Form 497K NUVEEN INVESTMENT TRUST

Nuveen International Small Cap Fund |

|

|

|

This summary prospectus is designed to provide investors with key Fund information in a clear and concise format. Before you invest, you may want to review the Fund’s complete prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders and other information about the Fund online at www.nuveen.com/prospectus. You can also get this information at no cost by calling (800) 257-8787 or by sending an e-mail request to [email protected]. If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the prospectus, reports to shareholders and other information will also be available from your financial intermediary. The Fund’s prospectus and statement of additional information, both dated November 30, 2022, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above. |

Investment Objective

The investment objective of the Fund is to seek long-term capital appreciation.

Fees and Expenses of the Fund

The following tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund or in other Nuveen Mutual Funds. More information about these and other discounts, as well as eligibility requirements for each share class, is available from your financial advisor and in “How You Can Buy and Sell Shares” on page 33 of the Fund’s prospectus and “Purchase and Redemption of Fund Shares” on page S-62 of the Fund’s statement of additional information. In addition, more information about sales charge discounts and waivers for purchases of shares through specific financial intermediaries is set forth in the appendix to the Fund’s prospectus entitled “Variations in Sales Charge Reductions and Waivers Available Through Certain Intermediaries.”

The tables and examples below do not reflect any commissions that shareholders may be required to pay directly to their financial intermediaries when buying or selling Class I shares.

Shareholder Fees

(fees paid directly from your investment)

Class A |

Class C |

Class R6 |

Class I |

|||||

Maximum Sales Charge (Load) Imposed on Purchases |

5.75% |

None |

None |

None |

||||

Maximum

Deferred Sales Charge (Load) |

None |

1.00% |

None |

None |

||||

Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None |

None |

None |

None |

||||

Exchange Fee |

None |

None |

None |

None |

||||

Annual Low Balance Account Fee (for accounts under $1,000)2 |

$15 |

$15 |

None |

$15 |

Summary Prospectus |

1

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Class A |

Class C |

Class R6 |

Class I |

|||||||||||||

Management Fees |

0.85 |

% |

0.85 |

% |

0.85 |

% |

0.85 |

% | ||||||||

Distribution and/or Service (12b-1) Fees |

0.25 |

% |

1.00 |

% |

0.00 |

% |

0.00 |

% | ||||||||

Other Expenses |

0.41 |

% |

0.41 |

% |

0.34 |

% |

0.41 |

% | ||||||||

Total Annual Fund Operating Expenses |

1.51 |

% |

2.26 |

% |

1.19 |

% |

1.26 |

% | ||||||||

Fee Waivers and/or Expense Reimbursements3 |

(0.32 |

)% |

(0.32 |

)% |

(0.32 |

)% |

(0.32 |

)% | ||||||||

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements |

1.19 |

% |

1.94 |

% |

0.87 |

% |

0.94 |

% | ||||||||

1 The contingent deferred sales charge on Class C shares applies only to redemptions within 12 months of purchase.

2 Fee applies to the following types of accounts under $1,000 held directly with the Fund: individual retirement accounts (IRAs), Coverdell Education Savings Accounts and accounts established pursuant to the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA).

3 The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses so that the total annual operating expenses of the Fund (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.99% through July 31, 2024 or 1.00% after July 31, 2024 of the average daily net assets of any class of Fund shares. However, because Class R6 shares are not subject to sub-transfer agent and similar fees, the total annual operating expenses for the Class R6 shares will be less than the expense limitation. The expense limitation expiring July 31, 2024 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund. The expense limitation in effect thereafter may be terminated or modified only with the approval of shareholders of the Fund.

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then either redeem or do not redeem your shares at the end of a period. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses are at the lesser of Total Annual Fund Operating Expenses or the applicable expense limitation. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class A |

Class C |

Class R6 |

Class I |

||||||||||

1 Year |

$ |

689 |

$ |

197 |

$ |

89 |

$ |

96 |

|||||

3 Years |

$ |

932 |

$ |

611 |

$ |

279 |

$ |

301 |

|||||

5 Years |

$ |

1,195 |

$ |

1,051 |

$ |

486 |

$ |

524 |

|||||

10 Years |

$ |

1,945 |

$ |

2,273 |

$ |

1,083 |

$ |

1,165 |

|||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 61% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities of small-capitalization companies, and invests at least 80% of its net assets in securities of non-U.S. companies. Small-capitalization companies are defined as companies that have market capitalizations within the market capitalization range of the companies in the MSCI World Ex USA Small Cap Index on the last business day of the month in which its most recent rebalancing was completed. The index currently is rebalanced semiannually in May and November of each year. On May 31, 2022, the capitalization range of companies in the index was $57 million to $14.4 billion. The Fund may invest up to 15% of its net assets in equity securities of companies located in emerging market countries.

