® Growth Index was approximately $2.2 trillion and the median was $17.8 billion. The subadviser selects stocks

using a unique, growth-oriented approach, focusing on high quality companies with sustainable earnings growth that are available at reasonable prices, which combines the use of proprietary analytical tools and the qualitative judgments of the

investment team. In general, the subadviser believes companies that are undervalued relative to their fundamentals and exhibit improving investor interest outperform the market over full market cycles. As a result, the subadviser’s investment

process begins by using tools to rank stocks based on expected returns, construct preliminary portfolios with the use of fundamental factors, and manage risk. All purchases and sales of portfolio securities, however, are subjected ultimately to the

investment team’s qualitative judgments developed from their cumulative investment experience. The entire process is designed to focus on company fundamentals through both quantitative and qualitative analysis to balance return generation with

risk management. Although the Fund typically invests in common stocks of domestic companies, the Fund may occasionally invest in the equity securities of foreign issuers (up to a maximum of 20% of total assets).

In order to generate additional income, the Fund may lend

portfolio securities to broker-dealers and other financial institutions provided that the value of the loaned securities does not exceed 30% of the Fund’s total assets. These loans earn income for the Fund and are collateralized by cash and

securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

Principal Risks of Investing in the Fund

As with any mutual fund, there can be no assurance that the

Fund’s investment objective will be met or that the net return on an investment in the Fund will exceed what could have been obtained through other investment or savings vehicles. Shares of the Fund are not bank deposits and are not guaranteed

or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the

value of the assets of the Fund goes down, you could lose money.

The following is a summary of the principal risks of investing

in the Fund.

Management Risk. The investment style or strategy used by the Fund may fail to produce the intended result. A subadviser’s assessment of a particular security or company may prove incorrect, resulting in losses or

underperformance.

Equity Securities Risk. The Fund’s investments in equity securities are subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day-to-day and may decline

significantly. The prices of individual stocks may be negatively affected by poor company results or other factors affecting individual prices, as well as industry and/or economic trends and developments affecting industries or the securities market

as a whole.

Growth Style Risk. Generally, “growth” stocks are stocks of companies that a subadviser believes have anticipated earnings ranging from steady to accelerated growth. Many investors buy growth stocks because of anticipated

superior earnings growth, but earnings disappointments often result in sharp price declines. Growth companies usually invest a high portion of earnings in their own businesses so their stocks may lack the dividends that can cushion share prices in a

down market. In addition, the value of growth stocks may be more sensitive to changes in current or expected earnings than the value of other stocks, because growth stocks trade at higher prices relative to current earnings.

Large-Cap Companies Risk.

Investing primarily in large-cap companies carries the risk that due to current market conditions these companies may be out of favor with investors. Large-cap companies may be unable to respond quickly to new competitive challenges or attain the

high growth rate of successful smaller companies.

Market Risk. The

Fund’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings or due to adverse political or economic developments here or abroad, changes in investor psychology, or heavy institutional

selling and other conditions or events (including, for example, military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). The prices of individual securities may fluctuate, sometimes dramatically, from day to day. The prices

of stocks and other equity securities tend to be more volatile than those of fixed-income securities.

VALIC Company I

- 2 -

Capital

Appreciation Fund

The coronavirus pandemic and the related governmental and

public responses have had and may continue to have an impact on the Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities

and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and

component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such

diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Securities Lending Risk.

Engaging in securities lending could increase the market and credit risk for Fund investments. The Fund may lose money if it does not recover borrowed securities, the value of the collateral falls, or the value of investments made with cash

collateral declines. The Fund’s loans will be collateralized by securities issued or guaranteed by the U.S. Government or its agencies and instrumentalities, which subjects the Fund to the credit risk of the U.S. Government or the issuing

federal agency or instrumentality. If the value of either the cash collateral or the Fund’s investments of the cash collateral falls below the amount owed to a borrower, the Fund also may incur losses that exceed the amount it earned on

lending the security. Securities lending also involves the risks of delay in receiving additional collateral or possible loss of rights in the collateral if the borrower fails. Another risk of securities lending is the risk that the loaned portfolio

securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price.

Performance Information

The returns presented for the Fund reflect the performance

of the Predecessor Fund. The Fund adopted the performance of the Predecessor Fund as a result of the Reorganization on May 24, 2021. The Fund had not yet commenced operations prior to the Reorganization. The performance information below is based on

the performance of the Predecessor Fund for periods prior to

the date of the Reorganization. The Fund and the Predecessor Fund had the

same investment objectives, strategies and portfolio management team as of the date of the Reorganization.

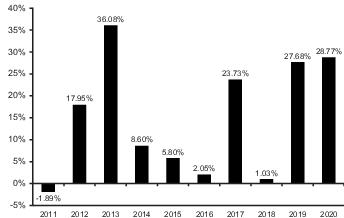

The following Risk/Return Bar Chart and Table illustrate

the risks of investing in the Fund by showing changes in the Predecessor Fund’s performance from calendar year to calendar year and comparing the Predecessor Fund’s average annual returns to those of the Russell 1000® Growth Index. Fees and expenses incurred at the contract level are not reflected in the bar chart or table. If these amounts were reflected,

returns would be less than those shown. Of course, past performance of the Predecessor Fund is not necessarily an indication of how the Fund will perform in the future.

