Form 497K Ultimus Managers Trust

Click here to view the fund’s statutory prospectus or statement of additional information

Ultimus Managers Trust

Westwood Alternative Income Fund

Summary Prospectus | November 30, 2022

Ticker: Ultra Shares — WMNUX

| Before you invest, you may want to review the Fund’s complete prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at https://westwoodgroup.com/product/alternative-income-fund/. You can also get this information at no cost by calling 1-877-FUND-WHG (1-877-386-3944) or by asking any financial intermediary that offers shares of the Fund. The Fund’s prospectus and statement of additional information, both dated November 30, 2022, as they may be amended from time to time, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website or phone number noted above. |

FUND INVESTMENT OBJECTIVE

The investment objective of the Westwood Alternative Income Fund (the “Fund” or “Alternative Income Fund”) seeks to provide absolute returns through a combination of current income and capital appreciation with low correlation to equity and fixed income markets.

FUND FEES AND EXPENSES

These tables describe the fees and expenses that you may pay if you buy, hold and sell Ultra Shares of the Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in Ultra Shares, which are not reflected in the table or the example below. Shares of the Fund are available in other share classes that have different fees and expenses.

Shareholder Fees

(fees paid directly from your investments)

| Redemption Fee | |

| (as a percentage of amount redeemed, if shares redeemed have been held for less than 30 days) | 1.00% |

1

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Ultra | |

| Shares | |

| Management Fees1 | 0.85% |

| Other Expenses2 | 0.27% |

| Total Annual Fund Operating Expenses | 1.12% |

| Less Fee Reductions and/or Expense Reimbursements3 | (0.27)% |

| Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | 0.85% |

| 1 | Management Fees consist of a base fee at an annualized rate of 0.53% of the Predecessor Fund’s and the Fund’s average daily net assets, and a positive or negative performance adjustment of up to an annualized rate of 0.32% based on the Predecessor Fund’s and the Fund’s Ultra Shares’ performance relative to the FTSE 1-Month U.S. Treasury Bill Index plus 2.00%, resulting in a minimum total fee of 0.21% and a maximum total fee of 0.85%. |

| 2 | “Other Expenses” reflect estimated amounts for the current fiscal year as a result of the reorganization of the Westwood Alternative Income Fund, a series of The Advisors’ Inner Circle Fund (the “Predecessor Fund”), into the Fund on November 1, 2021. |

| 3 | Westwood Management Corp. (the “Adviser”) has contractually agreed to waive its Management Fee at an annual rate in the amount of 0.01% of the Fund’s average daily net assets until March 1, 2024 (the “Management Fee Waiver Agreement”). The Adviser has contractually agreed to reduce fees and reimburse expenses in order to keep Total Annual Fund Operating Expenses for Ultra Shares (excluding Management Fees, interest, taxes, brokerage commissions, Rule 12b-1 distribution fees (if any), administrative servicing fee (if any), borrowing expenses such as dividend and interest expenses on securities sold short, Acquired Fund fees and expenses, costs to organize the Fund, other expenditures which are capitalized in accordance with generally accepted accounting principles, and extraordinary expenses (collectively, “excluded expenses”)) from exceeding 0.00% of the Fund’s Ultra Shares’ average daily net assets until March 1, 2024. In addition, the Adviser may receive from the Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the expense cap to recoup all or a portion of its prior fee reductions or expense reimbursements (other than Management Fee waivers pursuant to the Management Fee Waiver Agreement) made during the rolling three-year period preceding the date of the recoupment if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the expense cap (i) at the time of the fee waiver and/or expense reimbursement and (ii) at the time of the recoupment. This agreement may be terminated: (i) by the Board of Trustees (the “Board”) of Ultimus Managers Trust (the “Trust”), for any reason at any time; or (ii) by the Adviser, upon ninety (90) days’ prior written notice to the Trust, effective as of the close of business on March 1, 2024. This agreement will terminate automatically if the Fund’s investment advisory agreement with the Adviser is terminated. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and the contractual agreements to limit expenses remain in effect until March 1, 2024. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years |

| $87 | $301 | $563 | $1,313 |

2

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio) . A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended October 31, 2021, the portfolio turnover rate of the Predecessor Fund was 125% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund employs an absolute return strategy, which means that the Fund seeks to earn a positive total return through a combination of current income and capital appreciation in all market conditions, by maintaining a portfolio that is designed to have low volatility and low correlations with equity and fixed income markets over a full market cycle.

