Form 497K Managed Portfolio Series

Summary Prospectus March 31, 2023 |  | ||||

| Before you invest, you may want to review the Ecofin Global Renewables Infrastructure Fund's (the "Fund") prospectus, which contains more information about the Fund and its risks. The current Statutory Prospectus and Statement of Additional Information dated March 31, 2023, are incorporated by reference into this Summary Prospectus. You can find the Fund's Statutory Prospectus, Statement of Additional Information, reports to shareholders and other information about the Fund online at https://oef.tortoiseecofin.com/#product-comparison. You can also get this information at no cost by calling the Fund (toll-free) at 855-TCA-Fund (855-822-3863) or by sending an e-mail request to info@ecofininvest.com. | ||||||||

Investment Objective

The investment objective of the Fund is to generate long-term total return derived principally from a combination of capital appreciation and income over time.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund from a financial intermediary, which are not reflected in this table. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in A Class shares of funds in the TortoiseEcofin fund family. Sales loads and waivers may vary by financial intermediary. For more information on specific financial intermediary sales loads and waivers, see Appendix A to the statutory Prospectus. More information about these and other discounts is available from your financial professional and in the “Shareholder Information - Class Descriptions” section of the Fund’s Statutory Prospectus on page 65.

Shareholder Fees (fees paid directly from your investment) | A Class | Institutional Class | ||||||||||||

| Maximum Front-End Sales Charge (Load) Imposed on Purchases (as a percentage of the offering price) | 5.50 | % | None | |||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of initial investment or the value of the investment at redemption, whichever is lower) | None⁽¹⁾ | None | ||||||||||||

| Redemption Fee | None | None | ||||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | A Class | Institutional Class | ||||||||||||

| Management Fees | 0.75 | % | 0.75 | % | ||||||||||

| Distribution and Service (Rule 12b-1) Fees | 0.25 | % | 0.00 | % | ||||||||||

| Other Expenses | 0.15 | % | 0.15 | % | ||||||||||

| Total Annual Fund Operating Expenses | 1.15 | % | 0.90 | % | ||||||||||

(1)No sales charge is payable at the time of purchase on investments of $1 million or more, although the Fund may impose a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on certain redemptions. If imposed, the CDSC applies to redemptions made within 12 months of purchase and will be assessed on an amount equal to the lesser of the initial value of the shares redeemed and the value of shares redeemed at the time of redemption.

Example

This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. You may be required to pay brokerage commissions on your purchases and sales of Institutional Class shares of the Fund from a financial intermediary, which are not reflected in the example. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| One Year | Three Years | Five Years | Ten Years | |||||||||||

| A Class | $661 | $895 | $1,148 | $1,871 | ||||||||||

| Institutional Class | $92 | $287 | $498 | $1,108 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During the fiscal year ended November 30, 2022, the Fund’s portfolio turnover rate was 40% of its average portfolio value.

Principal Investment Strategies

Under normal circumstances, the Fund will principally focus its investment activities in equity securities of companies who are developers, owners and operators, in full or in part, of renewable electricity technology plants and systems, and related infrastructure investments. The Fund will typically emphasize those companies achieving measurable improvements in overall emissions, as defined as those gases and particles that are exhausted into the air as a result of fuel combustion-related activities (“Emissions”), relative to their market peers. The Fund’s investments in equity securities may include investments in other investment companies, real estate investment trusts (“REITs”), foreign investment funds, preferred stocks, rights, warrants, convertible securities, and initial public offerings. The Fund will be invested in a range of both developed and non-developed markets, commensurate with its investment criteria. The Fund considers non-developed market countries to be those countries defined as such by the MSCI Market Classification Framework.

