Form 497K PROSHARES TRUST

SUMMARY PROSPECTUS

October 1, 2021

|

Investment Grade — Interest Rate

Hedged

|

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a Fund’s annual and semiannual

shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports

will be made available on the Trust’s website (www.proshares.com), and you will be notified by mail each time a report is posted and provided with a

website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need

not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your

financial intermediary (such as your brokerage firm).

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to request

that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in

your account that you invest in through your financial intermediary.

This Summary Prospectus is designed to provide investors with key fund information in a clear and concise format. Before you

invest, you may want to review the Fund’s Full Prospectus, which contains more information about the Fund and its risks. The Fund’s Full Prospectus,

dated October 1, 2021, and Statement of Additional Information, dated October 1, 2021, and as each hereafter may be supplemented, are incorporated by reference into this Summary Prospectus. All of this information may be obtained at no cost either: online at ProShares.com/resources/prospectus_reports.html; by calling 866-PRO-5125 (866-776-5125); or by sending an email request to [email protected]. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus.

Any representation to the contrary is a criminal offense.

IGHG LISTED ON CBOE BZX U.S. EQUITIES EXCHANGE

Receive investor materials electronically:

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster

and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

1.

Go to www.icsdelivery.com

2.

Select the first letter of your brokerage firm’s name.

3.

From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not

be available. Please contact your brokerage firm.

4.

Complete the information requested, including the e-mail address where you would like to receive notifications for electronic

documents.

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change

your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to www.icsdelivery.com, perform

the first three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

PROSHARES.COM

Investment Grade — Interest Rate Hedged :: 3

Investment Grade — Interest Rate Hedged :: 3|

|

|

Investment Objective

ProShares Investment Grade — Interest Rate Hedged (the “Fund”) seeks investment results, before fees and expenses, that track the performance of the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index (the “Index”).

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage

of the value of your investment)

|

|

|

Management Fees

|

0.30%

|

|

Other Expenses

|

0.00%

|

|

Total Annual Fund Operating Expenses

|

0.30%

|

Example: This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of each period. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your approximate costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$31

|

$97

|

$169

|

$381

|

The Fund pays transaction and financing costs associated with the purchase and sale of securities and derivatives. These costs are not reflected in the table or the example above.

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the Fund’s shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the example above, affect the Fund’s performance. During the most recent fiscal year, the Fund’s annual portfolio turnover rate was 22% of the average value of its entire portfolio. This portfolio turnover rate is calculated without regard to cash instruments or derivatives transactions. If such transactions were included, the Fund’s portfolio turnover rate would be significantly higher.

Principal Investment Strategies

The Fund invests in financial instruments that ProShare Advisors believes, in combination, should track the performance of the Index.

The Index is comprised of (a) long positions in USD-denominated investment grade corporate bonds issued by both U.S. and foreign domiciled companies; and (b) short positions in U.S. Treasury notes or bonds (“Treasury Securities”) of, in aggregate, approximate equivalent duration to the investment grade bonds. The Index is constructed and maintained by FTSE International Limited. By taking short Treasury Security positions the Index seeks to mitigate the negative impact of rising Treasury interest rates (“interest rates”) on the performance of investment grade bonds (conversely limiting the positive impact of falling interest rates). The short positions are not intended to mitigate other factors influencing the price of investment grade bonds, such as credit risk, which may have a greater impact than rising or falling interest rates. The long investment grade bond positions included in the Index are designed to represent the more liquid universe of investment grade bonds offered within the United States.

Currently, the bonds eligible for inclusion in the Index include all investment grade bonds that are issued by U.S. and internationally domiciled companies that: are fixed rate; have a minimum rating of Baa3/BBB- by both Moody’s Investors Service, Inc. (“Moody’s”) and Standard and Poor’s Financial Services, LLC (“S&P”); have a minimum face amount outstanding of $1 billion; and have at least five and a half (5.5) years until maturity. The Index is reconstituted and rebalanced (including a reset of the interest rate hedge) on a monthly basis.