BMO Asset Management Corp. (“BMO AM”) assumed

subadvisory duties of the Predecessor Fund on June 7, 2018. From December 5, 2011 through June 6, 2018, BNY Mellon Asset Management North America Corporation (formerly known as The Boston Company Asset Management, LLC) served as subadviser to the

Predecessor Fund. From August 28, 2006 to December 2, 2011, Bridgeway Capital Management, Inc. served as subadviser to the Predecessor Fund.

During the period shown

in the bar chart:

| Highest

Quarterly Return: |

June 30, 2020 | 24.11% |

| Lowest

Quarterly Return: |

September 30, 2011 | -17.63% |

| Year

to Date Most Recent Quarter: |

June 30, 2021 | 15.81% |

VALIC Company I

- 3 -

Capital

Appreciation Fund

Average Annual Total Returns

(For the periods ended December 31, 2020)

| 1

Year |

5

Years |

10

Years | |||

|

Fund |

28.77% | 15.97% | 14.27% | ||

|

Russell 1000® Growth Index (reflects no deduction for fees, expenses or

taxes) |

38.49% | 21.00% | 17.21% |

Investment Adviser

The Fund’s investment adviser is VALIC.

The Fund is subadvised by BMO AM.

Portfolio

Managers

| Name and Title | Portfolio

Manager of the Fund Since | |

|

Ernesto Ramos Head of Disciplined Equities, Chief Investment Officer and Portfolio Manager, Co-Manager of the

Fund

|

2021 | |

|

Jason C. Hans Director and Portfolio Manager, Co-Manager of the

Fund |

2018* | |

|

J.P. Gurnee Vice President and Portfolio Manager, Co-Manager of the

Fund |

2021* |

* Includes management of the

Predecessor Fund.

Purchases and Sales of Fund

Shares

Shares of the Funds may only be purchased or redeemed

through Variable Contracts offered by the separate accounts of VALIC or other participating life insurance companies and through qualifying retirement plans (“Plans”) and IRAs. Shares of each Fund may be

purchased and redeemed each day the New York Stock Exchange is open, at

the Fund’s net asset value determined after receipt of a request in good order.

The Funds do not have any initial or subsequent investment

minimums. However, your insurance company may impose investment or account value minimums. The prospectus (or other offering document) for your Variable Contract contains additional information about purchases and redemptions of the Funds’

shares.

Tax Information

A Fund will not be subject to U.S. federal income tax so

long as it qualifies as a regulated investment company and distributes its income and gains each year to its shareholders. However, contractholders may be subject to federal income tax (and a federal Medicare tax of 3.8% that applies to net income,

including taxable annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the prospectus (or other offering document) for the Variable Contract for additional information regarding taxation.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

The Funds are not sold directly to the general public but

instead are offered to registered and unregistered separate accounts of VALIC and its affiliates and to Plans and IRAs. The Funds and their related companies may make payments to the sponsoring insurance company or its affiliates for recordkeeping

and distribution. These payments may create a conflict of interest as they may be a factor that the insurance company considers in including the Funds as underlying investment options in a variable contract. Visit your sponsoring insurance

company’s website for more information.

VALIC Company I

- 4 -

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/19/2024

- Dow, S&P inch up as AmEx gains; Netflix slump drags down Nasdaq

- Sony/Apollo bid for Paramount could be worth as much as $29 billion - Source

- Netflix Q1 earnings top estimates on blowout subscriber growth

- Wall St indexes split, Treasuries dip amid earnings, geopolitical crosscurrents

- Gold prices rally past $2,400 on reports of Israel strikes on Iran

- Tritium DCFC Limited (DCFC): Three Australian subsidiaries were determined to be insolvent or likely to become insolvent

- Hasbro (HAS) Announces Resignation of Cynthia Williams, President of Wizards of the Coast and Hasbro Gaming

- Frontier Communications (FYBR) says third party had gained unauthorized access to portions of its information technology environment

- Ibotta (IBTA) Prices 6.56M Share IPO at $88/sh

- Jabil falls after placing CEO on paid leave amid internal investigation

- Netflix, Tesla, Amex, P&G fall premarket; Paramount Global gains

- After-hours movers: Netflix, Intuitive Surgical, Nordstrom, KB Home

- Midday movers: Tesla, Blackstone, Las Vegas Sands fall; DR Horton rises

- After-hours movers: Alcoa rises; Equifax and Las Vegas Sands fall

- Midday movers: Travelers, JB Hunt fall; United Airlines rises

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- American International Group (AIG) PT Raised to $89 at Piper Sandler

- Cochlear receives FDA clearance to lower the age for the Osia System to 5-years-old

- Técnico Petrovic retorna à seleção de basquete com equipe experiente

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share