The Fund will invest at least 80% of its total assets in equity securities of renewable infrastructure companies, which consist of companies deriving at least 50% of revenues from activities in power generation, transmission, distribution, storage and ancillary or related services (“Renewable Infrastructure Universe”). Such companies invest in renewable generation or other net-zero carbon and related services, and/or contribute to reducing Emissions. These include, but are not limited to, those companies involved with owning solar, wind, hydro-electric, biomass, waste-to-energy and large-scale battery storage assets, as well as transmission and distribution assets related to delivering electricity, including renewable energy.

The Renewable Infrastructure Universe is a global investment universe that includes companies mainly based in North America, Europe and Asia, but also includes companies in other regions to a lesser extent. Under normal market conditions, the Fund will invest at least 40% of its total assets in foreign securities, which Ecofin Advisors Limited, the investment sub-adviser to the Fund (the "Sub-Adviser"), considers to be companies organized outside of the United States, whose principal listing exchange is outside the United States, or who derive a significant portion of their revenue or profits outside the United States.

The Fund’s investments in foreign securities may also include American Depositary Receipts (“ADR”s) and investments in non-developed market securities. The Fund may invest up to 20% of its total assets in securities of companies located in non-developed markets. The Renewable Infrastructure Universe includes a broad range of companies, ranging from small market capitalization companies to large market capitalization companies, with assets located throughout the world. The Fund may invest in companies of all market capitalizations. The Fund’s investment in securities of companies in the Renewable Infrastructure Universe may include illiquid securities. The Fund will concentrate in industries represented by infrastructure companies. The Fund is a non-diversified fund.

The Fund may invest up to 15% of its total assets in debt securities, including but not limited to debt securities issued or guaranteed by the U.S. government or government-related entities. The Fund may also invest in derivatives which are financial contracts whose values depend on, or are derived from, the values of underlying assets, reference rates, or indices. To manage risk, seek particular portfolio exposure as a substitute for a comparable market position in the underlying exposure, and/or to enhance return (including through the use of leverage), the Fund may invest in derivatives including options, futures, swap contracts and combinations of these instruments. The Fund may invest in futures, options and swap contracts on equity and debt securities, equity and debt indices and commodities (“Commodity Interests”) (i) with aggregate net notional value of up to 100% of the Fund’s net assets, or (ii) for which the initial margin and premiums do not exceed 5% of its net assets, in each case excluding bona fide hedging transactions.

2

The Sub-Adviser will seek to utilize a combined investment approach, incorporating a relatively broad exposure to the Renewable Infrastructure Universe, with targeted active weights towards those investments that the Sub-Adviser believes offer attractive risk-adjusted intrinsic value. These active weights can change over time, relative to changes in corporate strategy, share prices, regulatory changes or other factors such as, but not limited to, balance sheet and liquidity considerations, ESG risk considerations, project success or jurisdictional policy issues. The Sub-Adviser incorporates environmental, social and governance ("ESG") risk factors into its security selection and portfolio construction. ESG risk considerations include, but are not limited to, the Sub-Adviser evaluating specific environmental factors of a company’s policy towards carbon and potentially other emissions. From a social perspective, the Sub-Adviser analyzes potential portfolio companies’ metrics such as, but not limited to, the percent of women employed by the company, the existence of an equal opportunity policy, whether the company is a signatory to the UN Global Compact and also seeks to measure and create a positive improvement regarding abatement of other harmful emissions including PM2.5 which disproportionately affects some impoverished communities. In terms of governance, the Sub-Adviser incorporates an analysis of the company’s board composition such as the percent of independent directors and may also assess protection of minority interests. The Sub-Adviser analyzes these factors with a preference for positive and improving trends when considering individual stocks for purchase in the portfolio.

Principal Investment Risks

As with any mutual fund, there are risks to investing. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency. Remember, in addition to possibly not achieving your investment goals, you could lose all or a portion of your investment in the Fund over short or even long periods of time. The principal risks of investing in the Fund are:

General Market Risk. The Fund is subject to all of the business risks and uncertainties associated with any mutual fund, including the risk that it will not achieve its investment objective and that the value of an investment in its securities could decline substantially and cause you to lose some or all of your investment. The Fund’s net asset value (“NAV”) and investment return will fluctuate based upon changes in the value of its portfolio securities. Certain securities in the Fund’s portfolio may be worth less than the price originally paid for them, or less than they were worth at an earlier time.

