Form 497K PUTNAM VARIABLE TRUST

Summary prospectus

4 |30 |22

| FUND SYMBOLS | CLASS IA | CLASS IB |

| — | — |

Putnam VT Sustainable Leaders Fund

Before you invest, you may wish to review the fund’s prospectus, which contains more information about the fund and its risks. You may obtain the prospectus and other information about the fund, including the statement of additional information (SAI) and most recent reports to shareholders, at no cost by visiting putnam.com/individual/annuities, calling 1-800-225-1581, or e-mailing Putnam at [email protected].

The fund’s prospectus and SAI, both dated 4/30/22, are incorporated by reference into this summary prospectus.

Fund summary

Goal

Putnam VT Sustainable Leaders Fund seeks long-term capital appreciation.

Fees and expenses

The following table describes the fees and expenses you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. The fees and expenses information does not reflect insurance-related charges or expenses borne by contract holders indirectly investing in the fund. If it did, expenses would be higher.

Annual fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

| Share class | Management fees | Distribution and service (12b-1) fees |

Other expenses |

Total annual fund operating expenses |

| Class IA | 0.54% | N/A | 0.10% | 0.64% |

| Class IB | 0.54% | 0.25% | 0.10% | 0.89% |

Example

The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. The example does not reflect insurance-related charges or expenses. If it did, expenses would be higher. It assumes that you invest $10,000 in the fund for the time periods indicated and then redeem or hold all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower.

| Share class | 1 year | 3 years | 5 years | 10 years |

| Class IA | $65 | $205 | $357 | $798 |

| Class IB | $91 | $284 | $493 | $1,096 |

Portfolio turnover

The fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund performance. The fund’s turnover rate in the most recent fiscal year was 27%.

Investments, risks, and performance

Investments

We invest mainly in common stocks of U.S. companies of any size, with a focus on companies that we believe exhibit a commitment to financially material sustainable business practices. In evaluating investments for the fund, we view “financially material sustainable business practices” as business practices that we believe are reasonably likely to impact the financial condition or operating performance of a company and that relate to environmental, social, or corporate governance issues. We identify relevant environmental, social, or corporate governance issues on a sector-specific basis using an internally developed materiality map, which is informed by the sustainability issues identified by the Sustainability Accounting Standards Board as material to companies within a particular industry. As part of this analysis, we may utilize metrics and information such as emissions data, carbon intensity, sources of energy used for operations, water use and re-use, water generation and diversion from landfill, employee safety and diversity data, supplier audits, product safety, board composition, and incentive compensation structures. Stocks of companies that exhibit a commitment to financially material sustainable business practices are typically, but not always, considered to be growth stocks. Growth stocks are stocks of companies whose revenues, earnings, or cash flows are expected to grow faster than those of similar firms, and whose business growth and other characteristics may lead to an increase in stock price. We may consider, among other factors, a company’s sustainable business practices (as described above), valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments. We may also invest in non-U.S. companies.

Under normal circumstances, the fund invests at least 80% of the value of its net assets in securities that meet our sustainability criteria. These criteria are based on a proprietary materiality map that is informed by the sustainability issues identified as material by the Sustainability Accounting Standards Board. In applying these criteria, we will assign each company a proprietary environmental, social and/or corporate governance (ESG) rating ranging from 1 to 4 (1 indicating the highest (best) ESG rating and 4 indicating the lowest (worst) ESG rating). In order to meet our sustainability criteria for purposes of this investment policy, a company must be rated 2 or

| Summary prospectus of the Trust 1 |

1 by us. This policy is non-fundamental and may be changed only after 60 days’ notice to shareholders. In selecting each investment, we focus on companies that have a demonstrated commitment to sustainable business practices in areas that are relevant and material to their long-term financial returns and risk profiles. We believe that companies that have exhibited such a commitment also often demonstrate potential for strong financial growth. This commitment may be reflected through ESG policies, practices, or outcomes. The fund’s approach to sustainable investing incorporates fundamental research together with consideration of ESG factors. Environmental factors include, for example, a company’s carbon intensity and use of resources like water or minerals. Sustainability measures in this area might include plans to reduce waste, increase recycling, raise the proportion of energy supply from renewable sources, or improve product design to be less resource intensive. Social factors include, for example, labor practices and supply chain management. Sustainability measures in this area might include programs to improve employee well-being, commitment to workplace equality and diversity, or improved stewardship of supplier relationships and working conditions. Corporate governance factors include, for example, board composition and executive compensation. Sustainability measures in this area might include improvements in board independence or diversity, or alignment of management incentives with the company’s strategic sustainability objectives. The integrated approach of the fund combines analysis of the growing body of ESG data and deep fundamental analysis and looks for companies that demonstrate leadership, beyond compliance, on relevant sustainability issues. The characteristics that we may use when considering sustainability leadership include:

