Form 497K Managed Portfolio Series

Summary Prospectus March 31, 2023 |  | |||||||

| Before you invest, you may want to review the Tortoise Energy Infrastructure and Income Fund's (the “Fund”) prospectus, which contains more information about the Fund and its risks. The current Statutory Prospectus and Statement of Additional Information dated March 31, 2023, are incorporated by reference into this Summary Prospectus. You can find the Fund’s Statutory Prospectus, Statement of Additional Information, reports to shareholders and other information about the Fund online at https://oef.tortoiseecofin.com/#product-comparison. You can also get this information at no cost by calling the Fund (toll-free) at 855-TCA-Fund (855-822-3863) or by sending an e-mail request to info@tortoiseadvisors.com. | ||||||||

Investment Objective

The investment objectives of the Fund are primarily to seek current income and secondarily to seek long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund from a financial intermediary, which are not reflected in this table. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in A Class shares of funds in the TortoiseEcofin fund family. Sales loads and waivers may vary by financial intermediary. For more information on specific financial intermediary sales loads and waivers, see Appendix A to the statutory Prospectus. More information about these and other discounts is available from your financial professional and in the "Shareholder Information - Class Descriptions" section of the Fund's Statutory Prospectus on page 48.

Shareholder Fees (fees paid directly from your investment) | A Class | Institutional Class | C Class | |||||||||||||||||

Maximum Front-End Sales Charge (Load) Imposed on Purchases (as a percentage of the offering price) | 5.50 | % | None | None | ||||||||||||||||

Maximum Deferred Sales Charge (Load) (as a percentage of initial investment or the value of the investment at redemption, whichever is lower) | None⁽¹⁾ | None | 1.00 | %⁽²⁾ | ||||||||||||||||

| Redemption Fee (as a percentage of amount redeemed within 90 days of purchase) | None | None | None | |||||||||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | A Class | Institutional Class | C Class | |||||||||||||||||

| Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||||||

| Distribution and Service (Rule 12b-1) Fees | 0.25 | % | 0.00 | % | 1.00 | % | ||||||||||||||

Other Expenses | 0.13 | % | 0.13 | % | 0.13 | % | ||||||||||||||

| Total Annual Fund Operating Expenses | 1.38 | % | 1.13 | % | 2.13 | % | ||||||||||||||

(1)No sales charge is payable at the time of purchase on investments of $1 million or more, although the Fund may impose a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on certain redemptions. If imposed, the CDSC applies to redemptions made within 12 months of purchase and will be assessed on an amount equal to the lesser of the initial value of the shares redeemed and the value of shares redeemed at the time of redemption.

(2)The CDSC applies to redemptions made within 12 months of purchase and will be assessed on an amount equal to the lesser of the initial investment of the shares redeemed and the value of the shares redeemed at the time of redemption.

Example

This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. You may be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund from a financial intermediary, which are not reflected in the example. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

1

| One Year | Three Years | Five Years | Ten Years | |||||||||||

| A Class | $683 | $963 | $1,264 | $2,116 | ||||||||||

| Institutional Class | $115 | $359 | $622 | $1,375 | ||||||||||

| C Class | $316 | $667 | $1,144 | $2,462 | ||||||||||

You would pay the following expenses if you did not redeem your shares:

| One Year | Three Years | Five Years | Ten Years | |||||||||||

| C Class | $216 | $667 | $1,144 | $2,462 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year ended November 30, 2022, the Fund’s portfolio turnover rate was 10% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund will invest at least 80% of its total assets in equity and debt securities of other companies focused in the energy infrastructure sector and in equity and debt securities of master limited partnerships (“MLPs”) focused in the energy infrastructure sector. Companies focused in the energy infrastructure sector include MLP parent companies and other MLP affiliates (together with MLPs, “MLP Entities”), which may invest their assets in varying degrees in MLPs. Some of these parent companies and other affiliates primarily own equity interests in MLPs, while others may jointly own assets with MLPs, and still others may only invest small portions of their assets in equity interests of MLPs. The Fund’s investment adviser, Tortoise Capital Advisors, L.L.C., also doing business as TCA Advisors ("TCA Advisors" or the “Adviser”), considers the energy infrastructure sector to be comprised of companies that engage in one or more aspects of exploration, production, gathering, processing, refining, transmission, marketing, storage and delivery of energy products such as natural gas, natural gas liquids (including propane), crude oil, refined petroleum products or coal; oilfield services, including drilling, cementing and stimulations; the generation, transmission and distribution of electricity; water and wastewater treatment, distribution and disposal; or the generation, transportation and sale of alternative, non-fossil fuel based energy sources including, but not limited to, biodiesel, ethanol, biomass, geothermal, hydroelectric, nuclear, solar or wind energy. The Adviser considers a company to be focused in the energy infrastructure sector if at least 50% of the company’s assets are utilized in one or more of these activities. The Fund will also invest in MLP Entities and other companies operating in the natural resources sector, which includes companies principally engaged in owning or developing non-energy natural resources (including timber and minerals) and industrial materials, or supplying goods or services to such companies.

