Form 497K Morningstar Funds Trust

| Morningstar Funds Trust |

Morningstar Global Opportunistic Equity Fund (formerly, Morninstar Unconstrained Allocation fund) MSTSX

Summary Prospectus April 29, 2022, as amended and restated May 2, 2022 |

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information, reports to shareholders, and other information about the Fund online at http://connect.rightprospectus.com/Morningstar. You may also obtain this information at no cost by calling 877-626-3224 or by sending an email request to [email protected]. The Fund’s Prospectus and Statement of Additional Information dated April 29, 2022, as amended and restated May 2, 2022, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Fund seeks long-term capital appreciation over a full market cycle.

Fees and Expenses of the Fund

The following tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Shareholder Fees (Fees paid directly from your investment) | ||

| Sales Charge (Load) Imposed on Purchases | None | |

| Sales Charge (Load) Imposed on Reinvested Dividends | None | |

| Redemption Fee | None | |

| Exchange Fee | None | |

| Account Service Fee | None | |

| Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment) | ||

| Management Fees | 0.47% | |

| Distribution (12b-1) Fees | None | |

| Other Expenses | ||

| Sub-Accounting Fees |

0.10%1 | |

| Other Operating Expenses |

0.17%2 | |

| Total Other Expenses | 0.27% | |

| Acquired Fund Fees and Expenses | 0.11%3 | |

| Total Annual Fund Operating Expenses | 0.85%2 | |

| 1 | Represents fees assessed by financial intermediaries for providing certain account maintenance, record keeping, and transactional services with respect to Fund shares held by these intermediaries for their customers. |

| 2 | “Other Operating Expenses” and “Total Annual Fund Operating Expenses” have been restated to reflect current fees. |

| 3 | Acquired Fund Fees and Expenses (AFFE) represent costs incurred indirectly by the Fund as a result of its ownership of shares of another investment company, such as open- or closed-end mutual funds, exchange traded funds (ETFs), and business development companies (BDCs). AFFE are not reflected in the Fund’s financial statements, and therefore, the amount listed in Total Annual Fund Operating Expenses and Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursement will differ from those presented in the Financial Highlights. AFFEs have been restated to reflect the Fund’s change in strategy effective May 2, 2022. |

Example

The example below can help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. This example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| $87 | $271 | $471 | $1,049 |

Portfolio Turnover

The Fund will pay transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may mean higher transaction costs and could result in higher taxes if you hold Fund shares in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. For the Fund’s fiscal year ended April 30, 2021, the Fund’s portfolio turnover rate was 52% of the average value of its portfolio.

Principal Investment Strategies

In seeking long-term capital appreciation over a full market cycle, the Fund has significant flexibility and invests predominantly in equities across asset classes and geographies according to the portfolio management team’s assessment of their valuations and fundamental characteristics. The Fund will normally invest at least 80% of its assets in equity securities. The Fund invests in investment companies such as mutual funds and ETFs, which could represent a significant percentage of assets.

The Fund invests in equity securities, which may include common stocks and real estate investment trusts (REITs). The Fund may invest in companies of any size from any country, including emerging markets. Under normal market conditions, the Fund will invest significantly (e.g., at least 40% of its assets, unless market conditions are not deemed favorable, in which case the Fund would invest at least 30% of its assets) in companies organized or located in multiple countries outside the United States or doing a substantial amount of business in multiple countries outside the United States.

To meet its objective, the Fund may also invest up to 20% of its assets in fixed-income securities of varying maturity, duration, and quality. These may include U.S. and non-U.S. corporate debt securities, U.S. government debt securities, including Treasury Inflation Protected Bond Securities and zero-coupon securities, non-U.S. government debt securities, emerging-market debt securities, and mortgage-backed and asset-backed securities. The Fund may invest up to 20% of its assets in fixed-income securities that are rated below investment grade (commonly known as junk bonds) or, if unrated, are determined by the Fund’s subadviser(s) to be of comparable quality.

The Fund may also invest in derivatives, including options, futures, swaps, and forward foreign currency contracts, for risk management purposes or as part of its investment strategies.

