Form 497K PIMCO ETF Trust

.

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

SUMMARY PROSPECTUS

October 30, 2020 (as supplemented July 30, 2021)

|

Ticker |

MINT |

NYSE Arca |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail from the financial intermediary, such as a broker-dealer or bank, which offers the Fund unless you specifically request paper copies of the reports from the financial intermediary. Instead, the shareholder reports will be made available on a website, and the financial intermediary will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your financial intermediary.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the financial intermediary electronically by following the instructions provided by the financial intermediary.

You may elect to receive all future reports in paper free of charge from the financial intermediary. You should contact the financial intermediary if you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account at the financial intermediary.

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders (once available) and other information about the Fund online at pimcoetfs.com/resources . You can also get this information at no cost by calling 888.400.4ETF (888.400.4383) or by sending an email request to piprocess@dstsystems.com. The Fund’s prospectus and Statement of Additional Information, both dated October 30, 2020, as supplemented, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Fund seeks maximum current income, consistent with preservation of capital and daily liquidity.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment): N/A

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

Management Fees |

0.35% |

|

Other Expenses(1) |

0.02% |

|

Total Annual Fund Operating Expenses |

0.37% |

| 1 | “Other Expenses” include interest expense of 0.02%. Interest expense is borne by the Fund separately from the management fees paid to Pacific Investment Management Company LLC (“PIMCO”). Excluding interest expense, Total Annual Fund Operating Expenses are 0.35%. |

Example. The Example is intended to help you compare the cost of investing in the Fund with the costs of investing in other exchange-traded funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated, and then sell all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

Investors may pay brokerage commissions on their purchases and sales of Fund shares, which are not reflected in the Example. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$38 |

$119 |

$208 |

$468 |

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the Example tables, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 81% of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by investing under normal circumstances at least 80% of its net assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The average portfolio duration of this Fund will vary based on PIMCO’s market forecasts and will normally not exceed one year. Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. The dollar-weighted average portfolio maturity of the Fund is normally not expected to exceed three years.

The Fund primarily invests in U.S. dollar-denominated investment grade debt securities, rated Baa or higher by Moody’s Investors Service, Inc. (“Moody’s”), or equivalently rated by Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, determined by PIMCO to be of comparable quality. In the event that ratings services assign different ratings to the same security, PIMCO will use the highest rating as the credit rating for that security. The Fund may invest, without limitation, in U.S. dollar-denominated securities and instruments of foreign issuers.

The Fund may invest, without limitation, in mortgage or asset-backed securities, including to-be-announced transactions. The Fund may purchase and sell securities on a when-issued, delayed delivery or forward commitment basis. The Fund may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as buy backs or dollar rolls).

Principal Risks

It is possible to lose money on an investment in the Fund. The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are listed below.

Market Trading Risk: the risk that an active secondary trading market for Fund shares does not continue once developed, that the Fund may not

PIMCO ETF TRUST | SUMMARY

PROSPECTUS

PIMCO ETF TRUST | SUMMARY

PROSPECTUS

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

continue to meet a listing exchange’s trading or listing requirements, or that Fund shares trade at prices other than the Fund’s net asset value

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a fund with a longer average portfolio duration will be more sensitive to changes in interest rates than a fund with a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call outstanding securities prior to their maturity for a number of reasons (e.g., declining interest rates, changes in credit spreads and improvements in the issuer’s credit quality). If an issuer calls a security that the Fund has invested in, the Fund may not recoup the full amount of its initial investment and may be forced to reinvest in lower-yielding securities, securities with greater credit risks or securities with other, less favorable features

Credit Risk: the risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a forward commitment transaction, is unable or unwilling, or is perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or unwilling, to meet its financial obligations

Market Risk: the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid investments at an advantageous time or price or achieve its desired level of exposure to a certain sector. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed income funds may be higher than normal, causing increased supply in the market due to selling activity

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk, and credit risk

Foreign (Non-U.S.) Investment Risk: the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of portfolio securities, and the risk of unfavorable foreign government actions, including nationalization, expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments. Foreign securities may also be less liquid and more difficult to value than securities of U.S. issuers

