Form 497K PIMCO FUNDS

PIMCO All Asset All Authority Fund

Summary Prospectus

July 30, 2021 (as supplemented April 29, 2022)

| Share Class: |

Inst |

I-2 |

I-3 |

Admin |

A |

C |

| Ticker: |

PAUIX |

PAUPX |

PAUNX |

- |

PAUAX |

PAUCX |

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you

specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, pimco.com/literature, and you will be notified by mail each time a report

is posted and provided with a website link to access the report.

If you already elected to receive

shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by visiting pimco.com/edelivery or by contacting

your financial intermediary, such as a broker-dealer or bank.

You may elect to receive all future reports in paper free of charge. If you own these shares through a financial

intermediary, such as a broker-dealer or bank, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue

receiving paper copies of your shareholder reports by calling 888.87.PIMCO (888.877.4626). Your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or to all funds held in your account if

you invest through a financial intermediary, such as a broker-dealer or bank.

Before you invest, you may want to review the Fund’s prospectus, which, as supplemented, contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders (once available) and other information about the Fund online at http:// investments.pimco.com/prospectuses. You can also get this information at no cost by calling 888.87.PIMCO or by sending an email request to [email protected]. The Fund’s prospectus and Statement of Additional Information, dated July 30, 2021, respectively, as supplemented, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Fund seeks maximum real return, consistent with preservation of real capital and prudent investment management.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You

may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which

are not reflected in the table and example below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Class A shares of eligible funds offered by PIMCO Equity Series and PIMCO Funds. More information about these and other discounts is available in the “Classes of Shares” section on page 43 of the Fund’s prospectus, Appendix B to the Fund’s prospectus (Financial Firm-Specific Sales Charge Waivers and Discounts) or from your financial

professional.

Shareholder Fees (fees paid directly from your investment):

| |

Inst

Class |

I-2 |

I-3 |

Admin

Class |

Class A |

Class C |

| Maximum Sales

Charge (Load)

Imposed on

Purchases (as a

percentage of

offering price) |

None |

None |

None |

None |

5.50% |

None |

| Maximum Deferred

Sales Charge (Load)

(as a percentage of

the lower of the

original purchase

price or redemption

price) |

None |

None |

None |

None |

1.00% |

1.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| |

Inst

Class |

I-2 |

I-3 |

Admin

Class |

Class A |

Class C |

| Management Fees |

0.25% |

0.35% |

0.45% |

0.25% |

0.45% |

0.45% |

| Distribution and/or

Service (12b-1) Fees |

N/A |

N/A |

N/A |

0.25% |

0.25% |

1.00% |

| Other Expenses(1) |

0.50% |

0.50% |

0.50% |

0.50% |

0.50% |

0.50% |

| Acquired Fund Fees

and Expenses |

1.05% |

1.05% |

1.05% |

1.05% |

1.05% |

1.05% |

| Total Annual

Fund Operating

Expenses(2) |

1.80% |

1.90% |

2.00% |

2.05% |

2.25% |

3.00% |

| Fee Waiver and/or

Expense

Reimbursement(3)(4)

|

(0.02%) |

(0.02%) |

(0.07%) |

(0.02%) |

(0.02%) |

(0.02%) |

| Total Annual

Fund Operating

Expenses After

Fee Waiver

and/or Expense

Reimbursement(5) |

1.78% |

1.88% |

1.93% |

2.03% |

2.23% |

2.98% |

1

Interest expense of 0.50% results from the Fund’s ability to borrow money for

investment purposes from a committed line of credit. Such expense is required to be treated as a

Fund expense for accounting purposes and is not payable to PIMCO. Any interest expense amount will vary based on the Fund’s use of such line of credit in seeking to achieve the objective of the Fund.

