Form 497K RBC FUNDS TRUST

| Fund Summary | Access Capital Community Investment Fund | |||||

Investment Objective

The Fund’s investment objective is to provide current income consistent with the preservation of capital by investing primarily in high quality debt securities and other debt instruments supporting community development, including investments deemed to be qualified under the Community Reinvestment Act of 1977, as amended (the “CRA”).

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts on purchases of Class A shares of the Fund if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund. More information about these and other discounts is available from your financial intermediary and under the subheading “Reducing the Initial Sales Charge on Purchases of Class A Shares” on page 71 of the Fund’s Prospectus.

| Class A | Class I | Class IS | ||||||||||

| Shareholder Fees (fees paid directly from your investment) |

||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

3.75 | % | None | None | ||||||||

| Maximum Deferred Sales Charge (Load) (as a % of offering or sales price, whichever is less) |

None | 1 | None | None | ||||||||

| Annual Fund Operating Expenses |

||||||||||||

| Management Fees |

0.35 | % | 0.35 | % | 0.35 | % | ||||||

| Distribution and Service (12b-1) Fees |

0.25 | % | None | None | ||||||||

| Other Expenses |

||||||||||||

| Shareholder Servicing Fee |

None | 0.05 | % | None | ||||||||

| Other Expenses |

0.24 | % | 0.11 | % | 0.15 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total Other Expenses |

0.24 | % | 0.16 | % | 0.15 | % | ||||||

| Total Annual Fund Operating Expenses2 |

0.84 | % | 0.51 | % | 0.50 | % | ||||||

| Fee Waiver and/or Expense Reimbursement |

(0.04 | )% | (0.06 | )% | (0.10 | )% | ||||||

|

|

|

|

|

|

|

|||||||

| Total Annual Fund

Operating |

0.80 | % | 0.45 | % | 0.40 | % | ||||||

| 1 | A 1.00% Contingent Deferred Sales Charge (“CDSC”) is imposed on redemptions of Class A shares made within 12 months of a purchase of $1 million or more of Class A shares on which no front-end sales charge was paid. |

| 2 | The Advisor has contractually agreed to waive fees and/or pay operating expenses in order to limit the Fund’s total expenses (excluding brokerage and other investment-related costs, interest, taxes, dues, fees and other charges of governments and their agencies, extraordinary expenses such as litigation and indemnification, other expenses not incurred in the ordinary course of the Fund’s business and acquired fund fees and expenses) to 0.80% of the Fund’s average daily net assets for Class A shares, 0.45% for Class I shares and 0.40% for Class IS shares. The expense limitation agreement is in place until January 31, 2024 and may not be terminated by the Advisor prior to that date. The expense limitation agreement may be revised or terminated by the Fund’s board of trustees if the board consents to a revision or termination as being in the |

1

| Fund Summary | Access Capital Community Investment Fund | |||||

| best interests of the Fund. The Advisor is entitled to recoup from the Fund or class the fees and/or operating expenses previously waived or reimbursed for a period of 12 months from the date of such waiver or reimbursement, provided that such recoupment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed the lesser of: (i) the Fund’s expense limitation at the time of the waiver or reimbursement and (ii) the Fund’s expense limitation at the time of recoupment. |

Example: This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The costs for the Fund reflect the net expenses of the Fund that result from the contractual expense limitation in the first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Class A | Class I | Class IS | ||||||||||

| One Year |

$ | 454 | $ | 46 | $ | 41 | ||||||

| Three Years |

$ | 629 | $ | 158 | $ | 150 | ||||||

| Five Years |

$ | 820 | $ | 279 | $ | 270 | ||||||

| Ten Years |

$ | 1,370 | $ | 635 | $ | 619 | ||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 21% of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by investing primarily in high quality debt securities and other debt instruments supporting low- and moderate-income (“LMI”) individuals and communities and underserved areas of the United States. The Fund seeks to invest in affordable homeownership, quality affordable rental housing, small businesses and other community development activities with an aim to improve livability in LMI communities and underserved areas. Within those parameters, the Fund seeks a return consisting of current income and capital appreciation that is competitive relative to the Fund’s benchmark index. The Fund invests primarily in mortgage-backed securities, small business loans, municipal securities, and other instruments supporting the Fund’s impact goal of supporting LMI individuals and communities and underserved areas. These investments may involve private placement transactions and may include variable rate instruments. Certain investors in Class I shares of the Fund may express geographic and/or thematic preferences that will be sought when consistent with the Fund’s overall investment objective and impact goal. The Fund is non-diversified and, therefore, compared to a diversified investment company, the Fund may invest a greater percentage of its assets in securities of a particular issuer.