In seeking to achieve its goals, the Fund invests primarily in income producing convertible securities. Convertible securities include, but are not limited to, corporate bonds, debentures, notes or preferred stocks and their hybrids that can be converted into (exchanged for) common stock or other securities, such as warrants or options, which provide an opportunity for equity participation. Once a convertible security converts to common stock, the Fund would be an equity owner of the particular company as a common stockholder. The Fund may also invest in equity securities and non-convertible fixed income securities, and may invest in securities of any market capitalization, maturity, duration or credit quality, including securities rated below investment grade or, if unrated, deemed by the Adviser to be of comparable quality (“junk bonds”). The Fund may invest in foreign companies in both developed and emerging markets.

The Fund may seek to exploit certain arbitrage opportunities by, for example, selling common stocks or bonds short against positions in which the Fund has invested in convertible securities, or establishing short positions in convertible securities with long positions in the corresponding common stock or bond. When the Fund sells a security short, it is selling a security it does not own. The Fund may invest in derivative instruments, such as futures contracts, forward contracts, options and swaps (including credit default swaps) to seek to hedge risks such as issuer, equity market, credit, interest rate and foreign currency risks, or enhance the returns of the Fund. The Fund may also seek to generate income from option premiums by writing (selling) call and put options on individual securities, broad-based securities indexes or exchange-traded funds (“ETFs”). The Adviser seeks to identify undervalued convertible securities by utilizing quantitative tools and fundamental research to assess a security’s income characteristics, liquidity, credit quality,

3

volatility and equity value. The Adviser seeks to invest in companies with strong business models, quality management, and favorable financial conditions. The Adviser will consider selling a convertible security when it believes that the security is no longer undervalued, or there are unfavorable changes in the fundamentals of the underlying company or the structure of the convertible security. The Fund may buy and sell securities frequently, which could result in a high portfolio turnover rate.

When the Adviser believes that market conditions are unfavorable for profitable investing, or is otherwise unable to locate attractive investment opportunities, it may increase the Fund’s investments in cash or money market instruments to protect the Fund’s assets and maintain liquidity. When the Fund’s investments in cash or money market instruments increase, it may not participate in market advances or declines to the same extent that it would if the Fund remained more fully invested in equity and fixed income securities.

The Fund invests across various asset classes, sectors and securities, and, from time to time, will engage in frequent trading.

As a result of the Fund’s investment style, the Fund, from time to time, will engage in frequent trading.

PRINCIPAL RISKS

As with all mutual funds, there is no guarantee that the Fund will achieve its investment objective. You could lose money by investing in the Fund. A

Fund share is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency. The principal risk factors affecting shareholders’ investments in the Fund are set forth below.

Convertible Securities Risk – The value of a convertible security is influenced by changes in interest rates (with investment value declining as interest rates increase and increasing as interest rates decline) and the credit standing of the issuer. The price of a convertible security will also normally vary in some proportion to changes in the price of the underlying common stock because of the conversion or exercise feature. Convertible securities may be subordinate to other debt securities issued by the same issuer. Issuers of convertible securities are often not as strong financially as issuers with higher credit ratings. Convertible securities typically provide yields lower than comparable non-convertible securities. Their values may be more volatile than those of non-convertible securities, reflecting changes in the values of the securities into which they are convertible.

High Yield Bond Risk – High yield bonds (often called “junk bonds”) are debt securities rated below investment grade. Junk bonds are speculative, involve greater risks of default, downgrade, or price declines and are more volatile and tend to be less liquid than investment-grade securities. Companies issuing high yield bonds are less financially strong, are more likely to encounter financial difficulties, and are more vulnerable to adverse market events and negative sentiments than companies with higher credit ratings.

4

Fixed Income Risk – Fixed income securities are subject to a number of risks, including credit and interest rate risks. Credit risk is the risk that the issuer or obligor will not make timely payments of principal and interest. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The Fund is subject to greater levels of credit risk to the extent it holds below investment grade debt securities, or “junk bonds.” Interest rate risk is the risk that the value of a fixed income security will fall when interest rates rise. In general, the longer the maturity and the lower the credit quality of a fixed income security, the more likely its value will decline.

