Form 497K PUTNAM VARIABLE TRUST

Summary prospectus

4 |30 |22

| FUND SYMBOLS | CLASS IA | CLASS IB |

| — | — |

Putnam VT Government Money Market Fund

Before you invest, you may wish to review the fund’s prospectus, which contains more information about the fund and its risks. You may obtain the prospectus and other information about the fund, including the statement of additional information (SAI) and most recent reports to shareholders, at no cost by visiting putnam.com/individual/annuities, calling 1-800-225-1581, or e-mailing Putnam at [email protected].

The fund’s prospectus and SAI, both dated 4/30/22, are incorporated by reference into this summary prospectus.

Fund summary

Goal

Putnam VT Government Money Market Fund seeks as high a rate of current income as Putnam Investment Management, LLC believes is consistent with preservation of capital and maintenance of liquidity.

Fees and expenses

The following table describes the fees and expenses you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. The fees and expenses information does not reflect insurance-related charges or expenses borne by contract holders indirectly investing in the fund. If it did, expenses would be higher.

Annual fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

| Share class | Management fees | Distribution and service (12b-1) fees |

Other expenses |

Total annual fund operating expenses |

| Class IA | 0.27% | N/A | 0.17% | 0.44% |

| Class IB | 0.27% | 0.25% | 0.17% | 0.69% |

Example

The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. The example does not reflect insurance-related charges or expenses. If it did, expenses would be higher. It assumes that you invest $10,000 in the fund for the time periods indicated and then redeem or hold all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower.

| Share class | 1 year | 3 years | 5 years | 10 years |

| Class IA | $45 | $141 | $246 | $555 |

| Class IB | $70 | $221 | $384 | $859 |

Investments, risks, and performance

Investments

We invest at least 99.5 percent of the fund’s total assets in cash, U.S. government securities and repurchase agreements that are fully collateralized by U.S. government securities or cash. We invest mainly in debt securities that are obligations of the U.S. government, its agencies and instrumentalities and accordingly are backed by the full faith and credit of the United States (e.g., U.S. Treasury bills) or by the credit of a federal agency or government-sponsored entity (e.g., securities issued by Fannie Mae and Freddie Mac). The U.S. government securities in which we invest may also include variable and floating rate instruments and when-issued and delayed delivery securities (i.e., payment or delivery of the securities occurs at a future date for a predetermined price). Under normal circumstances, we invest at least 80% of the fund’s net assets in U.S. government securities and repurchase agreements that are fully collateralized by U.S. government securities. This policy may be changed only after 60 days’ notice to shareholders. The securities purchased by the fund are subject to quality, maturity, diversification and other requirements pursuant to rules promulgated by the SEC. We may consider, among other factors, credit and interest rate risks and characteristics of the issuer or counterparty, as well as general market conditions, when deciding whether to buy or sell investments.

Risks

The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions, investor sentiment and market perceptions, government actions, geopolitical events or changes, and factors related to a specific issuer, geography, industry or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. The novel coronavirus (COVID-19) pandemic and efforts to contain its spread are likely to negatively affect the value, volatility, and liquidity of the securities and other assets in which the fund invests and exacerbate other risks that apply to the fund. These effects could negatively impact the fund’s performance and lead to losses on your investment in the fund.

The values of money market investments usually rise and fall in response to changes in interest rates. Interest rate risk is generally lowest for investments with short maturities (a significant part of the fund’s investments). Changes in the financial condition of an issuer

| Summary prospectus of the Trust 1 |

or counterparty, changes in specific economic or political conditions that affect a particular type of issuer, and changes in general economic or political conditions can increase the risk of default by an issuer or counterparty, which can affect a security’s or instrument’s credit quality or value. Certain securities in which the fund may invest, including securities issued by certain U.S. government agencies and U.S. government sponsored enterprises, are not guaranteed by the U.S. government or supported by the full faith and credit of the United States.

There is no guarantee that the investment techniques, analyses, or judgments that we apply in making investment decisions for the fund will produce the intended outcome or that the investments we select for the fund will perform as well as other securities that were not selected for the fund. We, or the fund’s other service providers, may experience disruptions or operating errors that could negatively impact the fund.

