Form 497K SEASONS SERIES TRUST

July 29, 2021 1:23 PM EDT

Summary Prospectus

July 29, 2021

Seasons Series Trust

SA Putnam Asset Allocation Diversified Growth Portfolio

(Class 1, Class 2 and Class 3 Shares)

Seasons Series Trust’s Statutory

Prospectus and Statement of Additional Information, each dated July 29, 2021, as amended and supplemented from time to time, and the most

recent shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated and unaffiliated life insurance companies and is not

intended for use by other investors.

Before you

invest, you may want to review Seasons Series Trust’s Statutory Prospectus, which contains more information about the Portfolio and its risks. You can find the Statutory Prospectus and the above-incorporated information online at

www.aig.com/getprospectus. You can also get this information at no cost by calling (800) 445-7862 or by sending an e-mail request to [email protected].

The Securities and Exchange Commission has not approved or

disapproved these securities, nor has it determined that this Summary Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Goal

The Portfolio’s investment goal is capital

appreciation.

Fees and Expenses of the Portfolio

This table describes the fees and expenses that you may pay

if you buy, hold and sell shares of the Portfolio. The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy (“Variable

Contracts”) in which the Portfolio is offered. If separate account fees were shown, the Portfolio’s annual operating expenses would be higher. Please see your Variable Contract prospectus for more details on the separate account

fees.

Annual

Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Class 1 | Class 2 | Class 3 | |||

|

Management

Fees |

0.85% | 0.85% | 0.85% | ||

|

Service (12b-1)

Fees |

None | 0.15% | 0.25% | ||

|

Other

Expenses |

0.16% | 0.16% | 0.16% | ||

|

Total Annual Portfolio Operating Expenses Before Fee Waivers and/or Expense

Reimbursements |

1.01% | 1.16% | 1.26% | ||

|

Fee Waivers and/or Expense

Reimbursements1 |

0.15% | 0.15% | 0.15% |

| Class 1 | Class 2 | Class 3 | |||

|

Total Annual Portfolio Operating Expenses After Fee Waivers and/or Expense

Reimbursements1 |

0.86% | 1.01% | 1.11% |

| 1 | Pursuant to an Advisory Fee Waiver Agreement, SunAmerica Asset Management, LLC (“SunAmerica”) contractually agreed to waive a portion of its advisory fee for the Portfolio so that the advisory fee on average daily net assets payable to SunAmerica equals 0.70% on the first $250 million, 0.65% on the next $250 million, and 0.60% above $500 million. This waiver agreement may be modified or discontinued prior to July 31, 2022 only with the approval of the Board of Trustees (the “Board”) of Seasons Series Trust (the “Trust”), including a majority of the trustees of the Board who are not “interested persons” of the Trust as defined in the Investment Company Act of 1940, as amended. |

Expense

Example

This Example is intended to help you

compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then redeem or hold all of your shares at the end of

those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same and that all fee waivers and/or reimbursements remain in place through the term of the

applicable waiver and/or expense reimbursement. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information

on such

Seasons Series Trust

- 1 -

SA Putnam Asset

Allocation Diversified Growth Portfolio

charges. Although your actual costs may be higher or

lower, based on these assumptions and the net expenses shown in the fee table, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||

|

Class 1

Shares |

$88 | $307 | $543 | $1,223 | |||

|

Class 2

Shares |

103 | 354 | 624 | 1,396 | |||

|

Class 3

Shares |

113 | 385 | 677 | 1,509 |

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example,

affect the Portfolio’s performance.

During the

most recent fiscal year, the Portfolio’s portfolio turnover rate was 77% of the average value of its portfolio.

Principal Investment Strategies of the Portfolio

The Portfolio attempts to achieve its investment goal by

investing, under normal circumstances, through strategic allocation of approximately 80% (with a range of 65-95%) of its assets in equity securities and approximately 20% (with a range of 5-35%) of its assets in fixed income securities. Using

qualitative analysis and quantitative techniques, the subadviser adjusts portfolio allocations from time to time within these ranges to try to optimize the Portfolio’s performance consistent with its goal.

The subadviser invests mainly in a diversified portfolio of

equity securities (growth or value stocks or both) of companies of any size. The subadviser may consider, among other things, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future

earnings, cash flows and dividends when deciding whether to buy or sell equity investments. The subadviser also invests, to a lesser extent, in a diversified portfolio of fixed income investments, including both U.S. government obligations and

corporate obligations. The subadviser may consider, among other things, credit, interest rate and prepayment risks, as well as general market conditions when deciding whether to buy or sell fixed income investments.

