Form 497K NEXPOINT FUNDS II

| NexPoint Funds II | Summary Prospectus January 31, 2023 |

NexPoint Climate Tech Fund

Class A HSZAX Class C HSZCX Class Y HSZYX

Before you invest, you may want to review the Fund’s Statutory Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Statutory Prospectus, Statement of Additional Information and other information about the Fund online at https://www.nexpoint.com/nexpoint/funds/nexpoint-climate-tech-fund/. You can also get this information at no cost by calling 1-877-665-1287 or by sending an e-mail request to [email protected]. The Fund’s Statutory Prospectus and Statement of Additional Information, both dated January 31, 2023, as supplemented, are incorporated by reference into this Summary Prospectus.

Investment Objective

The investment objective of NexPoint Climate Tech Fund (“Climate Tech Fund” or the “Fund”) is to seek long-term growth of capital.

Fees and Expenses of the Fund

The following tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples.

You may qualify for sales charge discounts on purchases of Class A Shares if you and your family invest, or agree to invest in the future, at least $50,000 in NexPoint Funds II funds. More information about these and other discounts is available from your financial professional and in the “Reduced Sales Charges for Class A Shares” section on page 31 of the Fund’s Prospectus and the “Programs for Reducing or Eliminating Sales Charges” section on page 60 of the Fund’s Statement of Additional Information. Investors investing in the Fund through an intermediary should consult the Appendix to the Fund’s Prospectus, which includes information regarding financial intermediary-specific sales charges and related discount policies that apply to purchases through certain specified intermediaries.

Shareholder Fees (fees paid directly from your investment)

| Class A | Class C | Class Y | ||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

5.75% | None | None | |||||||||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions (as a % of offering price) |

None | None | None | |||||||||

| Maximum Deferred Sales Charge (Load) (as a % of the net asset value at the time of purchase or redemption, whichever is lower) |

None1 | 1.00%2 | None | |||||||||

| Exchange Fee |

None | None | None | |||||||||

| Redemption Fee |

None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | Class Y | ||||||||||

| Management Fee |

0.95% | 0.95% | 0.95% | |||||||||

| Distribution and/or Service (12b-1) Fees |

0.25% | 1.00% | None | |||||||||

| Other Expenses |

2.05% | 2.05% | 2.05% | |||||||||

| Interest Payments and Commitment Fees on Borrowed Funds |

0.03% | 0.03% | 0.03% | |||||||||

| Dividend Expense on Short Sales |

0.03% | 0.03% | 0.03% | |||||||||

| Remainder of Other Expenses |

1.99% | 1.99% | 1.99% | |||||||||

| Acquired Fund Fees and Expenses3 |

0.24% | 0.24% | 0.24% | |||||||||

| Total Annual Fund Operating Expenses |

3.49% | 4.24% | 3.24% | |||||||||

| Expense Reimbursement3 |

-2.19% | -2.19% | -2.19% | |||||||||

| Total Annual Fund Operating Expenses After Expense Reimbursement |

1.30% | 2.05% | 1.05% |

| 1 | Class A Shares bought without an initial sales charge in accounts aggregating $1 million or more at the time of purchase are subject to a 0.50% contingent deferred sales charge (“CDSC”) if the shares are sold within one year of purchase. |

| 2 | Class C Shares are subject to a 1% CDSC for redemptions of shares within one year of purchase. This CDSC does not apply to redemptions under a systematic withdrawal plan. |

| 3 | NexPoint Asset Management, L.P. (“NexPoint” or the “Adviser”) has contractually agreed to limit the total annual operating expenses (exclusive of fees paid by the Fund pursuant to its distribution plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), taxes, such as –––deferred tax expenses, dividend expenses on short sales, interest payments, brokerage commissions and other transaction costs, acquired fund fees and expenses and extraordinary expenses (collectively, the “Excluded Expenses”)) of the Fund to 1.15% of average daily net assets attributable to any class of the Fund (the “Expense Cap”). The Expense Cap will continue through at least January 31, 2024, and may not be terminated prior to this date without the action or consent of the Fund’s Board of Trustees. Under the expense limitation agreement, the Adviser may recoup waived and/or reimbursed amounts with respect to the Fund within thirty-six months of the date such amounts were waived or reimbursed, provided the Fund’s total annual operating expenses, including such recoupment, do not exceed the Expense Cap in effect at the time of such waiver/reimbursement. In addition, the fees and expenses shown in the table above and the Expense Example that follows include the Fund’s share of the fees and expenses of any affiliated funds in which the Fund invests. However, to avoid charging duplicative fees, the Adviser will waive and/or reimburse the Fund’s Management Fee with respect to the amount of its net assets invested in the underlying affiliated funds. The amount of this waiver will fluctuate |

