Form 497K Listed Funds Trust

Dividend Performers ETF (IPDP) Listed on Cboe BZX Exchange, Inc. Summary Prospectus dated January 31, 2023 | |||||

Before you invest, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and its risks. The current prospectus and SAI dated January 31, 2023, as supplemented, are incorporated by reference into this Summary Prospectus. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.innovativeportfolios.com. You can also get this information at no cost by calling 1-800-617-0004 or by sending an e-mail request to ETF@usbank.com.

Investment Objective

The Dividend Performers ETF’s (the “Fund”) investment objective is to seek to provide income. The Fund’s secondary objective is capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Shareholder Fees (fees paid directly from your investment) | None | |||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||

| Management Fees | 0.85% | |||||||

| Distribution and/or Service (12b-1) Fees | 0.00% | |||||||

| Other Expenses | 0.37% | |||||||

| Interest Expense | 0.37% | |||||||

Total Annual Fund Operating Expenses1,2 | 1.22% | |||||||

1 Restated to reflect the Fund’s current unified management fee as if it had been in effect during the previous fiscal year.

2 Total Annual Fund Operating Expenses do not correlate to the expense ratios in the Fund’s Financial Highlights because the Financial Highlights include only the direct operating expenses incurred by the Fund and exclude Interest Expense.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example does not take into account brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year: | $124 | 3 Years: | $387 | 5 Years: | $670 | 10 Years: | $1,477 | ||||||||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in the Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. For the fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 74% of the average value of its portfolio.

Principal Investment Strategies

The Fund’s investment strategy is twofold: (1) investing in dividend paying U.S. equity securities, and (2) credit spread options on an S&P 500 ETF or Index; both of which are described in detail below.

1

Dividend Investment Strategy

The Fund will invest in common stocks of dividend paying U.S. companies. The Fund invests, generally, in large capitalization companies ($10 billion or higher) but has the ability to invest in income-producing equity securities of all capitalizations with ten years of rising dividend payments. The Fund may also invest in equity real estate investment trusts (“REITs”). Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in dividend-paying securities.

The Fund’s adviser, Innovative Portfolios, LLC (the “Adviser”), invests the Fund’s assets in companies that have a ten-year history of paying dividends, appear to have the ability to continue to pay dividends, have a history of increasing their dividends, and meet certain risk standards (as discussed in more detail below). The Adviser will generally sell a security if the security is no longer expected to meet the Adviser’s dividend or growth expectations or if the risk characteristics place the equity in higher risk deciles.

The selection of dividend-paying stocks is based on the universe of companies based in the U.S. with a history of increasing dividends for 10 consecutive years (Dividend Achievers). That list is further sorted by the companies with the best downside risk (lowest) characteristics. Historically, the companies with lower downside risk scores have potential for long-term growth and have exhibited lower volatility and lower downside risk. The downside risk score utilizes a fundamental value approach, evaluating the security on certain factors (e.g., free cash-flow, revenue stability, profitability changes and trend, leverage, stock price volatility and correlation, and earning surprise persistency). These variables are used to evaluate downside risk on the securities, meaning the risk of the stock versus the potential return, with the objective to avoid downside risk. The portfolio is periodically rebalanced where companies with higher risk characteristics are exchanged for companies with lower risk characteristics. The quantitative nature of this screening process can lead to sector over-or-under weighting.

S&P 500 Options Strategy

The Fund intends to maintain approximately 20% asset exposure to a credit spread options strategy, although market conditions may dictate additional exposure. The Fund seeks to achieve a credit spread on an S&P 500 ETF or Index by selling/writing an out-of-the-money (an out-of-the-money put option is one whose strike price is lower than the market price of the underlying reference asset of the option) short put option each month while simultaneously purchasing an out-of-the-money long put option below the short option position. A credit spread is an options strategy that involves the purchase of one option and a sale of another option in the same class and with the same expiration but different strike prices. Such a strategy results in a net credit for entering the option position, and is profitable when the spreads narrow or expire. By buying a protective long put option, the Fund seeks to hedge any significant downside risk posed by the short put option.