2

Total Annual Fund Operating Expenses do not match the Ratio of Expenses to Average

Net Assets Excluding Waivers of the Fund, as set forth in the Financial Highlights table of the

Fund’s prospectus, because the Ratio of Expenses to Average Net Assets Excluding Waivers reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

3

PIMCO has contractually agreed, through July 31, 2022, to reduce its advisory fee to the extent that the Underlying PIMCO Fund Expenses attributable to advisory and supervisory and administrative

fees exceed 0.69% of the total assets invested in Underlying PIMCO Funds. PIMCO may recoup these waivers in future periods, not exceeding three years from the date of waiver, provided total expenses, including such recoupment, do not exceed

the annual expense limit that was in place at the time the amount being recouped was originally waived and the current annual expense limit. This waiver will automatically renew for one-year terms unless PIMCO provides written notice to the Trust at

least 30 days prior to the end of the then current term. The fee reduction is implemented based on a calculation of Underlying PIMCO Fund Expenses attributable to advisory and supervisory and administrative fees that is different from the calculation of

Acquired Fund Fees and Expenses listed in the table above.

4

PIMCO has contractually agreed, through July 31, 2022, to reduce its supervisory and

administrative fee for the Fund’s I-3 shares by 0.05% of the average daily net assets

attributable to I-3 shares of the Fund. This Fee Waiver Agreement renews annually

PIMCO Funds | Summary Prospectus

PIMCO All Asset All Authority Fund

unless terminated by PIMCO upon at least 30 days’ prior notice to the end of the contract term.

5

“Other Expenses” and Acquired Fund Fees and Expenses include interest expense of the Fund and of the

Underlying PIMCO Funds of 0.50% and 0.07%, respectively. Interest expense is borne by the Fund and the Underlying PIMCO Funds separately from the management fees paid to PIMCO. Excluding interest expense of the Fund and of the Underlying PIMCO

Funds, Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement are 1.21%, 1.31%, 1.36%, 1.46%, 1.66% and 2.41% for Institutional Class, I-2, I-3, Administrative Class, Class A and Class C shares,

respectively.

Example. The Example is intended to help you compare the cost of investing in Institutional Class, I-2, I-3,

Administrative Class, Class A or Class C shares of the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the noted class of shares for the time periods

indicated, and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although

your actual costs may be higher or lower, based on these assumptions your costs would be:

If you redeem your shares at the end of each period:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Institutional Class |

$181 |

$564 |

$973 |

$2,114 |

| I-2 |

$191 |

$595 |

$1,025 |

$2,220 |

| I-3 |

$196 |

$621 |

$1,071 |

$2,322 |

| Administrative Class |

$206 |

$641 |

$1,101 |

$2,378 |

| Class A |

$764 |

$1,213 |

$1,687 |

$2,991 |

| Class C |

$401 |

$925 |

$1,575 |

$3,316 |

If you do not redeem your shares:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$764 |

$1,213 |

$1,687 |

$2,991 |

| Class C |

$301 |

$925 |

$1,575 |

$3,316 |

Portfolio Turnover

The

Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account.

These costs, which are not reflected in the Annual Fund Operating Expenses or in the Example

tables, affect the Fund’s performance. During the most recent fiscal year, the Fund’s

portfolio turnover rate was 159% of the average value of its portfolio.

Principal

Investment Strategies

The Fund is a “fund of funds,” which is a term used to describe

mutual funds that pursue their investment objective by investing in other funds. The Fund seeks

to achieve its investment objective by investing under normal circumstances substantially all of its assets in the least expensive class of shares of any actively managed or smart beta funds (including mutual funds or exchange-traded funds)

of the Trust, or PIMCO ETF Trust or PIMCO Equity Series, each an affiliated open-end investment

company, except other funds of funds and PIMCO California Municipal Intermediate Value Fund,

PIMCO California Municipal Opportunistic

Value Fund, PIMCO National Municipal Intermediate Value Fund and PIMCO National Municipal Opportunistic Value Fund (collectively, “Underlying PIMCO Funds”). As

used in the investment objective, “real return” equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure, and “real capital” equals

capital less the estimated cost of inflation measured by the change in an official inflation measure. In addition to investing in Underlying PIMCO Funds, at the discretion of Pacific Investment Management Company LLC

(“PIMCO”) and without shareholder approval, the Fund may invest in additional Underlying PIMCO Funds created in the future.

