Form 497K Manager Directed Portfol

| Sphere 500 Climate Fund Trading Symbol: SPFFX Summary Prospectus January 31, 2023 www.reflectionam.com/sphere | ||||

Before you invest, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and its risks. The current prospectus and SAI dated January 31, 2023 (as each may be amended or supplemented), are incorporated by reference into this summary prospectus. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.oursphere.org/fund. You can also get this information at no cost by calling 1-844-2SPHERE or by sending an e-mail request to info@reflectionam.com.

Investment Objective

The Sphere 500 Climate Fund (the “Fund”) seeks to track the performance, before fees and expenses, of the Sphere 500 Fossil Free IndexTM (the “Index”).

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): | |||||

| Management Fee | 0.07% | ||||

| Distribution (12b-1) and/or Service Fees | None | ||||

Other Expenses(1) | 0.05% | ||||

Total Annual Fund Operating Expenses(1) | 0.12% | ||||

(1) Total Annual Fund Operating Expenses do not correlate to the Fund’s ratio of operating expenses to average net assets in the Fund’s Financial Highlights because “Other Expenses” reflects estimated shareholder servicing fees and expenses paid under the Shareholder Servicing Plan adopted by the Board of 0.05% for the current fiscal year.

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| One Year | Three Years | Five Years | Ten Years | ||||||||

| $12 | $39 | $68 | $154 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal period October 4, 2021 (commencement of operations) through September 30, 2022, the portfolio turnover rate for the Fund was 14% of the average value of its portfolio.

1

Principal Investment Strategies

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is designed to reflect the performance of large companies listed on U.S. exchanges while excluding fossil fuel, utility and other companies with material climate-related risks. More information about the Index can be found at www.bitadata.com/pages/SPFFXI.

The Index

The Index is constructed beginning with the largest 500 U.S. companies that trade on regulated U.S. exchanges by market capitalization. As of December 31, 2022, the market capitalization of companies in the Index ranged from approximately $10.2 billion to $2.1 trillion. The index administrator, BITA GmbH (the “Index Administrator”), then eliminates companies from this investable universe using data obtained from As You Sow, an unaffiliated non-profit organization that promotes environmental responsibility through shareholder advocacy. As You Sow eliminates companies from the Index based on their risk profile of being exposed to the fossil fuel industry or other exclusionary screens.

On a periodic basis, As You Sow publishes the current uninvestable lists, which are principally comprised of companies that contribute to climate change through fossil fuel activities. As You Sow designates a company as an uninvestable fossil fuel company if the company is engaged in producing, distributing, or refining fossil fuels; holding reserves of fossil fuels; is a utility that is primarily fossil fuel-powered, or is a producer of equipment for any of the above (i.e., companies that engage in oil, gas, or coal production, and downstream activities). The Index also excludes other uninvestable companies as determined from time to time by As You Sow.

If a company is included in As You Sow’s uninvestable list, that company is not eligible for inclusion in the Index. The Index Administrator then re-weights the remaining companies on a free-float market capitalization basis. A company’s free float-adjusted market capitalization is calculated by multiplying the number of shares readily available in the market by the price of such shares.

The Index is typically composed of approximately 400-450 companies and is rebalanced and reconstituted quarterly as of close on the third Friday of March, June, September, and December, based on data as of the close of business on the Friday of such reconstitution month. As of December 31, 2022 the Index was composed of 413 companies.

The Fund’s Investment Strategy

The Fund attempts to invest all, or substantially all, of its assets in the component securities that make up the Index in weightings that approximate the relative composition of the Index. By investing in component securities of the Index, under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities issued by companies that do not (1) derive any revenue from the sale of fossil fuels, (2) hold fossil fuel related assets or reserves, (3) use fossil fuels for power generation, or (4) produce fossil fuel-related equipment. By excluding companies that engage in these fossil fuel activities, the Index, and therefore the Fund, are not exposed to companies with material climate change risk. The Fund may invest in companies that use fossil fuel as part of their business or have used fossil fuels in the past.

Reflection Asset Management, LLC (the “Adviser”), serves as the investment adviser for the Fund and is responsible for trading on behalf of the Fund in line with the Index. Consistent with the Index, the Adviser rebalances the Fund quarterly. The Fund will generally use a “replication” strategy to achieve its investment objective, meaning it will invest in all the component securities of the Index in approximately the same weightings as in the Index. This is referred to as a passive or indexing approach to investing.

