Form 497K PROFESSIONALLY MANAGED

| Boston Common ESG Impact International Fund TICKER: BCAIX Summary Prospectus January 31, 2023 | |||||||

| 200 State Street, 7th Floor | Boston, MA 02109 | |||||||

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information, reports to shareholders and other information about the Fund online at http://www.bostoncommonfunds.com/internationalliterature.html. You may also obtain this information at no cost by calling (877) 777-6944 or by sending an email to compliance@bostoncommonasset.com. The Fund’s Prospectus and Statement of Additional Information, both dated January 31, 2023, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Boston Common ESG Impact International Fund (the “International Fund”) seeks long-term capital appreciation.

Fees and Expenses of the International Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the International Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment) | |||||

Redemption Fee (as a percentage of amount redeemed within 30 days of purchase) | 2.00% | ||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

| Management Fees | 0.80% | ||||

| Distribution and Service (12b-1) Fees | None | ||||

| Other Expenses | 0.17% | ||||

| Total Annual Fund Operating Expenses | 0.97% | ||||

| Fee Reduction and/or Expense Reimbursement | -0.11% | ||||

Total Annual Fund Operating Expenses After Fee Reduction and/or Expense Reimbursement(1) | 0.86% | ||||

(1) Effective March 2, 2022, the Adviser had contractually agreed to reduce its fees and/or pay International Fund expenses

(excluding acquired fund fees and expenses, interest expense in connection with investment activities, taxes, extraordinary

expenses, shareholder servicing fees and any other class specific expenses) in order to limit Total Annual Fund Operating

Expenses After Fee Reduction and/or Expense Reimbursement to 0.86% of the International Fund’s average daily net assets (the

“Expense Cap”). Prior to March 2, 2022, the International Fund’s Expense Cap was 1.20%. The Expense Cap is indefinite, but

will remain in effect until at least January 31, 2024 and may be terminated at any time by the Trust’s Board of Trustees (the

“Board”) upon 60 days’ notice to the Adviser, or by the Adviser with consent of the Board. The Adviser is permitted, with Board

approval, to be reimbursed for fee reductions and/or expense payments made in the prior three years. This reimbursement may be

requested if the aggregate amount actually paid by the International Fund toward operating expenses for such period (taking into

account any reimbursement) does not exceed the lesser of the Expense Cap in place at the time of waiver or at the time of

reimbursement.

1

Example

This Example is intended to help you compare the cost of investing in the International Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the International Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the International Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||||||

| $88 | $298 | $526 | $1,180 | ||||||||

Portfolio Turnover

The International Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when International Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the above example, affect the International Fund’s performance. During the most recent fiscal year ended September 30, 2021, the International Fund’s portfolio turnover rate was 22% of the average value of its portfolio.

Principal Investment Strategies

Boston Common Asset Management, LLC (“Boston Common” or the “Adviser”) seeks to preserve and build capital over the long-term through investing in a diversified portfolio of common stocks, American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”) and Global Depositary Receipts (“GDRs”) of companies we believe are high quality (lower debt/total capital, earnings stability and stable cash flow), sustainable and undervalued. We seek companies with sound governance and histories of responsible financial management that we believe are capable of consistent, visible profitability over a long time horizon. We look for indicators of quality in firms if they are experiencing superior growth and operating successfully in their respective economic sectors. We measure a firm’s growth by comparing its products or services or improving competitive conditions among its peers. We then determine whether any of the individual firms appear to be trading at discounts to their intrinsic value. Here our research-driven conviction is enhanced by our 360-degree perspective where we integrate financial and environmental, social, and governance (“ESG”) criteria into the stock selection process. We believe markets typically misvalue the risks and opportunities presented by ESG issues, both in terms of the timing and the magnitude of outcomes. We believe shareowner engagement plays a critically important role in raising the sustainability profile of our portfolios and empowers company management to be long-term in its focus.