The

Fund invests its assets in shares of the Underlying PIMCO Funds and does not invest directly in stocks or bonds of other issuers. Research Affiliates, the Fund’s asset allocation sub-adviser, determines how the Fund allocates and reallocates

its assets among the Underlying PIMCO Funds. In doing so, the asset allocation sub-adviser seeks concurrent exposure to a broad spectrum of asset classes.

Investments in Underlying PIMCO Funds. The Fund may invest in any or all of the Underlying PIMCO Funds, but will not normally invest in every Underlying PIMCO Fund at any particular time. The Fund’s investment in any particular Underlying

PIMCO Fund normally will not exceed 50% of its total assets. The Fund’s investments in the Short Strategy Underlying PIMCO Funds, which seek to gain a negative exposure to an asset class such as equities,

normally will not exceed 20% of its total assets. The Fund’s combined investments in the

Domestic Equity-Related Underlying PIMCO Funds normally will not exceed 50% of its total assets.

The Fund’s combined investments in the International Equity-Related Underlying PIMCO Funds normally will not exceed 50% of its total assets. The Fund’s combined investments in the Equity-Related Underlying PIMCO

Funds (less any investment in the Short Strategy Underlying PIMCO Funds) normally will not exceed

sixty-six and two-thirds percent of its total assets. In addition, the Fund’s combined

investments in Inflation-Related Underlying PIMCO Funds, which seek to gain exposure to an asset class such as U.S. Treasury Inflation-Protected Securities (“TIPS”), commodities, or real estate, normally will not exceed 75%

of its total assets.

Asset Allocation Investment Process. The Fund’s assets are not allocated according to a predetermined blend of shares of the Underlying PIMCO Funds. Instead, the

Fund’s asset allocation sub-adviser considers a broad range of quantitative data and qualitative inputs, both in isolation and to a material degree as inputs into a series of quantitative models that inform

the final allocation and trading decisions, which are made by the Fund’s portfolio managers. The quantitative data and qualitative inputs considered include (but are not limited to) macroeconomic data

relating to U.S. and foreign economies (such as economic growth measures, inflation measures, production and consumption measures, trade figures, fiscal policies and monetary policies) and financial market data relating

to U.S. and foreign asset classes (such as yield levels, income growth rates, valuation measures,

credit and default risk measures and financial statement data). These data points are primarily

used as inputs to a series of quantitative models, which collectively enable the asset allocation sub- adviser to

2 Summary Prospectus | PIMCO Funds

Summary

Prospectus

construct multiple optimized model portfolios for consideration in determining the Fund’s actual allocation and trading approach. These include models relating to capital

markets expectations, macroeconomic regimes, risk regimes, factor analysis of Underlying PIMCO Funds and portfolio construction. Multiple model portfolios are constructed, each optimized to different return and risk

parameters, so that the portfolio managers can assess the implications, attributes and tradeoffs of

different asset allocation approaches in determining the final allocation and trading decisions,

in seeking to achieve the objectives of the Fund.

In addition to these quantitative and model-driven

considerations, which comprise a majority of the asset allocation investment process, the

portfolio managers also may consider various qualitative inputs in refining their final allocation and trading decisions. These may include qualitative macroeconomic and financial market views held by the asset allocation sub-adviser and PIMCO, as

well as subjective assessments of liquidity risk, risk premia attractiveness, expected net flows into the Fund and investor behavioral factors.

The Fund’s asset allocation sub-adviser has the flexibility to reallocate the Fund’s assets among any or all of the Underlying PIMCO Funds based on the asset allocation

sub-adviser’s ongoing analyses of the absolute and relative attractiveness of the asset class and other investment exposures represented in each. These include (but are not limited to) exposures relating to U.S.

and foreign equity, fixed income, currency and commodity markets, as well as idiosyncratic exposures of specific companies, countries, issuers or risk premia. While these analyses are updated and reviewed

frequently, material shifts in asset allocation positioning are typically staged over longer periods of time, which reflects multiple considerations including market momentum, seeking best trading execution and

monitoring portfolio turnover.

