Form 497K Trust for Advised Portfo

| Regan Total Return Income Fund Investor Class: RCTRX Institutional Class: RCIRX Summary Prospectus January 31, 2023 www.reganfunds.com | ||||

Before you invest, you may want to review the Regan Total Return Income Fund’s (the “Fund”) statutory prospectus and statement of additional information, which contain more information about the Fund and its risks. The current statutory prospectus and statement of additional information dated January 31, 2023 , are incorporated by reference into this Summary Prospectus. You can find the Fund’s statutory prospectus, statement of additional information, reports to shareholders and other information about the Fund online at www.reganfunds.com. You can also get this information at no cost by calling 888-44-REGAN (888-447-3426) or by sending an e-mail request to ir@regancapital.com.

Investment Objective

The Fund seeks to provide a high level of risk-adjusted current income and capital appreciation.

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||

| Investor Class | Institutional Class | ||||||||||

| Management Fees | 0.89% | 0.89% | |||||||||

| Distribution and Service (Rule 12b-1) Fees | 0.25% | None | |||||||||

| Other Expenses | 0.53% | 0.51% | |||||||||

| Shareholder Servicing Fees | 0.15% | 0.10% | |||||||||

| Remainder of Other Expenses | 0.38% | 0.41% | |||||||||

Acquired Fund Fees and Expenses(1) | 0.01% | 0.01% | |||||||||

| Total Annual Fund Operating Expenses | 1.68% | 1.41% | |||||||||

Less: Fee Waiver and/or Expense Reimbursement(2) | -0.13% | -0.10% | |||||||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.55% | 1.31% | |||||||||

(1) “Total Annual Fund Operating Expenses” and “Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement” include 0.01% in acquired fund fees and expenses and, therefore, do not correlate to Ratio of expenses to average net assets – Before fees waived or reimbursed by the Adviser/After fees waived or reimbursed by the Adviser in the Financial Highlights, which do not include acquired fund fees and expenses.

(2) Pursuant to a contractual fee waiver and reimbursement agreement, Regan Capital, LLC (the “Adviser”) has agreed to waive fees and/or reimburse operating expenses (other than shareholder servicing fees, front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses, Rule 12b-1 fees, or intermediary servicing fees) for each class so that annual operating expenses will not exceed 1.20% (“Expense Cap”). The Expense Cap will remain in effect through at least January 31, 2024 and may be terminated only by the Trust for Advised Portfolios (the “Trust”) Board of Trustees’ (the “Board”). The Adviser may request recoupment from the Fund of previously waived fees and paid expenses for three years from the date such fees and expenses were waived or paid, provided that such recoupment does not cause the Fund’s expense

1

ratio (after the recoupment is taken into account) to exceed the lower of (1) the Expense Cap in place at the time such amounts were waived or paid and (2) the Fund’s Expense Cap at the time of recoupment.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The amounts calculated in the Example would be the same even if the assumed investment was not redeemed at the end of each period. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the Expense Cap only for the first year of each period). Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Investor Class | $158 | $517 | $900 | $1,976 | ||||||||||

| Institutional Class | $133 | $436 | $762 | $1,682 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 62.88% of the average value of its portfolio.

Principal Investment Strategies of the Fund

Under normal circumstances, the Fund aims to invest at least 80% of its net assets in mortgage-backed securities (“MBS”). MBS includes residential MBS (“RMBS”), which are securities issued, secured, or collateralized by government sponsored entities (“agency MBS”) or private entities (“non-agency MBS”) and backed by residential mortgages. In seeking to meet its objective, the Fund will primarily invest in RMBS that is non-agency MBS. Non-agency MBS are issued by non-governmental issuers such as commercial banks, savings and loan institutions, mortgage bankers, and private mortgage insurance companies. Some of the agency MBS that the Fund may hold are not guaranteed or backed by the full faith and credit of the U.S. Government, such as those issued by Fannie Mae and Freddie Mac. The Fund seeks to invest its assets in investment grade securities, but may invest without limit in fixed-income products that are rated below investment grade (i.e., “high yield” or “junk” ratings).