(1) Materiality. The company is focused on sustainability issues that are relevant to long term business success.

(2) Creativity and proactiveness. The company’s sustainability characteristics go beyond compliance to demonstrate heightened commitment.

(3) Transparency. The company’s goals are specific, with candid and consistent progress reporting.

(4) Impact. The sustainability characteristics create benefits that are meaningful both at the company and more broadly.

Risks

It is important to understand that you can lose money by investing in the fund.

The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions, investor sentiment and market perceptions, government actions, geopolitical events or changes, and factors related to a specific issuer, geography, industry or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. The novel coronavirus (COVID-19) pandemic and efforts to contain its spread are likely to negatively affect the value, volatility, and liquidity of the securities and other assets in which the fund invests and exacerbate other risks that apply to the fund. These effects could negatively impact the fund’s performance and lead to losses on your investment in the fund. Companies whose stocks we believe are undervalued by the market may have experienced adverse business developments or may be subject to special risks that have caused their stocks to be out of favor.

The value of a company’s stock may fall or fail to rise as a result of factors directly relating to that company, such as decisions made by its management or lower demand for the company’s products or services. A stock’s value may also fall because of factors affecting not just the company, but also other companies in the same industry or in a number of different industries, such as increases in production costs.

Growth stocks may be more susceptible to earnings disappointments, and the market may not favor growth-style investing. Stocks of small and midsize companies often trade in smaller volumes, and their prices may fluctuate more than stocks of larger companies. Stocks of these companies may therefore be more vulnerable to adverse developments than those of larger companies. From time to time, the fund may invest a significant portion of its assets in companies in one or more related industries or sectors, which would make the fund more vulnerable to adverse developments affecting those industries or sectors.

The value of international investments traded in foreign currencies may be adversely impacted by fluctuations in exchange rates. International investments, particularly investments in emerging markets, may carry risks associated with potentially less stable economies or governments (such as the risk of seizure by a foreign government, the imposition of currency or other restrictions, or high levels of inflation), and may be or become illiquid.

Investing with a focus on companies that exhibit a commitment to sustainable practices may result in the fund investing in certain types of companies, industries or sectors that the market may not favor. In evaluating an investment opportunity, we may make investment decisions based on information and data that is incomplete or inaccurate. Sustainability and ESG metrics are not uniformly defined and applying such metrics involves subjective assessments. Sustainability and ESG scorings and assessments of issuers can vary across third-party data providers and may change over time. In addition, a company’s business practices, products or services may change over time. As a result of these possibilities, among others, the fund may temporarily hold securities that are inconsistent with the fund’s sustainable investment criteria. Regulatory changes or interpretations regarding the definitions and/or use of ESG or other sustainability criteria could have a material adverse effect on the fund’s ability to invest in accordance with its investment policies and/or achieve its investment objective, as well as the ability of certain classes of investors to invest in funds, such as the fund, whose strategies include ESG or other sustainability criteria.

There is no guarantee that the investment techniques, analyses, or judgments that we apply in making investment decisions for the fund will produce the intended outcome or that the investments we select for the fund will perform as well as other securities that were not selected for the fund. We, or the fund’s other service providers, may experience disruptions or operating errors that could negatively impact the fund.