Emerging Markets Securities Risk – The Fund’s investments in emerging markets securities are considered speculative and subject to heightened risks in addition to the general risks of investing in foreign securities. Unlike more established markets, emerging markets may have governments that are less stable, markets that are less liquid and economies that are less developed. In addition, the securities markets of emerging market countries may consist of companies with smaller market capitalizations and may suffer periods of relative illiquidity; significant price volatility; restrictions on foreign investment; and possible restrictions on repatriation of investment income and capital. Furthermore, foreign investors may be required to register the proceeds of sales, and future economic or political crises could lead to price controls, forced mergers, expropriation or confiscatory taxation, seizure, nationalization or creation of government monopolies.

Foreign Securities Risk – Investing in foreign securities poses additional risks since political and economic events unique to a country or region will affect those markets and their issuers. These risks will not necessarily affect the U.S. economy or similar issuers located in the United States. Securities of foreign companies may not be registered with the U.S. Securities and Exchange Commission (the “SEC”) and foreign companies are generally not subject to the regulatory controls imposed on U.S. issuers and, as a consequence, there is generally less publicly available information about foreign securities than is available about domestic securities. Income from foreign securities owned by the Fund may be reduced by a withholding tax at the source, which tax would reduce income received from the securities comprising the Fund’s portfolio. Foreign securities may also be more difficult to value than securities of U.S. issuers. In addition, periodic U.S. Government restrictions on investments in issuers from certain foreign countries may require the Fund to sell such investments at inopportune times, which could result in losses to the Fund.

Derivatives Risk – The Fund’s use of futures contracts, forward contracts, options and swaps is subject to market risk, leverage risk, correlation risk, hedging risk and liquidity risk. Market risk is the risk that the market value of an investment may move up and down, sometimes rapidly and unpredictably. Leverage risk is the risk that the use of leverage may amplify the effects of market volatility on the Fund’s share price and may also cause the Fund to

5

liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly or at all with the underlying asset, rate or index. Hedging risk is the risk that derivative instruments used for hedging purposes may also limit any potential gain that may result from the increase in value of the hedged asset. To the extent that the Fund engages in hedging strategies, there can be no assurance that such strategy will be effective or that there will be a hedge in place at any given time. Liquidity risk is described elsewhere in this section. The Fund’s use of forwards and swaps is also subject to credit risk and valuation risk. Credit risk is the risk that the counterparty to a derivative contract will default or otherwise become unable to honor a financial obligation. Valuation risk is the risk that the derivative may be difficult to value. Each of these risks could cause the Fund to lose more than the principal amount invested in a derivative instrument.

Short Sales Risk – A short sale involves the sale of a security that the Fund does not own in the expectation of purchasing the same security (or a security exchangeable therefore) at a later date at a lower price. Short sales expose the Fund to the risk that it will be required to buy the security sold short (also known as “covering” the short position) at a time when the security has appreciated in value, thus resulting in a loss to the Fund. Investment in short sales may also cause the Fund to incur expenses related to borrowing securities. Reinvesting proceeds received from short selling may create leverage which can amplify the effects of market volatility on the Fund and, therefore, the Fund’s share price. Theoretically, uncovered short sales have the potential to expose the Fund to unlimited losses.

Equity Risk – Since it purchases equity securities, the Fund is subject to the risk that stock prices will fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of the Fund’s equity securities may fluctuate drastically from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response.

Warrants Risk – Warrants are instruments that entitle the holder to buy an equity security at a specific price for a specific period of time. Warrants may be more speculative than other types of investments. The price of a warrant may be more volatile than the price of its underlying security, and an investment in a warrant may therefore create greater potential for capital loss than an investment in the underlying security. A warrant ceases to have value if it is not exercised prior to its expiration date.

Liquidity Risk – Certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to accept a lower price to sell a security, sell other securities to raise cash, or give up an investment opportunity, any of which could have a negative effect on Fund management or performance.

6

Small- and Mid-Capitalization Company Risk – The small- and mid-capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, investments in these small- and mid-sized companies may pose additional risks, including liquidity risk, because these companies tend to have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, small- and mid-cap stocks may be more volatile than those of larger companies. These securities may be traded over-the-counter or listed on an exchange.

Large-Capitalization Company Risk – The large capitalization companies in which the Fund may invest may lag the performance of smaller capitalization companies because large capitalization companies may experience slower rates of growth than smaller capitalization companies and may not respond as quickly to market changes and opportunities.

