Form 497K PUTNAM MASSACHUSETTS

Putnam

Massachusetts Tax Exempt Income Fund

Summary prospectus

9 | 30 | 22

| FUND SYMBOLS | CLASS A | CLASS B | CLASS C | CLASS R6 | CLASS Y |

| PXMAX | PMABX | PMMCX | PMATX | PMAYX |

Putnam Massachusetts Tax Exempt Income Fund

Before you invest, you may wish to review the fund’s prospectus, which contains more information about the fund and its risks. You may obtain the prospectus and other information about the fund, including the statement of additional information (SAI) and most recent reports to shareholders, at no cost by visiting putnam.com/funddocuments, calling 1-800-225-1581, or e-mailing Putnam at [email protected].

The fund’s prospectus and SAI, both dated 9/30/22, are incorporated by reference into this summary prospectus.

Goal

Putnam Massachusetts Tax Exempt Income Fund seeks as high a level of current income exempt from federal income tax and Massachusetts personal income tax as we believe is consistent with preservation of capital.

Fees and expenses

The following tables describe the fees and expenses you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in class A shares of Putnam funds. More information about these and other discounts is available from your financial professional and in How do I buy fund shares? beginning on page 35 of the fund’s prospectus, in the Appendix to the fund’s prospectus, and in How to buy shares beginning on page II-1 of the fund’s statement of additional information (SAI).

Shareholder fees (fees paid directly from your investment)

| Share class | Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

| Class A | 4.00% | 1.00%* |

| Class B | NONE | 5.00%** |

| Class C | NONE | 1.00%*** |

| Class R6 | NONE | NONE |

| Class Y | NONE | NONE |

| 2 |

Annual fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

| Share class | Management fees | Distribution and service (12b-1) fees | Other expenses |

Total annual fund operating expenses |

| Class A | 0.42% | 0.25% | 0.12% | 0.79% |

| Class B | 0.42% | 0.85% | 0.12% | 1.39% |

| Class C | 0.42% | 1.00% | 0.12% | 1.54% |

| Class R6 | 0.42% | N/A | 0.11% | 0.53% |

| Class Y | 0.42% | N/A | 0.12% | 0.54% |

| * | Applies only to certain redemptions of shares bought with no initial sales charge. |

| ** | This charge is phased out over six years. |

| *** | This charge is eliminated after one year. |

Example

The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower.

| Share class | 1 year | 3 years | 5 years | 10 years |

| Class A | $477 | $642 | $821 | $1,339 |

| Class B | $642 | $740 | $961 | $1,505 |

| Class B (no redemption) | $142 | $440 | $761 | $1,505 |

| Class C | $257 | $486 | $839 | $1,632 |

| Class C (no redemption) | $157 | $486 | $839 | $1,632 |

| Class R6 | $54 | $170 | $296 | $665 |

| Class Y | $55 | $173 | $302 | $677 |

Portfolio turnover

The fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund performance. The fund’s turnover rate in the most recent fiscal year was 16%.

Investments, risks, and performance

Investments

We invest mainly in bonds that pay interest that is exempt from federal income tax and Massachusetts personal income tax (but that may be subject to federal alternative minimum tax (AMT)), are investment-grade in quality, and have intermediate- to long-term maturities (i.e., three years or longer). Under normal

| 3 |

circumstances, we invest at least 80% of the fund’s net assets in tax-exempt investments. Tax-exempt investments are issued by or for states, territories or possessions of the United States or by their political subdivisions, agencies, authorities or other government entities, and the income from these investments is exempt from both federal and Massachusetts personal income tax. This investment policy cannot be changed without the approval of the fund’s shareholders. We may consider, among other factors, credit, interest rate and prepayment risks, as well as general market conditions, when deciding whether to buy or sell investments.

Risks

It is important to understand that you can lose money by investing in the fund.

The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions, investor sentiment and market perceptions, government actions, geopolitical events or changes, and factors related to a specific issuer, geography, industry or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. The novel coronavirus (COVID-19) pandemic and efforts to contain its spread are likely to negatively affect the value, volatility, and liquidity of the securities and other assets in which the fund invests and exacerbate other risks that apply to the fund. These effects could negatively impact the fund’s performance and lead to losses on your investment in the fund.

The risks associated with bond investments include interest rate risk, which is the risk that the value of the fund’s investments is likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuers of the fund’s investments may default on payment of interest or principal. Bond investments may be more susceptible to downgrades or defaults during economic downturns or other periods of economic stress. Interest rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which can be more sensitive to changes in markets, credit conditions, and interest rates, and may be considered speculative. Since the fund invests in tax-exempt bonds, which, to be treated as tax-exempt under the Internal Revenue Code, may be issued only by limited types of issuers for limited types of projects, the fund’s investments may be focused in certain market segments. Consequently, the fund may be more vulnerable to fluctuations in the values of the securities it holds than a fund that invests more broadly. The fund’s performance will be closely tied to the economic and political conditions in Massachusetts, and can be more volatile than the performance of a more geographically diversified fund. To the extent the fund invests in securities of issuers located outside of Massachusetts, the fund may also be exposed to the risks affecting other states. Interest the fund receives might be taxable.