2

| Fund Summary | Access Capital Community Investment Fund | |||||

Community Investments. At the time of their share purchase, Class I investors meeting certain investment requirements may elect to have their investment amount invested in particular areas of the United States as their preferred geographic focus or Designated Target Region. If, after six months, the Advisor is unable to make appropriate investments in a shareholder’s Designated Target Region, the shareholder will have the option to redefine its Designated Target Region.

Each shareholder’s returns will be based on the investment performance of the Fund’s blended overall portfolio of investments and not just on the performance of the assets in the Designated Target Region(s) selected by that shareholder.

The Fund expects that substantially all or most of its investments will be considered eligible for regulatory credit under the Community Reinvestment Act of 1977 (“CRA”) and that shares of the Fund will be eligible for regulatory credit under the CRA.

Investment Program. The Fund is designed for investors seeking a competitive return on high quality debt securities that support affordable housing and/or underlying community development activities in distinct parts of the United States. Not all of the investors in the Fund are subject to CRA requirements, but may be seeking to make investments in underserved communities or to fulfill other socially responsible related investment objectives. Investors that are not subject to CRA requirements do not receive CRA credit for their investments.

Concentration in the Affordable Housing Industry. The Fund concentrates in the affordable housing industry, which means it will invest at least 25% of its total assets in the affordable housing industry. The Fund may, however, invest up to 100% of its total assets in the affordable housing industry. The Fund will invest a significant amount of its assets in securities issued by Government National Mortgage Association (“Ginnie Mae”) and government sponsored enterprises (“GSEs”), such as the Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”), Federal Housing Administration (“FHA”) project loans, and tax-exempt debt issued by state housing finance authorities (“HFAs”) to finance their work in affordable housing.

Credit Quality. The Fund will invest at least 75% of its total assets in securities (i) having a rating in the highest rating category assigned by a nationally recognized statistical rating organization; or (ii) if unrated, deemed by the Advisor to be of comparable quality to securities which are so rated; or (iii) issued or guaranteed by the U.S. Government, government agencies, or GSEs (together, “First Tier Holdings”). The remainder of the Fund’s total assets will be invested in First Tier Holdings or in securities rated at least in the second highest category assigned by a nationally recognized statistical rating organization, or, if unrated, deemed by the Advisor to be of comparable quality.

Duration. The Advisor seeks to maintain an overall average dollar-weighted portfolio duration for the Fund that is within certain percentage

3

| Fund Summary | Access Capital Community Investment Fund | |||||

ranges (such as 25%) above or below the Bloomberg Barclays U.S. Securitized Index. The duration of a bond is a measure of the approximate price sensitivity to changes in interest rates and is expressed in years. The longer the duration of the bond, the more sensitive the bond’s price is to changes in interest rates. The Advisor may use interest rate futures contracts, options on futures contracts and swaps to manage the Fund’s target duration. As of December 31, 2022, the duration of the Bloomberg Barclays U.S. Securitized Index was 5.92 years.

Principal Risks

The value of your investment in the Fund will change daily, which means that you could lose money. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. By itself, the Fund is not a balanced investment program. There is no guarantee that the Fund will meet its goal. The principal risks of investing in the Fund include:

U.S. Government Obligations Risk. Obligations of U.S. Government agencies, authorities, instrumentalities and sponsored enterprises (such as Fannie Mae and Freddie Mac) have historically involved little risk of loss of principal if held to maturity. However, the maximum potential liability of the issuers of some of these securities may greatly exceed their current resources and no assurance can be given that the U.S. Government would provide financial support to any of these entities if it is not obligated to do so by law. In September 2008, the U.S. Treasury and the Federal Housing Finance Agency (“FHFA”) announced that Fannie Mae and Freddie Mac would be placed into a conservatorship under FHFA. The effect that this conservatorship will have on the entities’ debt and securities guaranteed by the entities remains unclear. Fannie Mae and Freddie Mac are continuing to operate as going concerns while in conservatorship and each remains liable for all of its obligations, including its guaranty obligations, associated with its mortgage-backed securities. Should the FHFA take Fannie Mae and Freddie Mac out of conservatorship and return the entities to their shareholders, it is unclear what the new capital structures of the entities will be and whether the U.S. Treasury will continue to enforce its rights under the Senior Preferred Stock Purchase Agreement between it and the entities and what affect privatization of the entities will have on their ability to meet their respective obligations.

