Form 497K Managed Portfolio Series

| Cove Street Capital Small Cap Value Fund Summary Prospectus January 28, 2023 Institutional Class – (CSCAX) | ||||

Before you invest, you may want to review the Cove Street Capital Small Cap Value Fund’s (the “Fund”) prospectus, which contains more information about the Fund and its risks. The current Statutory Prospectus and Statement of Additional Information dated January 28, 2023, are incorporated by reference into this Summary Prospectus. You can find the Fund’s Statutory Prospectus, Statement of Additional Information, reports to shareholders and other information about the Fund online at covestreetfunds.com/resources/. You can also get this information at no cost by calling the Fund (toll-free) at (866)-497-0097 or by sending an e-mail request to mtynan@covestreetcapital.com.

Investment Objective

The Fund seeks capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment) | Institutional Class | ||||

| Maximum Sales Charge (Load) Imposed on Purchases | None | ||||

Redemption Fee (as a percentage of the amount redeemed within 60 days of purchase) | 2.00% | ||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Institutional Class | ||||

| Management Fees | 0.85% | ||||

| Other Expenses (including 0.01% in Interest Expense) | 0.47% | ||||

Acquired Fund Fees and Expenses(1) | 0.01% | ||||

Total Annual Fund Operating Expenses(1) | 1.33% | ||||

Fee Waiver/Reimbursement(2) | -0.06% | ||||

Total Annual Fund Operating Expenses After Fee Waiver/Reimbursement(1)(2) | 1.27% | ||||

(1)The Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to average net assets before expense waiver/recoupment included in the Financial Highlights section of the Fund's Statutory Prospectus, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

(2)Cove Street Capital, LLC (the “Adviser” or “Cove Street”) has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, taxes, brokerage commissions, and other transactional expenses, dividends paid on short sales and extraordinary expenses) do not exceed 1.25% of the Fund’s average daily net assets. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment occurred, provided that any such recoupment may not cause the Fund’s expenses to exceed the expense limit in effect at the time of the waiver or recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least January 28, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board or the Adviser, with the consent of the Board.

1

Example

This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the expense limitation for one year). Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| One Year | Three Years | Five Years | Ten Years | |||||||||||

| Institutional Class | $129 | $416 | $723 | $1,596 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 51% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in a limited number of equity securities of small capitalization companies. The equity securities in which the Fund invests include common stocks, preferred stocks, and real estate investment trusts (“REITs”). The Fund considers a company to be a small-cap company if it has a market capitalization, at the time of purchase, in the range of $50 million to $5 billion. Although the Fund will invest primarily in the equity securities of U.S. companies, the Fund may also invest up to 20% of its assets in the securities of foreign companies, including common and preferred stocks. From time to time, the Fund may focus its investments in securities of companies in the same economic sector. The Fund’s investment strategy involves a value-oriented focus on preservation of capital over the long term using a “bottom-up” approach. The Fund may show increased portfolio turnover in a given year in order to reflect tax strategies that reduce its realized gains and losses for the benefit of the shareholders.

Principal Risks

As with any mutual fund, there are risks to investing. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation ("FDIC") or any other governmental agency. In addition to possibly not achieving your investment goals, you could lose all or a portion of your investment in the Fund over short or even long periods of time. The principal risks of investing in the Fund are:

General Market Risk. The Fund’s net asset value and investment return will fluctuate based upon changes in the value of its portfolio securities. Certain securities selected for the Fund’s portfolio may be worth less than the price originally paid for them, or less than they were worth at an earlier time.

Management Risk. The Fund may not meet its investment objective or may underperform the market or other mutual funds with similar strategies if the Adviser cannot successfully implement the Fund’s investment strategies.

Equity Securities Risk. The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors, geographic markets, or companies in which the Fund invests.

2

Sector Emphasis Risk. The securities of companies in the same or related businesses, if comprising a significant portion of the Fund’s portfolio, may in some circumstances react negatively to market conditions, interest rates and economic, regulatory or financial developments and adversely affect the value of the portfolio.

Small-Cap Companies Risk. Investing in securities of small-sized companies may involve greater price volatility and less liquidity than investing in larger and more established companies. The Fund may hold a significant percentage of a company’s outstanding shares and may have to sell them at a discount from quoted prices.

Value-Style Investing Risk. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline.

Foreign Securities Risk. Investments in securities issued by foreign companies involves risks not generally associated with investments in the securities of U.S. companies, including risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory and tax requirements and market practices, including fluctuations in foreign currencies. There may be less information publicly available about foreign companies than about a U.S. company, and many foreign companies are not subject to accounting, auditing, and financial reporting standards, regulatory framework and practices comparable to those in the U.S.

Concentration Risk. The Fund may have a relatively high concentration of assets in a single or small number of issuers, which may reduce the Fund’s diversification and result in increased volatility.

Preferred Stock Risk. A preferred stock is a blend of the characteristics of a bond and common stock. It may offer a higher yield than common stock and has priority over common stock in equity ownership, but it does not have the seniority of a bond and, unlike common stock, its participation in the issuer’s growth may be limited. Although the dividend on a preferred stock may be set at a fixed annual rate, in some circumstances it may be changed or passed by the issuer. Preferred stock generally does not confer voting rights.

