Form 497K SEASONS SERIES TRUST

July 29, 2021 1:17 PM EDT

Summary Prospectus

July 29, 2021

Seasons Series Trust

SA Multi-Managed Moderate Growth Portfolio

(Class 1, Class 2 and Class 3 Shares)

Seasons Series Trust’s Statutory

Prospectus and Statement of Additional Information, each dated July 29, 2021, as amended and supplemented from time to time, and the most

recent shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated and unaffiliated life insurance companies and is not

intended for use by other investors.

Before you

invest, you may want to review Seasons Series Trust’s Statutory Prospectus, which contains more information about the Portfolio and its risks. You can find the Statutory Prospectus and the above-incorporated information online at

www.aig.com/getprospectus. You can also get this information at no cost by calling (800) 445-7862 or by sending an e-mail request to [email protected].

The Securities and Exchange Commission has not approved or

disapproved these securities, nor has it determined that this Summary Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Goal

The Portfolio’s investment goal is long-term growth of

capital, with capital preservation as a secondary objective.

Fees and Expenses of the Portfolio

This table describes the fees and expenses that you may pay

if you buy, hold and sell shares of the Portfolio. The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy (“Variable

Contracts”) in which the Portfolio is offered. If separate account fees were shown, the Portfolio’s annual operating expenses would be higher. Please see your Variable Contract prospectus for more details on the separate account

fees.

Annual

Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Class 1 | Class 2 | Class 3 | |||

|

Management

Fees |

0.85% | 0.85% | 0.85% | ||

|

Service (12b-1)

Fees |

None | 0.15% | 0.25% | ||

|

Other

Expenses |

0.30% | 0.30% | 0.30% | ||

|

Total Annual Portfolio Operating Expenses Before Fee Waivers and/or Expense

Reimbursements |

1.15% | 1.30% | 1.40% | ||

|

Fee Waivers and/or Expense

Reimbursements1 |

0.05% | 0.05% | 0.05% |

| Class 1 | Class 2 | Class 3 | |||

|

Total Annual Portfolio Operating Expenses After Fee Waivers and/or Expense

Reimbursements1 |

1.10% | 1.25% | 1.35% |

| 1 | Pursuant to a Fee Waiver Agreement, SunAmerica Asset Management, LLC (“SunAmerica”) contractually agreed to waive a portion of its advisory fee for the Portfolio so that the advisory fee on average daily net assets payable to SunAmerica equals 0.80% on the first $250 million, 0.75% on the next $250 million, and 0.70% above $500 million. This waiver agreement may be modified or discontinued prior to July 31, 2022 only with the approval of the Board of Trustees (the “Board”) of Seasons Series Trust (the “Trust”), including a majority of the trustees of the Board who are not “interested persons” of the Trust as defined in the Investment Company Act of 1940, as amended. |

Expense

Example

This Example is intended to help you

compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then redeem or hold all of your shares at the end of

those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same and that all fee waivers and/or reimbursements remain in place through the term of the

applicable waiver and/or expense reimbursement. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information

on such charges. Although your actual costs may be higher or

Seasons Series Trust

- 1 -

SA

Multi-Managed Moderate Growth Portfolio

lower, based on these assumptions and the net expenses shown

in the fee table, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||

|

Class 1

Shares |

$112 | $360 | $628 | $1,393 | |||

|

Class 2

Shares |

127 | 407 | 708 | 1,563 | |||

|

Class 3

Shares |

137 | 438 | 761 | 1,675 |

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example,

affect the Portfolio’s performance.

During the

most recent fiscal year, the Portfolio’s portfolio turnover rate was 70% of the average value of its portfolio.

Principal Investment Strategies of the Portfolio

The Portfolio attempts to achieve its investment goal by

allocating its assets among three distinct, actively-managed investment components (the “Managed Components”), each with a different investment strategy. The Managed Components include a small-cap growth component, a fixed income

component and a growth component.

The Managed

Components each invest to varying degrees, according to its investment strategy, in a diverse portfolio of securities including, but not limited to, common stocks, securities with equity characteristics (such as preferred stocks, warrants or fixed

income securities convertible into common stock), corporate and U.S. Government fixed income securities, money market instruments and/or cash or cash equivalents.