Renewable Energy Company Risk. Because the Fund invests in renewable energy companies, the value of Fund shares may be affected by events that adversely affect that industry, such as technology shifts, short product lifecycles, falling prices and profits, competition and general economic conditions, and may fluctuate more than that of a fund that does not concentrate in sustainable energy solutions companies.

Adviser and Sub-Adviser Risk. The Fund may not meet its investment objective or may underperform the market or other mutual funds with similar strategies if the Adviser and Sub-Adviser cannot successfully implement the Fund’s investment strategies.

Concentration Risk. The Fund’s strategy of focusing its investments in Renewable Infrastructure companies means that the performance of the Fund will be closely tied to the performance of the renewable electricity and utility infrastructure industry. The Fund’s focus in this industry presents more risk than if it were broadly diversified over numerous industries and sectors of the economy. An inherent risk associated with any investment focus is that the Fund may be adversely affected if one or two of its investments perform poorly.

Energy Infrastructure Industry Risk. Companies in the energy infrastructure industry are subject to many risks that can negatively impact the revenues and viability of companies in this industry, including, but not limited to risks associated with companies owning power infrastructure, propane assets, as well as capital markets, terrorism, natural disasters, climate change, operating, regulatory, environmental, supply and demand, and price volatility risks.

Renewable Energy Infrastructure Industry Risk. Companies in the renewable energy infrastructure industry are subject to many business, economic, environmental, and regulatory risks that can adversely affect the costs, revenues, profits, and viability of companies in the industry. These risks include, but are not limited to, the following: volatility in competing commodity prices and changes in supply and demand, which may affect the volume of energy commodities transported, processed, stored and or distributed; specific risks associated with companies owning and/or operating renewable energy or utility transmission systems; operating risks including outages, structural and maintenance, impairment and safety problems; changes in the regulatory environment at federal, state and local levels, and in foreign markets; environmental regulation and liability risk; terrorism risk; extreme weather and other natural disasters; and capital markets risk, resulting in a higher capital costs or impacting growth and access to capital.

3

New Technology Risk. New technologies used in renewable energy have a shorter commercial experience vs traditional energy production technologies. Also, advancements in renewable energy may create disruptive competitive threats to both incumbent technologies, such as centralized electric transmission and distribution networks; in progressively more efficient or lower cost versions of existing renewable technology, or possibly advancements or innovations in competing renewable technology.

ESG Risk. Applying ESG criteria to the investment process may exclude securities of certain issuers for non-investment reasons and therefore the Fund may forgo some market opportunities available to funds that do not use ESG criteria. Information used by the Sub-Adviser to evaluate the ESG rating of the Fund’s portfolio or any individual security may not be readily available, complete or accurate, and may vary across providers and issuers, as ESG is not a uniformly defined characteristic.

Increasing Scrutiny of ESG Matters Risk. The Adviser and its affiliates are subject to increasing scrutiny from regulators, elected officials, investors and other stakeholders with respect to ESG matters, which may adversely impact the ability of the Fund to raise capital from certain investors, constrain capital deployment opportunities for the Fund and harm the Adviser’s brand and reputation. In recent years, certain investors, including public pension funds, have placed increasing importance on the impacts of investments made by the funds to which they commit capital, including with respect to climate change, among other aspects of ESG. Conversely, certain investors have raised concerns as to whether the incorporation of ESG factors in the investment and portfolio management process may be inconsistent with the fiduciary duty to maximize return for investors. Investors may decide to not invest in the Fund based on their assessment of how the Adviser or Sub-Adviser approaches and considers the ESG cost of investments and whether the return-driven objective of the Fund aligns with such ESG considerations. In addition, anti-ESG sentiment has gained momentum across the United States, with several states having enacted or proposed “anti-ESG” policies, legislation or issued related legal opinions. If investors decide not to invest in the Fund based on their own assessment of the Fund’s approach to ESG, or are prohibited as a result of legislation, the Adviser’s ability to maintain the size of the Fund could be impaired.