Multimanager Approach—The Fund uses a multimanager approach, meaning the adviser may allocate assets to one or more subadvisers, in addition to open- and closed-end investment companies, ETFs, and individual securities (collectively “Allocation Decisions”). Each subadviser acts independently from the others and uses its own investment style and process to select securities, within the constraints of the Fund’s investment objective, strategies, and restrictions. Morningstar is responsible for selecting the investment strategies and Allocation Decisions, with the goal of maximizing return with a prudent level of risk for the strategy. Subject to the oversight of the board of trustees, Morningstar may change subadvisers and sell holdings at any time.

Principal Risks

You can lose money by investing in this Fund. The Fund can also underperform broad markets and other investments. The Fund’s principal risks include:

Multimanager and Subadviser Selection Risk—To a significant extent, the Fund’s performance depends on Morningstar’s skill in selecting subadvisers and each subadviser’s skill in selecting securities and executing its strategy. Subadviser strategies may occasionally be out of favor and subadvisers may underperform relative to their peers or benchmarks.

Asset Allocation Risk—In an attempt to invest in areas that look most attractive on a valuation basis, the Fund may favor asset classes or market segments that cause the Fund to underperform its benchmark. Given the wide latitude with which the adviser manages this portfolio, you should expect this Fund to periodically underperform broad markets.

Market Risk—The value of stocks and other securities can be highly volatile and prices may fluctuate widely, which means you should expect a wide range of returns and could lose money, even over a long time period. Various economic, industry, regulatory, political or other factors (such as natural disasters, epidemics and pandemics, war, terrorism, conflicts or social unrest) may disrupt U.S. and world economies and can dramatically affect markets generally, certain industry sectors, and/or individual companies. Recently, the global pandemic outbreak of an infectious respiratory illness caused by a novel coronavirus known as COVID-19 has resulted in substantial market volatility and global business disruption, impacting the global economy and the financial health of individual companies in significant and unforeseen ways. The duration and future impact of COVID-19 are currently unknown, which may exacerbate other types of risks that apply to the Fund and negatively impact Fund performance and the value of your investment in the Fund.

Foreign Securities Risk—Securities of non-U.S. issuers may be less liquid, more volatile, and harder to value than U.S. securities. They may also be subject to political, economic, and regulatory risks, and market instability.

Emerging-Markets Risk—Emerging-market countries may have relatively unstable governments and economies based on only a few industries, which can cause greater instability. These countries are also more likely to experience higher levels of inflation, deflation, or currency devaluations, which could hurt their economies and securities markets.

Investment Company and ETF Risk—An investment company, including an open- or closed-end mutual fund or ETF, in which the Fund invests may not achieve its investment objective or execute its investment strategies effectively, or a large purchase or redemption activity by shareholders might negatively affect the value of the shares. The Fund must also pay its pro rata portion of an investment company’s fees and expenses. Shares of ETFs trade on exchanges and may be bought and sold at market value. ETF shares may be thinly traded, making it difficult for the Fund to sell shares at a particular time or an anticipated price. ETF shares may also trade at a premium or discount to the net asset value of the ETF; at times, this premium or discount could be significant.

Smaller Companies Risk—The stocks of small- or mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies. Small companies may have limited product lines or financial resources, or may be dependent upon a small or inexperienced management group, and their securities may trade less frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs.

Currency Risk—Because this Fund may invest in securities of non-U.S. issuers, changes in currency exchange rates could hurt performance. Morningstar or a subadviser may decide not to hedge, or may not be successful in hedging, its currency exposure.

Interest-Rate Risk—The value of fixed-income securities, as well as some income-oriented equity securities that pay dividends, will typically decline when interest rates rise. The Fund may be subject to a greater risk or rising interest rates due to the current period of historically low interest rates.

Call Risk—During periods of falling interest rates, an issuer may call or repay a higher-yielding fixed income security before its maturity date, forcing the Fund to reinvest in fixed income securities with lower interest rates than the original obligations.

Credit Risk—Issuers of fixed-income securities could default or be downgraded if they fail to make required payments of principal or interest.

High-Yield Risk—High-yield securities and unrated securities of similar credit quality (commonly known as junk bonds) are subject to greater levels of credit and liquidity risks. High-yield securities are considered speculative with respect to the issuer’s continuing ability to make principal and interest payments.