The Portfolio may invest in foreign securities (up to 60%

of net assets), and short-term investments (up to 20% of net assets).

The Portfolio may invest in derivatives, such as equity

index futures, options, foreign currency forwards and total return swaps. The subadviser may invest in such

instruments for hedging and non-hedging purposes: for example, the

subadviser may use foreign currency forwards to increase or decrease the portfolio’s exposure to a particular currency or group of currencies. Derivatives may also be used as a substitute for a direct investment in the securities of one or

more issuers, or they may be used to take “short” positions, the values of which move in the opposite direction from the underlying investment, index or currency.

Principal Risks of Investing in the Portfolio

As with any mutual fund, there can be no assurance that the

Portfolio’s investment goal will be met or that the net return on an investment in the Portfolio will exceed what could have been obtained through other investment or savings vehicles. Shares of the Portfolio are not bank deposits and are not

guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Portfolio goes down, you could lose money.

The following is a summary of the principal risks of investing

in the Portfolio.

Equity Securities Risk. The Portfolio invests principally in equity securities and is therefore subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day-to-day and may

decline significantly.

Risk of Investing in

Bonds. As with any fund that invests significantly in bonds, the value of your investment in the Portfolio may go up or down in response to changes in interest rates or defaults (or even the potential for future

defaults) by bond issuers.

Credit Risk. Credit risk applies to most fixed income securities, but is generally not a factor for obligations backed by the “full faith and credit” of the U.S. Government. The Portfolio could lose money if the issuer

of a fixed income security is unable or perceived to be unable to pay interest or to repay principal when it becomes due.

Interest Rate Fluctuations Risk. Fixed income securities may be subject to volatility due to changes in interest rates. Duration is a measure of interest rate risk that indicates how price-sensitive a bond is to changes in interest rates. Longer-term

and lower coupon bonds tend to be more sensitive to changes in interest rates. Interest rates have been historically low, so the Portfolio faces a heightened risk that interest rates may rise. For example, a bond with a duration of three years will

decrease in value by approximately 3% if interest rates increase by 1%.

Seasons Series Trust

- 2 -

SA Putnam Asset

Allocation Diversified Growth Portfolio

Potential future changes in monetary policy made by

central banks and/or their governments are likely to affect the level of interest rates.

U.S. Government Obligations Risk. U.S. Treasury obligations are backed by the “full faith and credit” of the U.S. Government and generally have negligible credit risk. Securities issued or guaranteed by federal agencies or authorities and

U.S. Government-sponsored instrumentalities or enterprises may or may not be backed by the full faith and credit of the U.S. Government.

Foreign Investment Risk.

The Portfolio’s investments in the securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Portfolio invests may have markets that are less liquid, less

regulated and more volatile than U.S. markets. The value of the Portfolio’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions,

and political or financial instability and other conditions or events (including, for example, military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). Lack of information may also affect the value of these securities. The

risks of foreign investments are heightened when investing in issuers in emerging market countries.

Large-Cap Companies Risk.

Large-cap companies tend to go in and out of favor based on market and economic conditions. Large-cap companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the

Portfolio’s value may not rise as much as the value of portfolios that emphasize smaller companies.

Small- and Mid-Cap Companies Risk. Companies with smaller market capitalization (particularly under $1 billion depending on the market) tend to be at early stages of development with limited product lines, market access for products, financial resources,

access to new capital, or depth in management. It may be difficult to obtain reliable information and financial data about these companies. Consequently, the securities of smaller companies may not be as readily marketable and may be subject to more

abrupt or erratic market movements. Securities of small- and mid-cap companies are usually more volatile and entail greater risks than securities of large-cap companies.

Growth Stock Risk. Growth

stocks may lack the dividend yield associated with value stocks that can cushion total return in a bear market. Also, growth stocks normally carry a higher price/earnings ratio than many other stocks. Consequently, if earnings expectations are not

met, the

market price of growth stocks will often decline more than other

stocks.

Value Investing Risk. The Portfolio may focus on selecting value-style stocks. When investing in securities which are believed to be undervalued in the market, there is a risk that the market may not recognize a security’s intrinsic

value for a long period of time, or that a stock judged to be undervalued may actually be appropriately priced.