Non-Diversified Fund Risk. Because the Fund is “non-diversified” and may invest a greater percentage of its assets in the securities of a single issuer, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.

Equity Securities Risk. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value. The equity securities held by the Fund may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors, geographic markets, the equity securities of energy infrastructure companies in particular, or a particular company in which the Fund invests.

Foreign Securities Risk. Investments in securities of foreign companies involve risks not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks relating to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risks, and market practices, as well as fluctuations in foreign currencies.

ADR Risk. ADRs are generally subject to the same risks as the foreign securities because their values depend on the performance of the underlying foreign securities. ADRs may be purchased through “sponsored” or “unsponsored” facilities. A sponsored facility is established jointly by the issuer of the underlying security and a depositary, whereas a depositary may establish an unsponsored facility without participation by the issuer of the depositary security. Holders of unsponsored ADRs generally bear all the costs of such depositary receipts, and the issuers of unsponsored ADRs frequently are under no obligation to distribute shareholder communications received from the company that issues the underlying foreign securities or to pass through voting rights to the holders of the ADRs. As a result, there may not be a correlation between such information and the market values of unsponsored ADRs.

Non-Developed Markets Risk. Non-developed market countries are in the initial stages of industrialization and generally have low per capita income. In addition to the risks of foreign investing generally, investments in emerging market countries have additional and heightened risks due to less stable legal, political, and business frameworks to support securities markets. These risks include smaller securities markets with low or nonexistent trading volume and greater illiquidity and price volatility; more restrictive national policies on foreign investment; less transparent and established taxation policies; higher rates and volatility of inflation; increased volatility in currency exchange rates; and more delays in settling portfolio transactions. Because of these risk factors, the Fund’s investments in non-developed market countries are subject to greater price volatility and illiquidity than investments in developed foreign markets.

4

Large Cap Company Risk. The Fund’s investments in larger, more established companies are subject to the risk that larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative smaller competitors potentially resulting in lower markets for their common stock.

Mid Cap and Small Cap Companies Risk. The mid cap and small cap companies may not have the management experience, financial resources, product or business diversification and competitive strengths of large cap companies. Therefore, these securities may have more price volatility and be less liquid than the securities of larger, more established companies.

Debt Securities Risks. Investments in fixed income securities will be subject to credit risk, interest rate risk and prepayment risk. Credit risk is the risk that an issuer will default or fail to pay principal and interest when due. Interest rate risk is the risk that the value of fixed income securities fluctuates with changes in interest rates (e.g. increases in interest rates result in a decrease in value of fixed income securities). The Fund will be exposed to heightened interest rate risk as interest rates rise from historically low levels. Pre-payment risk is the risk that the principal on fixed income securities will be paid off prior to maturity causing the Fund to invest in fixed income securities with lower interest rates. Duration risk is the risk that holding long duration and long maturity investments will magnify certain other risks, including interest rate risk and credit risk.

Government-Sponsored Entities Risk. The Fund may invest in securities issued or guaranteed by government-sponsored entities. However, these securities may not be guaranteed or insured by the U.S. government and may only be supported by the credit of the issuing agency.

REIT Risk. The real estate industry has been subject to substantial fluctuations and declines on a local, regional and national basis in the past and may continue to be in the future. The value REITs fluctuates as real estate values change. Real estate values and incomes from real estate may decline due to economic downturns, changes in real estate market conditions, zoning laws and regulations, and increases in property taxes, operating expenses and interest rates.