Relative to a long-only investment in the same investment grade bonds, the Index may outperform in a rising interest rate environment and underperform in a falling or static interest rate environment. Performance of the Index could be particularly poor if investment grade credit deteriorates at the same time that Treasury interest rates fall. In addition, the performance of the Index, and by extension the Fund, depends on many factors beyond rising or falling interest rates, such as the perceived level of credit risk in the investment grade bond positions. These factors may be as or more important to the performance of the Index than the impact of interest rates. As such, there is no guarantee that the Index, and accordingly, the Fund, will have positive performance even in environments of sharply rising interest rates in which the short positions might be expected to mitigate the effect of such rises. The Index is published under the Bloomberg ticker symbol “CFIIIGHG.”

Under normal circumstances, the Fund will invest at least 80% of its total assets in component securities (i.e., securities of the Index) and invest at least 80% of its total assets in investment grade bonds.

The Fund will invest principally in the financial instruments set forth below. The Fund expects that its cash balances maintained in connection with the use of financial instruments will typically be held in money market instruments.

•Debt Instruments — The Fund invests in debt instruments, primarily investment grade bonds, that are issued by corporate issuers that are rated “investment-grade” by both

4 :: Investment Grade — Interest Rate Hedged

PROSHARES.COM

Moody’s and S&P. Credit rating agencies evaluate issuers and assign ratings based on their opinions of the issuer’s ability to pay interest and principal as scheduled. The bonds invested in by the Fund may include USD-denominated bonds issued by foreign-domiciled companies that are offered for sale in the United States.

•Derivatives — The Fund invests in derivatives, which are financial instruments whose value is derived from the value of an underlying asset or assets, such as stocks, bonds, funds (including exchange-traded funds (“ETFs”)), interest rates or indexes. The Fund primarily invests in derivatives as a substitute for obtaining short exposure in Treasury Securities but may also do so to a limited extent to obtain investment grade bond exposure. These derivatives principally include:

○Futures Contracts — Standardized contracts traded on, or subject to the rules of, an exchange that call for the future delivery of a specified quantity and type of asset at a specified time and place or, alternatively, may call for cash settlement. The Fund will use futures contracts to obtain short exposure to U.S. Treasury Securities.

ProShare Advisors uses a mathematical approach to investing. Using this approach, ProShare Advisors determines the type, quantity and mix of investment positions that it believes, in combination, the Fund should hold to produce returns consistent with the Fund’s investment objective. The Fund may invest in or gain exposure to only a representative sample of the securities in the Index or to securities not contained in the Index or in financial instruments, with the intent of obtaining exposure with aggregate characteristics similar to those of the Index. In managing the assets of the Fund, ProShare Advisors does not invest the assets of the Fund in securities or financial instruments based on ProShare Advisors’ view of the investment merit of a particular security, instrument, or company, nor does it conduct conventional investment research or analysis or forecast market movement or trends. The Fund seeks to remain fully invested at all times in securities and/or financial instruments that, in combination, provide exposure to the returns of the Index without regard to market conditions, trends or direction. In seeking to match the general credit profile of the Index, ProShare Advisors will rely solely on credit ratings provided by Moody’s and S&P. To the extent the Fund is overweight in a security that is perceived by the markets to have increased credit risk, the Fund’s performance will be adversely affected.

The Fund will concentrate (i.e., invest in securities that represent 25 percent or more of the value of the Index) or focus (i.e., invest in securities that represent a substantial portion of its value, but less than 25 percent) its investments in a particular industry or group of industries to approximately the same extent the Index is so concentrated or focused. As of May 31, 2021, the Index’s long exposure was concentrated in the financials and industrials industry groups.

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

Principal Risks

You could lose money by investing in the Fund.

The principal risks described below are intended to provide information about the factors likely to have a significant adverse impact on the Fund’s returns and consequently the value of an investment in the Fund. The risks are presented in an order intended to facilitate readability and their order does not imply that the realization of one risk is more likely to occur than another risk or likely to have a greater adverse impact than another risk.

