Form 497K PIMCO Managed Accounts

Fixed Income SHares: Series TE

Summary Prospectus

April 30, 2021

| Series |

TE |

| Ticker |

FXIEX |

As permitted by regulations adopted by the Securities and Exchange Commission, you

may not receive paper copies of shareholder reports from your financial intermediary, such as a

broker-dealer or bank, which offers the Portfolio unless you specifically request paper copies from your financial intermediary. Instead, the shareholder reports will be made

available on a website, and your financial intermediary will notify you by mail each time a report is

posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your financial intermediary.

If you already elected to receive shareholder reports electronically, you will not be

affected by this change and you need not take any action. You may elect to receive shareholder reports and

other communications from the Portfolio electronically by visiting pimco.com/edelivery or by following the instructions provided by the financial intermediary.

You may elect to receive all future reports in paper free of charge from your financial intermediary. You

should contact your financial intermediary if you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Portfolio, you can inform the Portfolio that you wish to continue receiving paper copies of your shareholder reports by calling

844.312.2113. Your election to receive reports in paper will apply to all portfolios held with the portfolio complex if you invest directly with the Portfolio or to all portfolios held in your account if you invest through a financial intermediary, such as a

broker-dealer or bank.

Before you invest, you may want to review the Portfolio’s prospectus, which, as supplemented, contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus, reports to shareholders, and other information about the Portfolio online at https://investments.pimco.com/products/pages/FISH.aspx. You can also get this information at no cost by calling 1-800-927-4648 or by sending an email request to [email protected]. The Portfolio’s prospectus and Statement of Additional Information, both dated April 30, 2021, as supplemented, are incorporated by reference

into this Summary Prospectus.

Investment Objectives

The Portfolio seeks high current income exempt from U.S. federal income tax consistent with prudent

investment management. Total return/capital appreciation is a secondary objective.

Fees and Expenses of the Portfolio

The tables below describe the fees and expenses you pay if you buy, hold and sell shares of the Portfolio. You may pay other fees, such as commissions and other fees to financial

intermediaries, which are not reflected in the table and example below.

| Shareholder Fees (fees paid directly from your investment): |

None |

Annual Portfolio Operating Expenses (expenses that you pay each year as

a percentage of the value of your investment):

| |

FISH: Series TE |

| Advisory Fees(1) |

0.00% |

| Other Expenses(2) |

0.04% |

| Total Annual Portfolio Operating Expenses(3) |

0.04% |

1

The Portfolio does not pay an advisory fee to Pacific Investment Management Company LLC (“PIMCO”) under the Investment Advisory Contract between the Trust and PIMCO (the

“Investment Advisory Contract”). However, the Portfolio is an integral part of “wrap-fee” programs, including those sponsored by investment advisers and

broker- dealers unaffiliated with the Portfolio or PIMCO. Participants in these programs pay a

“wrap” fee to the sponsor of the program. You should read carefully the wrap-fee brochure provided to you by the sponsor or your investment adviser. The brochure is required to include information about the fees charged to you by the sponsor and the fees paid by the

sponsor to PIMCO and its affiliates. You pay no additional fees or expenses to purchase shares of the Portfolio.

2

“Other Expenses” include interest expense of 0.04%. Interest expense is borne by

the Portfolio separately from the management fees paid to PIMCO. Excluding interest expense, Total Annual

Portfolio Operating Expenses are 0.00%.

3

Pursuant to an Expense Limitation Agreement between the Trust and PIMCO, PIMCO has contractually agreed to waive all

fees and/or pay or reimburse all expenses of the Portfolio, including organizational and offering expenses and expenses associated with obtaining or maintaining a Legal Entity Identifier, but excluding any brokerage fees and commissions and other portfolio

transaction expenses, costs, including interest expenses, of borrowing money or engaging in other types of leverage financing including, without limitation, through reverse repurchase agreements, tender option bonds, bank borrowings and credit

facilities, fees and expenses of any underlying funds or other pooled vehicles in which the Portfolio invests, taxes, governmental fees, dividends and interest on short positions, and extraordinary expenses, including extraordinary legal expenses. The

Expense Limitation Agreement will continue in effect, unless sooner terminated by the Trust’s Board of Trustees, for so long as PIMCO serves as the investment adviser to the Portfolio pursuant to the Investment Advisory Contract. During the fiscal year ended

December 31, 2020, the amounts waived and/or reimbursed pursuant to the Expense Limitation Agreement when rounded were less than 0.01%.

