Form 497K PIMCO VARIABLE INSURANCE

PIMCO CommodityRealReturn® Strategy

Portfolio

Summary Prospectus

April 30, 2021

| Share Class: |

Administrative Class |

As permitted by regulations adopted by the Securities and Exchange Commission, you may not be receiving

paper copies of the Portfolio's shareholder reports from the insurance company that offers your contract unless you specifically request paper copies from the insurance company or from your financial intermediary Instead, the shareholder reports will be made available

on a website, and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this

change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive all future reports in paper free of charge from the insurance

company. You should contact the insurance company if you wish to continue receiving paper copies of your

shareholder reports. Your election to receive reports in paper will apply to all portfolio companies available under your contract at the insurance company.

Before you invest, you may want to review the Portfolio’s

prospectus, which, as supplemented, contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus, reports to shareholders and other information about the Portfolio online at http://www.pimco.com/pvit. You can also get this information at no

cost by calling 1.800.927.4648 or by sending an email request to

[email protected]. The Portfolio’s prospectus and Statement of Additional Information, both dated April 30, 2021, as supplemented, are incorporated by reference

into this Summary Prospectus.

Investment Objective

The Portfolio seeks maximum real return, consistent with prudent investment management.

Fees and Expenses of the Portfolio

This table describes the fees and expenses that you may pay if you buy, hold and sell Administrative

Class shares of the Portfolio. You may pay other fees, such as commissions and other fees to financial

intermediaries, which are not reflected in the table and example below. Overall fees and expenses of

investing in the Portfolio are higher than shown because the table does not reflect variable contract fees and expenses.

| Shareholder Fees (fees paid directly from your investment): |

N/A |

Annual Portfolio Operating Expenses (expenses that you pay each year as

a percentage of the value of your investment):

| |

Administrative

Class |

| Management Fees |

0.74% |

| Distribution and/or Service (12b-1) Fees |

0.15% |

| Other Expenses(1) |

0.35% |

| Acquired Fund Fees and Expenses |

0.14% |

| Total Annual Portfolio Operating Expenses |

1.38% |

| Fee Waiver and/or Expense Reimbursement(2) |

(0.14%) |

| Total Annual Portfolio Operating Expenses After Fee Waiver

and/or Expense Reimbursement |

1.24% |

1

“Other Expenses” include interest expense of 0.35%. Interest expense is borne by

the Portfolio separately from the management fees paid to Pacific Investment Management Company LLC

(“PIMCO”). Excluding interest expense, Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement are 0.89% for Administrative Class shares.

2

PIMCO has contractually agreed to waive the Portfolio’s advisory fee and the supervisory and administrative fee in an amount equal to the management fee and administrative services fee,

respectively, paid by the PIMCO Cayman Commodity Portfolio I Ltd. (the “CRRS Subsidiary”) to PIMCO. The CRRS Subsidiary pays PIMCO a management fee and an administrative services fee at the annual rates of 0.49% and 0.20%, respectively, of its net

assets. This waiver may not be terminated by PIMCO and will remain in effect for as long as PIMCO’s contract with the CRRS Subsidiary is in place.

Example. The

Example is intended to help you compare the cost of investing in Administrative Class shares of the Portfolio with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 for the time periods indicated, and then

redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5%

return each year and that the Portfolio’s operating expenses remain the same. Although your actual costs may be higher or lower, the Example shows what your costs would be based on these assumptions. The Example does not reflect fees and

expenses of any variable annuity contract or variable life insurance policy, and would be higher if it

did.

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Administrative Class |

$126 |

$423 |

$742 |

$1,645 |

Portfolio Turnover

The Portfolio pays transaction costs when it buys and sells securities (or “turns over” its

portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in the Annual Portfolio Operating Expenses or in the Example table, affect the Portfolio’s performance. During the most

recent fiscal year, the Portfolio’s portfolio turnover rate was 250% of the average value of its portfolio.

Principal Investment Strategies

The Portfolio seeks to achieve its investment objective by investing under normal circumstances in commodity-linked derivative instruments backed by a portfolio of inflation-indexed

securities and other Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt

securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector

entities. “Real Return” equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure. The Portfolio invests in commodity-linked derivative instruments, including

swap agreements, futures, options on futures, commodity index-linked notes and commodity options, that

provide exposure to the investment returns of the commodities markets, without investing directly in physical

commodities. Commodities are assets that have tangible properties, such as oil, metals, and agricultural

products. The value of commodity-linked derivative instruments may be affected by overall market movements

and other factors affecting the value of a particular industry or commodity, such as weather, disease, embargoes, or political

PIMCO Variable Insurance Trust | Summary Prospectus

PIMCO CommodityRealReturn® Strategy Portfolio

and regulatory developments. The Portfolio may also invest in common and preferred securities as well as

convertible securities of issuers in commodity-related industries. When determining the target allocation

for the strategy, PIMCO may use proprietary quantitative models. The target allocations may include long,

short, or no positions in the underlying financial markets and commodities specified in the models. The

quantitative models are developed and maintained by PIMCO, and are subject to change over time without notice in PIMCO’s discretion. PIMCO also retains discretion over the final target asset allocation and the implementation of the target asset

allocation, which may include positions that are different from target allocations determined by

quantitative models.

The Portfolio will generally seek to gain exposure to the commodity markets primarily through investments

in swap agreements, futures, and options on futures and through investments in the PIMCO Cayman Commodity

Portfolio I Ltd., a wholly-owned subsidiary of the Portfolio organized under the laws of the Cayman Islands (the “CRRS Subsidiary”). The CRRS Subsidiary is advised by PIMCO, and has the same investment objective as the Portfolio. As

discussed in greater detail elsewhere in this prospectus, the CRRS Subsidiary (unlike the Portfolio) may

invest without limitation in commodity-linked swap agreements and other commodity-linked derivative instruments. In order to comply with certain issuer diversification limits imposed by the Internal Revenue Code, the Portfolio may invest up to 25% of

its total assets in the CRRS Subsidiary.