| depending on the Fund’s daily allocations to underlying affiliated funds. The “Total Annual Fund Operating Expenses” shown may not correlate to the Fund’s ratios of expenses to average daily net assets shown in the “Financial Highlights” section of the Fund’s prospectus, which do not include “Acquired Fund Fees and Expenses.” This affiliated fund fee waiver is expected to remain in effect permanently, and it cannot be terminated without the approval of the Fund’s Board of Trustees. |

Expense Example

This Example helps you compare the cost of investing in the Fund to the cost of investing in other mutual funds. The Example assumes that (i) you invest $10,000 in the Fund for the time periods indicated and then sell or redeem all your shares at the end of those periods, (ii) your investment has a 5% return each year, and (iii) operating expenses remain the same. Only the first year of each period in the Example takes into account the expense reimbursement described in the footnote above. Your actual costs may be higher or lower.

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class A |

$700 | $1,392 | $2,106 | $3,986 | ||||||||||||

| Class C |

||||||||||||||||

| if you do not sell your shares |

$208 | $1,088 | $1,981 | $4,274 | ||||||||||||

| if you sold all your shares at the end of the period |

$308 | $1,088 | $1,981 | $4,274 | ||||||||||||

| Class Y |

$107 | $793 | $1,502 | $3,389 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Expense Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 32% of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by investing at least 80% of its net assets plus borrowing for investment purposes under normal circumstances in equity securities, such as common and preferred stocks, of climate tech companies. This investment policy is not fundamental and may be changed by the Fund without shareholder approval upon 60 days’ prior written notice to shareholders. There can be no assurance that the Fund will achieve its investment objective.

The Fund defines “climate tech” as technologies and business models that act to decarbonize the energy, transport, buildings and infrastructure, industry, and agriculture sectors. The Fund defines a climate tech company as having at least 50% of its assets, income, earnings, sales or profits committed to or derived from technology solutions, products and services to help curb or mitigate effects of global climate change. Due to the evolving nature related to climate change the Adviser expects climate tech companies to be involved in a wide array of businesses. The Fund invests in companies across all market capitalizations. The Fund may invest in common stocks and preferred stocks of foreign companies, either directly or through American Depository Receipts (“ADRs”) or Global Depository Receipts (GDRs).

The portfolio managers seek to identify securities of companies with characteristics such as

| • | quality management focused on generating shareholder value |

| • | attractive products or services |

| • | appropriate capital structure |

| • | strong competitive positions in their industries |

The portfolio managers may consider selling a security when one of these characteristics no longer applies, or when valuation becomes excessive and more attractive alternatives are identified. The portfolio managers seek to diversify the portfolio across geographies, and industries.

The Fund may borrow for investment purposes. To the extent the Fund borrows and invests the proceeds, the Fund will create financial leverage. The use of borrowing for investment purposes increases both investment opportunity and investment risk.

The Fund may invest in securities issued by real estate investment trusts (“REITs”). REITs are publicly traded corporations or trusts that specialize in acquiring, holding and managing residential, commercial or industrial real estate.

The Fund may also sell securities short and use futures and options to gain short exposure. The Adviser will vary the Fund’s long and short exposures over time based on its assessment of market conditions and other factors.

The Fund also may invest to a lesser extent in debt securities and foreign (non-U.S.) securities. The Fund may also invest in exchange-traded funds (“ETFs”), closed-end funds or other mutual funds. The Fund may invest without limitation in warrants and may also use derivatives, primarily swaps (including equity, variance and volatility swaps), options and futures contracts on securities, interest rates, commodities and/or currencies, as substitutes for direct investments the Fund can make. The Fund may also use derivatives such as swaps, options (including options on futures), futures, and foreign currency transactions (e.g., foreign currency swaps, futures and forwards) to any extent deemed by the Adviser to be in the best interest of the Fund, and to the extent permitted by the 1940 Act, to hedge various investments for risk management and speculative purposes. The Fund may also invest in master limited partnerships (“MLPs”), which are typically characterized as “publicly traded partnerships” that qualify to be treated as partnerships for U.S. federal income

2

NexPoint Funds II Prospectus

January 31, 2023

tax purposes and are principally engaged in one or more aspects of the exploration, production, processing, transmission, marketing, storage or delivery of energy-related commodities, such as natural gas, natural gas liquids, coal, crude oil or refined petroleum products (collectively, the energy industry).