REITs and Other Real Estate Companies Risk—REITs and other real estate company securities are subject to, among other risks: declines in property values; defaults by mortgagors or other borrowers and tenants; increases in property taxes and other operating expenses; overbuilding in their sector of the real estate market; fluctuations in rental income; changes in interest rates; lack of availability of mortgage funds or financing; extended vacancies of properties, especially during economic downturns; changes in tax and regulatory requirements; losses due to environmental liabilities; or casualty or condemnation losses.

Derivatives Risk—A derivative is an instrument with a value based on the performance of an underlying currency, security, index, or other reference asset. Derivatives involve risks different from, or possibly greater than, the risks of investing in more traditional investments. Derivatives involve costs, may create leverage, and may be illiquid, volatile, or difficult to value. In addition, derivatives could cause losses if the counterparty to the transaction does not perform as promised. The investment results achieved by using derivatives may not match or fully offset changes in the value of the underlying currency, security, index, or other reference asset that the Fund was attempting to hedge or the investment opportunity it was trying to pursue.

U.S. Government Securities Risk—U.S. government obligations have different levels of credit support and, therefore, different degrees of credit risk. The U.S. government does not guarantee the market value of the securities it issues, so those values may fluctuate. Like most fixed-income securities, the prices of government securities typically fall when interest rates increase and rise when interest rates decline. In addition, the payment obligations on certain securities in which the Fund may invest, including securities issued by certain U.S. Government agencies and U.S. Government sponsored enterprises, are not guaranteed by the U.S. Government or supported by the full faith and credit of the United States.

Sovereign Debt Securities Risk—Sovereign debt instruments are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal on its sovereign debt, due, for example, to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s debt position in relation to the economy, or the failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies.

Mortgage-Related and Other Asset-Backed Securities Risk—Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust.

Mortgage- and asset-backed securities are subject to credit and interest rate risks, as well as extension and prepayment risks:

Extension Risk—Rising interest rates tend to extend the duration of mortgage-related securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, if the Fund holds mortgage-related securities, it may exhibit additional volatility.

Prepayment Risk—When interest rates decline, the value of mortgage-related securities with prepayment features may not increase as much as other fixed-income securities because borrowers may pay off their mortgages sooner than expected. In addition, the potential impact of prepayment on the price of asset-backed and mortgage-backed securities may be difficult to predict and result in greater volatility.

These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. TBA (or “to be announced”) commitments are forward agreements for the purchase or sale of securities, including mortgage-backed securities for a fixed price, with payment and delivery on an agreed upon future settlement date. The specific securities to be delivered are not identified at the trade date. However, delivered securities must meet specified terms, including issuer, rate and mortgage terms.

In addition, one of the major economic impacts of the COVID-19 pandemic has been loss of income, which has left many unable to repay their financial obligations, including their mortgage payments. It is difficult to predict how the effects of COVID-19, or government initiatives relating to COVID-19, may affect the federally backed mortgage market, the U.S. mortgage market as a whole and the price of securities relating to the mortgage markets, and in turn, the Fund’s investments.

Cybersecurity Risk—The Fund, like all companies, may be susceptible to operational and information security risks. Cybersecurity failures or breaches of the Fund or its service providers or the issuers of securities in which the Fund invests, have the ability to cause disruptions and impact business operations, and the Fund and their shareholders could be negatively impacted as a result.

Performance

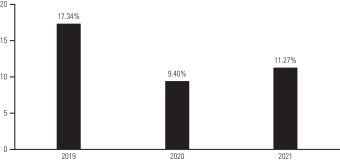

The bar chart and performance table that follow provide some indication of the risks of investing in the Fund. The bar chart shows the annual return for the Fund from year to year as of December 31. The table shows how the Fund’s average annual returns for periods ended December 31, 2021 (1 year and since inception) compare with those of broad measures of market performance. Prior to May 2, 2022, the Fund employed a different investment strategy. Therefore, the performance shown for periods prior to May 2, 2022 may have differed had the Fund’s current investment strategy been in effect. You may obtain the Fund’s updated performance information by visiting the website at http://connect.rightprospectus.com/Morningstar or by calling 877-626-3224. As with all mutual funds, the Fund’s past performance (before and after taxes) does not predict how the Fund will perform in the future.