The weighted average life of the Fund’s MBS investments will generally range from between 0 and 10 years. Weighted average life is a measure of the average amount of time that unpaid principal on a loan, mortgage, or bond remains outstanding. Typically, the duration of the Fund’s portfolio is less than 5 years. Duration is a measure of the sensitivity of a fixed-income security to a change in interest rate. For every 1% change in interest rates, a bond’s price will change by 1% for every year of duration.

The Fund may invest in other fixed-income securities, including commercial MBS (“CMBS”), asset-backed securities (including securities backed by consumer credit, auto loans, and aircraft leases), senior tranche collateralized loan obligations (“CLOs”), and securities of other fixed-income investment companies (including closed-end funds (“CEFs”) and exchange traded funds (“ETFs”)).

To the extent the Fund holds positions that are sensitive to interest rate volatility, the Fund may engage in hedging techniques to manage its exposure to interest rate risk such as by investing in exchange-traded and over-the-counter derivatives, including futures, options and swaps, such as interest rate swaps, credit default swaps, total return swaps, and swaptions, and to-be-announced (“TBA”) securities. The Fund may engage in leverage through the use of repurchase agreements or borrowing (subject to the limits of the Investment Company Act of 1940).

In selecting portfolio securities, the Adviser undertakes a bottom-up analysis on collateral characteristics and capital structure to find both deep value investments and trading opportunities. The Adviser’s bottom-up analysis focuses on individual security selection. In seeking deep value investments, the Adviser seeks securities whose

2

market price is significantly lower than the Adviser’s estimate of the security’s true value. The Adviser will overlay this analysis with a top-down macro qualitative analysis, which contains but is not limited to key factors, such as economic outlook, interest rates and real estate fundamentals. The Adviser regularly analyzes portfolio positions and actively sells investments that it believes are not optimal for the portfolio. The Adviser seeks to achieve a risk-adjusted return by continuously evaluating Fund assets against current risk-free rates of return of available bonds in the market, typically treasuries and other government-backed securities. A risk-adjusted return measures an investment’s profit after taking into account the degree of risk that was taken to achieve it. For example, if two or more investments have the same return over a given time period, the one that has the lowest risk will have a better risk-adjusted return. The risk is measured in comparison to that of a virtually risk-free investment such as Treasuries. Due to this method of determining which portfolio positions to buy and sell and the Adviser’s active trading, portfolio turnover will generally be 100% or greater.

Principal Risks of Investing in the Fund

Losing all or a portion of your investment is a risk of investing in the Fund. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Each risk summarized below is considered a principal risk of investing in the Fund, regardless of the order in which it appears, and could affect the value of your investment:

Mortgage-Backed Securities Risk. When interest rates increase, the market values of mortgage-backed securities decline. At the same time, however, mortgage refinancings and prepayments slow, which lengthens the effective duration of these securities. As a result, the negative effect of the interest rate increase on the market value of mortgage-backed securities is usually more pronounced than it is for other types of fixed income securities, potentially increasing the volatility of the Fund. Conversely, when market interest rates decline, while the value of mortgage-backed securities may increase, the rate of prepayment of the underlying mortgages also tends to increase, which shortens the effective duration of these securities. Mortgage-backed securities are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgage may decline in value and be insufficient, upon foreclosure, to repay the associated loan. Additionally, the liquidity of non-investment grade securities and sub-prime mortgage securities can change dramatically over time.

Credit Risk. There is a risk that the issuer of a mortgage-backed security will fail to pay interest or principal in a timely manner or that changes in the market’s perceptions of the issuer’s financial strength and ability to make such payments will cause the price of that security to decline.

Interest Rate Risk. Interest rates increasing may result in a decrease in the value of debt securities held by the Fund. Conversely, as interest rates decrease, mortgage-backed securities’ prices typically do not rise as much as the prices of comparable bonds. Recent market events stemming from the COVID-19 pandemic have impacted interest rates. Interest rates have fallen to historic lows during the COVID-19 pandemic and the Federal Reserve Bank and stimulus actions by the United States Congress have also caused interest rates to fall. An environment with falling interest rates may lead to a rise in the price of MBS or the increase in defaults on mortgages; falling interest rates can increase refinance activity which will increase the prepayment risk.