Principal Risks

When you sell Fund shares, they may be worth less than what you paid for them. Consequently, you can lose money by investing in the Fund. No assurance can be given that the Fund will achieve its investment objective, and investment results may vary substantially over time and from period to period. An investment in the Fund is not appropriate for all investors.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Each risk summarized below is a principal risk of investing in the Fund and different risks may be more significant at different times depending upon market conditions or other factors.

Climate Tech Companies Risk is the risk that climate tech companies may be more volatile than companies operating in more established industries. Climate tech companies are subject to specific risks, including, among others: fluctuations in commodity prices and/or interest rates; changes in governmental or environmental regulation; slowdowns in new construction; and seasonal weather conditions, extreme weather or other natural disasters. Certain investments may be dependent on U.S. and foreign government policies, including tax incentives and subsidies. The above factors could also impact the ability of climate tech companies to pay dividends comparable to those paid by other technology companies. The Fund’s performance relative to the market also may be impacted by whether the climate tech sector is out of favor with investors. Similarly, the Fund’s exclusion of investments in companies other than climate tech companies may adversely affect the Fund’s relative performance at times when those other types of investments are performing well.

Equity Securities Risk is the risk that stock prices will fall over short or long periods of time. In addition, common stocks represent a share of ownership in a company, and rank after bonds and preferred stock in their claim on the company’s assets in the event of bankruptcy. In addition to these risks, preferred stock and convertible securities are also subject to the risk that issuers will not make payments on securities held by the Fund, which could result in losses to the Fund. The credit quality of preferred stock and convertible securities held by the Fund may be lowered if an issuer’s financial condition changes, leading to greater volatility in the price of the security.

Counterparty Risk is the risk that a counterparty (the other party to a transaction or an agreement or the party with whom the Fund executes transactions) to a transaction with the Fund may be unable or unwilling to make timely principal, interest or settlement payments, or otherwise honor its obligations.

Credit Risk is the risk that the value of debt securities owned by the Fund may be affected by the ability of issuers to make principal and interest payments and by the issuer’s or counterparty’s credit quality. If an issuer cannot meet its payment obligations or if its credit rating is lowered, the value of its debt securities may decline. Lower quality bonds are generally more sensitive to these changes than higher quality bonds. Non-payment would result in a reduction of income to the Fund, a reduction in the value of the obligation experiencing non-payment and a potential decrease in the net asset value (“NAV”) of the Fund.

Currency Risk is the risk that fluctuations in exchange rates will adversely affect the value of the Fund’s foreign currency holdings and investments denominated in foreign currencies.

Derivatives Risk is a combination of several risks, including the risks that: (1) an investment in a derivative instrument may not correlate well with the performance of the securities or asset class to which the Fund seeks exposure, (2) derivative contracts, including options, may expire worthless and the use of derivatives may result in losses to the Fund, (3) a derivative instrument entailing leverage may result in a loss greater than the principal amount invested, (4) derivatives not traded on an exchange may be subject to credit risk, for example, if the counterparty does not meet its obligations (see also “Counterparty Risk”), and (5) derivatives not traded on an exchange may be subject to liquidity risk and the related risk that the instrument is difficult or impossible to value accurately. In addition, changes in laws or regulations may make the use of derivatives more costly, may limit the availability of derivatives, or may otherwise adversely affect the use, value or performance of derivatives. The Fund’s ability to pursue its investment strategy, including its strategy of investing in certain derivative instruments, may be limited to or adversely affected by the Fund’s intention to qualify as a regulated investment company (a “RIC”), and its strategy may bear adversely on its ability to so qualify.

Exchange-Traded Funds (“ETF”) Risk is the risk that the price movement of an ETF may not exactly track the underlying index and may result in a loss. In addition, shareholders bear both their proportionate share of the Fund’s expenses and indirectly bear similar expenses of the underlying investment company when the Fund invests in shares of another investment company.