2

Boston Common’s ESG research process integrates information from disparate sources to form a holistic understanding of corporate performance. The Adviser reviews company filings, trade journals, and industry reports to understand a company’s products and activities, and place it in context with its peers. We search business and news databases covering over 11,000 publications to capture events and analyses related to corporate practices. Boston Common references additional databases that document defense contracts, legal proceedings, and environmental violations, plus we subscribe to specialized ESG data services. The portfolio managers communicate regularly with trade unions, nongovernmental organizations, activist groups, and government agencies about corporate behavior on the ground and in the far reaches of the world. Boston Common queries corporate management through meetings, letter campaigns, emails, and phone calls about areas of particular concern. Drawing on this mosaic of sources, our analysts distill conclusions about a company’s overall profile across the full set of ESG issue areas. We may incorporate information from one or more third party ESG research providers, news sources, non-governmental organizations, and company and industry contacts. The Fund’s primary third party ESG research providers are MSCI ESG Ratings, MSCI ESG Metrics, MSCI ESG BISR Individual Screens, MSCI ESG Controversies, MSCI ESG BISR Global Sanctions, MSCI ESG Climate Change Metrics, ISS Climate Impact Reporting, Vigeo-Eiris, and Lexis-Nexis. We endeavor to integrate financial and sustainability factors into our investment process because we believe ESG research helps us identify companies that will be successful over the long-term. We evaluate companies on (E)nvironmental issues, looking for organizations that demonstrate a higher level of environmental responsibility than their peers and understand that natural resources are limited. We favor companies that conserve natural resources, reduce volume and toxicity of waste generated, and manage direct and indirect greenhouse gas emissions. We assess a company’s commitment to (S)ocial standards including human rights, animal welfare, workplace health and safety, and fair treatment of employees globally. We appraise companies’ adherence to best practices in (G)overnance, including policies favoring transparency and accountability to shareholders, and a commitment to diversity. As a result, we believe ESG research helps improve portfolio quality and financial return potential.

Boston Common’s principal belief is that companies with better ESG performance tend to serve as better long-term investments. Boston Common does not prioritize ESG impacts over returns and will not purchase a security for ESG purposes that has not met our financial criteria as it relates to an attractive balance of fundamentals and valuations.

The Fund’s ESG issue areas, which affect people and the planet include, but are not limited to, the following: environment, energy, human rights and employment, community, product purity and safety, governance, and labor and employment.

Boston Common selects stocks through bottom-up, fundamental research, while maintaining a disciplined approach to valuation and risk control. We may sell a security when its price reaches a set target if we believe that other investments are more attractive, or for other reasons we may determine.

Boston Common excludes securities of companies that: (1) receive significant revenues (>5%) or have leading market share in production and marketing of tobacco products, including components; (2) receive significant revenues (>5%) or have leading market share in production and marketing of alcoholic beverages, including components; (3) receive significant revenues (>5%) or have leading market share from gambling devices or activities including lotteries and hotels with casinos; (4) operate or have direct equity ownership of nuclear power plants, mine or process uranium for fuel supply crucial components of nuclear power reactors (zero tolerance); (5) receive significant revenues (>10%) from nuclear power plant design, construction, maintenance or parts; (6) demonstrate a history and pattern of marketing unsafe products, asserting false marketing claims, or engaging in irresponsible marketing; (7) engage in irresponsible animal testing or widespread abuses of animals, such as in entertainment and factory farming; (8) receive significant revenues (>5%) from the production of firearms or military weapons systems, including key components; (9) produce or manufacture biological, chemical, or nuclear weapons, anti-personnel landmines, or cluster munitions (zero tolerance); and (10) rank in the top 50 global defense contractors for weapons.

We use our voice as a shareowner to raise environmental, social, and governance issues with the management of select portfolio companies through a variety of channels. These may include engaging in dialogue with management, participating in shareholder proposal filings, voting proxies in accordance with our proxy voting guidelines, and participating in the annual shareholder meeting process. Through this effort, we seek to encourage a company’s management toward greater transparency, accountability, disclosure and commitment to ESG issues. In order to prioritize the Adviser’s focus and impact, Boston Common has established a three-year engagement framework with two to three key initiatives across our three sustainability pillars -environmental, social and governance. Boston Common continues to review these initiatives on an annual basis and track engagement impact through our reporting.