Borrowing for Investment

Purposes. The Fund may use leverage by borrowing for investment purposes to purchase additional shares of Underlying PIMCO Funds. The Fund can borrow

from banks up to a maximum of thirty-three and one-thirds percent of total assets. If at any time

the Fund’s borrowings exceed this thirty-three and one-thirds percent maximum limitation, the Fund will, within three business days, decrease its borrowings to the extent required. Borrowing requires the payment of interest and other loan

costs. To make such payments, the Fund may be forced to sell portfolio securities when it is not otherwise advantageous to do so. At times when the Fund’s borrowings are substantial, the interest expense to the

Fund may result in the Fund having little or no investment income. The use of leverage by borrowing

creates the potential for greater gains to shareholders of the Fund during favorable market

conditions and the risk of magnified losses during adverse market conditions. In addition, the Underlying PIMCO Funds may engage in certain transactions that give rise to a form of leverage.

Principal Risks

It is possible to lose money on an investment in the Fund. The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return,

are listed below.

Principal Risks of the Fund

Allocation Risk: the risk that a Fund could lose money as a result of less than optimal or poor asset allocation decisions. The

Fund could miss attractive investment opportunities by underweighting markets that subsequently

experience significant returns and could lose value by overweighting markets that subsequently experience significant declines

Fund of Funds

Risk: the risk that a Fund’s performance is closely related to the risks associated with the securities and other investments held by the Underlying PIMCO Funds

and that the ability of a Fund to achieve its investment objective will depend upon the ability of the Underlying PIMCO Funds to achieve their investment objectives

Leveraging Risk: the risk that certain transactions of the Fund, such as direct borrowing from banks, reverse repurchase

agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or

forward commitment transactions, or derivative instruments, may give rise to leverage, magnifying

gains and losses and causing the Fund to be more volatile than if it had not been leveraged. This means that leverage entails a heightened risk of loss

Certain principal risks of investing in the Underlying PIMCO Funds, and consequently the Fund, which could adversely affect its net asset value, yield and total return, are listed

below.

Certain Principal Risks of Underlying PIMCO Funds

As used in the risk disclosures below, the term “Fund” refers to one or more Underlying PIMCO Funds.

Market Trading Risk: the risk that an active secondary trading market for shares of a Fund that is an exchange-traded fund does not

continue once developed, that such Fund may not continue to meet a listing exchange’s

trading or listing requirements, or that such Fund’s shares trade at prices other than the Fund’s net asset value

Municipal Project-Specific Risk: the risk that a Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its

assets in the bonds of specific projects (such as those relating to education, health care, housing, transportation, and utilities), industrial development bonds, or in bonds from issuers in a single

state

Municipal Bond Risk: the risk that an Underlying PIMCO Fund may be affected significantly by the economic, regulatory or political developments affecting the ability of

issuers of debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax (“Municipal Bonds”) to pay interest or repay

principal

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a fund with a longer average portfolio duration will be more

sensitive to changes in interest rates than a fund with a shorter average portfolio duration

Call

Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call outstanding securities prior to their

maturity for a number of reasons

July 30, 2021 (as supplemented April 29, 2022) | SUMMARY PROSPECTUS 3

PIMCO

All Asset All Authority Fund

(e.g., declining interest rates, changes in credit spreads and improvements in the issuer’s credit quality).

If an issuer calls a security that the Fund has invested in, the Fund may not recoup the full amount of its initial investment and may be forced to reinvest in lower-yielding securities, securities with greater

credit risks or securities with other, less favorable features

Credit

Risk: the risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling, or

is perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or unwilling, to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as