Example. This Example is intended to help you compare the cost of investing in shares of the Portfolio with the costs of investing in other mutual funds. The Example assumes that you

invest $10,000 in shares of the Portfolio for the time periods indicated. The Example also assumes that

your investment has a 5% return each year and the Portfolio’s operating expenses remain the same. Although your actual costs may be higher or lower, the Example shows what your costs would be based on these assumptions.

| |

1 Year |

3 Years |

5 Years |

10 Years |

| FISH: Series TE |

$4 |

$13 |

$23 |

$51 |

Portfolio Turnover

The Portfolio pays transaction costs when it buys and sells securities (or “turns over” its

portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Portfolio shares are held in a taxable account. These costs, which are not reflected in the Annual Portfolio Operating Expenses or

in the Example table, can adversely affect the Portfolio’s performance. During the most recent

fiscal year, the Portfolio’s portfolio turnover rate was 57% of the average value of its portfolio.

Principal Investment Strategies

FISH: Series TE seeks to achieve its objective by investing in municipal securities to generate income

exempt from U.S. federal income tax. Under normal circumstances, the Portfolio will not purchase bonds

subject to the federal alternative minimum tax (“AMT”). The Portfolio normally invests at least

80% of its net assets (plus borrowings made for investment purposes) in a portfolio of U.S. fixed income instruments comprised of debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance,

exempt from federal income tax, including (but not limited to):

PIMCO Managed Accounts Trust | Summary Prospectus

Fixed Income SHares: Series TE

■

municipal debt securities issued by states and their agencies, authorities and other instrumentalities which are exempt from federal income tax;

■

municipal debt securities issued by local governments and their agencies, authorities and other instrumentalities which are exempt from federal income tax; and

■

tax-exempt structured notes, which may contain embedded derivatives.

The Portfolio may invest in instruments of any maturity. The average portfolio duration of the Portfolio

is expected to vary and may range anywhere from relatively short (e.g., less than two years) to relatively

long (e.g., more than ten years) based on PIMCO’s forecast for interest rates.

The Portfolio may invest without limit in U.S. dollar denominated securities. The Portfolio may invest without limit in U.S. Government securities, money market instruments and/or

“private activity” bonds that are exempt from federal income tax. To the extent distributions

derived from “private activity” bonds may be subject to the federal AMT, investments in such

“private activity” bonds will be limited by the 80% policy noted above. The Portfolio may invest more than 25% of its total assets in bonds of issuers in either California or New York, or both. To the extent that the Portfolio concentrates its

investments in California or New York, it will be particularly subject to California or New York

state-specific risks, as applicable.

The Portfolio will invest, under normal circumstances, in debt securities that are rated

“investment grade”, or, if unrated, determined by PIMCO to be of comparable quality, at the time of purchase. In the event that ratings services assign different ratings to the same security, PIMCO will use the highest rating as the credit rating

for that security.

Subject to the 80% policy noted above, the Portfolio

may invest the remainder of its assets in fixed income securities that generate income that is not exempt

from federal income tax (for example, Build America Bonds or, as noted above, “private activity” bonds to the extent distributions from them are subject to the federal AMT).

The Portfolio may invest in derivative instruments, such as options, futures contracts or swap

agreements, which may relate to fixed income securities, interest rates, currencies or currency exchange rates, commodities, real estate and other assets, and related indices. Although the Portfolio did not invest significantly in

derivative instruments as of the most recent fiscal year end, it may do so at any time. The Portfolio may

lend its portfolio securities to brokers, dealers and other financial institutions to earn income. The Portfolio may also invest in securities issued by entities, such as trusts, whose underlying assets are municipal bonds, including, without limitation, inverse

floating rate debt securities (“inverse floaters”). The Portfolio may seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using

other investment techniques (such as buy backs or dollar rolls).

The Portfolio will not change its policy to, under normal circumstances, invest at least 80% of its net

assets (plus the amount of any borrowings for investment purposes) in U.S. fixed income instruments comprised of

debt securities whose interest is,

in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax unless

the Portfolio provides shareholders with the notice required by Rule 35d-1 under the Investment Company Act

of 1940, as it may be amended or interpreted by the SEC from time to time.