3

Boston Common reviews ESG-related impacts by actively encouraging shareholders to participate in proxy voting. Boston Common reviews its custom proxy voting policy prior to the proxy season to ensure the Adviser’s custom voting policy captures the desired corporate engagements’ expectations. Boston Common reviews the proxy voting results with its proxy vendor's custom policy team at the end of the proxy season to ensure the expected outcomes were achieved.

Additionally, Boston Common measures and monitors its ESG engagement related impact by compiling the results of its direct dialogue with various portfolio holdings and the shareholder proposals initiated by Boston Common. In addition, Boston Common participates in both dialogue and shareholder proposals initiated by various industry-led coalition groups.

The International Fund will normally invest at least 80% of its net assets, plus borrowings for investment purposes, in the securities of non‑U.S. companies that meet the Adviser’s ESG criteria. The International Fund may invest in preferred stocks as well as in securities that are convertible into common stocks. The International Fund may also invest in ADRs, EDRs, and GDRs. Up to 10% of the International Fund’s total assets may be invested in securities of companies located in emerging markets. The International Fund generally seeks to invest in companies that have market capitalizations of $2 billion or greater.

Principal Investment Risks

There is the risk that you could lose all or a portion of your investment in the International Fund. The following risks are considered principal to the International Fund and could affect the value of your investment in the Fund:

•ESG Policy Risk: The International Fund’s ESG policy could cause the International Fund to perform differently compared to similar funds that do not have such a policy. This ESG policy may result in the International Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for ESG reasons when it might be otherwise disadvantageous for it to do so. The International Fund will vote proxies in a manner which is consistent with its ESG criteria, which may not always be consistent with maximizing short-term performance of the issuer.

•Risk of Focusing Investment on Region or Country: Investing a significant portion of assets in one country or region makes the International Fund more dependent upon the political and economic circumstances of that particular country or region.

◦Eurozone Investment Risk - The Economic and Monetary Union of the European Union (EMU) is comprised of the European Union (EU) members that have adopted the euro currency. By adopting the euro as its currency, a member state relinquishes control of its own monetary policies and is subject to fiscal and monetary controls. EMU members could voluntarily abandon or be forced out of the euro. Such events could impact the market values of Eurozone and various other securities and currencies, cause redenomination of certain securities into less valuable local currencies and create more volatile and illiquid markets. Certain countries and regions in the EU are experiencing significant financial difficulties. Some of these countries may be dependent on assistance from other European governments and institutions or agencies. One or more countries could depart from the EU, which could weaken the EU and, by extension, its remaining members. For example, the United Kingdom’s departure, described in more detail below.

◦United Kingdom Investment Risk - Commonly known as “Brexit,” the United Kingdom’s exit from the EU may result in substantial volatility in foreign exchange markets and may lead to a sustained weakness in the British pound’s exchange rate against the United States dollar, the euro and other currencies, which may impact fund returns. Brexit may destabilize some or all of the other EU member countries and/or the Eurozone. These developments could result in losses to the International Fund, as there may be negative effects on the value of the International Fund’s investments and/or on the Fund’s ability to enter into certain transactions or value certain investments, and these developments may make it more difficult for the International Fund to exit certain investments at an advantageous time or price.

•Impact Investing Risk: The Fund may not succeed in generating a positive ESG and/or social impact. The Fund’s incorporation of ESG and/or social impact criteria into its investment process may cause the Fund to perform differently from a fund that uses a different methodology to identify and/or incorporate ESG and/or social impact criteria or relies solely or primarily on financial metrics. In addition,it may cause it to forego opportunities to buy certain securities that otherwise might be advantageous, or to sell securities when it might otherwise be advantageous

4

to continue to hold these securities. The definition of “impact investing” will vary according to an investor’s beliefs and values. There is no guarantee that Boston Common’s definition of impact investing, ESG security selection criteria, or investment judgment will reflect the beliefs or values of any particular investor. To the extent Boston Common references third-party research and analytics in conducting its proprietary analysis, there is no guarantee that the data will be accurate. Third-party providers may be less effective at rating companies located in the emerging markets and ratings may not be available from time to time.