Investment Company and RIC Compliance Risk. The Fund may be subject to increased expenses and reduced performance as a result of its investments in other investment companies. When investing in other investment companies, the Fund bears its pro rata share of the other investment company’s fees and expenses including the duplication of advisory and other fees and expenses. If for any taxable year the Fund fails to qualify as a "regulated investment company" ("RIC"), the Fund’s taxable income will be subject to federal income tax at regular corporate rates. The resulting increase to the Fund’s expenses will reduce its performance and its income available for distribution to shareholders.

Rights and Warrants Risk. The price, performance and liquidity of warrants and rights to purchase equity securities are typically linked to the underlying stock. These instruments have many characteristics of convertible securities and, similarly, will react to variations in the general market for equity securities. Rights are similar to warrants, but normally have a short duration and are distributed directly by the issuer to its shareholders. Rights and warrants have no voting rights, receive no dividends and have no rights with respect to the assets of the issuer.

Initial Public Offering (“IPO”) Risk. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk.

Cybersecurity Risk. Investment advisers, including the Adviser, must rely in part on digital and network technologies (collectively “cyber networks”) to conduct their businesses. Such cyber networks might in some circumstances be at risk of cyber-attacks that could potentially seek unauthorized access to digital systems for purposes such as misappropriating sensitive information, corrupting data, or causing operational disruption.

Illiquid Investments Risk. The Fund may be exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair the Fund’s ability to sell particular securities or close call option positions at an advantageous price or in a timely manner. Illiquid investments may include restricted securities that cannot be sold immediately because of statutory and contractual restrictions on resale.

5

Convertible Securities Risk. Convertible securities are hybrid securities that have characteristics of both bonds and common stocks and are therefore subject to both debt security risks and equity risk. Convertible securities are subject to equity risk especially when their conversion value is greater than the interest and principal value of the bond. The prices of equity securities may rise or fall because of economic or political changes and may decline over short or extended periods of time.

U.S. Government Obligations Risk. While U.S. Treasury obligations are backed by the “full faith and credit” of the U.S. Government, such securities are nonetheless subject to credit risk (i.e., the risk that the U.S. Government may be, or be perceived to be, unable or unwilling to honor its financial obligations, such as making payments). Securities issued or guaranteed by federal agencies or authorities and U.S. Government-sponsored instrumentalities or enterprises may or may not be backed by the full faith and credit of the U.S. Government.

Preferred Stock Risk. A preferred stock is a blend of the characteristics of a bond and common stock. It may offer a higher yield than common stock and has priority over common stock in equity ownership, but it does not have the seniority of a bond and, unlike common stock, its participation in the issuer’s growth may be limited. Although the dividend on a preferred stock may be set at a fixed annual rate, in some circumstances it may be changed or passed by the issuer. Preferred stock generally does not confer voting rights.

Tax Risk. The Fund has elected to be, and intends to qualify each year for treatment as, a “regulated investment company” under the U.S. Internal Revenue Code of 1986, as amended (the “Code”). To maintain qualification for federal income tax purposes as a regulated investment company under the Code, the Fund must meet certain source-of-income, asset diversification and annual distribution requirements, as discussed in detail below under “Tax Consequences.”

Epidemic Risk. Widespread disease, including pandemics and epidemics have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. These disruptions could prevent the Fund from executing advantageous investment decisions in a timely manner and negatively impact the Fund’s ability to achieve its investment objectives. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund.