•Risks Associated with the Use of Derivatives — Investing in derivatives may be considered aggressive and may expose the Fund to greater risks and may result in larger losses or smaller gains than investing directly in the reference asset(s) underlying those derivatives. These risks include counterparty risk, liquidity risk and increased correlation risk. When the Fund uses derivatives, there may be imperfect correlation between the value of the reference asset(s) underlying the derivative (e.g., the Index) and the derivative, which may prevent the Fund from achieving its investment objective. Because derivatives often require only a limited initial investment, the use of derivatives also may expose the Fund to losses in excess of those amounts initially invested. Any costs associated with using derivatives will also have the effect of lowering the Fund’s return.

•Correlation Risk — A number of factors may affect the Fund’s ability to achieve a high degree of correlation with the Index, and there is no guarantee that the Fund will achieve a high degree of correlation. Failure to achieve a high degree of correlation may prevent the Fund from achieving its investment objective. This may be due, in many cases, to the impact of a limited trading market in the component bonds on the calculation of the Index.

Factors that may adversely affect the Fund’s correlation with the Index include fees, expenses, transaction costs, income items, valuation methodology, accounting standards and disruptions or illiquidity in the markets for the financial instruments in which the Fund invests. The Fund may not have investment exposure to all of the securities in the Index, or its weighting of investment exposure to securities may be different from that of the Index. In addition, the Fund may invest in securities not included in the Index. The Fund may take or refrain from taking positions in order to improve tax efficiency, comply with regulatory restrictions, or for other reasons, each of which may negatively affect the Fund’s correlation with the Index. The Fund may also be subject to large movements of assets into and out of the Fund, potentially resulting in the Fund being over- or underexposed to the Index and may be impacted by

PROSHARES.COM

Investment Grade — Interest Rate Hedged :: 5

Investment Grade — Interest Rate Hedged :: 5Index reconstitutions and Index rebalancing events. Additionally, the Fund’s underlying investments may trade on markets that may not be open on the same day as the Fund, which may cause a difference between the change in the performance of the Fund and change in the level of the Index on such day. Any of these factors could decrease correlation between the performance of the Fund and the Index and may hinder the Fund’s ability to meet its investment objective.

•Counterparty Risk — Investing in derivatives and repurchase agreements involves entering into contracts with third parties (i.e., counterparties). The use of derivatives and repurchase agreements involves risks that are different from those associated with ordinary portfolio securities transactions. The Fund will be subject to credit risk (i.e., the risk that a counterparty is or is perceived to be unwilling or unable to make timely payments or otherwise meet its contractual obligations) with respect to the amount it expects to receive from counterparties to derivatives and repurchase agreements entered into by the Fund. If a counterparty becomes bankrupt or fails to perform its obligations, or if any collateral posted by the counterparty for the benefit of the Fund is insufficient or there are delays in the Fund’s ability to access such collateral, the value of an investment in the Fund may decline.

The counterparty to a listed futures contract is the clearing organization for the listed future, which is held through a futures commission merchant (“FCM”) acting on behalf of the Fund. Consequently, the counterparty risk on a listed futures contract is the creditworthiness of the FCM and the exchange’s clearing corporation.

•Short Sale Exposure Risk — The Fund may seek “short” exposure through financial instruments, which would cause the Fund to be exposed to certain risks associated with selling short. These risks include, under certain market conditions, an increase in the volatility and decrease in the liquidity of the instruments underlying the short position, which may lower the Fund’s return, result in a loss, have the effect of limiting the Fund’s ability to obtain short exposure through financial instruments, or require the Fund to seek short exposure through alternative investment strategies that may be less desirable or more costly to implement. To the extent that, at any particular point in time, the financial instruments underlying the short position may be thinly traded or have a limited market, including due to regulatory action, the Fund may be unable to meet its investment objective due to a lack of available financial instruments or counterparties. During such periods, the Fund’s ability to issue additional Creation Units may be adversely affected. Obtaining short exposure through these instruments may be considered an aggressive investment technique. Any income, dividends or payments by the assets underlying the Fund’s short positions will negatively impact the Fund.