•Equity Risk: Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value. These fluctuations may cause a security to be worth less than its cost when originally purchased or less than it was worth at an earlier time.

The remaining principal risks are presented in alphabetical order. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

•Depositary Receipt Risk: Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. In addition, holders of depositary receipts may have limited voting rights, may not have the same rights afforded to stockholders of a typical company in the event of a corporate action, such as an acquisition, merger or rights offering, and may experience difficulty in receiving company stockholder communications. There is no guarantee that a financial institution will continue to sponsor a depositary receipt, or that the depositary receipts will continue to trade on an exchange, either of which could adversely affect the liquidity, availability and pricing of the depositary receipt. Changes in foreign currency exchange rates will affect the value of depositary receipts and, therefore, may affect the value of your investment in the International Fund.

•Emerging Markets Risk: Emerging markets may involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar.

•General Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. Securities in the Fund’s portfolio may underperform in comparison to securities in the general financial markets, a particular financial market, or other asset classes due to a number of factors, including: inflation (or expectations for inflation); interest rates; global demand for particular products or resources; natural disasters or events; pandemic diseases; terrorism; regulatory events; and government controls. U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including the impact of COVID-19 as a global pandemic, which has resulted in a public health crisis, disruptions to business operations and supply chains, stress on the global healthcare system, growth concerns in the U.S. and overseas, staffing shortages and the inability to meet consumer demand, and widespread concern and uncertainty. The global recovery from COVID-19 is proceeding at slower than expected rates due to the emergence of variant strains and may last for an extended period of time. Continuing uncertainties regarding interest rates, rising inflation, political events, rising government debt in the U.S. and trade tensions also contribute to market volatility. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. The war has contributed to recent market volatility and may continue to do so.

•Large Companies Risk: Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, large-cap companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

•Management Risk: Boston Common may fail to implement the International Fund’s investment strategies or meet its investment objective.