Derivatives Risk. Derivatives include instruments and contracts that are based on and valued in relation to one or more underlying securities, financial benchmarks, indices, or other reference obligations or measures of value. The use of derivatives could increase or decrease the Fund’s exposure to the risks of the underlying instrument. Using derivatives can have a leveraging effect and increase fund volatility. A small investment in derivatives could have a potentially large impact on the Fund’s performance. Derivatives transactions can be highly illiquid and difficult to unwind or value, and changes in the value of a derivative held by the Fund may not correlate with the value of the underlying instrument or the Fund’s other investments. Many of the risks applicable to trading the instruments underlying derivatives are also applicable to derivatives trading. However, additional risks are associated with derivatives trading that are possibly greater than the risks associated with investing directly in the underlying instruments. These additional risks include, but are not limited to, illiquidity risk and counterparty credit risk. For derivatives that are required to be cleared by a regulated clearinghouse, other risks may arise from the Fund’s relationship with a brokerage firm through which it submits derivatives trades for clearing, including in some cases from other clearing customers of the brokerage firm. The Fund would also be exposed to counterparty risk with respect to the clearinghouse. Financial reform laws have changed many aspects of financial regulation applicable to derivatives. Once implemented, new regulations, including margin, clearing, and trade execution requirements, may make derivatives more costly, may limit their availability, may present different risks or may otherwise adversely affect the value or performance of these instruments. The extent and impact of these regulations are not yet fully known and may not be known for some time.

Futures Contracts Risk. The price of a futures contract may change rapidly in response to changes in the markets and the general economic environment. Futures investments may result in investment exposures that are greater than their cost would suggest, meaning that a small investment in futures could have a large potential effect on the performance of the Fund. Generally, the purchase of a futures contract will increase the Fund’s exposure to the volatility of the underlying asset while the value of a futures contract that is sold will perform inversely to the underlying asset. The successful use of futures by the Fund will be subject to the Adviser’s ability to predict correctly movements in the direction of relevant markets, as well as interest rates, currency exchange rates and other economic factors.

6

Options Risk. Purchasing and writing put and call options are highly specialized activities and entail greater than ordinary investment risks. The Fund may not fully benefit from or may lose money on an option if changes in its value do not correspond as anticipated to changes in the value of the underlying securities. If the Fund is not able to sell an option held in its portfolio, it would have to exercise the option to realize any profit and would incur transaction costs upon the purchase or sale of the underlying securities. Ownership of options involves the payment of premiums, which may adversely affect the Fund’s performance. To the extent that the Fund invests in over-the-counter options, the Fund may be exposed to counterparty risk.

Swap Agreements Risk. A swap is a derivative that provides leverage, allowing the Fund to obtain exposure to an underlying asset, reference rate or index in an amount that is greater than the amount the Fund has invested. By using swap agreements, the Fund is exposed to counterparty credit risk. The use of swap agreements could cause the Fund to be more volatile, resulting in larger gains or losses in response to changes in the values of the assets, reference rates or indices underlying the swap agreements than if the Fund had made direct investments in such assets, reference rates or indices.

Who Should Invest

Before investing in the Fund, investors should consider their investment goals, time horizons and risk tolerance. The Fund may be an appropriate investment for investors who are seeking:

•An investment vehicle for accessing a portfolio of growth and income related to renewable infrastructure and related services;

•A traditional flow-through mutual fund structure with daily liquidity at NAV;

•Simplified tax reporting through a Form 1099;

•A portfolio offering a diversified geographic exposure to companies that possess a variety of project asset locations, including investing in currencies other than USD, typically on an unhedged basis;

•A fund offering the potential for total return through capital appreciation and current income;

•A fund that may be suitable for retirement and other tax exempt accounts;

•Potential diversification of their overall investment portfolio; and

•Professional securities selection and active management by an experienced adviser.

The Fund is designed for long-term investors and is not designed for investors who are seeking short-term gains. The Fund will take reasonable steps to identify and reject orders from market timers. See “Shareholder Information – Buying Shares” and “– Redeeming Shares” of the Fund’s Statutory Prospectus.