The target allocation of the Portfolio’s assets among

the components is as follows:

| • | Small-Cap Growth Component | 18.0% |

| • | Fixed Income Component | 41.4% |

| • | Growth Component | 40.6% |

Differences in investment

returns among the Managed Components will cause the actual percentages to vary over the course of a calendar quarter from the target allocations referenced above. Accordingly, the Portfolio’s assets will be reallocated or

“rebalanced” among the Managed Components on at least a quarterly basis to restore the target allocations for the Portfolio.

The Small-Cap Growth Component invests principally in

equity securities, including those of lesser known or high

growth companies or industries, such as technology, telecommunications,

media, healthcare, energy, real estate investment trusts and consumer cyclicals. Although the component’s investments will primarily be in small-capitalization companies, the component may invest substantially in mid-capitalization companies

and, to a smaller degree, large-capitalization companies.

As noted above, approximately 41.4% of the

Portfolio’s assets will be allocated to the Fixed Income Component, which, under normal circumstances, invests primarily in investment grade fixed income securities (U.S. or foreign). The component may also invest substantially in short-term

investments, foreign securities (including securities denominated in foreign currencies), asset-backed and mortgage-backed securities and when-issued and delayed-delivery securities.

Under normal market conditions, the subadviser for the

Growth Component invests primarily in established companies with capitalizations within the range of companies included in the Russell 1000® Growth

Index. As of May 31, 2021, the market capitalization range of the companies in the Russell 1000® Growth Index was between approximately $3.53

billion and $2.28 trillion. The subadviser for the Growth Component emphasizes a bottom-up stock selection process, seeking attractive investments on an individual company basis. In selecting securities for investment, the subadviser for the Growth

Component typically invests in companies it believes have strong name recognition and sustainable competitive advantages with above average business visibility, the ability to deploy capital at high rates of return, strong balance sheets and an

attractive risk/reward.

The subadviser for the Growth

Component generally considers selling a portfolio holding when it determines that the holding no longer satisfies its investment criteria. The Growth Component may invest in foreign securities, which may include emerging market securities. The

Growth Component may invest in equity securities.

The

subadviser for the Growth Component actively integrates sustainability into the investment process by using environmental, social and governance (“ESG”) factors as a lens for additional fundamental research, which

can contribute to investment decision-making. The subadviser for the Growth Component seeks to understand how environmental and social initiatives within companies can create value by strengthening durable competitive advantages, creating

growth opportunities, driving profitability and/or aligning with secular growth trends. The subadviser for the Growth Component generally engages with company management teams to discuss their ESG practices, with

Seasons Series Trust

- 2 -

SA

Multi-Managed Moderate Growth Portfolio

the aim of identifying how sustainability themes present

opportunities and risks that can be material to the value of the security over the long term. Other aspects of the investment process include a proprietary, systematic evaluation of governance policies, specifically focusing on

compensation alignment on long-term value creation. The subadviser for the Growth Component does not treat ESG as a deterministic, reductive screen, nor as a portfolio construction tool layered on top of a passive vehicle.

Principal Risks of Investing in the Portfolio

As with any mutual fund, there can be no assurance that the

Portfolio’s investment goal will be met or that the net return on an investment in the Portfolio will exceed what could have been obtained through other investment or savings vehicles. Shares of the Portfolio are not bank deposits and are not

guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Portfolio goes down, you could lose money.

The following is a summary of the principal risks of investing

in the Portfolio.

Equity Securities Risk. The Portfolio invests principally in equity securities and is therefore subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day-to-day and may

decline significantly.

Large-Cap Companies Risk. Large-cap companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the Portfolio’s value may not rise as much as the value of portfolios

that emphasize smaller companies.

Growth Stock

Risk. Growth stocks may lack the dividend yield associated with value stocks that can cushion total return in a bear market. Also, growth stocks normally carry a higher price/earnings ratio than many other stocks.

Consequently, if earnings expectations are not met, the market price of growth stocks will often decline more than other stocks.

Risk of Investing in Bonds.

The value of your investment in the Portfolio may go up or down in response to changes in interest rates or defaults (or even the potential for future defaults) by bond issuers.