•Long/Short Risk — The Fund seeks long exposure to certain factors and short exposure to certain other factors. There is no guarantee that the returns on the Fund’s long or short positions will produce positive returns and the Fund could lose money if either or both the Fund’s long and short positions produce negative returns.

•Debt Instrument Risk — Debt instruments are subject to adverse issuer, political, regulatory, market and economic developments, as well as developments that affect specific economic sectors, industries or segments of the market. Debt markets can be volatile and the value of instruments correlated with these markets may fluctuate dramatically from day to day. In a low or negative interest rate environment, debt instruments may trade at negative yields, which means the purchaser of the instrument may receive at maturity less than the total amount invested. Negative or very low interest rates could magnify the risks associated with changes in interest rates. In general, changing interest rates, including rates that fall below zero, could have unpredictable effects on markets and may expose fixed-income and related markets to heightened volatility. Debt instruments in the Index may underperform other debt instruments that track other markets, segments and sectors.

•Credit Risk — Due to its exposure to debt instruments, the Fund will be subject to credit risk which is the risk that an issuer of debt instruments is unwilling or unable to make timely payments to meet its contractual obligations. When credit risk increases, the price of the debt instruments that comprise the Index will typically decrease. Conversely, when credit risk of the debt instruments decreases, the level of the Index will typically increase. By using sampling techniques, the Fund may be overexposed to certain debt instruments that would adversely affect the Fund upon the markets’ perceived view of increased credit risk or upon a downgrade or default of such instruments. During an economic downturn, rates of default tend to increase. The hedging methodology of the Index does not seek to mitigate credit risk.

•Interest Rate Risk — Interest rate risk is the risk that debt instruments or related financial instruments may fluctuate in value due to changes in interest rates. A wide variety of factors can cause interest rates to fluctuate (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). Commonly, investments subject to interest rate risk will decrease in value when interest rates rise and increase in value when interest rates decline. A rising interest rate environment may cause the value of debt instruments to decrease and adversely impact the liquidity of debt instruments. Without taking into account other factors, the value of securities with longer maturities typically fluctuates more in response to interest rate changes than securities with shorter maturities. These factors may cause the value of an investment in the Fund to change.

6 :: Investment Grade — Interest Rate Hedged

PROSHARES.COM

The Fund seeks to mitigate this risk by taking short positions in U.S. Treasury Securities; such short positions should increase in value in rising interest rate environments and should decrease in value in falling interest rate environments, thereby mitigating gains and losses in the Fund’s investment positions arising from changing Treasury interest rates. The Fund does not attempt to mitigate credit risk or other factors which may have a greater influence on its investments than interest rate risk. Such other factors may impact debt instrument prices in an opposite way than interest rates making it difficult to directly observe the impact of changes in interest rates on debt instruments. When interest rates fall, an unhedged investment in the same debt instrument will outperform the Fund. Because the duration hedge is reset on a monthly basis, interest rate risk can develop intra-month. Furthermore, while the Fund is designed to hedge the interest rate exposure of the long bond positions, it is possible that a degree of exposure may remain even at the time of rebalance.

•Prepayment Risk — Many types of debt instruments are subject to prepayment risk, which is the risk that the issuer of the security will repay principal (in part or in whole) prior to the maturity date. Debt instruments allowing prepayment may offer less potential for gains during a period of declining interest rates, as the proceeds may be reinvested at lower interest rates.

•Hedging Risk — The Index seeks to mitigate the potential negative impact of rising Treasury interest rates on the performance of investment grade bonds. The short positions in Treasury Securities are not intended to mitigate credit risk or other factors influencing the price of investment grade bonds, which may have a greater impact than rising or falling interest rates. There is no guarantee that the short positions will completely eliminate the interest rate risk of the long investment grade bond positions. The hedge cannot fully account for changes in the shape of the Treasury interest rate (yield) curve. Because the duration hedge is reset on a monthly basis, interest rate risk can develop intra-month that is not addressed by the hedge. The Fund could lose money if either or both the Fund’s long and short positions produce negative returns.