5

Performance

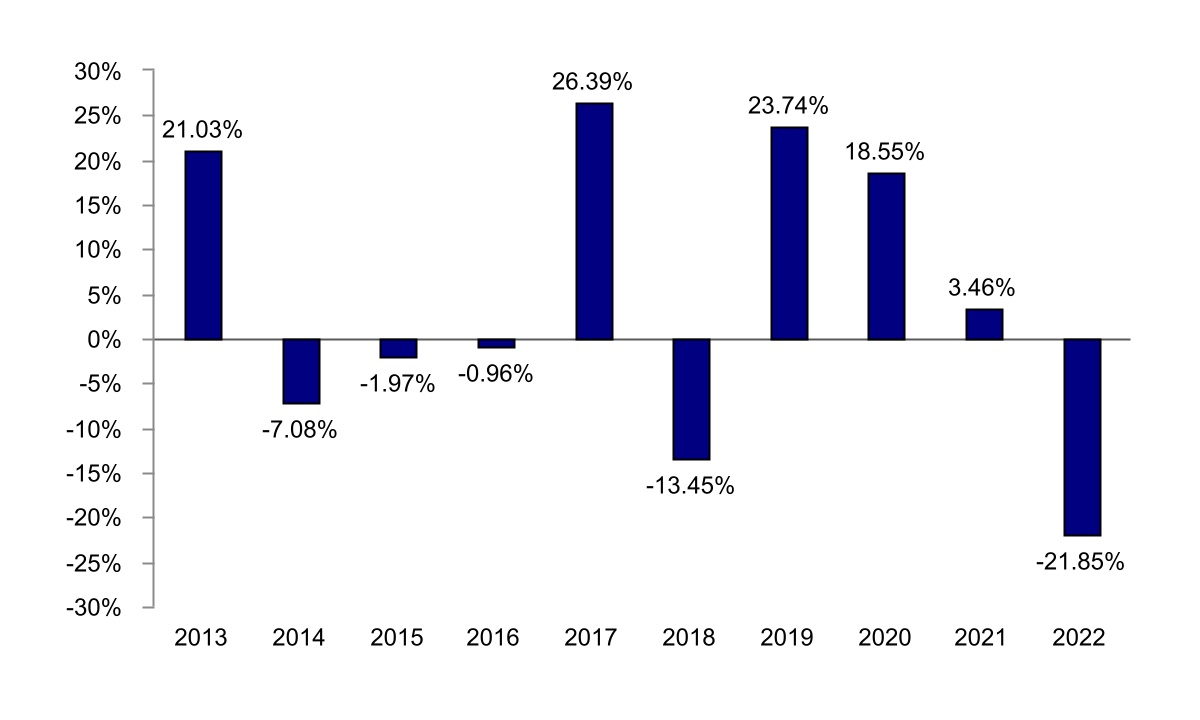

The following performance information provides some indication of the risks of investing in the International Fund. The bar chart below illustrates how the International Fund’s total returns have varied from year‑to‑year. The table below illustrates how the International Fund’s average annual total returns for the 1-year, 5-year, 10-year and since-inception periods compare with that of a broad-based securities index. This comparison is provided to offer a broader market perspective. The International Fund’s past performance, before and after taxes, is not necessarily an indication of how the International Fund will perform in the future and does not guarantee future results. Updated performance information is available on the International Fund’s website at www.bostoncommonfunds.com.

Calendar Year Total Return

As of December 31,

| Highest Quarterly Return: | Q2, 2020 | 18.15 | % | |||||

| Lowest Quarterly Return: | Q1, 2020 | -19.34 | % | |||||

| Average Annual Total Return as of December 31, 2022 | ||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception (12/29/2010) | |||||||||||

| International Fund | ||||||||||||||

| Return Before Taxes | -21.85% | 0.53% | 3.55% | 2.88% | ||||||||||

| Return After Taxes on Distributions | -21.9% | 0.29% | 3.27% | 2.65% | ||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | -12.59% | 0.62% | 2.96% | 2.42% | ||||||||||

| MSCI EAFE® Index (reflects no deduction for fees, expenses or taxes) | -14.45% | 1.54% | 4.67% | 4.16% | ||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and does not reflect the impact of state and local taxes. Actual after-tax returns depend on the individual investor’s situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or Individual Retirement Accounts (“IRAs”).

6

In certain cases, Return After Taxes on Distribution and Sale of Fund Shares may be higher than the other return figures for the same period. This will occur when a capital loss is realized upon the sale of International Fund shares or provides an assumed tax benefit that increases the return. Your actual after-tax returns depend on your tax situation and may differ from these shown.

Investment Adviser

Boston Common Asset Management, LLC

Portfolio Managers

The International Fund is team-managed by the Portfolio Managers listed below:

| Name | Title | Managed the Fund Since | ||||||

| Matt Zalosh, CFA | CIO-International Strategies | December 2010 | ||||||

| Praveen Abichandani, CFA | Portfolio Manager | December 2010 | ||||||

| Geeta B. Aiyer, CFA | Chief ESG Strategist | December 2010 | ||||||

| Corné Biemans | Portfolio Manager | December 2013 | ||||||

| Steven Heim | Director, ESG Research | December 2010 | ||||||

Purchase and Sale of International Fund Shares

You may purchase, redeem, or exchange International Fund shares on any business day by written request via mail (Boston Common Funds, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701), by wire transfer, by telephone at 1-877-777-6944, or through a financial intermediary. The minimum initial investment in the International Fund is $10,000. You can make additional investments at any time with $1,000 or more.

Tax Information

The International Fund’s distributions are taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the International Fund through a broker-dealer or other financial intermediary (such as a bank), the International Fund and its related companies may pay the intermediary for the sale of International Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the International Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

7

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- COOLA Celebrates 20 Years of Innovation With a Modern New Look

- Blackwell 3D Launches New Website, Eyes Project Development

- ROSEN, A RANKED AND LEADING FIRM, Encourages Innoviz Technologies Ltd. Investors to Secure Counsel Before Important Deadline in Securities Class Action – INVZ, INVZW

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share