The short option premium is derived from “implied volatility” — the expected level of volatility priced into an option — and is higher, on average, than the volatility actually experienced on the security underlying the option. For example, an option buyer typically pays a premium to an option seller, such as the Fund, that is priced based on the expected amount by which the value of the instrument underlying the option will move up or down. On average, this expected amount of value movement (or implied volatility) is generally greater than the amount by which the value of the underlying instrument actually moves (realized volatility). By entering into derivatives contracts, the Fund is, in essence, accepting a risk that its counterparty seeks to transfer in exchange for the premium received by the Fund under the derivatives contract. By providing this risk transfer service, the Fund seeks to benefit over the long-term from the difference between the level of volatility priced into the options it sells and the level of volatility realized on the securities underlying those options. There can be no assurance that the variance risk premium will be positive for the Fund’s investments at any time or on average and over time.

The premium paid for a long put option is typically priced based on the expected amount by which the value of the instrument underlying the option will move up or down. On average, this expected amount of value movement (or implied volatility) is generally greater than the amount by which the value of the underlying instrument actually moves (realized volatility). By entering into this derivative contract, the Fund is, in essence, transferring a risk that its counterparty seeks to accept in exchange for the premium received by the counterparty under the derivatives contract. By transferring this risk to a counterparty, the Fund seeks to benefit over the long-term from the difference in premium collected on the short put option premium above and the long option premium paid herein. There can be no assurance that the variance risk premium will be positive for the Fund’s investments at any time or on average and over time.

A put option typically gives the option buyer the right to sell, and obligates the option seller to purchase, a security at an agreed-upon price. Generally, the Fund intends to sell put options that are out-of-the-money. Options that are more substantially out-of-the-money generally would pay lower premiums than options that are at or slightly out-of-the-money. By selling put options, the Fund will sell protection against depreciation below the option exercise price to the option purchaser in exchange for an option premium. If an option is exercised, the Fund will either purchase or sell the security at the strike price or pay to the option holder the difference between the strike price and the current price level of the underlying equity security, ETF or index, depending on the terms of the option.

2

The potential returns of the Fund are generally limited to the amount of cash (premiums) the Fund receives when selling short puts, net of any cash (premiums) paid by the Fund to purchase long puts, plus the returns of the underlying Investments in which the Fund invests.

When the Fund enters into derivatives transactions, it is typically required to post collateral to secure its payment or delivery obligations. The Fund invests as indicated above in common stocks of dividend paying companies. These securities will be used to meet margin requirements on the Fund’s option writing strategy. The Fund may write put options in respect of an underlying security in which the Fund does not have a short position (so-called “naked” put options). The Fund may hold positions in equities and ETFs to the extent necessary to meet margin requirements. Generally, the investment goal is to write options with a target of 20% spread notional exposure however market conditions may dictate more notional exposure. The Fund may be considered to have created investment leverage; leverage increases the volatility of the Fund and may result in losses greater than if the Fund had not been leveraged.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with those of other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s net asset value (“NAV”), trading price, yield, total return and/or ability to meet its investment objective. The following risks could affect the value of your investment in the Fund:

•Cybersecurity Risk. Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets or proprietary information, or cause the Fund, the Adviser, and/or other service providers (including custodians and financial intermediaries) to suffer data breaches or data corruption. Additionally, cybersecurity failures or breaches of the electronic systems of the Fund, the Adviser, or the Fund’s other service providers, market makers, Authorized Participants (“APs”), the Fund’s primary listing exchange, or the issuers of securities in which the Fund invests have the ability to disrupt and negatively affect the Fund’s business operations, including the ability to purchase and sell Fund Shares, potentially resulting in financial losses to the Fund and its shareholders.