When interest rates fall, an unhedged investment in the same investment grade bonds will outperform the Fund. Performance of the Fund could be particularly poor if investment grade credit deteriorates at the same time that interest rates fall. Furthermore, when interest rates remain unchanged, an investment in the Fund will underperform a long-only investment in the same investment grade bonds due to the ongoing costs associated with short exposure to Treasury securities or other factors.

There is no guarantee the Fund will have positive returns, even in environments of sharply rising Treasury interest rates in which the Fund’s short positions might be expected to mitigate the effects of such rises.

•Foreign Investments Risk — Exposure to securities of foreign issuers may provide the Fund with increased risk. Various factors related to foreign investments may negatively impact the Fund’s and the Index’s performance, such as: i) fluctuations in the value of the applicable foreign currency; ii) differences in securities settlement practices; iii) uncertainty associated with evidence of ownership of investments in countries that lack centralized custodial services; iv) possible regulation of, or other limitations on, investments by U.S. investors in foreign investments; v) potentially higher brokerage commissions; vi) the possibility that a foreign government may withhold portions of interest and dividends at the source; vii) taxation of income earned in foreign countries or other foreign taxes imposed; viii) foreign exchange controls, which may include suspension of the ability to transfer currency from a foreign country; ix) less publicly available information about foreign issuers; x) changes in the denomination currency of a foreign investment; and xi) less certain legal systems in which the Fund may encounter difficulties or be unable to pursue legal remedies. Foreign investments also may be more susceptible to political, social, economic and regional factors than may be the case with U.S. securities. In addition, markets for foreign investments are usually less liquid, more volatile and significantly smaller than markets for U.S. securities, which may affect, among other things, the Fund’s ability to purchase or sell foreign investments at appropriate times and prices. Because of differences in settlement times and/or foreign market holidays, transactions in a foreign market may take place one or more days after the necessary exposure to these investments is determined. Until the transactions are effected, the Fund is exposed to increased foreign currency risk and market risk and, ultimately, increased correlation risk.

•Concentration and Focused Investing — The Index may concentrate (i.e., composed of securities that represent 25 percent or more of the value of the Index) or focus (i.e., composed of securities that represent a substantial portion of its value, but less than 25 percent) in an industry or group of industries. The Fund will allocate its investments to approximately the same extent as the Index. As a result, the Fund may be subject to greater market fluctuations than a fund that is more broadly invested across industries. Financial, economic, business, regulatory conditions, and other developments affecting issuers in a particular industry or group of industries will have a greater effect on the Fund, and if securities of the particular industry or group of industries fall out of favor, the Fund could underperform, or its net asset value may be more volatile than, funds that have greater industry diversification.

•Index Performance Risk — The Index is maintained by a third party provider unaffiliated with the Fund or ProShare Advisors. There can be no guarantee or assurance that the methodology used by the third party provider to create the Index will result in the Fund achieving positive returns. Further, there can be no guarantee that the methodology underlying

PROSHARES.COM

Investment Grade — Interest Rate Hedged :: 7

Investment Grade — Interest Rate Hedged :: 7the Index or the daily calculation of the Index will be free from error. For an Index with exposure to foreign, and especially emerging markets, there may be heightened risks associated with the adequacy and reliability of the information used to calculate the Index, because there might be less, incomplete or inaccurate information available about securities issuers in those markets due to different or less stringent market or accounting regulation or practices. ProShare Advisors has no ability to assess a third party provider’s due diligence process over index data prior to its use in index computation, construction and/or rebalancing. It is also possible that the value of the Index may be subject to intentional manipulation by third-party market participants. The Index used by the Fund may underperform other asset classes and may underperform other similar indices. Each of these factors could have a negative impact on the performance of the Fund.

