Form 497K Trust for Advised Portfo

| Ziegler Senior Floating Rate Fund Class A: ZFLAX Class C: ZFLCX Institutional Class: ZFLIX Summary Prospectus January 31, 2023 www.zcmfunds.com | ||||

Before you invest, you may want to review the Ziegler Senior Floating Rate Fund’s (the “Fund”) statutory prospectus and statement of additional information, which contain more information about the Fund and its risks. The current statutory prospectus and statement of additional information dated January 31, 2023, are incorporated by reference into this Summary Prospectus. You can find the Fund’s statutory prospectus, statement of additional information, reports to shareholders and other information about the Fund online at www.zieglercapfunds.com. You can also get this information at no cost by calling 833-777-1533 or by sending an e-mail request to letters@zieglercap.com.

Investment Objective

The Fund seeks total return, comprised of current income and capital appreciation.

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and the Example below. You may qualify for sales charge discounts if you or your family invest, or agree to invest in the future, at least $100,000 in the Fund. You may qualify for a sales charge waiver if you or your family invest, or agree to invest in the future, at least $1,000,000 in the Fund. More information about these and other discounts is available from your financial intermediary, in the Fund’s Prospectus on page 20 under the heading “Qualifying for a Reduced Class A Sales Charge” and in the Fund’s statement of additional information (the “SAI”) on page 27 under the heading “Sales Charge Waivers and Reductions.”

SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||

| Class A | Class C | Institutional Class | ||||||||||||||||||

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.25% | None | None | |||||||||||||||||

Maximum Deferred Sales Charge (Load) (as a percentage of original cost of shares or current market value, whichever is less) | 1.00% | 1 | 1.00% | 2 | None | |||||||||||||||

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and Distributions | None | None | None | |||||||||||||||||

Redemption Fee (as a percentage of amount redeemed on shares held for 60 days or less) | 1.00% | None | None | |||||||||||||||||

Exchange Fee | None | None | None | |||||||||||||||||

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||

| Class A | Class C | Institutional Class | ||||||||||||||||||

| Management Fees | 0.65% | 0.65% | 0.65% | |||||||||||||||||

| Distribution and Service (Rule 12b-1) Fees | 0.25% | 1.00% | None | |||||||||||||||||

| Other Expenses | 0.60% | 0.60% | 0.61% | |||||||||||||||||

Acquired Fund Fees and Expenses 3 | 0.02% | 0.02% | 0.02% | |||||||||||||||||

| Total Annual Fund Operating Expenses | 1.52% | 2.27% | 1.28% | |||||||||||||||||

Less: Fee Waiver and/or Expense Reimbursement 4 | -0.51% | -0.51% | -0.52% | |||||||||||||||||

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.01% | 1.76% | 0.76% | |||||||||||||||||

1.Although there is no front-end sales charge on purchases of $1 million or more, there is a maximum deferred sales charge of 1.00% if you redeem within 18 months of such a purchase. This charge is waived for certain investors.

2.There is a maximum deferred sales charge of 1.00% if you redeem within 1 year of purchase. This charge is waived for certain investors.

3.Total Annual Fund Operating Expenses do not correlate to the “Ratio of expenses to average net assets” either “Before fees waived / reimbursed by the Adviser” or “After fees waived / reimbursed by the Adviser” provided in the Financial Highlights because the Financial Highlights reflect the operating expenses of the Fund and do not include 0.02% that is attributed to acquired fund fees and expenses.

4.Pursuant to a contractual fee waiver and reimbursement agreement, Ziegler Capital Management, LLC (the “Adviser”) has contractually agreed to waive a portion or all of its management fees and pay Fund expenses (excluding acquired fund fees and expenses, taxes, interest expense, dividends on securities sold short, and extraordinary expenses) in order to limit the total annual fund operating expenses to 0.99%, 1.74%, and 0.74% of average daily net assets of the Fund’s Class A, Class C, and Institutional Class shares, respectively (the “Expense Caps”). The Expense Caps will remain in effect through at least January 31, 2024 and may be terminated only by the Trust for Advised Portfolios (the “Trust”) Board of Trustees (the “Board”). The Adviser may request recoupment of previously waived fees and paid expenses from the Fund for three years from the date they were waived or paid, subject to, if different, the Expense Cap at the time of waiver/payment or the Expense Cap at the time of recoupment, whichever is lower.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then either hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the Expense Caps for the first year). Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