Prepayment Risk. When interest rates fall, certain obligations may be paid off by the obligor earlier than expected by refinancing their mortgages, resulting in prepayment of the mortgage-backed securities held by the Fund. The Fund would then lose any price appreciation above the mortgage’s principal and would have to reinvest the proceeds at lower yields, resulting in a decline in the Fund’s income.

Extension Risk. When interest rates rise, homeowners may pay their debt at slower rates, resulting in lengthening the average life of mortgage-backed securities held by the Fund. This would delay the Fund’s ability to reinvest proceeds at higher interest rates.

Real Estate and Regulatory Actions Risk. Mortgage backed securities are dependent on real estate prices and real estate fundamentals. When real estate prices face a significant decline, the Fund’s securities may be negatively affected. Regulatory actions may also have an adverse impact on real estate prices.

Derivatives Risk. Using derivatives can increase the Fund’s losses and reduce opportunities for gains when market prices, interest rates, currencies, or the derivatives themselves, behave in a way not anticipated by the

3

Fund. Using derivatives also can have a leveraging effect and increase Fund volatility. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Derivatives may be difficult to sell, unwind or value, and the counterparty may default on its obligations to the Fund. Derivatives are generally subject to the risks applicable to the assets, rates, indices or other indicators underlying the derivative. The value of a derivative may fluctuate more than the underlying assets, rates, indices or other indicators to which it relates. Use of derivatives may have different tax consequences for the Fund than an investment in the underlying security, and those differences may affect the amount, timing and character of income distributed to shareholders.

Futures Contract Risk. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so.

Options Risk. Purchasing and writing options, both put and call, are specialized activities that entail greater than normal investment risks. The Fund may not benefit to the same extent as directly holding the underlying asset. The Fund may also lose money on an option if changes in its value do not correspond to the changes in value of the underlying security. If the Fund is not able to close out an option position in its portfolio, it may have to exercise the option to realize any gain and may incur transaction costs upon the purchase or sale of such underlying securities. Some options involve the payment of premiums which may affect Fund performance. If the Fund invests in over-the-counter options, the Fund may be exposed to counterparty risk.

Swaps Risk. Swaps involve the risk that the party with whom the Fund has entered into the swap transaction with defaults on its obligation to pay or that the Fund cannot meet its obligation to the pay the other party. Swap agreements may increase or decrease the overall volatility of the Fund’s investments and share price. To the extent the swap agreement increases the Fund’s exposure to long or short term interest rates, it may also affect the values of mortgage backed securities, and inflation sensitivity, and borrowing rates.

To Be Announced (“TBA”) Security Risk. A TBA is a contract to purchase or sell a MBS at some point in the future and may be classified as a derivative in certain circumstances. Due to the forward-settling nature of TBAs, there is risk that the value of the underlying MBS will fluctuate greater than anticipated or that the TBA may not correlate to the underlying MBS or to the MBS market as a whole. There is also counterparty risk with entering into a TBA contract.

High-Yield Securities Risk. Fixed income securities that are rated below investment grade (i.e., “junk bonds”) are subject to additional risk factors due to the speculative nature of these securities, such as increased possibility of default liquidation of the security, and changes in value based on public perception of the issuer.

Sub-Prime Mortgage Risk. Sub-prime mortgages face the risk that the issuer of the security will default on interest or principal payments. The risk of non-payment is more pronounced in sub-prime mortgages than in highly ranked securities. Because there is increased risk of non-payment, the securities may be less liquid and subject to greater declines in value than highly rated instruments, especially in times of market stress.