The derivative instruments in which the Portfolio and the CRRS Subsidiary primarily intend to invest are

instruments linked to certain commodity indices. Additionally, the Portfolio or the CRRS Subsidiary may

invest in derivative instruments linked to the value of a particular commodity or commodity futures contract, or a subset of commodities or commodity futures contracts. The Portfolio’s or the CRRS Subsidiary’s investments in commodity-linked

derivative instruments may specify exposure to commodity futures with different roll dates, reset dates or

contract months than those specified by a particular commodity index. As a result, the commodity-linked

derivatives component of the Portfolio’s portfolio may deviate from the returns of any particular

commodity index. The Portfolio or the CRRS Subsidiary may over-weight or under-weight its exposure to a

particular commodity index, or a subset of commodities, such that the Portfolio has greater or lesser

exposure to that index than the value of the Portfolio’s net assets, or greater or lesser exposure to

a subset of commodities than is represented by a particular commodity index. Such deviations will

frequently be the result of temporary market fluctuations, and under normal circumstances the Portfolio

will seek to maintain notional exposure to one or more commodity indices within 5% (plus or minus) of the

value of the Portfolio’s net assets.

The Portfolio may also invest

in leveraged or unleveraged commodity index-linked notes, which are derivative debt instruments with principal and/or coupon payments linked to the performance of commodity indices. These commodity index-linked notes are sometimes

referred to as “structured notes” because the terms of these notes may be

structured by the issuer and the purchaser of the note. The value of these notes will rise or fall in response to changes in the underlying commodity or related index of

investment.

Assets not invested in commodity-linked derivative instruments

or the CRRS Subsidiary may be invested in inflation-indexed securities and other Fixed Income Instruments,

including derivative Fixed Income Instruments. In addition, the Portfolio may invest its assets in particular

sectors of the commodities market.

The average portfolio duration of the fixed income portion of this Portfolio will vary based on

PIMCO’s forecast for interest rates and under normal market conditions is not expected to exceed ten years. Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The

longer a security’s duration, the more sensitive it will be to changes in interest rates. The Portfolio may invest up to 10% of its total assets in high yield securities (“junk bonds”), as rated by Moody’s

Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, as determined by PIMCO. In the event that ratings services assign different ratings to the same security, PIMCO

will use the highest rating as the credit rating for that security. The Portfolio may invest up to 30% of

its total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar-denominated securities of foreign issuers. The Portfolio may invest up to 10% of its total assets in securities and instruments that are

economically tied to emerging market countries (this limitation does not apply to investment grade

sovereign debt denominated in the local currency with less than 1 year remaining to maturity, which means

the Portfolio may invest, together with any other investments denominated in foreign currencies, up to 30%

of its total assets in such instruments). The Portfolio will normally limit its foreign currency exposure (from non-U.S. dollar-denominated securities or currencies) to 20% of its total assets. The Portfolio may, without limitation, seek to obtain market

exposure to the securities in which it primarily invests by entering into a series of purchase and sale

contracts or by using other investment techniques (such as buy backs or dollar rolls). The Portfolio may

also invest up to 10% of its total assets in preferred securities. The Portfolio may purchase and sell securities on a when-issued, delayed delivery or forward commitment basis and may engage in short sales.

Principal Risks

It is possible to lose money on an investment in the Portfolio. Under certain conditions, generally in a market where the value of both commodity-linked derivative instruments and fixed income securities are declining, the Portfolio may experience

substantial losses. The principal risks of investing in the Portfolio, which could adversely affect its net

asset value, yield and total return, are:

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a portfolio with a

longer average portfolio duration will be more sensitive to changes in interest rates than a portfolio with

a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call

2 Summary Prospectus | PIMCO Variable Insurance Trust

Summary Prospectus

outstanding securities prior to their maturity for a number of reasons (e.g., declining interest

rates, changes in credit spreads and improvements in the issuer’s credit quality). If an issuer calls a security that the Portfolio has invested in, the Portfolio may not recoup the full amount of its initial investment and may be

forced to reinvest in lower-yielding securities, securities with greater credit risks or securities with

other, less favorable features

Credit Risk: the risk that the Portfolio could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling, or is

perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or

unwilling, to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as “junk

bonds”) are subject to greater levels of credit, call and liquidity risks. High yield securities are

considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Market

Risk: the risk that the value of securities owned by the Portfolio may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally

or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the

issuer’s goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Portfolio may be unable to sell illiquid investments at an advantageous time or price or

achieve its desired level of exposure to a certain sector. Liquidity risk may result from the lack of an

active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed

income funds may be higher than normal, causing increased supply in the market due to selling

activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage, liquidity, interest rate, market, credit and

management risks, and valuation complexity. Changes in the value of a derivative may not correlate

perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and

the Portfolio could lose more than the initial amount invested. The Portfolio’s use of derivatives may result in losses to the Portfolio, a reduction in the Portfolio’s returns and/or increased volatility. Over-the-counter

(“OTC”) derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative

transactions might not be available for OTC derivatives. The primary credit risk on derivatives that are

exchange-traded or traded through a central clearing counterparty resides with the Portfolio's clearing broker or the clearinghouse. Changes in regulation relating to a mutual fund’s use of derivatives and

related instruments could potentially limit or impact the Portfolio’s ability to invest in derivatives, limit the Portfolio’s ability to employ certain strategies that use derivatives

and/or adversely affect the value of derivatives and the Portfolio’s performance

Model Risk: the risk that the Portfolio’s investment models used in making investment allocation decisions may not adequately take into account certain factors, may contain design flaws or

faulty assumptions, and may rely on incomplete or inaccurate data, any of which may result in a decline in

the value of an investment in the Portfolio

Commodity

Risk: the risk that investing in commodity-linked derivative instruments may subject the Portfolio to greater volatility than investments in traditional securities. The

value of commodity-linked derivative instruments may be affected by changes in overall market movements,

commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, public health emergencies, embargoes, tariffs and international economic, political

and regulatory developments

Equity

Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not specifically related

to a particular company or to factors affecting a particular industry or industries. Equity securities

generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.) Investment Risk: the risk that investing in foreign

(non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a portfolio that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing

standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of

portfolio securities, and the risk of unfavorable foreign government actions, including nationalization,

expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments.