Interest Rate Risk. The Fund’s yield will fluctuate as the general level of interest rates change. During periods when interest rates are low, the Fund’s yield will also be low. The values of some or all of the Fund’s investments may change in response to movements in interest rates. If interest rates rise, the values of debt securities will generally fall and vice versa. In general, the longer the average maturity or duration of the Fund’s investment portfolio, the greater the sensitivity to changes in interest rates. Interest rate changes are influenced by a number of factors including government policy, inflation expectations, and supply and demand. The Fund assumes the risk that the value of the security at delivery may be more or less than the purchase price.

4

| Fund Summary | Access Capital Community Investment Fund | |||||

CRA Strategy Risk. Portfolio decisions take into account the Fund’s goal of holding securities in designated geographic areas and will not be exclusively based on the investment characteristics of the securities, which may or may not have an adverse effect on the Fund’s investment performance. CRA qualified securities in geographic areas sought by the Fund may not provide as favorable a return as CRA qualified securities in other geographic areas. The Fund may sell securities for reasons relating to CRA qualification at times when such sales may not be desirable and may hold short-term investments that produce relatively low yields pending the selection of long-term investments believed to be CRA qualified.

LIBOR Discontinuance or Unavailability Risk. The London Interbank Offered Rate (“LIBOR”) is intended to represent the rate at which contributing banks may obtain short-term borrowings from each other in the London interbank market. On March 5, 2021, the United Kingdom Financial Conduct Authority (“FCA”), which regulates LIBOR, announced that LIBOR will either cease to be provided by any administrator, or no longer be representative (i) immediately after December 31, 2021 for one-week and two-month U.S. Dollar LIBOR settings and (ii) immediately after June 30, 2023 for the remaining U.S. Dollar LIBOR settings. As of January 1, 2022, as a result of supervisory guidance from U.S. regulators, some U.S. regulated entities have ceased entering into new LIBOR contracts with limited exceptions. While publication of the one-, three- and six- month Sterling LIBOR settings has continued on the basis of a changed methodology (known as “synthetic LIBOR”), this rate has been designated by the FCA as unrepresentative of the underlying market it seeks to measure and is solely available for use in legacy transactions and will cease immediately after the final publication on March 31, 2023. Certain bank-sponsored committees in other jurisdictions, including Europe, the United Kingdom, Japan and Switzerland, have selected alternative reference rates denominated in other currencies. As a result, it is possible that LIBOR may no longer be available or no longer deemed an appropriate reference rate upon which to determine the interest rate on or impacting certain loans, notes, derivatives and other instruments or investments comprising some or all of the Fund’s portfolio.

Leverage Risk. Leverage may result from certain transactions, borrowing and reverse repurchase agreements. Leverage may exaggerate the effect of a change in the value of the Fund’s portfolio securities, causing the Fund to be more volatile than if leverage was not used.

Duration Management Risk. The Fund’s investments in derivative instruments that are intended to manage duration can result in sizeable realized and unrealized capital gains and losses relative to the gains and losses from the Fund’s investments in bonds and other securities.

Derivatives Risk. Derivatives and other similar instruments (collectively referred to as “derivatives”), including options contracts, futures contracts, forwards, options on futures contracts and swap agreements (including, but not limited to, credit default swaps and swaps on exchange-traded funds), may be riskier than other types of investments and could result in losses that