Focused Investment Risk is the risk that although the Fund is a diversified fund, it may invest in securities of a limited number of issuers in an effort to achieve a potentially greater

3

investment return than a fund that invests in a larger number of issuers. As a result, price movements of a single issuer’s securities will have a greater impact on the Fund’s net asset value, causing it to fluctuate more than that of a more widely diversified fund.

Growth Investing Risk is the risk of investing in growth stocks that may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing company’s growth potential. Growth-oriented funds will typically underperform when value investing is in favor.

Hedging Risk is the risk that, although intended to limit or reduce investment risk, hedging strategies may also limit or reduce the potential for profit. There is no assurance that hedging strategies will be successful.

Illiquid and Restricted Securities Risk is the risk that the Adviser may not be able to sell illiquid or restricted securities, such as securities issued pursuant to Rule 144A of the Securities Act of 1933, at the price it would like or may have to sell them at a loss. Securities of non-U.S. issuers, and emerging or developing markets securities in particular, are subject to greater liquidity risk.

Interest Rate Risk is the risk that fixed income securities will decline in value because of changes in interest rates. When interest rates decline, the value of fixed rate securities already held by the Fund can be expected to rise. Conversely, when interest rates rise, the value of existing fixed rate portfolio securities can be expected to decline. A fund with a longer average portfolio duration will be more sensitive to changes in interest rates than a fund with a shorter average portfolio duration.

Leverage Risk is the risk associated with the use of leverage for investment purposes to create opportunities for greater total returns. Any investment income or gains earned with respect to the amounts borrowed that are in excess of the interest that is due on the borrowing will augment the Fund’s income. Conversely, if the investment performance with respect to the amounts borrowed fails to cover the interest on such borrowings, the value of the Fund’s shares may decrease more quickly than would otherwise be the case. Interest payments and fees incurred in connection with such borrowings will reduce the amount of net income available for payment to Fund shareholders.

Management Risk is the risk associated with the fact that the Fund relies on the Adviser’s ability to achieve its investment objective. The Adviser may be incorrect in its assessment of the intrinsic value of the companies whose securities the Fund holds, which may result in a decline in the value of Fund shares and failure to achieve its investment objective.

Mid-Cap Company Risk is the risk that investing in securities of mid-cap companies may entail greater risks than investments in larger, more established companies. Mid-cap companies tend to have more narrow product lines, more limited financial resources and a more limited trading market for their stocks, as compared with larger companies. As a result, their stock prices may decline significantly as market conditions change.

MLP Risk is the risk of investing in MLP units, which involves some risks that differ from an investment in the equity securities of a company. The Fund may invest in MLP units. Holders of MLP units have limited control and voting rights on matters affecting the partnership. Holders of units issued by an MLP are exposed to a remote possibility of liability for all of the obligations of that MLP in certain instances. Holders of MLP units are also exposed to the risk that they will be required to repay amounts to the MLP that are wrongfully distributed to them. Additionally, a sustained reduced demand for crude oil, natural gas and refined petroleum products could adversely affect MLP revenues and cash flows and changes in the regulatory environment could adversely affect the profitability of MLPs. Investments in MLP units also present special tax risks. See “MLP Tax Risk” below.

MLP Tax Risk is the risk that the MLPs in which the Fund invests will fail to be treated as partnerships for U.S. federal income tax purposes. If an MLP does not meet current legal requirements to maintain its partnership status, or if it is unable to do so because of tax or other law changes, it would be treated as a corporation for U.S. federal income tax purposes. In that case, the MLP would be obligated to pay U.S. federal income tax (as well as state and local taxes) at the entity level on its taxable income and distributions received by the Fund would be characterized as dividend income to the extent of the MLP’s current and accumulated earnings and profits for federal tax purposes. The classification of an MLP as a corporation for U.S. federal income tax purposes could have the effect of reducing the amount of cash available for distribution by the MLP and the value of the Fund’s investment in any such MLP. As a result, the value of the Fund’s shares and the cash available for distribution to Fund shareholders could be reduced.