Foreign securities may also be less liquid and more difficult to value than securities of U.S.

issuers

Emerging Markets Risk: the risk of investing in emerging market

securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a result

of default or other adverse credit event resulting from an issuer’s inability or unwillingness to

make principal or interest payments in a timely fashion

Currency

Risk: the risk that foreign (non-U.S.) currencies will change in value relative to the U.S. dollar and affect the Portfolio’s investments

April 30, 2021 | SUMMARY PROSPECTUS 3

PIMCO CommodityRealReturn® Strategy Portfolio

in foreign (non-U.S.) currencies or

in securities that trade in, and receive revenues in, or in derivatives that provide exposure to, foreign (non-U.S.) currencies

Leveraging Risk: the risk that certain transactions of the Portfolio, such as reverse repurchase agreements, loans of portfolio

securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivative

instruments, may give rise to leverage, magnifying gains and losses and causing the Portfolio to be more

volatile than if it had not been leveraged. This means that leverage entails a heightened risk of

loss

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO, including the use of quantitative models or methods, will not produce the desired results and

that actual or potential conflicts of interest, legislative, regulatory, or tax restrictions, policies or

developments may affect the investment techniques available to PIMCO and the individual portfolio manager in connection with managing the Portfolio and may cause PIMCO to restrict or prohibit participation in certain investments. There is no

guarantee that the investment objective of the Portfolio will be achieved

Inflation-Indexed Security Risk: the risk that inflation-indexed debt securities are subject to the effects of changes in market interest rates caused by factors other than inflation (real interest rates). In general, the value of an inflation-indexed security,

including TIPS, tends to decrease when real interest rates increase and can increase when real interest

rates decrease. Interest payments on inflation-indexed securities are unpredictable and will fluctuate as

the principal and interest are adjusted for inflation. There can be no assurance that the inflation index

used will accurately measure the real rate of inflation in the prices of goods and services. Any increase

in the principal amount of an inflation-indexed debt security will be considered taxable ordinary income,

even though the Portfolio will not receive the principal until maturity

Tax

Risk: the risk that the tax treatment of swap agreements and other derivative instruments, such as commodity-linked derivative instruments, including commodity index-linked notes, swap

agreements, commodity options, futures, and options on futures, may be affected by future regulatory or

legislative changes that could affect whether income from such investments is “qualifying income” under Subchapter M of the Internal Revenue Code, or otherwise affect the character, timing and/or amount of the Portfolio’s taxable income

or gains and distributions

Subsidiary Risk: the risk that, by investing in the CRRS Subsidiary, the Portfolio is indirectly exposed to the risks associated with the CRRS Subsidiary’s investments. The CRRS

Subsidiary is not registered under the 1940 Act and may not be subject to all the investor protections of

the 1940 Act. There is no guarantee that the investment objective of the CRRS Subsidiary will be

achieved

Short Exposure Risk: the risk of entering into short sales, including the potential loss of more money than the actual cost of the investment, and the risk that the third party to the short

sale will not fulfill its contractual obligations, causing a loss to the Portfolio

Please see “Description of Principal Risks” in the Portfolio's prospectus for a more detailed description of the risks of investing in the Portfolio. An investment in the Portfolio is not a

deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Performance

Information

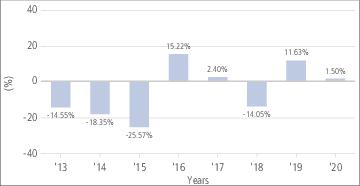

The performance information shows summary performance

information for the Portfolio in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Portfolio by showing changes in its

performance from year to year and by showing how the Portfolio’s average annual returns compare with

the returns of a broad-based securities market index. The Portfolio’s performance information

reflects applicable fee waivers and/or expense limitations in effect during the periods presented. Absent such fee waivers and/or expense limitations, if any, performance would have been lower. Performance shown does not reflect any charges or expenses imposed by an insurance company, and, if it did, performance

shown would be lower. The bar chart and the table show performance of the Portfolio’s Administrative Class shares. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in

the future.

The Bloomberg Commodity Index Total Return is an unmanaged index composed of futures contracts on a number of physical commodities. The index is designed to be a highly liquid and

diversified benchmark for commodities as an asset class.

Performance for the Portfolio is updated daily and monthly and may be obtained as follows: daily updates

on the net asset value may be obtained by calling 1-888-87-PIMCO and monthly performance may be obtained at

www.pimco.com/pvit.

Calendar Year Total Returns — Administrative Class

| Best Quarter |

June 30, 2016 |

13.70% |

| Worst Quarter |

March 31, 2020 |

-27.08% |

Average Annual Total Returns (for periods ended 12/31/20)

| |

1 Year |

5 Years |

10 Years |

| Administrative Class Return |

1.35% |

2.67% |

-5.39% |

| Bloomberg Commodity Index Total Return (reflects no deductions for fees, expenses or taxes) |

-3.12% |

1.03% |

-6.50% |

4 Summary Prospectus | PIMCO Variable Insurance Trust

Summary Prospectus

Investment Adviser/Portfolio Managers

PIMCO serves as the investment adviser for the Portfolio. The Portfolio’s portfolio is jointly and primarily managed by Nicholas J. Johnson, Steve

Rodosky and Greg Sharenow. Messrs. Johnson, Rodosky and Sharenow are Managing Directors of PIMCO. Mr.

Johnson has managed the Portfolio since January 2015, Mr. Rodosky has managed the Portfolio since January

2019 and Mr. Sharenow has managed the Portfolio since November 2018.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio currently are sold to segregated asset accounts (“Separate Accounts”)

of insurance companies that fund variable annuity contracts and variable life insurance policies (“Variable Contracts”) and other funds that serve as underlying investment options for Variable Contracts (i.e., variable insurance funds). Investors do not deal directly with the Portfolio to purchase and redeem shares. Please refer to the prospectus for the Separate Account

for information on the allocation of premiums and on transfers of accumulated value among sub-accounts of

the Separate Account.

Tax Information

The shareholders of the Portfolio are the insurance companies offering the variable products or other variable insurance funds. Please refer to the prospectus for the Separate Account and the

Variable Contract for information regarding the federal income tax treatment of distributions to the

Separate Account.

Payments to Insurance Companies and

Other Financial Intermediaries

The Portfolio and/or its related companies (including PIMCO) may pay the insurance company and other

intermediaries for the sale of the Portfolio and/or other services. These payments may create a conflict of

interest by influencing the insurance company or intermediary and your salesperson to recommend a Variable

Contract and the Portfolio over another investment. Ask your insurance company or salesperson or visit your

financial intermediary’s Web site for more information.