•Market Price Variance Risk — Investors buy and sell Fund shares in the secondary market at market prices, which may be different from the NAV per share of the Fund (i.e., the secondary market price may trade at a price greater than NAV (a premium) or less than NAV (a discount)). The market price of the Fund’s shares will fluctuate in response to changes in the value of the Fund’s holdings, supply and demand for shares and other market factors. In addition, the instruments held by the Fund may be traded in markets on days and at times when the Fund’s listing exchange is closed for trading. As a result, the value of the Fund’s holdings may vary, perhaps significantly, on days and at times when investors are unable to purchase or sell Fund shares. ProShare Advisors cannot predict whether shares will trade above, below or at a price equal to the value of the Fund’s holdings.

•Early Close/Late Close/Trading Halt Risk — An exchange or market may close early, close late or issue trading halts on specific securities or financial instruments. As a result, the ability to trade certain securities or financial instruments may be restricted, which may disrupt the Fund’s creation and redemption process, potentially affect the price at which the Fund’s shares trade in the secondary market, and/or result in the Fund being unable to trade certain securities or financial instruments at all. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and/or may incur substantial trading losses. If trading in the Fund’s shares are halted, investors may be temporarily unable to trade shares of the Fund.

•Liquidity Risk — In certain circumstances, such as the disruption of the orderly markets for the financial instruments in which the Fund invests, the Fund might not be able to acquire or dispose of certain holdings quickly or at prices that represent true market value in the judgment of ProShare Advisors. Markets for the financial instruments in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, political crises, health crises, natural disasters, excessive volatil

ity, new legislation, or regulatory changes inside or outside of the U.S. For example, regulation limiting the ability of certain financial institutions to invest in certain financial instruments would likely reduce the liquidity of those instruments. These situations may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Index.

•Portfolio Turnover Risk — The Fund may incur high portfolio turnover to manage the Fund’s investment exposure. Additionally, active market trading of the Fund’s shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions. High levels of portfolio transactions increase brokerage and other transaction costs and may result in increased taxable capital gains. Each of these factors could have a negative impact on the performance of the Fund.

•Tax Risk — In order to qualify for the special tax treatment accorded a regulated investment company (“RIC”) and its shareholders, the Fund must derive at least 90% of its gross income for each taxable year from “qualifying income,” meet certain asset diversification tests at the end of each taxable quarter, and meet annual distribution requirements. The Fund’s pursuit of its investment strategies will potentially be limited by the Fund’s intention to qualify for such treatment and could adversely affect the Fund’s ability to so qualify. The Fund can make certain investments, the treatment of which for these purposes is unclear. If, in any year, the Fund were to fail to qualify for the special tax treatment accorded a RIC and its shareholders, and were ineligible to or were not to cure such failure, the Fund would be taxed in the same manner as an ordinary corporation subject to U.S. federal income tax on all its income at the fund level. The resulting taxes could substantially reduce the Fund’s net assets and the amount of income available for distribution. In addition, in order to requalify for taxation as a RIC, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest, and make certain distributions. Please see the Statement of Additional Information for more information.

•Valuation Risk — In certain circumstances (e.g., if ProShare Advisors believes market quotations do not accurately reflect the fair value of an investment, or a trading halt closes an exchange or market early), ProShare Advisors may, pursuant to procedures established by the Board of Trustees of the Fund, choose to determine a fair value price as the basis for determining the market value of such investment for such day. The fair value of an investment determined by ProShare Advisors may be different from other value determinations of the same investment. Portfolio investments that are valued using techniques other than market quotations, including “fair valued” investments, may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. In addition, there is no assurance that the Fund could sell a portfolio investment for the value

8 :: Investment Grade — Interest Rate Hedged

PROSHARES.COM

established for it at any time, and it is possible that the Fund would incur a loss because a portfolio investment is sold at a discount to its established value.