Leveraging Risk: the risk that certain transactions of the Fund, such as reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions may give rise to leverage, magnifying gains and losses and causing the Fund to

be more volatile than if it had not been leveraged. This means that leverage entails a heightened risk of loss

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results and that actual or potential conflicts of interest, legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to PIMCO and the individual portfolio manager in connection with managing the Fund and may cause PIMCO to restrict or prohibit participation in certain investments. There is no guarantee that the investment objective of the Fund will be achieved

LIBOR Transition Risk: the risk related to the anticipated discontinuation of the London Interbank Offered Rate (“LIBOR”) by the end of 2021. Certain instruments held by the Fund rely in some fashion upon LIBOR. Although the transition process away from LIBOR has become increasingly well-defined in advance of the anticipated discontinuation date, there remains uncertainty regarding the nature of any replacement rate, and any potential effects of the transition away from LIBOR on the Fund or on certain instruments in which the Fund invests can be difficult to ascertain. The transition process may involve, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR and may result in a reduction in value of certain instruments held by the Fund

Please see “Description of Principal Risks” in the Fund’s prospectus for a more detailed description of the risks of investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance Information

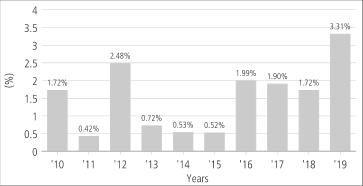

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities market index. Absent any applicable fee waivers and/or expense limitations, performance would have been lower. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The FTSE 3-Month Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 3 month Treasury Bill issues. The Fund began operations on 11/16/09. Index comparisons began on 11/30/09.

Performance for the Fund is updated daily and quarterly and may be obtained as follows: daily and quarterly updates on the net asset value and performance page at https://www.pimco.com/en-us/investments/etf.

2SUMMARY PROSPECTUS | PIMCO ETF TRUST

Summary Prospectus

Calendar Year Total Returns*

*The year-to-date return as of September 30, 2020 is 1.37%. For the periods shown in the bar chart, the highest quarterly return was 1.24% in the Q1 2012, and the lowest quarterly return was -0.57% in the Q3 2011.

Average Annual Total Returns (for periods ended 12/31/19)

|

1 Year |

5 Years |

10 Years | |

|

Return Before Taxes |

3.31% |

1.88% |

1.53% |

|

Return After Taxes on Distributions(1) |

2.19% |

1.14% |

0.97% |

|

Return After Taxes on Distributions and Sales of Fund Shares(1) |

1.95% |

1.11% |

0.94% |

|

FTSE 3-Month Treasury Bill Index (reflects no deductions for fees, expenses or taxes) |

2.25% |

1.05% |

0.56% |

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. |

Investment Adviser/Portfolio Managers

.

.

.

.

.

PIMCO serves as the investment adviser for the Fund. The Fund’s portfolio is jointly and primarily managed by Jerome Schneider,

Andrew Wittkop and Nathan Chiaverini. Mr. Schneider is a Managing Director of PIMCO, and he has managed the Fund since its inception in November 2009. Mr. Wittkop is an Executive Vice President of PIMCO, and he has managed the Fund since July 2021. Mr. Chiaverini is a Senior Vice President of PIMCO, and he has managed the Fund since July 2021.

Purchase and Sale of Fund Shares

The Fund is an exchange-traded fund (“ETF”). Individual Fund shares may only be purchased and sold on a national securities exchange through a broker-dealer and may not be purchased or redeemed directly with the Fund. The price of Fund shares is based on market price, and because ETF shares trade at market prices rather than net asset value (“NAV”), shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (“bid”) and the lowest price a seller is willing to accept for shares (“ask”) when buying or selling shares in the secondary market (the “bid-ask spread”). Recent information, including information about the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads, is included on the Fund’s website at https://www.pimco.com/en-us/investments/etf.

Tax Information

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or a combination of the two, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case distributions may be taxable upon withdrawal.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary, PIMCO or other related companies may pay the intermediary for the sale of Fund shares or related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

October 30, 2020 (as supplemented July 30, 2021) | SUMMARY PROSPECTUS3

.

ETF4750_073021

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Pacific Investment Management Company, LLC (PIMCO)Sign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share