In addition to making direct investments in MLP equity units, the Adviser intends to invest the Fund’s remaining assets in such a way as to provide, in total, a high level of correlation with MLP equities. These other investments may include equity and debt securities of entities that own interests in MLPs or assets owned in common with MLPs. The Fund will also invest in securities of entities that operate in industries similar to MLPs, such as energy infrastructure, even though such entities have no direct affiliation with an MLP.

The Fund will purchase securities across the capital structure of MLP Entities, including equity and debt securities of MLPs and their affiliates. The Fund may invest in equity securities of MLP Entities and other issuers without regard for their market capitalizations.

2

The Adviser intends to allocate the Fund’s assets towards the mix of equity and debt securities it deems appropriate based upon its view of economic, market, and political conditions. As a result of this asset allocation the Fund’s portfolio may, at times, be significantly invested in either equity or debt securities, or both. The Fund’s investment in equity securities may include both common and preferred stock. The Fund’s investment in debt securities may include both investment grade debt securities and high yield debt securities (often called “junk bonds”), which are securities rated below investment grade (that is, rated Ba or lower by Moody’s Investors Service, Inc. (“Moody’s”) or BB or lower by Standard & Poor’s Ratings Group (“S&P”), comparably rated by another statistical rating organization, or, if unrated, determined by the Adviser to be of comparable credit quality). The Fund will only purchase debt securities which, at the time of acquisition, are rated at least B3 by Moody’s or B- by Standard & Poor’s or are comparably rated by another statistical rating organization, or, if unrated, are determined by the Adviser to be of comparable credit quality. The Fund may invest in debt securities of any maturity.

The Fund may invest in foreign securities and U.S. dollar denominated foreign issuers. Such investments in securities of foreign issuers may include sponsored or unsponsored American Depository Receipts (“ADRs”) and Yankee bonds. ADRs are receipts that represent interests in foreign securities held on deposit by U.S. banks. Yankee bonds are bonds denominated in U.S. dollars that are publicly issued in the United States by foreign banks and corporations.

In certain market environments, the Fund may, but is not required to, use various hedging techniques, such as the buying and selling of options, including covered call options, to seek to mitigate one or more risks associated with investments in MLPs and energy infrastructure assets including market risk and interest rate risk, which, among other factors, could adversely affect market valuations of specific securities or certain sectors of the energy MLP and energy infrastructure market place, or the Fund’s overall portfolio.

The Fund may invest up to 15% of its net assets in securities that are not registered under the Securities Act of 1933 or that otherwise may not be sold in public offerings, which are commonly known as “restricted” securities. The Fund will typically acquire restricted securities in directly negotiated transactions.

The Fund may invest in initial public offerings (“IPOs”), other investment companies including exchange-traded funds (“ETFs”), and exchange-traded notes (“ETNs”). ETFs are investment companies that generally seek to track the performance of specific indices, shares of which are traded on exchanges. The Fund will include ETFs that primarily invest in MLPs and/or other companies focused in the energy infrastructure sector for purposes of satisfying the Fund’s investment strategy of investing at least 80% of its total assets in equity and debt securities of MLPs focused in the energy infrastructure sector, and in equity and debt securities of other companies focused in the energy infrastructure sector. ETNs are unsecured debt securities issued by a bank that are linked to the total return of a market index.