Interest Rate Fluctuations Risk. Fixed income securities may be subject to volatility due to changes in interest rates. Duration is a measure of interest rate risk that indicates how price-sensitive a bond is to changes in interest rates. Longer-term

and lower coupon bonds tend

to be more sensitive to changes in interest rates. Interest rates have

been historically low, so the Portfolio faces a heightened risk that interest rates may rise. For example, a bond with a duration of three years will decrease in value by approximately 3% if interest rates increase by 1%. Potential future changes in

monetary policy made by central banks and/or their governments are likely to affect the level of interest rates.

Credit Risk. Credit risk

applies to most fixed income securities, but is generally not a factor for obligations backed by the “full faith and credit” of the U.S. Government. The Portfolio could lose money if the issuer of a fixed income security is unable or

perceived to be unable to pay interest or to repay principal when it becomes due.

Foreign Investment Risk.

The Portfolio’s investments in the securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Portfolio invests may have markets that are less liquid, less

regulated and more volatile than U.S. markets. The value of the Portfolio’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions,

and political or financial instability and other conditions or events (including, for example, military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). Lack of information may also affect the value of these securities. The

risks of foreign investments are heightened when investing in issuers in emerging market countries.

ESG Investment Risk. The

Portfolio’s adherence to its ESG criteria and application of related analyses when selecting investments may impact the Portfolio’s performance, including relative to similar funds that do not adhere to such criteria or apply such

analyses. Additionally, the Portfolio’s adherence to its ESG criteria and application of related analyses in connection with identifying and selecting investments may require subjective analysis and may be more difficult if data about a

particular company or market is limited, such as with respect to issuers in emerging markets countries. The Portfolio may invest in companies that do not reflect the beliefs and values of any particular investor. Socially responsible norms differ by

country and region, and a company’s ESG practices or the subadviser’s assessment of such may change over time.

Currency Volatility Risk.

The value of the Portfolio’s foreign investments may fluctuate due to changes in currency exchange rates. A decline in the value of foreign currencies relative to the U.S. dollar generally can be

Seasons Series Trust

- 3 -

SA

Multi-Managed Moderate Growth Portfolio

expected to depress the value of the Portfolio’s

non-U.S. dollar-denominated securities.

Mortgage- and

Asset-Backed Securities Risk. The characteristics of mortgage-backed and asset-backed securities differ from traditional fixed income securities. Mortgage-backed securities are subject to “prepayment

risk” and “extension risk.” Prepayment risk is the risk that, when interest rates fall, certain types of obligations will be paid off by the obligor more quickly than originally anticipated and the Portfolio may have to invest the

proceeds in securities with lower yields. Extension risk is the risk that, when interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall. Small movements in

interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed and asset-backed securities. Mortgage-backed and asset-backed securities are also subject to credit risk.

Small- and Mid-Cap Companies Risk. Securities of small- and mid-cap companies are usually more volatile and entail greater risks than securities of large-cap companies.

Affiliated Fund Rebalancing Risk. The Portfolio may be an investment option for other mutual funds for which SunAmerica serves as investment adviser that are managed as “funds of funds.” From time to time, the Portfolio may experience

relatively large redemptions or investments due to the rebalancing of a fund of funds. In the event of such redemptions or investments, the Portfolio could be required to sell securities or to invest cash at a time when it is not advantageous to do

so.

Management Risk. The Portfolio is subject to management risk because it is an actively-managed investment portfolio. The Portfolio’s portfolio managers apply investment techniques and risk analyses in making investment decisions,

but there can be no guarantee that these decisions or the individual securities selected by the portfolio managers will produce the desired results.

Market Risk. The

Portfolio’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings. The market as a whole can decline for many reasons, including adverse political or economic developments in the United

States or abroad, changes in investor psychology, or heavy institutional selling and other conditions or events (including, for example, military confrontations, war, terrorism, disease/virus, outbreaks and epidemics). In addition, the

adviser’s or a subadviser’s assessment of securities held in the Portfolio may prove incorrect, resulting in losses or poor performance even in a rising market.

The coronavirus pandemic and the related governmental and public responses

have had and may continue to have an impact on the Portfolio’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities and sectors

of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and component parts,

and reduced or disrupted operations for the issuers in which the Portfolio invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such diseases

could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Issuer Risk. The value of a

security may decline for a number of reasons directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services.

Real Estate Industry Risk.