To the extent the Index concentrates (i.e., holds more than 25% of its total assets) in the securities of a particular industry or group of related industries, the Fund will concentrate its investments to approximately the same extent as the Index. As of the fiscal period ended September 30, 2022, the Index was not concentrated in any industry or group of industries; however, the Index, and therefore the Fund, had significant exposure to the information technology sector. As of the fiscal period September 30, 2022, the Fund had invested 25.5% of its net assets in the information technology sector.

2

Climate-Focused Investing

By investing in the Index, the Fund will invest in companies that do not contribute to climate change in a material way through their fossil fuel activities. According to the U.S. Energy Information Administration, in 2020, 73% of greenhouse gas emissions came from burning fossil fuels. The Fund also seeks to vote proxies in a climate-focused way, such as voting for proposals to reduce or eliminate greenhouse gas emissions, using voting guidelines from As You Vote, an affiliate of As You Sow.

Principal Risks

Before investing in the Fund, you should carefully consider your own investment goals, the amount of time you are willing to leave your money invested, and the amount of risk you are willing to take. Remember, in addition to possibly not achieving your investment goals, you could lose all or a portion of your investment in the Fund over long or even short periods of time. The principal risks of investing in the Fund are:

•Climate Investing Considerations Risk. Considerations related to climate risk, such as environmental criteria (e.g., fossil fuel screens), applied to the Index’s construction may limit the number of investment opportunities available to the Fund, and as a result, at times, the Fund may underperform funds that are not subject to similar investment considerations. For example, the Index may exclude certain securities due to climate-focused considerations when other investment considerations would suggest that investing in such securities would be advantageous. The Fund may also underperform funds that invest in the energy and utilities sectors, particularly in times of rising oil, gas and energy prices.

•General Market Risk; Recent Market Events. The market value of a security may move up or down, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole. U.S. and international markets have experienced volatility in recent months and years due to a number of economic, political and global macro factors, including rising inflation, the war between Russia and Ukraine and the impact of the coronavirus (COVID-19) global pandemic. While U.S. and global economies are recovering from the effects of COVID-19, labor shortages and the inability to meet consumer demand have restricted growth. Uncertainties regarding the level of central banks’ interest rate increases, political events, the Russia-Ukraine conflict, trade tensions and the possibility of a national or global recession have also contributed to market volatility.

Global economies and financial markets are increasingly interconnected, which increases the possibility that conditions in one country or region might adversely impact issuers in a different country or region. Continuing market volatility as a result of recent market conditions or other events may have adverse effects on the Fund’s returns. The Adviser will monitor developments and seek to manage the Fund in a manner consistent with achieving the Fund’s investment objective, but there can be no assurance that they will be successful in doing so.

•Small Fund Risk. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board of Trustees may determine to liquidate the Fund. Liquidation of the Fund can be initiated without shareholder approval by the Board of Trustees if it determines that liquidation is in the best interest of shareholders. As a result, the timing of the Fund's liquidation may not be favorable.

•Common Stock Risk. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

•Large-Capitalization Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Larger companies also may not be able to attain the high growth rates of successful smaller companies.

3

•Sector Risk. To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors.

◦Information Technology Sector Risk. Market or economic factors impacting information technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Information technology companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability.

•Passive Investment Risk. The Fund is not actively managed and the Adviser would not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Index or the selling of shares of that security is otherwise required upon a reconstitution of the Index in accordance with the Index methodology. The Fund invests in securities included in the Index, regardless of their investment merits. The Fund does not take defensive positions under any market conditions, including conditions that are adverse to the performance of the Fund.

•Index Calculation Risk. There is no assurance that the Index Administrator will compile the Index accurately or that the Index will be reconstituted, rebalanced, calculated or disseminated accurately. The Index relies directly or indirectly on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Administrator, or the Adviser can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or a correct valuation of securities, nor can they guarantee the availability or timeliness of the production of the Index.

•Limited Operating History Risk. The Fund is a recently organized investment company with a limited operating history. As a result, prospective investors have a limited track record or history on which to base their investment decision.

•Cybersecurity Risk. With the increased use of technologies such as the Internet to conduct business, the Fund is susceptible to operational, information security, and related risks. Cyber incidents affecting the Fund or its service providers may cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Fund’s ability to calculate its net asset value (“NAV”), impediments to trading, the inability of shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs.