Performance

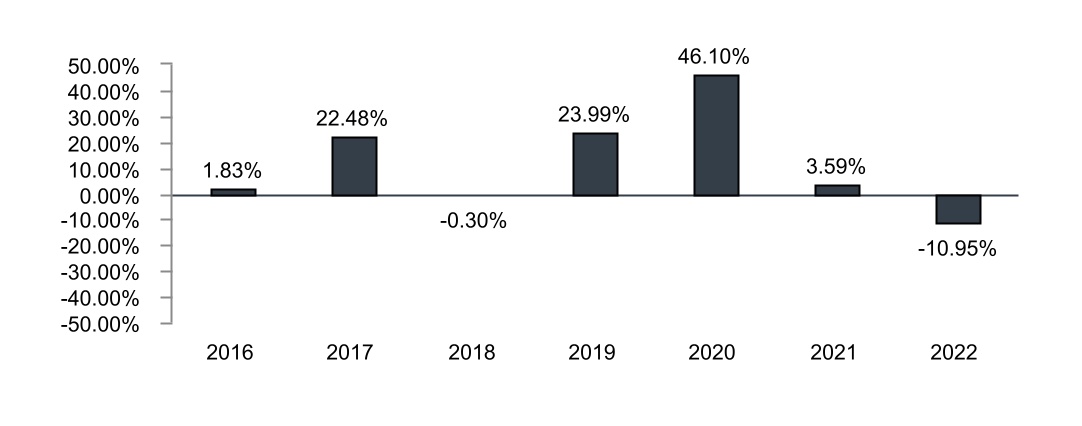

Prior performance shown below for the period prior to the Fund's reorganization as a mutual fund is for the Ecofin Global Renewables Infrastructure Fund Limited, established in November 2015 (which later changed its name to the Tortoise Global Renewables Infrastructure Fund Limited in May 2019), (the “Predecessor Fund”), an unregistered Cayman Islands limited liability company. The Predecessor Fund was reorganized into the Fund by transferring substantially all of the Predecessor Fund’s assets to the Fund in exchange for Institutional Class shares of the Fund on August 7, 2020, the date that the Fund commenced operations (the “Reorganization”). The Predecessor Fund was managed in the same style as the Fund. The Sub-Adviser served as the investment adviser to the Predecessor Fund for the entire performance period shown for the Predecessor Fund and is responsible for the portfolio management and trading for the Fund. Each of the Fund’s portfolio managers was a portfolio manager of the Predecessor Fund at the time of the Reorganization. The Fund’s investment objective, policies, guidelines and restrictions are, in all material respects, the same as those of the Predecessor Fund.

7

The following information shows the returns of the Early Investor Shares of the Predecessor Fund since its inception in November 2015 until the Reorganization, after which the performance is that of the Fund. The Early Investor Shares are similar to the Fund’s Institutional class but, at a point in time, were subject to performance and other fees. The expenses of the Predecessor Fund's Early Investor Shares were greater than the expenses of the Fund's Institutional Class shares. From its inception through the date of the Reorganization, the Predecessor Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended (the “1940 Act”), or Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. The Predecessor Fund's performance was calculated using a methodology of time-weighted total returns from official net asset values. Since the Reorganization, the Fund’s performance has been calculated using the standard formula set forth in rules promulgated by the SEC, which differs in certain respects from the methods used to compute total return for the Predecessor Fund.

The information below provides some indications of the risks of investing in the Fund. The bar chart shows how the performance for the Predecessor Fund, and following the Reorganization the performance of the Fund's Institutional Class shares, varied from year to year. The Fund returns shown in the performance table reflect the maximum sales charge of 5.50% for the Fund's A Class. The Predecessor Fund’s past performance shown below is not necessarily an indication of how the Fund will perform in the future. Past performance (before and after taxes) will not necessarily continue in the future. Updated performance information is available at www.tortoiseecofin.com or by calling 855-TCA-FUND (855-822-3863).