PVIT1850S_043021

PIMCO CommodityRealReturn® Strategy

Portfolio

Summary Prospectus

April 30, 2021

| Share Class: |

Advisor Class |

As permitted by regulations adopted by the Securities and Exchange Commission, you may not be receiving

paper copies of the Portfolio's shareholder reports from the insurance company that offers your contract unless you specifically request paper copies from the insurance company or from your financial intermediary Instead, the shareholder reports will be made available

on a website, and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this

change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive all future reports in paper free of charge from the insurance

company. You should contact the insurance company if you wish to continue receiving paper copies of your

shareholder reports. Your election to receive reports in paper will apply to all portfolio companies available under your contract at the insurance company.

Before you invest, you may want to review the Portfolio’s

prospectus, which, as supplemented, contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus, reports to shareholders and other information about the Portfolio online at http://www.pimco.com/pvit. You can also get this information at no

cost by calling 1.800.927.4648 or by sending an email request to

[email protected]. The Portfolio’s prospectus and Statement of Additional Information, both dated April 30, 2021, as supplemented, are incorporated by reference

into this Summary Prospectus.

Investment Objective

The Portfolio seeks maximum real return, consistent with prudent investment management.

Fees and Expenses of the Portfolio

This table describes the fees and expenses that you may pay if you buy, hold and sell Advisor Class

shares of the Portfolio. You may pay other fees, such as commissions and other fees to financial intermediaries, which are not reflected in the table and example below. Overall fees and expenses of investing in the Portfolio are

higher than shown because the table does not reflect variable contract fees and expenses.

| Shareholder Fees (fees paid directly from your investment): |

N/A |

Annual Portfolio Operating Expenses (expenses that you pay each year as

a percentage of the value of your investment):

| |

Advisor

Class |

| Management Fees |

0.74% |

| Distribution and/or Service (12b-1) Fees |

0.25% |

| Other Expenses(1) |

0.35% |

| Acquired Fund Fees and Expenses |

0.14% |

| Total Annual Portfolio Operating Expenses |

1.48% |

| Fee Waiver and/or Expense Reimbursement(2) |

(0.14%) |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or

Expense Reimbursement |

1.34% |

1

“Other Expenses” include interest expense of 0.35%. Interest expense is borne by

the Portfolio separately from the management fees paid to Pacific Investment

Management Company LLC

(“PIMCO”). Excluding interest expense, Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement are 0.99% for Advisor Class shares.

2

PIMCO has contractually agreed to waive the Portfolio’s advisory fee and the supervisory and administrative fee in

an amount equal to the management fee and administrative services fee, respectively, paid by the PIMCO Cayman Commodity Portfolio I Ltd. (the “CRRS Subsidiary”) to PIMCO. The CRRS Subsidiary pays PIMCO a management fee and an

administrative services fee at the annual rates of 0.49% and 0.20%, respectively, of its net assets. This waiver may not be terminated by PIMCO and will remain in effect for as long as PIMCO’s contract with the CRRS Subsidiary is in place.

Example. The Example is intended to help you compare the cost of investing in Advisor Class shares of the Portfolio with the costs of investing in other mutual funds. The Example

assumes that you invest $10,000 for the time periods indicated, and then redeem all your shares at the end

of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. Although your actual costs may be higher or lower, the Example shows what your costs would be

based on these assumptions. The Example does not reflect fees and expenses of any variable annuity contract

or variable life insurance policy, and would be higher if it did.

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Advisor Class |

$136 |

$454 |

$795 |

$1,756 |

Portfolio Turnover

The Portfolio pays transaction costs when it buys and sells securities (or “turns over” its

portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in the Annual Portfolio Operating Expenses or in the Example table, affect the Portfolio’s performance. During the most

recent fiscal year, the Portfolio’s portfolio turnover rate was 250% of the average value of its portfolio.

Principal Investment Strategies

The Portfolio seeks to achieve its investment objective by investing under normal circumstances in commodity-linked derivative instruments backed by a portfolio of inflation-indexed

securities and other Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt

securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector

entities. “Real Return” equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure. The Portfolio invests in commodity-linked derivative instruments, including

swap agreements, futures, options on futures, commodity index-linked notes and commodity options, that

provide exposure to the investment returns of the commodities markets, without investing directly in physical

commodities. Commodities are assets that have tangible properties, such as oil, metals, and agricultural

products. The value of commodity-linked derivative instruments may be affected by overall market movements

and other factors affecting the value of a particular industry or commodity, such as weather, disease, embargoes, or political and regulatory developments. The Portfolio may also invest in common and preferred securities as well as convertible

securities of issuers in

PIMCO Variable Insurance Trust | Summary Prospectus

PIMCO CommodityRealReturn® Strategy Portfolio

commodity-related industries. When determining the target allocation for the strategy, PIMCO may use

proprietary quantitative models. The target allocations may include long, short, or no positions in the

underlying financial markets and commodities specified in the models. The quantitative models are developed

and maintained by PIMCO, and are subject to change over time without notice in PIMCO’s discretion.

PIMCO also retains discretion over the final target asset allocation and the implementation of the target

asset allocation, which may include positions that are different from target allocations determined by

quantitative models.

The Portfolio will generally seek to gain exposure to the commodity markets primarily through investments

in swap agreements, futures, and options on futures and through investments in the PIMCO Cayman Commodity

Portfolio I Ltd., a wholly-owned subsidiary of the Portfolio organized under the laws of the Cayman Islands (the “CRRS Subsidiary”). The CRRS Subsidiary is advised by PIMCO, and has the same investment objective as the Portfolio. As

discussed in greater detail elsewhere in this prospectus, the CRRS Subsidiary (unlike the Portfolio) may

invest without limitation in commodity-linked swap agreements and other commodity-linked derivative instruments. In order to comply with certain issuer diversification limits imposed by the Internal Revenue Code, the Portfolio may invest up to 25% of

its total assets in the CRRS Subsidiary.