These risks include declines in the value of real estate, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, changes in zoning laws, casualty or

condemnation losses, fluctuations in rental income, changes in neighborhood values, changes in the appeal of properties to tenants and increases in interest rates. If the Portfolio has rental income or income from the disposition of real property,

the receipt of such income may adversely affect its ability to retain its tax status as a regulated investment company.

When-Issued and Delayed Delivery Transactions Risk. When-issued and delayed delivery securities involve the risk that the security the Portfolio buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other

party to the transaction will not meet its obligation. If this occurs, the Portfolio may lose both the investment opportunity for the assets it set aside to pay for the security and any gain in the security’s price.

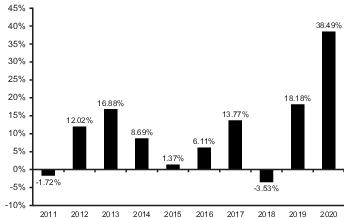

Performance Information

The following bar chart illustrates the risks of investing

in the Portfolio by showing changes in the Portfolio’s performance from calendar year to calendar year and the table compares the Portfolio’s average annual returns to those of the S&P 500® Index, the Russell 1000® Growth

Seasons Series Trust

- 4 -

SA

Multi-Managed Moderate Growth Portfolio

Index and a blended index and each of its components. The

blended index consists of 37.9% Russell 1000® Index, 42.3% Bloomberg Barclays U.S. Aggregate Bond Index, 18.0% Russell 2000® Index and 1.8% FTSE Treasury Bill 3-Month Index (the “Blended Index”). Fees and expenses incurred at the contract level are not reflected

in the bar chart or table. If these amounts were reflected, returns would be less than those shown. Of course, past performance is not necessarily an indication of how the Portfolio will perform in the future.

Effective May 1, 2019, Morgan Stanley Investment Management

Inc. (“MSIM”) assumed management of the Growth Component of the Portfolio, which was previously managed by Janus Capital Management LLC. Effective October 24, 2014, the subadvisory agreement between SunAmerica and Lord Abbett & Co.

LLC and the subadvisory agreement between SunAmerica and PineBridge Investments LLC were terminated with respect to the Portfolio.

(Class 1 Shares)

During the period shown

in the bar chart:

| Highest

Quarterly Return: |

June 30, 2020 | 26.14% |

| Lowest

Quarterly Return: |

September 30, 2011 | -11.10% |

| Year

to Date Most Recent Quarter: |

June 30, 2021 | 6.27% |

Average Annual Total Returns (For the periods

ended December 31, 2020)

| 1

Year |

5

Years |

10

Years | |||

|

Class 1

Shares |

38.49% | 13.77% | 10.45% | ||

|

Class 2

Shares |

38.19% | 13.60% | 10.28% | ||

|

Class 3

Shares |

38.06% | 13.48% | 10.18% | ||

|

Blended

Index |

15.80% | 10.56% | 9.24% | ||

|

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or

taxes) |

7.51% | 4.44% | 3.84% | ||

|

FTSE Treasury Bill 3 Month Index (reflects no deduction for fees, expenses or

taxes) |

0.58% | 1.16% | 0.60% | ||

|

Russell 1000® Index (reflects no deduction for fees, expenses or

taxes) |

20.96% | 15.60% | 14.01% | ||

|

Russell 1000® Growth Index (reflects no deduction for fees, expenses or

taxes) |

38.49% | 21.00% | 17.21% | ||

|

Russell 2000® Index (reflects no deduction for fees, expenses or

taxes) |

19.96% | 13.26% | 11.20% | ||

|

S&P 500® Index (reflects no deduction for fees, expenses or

taxes) |

18.40% | 15.22% | 13.88% |

Investment Adviser

The Portfolio’s investment adviser is SunAmerica. The

Portfolio is subadvised by J.P. Morgan Investment Management, Inc. (“JPMorgan”), MSIM and Wellington Management Company LLP (“Wellington Management”). The portfolio managers are noted below.