Principal Risks

It is possible to lose money on an investment in the Portfolio. The principal risks of investing in the Portfolio, which could adversely affect its net asset value, yield and total return,

are:

Small Portfolio Risk: the risk that a smaller Portfolio may not achieve investment or trading efficiencies. Additionally, a smaller Portfolio may be more adversely affected by large purchases

or redemptions of Portfolio shares

Municipal Securities Risk: the risk that investing in municipal securities subjects the Portfolio to certain risks, including variations in the quality of municipal securities, both within a particular classification and between classifications. The rates of

return on municipal securities can depend on a variety of factors, including general money market

conditions, the financial condition of the issuer, general conditions of the municipal bond market, the

size of a particular offering, the maturity of the obligation, and the rating of the issue

Municipal Project-Specific Risk: the risk that the Portfolio may be more

sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in the bonds of specific projects (such as those relating to education, health care, housing, transportation, and utilities), industrial

development bonds, or in bonds from issuers in a single state

Municipal Bond Market Risk: the risk that the Portfolio may be adversely affected due to factors such as limited amount of public information available regarding the municipal bonds held in the Portfolio as compared to that for corporate equities or

bonds, legislative changes and local and business developments, general conditions of the municipal bond

market, the size of the particular offering, the rating of the issue and the maturity of the obligation

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a portfolio with a longer average portfolio duration will be more

sensitive to changes in interest rates than a portfolio with a shorter average portfolio duration

Credit Risk: the risk that the Portfolio could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling, or is

perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or

unwilling, to meet its financial obligations

Market

Risk: the risk that the value of securities owned by the Portfolio may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally

or particular industries

Focused Investment Risk: the risk that, to the extent that the

Portfolio focuses its investments in a particular sector, it may be

2 Summary Prospectus | PIMCO Managed Accounts Trust

Summary Prospectus

susceptible to loss due to adverse developments affecting that sector. Furthermore, the Portfolio may invest a substantial portion of its assets in companies in related sectors that may share

common characteristics, are often subject to similar business risks and regulatory burdens, and whose

securities may react similarly to market developments, which will subject the Portfolio to greater risk. The Portfolio also will be subject to focused investment risk to the extent that it invests a substantial portion of its assets in a particular issuer,

market, asset class, country or geographic region

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage,

liquidity, interest rate, market, credit and management risks, and valuation complexity. Changes in the

value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the

underlying asset, rate or index, and the Portfolio could lose more than the initial amount invested. The

Portfolio’s use of derivatives may result in losses to the Portfolio, a reduction in the Portfolio’s returns and/or increased volatility. Over-the-counter (“OTC”) derivatives are also subject to the risk that a counterparty

to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative transactions might not be available for OTC derivatives. The primary credit

risk on derivatives that are exchange-traded or traded through a central clearing counterparty resides with

the Portfolio's clearing broker or the clearinghouse. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Portfolio’s ability to invest in derivatives, limit the

Portfolio’s ability to employ certain strategies that use derivatives and/or adversely affect the value

of derivatives and the Portfolio’s performance

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Portfolio may be unable to sell

illiquid investments at an advantageous time or price or achieve its desired level of exposure to a certain

sector. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate

environment or other circumstances where investor redemptions from fixed income funds may be higher than

normal, causing increased supply in the market due to selling activity

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results and that

actual or potential conflicts of interest, legislative, regulatory, or tax restrictions, policies or

developments may affect the investment techniques available to PIMCO and the individual portfolio manager in

connection with managing the Portfolio and may cause PIMCO to restrict or prohibit participation in certain

investments. There is no guarantee that the investment objective of the Portfolio will be achieved

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the

issuer’s goods or services

California State-Specific Risk: the risk that the Portfolio, to the extent it concentrates its investments in California municipal bonds, may be affected significantly by economic, regulatory or political developments affecting the ability of California issuers

to pay interest or repay principal

New York State-Specific Risk: the risk that the Portfolio, to the extent it concentrates its investments in New York municipal bonds, may be affected significantly by economic, regulatory or political developments affecting the ability of New York issuers to

pay interest or repay principal

Turnover

Risk: the risk that high levels of portfolio turnover may increase transaction costs and taxes and may lower investment performance

Please see “Description of Principal Risks” for more information regarding the risks associated with investing in the Portfolio. An investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency.

Performance Information

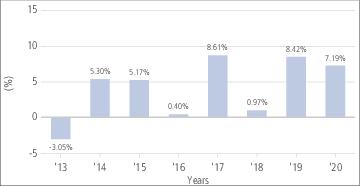

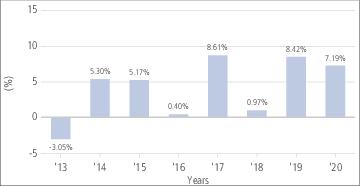

The performance information shows summary performance information for the Portfolio in a bar chart and an Average Annual

Total Returns table. The information provides some indication of the risks of investing in the Portfolio by

showing changes in its performance from year to year and by showing how the Portfolio’s average annual total returns compare with the returns of a broad-based securities market index. Absent any applicable fee waivers and/or expense limitations, performance would have been lower. The information in the

bar chart and Average Annual Total Returns Table does not reflect payment of any applicable

“wrap” fees by clients of “wrap-fee” programs that invest in the Portfolio to the program sponsors. The Portfolio’s past performance, before and after taxes, is not necessarily an indication of how the Portfolio will perform in the future.