The derivative instruments in which the Portfolio and the CRRS Subsidiary primarily intend to invest are

instruments linked to certain commodity indices. Additionally, the Portfolio or the CRRS Subsidiary may

invest in derivative instruments linked to the value of a particular commodity or commodity futures contract, or a subset of commodities or commodity futures contracts. The Portfolio’s or the CRRS Subsidiary’s investments in commodity-linked

derivative instruments may specify exposure to commodity futures with different roll dates, reset dates or

contract months than those specified by a particular commodity index. As a result, the commodity-linked

derivatives component of the Portfolio’s portfolio may deviate from the returns of any particular

commodity index. The Portfolio or the CRRS Subsidiary may over-weight or under-weight its exposure to a

particular commodity index, or a subset of commodities, such that the Portfolio has greater or lesser

exposure to that index than the value of the Portfolio’s net assets, or greater or lesser exposure to

a subset of commodities than is represented by a particular commodity index. Such deviations will

frequently be the result of temporary market fluctuations, and under normal circumstances the Portfolio

will seek to maintain notional exposure to one or more commodity indices within 5% (plus or minus) of the

value of the Portfolio’s net assets.

The Portfolio may also invest

in leveraged or unleveraged commodity index-linked notes, which are derivative debt instruments with principal and/or coupon payments linked to the performance of commodity indices. These commodity index-linked notes are sometimes

referred to as “structured notes” because the terms of these notes may be structured by the

issuer and the purchaser of the note. The value of these notes will rise or fall in response to changes in the underlying commodity or related index of investment.

Assets not invested in commodity-linked derivative instruments or the CRRS Subsidiary may be invested in inflation-indexed securities and other Fixed Income Instruments, including derivative

Fixed Income Instruments. In addition, the Portfolio may invest its assets in particular sectors of the

commodities market.

The average portfolio duration of the fixed income

portion of this Portfolio will vary based on PIMCO’s forecast for interest rates and under normal

market conditions is not expected to exceed ten years. Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in

interest rates. The Portfolio may invest up to 10% of its total assets in high yield securities (“junk

bonds”), as rated by Moody’s Investors Service, Inc. (“Moody’s”), Standard

& Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, as determined by PIMCO. In the event that ratings services

assign different ratings to the same security, PIMCO will use the highest rating as the credit rating for

that security. The Portfolio may invest up to 30% of its total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar-denominated securities of foreign issuers. The Portfolio may invest up

to 10% of its total assets in securities and instruments that are economically tied to emerging market

countries (this limitation does not apply to investment grade sovereign debt denominated in the local currency with less than 1 year remaining to maturity, which means the Portfolio may invest, together with any other investments denominated in foreign

currencies, up to 30% of its total assets in such instruments). The Portfolio will normally limit its

foreign currency exposure (from non-U.S. dollar-denominated securities or currencies) to 20% of its total assets. The Portfolio may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a

series of purchase and sale contracts or by using other investment techniques (such as buy backs or dollar

rolls). The Portfolio may also invest up to 10% of its total assets in preferred securities. The Portfolio may purchase and sell securities on a when-issued, delayed delivery or forward commitment basis and may engage in short sales.

Principal Risks

It is possible to lose money on an investment in the Portfolio. Under certain conditions, generally in a market where the value of both commodity-linked derivative instruments and fixed income securities are declining, the Portfolio may experience

substantial losses. The principal risks of investing in the Portfolio, which could adversely affect its net

asset value, yield and total return, are:

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a portfolio with a

longer average portfolio duration will be more sensitive to changes in interest rates than a portfolio with

a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call outstanding securities prior to their maturity

for a number of reasons (e.g., declining interest rates, changes in credit spreads and improvements in the issuer’s credit quality). If an

issuer calls a security

2 Summary Prospectus | PIMCO Variable Insurance Trust

Summary Prospectus

that the Portfolio has invested in,

the Portfolio may not recoup the full amount of its initial investment and may be forced to reinvest in

lower-yielding securities, securities with greater credit risks or securities with other, less favorable

features

Credit Risk: the risk that the Portfolio could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling, or is

perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or

unwilling, to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as “junk

bonds”) are subject to greater levels of credit, call and liquidity risks. High yield securities are

considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Market

Risk: the risk that the value of securities owned by the Portfolio may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally

or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the

issuer’s goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Portfolio may be unable to sell illiquid investments at an advantageous time or price or

achieve its desired level of exposure to a certain sector. Liquidity risk may result from the lack of an

active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed

income funds may be higher than normal, causing increased supply in the market due to selling

activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage, liquidity, interest rate, market, credit and

management risks, and valuation complexity. Changes in the value of a derivative may not correlate

perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and

the Portfolio could lose more than the initial amount invested. The Portfolio’s use of derivatives may result in losses to the Portfolio, a reduction in the Portfolio’s returns and/or increased volatility. Over-the-counter

(“OTC”) derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative

transactions might not be available for OTC derivatives. The primary credit risk on derivatives that are

exchange-traded or traded through a central clearing counterparty resides with the Portfolio's clearing broker or the clearinghouse. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially

limit or impact the Portfolio’s ability to invest in derivatives, limit the Portfolio’s ability to employ

certain strategies that use

derivatives and/or adversely affect the value of derivatives and the Portfolio’s performance

Model Risk: the risk that the Portfolio’s investment models used in making investment allocation decisions may not adequately take into account certain factors, may contain design flaws or

faulty assumptions, and may rely on incomplete or inaccurate data, any of which may result in a decline in

the value of an investment in the Portfolio

Commodity

Risk: the risk that investing in commodity-linked derivative instruments may subject the Portfolio to greater volatility than investments in traditional securities. The

value of commodity-linked derivative instruments may be affected by changes in overall market movements,

commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, public health emergencies, embargoes, tariffs and international economic, political

and regulatory developments

Equity

Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not specifically related

to a particular company or to factors affecting a particular industry or industries. Equity securities

generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.) Investment Risk: the risk that investing in foreign

(non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a portfolio that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing

standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of

portfolio securities, and the risk of unfavorable foreign government actions, including nationalization,

expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments.