The Fund’s sub-adviser seeks to invest in companies with improving fundamental profiles as well as sustainable, above-average earnings growth, high or rising returns on invested capital and reasonable relative valuations. In selecting securities, the sub-adviser initially narrows the investable universe using a quantitative screen that evaluates and ranks equity securities within regional peer groups. Next, securities with limited trading liquidity and research coverage are eliminated. The sub-adviser conducts a regular review of the remaining securities’ fundamental characteristics, including revenue and earnings growth, positive earnings revisions, earnings consistency, high or improving returns on invested capital and free cash flow, reasonable financial leverage and attractive relative valuation, to further narrow the list of

2

investable securities. Finally, the sub-adviser conducts a qualitative fundamental review of the remaining securities in order to select securities for the Fund’s portfolio.

The sub-adviser generally will sell an equity security for any of the following reasons: the company’s business fundamentals are deteriorating; there has been a decline in investor sentiment; the security has become significantly overvalued; there has been a significant price decline relative to peers; to maintain portfolio construction and risk control guidelines; or to replace the security with that of a company with better performance potential.

The Fund may utilize options, including options on foreign currencies, futures contracts, options on futures contracts, and forward foreign currency exchange contracts (“derivatives”). The Fund may use these derivatives to manage market risk or business risk, enhance the Fund’s return, or hedge against adverse movements in currency exchange rates.

Principal Risks

The value of your investment in this Fund will change daily. You could lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The principal risks of investing in the Fund listed below are presented alphabetically to facilitate your ability to find particular risks and compare them with the risks of other funds. Each risk summarized below is considered a "principal risk" of investing in the Fund, regardless of the order in which it appears.

Active Management Risk—The Fund’s sub-adviser actively manages the Fund’s investments. Consequently, the Fund is subject to the risk that the investment techniques and risk analyses employed by the Fund’s sub-adviser may not produce the desired results. This could cause the Fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Currency Risk—Changes in currency exchange rates will affect the value of non-U.S. securities, the value of dividends and interest earned from such securities, gains and losses realized on the sale of such securities, and derivative transactions tied to such securities. A strong U.S. dollar relative to these other currencies will adversely affect the value of the Fund's portfolio.

Cybersecurity Risk—Cybersecurity risk is the risk of an unauthorized breach and access to Fund assets, customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund, its investment adviser or sub-adviser, custodian, transfer agent, distributor or other service provider or a financial intermediary to suffer a data breach, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its service providers may adversely impact the Fund or its shareholders. Additionally, a cybersecurity breach could affect the issuers in which the Fund invests, which may cause the Fund’s investments to lose value.

Derivatives Risk—The use of derivatives involves additional risks and transaction costs which could leave the Fund in a worse position than if it had not used these instruments. Derivative instruments can be used to acquire or to transfer the risk and returns of a security or other asset without buying or selling the security or asset. These instruments may entail investment exposures that are greater than their cost would suggest. As a result, a small investment in derivatives can result in losses that greatly exceed the original investment. Derivatives can be highly volatile, illiquid and difficult to value. An over-the-counter derivative transaction between the Fund and a counterparty that is not cleared through a central counterparty also involves the risk that a loss may be sustained as a result of the failure of the counterparty to the contract to make required payments. The payment obligation for a cleared derivative transaction is guaranteed by a central counterparty, which exposes the Fund to the creditworthiness of the central counterparty.

Emerging Markets Risk—The risk of foreign investment often increases in countries with emerging markets or that are otherwise economically tied to emerging market countries. For example, these countries may have more unstable governments than developed countries and their economies may be based on only a few industries. Emerging market countries may also have less stringent regulation of accounting, auditing, financial reporting and recordkeeping requirements, which would affect the Fund’s ability to evaluate potential portfolio companies. As a result, there could be less information about issuers in emerging market countries, which could negatively affect the ability of the Fund’s sub-adviser to evaluate local companies or their potential impact on the Fund’s performance. Because their financial markets may be very small, prices of financial instruments in emerging market countries may be volatile and difficult to determine. Financial instruments of issuers in these countries may have lower overall liquidity than those of issuers in more developed countries. In addition, foreign investors such as the Fund are subject to a variety of special restrictions in many emerging market countries. Shareholder claims and regulatory actions that are available in the U.S. may be difficult or impossible to pursue in emerging market countries.