“junk bonds”) are subject to greater levels of credit, call and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer’s continuing ability to make

principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Distressed Company

Risk: the risk that securities of distressed companies may be subject to greater levels of credit, issuer and liquidity risk than a portfolio that does not

invest in such securities. Securities of distressed companies include both debt and equity securities. Debt securities of distressed companies are considered predominantly speculative with respect to the issuers’

continuing ability to make principal and interest payments

Market

Risk: the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally

or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand

for the issuer’s goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid investments at an advantageous time or price

or achieve its desired level of exposure to a certain sector. Liquidity risk may result from the

lack of an active market, reduced number and capacity of traditional market participants to make

a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed income funds may be higher than normal, causing increased

supply in the market due to selling activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including

leverage, liquidity, interest rate, market, credit and management risks, and valuation

complexity. Changes in the value of a derivative may not correlate perfectly with, and may be

more sensitive to market events than, the underlying asset, rate or index, and the Fund could lose more than the initial amount invested. The Fund’s use of derivatives may result in losses to the Fund, a reduction in

the Fund’s returns and/or increased volatility. Over-the-counter (“OTC”) derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual

obligations to the other party, as many of the protections afforded to centrally-cleared derivative transactions might not be available for OTC derivatives. The primary credit risk

on derivatives that are exchange-traded or traded through a central clearing counterparty resides

with the Fund's clearing broker or the clearinghouse. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Fund’s ability to invest in derivatives, limit the

Fund’s ability to employ certain strategies that use derivatives and/or adversely affect the value of derivatives and the Fund’s performance

Futures Contract

Risk: the risk that, while the value of a futures contract tends to correlate with the value of the underlying asset that it represents, differences between the

futures market and the market for the underlying asset may result in an imperfect correlation. Futures contracts may involve risks different from, and possibly greater than, the risks associated with investing

directly in the underlying assets. The purchase or sale of a futures contract may result in losses in excess of the amount invested in the futures contract

Model

Risk: the risk that the Underlying PIMCO Fund’s investment models used in making investment allocation decisions, and the indexation or quantitative methodologies used

in constructing an underlying index or model portfolio for an Underlying PIMCO Fund that seeks to

track the investment results of such underlying index or model portfolio, may not adequately take into account certain factors or may rely on inaccurate data, may contain design flaws or faulty assumptions, and may rely on incomplete or

inaccurate data, any of which may result in a decline in the value of an investment in the Underlying PIMCO Fund

Commodity

Risk: the risk that investing in commodity-linked derivative instruments may subject the Fund to greater volatility than investments in traditional securities.

The value of commodity-linked derivative instruments may be affected by changes in overall market

movements, commodity index volatility, changes in interest rates, or factors affecting a

particular industry or commodity, such as drought, floods, weather, livestock disease, public health emergencies, embargoes, tariffs and international economic, political and regulatory developments

Equity

Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not

specifically related to a particular company or to factors affecting a particular industry or industries. Equity securities generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in

mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.)

Investment Risk: the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than

a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing

4 Summary Prospectus | PIMCO Funds

Summary

Prospectus

reporting, accounting and auditing standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of portfolio securities, and the risk of

unfavorable foreign government actions, including nationalization, expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments. Foreign securities may also be less

liquid and more difficult to value than securities of U.S. issuers

Real Estate Risk: the risk that the Fund’s investments in Real Estate Investment Trusts (“REITs”) or real

estate-linked derivative instruments will subject the Fund to risks similar to those associated with direct ownership of real estate, including losses from casualty or condemnation, and changes in local and general

economic conditions, supply and demand, interest rates, zoning laws, regulatory limitations on

rents, property taxes and operating expenses. A Fund’s investments in REITs or real estate-linked derivative instruments subject it to management and tax risks. In addition, privately traded REITs subject a Fund to liquidity and valuation

risk

Emerging Markets Risk: the risk of investing in emerging market securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a

result of default or other adverse credit event resulting from an issuer’s inability or

unwillingness to make principal or interest payments in a timely fashion

Currency

Risk: the risk that foreign (non-U.S.) currencies will change in value relative to the U.S. dollar and affect the Fund’s investments in foreign (non-U.S.) currencies

or in securities that trade in, and receive revenues in, or in derivatives that provide exposure to, foreign (non-U.S.) currencies

Leveraging

Risk: the risk that certain transactions of the Fund, such as reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery

or forward commitment transactions, or derivative instruments, may give rise to leverage,

magnifying gains and losses and causing the Fund to be more volatile than if it had not been

leveraged. This means that leverage entails a heightened risk of loss

Smaller Company Risk: the risk that the value of securities issued by a smaller company may go up or down, sometimes rapidly and

unpredictably as compared to more widely held securities, due to narrow markets and limited

resources of smaller companies. A Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk

Issuer

Non-Diversification Risk: the risk of focusing investments in a small number of issuers, including being more susceptible to risks associated with a single economic,

political or regulatory occurrence than a more diversified portfolio might be. Funds that are

“non-diversified” may invest a greater percentage of their assets in the securities

of a single issuer (such as bonds issued by a particular state) than funds that are “diversified”

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO and Research Affiliates, including the use of quantitative models or methods,

will not produce the desired results and that actual or potential conflicts of interest, legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to PIMCO or

Research Affiliates and the individual portfolio managers in connection with managing the Fund and may cause PIMCO or Research Affiliates to restrict or prohibit participation in certain investments.

There is no guarantee that the investment objective of the Fund will be achieved

Short Exposure Risk: the risk of entering into short sales, including the potential loss of more money than the actual cost of the

investment, and the risk that the third party to the short sale will not fulfill its contractual

obligations, causing a loss to the Fund. Also, to the extent the Fund seeks to gain negative exposure to an asset class such as equities, such exposure may create the potential for losses should those asset classes deliver positive

returns

Tax Risk: the risk that the tax treatment of swap agreements and other derivative instruments, such as commodity-linked derivative instruments, including commodity index-linked

notes, swap agreements, commodity options, futures, and options on futures, may be affected by future regulatory or legislative changes that could affect whether income from such investments is “qualifying

income” under Subchapter M of the Internal Revenue Code, or otherwise affect the character, timing and/or amount of the Fund’s taxable income or gains and distributions

Subsidiary Risk: the risk that, by investing in certain Underlying PIMCO Funds that invest in a subsidiary (each a

“Subsidiary”), the Fund is indirectly exposed to the risks associated with a Subsidiary’s investments. The Subsidiaries are not registered under the 1940 Act and may not be subject to all the investor

protections of the 1940 Act. There is no guarantee that the investment objective of a Subsidiary will be achieved

Value

Investing Risk: a value stock may decrease in price or may not increase in price as anticipated by PIMCO if it continues to be undervalued by the market or the factors that

the portfolio manager believes will cause the stock price to increase do not occur

Convertible Securities Risk: as convertible securities share both fixed income and equity characteristics, they are subject to risks to

which fixed income and equity investments are subject. These risks include equity risk, interest

rate risk and credit risk

Exchange-Traded Fund Risk: the risk that an exchange-traded fund may not track the performance of the index it is designed to track, among other reasons, because of exchange

rules, market prices of shares of an exchange-traded fund may fluctuate rapidly and materially,

or shares of an exchange-traded fund may trade significantly above or below net asset value, any

of which may cause losses to the Fund invested in the exchange-traded fund

Tracking Error Risk: the risk that the portfolio of a Fund that seeks to track the investment results of an underlying index may

not closely track the underlying index for a number of reasons. The Fund incurs operating

July 30, 2021 (as supplemented April 29, 2022) | SUMMARY PROSPECTUS 5

PIMCO

All Asset All Authority Fund

expenses, which are not applicable to the underlying index, and the costs of buying and selling securities, especially when rebalancing the Fund’s portfolio to reflect

changes in the composition of the underlying index. Performance of the Fund and the underlying index may vary due to asset valuation differences and differences between the Fund’s portfolio and the underlying index due

to legal restrictions, cost or liquidity restraints. The risk that performance of the Fund and the

underlying index may vary may be heightened during periods of increased market volatility or

other unusual market conditions. In addition, a Fund’s use of a representative sampling approach may cause the Fund to be less correlated to the return of the underlying index than if the Fund held all of the

securities in the underlying index

Indexing Risk: the risk that an Underlying PIMCO Fund that seeks to track the investment results of an underlying index is negatively affected by general declines in the asset

classes represented by the underlying index

LIBOR Transition Risk: the risk related to the anticipated discontinuation of the London Interbank Offered Rate

(“LIBOR”). Certain instruments held by the Fund rely in some fashion upon LIBOR.