Class A (with or without redemption at end of period; incorporates front-end sales charge) | $524 | $837 | $1,172 | $2,119 | ||||||||||

Class C (with redemption at end of period) | $279 | $660 | $1,169 | $2,566 | ||||||||||

Class C (without redemption at end of period) | $179 | $660 | $1,169 | $2,566 | ||||||||||

Institutional Class (with or without redemption at end of period) | $76 | $348 | $642 | $1,477 | ||||||||||

2

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 26% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in senior secured floating rate loans, other senior secured floating rate debt instruments, and in other instruments that have economic characteristics similar to such instruments.

A senior secured loan is considered “senior” because, in the event of the borrower’s bankruptcy, the holder of the instrument is paid before other parties. A senior secured loan is “secured” because the loan is collateralized with assets that can be sold to repay the holder if necessary. Even though senior debt holders are in line to be repaid first in the event of bankruptcy, they will not necessarily receive the full amount they are owed. “Floating rate” instruments reset their interest rate periodically over a base rate, with rates tied to a representative interest rate index, typically 30-day, 90-day, or 180-day Secured Overnight Financing Rate (“SOFR”). The Secured Overnight Financing Rate has been designated the replacement benchmark rate for U.S. dollar denominated securities the Fund may own. The transition of outstanding London Inter-bank Offered Rate based instruments to the SOFR is currently expected to conclude between by June 2023.

The Fund’s strategy has a duration of approximately 90 days and, as a result, a one percent increase in interest rates would likely have a minimal direct effect on the prices of the Fund’s holdings. Duration measures a bond’s or portfolio’s sensitivity to interest rate changes and is expressed as a measure of time. The longer the duration is, the greater the risk. For example, if a portfolio has a duration of 5 years, a 1% increase in interest rates could be expected to result in a 5% decrease in the value of the portfolio. Shorter duration results in lower expected volatility.

Floating rate loans are generally purchased from banks or other financial institutions through assignments or participations. A direct interest in a floating rate loan may be acquired directly from the lending agent or another lender by assignment or an indirect interest may be acquired as a participation in another lender’s portion of a floating rate loan. An assignment is a transfer of debt, and all the rights and obligations associated with it, from a creditor to a third-party, in order to improve the creditor’s liquidity and/or to reduce its risk exposure. A participation permits investors to buy portions of an outstanding loan or package of loans, and holders to participate, on a pro rata basis, in collecting interest and principal payments.

The Fund may, but does not currently, use leverage, which is the use of borrowed capital for investment purposes with the expectation that the profits made will be greater than the interest payable, in an effort to maximize its return through borrowing, generally from banks. The Fund may borrow in an amount of up to 33.33% of the Fund’s total assets after such borrowing.

The Fund may invest up to 100% of its net assets in floating rate loans and floating rate debt securities that are determined to be below investment grade (sometimes referred to as “high yield” or “junk”). Investment grade securities are: (1) securities rated BBB- or higher by Standard & Poor’s Ratings Services (“S&P”) or Baa3 or higher by Moody’s Investors Service, Inc. (“Moody’s”) or an equivalent rating by another nationally recognized statistical rating organization (“NRSRO”), (2) securities with comparable short-term NRSRO ratings, or (3) unrated securities determined by Pretium Credit Management, LLC (the “Sub-Adviser” or “Pretium”) to be of comparable quality at the time of purchase.

The Fund invests in loans and debt securities as determined by the Sub-Adviser. The Sub-Adviser performs its own independent credit analysis on each borrower and on the collateral securing each loan. The Sub-Adviser considers the nature of the industry in which the borrower operates, the nature of the borrower’s assets and the general quality and creditworthiness of the borrower.

3

The Fund may invest in floating rate loans and/or floating rate debt securities of non-U.S. borrowers or issuers; in those situations, the Fund will only invest in such loans or securities that are U.S. dollar denominated or otherwise provide for payment in U.S. dollars. The Fund may invest in defaulted or distressed loans and loans to bankrupt companies. Some of the floating rate loans and debt securities in which the Fund may invest will be considered to be illiquid, although the Fund may invest no more than 15% of its net assets in illiquid investments.