3

Equity Security Risk—Equity securities in the Fund’s portfolio may decline significantly in price over short or extended periods of time, and such declines may occur because of declines in the equity market as a whole, or because of declines in only a particular country, company, industry, or sector of the market. From time to time, the Fund may invest a significant portion of its assets in companies in one or more related sectors or industries which would make the Fund more vulnerable to adverse developments affecting such sectors or industries.

Foreign Investment Risk—Non-U.S. issuers or U.S. issuers with significant non-U.S. operations may be subject to risks in addition to those of issuers located in or that principally operate in the United States as a result of, among other things, political, social and economic developments abroad and different legal, regulatory and tax environments. Foreign investments may also have lower liquidity and be more difficult to value than investments in U.S. issuers. To the extent the Fund invests a significant portion of its assets in the securities of companies in a single country or region, it may be more susceptible to adverse conditions affecting that country or region. Foreign investments may also be subject to risk of loss because of more or less foreign government regulation, less public information, less stringent investor protections and less stringent accounting, corporate governance, financial reporting and disclosure standards. The Fund currently invests a significant portion of its assets in companies located in Japan, although this may change over time.

Growth Stock Risk—Growth stocks tend to be more volatile than certain other types of stocks and their prices usually fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings and may lack dividends that can help cushion its share price in a declining market.

Industrials Sector Risk—The Fund currently invests a significant portion of its assets in the industrials sector, although this may change over time. Industrials companies are affected by various factors, including the general state of the economy, exchange rates, commodity prices, intense competition, consolidation, domestic and international politics, government regulation, import controls, excess capacity, consumer demand and spending trends. In addition, industrials companies may also be significantly affected by overall capital spending levels, economic cycles, rapid technological changes, delays in modernization, labor relations, environmental liabilities, governmental and product liability and e-commerce initiatives.

Market Risk—The market value of the Fund’s investments may go up or down, sometimes rapidly or unpredictably and for short or extended periods of time, due to the particular circumstances of individual issuers or due to general conditions impacting issuers more broadly. Global economies and financial markets have become highly interconnected, and thus economic, market or political conditions or events in one country or region might adversely impact the value of the Fund’s investments whether or not the Fund invests in such country or region. Events such as war, terrorism, natural and environmental disasters and the spread of infectious illnesses or other public health emergencies may have a severe negative impact on the global economy, could cause financial markets to experience extreme volatility and losses, and could result in the disruption of trading and the reduction of liquidity in many instruments. Additionally, as inflation increases, the value of the Fund’s assets can decline.

Small-Cap Company Risk—Securities of small-cap companies involve substantial risk. Prices of small-cap securities may be subject to more abrupt or erratic movements, and to wider fluctuations and lower liquidity, than security prices of larger, more established companies or broader market averages in general. It may be difficult to sell small-cap securities at the desired time and price.

Fund Performance

The following bar chart and table provide some indication of the potential risks of investing in the Fund. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at www.nuveen.com/performance or by calling (800) 257-8787.

4

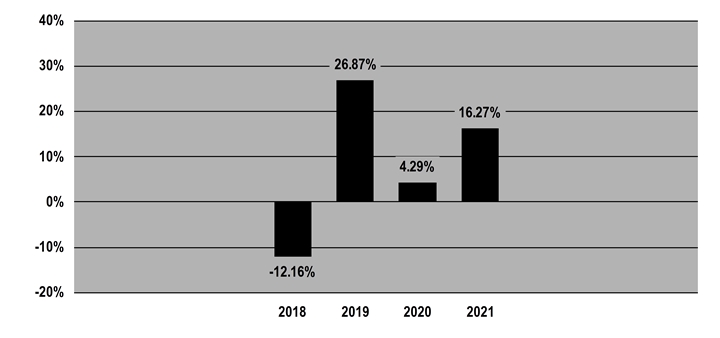

The bar chart below shows the variability of the Fund’s performance from year to year for Class A shares. The bar chart and highest/lowest quarterly returns that follow do not reflect sales charges, and if these charges were reflected, the returns would be less than those shown.