•Derivatives Securities Risk. The Fund invests in options that derive their performance from the performance of the S&P 500® Index. Derivatives, such as the options in which the Fund invests, can be volatile and involve various types and degrees of risks, depending upon the characteristics of a particular derivative. Derivatives may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in a derivative could have a substantial impact on the performance of the Fund. The Fund could experience a loss if its derivatives do not perform as anticipated, or are not correlated with the performance of their underlying asset or if the Fund is unable to purchase or liquidate a position because of an illiquid secondary market. The market for many derivatives is, or suddenly can become, illiquid. Changes in liquidity may result in significant, rapid, and unpredictable changes in the prices for derivatives.

•Distribution Policy Risk. The Fund’s distributions in respect of any period may exceed the amount of the Fund’s income and gains for that period. In that case, some or all of the Fund’s distributions may constitute a return of capital to shareholders. It is possible for the Fund to suffer substantial investment losses and simultaneously experience additional asset reductions as a result of its distributions to shareholders. A return of capital distribution generally will not be taxable but will decrease the shareholder’s cost basis in the shares of the Fund and will result in a higher capital gain or lower capital loss when those shares on which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets. A distribution constituting a return of capital is not a distribution of income or capital gains earned by the Fund and should not be confused with the Fund’s “yield” or “income.”

•Equity Market Risk. The trading prices of equity securities and other instruments fluctuate in response to a variety of factors. The Fund’s NAV and market price may fluctuate significantly in response to these and other factors. As a result, an investor could lose money over short or long periods of time.

•ETF Risks. The Fund is an ETF and invests in other ETFs, and, as a result of this structure, is exposed directly or indirectly to the following risks:

◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as APs. In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. Shares may trade at a material discount to NAV and possibly face delisting if either: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

3

◦Costs of Buying or Selling Shares Risk. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

◦Shares May Trade at Prices Other Than NAV Risk. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant.

◦Trading Risk. Although Shares are listed for trading on the Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares.

•Implied Volatility Risk. When the Fund sells an option, it gains the amount of the premium it receives, but also incurs a liability representing the value of the option it has sold until the option is either exercised and finishes “in the money,” meaning it has value and can be sold, or the option expires worthless, or the expiration of the option is “rolled,” or extended forward. The value of the options in which the Fund invests is based partly on the volatility used by market participants to price such options (i.e., implied volatility). Accordingly, increases in the implied volatility of such options will cause the value of such options to increase (even if the prices of the options’ underlying stocks do not change), which will result in a corresponding increase in the liabilities of the Fund under such options and thus decrease the Fund’s NAV.

•Large Shareholder Risk. To the extent a large proportion of the shares of the Fund are highly concentrated or held by a small number of shareholders (or a single shareholder), including funds or accounts over which the Adviser or an affiliate of the Adviser has investment discretion, the Fund is subject to the risk that these shareholders will redeem Fund Shares in large amounts rapidly or unexpectedly. In addition, a third-party investor, the Adviser or an affiliate of the Adviser, an authorized participant, a lead market maker, or another entity may invest in the Fund and hold its investment solely to facilitate commencement of the Fund or to facilitate the Fund’s achieving a specified size or scale (i.e., a seed investor). In such case, an investor may own a majority of the Fund’s shares. Similar to other large shareholders, there is a risk that such seed investors may redeem all or a significant portion of their investment in the Fund with little or no notice to the Fund. Any such redemptions could adversely affect the ability of the Fund to conduct its investment program, including by causing the Fund to dispose of investments at unfavorable times or increase its cash holdings, diluting its investment returns. An unexpected large redemption also may have an adverse effect on the market price of the Fund’s Shares.

•Leveraging Risk. The use of leverage, such as that embedded in options, could magnify the Fund’s gains or losses.