The Fund may also invest up to 15% of its net assets in collateralized loan obligations (“CLOs”), which are securitized debt instruments backed solely by a pool of floating rate loans and other debt securities. The Fund will maintain a cash balance and has established a line of credit to meet shareholder redemptions and short-term liquidity needs.

Principal Investment Risks

Investors in the Fund may lose money. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. There are risks associated with the types of securities in which the Fund invests. These risks include:

Bank Loans and Senior Loans Risk. Bank loans and senior loans are subject to credit risk, interest rate risk and liquidity risk. In addition, bank loans and senior loans are subject to the risk that the value of the collateral, if any, securing a loan may decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. In the event of a default, the Fund may have difficulty collecting on any collateral and would not have the ability to collect on any collateral for an uncollateralized loan.

Borrowing and Leverage Risk. Borrowing money to buy securities exposes the Fund to leverage because the Fund can achieve a return on a capital base larger than the assets that shareholders have contributed to the Fund. Borrowing may cause the Fund to be more volatile because it may exaggerate the effect of any increase or decrease in the value of the Fund’s portfolio securities. Borrowing may also cause the Fund to liquidate positions when it may not be advantageous to do so. In addition, borrowing will cause the Fund to incur interest expenses and other fees.

CLO Risk. CLOs are typically collateralized by a pool of loans, which may include, among others, domestic and foreign senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. The cash flows from CLOs are split into two or more portions, called tranches, varying in risk and yield. CLO tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of protecting tranches as well as market anticipation of defaults

Counterparty Risk. Counterparty risk arises upon entering into borrowing arrangements and over-the counter contracts such as swaps and is the risk from the potential inability of counterparties to meet the terms of their contracts.

Credit Risk. The issuer of instruments in which the Fund invests may be unable to meet interest and/or principal payments. An issuer’s securities may decrease in value if its financial strength weakens which may reduce its credit rating and possibly its ability to meet its contractual obligations.

Defaulted Debt Securities Risk. Investing in defaulted debt securities is speculative and involves substantial risks. Defaulted debt securities generally do not generate interest payments. Principal on defaulted debt might not be repaid, and the Fund could lose up to its entire investment. Certain of the issuers of securities may be involved in bankruptcy or other reorganization proceedings. Although such investments may result in significant returns to the Fund, they involve a substantial degree of risk. Many of the events within a bankruptcy case are adversarial and often beyond the control of the creditors. Accordingly, a bankruptcy court may approve actions that are contrary to the interests of the Fund. Such investments can result in a total loss of principal.

Floating Rate Securities Risk. The interest rates payable on floating rate securities are not fixed and may fluctuate based upon changes in market rates. The interest rate on a floating rate security is a variable rate which is tied to another interest rate, such as the SOFR. Floating rate securities are subject to interest rate risk and credit risk.

4

Foreign Securities Risk. Foreign securities and dollar denominated securities of foreign issuers involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments. Foreign securities also involve risks such as currency fluctuations and delays in enforcement of rights.

High Yield Securities Risk. High yield debt obligations (or junk bonds) are speculative investments that are usually issued by highly indebted companies, which means there is an increased risk that these companies might not generate sufficient cash flow to pay their debts. Consequently, high yield securities and loans entail greater risk of loss of principal than securities and loans that are rated investment grade.

Illiquid Investment Risk. Illiquid assets held by the Fund may be difficult to sell particularly during times of market turmoil. Illiquid assets may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a price that is less than the price at which it is valued and/or at a loss relative to its cost.

Inflation Risk. Inflation risk results from the variation in the value of cash flows from a security due to inflation, as measured in terms of purchasing power.

Interest Rate Risk. Interest rate changes may affect the value of a debt instrument indirectly (especially in the case of fixed rate securities) and directly (especially in the case of instruments whose rates are adjustable). An increase in interest rates may result in a decrease in the value of debt securities held by the Fund. Fixed income securities with longer duration generally have greater sensitivity to changes in interest rates than fixed income securities with shorter duration.