REIT Risk. The real estate industry has been subject to substantial fluctuations and declines on a local, regional and national basis in the past and may continue to be in the future. Also, the value of a REIT can be hurt by economic downturns or by changes in real estate values, rents, property taxes, interest rates, tax treatment, regulations, or the legal structure of a real estate investment trust.

Epidemic Risk. Widespread disease, including pandemics and epidemics have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. These disruptions could prevent the Fund from executing advantageous investment decisions in a timely manner and negatively impact the Fund’s ability to achieve its investment objectives. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund.

Performance

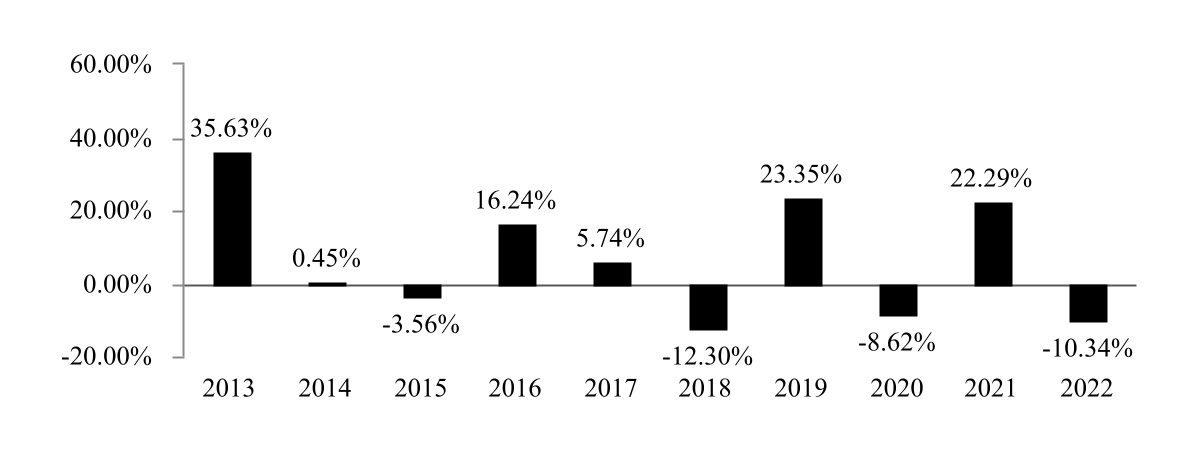

The accompanying bar chart and table provide some indication of the risks of investing in the Fund by showing how the Fund’s total return has varied from year-to-year. Below the bar chart are the Fund’s highest and lowest quarterly returns during the period shown in the bar chart. The performance table that follows shows the Fund’s average annual total returns over time compared with broad-based securities market indices. Past performance (before and after taxes) will not necessarily continue in the future. Updated performance information is available at www.covestreetfunds.com or by calling (866) 497-0097.

3

Calendar Year Total Returns as of December 31:

| Best Quarter | Worst Quarter | ||||||||||

| Q4 2020 | 24.52% | Q1 2020 | -39.81% | ||||||||

Average Annual Total Returns for the periods ended December 31, 2022(1) | ||||||||||||||

| One Year | Five Years | Ten Years | Since Inception (9/30/1998) | |||||||||||

| Institutional Class | ||||||||||||||

| Return Before Taxes | -10.34% | 1.63% | 5.76% | 8.73% | ||||||||||

| Return After Taxes on Distributions | -13.27% | 0.13% | 4.17% | 7.68% | ||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | -3.93% | 1.19% | 4.34% | 7.35% | ||||||||||

Russell 2000® Index (reflects no deduction for fees, expenses or taxes) | -20.44% | 4.13% | 9.01% | 8.14% | ||||||||||

Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) | -14.48% | 4.13% | 8.48% | 8.64% | ||||||||||

(1)The CSC Small Cap Value Fund, a series of CNI Charter Funds, (the “Predecessor Fund”) transferred its assets into the Fund in a tax-free reorganization on January 23, 2012. Performance information shown includes the performance of the Predecessor Fund for periods prior to January 23, 2012.

After tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. In certain cases, the figure representing Return After Taxes on Distributions and Sale of Fund Shares may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-advantaged arrangements such as 401(k) plans or individual retirement accounts (“IRAs”).

Management

Investment Adviser

Cove Street Capital, LLC is the Fund’s investment adviser.

Portfolio Manager

Jeffrey Bronchick, CFA, Principal and Portfolio Manager of the Adviser since July 2011, is the portfolio manager responsible for the day-to-day management of the Fund. He has managed the Fund since September 30, 1998, through the Fund’s predecessors.

4

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any day that the New York Stock Exchange (“NYSE”) is open for business by written request via mail (Cove Street Capital Small Cap Value Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701), by wire transfer, by contacting the Fund by telephone at (866) 497-0097, or through a financial intermediary. The minimum investment amount is $2,500 for your initial investment in the Fund and $100 for subsequent investments. The Adviser may reduce or waive the minimum.

Tax Information

The Fund’s distributions are generally taxable, and will be taxed as ordinary income or capital gains, unless you are a tax-exempt organization or are investing through a tax-advantaged arrangement such as a 401(k) plan or IRA. Distributions on investments made through tax-advantaged arrangements may be taxed as ordinary income when withdrawn from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund and/or its Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create conflicts of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BGHL (EUR): NAV(s)

- Prosafe SE: Operational Update - April 2024

- Proposed Increase in Size of Offer for Subscription and Re-Opening of Offer for Subscription to Further Applications

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share