Seasons Series Trust

- 5 -

SA

Multi-Managed Moderate Growth Portfolio

Portfolio

Managers

| Name and Title | Portfolio

Manager of the Portfolio Since | |

| Small-Cap Growth Component – JPMorgan | ||

|

Phillip D. Hart, CFA Managing Director and Portfolio

Manager |

2013 | |

|

Wonseok Choi, PhD Managing Director and Portfolio

Manager |

2019 | |

|

Jonathan L. Tse, CFA Executive Director and Portfolio

Manager |

2019 | |

|

Akash Gupta, CFA Executive Director and Portfolio

Manager |

2019 | |

| Fixed Income Component – Wellington Management | ||

|

Campe Goodman, CFA Senior Managing Director and Fixed Income Portfolio

Manager |

2004 | |

|

Joseph F. Marvan, CFA Senior Managing Director and Fixed Income Portfolio

Manager |

2010 | |

|

Robert D. Burn, CFA Managing Director and Fixed Income Portfolio

Manager |

2016 | |

| Growth Component – MSIM | ||

|

Dennis P. Lynch Managing

Director |

2019 | |

|

Sam G. Chainani, CFA Managing

Director |

2019 | |

|

Jason C. Yeung, CFA Managing

Director |

2019 | |

|

Armistead B. Nash Managing

Director |

2019 | |

|

David S. Cohen Managing

Director |

2019 | |

|

Alexander T. Norton Executive

Director |

2019 | |

Purchases and Sales of Portfolio

Shares

Shares of the Portfolios may only be purchased or redeemed

through Variable Contracts offered by the

separate accounts of participating life insurance companies. Shares of a

Portfolio may be purchased and redeemed each day the New York Stock Exchange is open, at the Portfolio’s net asset value determined after receipt of a request in good order.

The Portfolios do not have any initial or subsequent

investment minimums. However, your insurance company may impose investment or account minimums. Please consult the prospectus (or other offering document) for your Variable Contract which may contain additional information about purchases and

redemptions of Portfolio shares.

Tax Information

The Portfolios will not be subject to U.S. federal income

tax so long as they qualify as regulated investment companies and distribute their income and gains each year to their shareholders. However, contractholders may be subject to U.S. federal income tax (and a U.S. federal Medicare tax of 3.8% that

applies to net investment income, including taxable annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the prospectus (or other offering document) for the Variable Contract for additional

information regarding taxation.

Payments to

Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

The Portfolios are not sold directly to the general public

but instead are offered as an underlying investment option for Variable Contracts. A Portfolio and its related companies may make payments to the sponsoring insurance company (or its affiliates) for distribution and/or other services. These payments

may create a conflict of interest as they may be a factor that the insurance company considers in including a Portfolio as an underlying investment option in the Variable Contract. The prospectus (or other offering document) for your Variable

Contract may contain additional information about these payments.

Seasons Series Trust

- 6 -

[THIS PAGE INTENTIONALLY LEFT BLANK]

- 7 -

CSP-999999994.6 (7/21)

- 8 -

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/19/2024

- Nasdaq, S&P stumble as Netflix, chip stocks drag; AmEx boosts Dow

- Sony/Apollo bid for Paramount could be worth as much as $29 billion - Source

- Netflix Q1 earnings top estimates on blowout subscriber growth

- Wall St indexes split, Treasuries dip amid earnings, geopolitical crosscurrents

- Gold prices rally past $2,400 on reports of Israel strikes on Iran

- Tritium DCFC Limited (DCFC): Three Australian subsidiaries were determined to be insolvent or likely to become insolvent

- Hasbro (HAS) Announces Resignation of Cynthia Williams, President of Wizards of the Coast and Hasbro Gaming

- Frontier Communications (FYBR) says third party had gained unauthorized access to portions of its information technology environment

- Jabil falls after placing CEO on paid leave amid internal investigation

- Ibotta (IBTA) Prices 6.56M Share IPO at $88/sh

- Midday movers: Netflix, Super Micro fall; Paramount Global gains

- After-hours movers: Netflix, Intuitive Surgical, Nordstrom, KB Home

- Midday movers: Tesla, Blackstone, Las Vegas Sands fall; DR Horton rises

- After-hours movers: Alcoa rises; Equifax and Las Vegas Sands fall

- Midday movers: Travelers, JB Hunt fall; United Airlines rises

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Stacey Lasser of Mednet to Present at the 2nd Annual Clinical Outsourcing Group New England Conference in Boston

- ROSEN, THE FIRST FILING FIRM, Encourages SSR Mining Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – SSRM

- Six Flags Sets Date to Announce First Quarter 2024 Earnings

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share