Absolute Return Strategy Risk – The Fund’s absolute return strategy may cause the Fund to underperform compared to equity or fixed income markets or other mutual funds that do not utilize an absolute return strategy. For example, in rising markets, the Fund’s short positions may significantly impact the Fund’s overall performance and cause the Fund to underperform or sustain losses. Periodic underperformance is to be expected and is a result of the Fund’s overall hedging techniques employed for the absolute return strategy. Additionally, there is a risk that the Adviser will be unable to construct a portfolio that limits the Fund’s exposure to market movements, and as a result, the Fund’s performance may reflect general market movements.

Foreign Currency Risk – As a result of the Fund’s investments in securities or other investments denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar, in which case, the dollar value of an investment in the Fund would be adversely affected.

Preferred Stock Risk – Preferred stocks are sensitive to interest rate changes, and are also subject to equity risk, which is the risk that stock prices will fall over short or extended periods of time. The rights of preferred stocks on the distribution of a company’s assets in the event of a liquidation are generally subordinate to the rights associated with a company’s debt securities.

Regional Focus Risk – To the extent that it focuses its investments in a particular geographic region, the Fund may be more susceptible to economic, political, regulatory or other events or conditions affecting issuers and countries within that region. As a result, the Fund may be subject to greater price volatility and risk of loss than a fund holding more geographically diverse investments.

7

Portfolio Turnover Risk – Due to its investment strategy, the Fund may buy and sell securities frequently. Such a strategy often involves higher expenses, including brokerage commissions, and may increase the amount of capital gains (in particular, short-term gains) realized by the Fund. Shareholders may pay tax on such capital gains.

ETF Risk – ETFs are pooled investment vehicles, such as registered investment companies and grantor trusts, whose shares are listed and traded on U.S. and non-U.S. stock exchanges or otherwise traded in the over-the-counter market. To the extent that the Fund invests in ETFs, the Fund will be subject to substantially the same risks as those associated with the direct ownership of the securities in which the ETF invests, and the value of the Fund’s investment will fluctuate in response to the performance of the ETF’s holdings. ETFs typically incur fees that are separate from those of the Fund. Accordingly, the Fund’s investments in ETFs will result in the layering of expenses such that shareholders will indirectly bear a proportionate share of the ETFs’ operating expenses, in addition to paying Fund expenses. Because the value of ETF shares depends on the demand in the market, shares may trade at a discount or premium to their net asset value (“NAV”) and the Adviser may not be able to liquidate the Fund’s holdings at the most optimal time, which could adversely affect the Fund’s performance.

Money Market Instruments Risk – The value of money market instruments may be affected by changing interest rates and by changes in the credit ratings of the investments. An investment in a money market fund is not a bank deposit and is not insured or guaranteed by any bank, the FDIC or any other government agency. A money market fund’s sponsor has no legal obligation to provide financial support to the fund, and there should be no expectation that the sponsor will provide financial support to the fund at any time. Certain money market funds float their NAV while others seek to preserve the value of investments at a stable NAV (typically, $1.00 per share). An investment in a money market fund, even an investment in a fund seeking to maintain a stable NAV per share, is not guaranteed and it is possible for the Fund to lose money by investing in these and other types of money market funds. If the liquidity of a money market fund’s portfolio deteriorates below certain levels, the money market fund may suspend redemptions (i.e., impose a redemption gate) and thereby prevent the Fund from selling its investment in the money market fund or impose a fee of up to 2% on amounts the Fund redeems from the money market fund (i.e., impose a liquidity fee). These measures may result in an investment loss or prohibit the Fund from redeeming shares when the Adviser would otherwise redeem shares. Money market funds and the securities they invest in are subject to comprehensive regulations. The enactment of new legislation or regulations, as well as changes in interpretation and enforcement of current laws, may affect the manner of operation, performance and/or yield of money market funds.

8

Market Risk – The prices of and the income generated by the Fund’s securities may decline in response to, among other things, investor sentiment, general economic and market conditions, regional or global instability, and currency and interest rate fluctuations. In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund.

Frequent Trading Risk – The Fund’s frequent trading strategy will result in high portfolio turnover and may be more likely to result in realized capital gains that must be distributed to shareholders as taxable income and in increased brokerage and other transaction costs.

Quantitative Security Selection Risk – The Adviser uses a quantitative model as a part of the Fund’s investment strategy, and its processes and securities selection could be adversely affected if it relies on erroneous or outdated data. In addition, securities selected using the quantitative model could perform differently from the financial markets as a whole as a result of the characteristics used in the analysis, the weight placed on each characteristic, and changes in the characteristic’s historical trends.