Class A Annual Total Return* |

*Class A year-to-date total return as of September 30, 2022 was -31.39%. The performance of the other share classes will differ due to their different expense structures.

During the four-year period ended December 31, 2021, the Fund’s highest and lowest quarterly returns were

16.32%

and -25.43%, respectively, for the quarters ended June 30, 2020 and March 31,

2020.

The table below shows the variability of the Fund’s average annual returns and how they compare over the time periods indicated with those of a broad measure of market performance and an index of funds with similar investment objectives. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns are shown for Class A shares only; after-tax returns for other share classes will vary. Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold Fund shares in tax-deferred accounts such as IRAs or employer-sponsored retirement plans.

Both the bar chart and the table assume that all distributions have been reinvested. Performance reflects fee waivers, if any, in effect during the periods presented. If any such waivers had not been in place, returns would have been reduced.

|

|

|

|

|

Average Annual Total Returns | |||||

|

|

|

|

|

for the Periods Ended | |||||

|

|

|

|

|

December 31, 2021 | |||||

|

|

Inception

|

1 Year |

Since

| ||||||

Class A (return before taxes) |

|

12/18/17 |

|

|

9.58 |

% |

|

6.46 |

% | |

Class A (return after taxes on distributions) |

|

|

|

|

7.97 |

% |

|

5.94 |

% | |

Class A (return after taxes on distributions and sale of Fund shares) |

|

|

|

|

6.43 |

% |

|

5.02 |

% | |

Class C (return before taxes) |

|

12/18/17 |

|

|

15.37 |

% |

|

7.21 |

% | |

Class R6 (return before taxes) |

|

12/18/17 |

|

|

16.58 |

% |

|

8.33 |

% | |

Class I (return before taxes) |

|

12/18/17 |

|

|

16.54 |

% |

|

8.29 |

% | |

MSCI World Ex USA Small Cap Index1 |

|

|

|

|

|

|

|

|

| |

(reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or other taxes) |

|

|

|

|

11.14 |

% |

|

7.05 |

% | |

Lipper International Small/Mid-Cap Funds Category Average2 |

|

|

|

|

|

|

|

|

| |

(reflects no deduction for taxes or sales loads) |

|

|

|

|

11.34 |

% |

|

8.23 |

% | |

1 |

A free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of smaller capital stocks in developed markets, excluding the U.S. market. | |||||||||

2 |

Represents the average annualized returns for all reporting funds in the Lipper International Small/Mid-Cap Funds Category. | |||||||||

5

Management

Investment Adviser

Nuveen Fund Advisors, LLC

Sub-Adviser

Nuveen Asset Management, LLC

Portfolio Managers

Name |

Title |

Portfolio Manager of Fund Since |

Adam J. Kuhlmann |

Managing Director |

December 2017 |

Dean G. DuMonthier, CFA |

Managing Director |

May 2019 |

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund on any business day through a financial advisor or other financial intermediary. The Fund’s initial and subsequent investment minimums generally are as follows, although certain financial intermediaries may impose their own investment minimums and the Fund may reduce or waive the minimums in some cases:

Class A and Class C |

Class R6 |

Class I | |

Eligibility and Minimum Initial Investment |

$3,000 for all accounts except: • $2,500 for Traditional/ • $2,000 for Coverdell • $250 for accounts opened through fee-based programs. • No minimum for retirement plans. |

Available only to certain qualified retirement plans and other investors as described in the prospectus and through fee-based programs. $1 million for all accounts except: • $100,000 for clients of financial intermediaries who charge such clients an ongoing fee for advisory, investment, consulting or related services. • No minimum for certain qualified retirement plans and certain other categories of eligible investors as described in the prospectus. |

Available only through fee-based programs and certain retirement plans, and to other limited categories of investors as described in the prospectus. $100,000 for all accounts except: • $250 for clients of financial intermediaries and family offices that have accounts holding Class I shares with an aggregate value of at least $100,000 (or that are expected to reach this level). • No minimum for eligible retirement plans and certain other categories of eligible investors as described in the prospectus. |

Minimum |

$100 |

No minimum. |

No minimum. |

Tax Information

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as an IRA or 401(k) plan (in which case you may be taxed upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund, its distributor or its investment adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

MPM-WINSC-1122P |

6

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- /C O R R E C T I O N -- MYCOM OSI/

- Freddie Mac Multifamily Announces More Than $20 Billion in Impact Bonds Issued Since Program Inception

- IBN Named Official Media Partner of Podfest Master Class 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share