Calendar Year Total Returns as of December 31

| Best Quarter | Worst Quarter | ||||

Q4 2020 27.10% | Q1 2020 -11.67% | ||||

| Average Annual Total Returns for the periods ended December 31, 2022 | ||||||||||||||||||||

| One Year | Five Year | Since Inception (November 2, 2015)1 | ||||||||||||||||||

| Institutional Class | ||||||||||||||||||||

| Return Before Taxes | -10.95 | % | 10.75 | % | 11.08 | % | ||||||||||||||

| Return After Taxes on Distributions | -11.36 | % | 10.32 | % | 10.78 | % | ||||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | -6.18 | % | 8.54 | % | 9.00 | % | ||||||||||||||

| A Class Shares | ||||||||||||||||||||

| Returns Before Taxes | -15.98 | % | 9.28 | % | 9.98 | % | ||||||||||||||

S&P Global Infrastructure Net Total Return Index 2 | -0.99 | % | 2.99 | % | 5.17 | % | ||||||||||||||

S&P Global Infrastructure Total Return Index (reflects no deduction for fees, expenses, or taxes) 2 | -0.17 | % | 3.88 | % | 6.09 | % | ||||||||||||||

8

(1)Prior to the launch of the Fund, the Predecessor Fund calculated its official NAV weekly. The net return of the Predecessor Fund was adjusted to a calendar quarter end in the presentation above using the nearest weekly official valuation point and the returns and expense accruals were adjusted accordingly.

(2)The S&P Global Infrastructure Indices’ returns vary based on the treatment of regular cash dividends. The S&P Global Infrastructure Net Total Return Index reflects a reinvestment of regular cash dividends at the close on the ex-date after the deduction of applicable withholding taxes, whereas the S&P Global Infrastructure Total Return Index reflects a reinvestment of regular cash dividends at the close on the ex-date without consideration for withholding taxes.

After tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Prior to the Reorganization, the Fund was an unregistered fund that did not qualify as a regulated investment company for federal income tax purposes and did not pay dividends and distributions. The “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than other return figures when a capital loss occurs upon redemption of portfolio shares and provides an assumed tax benefit for the investor. Actual after-tax returns depend on your situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to those investors who hold their shares through tax-advantaged arrangements such as 401(k) plans or individual retirement accounts (“IRAs”).

Investment Adviser, Sub-Adviser, and Portfolio Managers

TCA Advisors is the Fund’s investment adviser. Ecofin Advisors Limited is the Fund’s sub-adviser. Primary responsibility for the day-to-day management of the Fund’s portfolio is the joint responsibility of Matthew Breidert and Michel Sznajer, both of the Sub-Adviser. Mr. Breidert is a Managing Director and Senior Portfolio Manager of the Sub-Adviser. Mr. Sznajer is a Portfolio Manager and Managing Director of the Sub-Adviser. Each portfolio manager has managed the Fund since its inception in August 2020. Mr. Breidert and Mr. Sznajer were portfolio managers of the Predecessor Fund since its inception in 2015 and since joining the firm in 2016, respectively.

Purchase and Sale of Fund Shares

You may purchase, exchange, or redeem Fund shares on any day that the New York Stock Exchange (“NYSE”) is open for business by written request via mail (Ecofin Global Renewables Infrastructure Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701), by contacting the Fund by telephone at 855-TCA-FUND (855-822-3863) or through a financial intermediary. You may also purchase or redeem Fund shares by wire transfer. The minimum initial and subsequent investment amounts are shown below. The Adviser may reduce or waive the minimums.

| A Class | Institutional Class | |||||||||||||

| Minimum Initial Investment | $2,500 | $1,000,000 | ||||||||||||

| Subsequent Minimum Investment | $100 | $100 | ||||||||||||

Tax Information

The Fund’s distributions are generally taxable, and will be taxed as ordinary income or capital gains, unless you are a tax-exempt organization or are investing through a tax-advantaged arrangement such as a 401(k) plan or an IRA. For more information, please see “Tax Consequences” of the Fund’s Statutory Prospectus. Distributions on investments made through tax-advantaged arrangements may be taxed as ordinary income when withdrawn from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank or financial adviser, and including affiliates of the Adviser), the Fund and/or its Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create conflicts of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

9

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

- ClearSign Technologies Corporation Provides Full Year 2023 Update

- Varex Schedules Second Quarter Fiscal Year 2024 Earnings Release and Conference Call

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share