Principal Investment Risks

As with any mutual fund, there are risks to investing. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency. Remember, in addition to possibly not achieving your investment goals, you could lose all or a portion of your investment in the Fund over short or even long periods of time. The principal risks of investing in the Fund are:

Energy and Natural Resource Company Risk. Under normal circumstances, the Fund concentrates its investments in the energy infrastructure sector and may invest a significant portion of its assets in the natural resources sector of the economy, which includes a number of risks, including the following: supply and demand risk, depletion and exploration risk, marine transportation companies risk, regulatory risk, commodity pricing risk, weather risk, cash flow risk, affiliated party risk, catastrophe risk, acquisition risk, and natural resources sector risk. For example, decreases in oil prices may have a substantial impact on the prices of publicly-traded equity securities of energy infrastructure companies. The Fund considers the following industries as making up the energy infrastructure sector: energy, materials, transportation and utilities.

Concentration Risk. The Fund’s strategy of focusing its investments in energy infrastructure companies means that the performance of the Fund will be closely tied to the performance of the energy infrastructure industry. The Fund’s focus in this industry presents more risk than if it were broadly diversified over numerous industries and sectors of the economy. An inherent risk associated with any investment focus is that the Fund may be adversely affected if one or two of its investments perform poorly.

3

Debt Securities Risks. Investments in fixed income securities will be subject to credit risk, interest rate risk and prepayment risk. Credit risk is the risk that an issuer will default or fail to pay principal and interest when due. Interest rate risk is the risk that the value of fixed income securities fluctuates with changes in interest rates (e.g., increases in interest rates result in a decrease in value of fixed income securities). The Fund will be exposed to heightened interest rate risk as interest rates rise from historically low levels. Pre-payment risk is the risk that the principal on fixed income securities will be paid off prior to maturity causing the Fund to invest in fixed income securities with lower interest rates. Duration risk is the risk that holding long duration and long maturity investments will magnify certain other risks, including interest rate risk and credit risk.

MLP Risk. MLPs are subject to many risks, including those that differ from the risks involved in an investment in the common stock of a corporation. Holders of MLP units have limited control and voting rights on matters affecting the partnership and are exposed to a remote possibility of liability for all of the obligations of that MLP. Holders of MLP units are also exposed to the risk that they will be required to repay amounts to the MLP that are wrongfully distributed to them. In addition, the value of the Fund’s investment in an MLP will depend largely on the MLP’s treatment as a partnership for U.S. federal income tax purposes. Furthermore, MLP interests may not be as liquid as other more commonly traded equity securities.

MLP Affiliate Risk. The performance of securities issued by MLP affiliates, including common shares of corporations that own general partner interests, primarily depends on the performance of an MLP. The risks and uncertainties that affect the MLP, its operational results, financial condition, cash flows and distributions also affect the value of securities held by that MLP’s affiliate.

Below Investment Grade Debt Securities Risk. Investments in below investment grade debt securities and unrated securities of similar credit quality as determined by the Adviser (commonly known as “junk bonds”) involve a greater risk of default and are subject to greater levels of credit and liquidity risk. Below investment grade debt securities have speculative characteristics and their value may be subject to greater fluctuation than investment grade debt securities.

Capital Markets Risk. MLPs normally pay out the majority of their operating cash flows to partners. Therefore, MLPs and other issuers in which the Fund invests may rely significantly on capital markets for access to equity and debt financing in order to fund organic growth projects and acquisitions. Should market conditions limit issuers’ access to capital markets, their distribution growth prospects could be at risk.

Counterparty Risk. Counterparty risk is the risk that the other party or parties to an agreement or a participant to a transaction, such as a broker, might default on a contract or fail to perform by failing to pay amounts due or failing to fulfill the obligations of the contract or transaction.

Credit Risk. If an issuer or guarantor of a debt security held by the Fund or a counterparty to a financial contract with the Fund defaults or is downgraded or is perceived to be less creditworthy, or if the value of the assets underlying a security declines, the value of the Fund’s portfolio will typically decline.

Cybersecurity Risk. Investment advisers, including the Adviser, must rely in part on digital and network technologies (collectively “cyber networks”) to conduct their businesses. Such cyber networks might in some circumstances be at risk of cyber-attacks that could potentially seek unauthorized access to digital systems for purposes such as misappropriating sensitive information, corrupting data, or causing operational disruption.