Although the transition process away from LIBOR has become increasingly well-defined in advance

of the anticipated discontinuation date, there remains uncertainty regarding the nature of any replacement rate, and any potential effects of the transition away from LIBOR on the Fund or on certain instruments in

which the Fund invests can be difficult to ascertain. The transition process may involve, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR and may result in

a reduction in value of certain instruments held by the Fund

Please see “Description of Principal Risks” in the Fund's prospectus for a more detailed

description of the risks of investing in the Fund. An investment in the Fund is not a deposit of

a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

government agency.

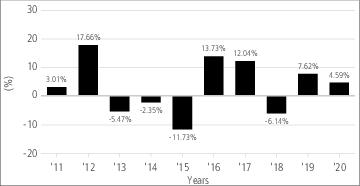

Performance Information

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some

indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a primary and a secondary

broad-based securities market index and an index of similar funds. Absent any applicable fee

waivers and/or expense limitations, performance would have been lower. The bar chart shows

performance of the Fund’s Institutional Class shares. For periods prior to the inception date of I-3 shares (April 27, 2018), performance information shown in the table for that class is based on the performance of the Fund’s

Institutional Class shares, adjusted to reflect the fees and expenses paid by the I-3 shares. The Administrative Class of the Fund has not commenced operations as of the date of this prospectus. Performance in the Average

Annual Total Returns table

reflects the

impact of sales charges. The Fund’s past performance,

before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The Fund measures its performance against a primary benchmark and a secondary benchmark. The Fund’s

primary benchmark is the Bloomberg U.S. TIPS Index. The Bloomberg U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation Protected Securities (“TIPS”) rated investment

grade (Baa3 or better) that have at least one year to final maturity and at least $500 million par amount outstanding. The CPI + 650 Basis Points benchmark, the secondary benchmark, is created by adding 6.5% to the annual

percentage change in the Consumer Price Index (“CPI”). The CPI is an unmanaged index

representing the rate of inflation of the U.S. consumer prices as determined by the US Bureau of

Labor Statistics. Lipper Alternative Global Macro Funds Average is a total return performance average of Funds tracked by Lipper, Inc. that, by prospectus language, invest around the world using economic theory to

justify the decision-making process. The strategy is typically based on forecasts and analysis about interest rate trends, the general flow of funds, political changes, government policies, intergovernmental relations,

and other broad systemic factors. These funds generally trade a wide range of markets and geographic regions, employing a broad range of trading ideas and instruments.

Performance for the Fund is updated daily and quarterly and may be obtained as follows: daily and quarterly

updates on the net asset value and performance page at

https://www.pimco.com/en-us/product-finder.

Calendar Year Total Returns — Institutional Class

| Best Quarter |

June 30, 2020 |

13.13% |

| Worst Quarter |

March 31, 2020 |

-19.37% |

| Year-to-Date |

June 30, 2021 |

12.94% |

6 Summary Prospectus | PIMCO Funds

Summary Prospectus

Average Annual Total Returns (for periods

ended 12/31/20)

| |

1 Year |

5 Years |

10 Years |

| Institutional Class Return Before Taxes |

4.59% |

6.13% |

2.89% |

| Institutional Class Return After Taxes on Distributions(1) |

2.70% |

4.23% |

0.74% |

| Institutional Class Return After Taxes on Distributions

and Sales of Fund Shares(1) |

2.70% |

3.90% |

1.28% |

| I-2 Return Before Taxes |

4.48% |

6.02% |

2.79% |

| I-3 Return Before Taxes |

4.44% |

5.96% |

2.71% |

| Class A Return Before Taxes |

-1.58% |

4.47% |

1.86% |

| Class C Return Before Taxes |

2.39% |

4.87% |

1.67% |

| Bloomberg U.S. TIPS Index (reflects no deductions for

fees, expenses or taxes) |

10.99% |

5.08% |

3.81% |

| Consumer Price Index + 650 Basis Points (reflects no

deductions for fees, expenses or taxes) |

7.80% |

8.43% |

8.22% |

| Lipper Alternative Global Macro Funds Average (reflects

no deductions for taxes) |

5.53% |

5.06% |

3.78% |

1

After-tax returns are calculated using the highest historical individual federal

marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax

returns depend on an investor’s tax situation and may differ from those shown, and the

after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.After-tax returns are for Institutional Class shares only. After-tax returns for other classes will

vary.