5

| Fund Summary | Access Capital Community Investment Fund | |||||

significantly exceed the Fund’s original investment. The performance of derivatives depends largely on the performance of their underlying asset reference, rate, or index; therefore, derivatives often have risks similar to those risks of the underlying asset, reference rate or index, in addition to other risks. However, the value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, reference, rate or index. Many derivatives create leverage thereby causing the Fund to be more volatile than it would have been if it had not used derivatives. Over-the-counter (“OTC”) derivatives are traded bilaterally between two parties, which exposes the Fund to heightened liquidity risk, valuation risk and counterparty risk (the risk that the derivative counterparty will not fulfill its contractual obligations), including the credit risk of the derivative counterparty, compared to other types of investments. Changes in the value of a derivative may also create margin delivery or settlement payment obligations for the Fund. Certain derivatives are subject to exchange trading and/or mandatory clearing (which interposes a central clearinghouse to each participant’s derivative transaction). Exchange trading, central clearing and margin requirements are intended to reduce counterparty credit risk and increase liquidity and transparency, but do not make a derivatives transaction risk-free and may subject the Fund to increased costs. The use of derivatives may not be successful, and certain of the Fund’s transactions in derivatives may not perform as expected, which may prevent the Fund from realizing the intended benefits, and could result in a loss to the Fund. In addition, given their complexity, derivatives expose the Fund to risks of mispricing or improper valuation, as well as liquidity risk. The use of derivatives is also subject to operational risk which refers to risk related to potential operational issues, including documentation issues, settlement issues, system failures, inadequate controls, and human error, as well as legal risk which refers to the risk of loss resulting from insufficient documentation, insufficient capacity or authority of counterparty, or legality or enforceability of a contract.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s net asset value (“NAV”) and liquidity.

Coordination of Investments Risk. Many of the fixed-income private placement debt securities purchased by the Fund are developed by a variety of organizations that rely on other entities. A lack of interest of other entities in developing investments could adversely affect the economic and financial objectives of the Fund. A limited or dwindling supply of funds available for credit enhancement on Fund investments may adversely affect full realization of the Fund’s investment objective. Regulatory or statutory changes may affect the willingness or ability of housing related entities to work in the affordable housing private placement area.

6

| Fund Summary | Access Capital Community Investment Fund | |||||

Concentration Risk. The Fund’s investments are expected to be closely tied to the affordable housing industry and its performance may be more volatile than the performance of a fund that does not concentrate its investments in a particular economic industry or sector.

Non-Diversified Fund Risk. As a non-diversified fund, the Fund may invest a larger portion of its assets in fewer issuers and be more sensitive to any single economic, business, political or regulatory occurrence than a diversified fund.

Market Risk. The markets in which the Fund invests may go down in value, sometimes sharply and unpredictably. The success of the Fund’s investment program may be affected by general economic and market conditions, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws, and national and international political circumstances. Unexpected volatility or illiquidity could impair the Fund’s profitability or result in losses.

Issuer/Credit Risk. There is a possibility that issuers of securities in which the Fund may invest may default on the payment of interest or principal on the securities when due, which would cause the Fund to lose money. There can be no assurance of the continued availability of support from GSEs, HFAs, or other credit enhancers and changes in their credit ratings may constrain their value to the Fund as potential sources of credit enhancement.

Prepayment Risk. The value of some mortgage-backed and asset-backed securities in which the Fund invests may fall due to unanticipated levels of principal prepayments that can occur when interest rates decline.

Call Risk. Call risk is the chance that during periods of falling interest rates, a bond issuer will “call” – or repay – a high-yielding bond before its maturity date. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income.

Active Management Risk. The Fund is subject to management risk because it is an actively managed investment portfolio. The Advisor and each individual portfolio manager will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. Additionally, legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available in connection with managing the Fund and may also adversely affect the ability of the Fund to achieve its investment objective.

Qualification for CRA Credit Risk. For an institution to receive CRA credit with respect to Fund shares, the Fund must hold CRA qualifying investments that relate to the institution’s delineated CRA assessment area. The Fund expects that substantially all or most investments will be considered eligible for regulatory credit under the CRA but there is no guarantee that an investor will receive CRA credit for their investment in the Fund.

7

| Fund Summary | Access Capital Community Investment Fund | |||||

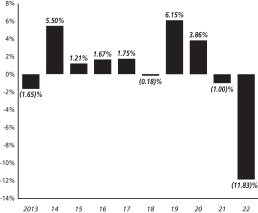

Performance Information

The bar chart and performance table provide an indication of the risks of an investment in the Fund by showing changes in performance from year to year and by showing how the Fund’s average annual total returns (before and after taxes) compare with those of a broad-based securities index. The returns for Class A shares and Class IS shares may be different than the returns of Class I shares shown in the bar chart and performance table because fees and expenses of the three classes differ. The bar chart shows the Fund’s performance for the past ten calendar years. Past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated information on the Fund’s performance can be obtained by visiting www.rbcgam.com or by calling 1-800-422-2766.