4

Derivatives Risk. Derivatives include instruments and contracts that are based on and valued in relation to one or more underlying securities, financial benchmarks, indices, or other reference obligations or measures of value. The use of derivatives could increase or decrease the Fund’s exposure to the risks of the underlying instrument. Using derivatives can have a leveraging effect and increase fund volatility. A small investment in derivatives could have a potentially large impact on the Fund’s performance. Derivatives transactions can be highly illiquid and difficult to unwind or value, and changes in the value of a derivative held by the Fund may not correlate with the value of the underlying instrument or the Fund’s other investments. Many of the risks applicable to trading the instruments underlying derivatives are also applicable to derivatives trading. However, additional risks are associated with derivatives trading that are possibly greater than the risks associated with investing directly in the underlying instruments. These additional risks include, but are not limited to, illiquidity risk and counterparty credit risk. For derivatives that are required to be cleared by a regulated clearinghouse, other risks may arise from the Fund’s relationship with a brokerage firm through which it submits derivatives trades for clearing, including in some cases from other clearing customers of the brokerage firm. The Fund would also be exposed to counterparty risk with respect to the clearinghouse. Financial reform laws have changed many aspects of financial regulation applicable to derivatives. Once implemented, new regulations, including margin, clearing, and trade execution requirements, may make derivatives more costly, may limit their availability, may present different risks or may otherwise adversely affect the value or performance of these instruments. The extent and impact of these regulations are not yet fully known and may not be known for some time.

Equity Securities Risk. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value. The equity securities held by the Fund may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors, geographic markets, the equity securities of energy infrastructure companies in particular, or a particular company in which the Fund invests.

Investment Company and RIC Compliance Risk. The Fund may be subject to increased expenses and reduced performance as a result of its investments in other investment companies. When investing in other investment companies, the Fund bears its pro rata share of the other investment company’s fees and expenses including the duplication of advisory and other fees and expenses. If for any taxable year the Fund fails to qualify as a “regulated investment company” (a “RIC”), the Fund’s taxable income will be subject to federal income tax at regular corporate rates. The resulting increase to the Fund’s expenses will reduce its performance and its income available for distribution to shareholders.

ETF Risk. Investing in an ETF will provide the Fund with exposure to the securities comprising the index on which the ETF is based and will expose the Fund to risks similar to those of investing directly in those securities. Shares of ETFs typically trade on securities exchanges and may at times trade at a premium or discount to their net asset values. In addition, an ETF may not replicate exactly the performance of the benchmark index it seeks to track for a number of reasons, including transaction costs incurred by the ETF, the temporary unavailability of certain index securities in the secondary market or discrepancies between the ETF and the index with respect to the weighting of securities or the number of securities held. Investing in ETFs, which are investment companies, involves duplication of advisory fees and certain other expenses. The Fund will pay brokerage commissions in connection with the purchase and sale of shares of ETFs.

ETN Risk. ETNs are debt securities that combine certain aspects of ETFs and bonds. ETNs are not investment companies and thus are not regulated under the 1940 Act. ETNs, like ETFs, are traded on stock exchanges and generally track specified market indices, and their value depends on the performance of the underlying index and the credit rating of the issuer. ETNs may be held to maturity, but unlike bonds there are no periodic interest payments and principal is not protected.

Foreign Securities Risk. Investments in securities of foreign companies involve risks not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks relating to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risks, and market practices, as well as fluctuations in foreign currencies.

5

Currency Risk. When the Fund buys or sells securities on a foreign stock exchange, the transaction is undertaken in the local currency rather than in U.S. dollars, which carries the risk that the value of the foreign currency will increase or decrease, which may impact the value of the Fund’s portfolio holdings and your investment. Foreign countries may adopt economic policies and/or currency exchange controls that affect its currency valuations in a disadvantageous manner for U.S. investors and companies and restrict or prohibit the Fund’s ability to repatriate both investment capital and income, which could place the Fund’s assets in such country at risk of total loss.

ADR Risk. ADRs are generally subject to the same risks as the foreign securities because their values depend on the performance of the underlying foreign securities. ADRs may be purchased through “sponsored” or “unsponsored” facilities. A sponsored facility is established jointly by the issuer of the underlying security and a depositary, whereas a depositary may establish an unsponsored facility without participation by the issuer of the depositary security. Holders of unsponsored ADRs generally bear all the costs of such depositary receipts, and the issuers of unsponsored ADRs frequently are under no obligation to distribute shareholder communications received from the company that issues the underlying foreign securities or to pass through voting rights to the holders of the ADRs. As a result, there may not be a correlation between such information and the market values of unsponsored ADRs.