Derivatives Risk. To the

extent a derivative contract is used to hedge another position in the portfolio, the Portfolio will be exposed to the risks associated with hedging as described in the Glossary. To the extent a forward, futures contract or swap is used to

enhance return, rather than as a hedge, the Portfolio will be directly exposed to the risks of the contract. Gains or losses from non-hedging positions may be substantially greater than the cost of the position.

Counterparty Risk.

Counterparty risk is the risk that a counterparty to a security, loan or derivative held by the Portfolio becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties. The Portfolio may experience significant delays

in obtaining any recovery in a bankruptcy or other reorganization proceeding, and there may be no recovery or limited recovery in such circumstances.

Hedging Risk. While hedging

strategies can be very useful and inexpensive ways of reducing risk, they are sometimes ineffective due to unexpected changes in the market or exchange rates. Hedging also involves the risk that changes in the value of the related security will not

match those of the instruments being hedged as expected, in which case any losses on the instruments being hedged may not be reduced. For gross currency hedges, there is an additional risk, to the extent that these transactions create exposure to

currencies in which the Portfolio’s securities are not denominated.

Management Risk. The

Portfolio is subject to management risk because it is an actively-managed investment portfolio. The Portfolio’s portfolio managers apply investment techniques and risk analyses in making investment decisions, but there can be no guarantee that

these decisions or the individual securities selected by the portfolio managers will produce the desired results.

Market Risk. The

Portfolio’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings. The market as a whole can decline for many reasons, including adverse political or economic developments in the United

States or abroad, changes in investor psychology, or heavy institutional selling and

Seasons Series Trust

- 3 -

SA Putnam Asset

Allocation Diversified Growth Portfolio

other conditions or events (including, for example,

military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). In addition, the adviser’s or a subadviser’s assessment of securities held in the Portfolio may prove incorrect, resulting in losses or poor performance

even in a rising market.

The coronavirus pandemic and

the related governmental and public responses have had and may continue to have an impact on the Portfolio’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity

in certain classes of securities and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain

raw materials, supplies and component parts, and reduced or disrupted operations for the issuers in which the Portfolio invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence,

reoccurrence and pendency of such diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Issuer Risk. The value of a

security may decline for a number of reasons directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services.

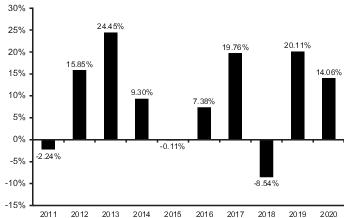

Performance Information

The following bar chart illustrates the risks of investing

in the Portfolio by showing changes in the Portfolio’s performance from calendar year to calendar year and the

table compares the Portfolio’s average annual returns to those of

the S&P 500® Index and a blended index and each of its components. The blended index consists of 60% Russell 3000® Index, 15% MSCI EAFE Index (net), 15% Bloomberg Barclays U.S. Aggregate Bond Index, 5% JP Morgan Developed Market High Yield Index, and 5% MSCI

Emerging Markets Index (net)SM (the “Blended Index”). Fees and expenses incurred at the contract level are not reflected in the bar chart or

table. If these amounts were reflected, returns would be less than those shown. Of course, past performance is not necessarily an indication of how the Portfolio will perform in the future.

(Class 1 Shares)

During the period shown

in the bar chart:

| Highest

Quarterly Return: |

June 30, 2020 | 16.68% |

| Lowest

Quarterly Return: |

March 31, 2020 | -18.17% |

| Year

to Date Most Recent Quarter: |

June 30, 2021 | 12.43% |

Seasons Series Trust

- 4 -

SA Putnam Asset

Allocation Diversified Growth Portfolio

Average Annual Total Returns

(For the periods ended December 31, 2020)

| 1

Year |

5

Years |

10

Years | |||

|

Class 1

Shares |

14.06% | 10.01% | 9.51% | ||

|

Class 2

Shares |

13.89% | 9.85% | 9.34% | ||

|

Class 3

Shares |

13.77% | 9.74% | 9.23% | ||

|

Blended

Index |

16.44% | 12.29% | 10.35% | ||

|

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or

taxes) |

7.51% | 4.44% | 3.84% | ||

|

JP Morgan Developed Market High Yield Index (reflects no deduction for fees, expenses or