The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| 2 Summary prospectus of the Trust |

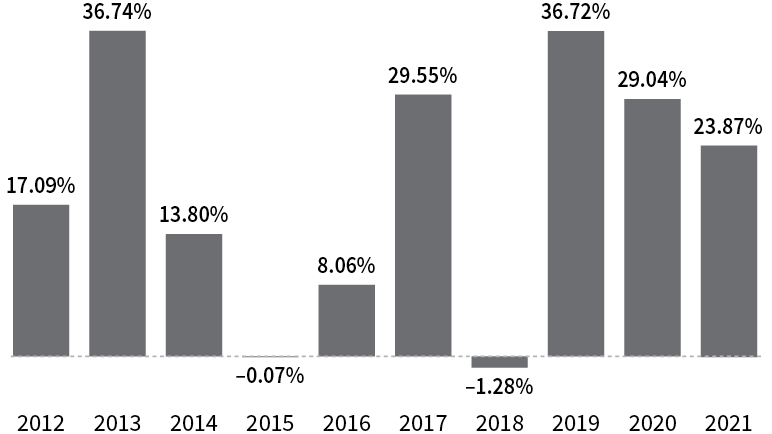

Performance

The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. Before April 30, 2018, the fund was managed with a materially different investment strategy and may have achieved materially different performance results under its current investment strategy from that shown for periods before this date. The performance information does not reflect insurance-related charges or expenses. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results.

Annual total returns for class IA shares

|

Year-to- date performance through 3/31/22 |

–9.49% |

|

Best calendar quarter Q2 2020 |

24.12% |

|

Worst calendar quarter Q1 2020 |

–16.05% |

Average annual total returns

(for periods ended 12/31/21)

| Share class | 1 year | 5 years | 10 years |

| Class IA | 23.87% | 22.82% | 18.58% |

| Class IB | 23.56% | 22.51% | 18.29% |

| S&P 500® Index (no deduction for fees, expenses or taxes) |

28.71% | 18.47% | 16.55% |

| Putnam VT Sustainable Leaders Linked Benchmark (no deduction for fees, expenses or taxes) |

28.71% | 21.40% | 17.87% |

| The Putnam VT Sustainable Leaders Linked Benchmark represents the performance of the Russell 3000® Growth Index through August 31, 2019, and the performance of the S&P 500® Index thereafter. |

| * | Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell ® is a trademark of Frank Russell Company. |

Your fund’s management

Investment advisor

Putnam Investment Management, LLC

Portfolio managers

Katherine Collins, Head of Sustainable Investing, portfolio manager of the fund since 2018

Stephanie Dobson, Portfolio Manager, portfolio manager of the fund since 2018

Sub-advisor

Putnam Investments Limited*

| * | Though the investment advisor has retained the services of Putnam Investments Limited (PIL), PIL does not currently manage any assets of the fund. |

Purchase and sale of fund shares

Fund shares are offered to separate accounts of various insurers. The fund requires no minimum investment, but insurers may require minimum investments from those purchasing variable insurance products for which the fund is an underlying investment option. Insurers may purchase or sell shares on behalf of separate accounts by submitting an order to Putnam Retail Management any day the New York Stock Exchange (NYSE) is open. Some restrictions may apply.

Tax information

Generally, owners of variable insurance contracts are not taxed currently on income or gains realized with respect to such contracts. However, some distributions from such contracts may be taxable at ordinary income tax rates and distributions to contract owners younger than 59½ may be subject to a 10% penalty tax. For more information, please see the prospectus (or other offering document) for your variable insurance contract.

Payments to insurance companies

The fund is offered as an underlying investment option for variable insurance contracts. The fund and its related companies may make payments to the sponsoring insurance company (or its affiliates) and dealers for distribution and/or other services. These payments may create an incentive for the insurance company to include the fund, rather than another investment, as an option in its products and may create a conflict of interest for dealers in recommending the fund over another investment. The prospectus (or other offering document) for your variable insurance contract may contain additional information about these payments.

Information about the Summary Prospectus, Prospectus, and SAI

The summary prospectus, prospectus, and SAI for a fund provide information concerning the fund. The summary prospectus, prospectus, and SAI are updated at least annually and any information provided in a summary prospectus, prospectus, or SAI can be changed without a shareholder vote unless specifically stated otherwise. The summary prospectus, prospectus, and the SAI are not contracts between the fund and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Additional information is available at putnam.com/individual/annuities, by calling 1-800-225-1581, or by e-mailing Putnam at [email protected].

| Summary prospectus of the Trust 3 |

File No. 811-05346 VTBP013 328636 4/22

| 4 Summary prospectus of the Trust |

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Putnam InvestmentsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share