Non-U.S. Securities Risk is the risk associated with investing in non-U.S. issuers. Investments in securities of non-U.S. issuers involve certain risks not involved in domestic investments (for example, fluctuations in foreign exchange rates (for non-U.S. securities not denominated in U.S. dollars); future foreign economic, financial, political and social developments; nationalization; exploration or confiscatory taxation; smaller markets; different trading and settlement practices; less governmental supervision; and different accounting, auditing and financial recordkeeping standards and requirements) that may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies. These risks are magnified for investments in issuers tied economically to emerging markets, the economies of which tend to be more volatile than the economies of developed

4

NexPoint Funds II Prospectus

January 31, 2023

markets. In addition, certain investments in non-U.S. securities may be subject to foreign withholding and other taxes on interest, dividends, capital gains or other income or proceeds. Those taxes will reduce the Fund’s yield on any such securities. See the “Taxation” section below.

Operational and Technology Risk is the risk that cyber- attacks, disruptions, or failures that affect the Fund’s service providers, counterparties, market participants, or issuers of securities held by the Fund may adversely affect the Fund and its shareholders, including by causing losses for the Fund or impairing Fund operations.

Other Investment Companies Risk is the risk that when the Fund invests a portion of its assets in investment companies, including open-end funds, closed-end funds, ETFs and other types of investment companies, those assets will be subject to the risks of the purchased investment companies’ portfolio securities, and a shareholder in the Fund will bear not only his or her proportionate share of the Fund’s expenses, but also indirectly the expenses of the purchased investment companies. Risks associated with investments in closed-end funds also generally include market risk, leverage risk, risk of market price discount from NAV, risk of anti-takeover provisions and non-diversification.

Pandemics and Associated Economic Disruption An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in late 2019 and subsequently spread globally (“COVID-19”). This coronavirus has resulted and may continue to result in the closing of borders, enhanced health screenings, disruptions to healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general anxiety and economic uncertainty. The impact of this coronavirus may be short-term or may last for an extended period of time and has resulted and may continue to result in a substantial economic downturn. Health crises caused by outbreaks of disease, such as the coronavirus, may exacerbate other pre-existing political, social and economic risks. The impact of this outbreak, and other epidemics and pandemics that may arise in the future, could continue to negatively affect the global economy, as well as the economies of individual countries, individual companies and the market in general in significant and unforeseen ways. For example, a widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, and impact the Fund’s ability to complete repurchase requests. Any such impact could adversely affect the Fund’s performance, the performance of the securities in which the Fund invests, lines of credit available to the Fund and may lead to losses on your investment in the Fund. In addition, the increasing interconnectedness of markets around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a single or small number of issuers.

Real Estate Securities Risk is the risk that an investment in real estate securities will be closely linked to the performance of the real estate markets. Property values or income may fall due to increasing vacancies or declining rents resulting from economic, legal, cultural or technological developments.

REIT-Specific Risk includes the risk that an investment in the stocks of REITs will decline because of adverse developments affecting the real estate industry and real property values. An investment in a REIT also may be adversely affected or lost if the REIT fails to qualify as a REIT for tax purposes. In the event an investment fails to qualify as a REIT for tax purposes, the REIT will be subject to U.S. federal income tax (as well as state and local taxes) as a C corporation. The resulting corporate taxes could reduce the Fund’s net assets, the amount of income available for distribution and the amount of the Fund’s distributions. REITs are also subject to heavy cash flow dependency, defaults by borrowers and liquidity risk. In addition, REITs could possibly fail to (i) qualify for favorable tax treatment under applicable tax law, or (ii) maintain their exemption from registration under the 1940 Act.

Securities Lending Risk is the risk that the Fund may make secured loans of its portfolio securities. Any decline in the value of a portfolio security that occurs while the security is out on loan is borne by the Fund, and will adversely affect performance. Also, there may be delays in recovery of securities loaned, losses in the investment of collateral, and loss of rights in the collateral should the borrower of the securities fail financially while holding the security.

Securities Market Risk is the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting particular companies or the securities markets generally. A general downturn in the securities market may cause multiple asset classes to decline in value simultaneously. Many factors can affect this value and you may lose money by investing in the Fund.

Short Sales Risk is the risk of loss associated with any appreciation on the price of a security borrowed in connection with a short sale. The Fund may engage in short sales that are not made “against-the-box,” which means that the Fund may sell short securities even when they are not actually owned or otherwise covered at all times during the period the short position is open. Short sales that are not made “against-the-box” involve unlimited loss potential since the market price of securities sold short may continuously increase.