•Third Party Data Risk. The composition of the Index, and consequently the Fund’s portfolio, is heavily dependent on information and data published by independent third parties (“Third Party Data”). When Third Party Data proves to be incorrect or incomplete, any decisions made in reliance thereon may lead to the inclusion or exclusion of securities from the Index that would have been excluded or included had the Third Party Data been correct and complete. If the composition of the Index reflects such errors, the Fund’s portfolio can also be expected to reflect the errors.

•Tracking Error Risk. As with all index funds, the performance of the Fund and its Index may differ from each other for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the Index. In addition, the Fund may not be fully invested in the securities of the Index at all times or may hold securities not included in the Index.

•Operational Risk. Operational risks include human error, changes in personnel, system changes, faults in communication, and failures in systems, technology, or processes. Various operational events or circumstances are outside the Adviser’s control, including instances at third parties. The Fund and the Adviser seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address these risks.

4

Performance

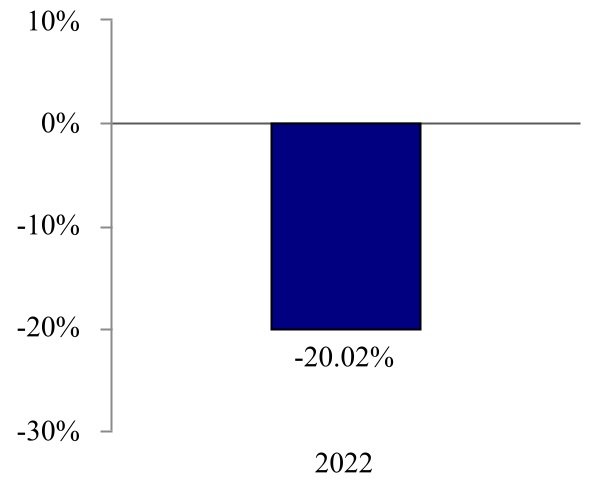

The bar chart and performance table below illustrate the risks and volatility of an investment in the Fund by showing the performance of the Fund since inception and by showing changes in how the Fund’s average annual returns for the one year and since inception periods compared with those of the Index and a broad measure of market performance. The Fund’s past performance, both before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is also available on the Fund’s website at www.oursphere.org/fund.

Calendar Year Total Return as of December 31

During the period of time shown in the bar chart, the highest return for a calendar quarter was 5.40% for the quarter ended December 31, 2022, and the lowest return for a calendar quarter was -15.97% for the quarter ended June 30, 2022.

Average Annual Total Returns

(For the Periods Ended December 31, 2022)

| 1 Year | Since Inception (October 4, 2021) | |||||||

| Sphere 500 Climate Fund* | ||||||||

| Return Before Taxes | -20.02% | -10.39% | ||||||

| Return After Taxes on Distributions | -20.16% | -10.53% | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares | -11.76% | -7.89% | ||||||

Sphere 500 Fossil Free Index | -23.01% | -14.35% | ||||||

| S&P 500 Index | -18.11% | -7.27% | ||||||

* Effective November 14, 2022, the Fund changed its name from the Sphere 500 Fossil Free Fund to the Sphere 500 Climate Fund.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who are exempt from tax or hold their Fund shares through tax-deferred or other tax-advantaged arrangements such as 401(k) plans or individual retirement accounts (“IRAs”). In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

5

Management of the Fund

Investment Adviser

Reflection Asset Management, LLC serves as investment adviser to the Fund.

Portfolio Manager

Jason Britton, Chief Executive Officer and Portfolio Manager of the Adviser, is responsible for the day-to-day management of the Fund’s portfolio and has served as portfolio manager since the Fund’s inception in October 2021.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any business day by written request via mail to: Sphere 500 Climate Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701, by telephone at 1-844-2SPHERE, by wire transfer or through a financial intermediary. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the intermediary directly. There is no minimum initial investment in the Fund and additional investments may be made in any amount.

Tax Information

The Fund’s distributions will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred or other tax-advantaged arrangement, such as a 401(k) plan or an IRA. You may be taxed later upon withdrawal of monies from such tax-deferred arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund, the Adviser, and their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create conflicts of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cumberland County Approves Hecate Energy's 150 MW Solar Energy Facility in Virginia

- Lincoln Avenue Communities Breaks Ground on Affordable Housing Development in Orlando, Florida

- Grant of warrants

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share