Foreign securities may also be less liquid and more difficult to value than securities of U.S.

issuers

Emerging Markets Risk: the risk of investing in emerging market

securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a result

of default or other adverse credit event resulting from an issuer’s inability or unwillingness to

make principal or interest payments in a timely fashion

Currency

Risk: the risk that foreign (non-U.S.) currencies will change in value relative to the U.S. dollar and affect the Portfolio’s investments in foreign (non-U.S.) currencies or in

securities that trade in, and receive revenues in, or in derivatives that provide exposure to, foreign (non-U.S.) currencies

April 30, 2021 | SUMMARY PROSPECTUS 3

PIMCO

CommodityRealReturn® Strategy Portfolio

Leveraging

Risk: the risk that certain transactions of the Portfolio, such as reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or

forward commitment transactions, or derivative instruments, may give rise to leverage, magnifying gains and

losses and causing the Portfolio to be more volatile than if it had not been leveraged. This means that leverage entails a heightened risk of loss

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO, including the use of quantitative models or

methods, will not produce the desired results and that actual or potential conflicts of interest,

legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to PIMCO and the individual portfolio manager in connection with managing the Portfolio and may cause PIMCO to restrict

or prohibit participation in certain investments. There is no guarantee that the investment objective of

the Portfolio will be achieved

Inflation-Indexed Security

Risk: the risk that inflation-indexed debt securities are subject to the effects of changes in market interest rates caused by factors other than inflation (real

interest rates). In general, the value of an inflation-indexed security, including TIPS, tends to decrease

when real interest rates increase and can increase when real interest rates decrease. Interest payments on

inflation-indexed securities are unpredictable and will fluctuate as the principal and interest are

adjusted for inflation. There can be no assurance that the inflation index used will accurately measure the

real rate of inflation in the prices of goods and services. Any increase in the principal amount of an

inflation-indexed debt security will be considered taxable ordinary income, even though the Portfolio will

not receive the principal until maturity

Tax

Risk: the risk that the tax treatment of swap agreements and other derivative instruments, such as commodity-linked derivative instruments, including commodity index-linked notes, swap

agreements, commodity options, futures, and options on futures, may be affected by future regulatory or

legislative changes that could affect whether income from such investments is “qualifying income” under Subchapter M of the Internal Revenue Code, or otherwise affect the character, timing and/or amount of the Portfolio’s taxable income

or gains and distributions

Subsidiary Risk: the risk that, by investing in the CRRS Subsidiary, the Portfolio is indirectly exposed to the risks associated with the CRRS Subsidiary’s investments. The CRRS

Subsidiary is not registered under the 1940 Act and may not be subject to all the investor protections of

the 1940 Act. There is no guarantee that the investment objective of the CRRS Subsidiary will be

achieved

Short Exposure Risk: the risk of entering into short sales, including the potential loss of more money than the actual cost of the investment, and the risk that the third party to the short

sale will not fulfill its contractual obligations, causing a loss to the Portfolio

Please see “Description of Principal Risks” in the Portfolio's prospectus for a more detailed description of the risks of investing in the Portfolio. An investment in the Portfolio is not a

deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Performance

Information

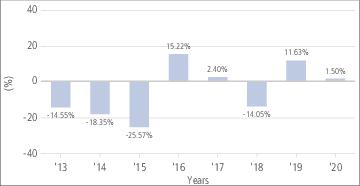

The performance information shows summary performance

information for the Portfolio in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Portfolio by showing changes in its

performance from year to year and by showing how the Portfolio’s average annual returns compare with

the returns of a broad-based securities market index. The Portfolio’s performance information

reflects applicable fee waivers and/or expense limitations in effect during the periods presented. Absent such fee waivers and/or expense limitations, if any, performance would have been lower. Performance shown does not reflect any charges or expenses imposed by an insurance company, and, if it did, performance

shown would be lower. The bar chart and the table show performance of the Portfolio’s Advisor Class shares. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the

future.

The Bloomberg Commodity Index Total Return is an unmanaged index composed of futures contracts on a number of physical

commodities. The index is designed to be a highly liquid and diversified benchmark for commodities as an

asset class.

Performance for the Portfolio is updated daily and monthly

and may be obtained as follows: daily updates on the net asset value may be obtained by calling 1-888-87-PIMCO and monthly performance may be

obtained at

www.pimco.com/pvit.

Calendar Year Total Returns — Advisor Class

| Best Quarter |

June 30, 2016 |

13.66% |

| Worst Quarter |

March 31, 2020 |

-27.07% |

Average Annual Total Returns (for periods ended 12/31/20)

| |

1 Year |

5 Years |

10 Years |

| Advisor Class Return |

1.23% |

2.54% |

-5.49% |

| Bloomberg Commodity Index Total Return (reflects no deductions for fees, expenses or taxes) |

-3.12% |

1.03% |

-6.50% |

4 Summary Prospectus | PIMCO Variable Insurance Trust

Summary Prospectus

Investment Adviser/Portfolio Managers

PIMCO serves as the investment adviser for the Portfolio. The Portfolio’s portfolio is jointly and primarily managed by Nicholas J. Johnson, Steve

Rodosky and Greg Sharenow. Messrs. Johnson, Rodosky and Sharenow are Managing Directors of PIMCO. Mr.

Johnson has managed the Portfolio since January 2015, Mr. Rodosky has managed the Portfolio since January

2019 and Mr. Sharenow has managed the Portfolio since November 2018.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio currently are sold to segregated asset accounts (“Separate Accounts”)

of insurance companies that fund variable annuity contracts and variable life insurance policies (“Variable Contracts”) and other funds that serve as underlying investment options for Variable Contracts (i.e., variable insurance funds). Investors do not deal directly with the Portfolio to purchase and redeem shares. Please refer to the prospectus for the Separate Account

for information on the allocation of premiums and on transfers of accumulated value among sub-accounts of

the Separate Account.

Tax Information

The shareholders of the Portfolio are the insurance companies offering the variable products or other variable insurance funds. Please refer to the prospectus for the Separate Account and the

Variable Contract for information regarding the federal income tax treatment of distributions to the

Separate Account.

Payments to Insurance Companies and

Other Financial Intermediaries

The Portfolio and/or its related companies (including PIMCO) may pay the insurance company and other

intermediaries for the sale of the Portfolio and/or other services. These payments may create a conflict of

interest by influencing the insurance company or intermediary and your salesperson to recommend a Variable

Contract and the Portfolio over another investment. Ask your insurance company or salesperson or visit your

financial intermediary’s Web site for more information.

PVIT1838S_043021

PIMCO CommodityRealReturn® Strategy

Portfolio

Summary Prospectus

April 30, 2021

| Share Class: |

Institutional Class |

As permitted by regulations adopted by the Securities and Exchange Commission, you may not be receiving

paper copies of the Portfolio's shareholder reports from the insurance company that offers your contract unless you specifically request paper copies from the insurance company or from your financial intermediary Instead, the shareholder reports will be made available

on a website, and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this

change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive all future reports in paper free of charge from the insurance

company. You should contact the insurance company if you wish to continue receiving paper copies of your

shareholder reports. Your election to receive reports in paper will apply to all portfolio companies available under your contract at the insurance company.