Investment

Adviser/Portfolio Managers

PIMCO serves as the investment adviser for the Fund. Research Affiliates serves as the asset allocation sub-adviser to the Fund. The Fund’s portfolio is jointly and primarily managed by Robert D. Arnott and Christopher J. Brightman. Mr. Arnott is the Chairman and Founder of Research Affiliates and he has managed the Fund since its inception in

October 2003. Mr. Brightman is Chief Executive Officer and Chief Investment Officer of Research

Affiliates and he has managed the Fund since November 2016.

Purchase and Sale of Fund Shares

Fund shares may be purchased or sold (redeemed) on any business day (normally any day when the New York Stock

Exchange (“NYSE”) is open). Generally, purchase and redemption orders for Fund shares are processed at the net asset value next calculated after an order is received by the Fund.

Institutional Class, I-2, I-3 and Administrative Class

The minimum initial investment for Institutional Class, I-2, I-3 and Administrative Class shares of the Fund is $1 million, except that the minimum initial investment may be

modified for certain financial firms that submit orders on behalf of their customers.

You may sell (redeem) all or part of your Institutional Class, I-2, I-3 and Administrative Class shares of the

Fund on any business day. If you are the registered owner of the shares on the books of the Fund, depending on the elections made on the Account Application, you may sell by:

◾

Sending a written request by regular mail to:PIMCO Funds

P.O. Box 219024, Kansas City, MO 64121-9024

or by overnight mail to:

PIMCO Funds c/o DST Asset Manager Solutions, Inc.

430 W 7th Street, STE 219024, Kansas City, MO 64105-1407

P.O. Box 219024, Kansas City, MO 64121-9024

or by overnight mail to:

PIMCO Funds c/o DST Asset Manager Solutions, Inc.

430 W 7th Street, STE 219024, Kansas City, MO 64105-1407

◾

Calling us at 888.87.PIMCO and a Shareholder Services associate will assist you

◾

Sending a fax to our Shareholder Services department at 816.421.2861

◾

Sending an e-mail to [email protected]

Class A and Class C

The minimum initial investment for Class A and Class C shares of the Fund is $1,000. The minimum subsequent investment for Class A and Class C shares is $50. The minimum initial

investment may be modified for certain financial firms that submit orders on behalf of their

customers. You may purchase or sell (redeem) all or part of your Class A and Class C shares

through a broker-dealer, or other financial firm, or, if you are the registered owner of the shares on the books of the Fund, by regular mail to PIMCO Funds, P.O. Box 219294, Kansas City, MO 64121-9294 or overnight mail to PIMCO Funds, c/o

DST Asset Manager Solutions, Inc., 430 W. 7th Street, STE 219294, Kansas City, MO 64105-1407. The

Fund reserves the right to require payment by wire or U.S. Bank check in connection with accounts opened directly with the Fund by Account Application.

Tax Information

The

Fund’s distributions are generally taxable to you as ordinary income, capital gains, or a combination of the two, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case

distributions may be taxable upon withdrawal. Distributions paid by the Fund that are

properly designated as “exempt interest dividends” normally will be exempt from

federal income taxes, but may not be exempt from the federal alternative minimum tax.

Payments to Broker-Dealers and Other Financial Firms

If you purchase shares of the Fund through a broker-dealer or other financial firm (such as a bank), the Fund and/or its related companies (including PIMCO) may pay the financial

firm for the sale of those shares of the Fund and/or related services. These payments may create a

conflict of interest by influencing the broker-dealer or other financial firm and your

salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial firm’s website for more information.

July 30, 2021 (as supplemented April 29, 2022) | SUMMARY PROSPECTUS 7

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Pacific Investment Management Company, LLC (PIMCO)Sign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share