Investment Risk. When you sell your shares of the Fund, they could be worth less than what you paid for them. Therefore, you may lose money by investing in the Fund.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer's goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets.

Loan Interests Risk. The Fund may be unable to sell its loan interests at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are less than what the Fund regards as their fair market value. Accordingly, loan interests may at times be illiquid. Loan interests may be difficult to value and may have extended settlement periods (i.e., more than seven days after the sale). As a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet a Fund’s redemption obligations until potentially a substantial period after the sale of the loans. The Fund, therefore, may be forced to sell other assets at a loss to pay redemption proceeds. To assist with cash management and liquidity, the Fund will maintain a cash balance and has established a line of credit facility.

Interests in loans made to finance highly leveraged companies or transactions, such as corporate acquisitions, may be especially vulnerable to adverse changes in economic or market conditions. Interests in secured loans have the benefit of collateral and, typically, of restrictive covenants limiting the ability of the borrower to further encumber its assets. There is a risk that the value of any collateral securing a loan in which the Fund has an interest may decline and that the collateral may not be sufficient to cover the amount owed on the loan. In the event the borrower defaults, the Fund’s access to the collateral may be limited or delayed by bankruptcy or other insolvency laws. Further, in the event of a default, second lien secured loans will generally be paid only if the value of the collateral exceeds the amount of the borrower’s obligations to the first lien secured lenders, and the remaining collateral may not be sufficient to cover the full amount owed on the loan in which the Fund has an interest. The Fund may acquire a participation interest in a loan that is held by another party. When the Fund’s loan interest is a participation, the Fund may have less control over the exercise of remedies than the party selling the participation interest, and it normally would not have any direct rights against the borrower.

In addition, loans may not be considered securities and, therefore, the Fund may not have the protections of the federal securities laws with respect to its holdings in such loans.

Manager Risk. The Fund is an actively managed portfolio. The Sub-Adviser’s practices and investment strategies may not work to produce the desired results.

5

Market Risk. Overall securities market risks will affect the value of individual instruments in which the Fund invests. Factors such as economic growth and market conditions, interest rate levels, and political events affect the U.S. securities markets. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money.

In the past several years, financial markets, such as those in the United States, Europe, Asia and elsewhere, have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. Governmental and non-governmental issuers have defaulted on, or been forced to restructure, their debts. These conditions may continue, recur, worsen or spread.

Economies and financial markets throughout the world are becoming increasingly interconnected. As a result, whether or not the Fund invests in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, the value and liquidity of the Fund’s investments may be negatively affected.

Periods of market volatility may occur in response to pandemics, acts of war, or events affecting global markets. These types of events could adversely affect the Fund’s performance. For example, since December 2019, a novel strain of coronavirus (COVID-19) has spread globally, which has resulted in the temporary closure of many corporate offices, retail stores, manufacturing facilities and factories, and other businesses across the world.

In addition, Russia’s military invasion of Ukraine in February 2022, the resulting responses by the United States and other countries, and the potential for wider conflict could increase volatility and uncertainty in the financial markets and adversely affect regional and global economies.

Regulatory Risk. Changes in government regulations may adversely affect the value of a security.

Unrated Securities Risk. Because the Fund may purchase securities that are not rated by any rating organization, the Sub-Adviser may internally assign ratings to certain of those securities, after assessing their credit quality, in categories of those similar to those of rating organizations. Some unrated securities may not have an active trading market or may be difficult to value, which means the Fund might have difficulty selling them promptly at an acceptable price.