Small-Cap Company Risk is the risk that investing in the securities of small-cap companies either directly or indirectly through investments in ETFs, closed-end funds or mutual funds (“Underlying Funds”) may pose greater market and liquidity risks than larger, more established companies, because of limited product lines and/or operating history, limited financial resources, limited trading markets, and the

5

potential lack of management depth. In addition, the securities of such companies are typically more volatile than securities of larger capitalization companies.

Swaps Risk involves both the risks associated with an investment in the underlying investments or instruments (including equity investments) and counterparty risk. In a standard over-the-counter (“OTC”) swap transaction, two parties agree to exchange the returns, differentials in rates of return or some other amount calculated based on the “notional amount” of predetermined investments or instruments, which may be adjusted for an interest factor. Swaps can involve greater risks than direct investments in securities, because swaps may be leveraged and OTC swaps are subject to counterparty risk (e.g., the risk of a counterparty’s defaulting on the obligation or bankruptcy), credit risk and pricing risk (i.e., swaps may be difficult to value). Swaps may also be considered illiquid. Certain swap transactions, including certain classes of interest rate swaps and index credit default swaps, may be subject to mandatory clearing and exchange trading, although the swaps in which the Fund will invest are not currently subject to mandatory clearing and exchange trading. The use of swaps is a highly specialized activity which involves investment techniques, risk analyses and tax planning different from those associated with ordinary portfolio securities transactions. The value of swaps, like many other derivatives, may move in unexpected ways and may result in losses for the Fund.

Value Investing Risk is the risk of investing in undervalued stocks that may not realize their perceived value for extended periods of time or may never realize their perceived value. Value stocks may respond differently to market and other developments than other types of stocks. Value-oriented funds will typically underperform when growth investing is in favor.

Performance

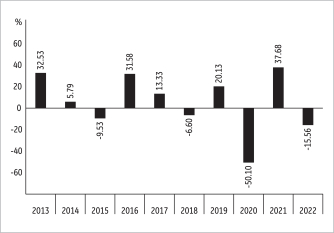

The bar chart and the Average Annual Total Returns table below provide some indication of the risks of investing in the Fund by showing changes in the performance of the Fund’s Class A Shares for each full calendar year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities market index or indices.

Prior to September 14, 2022, the Fund was managed pursuant to a different investment strategy. As a result of the difference in investment strategy, the performance information presented for periods prior to September 14, 2022 reflects management of the Fund consistent with investment strategies in effect during those periods and might have differed materially if the Fund’s investments had been managed under its current investment strategies.

As with all mutual funds, the Fund’s past performance (before and after taxes) does not predict how the Fund will perform in the future. The Fund’s performance reflects applicable fee waivers and/or expense limitations in effect during the periods presented, without which returns would have been lower. Both the chart and the table assume the reinvestment of dividends and distributions. The bar chart does not reflect the deduction of applicable sales charges for Class A Shares. If sales charges had been reflected, the returns for Class A Shares would be less than those shown below. The returns of Class C and Class Y Shares would have substantially similar returns as Class A because the classes are invested in the same portfolio of securities and the annual returns would differ only to the extent that the classes have different expenses (including sales charges). Updated information on the Fund’s performance can be obtained by visiting https://www.nexpoint.com/nexpoint/funds/nexpoint-climate-tech-fund/or by calling 1-877-665-1287.

Prior to September 14, 2022, the Fund was managed pursuant to different principal investment strategies, and thus, the performance presented prior to this date should not be attributed to the current principal investment strategies. The Fund’s performance shown below might have differed materially had the Fund been managed pursuant to the current principal investment strategies prior to September 14, 2022.

Calendar Year Total Returns

The bar chart shows the performance of the Fund’s Class A shares as of December 31.

The highest calendar quarter total return for Class A Shares of the Fund was 20.85% for the quarter ended March 31, 2019 and the lowest calendar quarter total return was -53.70% for the quarter ended March 31, 2020.