Hedging Risk. It is not possible to hedge fully or perfectly against any risk. While hedging can reduce losses, it can also reduce or eliminate gains or cause losses if the market moves in a different manner than anticipated by the Fund or if the cost of the derivative outweighs the benefit of the hedge. Hedging also involves the risk that changes in the value of the derivative will not match those of the holdings being hedged as expected by the Fund, in which case any losses on the holdings being hedged may not be reduced or may be increased. There can be no assurance that the Fund’s hedging strategies will be effective or that hedging transactions will be available to the Fund. The Fund is not required to engage in hedging transactions at any given time or from time to time, even under volatile market environment and the Fund may choose not to do so from time to time.

Interest Rate Risk. MLPs and other higher yield securities historically have shown sensitivity to interest rate movements. In an increasing interest rate environment, these types of securities may experience upward pressure on their yields in order to stay competitive with other interest rate sensitive securities. Also, significant portions of the market value of MLPs and other higher yield securities may be based upon their current yields. Accordingly, the prices of these securities may be sensitive to fluctuations in interest rates and may decline when interest rates rise.

IPO Risk. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk.

Leverage Risk. Certain transactions, including the use of derivatives, may give rise to a form of leverage. To mitigate leveraging risk, the Fund’s custodian will segregate or identify liquid assets or otherwise cover the transactions that may give rise to such risk. Leveraging may cause the Fund to liquidate portfolio positions to satisfy its obligations or to meet segregation requirements when it may not be advantageous to do so. Leveraging may cause the Fund to be more volatile than if the Fund had not been leveraged.

Illiquid Investments Risk. The Fund may be exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair the Fund’s ability to sell particular securities or close call option positions at an advantageous price or in a timely manner. Illiquid investments may include restricted securities that cannot be sold immediately because of statutory and contractual restrictions on resale.

Liquidity Risk. The Fund may not be able to sell some or all of the investments that it holds due to a lack of demand in the marketplace or other factors such as market turmoil, or if the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs it may only be able to sell those investments at a loss. In addition, the reduction in dealer market-making capacity in the fixed income markets that has occurred in recent years has the potential to decrease the liquidity of the Fund’s investments. Illiquid assets may also be difficult to value.

Adviser Risk. The Fund may not meet its investment objective or may underperform the market or other mutual funds with similar strategies if the Adviser cannot successfully implement the Fund’s investment strategies.

6

General Market Risk. The Fund is subject to all of the business risks and uncertainties associated with any mutual fund, including the risk that it will not achieve its investment objective and that the value of an investment in its securities could decline substantially and cause you to lose some or all of your investment. The Fund’s net asset value (“NAV”) and investment return will fluctuate based upon changes in the value of its portfolio securities. Certain securities in the Fund’s portfolio may be worth less than the price originally paid for them, or less than they were worth at an earlier time.

Covered Call Option Risk. If the Fund writes a covered call option, during the option’s life the Fund gives up the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but retains the risk of loss should the price of the underlying security decline. Moreover, the writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option.

Preferred Stock Risk. A preferred stock is a blend of the characteristics of a bond and common stock. It may offer a higher yield than common stock and has priority over common stock in equity ownership, but it does not have the seniority of a bond and, unlike common stock, its participation in the issuer’s growth may be limited. Although the dividend on a preferred stock may be set at a fixed annual rate, in some circumstances it may be changed or passed by the issuer. Preferred stock generally does not confer voting rights.

Mid Cap and Small Cap Companies Risk. The mid cap and small cap companies may not have the management experience, financial resources, product or business diversification and competitive strengths of large cap companies. Therefore, these securities may have more price volatility and be less liquid than the securities of larger, more established companies.

Tax Risk. The Fund has elected to be, and intends to qualify each year for treatment as, a “regulated investment company” under the U.S. Internal Revenue Code of 1986, as amended (the “Code”). To maintain qualification for federal income tax purposes as a regulated investment company under the Code, the Fund must meet certain source-of-income, asset diversification and annual distribution requirements, as discussed in detail below under “Tax Consequences.”

Depreciation or other cost recovery deductions passed through to the Fund from investments in MLPs in a given year will generally reduce the Fund’s taxable income, but those deductions may be recaptured in the Fund’s income in one or more subsequent years. When recognized and distributed, recapture income will generally be taxable to shareholders at the time of the distribution at ordinary income tax rates, even though those shareholders might not have held shares in the Fund at the time the deductions were taken by the Fund, and even though those shareholders will not have corresponding economic gain on their shares at the time of the recapture. In order to distribute recapture income or to fund redemption requests, the Fund may need to liquidate investments, which may lead to additional recapture income.