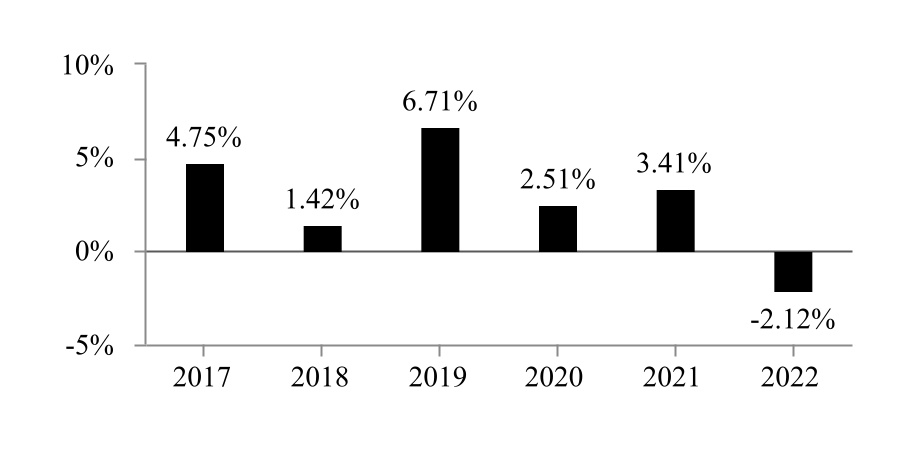

Performance

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s Institutional Class performance from year to year. The table illustrates how the Fund’s average annual returns for the period indicated compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is posted on the Fund’s website www.zieglercapfunds.com or by calling the Fund toll-free at 833-777-1533.

Calendar year ended December 31,

6

During the period of time shown in the bar chart, the Fund’s highest quarterly return was 8.60% for the quarter ended June 30, 2020, and the lowest quarterly return was -11.32% for the quarter ended March 31, 2020.

Average Annual Total Returns

For the Periods Ended December 31, 2022

| Institutional Class | 1 Year | 5 Years | Since Inception April 1, 2016 | ||||||||||||||

| Return Before Taxes | -2.12% | 2.35% | 3.33% | ||||||||||||||

| Return After Taxes on Distributions | -4.20% | 0.40% | 1.41% | ||||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | -1.26% | 0.97% | 1.73% | ||||||||||||||

| Class A | |||||||||||||||||

| Return Before Taxes | -6.50% | 1.27% | 2.46% | ||||||||||||||

| Class C | |||||||||||||||||

| Return Before Taxes | -4.05% | 1.32% | 2.30% | ||||||||||||||

Credit Suisse Leveraged Loan Index (reflects no deduction for fees, expenses, or taxes) | -1.06% | 3.23% | 4.26% | ||||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown only for Institutional; after-tax returns for Class A and Class C will vary to the extent they have different expenses.

In certain cases, the figure representing “Return after Taxes on Distributions and Sale of Fund Shares” may be higher than other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

Management

Investment Adviser. Ziegler Capital Management, LLC

Investment Sub-Adviser. Pretium Credit Management, LLC

Portfolio Managers. Roberta Goss with the Sub-Adviser has been the Fund’s portfolio manager since September 2019. Christina O’Hearn with the Sub-Adviser has been the Fund’s portfolio manager since January 2023. Eduardo Cortes with the Adviser has been the Fund’s portfolio manager since January 2023. Each portfolio manager is jointly and primarily responsible for the day-to-day management of the Fund’s portfolio.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any business day by written request via mail to Ziegler Senior Floating Rate Fund c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701, by telephone at 833-777-1533, by wire transfer, or through a financial intermediary. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly. The minimum initial and subsequent investment amounts are shown below. The minimum initial and subsequent investment for Institutional Shares may be modified for certain types of investors.

| Class A | Class C | Institutional Class | |||||||||

Regular Accounts | |||||||||||

Minimum Initial Investment | $1,000 | $1,000 | $1,000,000 | ||||||||

Minimum Subsequent Investment | $100 | $100 | No Minimum | ||||||||

Individual Retirement Accounts | |||||||||||

Minimum Initial Investment | $250 | $250 | $1,000,000 | ||||||||

Minimum Subsequent Investment | $100 | $100 | No Minimum | ||||||||

7

Tax Information

The Fund’s distributions are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you invest though a tax-advantaged arrangement, such as a 401(k) plan or an IRA. Distributions on investments made through tax-advantaged arrangements may be taxed later upon withdrawal of assets from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary, the Fund and/or the Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Highwire PR Announces Appointment of Two Independent Board Members

- Elastos Releases Inaugural BIT Index to Track Awareness, Knowledge and Use of Bitcoin around the Globe

- Shortwave Infrared (SWIR) Market Size to Touch USD 393.58 million, Rising at a CAGR of 9.1% by 2031: SNS Insider

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share