PERFORMANCE INFORMATION

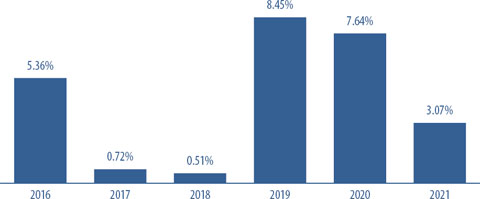

The bar chart and table that follow provide some indication of the risks of investing in the Fund by showing changes in the performance of the Ultra Shares of the Fund from year-to-year and by showing how the average annual returns for 1-year, 5-years, and since inception of the Fund compare with those of the FTSE 1-Month U.S. Treasury Bill Index. The performance shown in bar chart and table for periods prior to November 1, 2021 represents the performance of the Ultra Shares of the Predecessor Fund. The Fund is the successor to the Predecessor Fund through a reorganization with the Fund on November 1, 2021 (the “Reorganization”). How the Fund and the Predecessor Fund have performed in the past (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.westwoodfunds.com or by calling 1-877-FUND-WHG (1-877-386-3944).

9

Calendar Year Returns*

| * | The Fund’s year-to-date return through September 30, 2022 was (3.03)%. |

| BEST QUARTER | WORST QUARTER |

| 3.55% | (2.73)% |

| (12/31/2020) | (3/31/2020) |

Average Annual Total Returns for Periods Ended December 31, 2021

This table compares the Fund’s Ultra Shares’ average annual total returns for the periods ended December 31, 2021 to those of an appropriate broad-based index.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

| Westwood Alternative Income Fund – | Since Inception | ||

| Ultra | 1 Year | 5 Years | (May 1, 2015) |

| Fund Returns Before Taxes | 3.07% | 4.02% | 3.82% |

| Fund Returns After Taxes on Distributions | 2.04% | 3.15% | 2.79% |

| Fund Returns After Taxes on Distributions and Sale of Fund Shares | 1.86% | 2.74% | 2.50% |

| FTSE

1-Month U.S. Treasury Bill Index (reflects no deduction for fees, expenses, or taxes) |

0.04% | 1.06% | 0.83% |

10

INVESTMENT ADVISER

Westwood Management Corp. is the Fund’s investment adviser.

PORTFOLIO MANAGERS

Mr. Adrian Helfert, Senior Vice President and Chief Investment Officer of Multi-Asset Portfolios, has managed the Fund since 2020.*

Mr. Christopher Hartman, Vice President Portfolio Manager of the Multi-Asset Portfolios, has managed the Fund since 2021.*

| * | Including managing the Predecessor Fund through its reorganization into the Fund on November 1, 2021. |

PURCHASE AND SALE OF FUND SHARES

To purchase Ultra Shares of a Fund for the first time, you must invest at least $20,000,000. There is no minimum for subsequent investments.

| Ultra | Shares of the Funds are offered exclusively to: |

| ● | employer retirement plans; |

| ● | health savings accounts under section 223 of the Internal Revenue Code of 1986, as amended (the “Code”), if such accounts are maintained by the Funds at an omnibus level; |

| ● | endowments and foundations and local, city and state agencies (or entities acting on their behalf); |

| ● | unaffiliated registered investment companies; |

| ● | collective investment trusts; |

| ● | banks and trust companies or law firms acting as trustee or manager for trust accounts; |

| ● | insurance companies; and |

| ● | Ultra Shares shareholders purchasing Ultra Shares through the reinvestment of dividends or other distributions. |

If you own your shares directly, you may redeem your shares on any day that the New York Stock Exchange (the “NYSE”) is open for business by contacting the Funds directly by mail at Westwood Funds, 4221 N. 203rd Street, Suite 100, Elkhorn, NE 68022 or telephone at 1-877-FUND-WHG (1-877-386-3944) or telephone at 1-877-FUND-WHG (1-877-386-3944).

If you own your shares through an account with a broker or other institution, contact that broker or institution to redeem your shares. Your broker or institution may charge a fee for its services in addition to the fees charged by the Funds.

11

TAX INFORMATION

Each Fund intends to make distributions that may be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or IRA, in which case your distribution will be taxed when withdrawn from the tax-deferred account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Funds through a broker-dealer or other financial intermediary (such as a bank), the Funds and their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Funds over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Lyrical Asset Management LP: Notice of Intent to Close U.S. Value ETF (USVT)

- China's Top Tier in Heilongjiang

- CONVENING NOTICE TO THE ORDINARY GENERAL MEETINGS OF SHAREHOLDERS

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share