There is no guarantee that the investment techniques, analyses, or judgments that we apply in making investment decisions for the fund will produce the intended outcome or that the investments we select for the fund will perform as well as other securities that were not selected for the fund. We, or the fund’s other service providers, may experience disruptions or operating errors that could negatively impact the fund.

| 4 |

The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

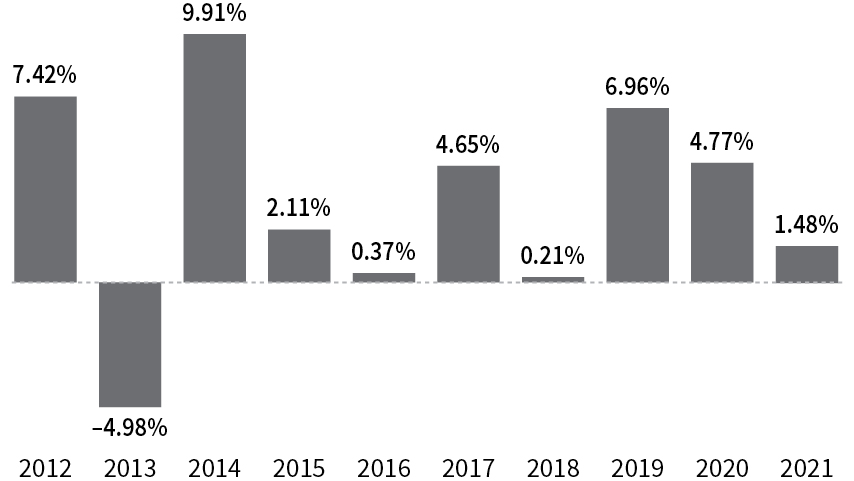

Performance

The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. The bar chart does not reflect the impact of sales charges. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the fund are available at putnam.com.

Annual total returns for class A shares before sales charges

|

Year-to-date performance through 6/30/22 |

–10.28% |

|

Best calendar quarter Q1 2014 |

3.46% |

|

Worst calendar quarter Q2 2013 |

–3.65% |

Average annual total returns after sales charges (for periods ended 12/31/21)

| Share class | 1 year | 5 years | 10 years |

| Class A before taxes | –2.58% | 2.74% | 2.79% |

| Class A after taxes on distributions | –2.59% | 2.72% | 2.76% |

| Class A after taxes on distributions and sale of fund shares | –0.85% | 2.65% | 2.76% |

| Class B before taxes | –4.20% | 2.60% | 2.69% |

| Class C before taxes | –0.27% | 2.81% | 2.57% |

| Class R6 before taxes* | 1.73% | 3.85% | 3.44% |

| Class Y before taxes | 1.73% | 3.84% | 3.44% |

| Bloomberg Municipal Bond Index† (no deduction for fees, expenses or taxes) | 1.52% | 4.17% | 3.72% |

| * | Performance for class R6 shares prior to their inception (5/22/18) is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R6 shares; had it, returns would have been higher. |

| † | Source: Bloomberg Index Services Limited. |

| BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors, own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

| 5 |

| After-tax returns reflect the historical highest individual federal marginal income tax rates and do not reflect state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown for class A shares only and will vary for other classes. These after-tax returns do not apply if you hold your fund shares through a 401(k) plan, an IRA, or another tax-advantaged arrangement. |

| Class B and C share performance reflects conversion to class A shares after eight years. |

Your fund’s management

Investment advisor

Putnam Investment Management, LLC

Portfolio managers

Paul

Drury

Portfolio Manager, portfolio manager

of the fund since 2002

Garrett

Hamilton

Portfolio Manager, portfolio manager

of the fund since 2016

Sub-advisor

Putnam Investments Limited*

| * | Though the investment advisor has retained the services of Putnam Investments Limited (PIL), PIL does not currently manage any assets of the fund. |

Purchase and sale of fund shares

You can open an account, purchase and/or sell fund shares, or exchange them for shares of another Putnam fund by contacting your financial professional or by calling Putnam Investor Services at 1-800-225-1581. Purchases of class B shares are closed to new and existing investors except by exchange from class B shares of another Putnam fund or through dividend and/or capital gains reinvestment.

When opening an account, you must complete and mail a Putnam account application, along with a check made payable to the fund, to: Putnam Investments, P.O. Box 219697, Kansas City, MO 64121-9697. The minimum initial investment of $500 is currently waived, although Putnam reserves the right to reject initial investments under $500 at its discretion. There is no minimum for subsequent investments.

You can sell your shares back to the fund or exchange them for shares of another Putnam fund any day the New York Stock Exchange (NYSE) is open. Shares may be sold or exchanged by mail, by phone, or, for exchanges only, online at putnam.com. Some restrictions may apply.

Tax information

The fund intends to distribute income that is exempt from federal income tax and personal income tax of the state identified in the fund’s name, but distributions will be subject to federal income tax to the extent attributable to other income, including income earned by the fund on investments in taxable securities or capital gains realized on the disposition of its investments.

| 6 |

Financial intermediary compensation

If you purchase the fund through a broker/dealer or other financial intermediary (such as a bank or financial professional), the fund and its related companies may pay that intermediary for the sale of fund shares and related services. Please bear in mind that these payments may create a conflict of interest by influencing the broker/dealer or other intermediary to recommend the fund over another investment. Ask your advisor or visit your advisor’s website for more information.

Information about the Summary Prospectus, Prospectus, and SAI

The summary prospectus, prospectus, and SAI for a fund provide information concerning the fund. The summary prospectus, prospectus, and SAI are updated at least annually and any information provided in a summary prospectus, prospectus, or SAI can be changed without a shareholder vote unless specifically stated otherwise. The summary prospectus, prospectus, and the SAI are not contracts between the fund and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Additional information, including current performance, is available at putnam.com/funddocuments, by calling 1-800-225-1581, or by e-mailing Putnam at [email protected].

| 7 |

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Putnam InvestmentsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share