Epidemic Risk. Widespread disease, including pandemics and epidemics have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. These disruptions could prevent the Fund from executing advantageous investment decisions in a timely manner and negatively impact the Fund’s ability to achieve its investment objectives. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund.

Who Should Invest

Before investing in the Fund, investors should consider their investment goals, time horizons and risk tolerance. The Fund may be an appropriate investment for investors who are seeking:

1.An investment vehicle for accessing a portfolio of MLP and energy infrastructure companies;

2.A traditional flow-through mutual fund structure with daily liquidity at NAV;

3.Simplified tax reporting through a Form 1099;

4.A fund offering the potential for current income and secondarily long-term capital appreciation;

5.A fund that may be suitable for retirement and other tax exempt accounts;

7

6.Potential diversification of their overall investment portfolio; and

7.Professional securities selection and active management by an experienced adviser.

The Fund is designed for long-term investors and is not designed for investors who are seeking short-term gains. The Fund will take reasonable steps to identify and reject orders from market timers. See “Shareholder Information - Buying Shares” and “- Redeeming Shares” of the Fund’s Statutory Prospectus.

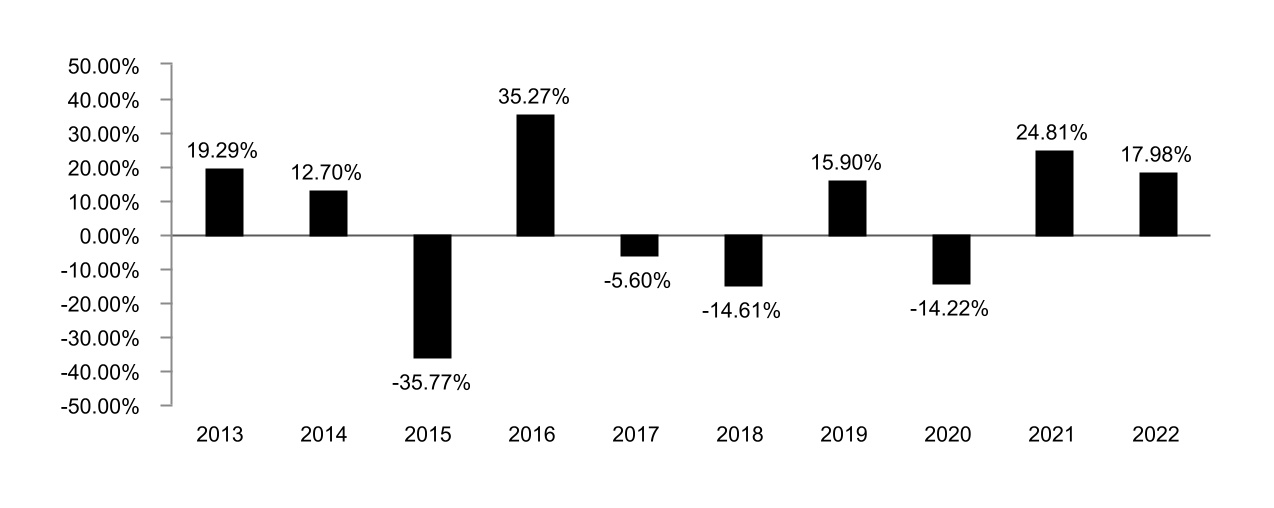

Performance

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the performance of Institutional Class shares of the Fund from year to year and by showing how the average annual returns of the Fund over time compare to the performance of a broad-based market index. Fund returns shown in the performance table reflect the maximum sales charge of 5.50% for the Fund’s A Class shares and the contingent deferred sales charge of 1.00% during the one year period for the Class C shares. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.tortoiseecofin.com or by calling 855-TCA-FUND (855-822-3863).