6

NexPoint Funds II Prospectus

January 31, 2023

Average Annual Total Returns

(For the periods ended December 31, 2022)

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A (inception 9/30/98) |

||||||||||||

| Return Before Taxes |

-20.42% | -9.31% | 1.50% | |||||||||

| Return After Taxes on Distributions |

-20.42% | -10.87% | -0.88% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

-12.09% | -6.83% | 1.08% | |||||||||

| Return Before Taxes |

||||||||||||

| Class C (inception 9/30/99) |

-17.00% | -8.92% | 1.34% | |||||||||

| Class Y (inception 9/30/98) |

-15.32% | -8.04% | 2.34% | |||||||||

| MSCI ACWI Index (reflects no deduction for fees, expenses or taxes) |

-17.96% | 5.76% | 8.56% | |||||||||

| S&P Small-Cap 600 Index* ( (reflects no deduction for fees, expenses or taxes) |

-16.15% | 5.82% | 10.77% | |||||||||

* Effective September 14, 2022, the Fund’s investment adviser elected to change the benchmark index from the Standard & Poor’s Small Cap 600 Growth Index to the MSCI ACWI Index as this index is more reflective of the Fund’s investment strategy.

After-tax returns in the table above are shown for Class A Shares only and after-tax returns for other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. For example, after-tax returns shown are not relevant to investors who hold their Fund shares through tax- advantaged arrangements, such as 401(k) plans or individual retirement accounts.

In some cases, average annual return after taxes on distributions and sale of fund shares may be higher than the average annual return after taxes on distributions because of realized losses that would have been sustained upon the sale of fund shares immediately after the relevant periods. The calculations assume that an investor holds the shares in a taxable account, is in the actual historical highest individual federal marginal income tax bracket for each year and would have been able to immediately utilize the full realized loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisers regarding their personal tax situations.

Portfolio Management

NexPoint Asset Management, L.P. serves as the investment adviser to the Fund. The portfolio managers for the Fund are:

| Portfolio Manager | Portfolio Managers Experience in this Fund |

Title with Adviser | ||

| James Dondero | 7 years | Co-Founder | ||

| Scott Johnson | Less than 1 year | Managing Director |

Purchase and Sale of Fund Shares

Purchase minimum (for Class A and Class C Shares) (reduced for certain accounts)

| By mail | By wire | Automatic | ||||||||||

| Initial Investment |

$ | 500 | $ | 1,000 | $ | 25 | ||||||

| Subsequent Investments |

$ | 100 | $ | 1,000 | $ | 25 | ||||||

There is no program asset size or minimum investment requirements for initial and subsequent purchases of shares by eligible omnibus account investors.

Purchase minimum (for Class Y Shares) (eligible investors only)

| Initial Investment |

None | |||

| Subsequent Investments |

None |

Class Y Shares are available to investors who invest through programs or platforms maintained by an authorized financial intermediary.

Individual investors that invest directly with the Fund are not eligible to invest in Class Y Shares.

The Fund reserves the right to apply or waive investment minimums under certain circumstances as described in the Prospectus under the “Choosing a Share Class” section.

You may purchase shares of the Fund by mail, bank wire, electronic funds transfer or by telephone after you have opened an account with the Fund. You may obtain an account application from your financial intermediary, from the Fund by calling 1-877-665-1287 or from the Fund’s website at https://www.nexpointassetmgmt.com/resources/#forms.

In general, you may sell (redeem) all or part of your Fund shares on any business day through the following options:

| • | Through your Financial Intermediary |

| • | By writing to NexPoint Funds II — NexPoint Climate Tech Fund, PO Box 219424, Kansas City, Missouri 64121- 9424, or |

| • | By calling DST Asset Manager Solutions, Inc. at 1-877-665-1287 |

Financial intermediaries may independently charge fees for shareholder transactions or for advisory services. Please see their materials for details.

Tax Information

The Fund intends to make distributions that generally will be taxable to you as ordinary income, qualified dividend income or capital gains, unless you are a tax-exempt investor or otherwise investing in the Fund through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. If you are investing in the Fund through a tax-advantaged arrangement, you may be taxed later upon withdrawals from that arrangement.

7

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

NFII-HSZ-SUMPROS-0123

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Clear Digital Wins 12 ADDY Awards from the American Advertising Federation of Silicon Valley

- Motel 6 Receives Franchisees' Choice Designation for the Fourth Year in a Row

- BABE BY BUCKED UP MAKES ITS OFFICIAL DEBUT IN MAJOR RETAILERS NATIONWIDE

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share