Counterparty Risk. Typically, a derivative contract involves leverage, i.e., it provides exposure to potential gain or loss from a change in the level of the market price of a security, currency or commodity (or a basket or index) in a notional amount that exceeds the amount of cash or assets required to establish or maintain the derivative contract. Many of these derivative contracts, including options and swaps, will be privately negotiated in the over-the-counter market. Fund transactions involving a counterparty are subject to the risk that the counterparty or a third party will not fulfill its obligation to the Fund. Counterparty risk may arise because of the counterparty’s financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or

4

other reasons, whether foreseen or not. A counterparty’s inability to fulfill its obligation may result in significant financial loss to the Fund.

Asset-Backed Securities Risk (“ABS”). ABS represent participations in, or are secured by and payable from, assets such as installment sales or loan contracts, leases, credit card receivables and other categories of receivables. Certain debt instruments may only pay principal at maturity or may only represent the right to receive payments of principal or payments of interest on underlying pools of mortgages, assets or government securities, but not both. The value of these types of instruments may change more drastically than debt securities that pay both principal and interest. The Fund may obtain a below market yield or incur a loss on such instruments during periods of declining interest rates. Principal only and interest only instruments are subject to extension risk. Certain ABS may provide, upon the occurrence of certain triggering events or defaults, for the investors to become the holders of the underlying assets. In that case, the Fund may become the holder of securities that it could not otherwise purchase, based on its investment strategies or its investment restrictions and limitations, at a time when such securities may be difficult to dispose of because of adverse market conditions.

Portfolio Turnover Risk. As a result of its active trading strategy, the Fund may incur higher levels of brokerage fees and commissions, and cause higher levels of current tax liability to shareholders in the Fund.

Principal Risks of Investing in the Fund

Losing all or a portion of your investment is a risk of investing in the Fund. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Each risk summarized below is considered a principal risk of investing in the Fund, regardless of the order in which it appears, and could affect the value of your investment:

Mortgage-Backed Securities Risk. When interest rates increase, the market values of mortgage-backed securities decline. At the same time, however, mortgage refinancings and prepayments slow, which lengthens the effective duration of these securities. As a result, the negative effect of the interest rate increase on the market value of mortgage-backed securities is usually more pronounced than it is for other types of fixed income securities, potentially increasing the volatility of the Fund. Conversely, when market interest rates decline, while the value of mortgage-backed securities may increase, the rate of prepayment of the underlying mortgages also tends to increase, which shortens the effective duration of these securities. Mortgage-backed securities are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgage may decline in value and be insufficient, upon foreclosure, to repay the associated loan. Additionally, the liquidity of non-investment grade securities and sub-prime mortgage securities can change dramatically over time.

Credit Risk. There is a risk that the issuer of a mortgage-backed security will fail to pay interest or principal in a timely manner or that changes in the market’s perceptions of the issuer’s financial strength and ability to make such payments will cause the price of that security to decline.

Interest Rate Risk. Interest rates increasing may result in a decrease in the value of debt securities held by the Fund. Conversely, as interest rates decrease, mortgage-backed securities’ prices typically do not rise as much as the prices of comparable bonds. Recent market events stemming from the COVID-19 pandemic have impacted interest rates. Interest rates have fallen to historic lows during the COVID-19 pandemic and the Federal Reserve Bank and stimulus actions by the United States Congress have also caused interest rates to fall. An environment with falling interest rates may lead to a rise in the price of MBS or the increase in defaults on mortgages; falling interest rates can increase refinance activity which will increase the prepayment risk.

Prepayment Risk. When interest rates fall, certain obligations may be paid off by the obligor earlier than expected by refinancing their mortgages, resulting in prepayment of the mortgage-backed securities held by the Fund. The Fund would then lose any price appreciation above the mortgage’s principal and would have to reinvest the proceeds at lower yields, resulting in a decline in the Fund’s income.

Extension Risk. When interest rates rise, homeowners may pay their debt at slower rates, resulting in lengthening the average life of mortgage-backed securities held by the Fund. This would delay the Fund’s ability to reinvest proceeds at higher interest rates.

5

Real Estate and Regulatory Actions Risk. Mortgage backed securities are dependent on real estate prices and real estate fundamentals. When real estate prices face a significant decline, the Fund’s securities may be negatively affected. Regulatory actions may also have an adverse impact on real estate prices.