taxes) |

5.34% | 8.48% | 6.95% | ||

|

MSCI EAFE Index (net) (reflects no deduction for fees or

expenses) |

7.82% | 7.45% | 5.51% | ||

|

MSCI Emerging Markets Index

(net)SM |

18.31% | 12.81% | 3.63% | ||

|

Russell 3000® Index (reflects no deduction for fees, expenses or

taxes) |

20.89% | 15.43% | 13.79% | ||

|

S&P 500® Index (reflects no deduction for fees, expenses or

taxes) |

18.40% | 15.22% | 13.88% |

Investment Adviser

The Portfolio’s investment adviser is SunAmerica. The

Portfolio is subadvised by Putnam Investment Management, LLC and the portfolio managers are noted below.

Portfolio

Managers

| Name and Title | Portfolio

Manager of the Portfolio Since | |

|

Robert J. Schoen Chief Investment Officer, Global Asset Allocation and Portfolio

Manager |

2002 | |

|

Jason R. Vaillancourt Co-Head of Global Asset Allocation and Portfolio

Manager |

2011 | |

|

Brett S. Goldstein Co-Chief Investment Officer and Portfolio

Manager |

2019 | |

|

Adrian H. Chan Portfolio

Manager |

June 2021 |

Purchases and Sales of

Portfolio Shares

Shares of the Portfolios may only be purchased or redeemed

through Variable Contracts offered by the

separate accounts of participating life insurance companies. Shares of a

Portfolio may be purchased and redeemed each day the New York Stock Exchange is open, at the Portfolio’s net asset value determined after receipt of a request in good order.

The Portfolios do not have any initial or subsequent

investment minimums. However, your insurance company may impose investment or account minimums. Please consult the prospectus (or other offering document) for your Variable Contract which may contain additional information about purchases and

redemptions of Portfolio shares.

Tax Information

The Portfolios will not be subject to U.S. federal income

tax so long as they qualify as regulated investment companies and distribute their income and gains each year to their shareholders. However, contractholders may be subject to U.S. federal income tax (and a U.S. federal Medicare tax of 3.8% that

applies to net investment income, including taxable annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the prospectus (or other offering document) for the Variable Contract for additional

information regarding taxation.

Payments to

Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

The Portfolios are not sold directly to the general public

but instead are offered as an underlying investment option for Variable Contracts. A Portfolio and its related companies may make payments to the sponsoring insurance company (or its affiliates) for distribution and/or other services. These payments

may create a conflict of interest as they may be a factor that the insurance company considers in including a Portfolio as an underlying investment option in the Variable Contract. The prospectus (or other offering document) for your Variable

Contract may contain additional information about these payments.

Seasons Series Trust

- 5 -

[THIS PAGE INTENTIONALLY LEFT BLANK]

- 6 -

[THIS PAGE INTENTIONALLY LEFT BLANK]

- 7 -

CSP-812546_505_737.4 (7/21)

- 8 -

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/24/2024

- Shares jump on tech boost; fragile yen on intervention watch

- Tesla touts acceleration of new models, but Q1 results fall short of estimates

- Oil prices steady after rallying on US stock decline, business data

- Yen on the brink, but Tesla pulls back

- Dollar recovers from PMI slump, yen closes in on 155 per dollar

- Fisker (FSR) Appoints Michael Healy as Chief Restructuring Officer

- Seagate Technology (STX) Enters $600M Asset Purchase Agreement with Avago

- China acquired top-end Nvidia AI chips despite recent US ban- Reuters

- Wolfe Research Downgrades Warner Brothers Discovery (WBD) to Underperform, 'out of concern that an incipient advertising downturn put guidance at risk'

- Wall Street closes higher as investors digest earnings, megacap outlook

- Tesla, AT&T, Biogen and Hasbro rise premarket; Uber, Enphase fall

- After-hours movers: Tesla, Texas Instruments, Seagate, Visa and more

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

- After-hours movers: Cadence Design Systems, Cleveland-Cliffs, Riot Platforms, and more

- Midday movers: Tesla, Li Auto and CNH Industrial fall; Salesforce rises

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ascend Hires Scott Law as COO and Continues Strengthening Foundation

- Cortechs.ai Announces Major FDA 510(k)-Pending Update to NeuroQuant Software, Expanding Capabilities in Neuroimaging

- MIT Sloan CIO Symposium Selects Finalists for 2024 Innovation Showcase

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share