Calendar Year Total Return

Morningstar Global Opportunistic Equity Fund % Total Return

| Year-to-Date Return as of | March 31, 2022 | -2.13 | % | |||

| Best Quarter | 4Q 2020 | 15.90 | % | |||

| Worst Quarter | 1Q 2020 | -19.27 | % |

| Average Annual Total Return (For the period ended December 31, 2021) | 1 Year | Since Inception 11/2/2018 | ||||||||

| Return Before Taxes | 11.27 | % | 10.42 | % | ||||||

| Return After Taxes on Distributions | 5.33 | % | 7.56 | % | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 9.14 | % | 7.38 | % | ||||||

| Morningstar Unconstrained Allocation Blended Index1, 2 (reflects no deduction for fees, expenses, or taxes other than withholding taxes, as noted) |

6.21 | % | 10.41 | % | ||||||

| Morningstar Global Markets NR Index2 (reflects no deduction for fees, expenses, or taxes other than withholding taxes, as noted) |

17.80 | % | 16.20 | % | ||||||

| 1 | The Morningstar Unconstrained Allocation Blended Index is composed of 50% Morningstar Global Markets NR Index and 50% Bloomberg Multiverse Total Return Index. The Morningstar Global Markets NR Index captures the performance of the stocks located in the developed and emerging countries across the world. The Bloomberg Multiverse Total Return Index provides a broad-based measure of the global fixed-income bond market. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to those who do not benefit from double taxation treaties. |

| 2 | Effective May 2, 2022, the Fund elected to change its benchmark index from the Morningstar Unconstrained Allocation Blended Index to the Morningstar Global Markets NR Index. The Fund believes the composition of the Morningstar Global Markets NR Index more accurately reflects the Fund’s current investment strategy and portfolio characteristics. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Fund Management

Morningstar is the investment adviser for the Fund and has overall supervisory responsibility for the general management and investment of the Fund’s portfolio. The Fund is managed in a multimanager structure. On behalf of Morningstar, the following persons have primary responsibility for the Fund and, subject to oversight by the board of trustees, are responsible for selecting and overseeing the subadviser listed below.

| Portfolio Manager | Position with Morningstar | Start Date with the Fund | ||

| Morningstar Investment Management LLC | ||||

| Marta K. Norton, CFA | Chief Investment Officer and Portfolio Manager | Since Inception (November 2018) | ||

| Richard M. Williamson, CFA, CIPM | Portfolio Manager and Head of Outcome Based Strategies | December 2020 | ||

Subadviser and Portfolio Managers

Morningstar currently plans to allocate assets to the following subadviser and may adjust these allocations at any time. The portfolio managers listed below are responsible for the day-to-day management of the subadviser’s allocated portion of the Fund’s portfolio:

| Portfolio Manager | Position with Subadviser | Start Date with the Fund | ||

| Lazard Asset Management LLC | ||||

| Bertrand Cliquet, CFA | Portfolio Manager/Analyst | Since Inception (November 2018) | ||

| Matthew Landy | Senior Vice President and Portfolio Manager/Analyst |

Since Inception (November 2018) | ||

| John Mulquiney, CFA | Portfolio Manager/Analyst | Since Inception (November 2018) | ||

| Warryn Robertson | Portfolio Manager/Analyst | Since Inception (November 2018) | ||

Purchase and Sale of Fund Shares

Fund shares are available through investment programs provided by financial institutions (each, a Program). Such Programs include, but are not limited to, Morningstar Managed Portfolios, an investment advisory program sponsored by Morningstar Investment Services LLC, a wholly-owned subsidiary of the adviser, investment advisory programs provided by unaffiliated financial advisers, managed account advisory services that certain third party retirement plan sponsors (e.g., employers) and/or retirement plan recordkeepers make available to their retirement plan participants and solutions provided in model portfolio marketplaces. There are no initial or subsequent minimum purchase amounts for the Fund. Orders to sell or “redeem” shares must be placed through the financial institution providing the Program to you and may trigger a purchase or sale of the Fund’s underlying investments. Fund shares may be purchased or redeemed on any day the New York Stock Exchange (NYSE) is open. At any time that an investor in the Fund ceases to be eligible for a Program, the provider of that Program may direct the redemption of that investor’s Fund shares and no further purchases will be allowed.

See the Purchase and Sale of Fund Shares section on page 120 of the prospectus for more information.

Tax Information

The Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, in which case your distributions may be taxed as ordinary income when withdrawn from the tax-advantaged account.

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Morningstar, Inc.Sign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share