Calendar Year Total Returns as of December 31(1)

(1)The Fund is the accounting successor to the Advisory Research MLP & Energy Income Fund (the "Energy Infrastructure and Income Predecessor Fund"). Accordingly, the performance shown in the bar chart and performance table for periods prior to November 15, 2019, represents the performance of the Energy Infrastructure and Income Predecessor Fund.

| Best Quarter | Worst Quarter | ||||

Q2 2020 34.09% | Q1 2020 -43.64% | ||||

8

| Average Annual Total Returns for the periods ended December 31, 2022 | ||||||||||||||||||||||||||

| One Year | Five Years | Ten Years | Since Inception(1) | |||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||

| Return Before Taxes | 17.98 | % | 4.57 | % | 3.26 | % | 4.59 | % | ||||||||||||||||||

| Return After Taxes on Distributions | 17.45 | % | 3.94 | % | 2.47 | % | 3.80 | % | ||||||||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 11.00 | % | 3.32 | % | 2.29 | % | 3.44 | % | ||||||||||||||||||

| A Class | ||||||||||||||||||||||||||

| Return Before Taxes | 11.04 | % | 3.17 | % | 2.42 | % | 3.86 | % | ||||||||||||||||||

| C Class | ||||||||||||||||||||||||||

| Return Before Taxes | 15.83 | % | 3.55 | % | 2.23 | % | 3.63 | % | ||||||||||||||||||

Alerian MLP Index (reflects no deduction for fees, expenses or taxes) | 30.92 | % | 4.08 | % | 1.99 | % | 3.31 | % | ||||||||||||||||||

(1)The Fund offers multiple classes of shares. A Class shares of the Energy Infrastructure and Income Predecessor Fund commenced operations on May 18, 2011. C Class shares of the Energy Infrastructure and Income Predecessor Fund commenced operations on April 2, 2012. Institutional Class shares of the Energy Infrastructure and Income Predecessor Fund commenced operations on December 27, 2010. The performance figures for A Class and C Class include the performance for the Institutional Class for the periods prior to the start date of each such Class adjusted for the higher expenses applicable to A Class and C Class shares. For the index shown, the measurement period used in computing the returns for the “Since Inception” period begins on December 27, 2010.

After tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. The after-tax returns are shown only for the Institutional Class and the after-tax returns for the other classes will vary to the extent they have different expenses. Furthermore, the after-tax returns shown are not relevant to those investors who hold their shares through tax-advantaged arrangements such as 401(k) plans or individual retirement accounts (“IRAs”).

Investment Adviser and Portfolio Managers

Tortoise Capital Advisors, L.L.C., also doing business as TCA Advisors (the “Adviser”), is the Fund’s investment adviser. Primary responsibility for the day-to-day management of the Fund’s portfolio is the joint responsibility of a team of portfolio managers consisting of Brian A. Kessens, James R. Mick, Matthew G.P. Sallee and Robert J. Thummel, Jr.

Each of Messrs. Kessens, Mick, Sallee and Thummel is a Managing Director and Senior Portfolio Manager of the Adviser. Mr. Thummel is also Investment Strategist of the Adviser. Mr. Kessens has been a portfolio manager of the Fund since October 30, 2020. Messrs. Mick, Sallee, and Thummel have each been portfolio managers of the Fund since October 31, 2022.

Purchase and Sale of Fund Shares

You may purchase, exchange, or redeem Fund shares on any day that the New York Stock Exchange (“NYSE”) is open for business by written request via mail (Tortoise Energy Infrastructure and Income Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701), by contacting the Fund by telephone at 855-TCA-FUND (855-822-3863) or through a financial intermediary. You may also purchase or redeem Fund shares by wire transfer. The minimum initial and subsequent investment amounts are shown below. The Adviser may reduce or waive the minimums in its sole discretion.

9

| A Class and C Class Shares | To Open Your Account | To Add to Your Account | ||||||||||||

| Direct Regular Accounts | $2,500 | $500 | ||||||||||||

| Direct Retirement Accounts | $2,500 | $500 | ||||||||||||

| Automatic Investment Plans | $2,500 | $100 | ||||||||||||

| Gift Account for Minors | $2,500 | $500 | ||||||||||||

| Institutional Class Shares | ||||||||||||||

| All Accounts | $1,000,000 | $100 | ||||||||||||

Tax Information

The Fund’s distributions are generally taxable, and will be taxed as ordinary income or capital gains, unless you are a tax-exempt organization or are investing through a tax-advantaged arrangement such as a 401(k) plan or an IRA. For more information, please see “Tax Consequences” of the Fund’s Statutory Prospectus. Distributions on investments made through tax-advantaged arrangements may be taxed as ordinary income when withdrawn from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank or financial adviser, and including affiliates of the Adviser), the Fund and/or its Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create conflicts of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

10

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- NetLogistik Named to Inbound Logistics Top 100 Logistics IT Providers Award 2024

- April Edition of Best’s Review Ranks Largest Asia-Pacific Insurers

- Transaction in Own Shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share