Derivatives Risk. Using derivatives can increase the Fund’s losses and reduce opportunities for gains when market prices, interest rates, currencies, or the derivatives themselves, behave in a way not anticipated by the Fund. Using derivatives also can have a leveraging effect and increase Fund volatility. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Derivatives may be difficult to sell, unwind or value, and the counterparty may default on its obligations to the Fund. Derivatives are generally subject to the risks applicable to the assets, rates, indices or other indicators underlying the derivative. The value of a derivative may fluctuate more than the underlying assets, rates, indices or other indicators to which it relates. Use of derivatives may have different tax consequences for the Fund than an investment in the underlying security, and those differences may affect the amount, timing and character of income distributed to shareholders.

Futures Contract Risk. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so.

Options Risk. Purchasing and writing options, both put and call, are specialized activities that entail greater than normal investment risks. The Fund may not benefit to the same extent as directly holding the underlying asset. The Fund may also lose money on an option if changes in its value do not correspond to the changes in value of the underlying security. If the Fund is not able to close out an option position in its portfolio, it may have to exercise the option to realize any gain and may incur transaction costs upon the purchase or sale of such underlying securities. Some options involve the payment of premiums which may affect Fund performance. If the Fund invests in over-the-counter options, the Fund may be exposed to counterparty risk.

Swaps Risk. Swaps involve the risk that the party with whom the Fund has entered into the swap transaction with defaults on its obligation to pay or that the Fund cannot meet its obligation to the pay the other party. Swap agreements may increase or decrease the overall volatility of the Fund’s investments and share price. To the extent the swap agreement increases the Fund’s exposure to long or short term interest rates, it may also affect the values of mortgage backed securities, and inflation sensitivity, and borrowing rates.

To Be Announced (“TBA”) Security Risk. A TBA is a contract to purchase or sell a MBS at some point in the future and may be classified as a derivative in certain circumstances. Due to the forward-settling nature of TBAs, there is risk that the value of the underlying MBS will fluctuate greater than anticipated or that the TBA may not correlate to the underlying MBS or to the MBS market as a whole. There is also counterparty risk with entering into a TBA contract.

High-Yield Securities Risk. Fixed income securities that are rated below investment grade (i.e., “junk bonds”) are subject to additional risk factors due to the speculative nature of these securities, such as increased possibility of default liquidation of the security, and changes in value based on public perception of the issuer.

Sub-Prime Mortgage Risk. Sub-prime mortgages face the risk that the issuer of the security will default on interest or principal payments. The risk of non-payment is more pronounced in sub-prime mortgages than in highly ranked securities. Because there is increased risk of non-payment, the securities may be less liquid and subject to greater declines in value than highly rated instruments, especially in times of market stress.

6

Counterparty Risk. Typically, a derivative contract involves leverage, i.e., it provides exposure to potential gain or loss from a change in the level of the market price of a security, currency or commodity (or a basket or index) in a notional amount that exceeds the amount of cash or assets required to establish or maintain the derivative contract. Many of these derivative contracts, including options and swaps, will be privately negotiated in the over-the-counter market. Fund transactions involving a counterparty are subject to the risk that the counterparty or a third party will not fulfill its obligation to the Fund. Counterparty risk may arise because of the counterparty’s financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or other reasons, whether foreseen or not. A counterparty’s inability to fulfill its obligation may result in significant financial loss to the Fund.

Asset-Backed Securities Risk (“ABS”). ABS represent participations in, or are secured by and payable from, assets such as installment sales or loan contracts, leases, credit card receivables and other categories of receivables. Certain debt instruments may only pay principal at maturity or may only represent the right to receive payments of principal or payments of interest on underlying pools of mortgages, assets or government securities, but not both. The value of these types of instruments may change more drastically than debt securities that pay both principal and interest. The Fund may obtain a below market yield or incur a loss on such instruments during periods of declining interest rates. Principal only and interest only instruments are subject to extension risk. Certain ABS may provide, upon the occurrence of certain triggering events or defaults, for the investors to become the holders of the underlying assets. In that case, the Fund may become the holder of securities that it could not otherwise purchase, based on its investment strategies or its investment restrictions and limitations, at a time when such securities may be difficult to dispose of because of adverse market conditions.