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

Investment Results

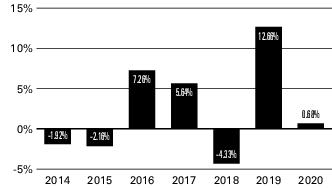

The bar chart below shows how the Fund’s investment results have varied from year to year, and the table shows how the Fund’s average annual total returns for various periods compare with a broad measure of market performance. This information provides some indication of the risks of investing in the Fund. Past results (before and after taxes) are not predictive of future results. Updated information on the Fund’s results can be obtained by visiting the Fund’s website (www.proshares.com).

Annual Returns as of December 31

|

Best Quarter

|

(ended

|

6/30/2020

|

):

|

9.55%

|

|

Worst Quarter

|

(ended

|

3/31/2020

|

):

|

-14.97%

|

|

Year-to-Date

|

(ended

|

6/30/2021

|

):

|

2.42%

|

Average Annual Total Returns

As of December 31, 2020

|

|

One

Year

|

Five

Years

|

Since

Inception

|

Inception

Date

|

|

Before Tax

|

0.68%

|

4.22%

|

2.70%

|

11/5/2013

|

|

After Taxes on

Distributions

|

-0.53%

|

2.71%

|

1.20%

|

—

|

|

After Taxes on

Distributions and Sale

of Shares

|

0.35%

|

2.56%

|

1.37%

|

—

|

|

FTSE Corporate

Investment Grade

(Treasury Rate-Hedged)

Index1

|

0.35%

|

4.29%

|

2.93%

|

—

|

1

Reflects no deduction for fees, expenses or taxes. Adjusted to reflect the reinvestment of income paid by issuers in the Index. “Since Inception” returns are calculated from the date the Fund commenced operations, not the date of inception of the Index.

Average annual total returns are shown on a before- and after-tax basis for the Fund. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold shares through tax-deferred arrangements, such as a retirement account. After-tax returns may exceed the return before taxes due to a tax benefit from realizing a capital loss on a sale of shares.

Management

The Fund is advised by ProShare Advisors. Alexander Ilyasov, Senior Portfolio Manager, and Benjamin McAbee, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and August 2016, respectively.

Purchase and Sale of Fund Shares

The Fund will issue and redeem shares only to Authorized Participants (typically broker-dealers) in exchange for the deposit or delivery of a basket of assets (securities and/or cash) in large blocks, known as Creation Units. Shares of the Fund may only be purchased and sold by retail investors in secondary market transactions through broker-dealers or other financial intermediaries. Shares of the Fund are listed for trading on a national securities exchange and because shares trade at market prices rather than NAV, shares of the Fund may trade at a price greater than NAV (premium) or less than NAV (discount). In addition to brokerage commissions, investors incur the costs of the difference between the highest price a buyer is willing to pay to purchase shares of the Funds (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (the “bid-ask spread”). The bid-ask spread varies over time for Fund shares based on trading volume and market liquidity. Recent information, including information about a Fund’s NAV, market price, premiums and discounts, and bid-ask spreads, is included on the Fund’s website (www.proshares.com).

Tax Information

Income and capital gains distributions you receive from the Fund generally are subject to federal income taxes and may also be subject to state and local taxes. The Fund intends to distribute income, if any, monthly, and capital gains, if any, at least annually. Distributions for this Fund may be higher than those of most ETFs.

This page intentionally left blank.

This page intentionally left blank.

Investment Company Act file number 811-21114

ProShares Trust

7272 Wisconsin Avenue, 21st Floor, Bethesda, MD 20814

866.PRO.5125 866.776.5125

ProShares.com

7272 Wisconsin Avenue, 21st Floor, Bethesda, MD 20814

866.PRO.5125 866.776.5125

ProShares.com

© 2021 ProShare Advisors LLC. All rights reserved.IGHG--OCT21

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Orion Group’s Facilities Maintenance Business Enters Lock, Door, Safe, and Access Control Market Through Partnership with Academy Locksmith

- Vext Announces Delay of Annual Filings and Postponement of Conference Call

- Futu Holdings Limited Announces Filing of Its Annual Report on Form 20-F for Fiscal Year 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share