Before you invest, you may want to review the Portfolio’s

prospectus, which, as supplemented, contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus, reports to shareholders and other information about the Portfolio online at http://www.pimco.com/pvit. You can also get this information at no

cost by calling 1.800.927.4648 or by sending an email request to

[email protected]. The Portfolio’s prospectus and Statement of Additional Information, both dated April 30, 2021, as supplemented, are incorporated by reference

into this Summary Prospectus.

Investment Objective

The Portfolio seeks maximum real return, consistent with prudent investment management.

Fees and Expenses of the Portfolio

This table describes the fees and expenses that you may pay if you buy, hold and sell Institutional Class

shares of the Portfolio. You may pay other fees, such as commissions and other fees to financial

intermediaries, which are not reflected in the table and example below. Overall fees and expenses of

investing in the Portfolio are higher than shown because the table does not reflect variable contract fees and expenses.

| Shareholder Fees (fees paid directly from your investment): |

N/A |

Annual Portfolio Operating Expenses (expenses that you pay each year as

a percentage of the value of your investment):

| |

Institutional

Class |

| Management Fees |

0.74% |

| Other Expenses(1) |

0.35% |

| Acquired Fund Fees and Expenses |

0.14% |

| Total Annual Portfolio Operating Expenses |

1.23% |

| Fee Waiver and/or Expense Reimbursement(2)

|

(0.14%) |

| Total Annual Portfolio Operating Expenses After Fee Waiver

and/or Expense Reimbursement |

1.09% |

1

“Other Expenses” include interest expense of 0.35%. Interest expense is borne by

the Portfolio separately from the management fees paid to Pacific Investment

Management Company LLC

(“PIMCO”). Excluding interest expense, Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement are 0.74% for Institutional Class shares.

2

PIMCO has contractually agreed to waive the Portfolio’s advisory fee and the supervisory and administrative fee in

an amount equal to the management fee and administrative services fee, respectively, paid by the PIMCO Cayman Commodity Portfolio I Ltd. (the “CRRS Subsidiary”) to PIMCO. The CRRS Subsidiary pays PIMCO a management fee and an

administrative services fee at the annual rates of 0.49% and 0.20%, respectively, of its net assets. This waiver may not be terminated by PIMCO and will remain in effect for as long as PIMCO’s contract with the CRRS Subsidiary is in place.

Example. The Example is intended to help you compare the cost of investing in Institutional Class shares of the Portfolio with the costs of investing in other mutual funds. The Example

assumes that you invest $10,000 for the time periods indicated, and then redeem all your shares at the end

of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. Although your actual costs may be higher or lower, the Example shows what your costs would be

based on these assumptions. The Example does not reflect fees and expenses of any variable annuity contract

or variable life insurance policy, and would be higher if it did.

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Institutional Class |

$111 |

$376 |

$662 |

$1,476 |

Portfolio Turnover

The Portfolio pays transaction costs when it buys and sells securities (or “turns over” its

portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in the Annual Portfolio Operating Expenses or in the Example table, affect the Portfolio’s performance. During the most

recent fiscal year, the Portfolio’s portfolio turnover rate was 250% of the average value of its portfolio.

Principal Investment Strategies

The Portfolio seeks to achieve its investment objective by investing under normal circumstances in commodity-linked derivative instruments backed by a portfolio of inflation-indexed

securities and other Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt

securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector

entities. “Real Return” equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure. The Portfolio invests in commodity-linked derivative instruments, including

swap agreements, futures, options on futures, commodity index-linked notes and commodity options, that

provide exposure to the investment returns of the commodities markets, without investing directly in physical

commodities. Commodities are assets that have tangible properties, such as oil, metals, and agricultural

products. The value of commodity-linked derivative instruments may be affected by overall market movements

and other factors affecting the value of a particular industry or commodity, such as weather, disease, embargoes, or political and regulatory developments. The Portfolio may also invest in common and preferred securities as well as convertible

securities of issuers in

PIMCO Variable Insurance Trust | Summary Prospectus

PIMCO CommodityRealReturn® Strategy Portfolio

commodity-related industries. When determining the target allocation for the strategy, PIMCO may use

proprietary quantitative models. The target allocations may include long, short, or no positions in the

underlying financial markets and commodities specified in the models. The quantitative models are developed

and maintained by PIMCO, and are subject to change over time without notice in PIMCO’s discretion.

PIMCO also retains discretion over the final target asset allocation and the implementation of the target

asset allocation, which may include positions that are different from target allocations determined by

quantitative models.

The Portfolio will generally seek to gain exposure to the commodity markets primarily through investments

in swap agreements, futures, and options on futures and through investments in the PIMCO Cayman Commodity

Portfolio I Ltd., a wholly-owned subsidiary of the Portfolio organized under the laws of the Cayman Islands (the “CRRS Subsidiary”). The CRRS Subsidiary is advised by PIMCO, and has the same investment objective as the Portfolio. As

discussed in greater detail elsewhere in this prospectus, the CRRS Subsidiary (unlike the Portfolio) may

invest without limitation in commodity-linked swap agreements and other commodity-linked derivative instruments. In order to comply with certain issuer diversification limits imposed by the Internal Revenue Code, the Portfolio may invest up to 25% of

its total assets in the CRRS Subsidiary.

The derivative instruments in which the Portfolio and the CRRS Subsidiary primarily intend to invest are

instruments linked to certain commodity indices. Additionally, the Portfolio or the CRRS Subsidiary may

invest in derivative instruments linked to the value of a particular commodity or commodity futures contract, or a subset of commodities or commodity futures contracts. The Portfolio’s or the CRRS Subsidiary’s investments in commodity-linked

derivative instruments may specify exposure to commodity futures with different roll dates, reset dates or

contract months than those specified by a particular commodity index. As a result, the commodity-linked

derivatives component of the Portfolio’s portfolio may deviate from the returns of any particular

commodity index. The Portfolio or the CRRS Subsidiary may over-weight or under-weight its exposure to a

particular commodity index, or a subset of commodities, such that the Portfolio has greater or lesser

exposure to that index than the value of the Portfolio’s net assets, or greater or lesser exposure to

a subset of commodities than is represented by a particular commodity index. Such deviations will

frequently be the result of temporary market fluctuations, and under normal circumstances the Portfolio

will seek to maintain notional exposure to one or more commodity indices within 5% (plus or minus) of the

value of the Portfolio’s net assets.