Portfolio Turnover Risk. As a result of its active trading strategy, the Fund may incur higher levels of brokerage fees and commissions, and cause higher levels of current tax liability to shareholders in the Fund.

Performance

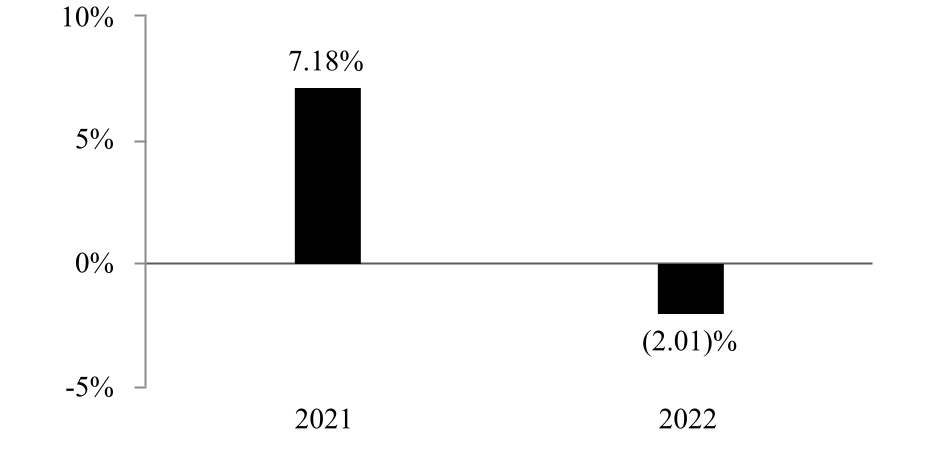

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance for the calendar year ended December 31, 2022 for Institutional Class shares. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is posted on the Fund’s website at www.reganfunds.com or by calling the Fund toll-free at 888-44-REGAN (888-447-3426).

Calendar Year Ended December 31,

During the period of time shown in the bar chart, the Fund’s highest quarterly return was 2.58% for the quarter ended March 31, 2021 and the lowest quarterly return was -1.78% for the quarter ended June 30, 2022.

7

Average Annual Total Returns

For the Periods Ended December 31, 2022

1 Year | Since Inception October 1, 2020 | ||||||||||

| Institutional Class | |||||||||||

| Return Before Taxes | -2.01% | 5.98% | |||||||||

| Return After Taxes on Distributions | -4.14% | 2.94% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | -1.19% | 3.33% | |||||||||

| Investor Class | |||||||||||

| Return Before Taxes | -2.22% | 5.72% | |||||||||

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | -13.01% | -6.39% | |||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Management

Investment Adviser: Regan Capital, LLC serves as the Fund’s investment adviser.

Portfolio Managers: Skyler Weinand, CFA and Chris Hall serve as the portfolio managers jointly and are primarily responsible for the day-to-day management of the Fund and have acted in this capacity since the Fund’s inception in October 2020.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any business day by written request via mail to Regan Total Return Income Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701, by telephone at 888-44-REGAN (888-447-3426), by wire transfer, or through a financial intermediary. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly. The minimum initial and subsequent investment amounts are shown below. The minimum initial and subsequent investment may be modified for certain financial firms that submit orders on behalf of their customers.

Tax Information

| Investor Class | Institutional Class | |||||||

| Minimum Initial Investment | $1,000 | $100,000 | ||||||

| Minimum Subsequent Investment | $100 | $500 | ||||||

The Fund’s distributions are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you invest though a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account (“IRA”). Distributions on investments made through tax-advantaged arrangements may be taxed later upon withdrawal of assets from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary, the Fund or the Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Oragenics, Inc. Announces Notification of Noncompliance with Additional NYSE American Continued Listing Standards

- Four ONDA Partners Earn Placement on D Magazine’s Best Lawyers List

- FluroTech and GS Heli Announce Execution of Definitive Agreement

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share