Annual Total Returns for Class I Shares

|

||||||||||||||||

| During the periods shown in the chart for Class I shares of the Fund: |

|

|||||||||||||||

| Quarter | Year | Returns | ||||||||||||||

| Best quarter: | 1Q | 2020 | 2.22% | |||||||||||||

| Worst quarter: | 3Q | 2022 | (5.15)% | |||||||||||||

Performance Table

The table below shows after-tax returns for Class I shares only. Before-tax returns for Class A shares assume applicable maximum sales charges. After-tax returns for Class A shares will differ. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as qualified retirement plans. In some cases, returns after taxes on distributions and sale of Fund shares may be higher than returns before taxes because the calculations assume that the investor received a tax benefit for any loss incurred on the sale of the shares. The inception date of the Fund (Class I) is June 23, 1998. Since inception performance is based on an inception date of July 1, 1998. The inception dates of Class A shares and Class IS shares of the Fund are January 29, 2009 and March 11, 2019, respectively. Performance shown for Class A and Class IS prior to their inception dates is based on the performance of Class I shares, adjusted to reflect the respective fees and expenses of Class A shares

8

| Fund Summary | Access Capital Community Investment Fund | |||||

and Class IS shares and the applicable sales charges. The index below shows how the Fund’s performance compares with the returns of a broad-based securities market index.

| Average Annual Total Returns (for the periods ended December 31, 2022) |

| |||||||||||||||||

| Past Year |

Past 5 Years |

Past 10 Years |

Since Inception |

|||||||||||||||

| Class I Return Before Taxes |

(11.83)% | (0.80)% | 0.43% | 3.19% | ||||||||||||||

| Class I Return After Taxes on Distributions |

(12.69)% | (1.78)% | (0.75)% | 1.53% | ||||||||||||||

| Class I Return After Taxes on Distributions and Sale of Shares |

(6.99)% | (0.98)% | (0.17)% | 1.80% | ||||||||||||||

| Class A Return Before Taxes |

(15.40)% | (1.90)% | (0.32)% | 2.71% | ||||||||||||||

| Class IS Return Before Taxes |

(11.69)% | (0.71)% | 0.57% | 3.42% | ||||||||||||||

| Bloomberg Barclays U.S. Securitized Index (reflects no deduction for fees, expenses or taxes; inception calculated from June 30, 1998) |

(11.67)% | (0.43)% | 0.80% | 3.72% | ||||||||||||||

Investment Advisor

RBC Global Asset Management (U.S.) Inc.

Portfolio Managers

The following individual is primarily responsible for the day-to-day management of the Fund’s portfolio:

| • | Brian Svendahl, Senior Portfolio Manager of the Advisor, has been a portfolio manager of the Fund, and its predecessor, since 2006. |

Tax Information

The Fund’s distributions generally are taxable to you as ordinary income, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account, in which case you may be taxed later upon withdrawal of your investment from such arrangement.

Important Additional Information

Purchase and Sale of Fund Shares

You may purchase or redeem (sell) shares of the Fund by phone (1-800-422-2766), by mail (RBC Funds, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701) or by wire. The following table

9

| Fund Summary | Access Capital Community Investment Fund | |||||

provides the Fund’s minimum initial and subsequent investment requirements, which may be reduced or modified in some cases.

| Minimum Initial Investment: | ||

| Class A |

$1,000 ($250 IRA) | |

| Class I |

$1,000,000 ($0 through Qualified Retirement Benefit Plans) | |

| Class IS |

$2,500 ($0 through Qualified Retirement Benefit Plans) | |

| Minimum Subsequent Investment: | ||

| Class A |

None | |

| Class I |

None | |

| Class IS |

None | |

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and/or the Advisor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

10

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 420 with CNW — Study Enumerates Therapeutic Effects, Quality of Life Benefits of Medical Cannabis

- Blackwell 3D Acquires Operating Dubai LLC, Inches Closer to Project Readiness

- Sysco Declares Increase to Quarterly Dividend

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share