The Portfolio may also invest

in leveraged or unleveraged commodity index-linked notes, which are derivative debt instruments with principal and/or coupon payments linked to the performance of commodity indices. These commodity index-linked notes are sometimes

referred to as “structured notes” because the terms of these notes may be structured by the

issuer and the purchaser of the note. The value of these notes will rise or fall in response to changes in the underlying commodity or related index of investment.

Assets not invested in commodity-linked derivative instruments or the CRRS Subsidiary may be invested in inflation-indexed securities and other Fixed Income Instruments, including derivative

Fixed Income Instruments. In addition, the Portfolio may invest its assets in particular sectors of the

commodities market.

The average portfolio duration of the fixed income

portion of this Portfolio will vary based on PIMCO’s forecast for interest rates and under normal

market conditions is not expected to exceed ten years. Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in

interest rates. The Portfolio may invest up to 10% of its total assets in high yield securities (“junk

bonds”), as rated by Moody’s Investors Service, Inc. (“Moody’s”), Standard

& Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, as determined by PIMCO. In the event that ratings services

assign different ratings to the same security, PIMCO will use the highest rating as the credit rating for

that security. The Portfolio may invest up to 30% of its total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar-denominated securities of foreign issuers. The Portfolio may invest up

to 10% of its total assets in securities and instruments that are economically tied to emerging market

countries (this limitation does not apply to investment grade sovereign debt denominated in the local currency with less than 1 year remaining to maturity, which means the Portfolio may invest, together with any other investments denominated in foreign

currencies, up to 30% of its total assets in such instruments). The Portfolio will normally limit its

foreign currency exposure (from non-U.S. dollar-denominated securities or currencies) to 20% of its total assets. The Portfolio may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a

series of purchase and sale contracts or by using other investment techniques (such as buy backs or dollar

rolls). The Portfolio may also invest up to 10% of its total assets in preferred securities. The Portfolio may purchase and sell securities on a when-issued, delayed delivery or forward commitment basis and may engage in short sales.

Principal Risks

It is possible to lose money on an investment in the Portfolio. Under certain conditions, generally in a market where the value of both commodity-linked derivative instruments and fixed income securities are declining, the Portfolio may experience

substantial losses. The principal risks of investing in the Portfolio, which could adversely affect its net

asset value, yield and total return, are:

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a portfolio with a

longer average portfolio duration will be more sensitive to changes in interest rates than a portfolio with

a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call outstanding securities prior to their maturity

for a number of reasons (e.g., declining interest rates, changes in credit spreads and improvements in the issuer’s credit quality). If an

issuer calls a security

2 Summary Prospectus | PIMCO Variable Insurance Trust

Summary Prospectus

that the Portfolio has invested in,

the Portfolio may not recoup the full amount of its initial investment and may be forced to reinvest in

lower-yielding securities, securities with greater credit risks or securities with other, less favorable

features

Credit Risk: the risk that the Portfolio could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling, or is

perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or

unwilling, to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as “junk

bonds”) are subject to greater levels of credit, call and liquidity risks. High yield securities are

considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Market

Risk: the risk that the value of securities owned by the Portfolio may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally

or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the

issuer’s goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Portfolio may be unable to sell illiquid investments at an advantageous time or price or

achieve its desired level of exposure to a certain sector. Liquidity risk may result from the lack of an

active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed

income funds may be higher than normal, causing increased supply in the market due to selling

activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage, liquidity, interest rate, market, credit and

management risks, and valuation complexity. Changes in the value of a derivative may not correlate

perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and

the Portfolio could lose more than the initial amount invested. The Portfolio’s use of derivatives may result in losses to the Portfolio, a reduction in the Portfolio’s returns and/or increased volatility. Over-the-counter

(“OTC”) derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative

transactions might not be available for OTC derivatives. The primary credit risk on derivatives that are

exchange-traded or traded through a central clearing counterparty resides with the Portfolio's clearing broker or the clearinghouse. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially

limit or impact the Portfolio’s ability to invest in derivatives, limit the Portfolio’s ability to employ

certain strategies that use

derivatives and/or adversely affect the value of derivatives and the Portfolio’s performance

Model Risk: the risk that the Portfolio’s investment models used in making investment allocation decisions may not adequately take into account certain factors, may contain design flaws or

faulty assumptions, and may rely on incomplete or inaccurate data, any of which may result in a decline in

the value of an investment in the Portfolio

Commodity

Risk: the risk that investing in commodity-linked derivative instruments may subject the Portfolio to greater volatility than investments in traditional securities. The

value of commodity-linked derivative instruments may be affected by changes in overall market movements,

commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, public health emergencies, embargoes, tariffs and international economic, political

and regulatory developments

Equity

Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not specifically related

to a particular company or to factors affecting a particular industry or industries. Equity securities

generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.) Investment Risk: the risk that investing in foreign

(non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a portfolio that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing

standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of

portfolio securities, and the risk of unfavorable foreign government actions, including nationalization,

expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments.

Foreign securities may also be less liquid and more difficult to value than securities of U.S.

issuers

Emerging Markets Risk: the risk of investing in emerging market

securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a result

of default or other adverse credit event resulting from an issuer’s inability or unwillingness to

make principal or interest payments in a timely fashion

Currency

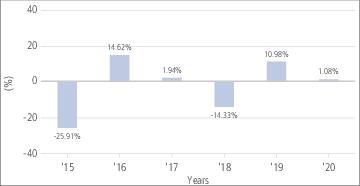

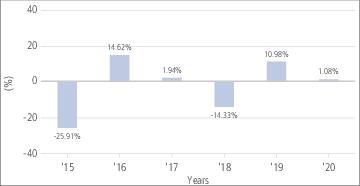

Risk: the risk that foreign (non-U.S.) currencies will change in value relative to the U.S. dollar and affect the Portfolio’s investments in foreign (non-U.S.) currencies or in