The fund may not achieve its goal, and is not intended to be a complete investment program. You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Performance

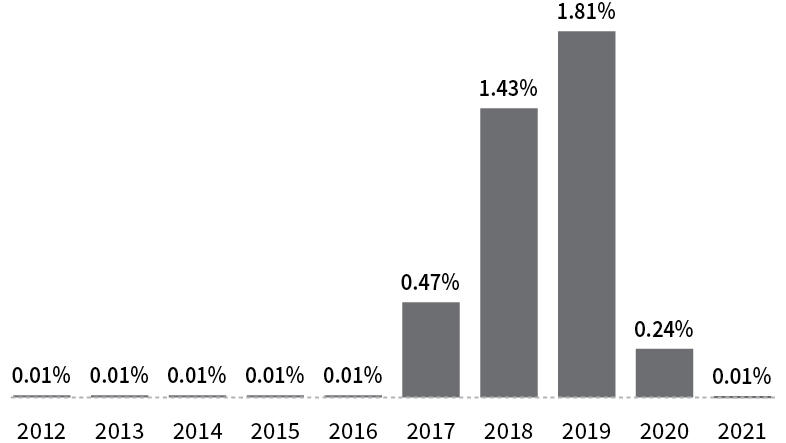

The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. Before April 30, 2016, the fund was managed with a materially different investment strategy (which allowed the fund to invest in a broader range of money market instruments) and may have achieved materially different performance results under its current strategy from that shown for periods before this date. The performance information does not reflect insurance-related charges or expenses. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results.

Annual total returns for class IA shares

|

Year-to- date performance through 3/31/22 |

0.00% |

|

Best calendar quarter Q2 2019 |

0.51% |

|

Worst calendar quarter Q4 2021 |

0.00% |

Average annual total returns

(for periods ended 12/31/21)

| Share class | 1 year | 5 years | 10 years |

| Class IA | 0.01% | 0.79% | 0.40% |

| Class IB | 0.01% | 0.63% | 0.32% |

Your fund’s management

Investment advisor

Putnam Investment Management, LLC

Sub-advisor

Putnam Investments Limited*

| * | Though the investment advisor has retained the services of Putnam Investments Limited (PIL), PIL does not currently manage any assets of the fund. |

Purchase and sale of fund shares

Fund shares are offered to separate accounts of various insurers. The fund requires no minimum investment, but insurers may require minimum investments from those purchasing variable insurance products for which the fund is an underlying investment option. Insurers may purchase or sell shares on behalf of separate accounts by submitting an order to Putnam Retail Management any day the New York Stock Exchange (NYSE) is open. Some restrictions may apply.

Tax information

Generally, owners of variable insurance contracts are not taxed currently on income or gains realized with respect to such contracts. However, some distributions from such contracts may be taxable at ordinary income tax rates and distributions to contract owners younger than 59½ may be subject to a 10% penalty tax. For more information, please see the prospectus (or other offering document) for your variable insurance contract.

Payments to insurance companies

The fund is offered as an underlying investment option for variable insurance contracts. The fund and its related companies may make payments to the sponsoring insurance company (or its affiliates) and dealers for distribution and/or other services. These payments may create an incentive for the insurance company to include the fund, rather than another investment, as an option in its products and may create a conflict of interest for dealers in recommending the fund over another investment. The prospectus (or other offering document) for your variable insurance contract may contain additional information about these payments.

Information about the Summary Prospectus, Prospectus, and SAI

The summary prospectus, prospectus, and SAI for a fund provide information concerning the fund. The summary prospectus, prospectus, and SAI are updated at least annually and any information provided in a summary prospectus, prospectus, or SAI can be changed without a shareholder vote unless specifically stated otherwise. The summary prospectus, prospectus, and the SAI are not contracts between the fund and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Additional information is available at putnam.com/individual/annuities, by calling 1-800-225-1581, or by e-mailing Putnam at [email protected].

File No. 811-05346 VTBP039 328623 4/22

| 2 Summary prospectus of the Trust |

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Putnam InvestmentsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share