The Portfolio’s benchmark is the Bloomberg Barclays 1-Year Municipal Bond Index. The Bloomberg Barclays 1-Year

Municipal Bond Index is the 1 Year (1-2) component of the Municipal Bond Index. The Bloomberg Barclays

Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long term tax-exempt bond market. To be included in the Index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following

ratings agencies: Moody’s, S&P and Fitch. If only two of the three agencies rate the security,

the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. They must have an outstanding par value of at least $7 million and be issued as part of a transaction

of at least $75 million. The bonds must be fixed rate, have a dated-date after December 31, 1990, and must

be at least one year from their maturity date. Remarketed issues, taxable municipal bonds, bonds with floating rates, and derivatives, are excluded from the benchmark. It is not possible to invest directly in an index.

April 30, 2021 | SUMMARY PROSPECTUS 3

Fixed

Income SHares: Series TE

Calendar Year Total Returns

| Best Quarter |

June 30, 2020 |

4.27% |

| Worst Quarter |

June 30, 2013 |

-4.20% |

Average Annual Total Returns (for periods ended 12/31/20)

| |

1 Year |

5 Years |

Since Inception |

Inception

Date |

| Fixed Income SHares: Series TE - Before

Taxes |

7.19% |

5.05% |

3.99% |

6/25/2012 |

| Fixed Income SHares: Series TE - After Taxes on Distributions(1) |

7.15% |

4.74% |

3.78% |

|

| Fixed Income SHares: Series TE - After

Taxes on Distributions and Sale of

Portfolio Shares |

5.66% |

4.41% |

3.58% |

|

| Bloomberg Barclays 1-Year Municipal Bond Index (reflects no deductions for fees, expenses or taxes) |

1.76% |

1.43% |

1.11% |

|

1

After-tax returns are calculated using the highest historical individual federal marginal

income tax rates and do not reflect the impact of state and local taxes.Actual after-tax returns depend on an investor's tax situation and may differ from these returns shown. After-tax returns shown are not

relevant to investors, who hold their shares through tax advantaged arrangements such as 401(k) plans or individual retirement accounts.In some cases, the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Portfolio shares at the end of the measurement

period.

Investment Adviser/Portfolio Manager

PIMCO serves as the investment adviser and administrator for the Portfolio. The Portfolio is jointly and primarily managed by David Hammer and Rachel Betton. Mr. Hammer is a Managing Director and head of municipal bond portfolio management in PIMCO’s Newport Beach office. Ms. Betton is a Senior Vice President and municipal bond portfolio

manager in PIMCO’s New York office. Mr. Hammer has managed the Portfolio since August 2015. Ms.

Betton has managed the Portfolio since January 2020.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio may be purchased only by or on behalf of “wrap”

account clients where PIMCO or Virtus Fund Advisors, LLC (each, as applicable, the “Wrap Program

Adviser”) has an agreement to serve as investment adviser or sub-adviser to the account with the wrap program sponsor (typically a registered investment adviser, bank or broker-dealer)

or directly with the client. A client agreement to open an account typically may be obtained by contacting the wrap program sponsor. Minimum investment amounts for investing in a

Portfolio can be found in the wrap-fee brochure provided to you by the wrap program sponsor or your

investment adviser. Generally, purchase and redemption orders for Portfolio shares are processed at the net asset value (“NAV”) next calculated after the broker-dealer who executes trades for the applicable wrap account receives the order on behalf of

the account. Orders received by the broker-dealer prior to the time the Portfolio’s NAV is determined

on a business day will be processed at that day’s NAV, even if the order is received by the transfer agent after the Portfolio’s NAV has been calculated that day, as long as the order is received by the transfer agent prior to such

time as agreed upon by the transfer agent and the broker-dealer.

Tax Information

Except as noted below, the Portfolio’s distributions are generally taxable to you as ordinary

income, capital gains or a combination of the two, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case distributions may be taxable upon

withdrawal.

FISH Series TE Portfolio intends to make distributions that

consist of exempt-interest dividends, which are generally not taxable to shareholders for federal income

tax purposes, but a portion of its distributions may be subject to the federal AMT. A portion of that

Portfolio’s distributions may not qualify as exempt-interest dividends; such distributions will

generally be taxable to shareholders as ordinary income or capital gains.

FISH2090_043021

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Pacific Investment Management Company, LLC (PIMCO)Sign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share