•Liquidity Risk. Liquidity risk refers to the possibility that the Fund may not be able to buy or sell a security at a favorable price or time. Consequently, the Fund may have to accept a lower price to sell a security, sell other securities to raise cash, or decline an investment opportunity, any of which could have a negative effect on the Fund’s performance. Infrequent trading of securities also may lead to an increase in their price volatility.

•Management Risk. The Adviser continuously evaluates the Fund’s holdings, purchases and sales with a view to achieving the Fund’s investment objectives. However, achievement of the stated investment objective cannot be guaranteed. The Adviser’s judgment about the markets, the economy, or companies may not anticipate actual market movements, economic conditions or company performance, and these factors may affect the return on your investment.

•Market Capitalization Risk.

◦Large-Capitalization Investing Risk. The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies also may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes.

◦Mid-Capitalization Investing Risk. The securities of mid-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large-capitalization companies. The securities of mid-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large-capitalization stocks or the stock market as a whole.

◦Small-Capitalization Investing Risk. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities

4

of small-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole. There is typically less publicly available information concerning smaller-capitalization companies than for larger, more established companies.

•Market Risk. The trading prices of securities and other instruments fluctuate in response to a variety of factors. These factors include events impacting the entire market or specific market segments, such as political, market and economic developments, as well as events that impact specific issuers. The Fund’s NAV and market price, like security and commodity prices generally, may fluctuate significantly in response to these and other factors. As a result, an investor could lose money over short or long periods of time. U.S. and international markets have experienced significant periods of volatility in recent years due to a number of these factors, including the impact of the COVID-19 pandemic and related public health issues, growth concerns in the U.S. and overseas, uncertainties regarding interest rates, trade tensions and the threat of tariffs imposed by the U.S. and other countries. In addition, local, regional or global events such as war, including Russia’s invasion of Ukraine, acts of terrorism, spread of infectious diseases or other public health issues, recessions, rising inflation, or other events could have a significant negative impact on the Fund and its investments. These developments as well as other events could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets. It is unknown how long circumstances related to the COVID-19 pandemic will persist, whether they will reoccur in the future, whether efforts to support the economy and financial markets will be successful, and what additional implications may follow from the pandemic. The impact of these events and other epidemics or pandemics in the future could adversely affect Fund performance.

•Options Risk. Selling (writing) and buying options are speculative activities and entail greater than ordinary investment risks. The Fund’s use of put options can lead to losses because of adverse movements in the price or value of the underlying asset, which may be magnified by certain features of the options. When selling a put option, the Fund will receive a premium; however, this premium may not be enough to offset a loss incurred by the Fund if the price of the underlying asset is below the strike price by an amount equal to or greater than the premium. Purchasing of put options involves the payment of premiums, which may adversely affect the Fund’s performance. Purchasing a put option gives the purchaser of the option the right to sell a specified quantity of an underlying asset at a fixed exercise price over a defined period of time. Purchased put options may expire worthless resulting in the Fund’s loss of the premium it paid for the option.

The value of an option may be adversely affected if the market for the option becomes less liquid or smaller, and will be affected by changes in the value or yield of the option’s underlying asset, an increase in interest rates, a change in the actual or perceived volatility of the stock market or the underlying asset and the remaining time to expiration. Additionally, the value of an option does not increase or decrease at the same rate as the underlying asset. The Fund’s use of options may reduce the Fund’s ability to profit from increases in the value of the underlying asset. If the price of the underlying asset of an option is above the strike price of a written put option, the value of the option, and consequently of the Fund, may decline significantly more than if the Fund invested directly in the underlying asset instead of using options.

Positions may be bought back for a gain or loss and rolled out in the future to create a new spread, and this may occur outside of the normal systematic strategy execution. In a strong market decline where the buyback involves an “in the money” (i.e., an option with a strike price less than the current level of the benchmark index) option, there may be a “debit” roll, whereby the cash needed to close out the option position exceeds the new sale’s proceeds.

•Other Investment Companies Risk. The risks of investment in other investment companies, including ETFs, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company. Investments in ETFs also are subject to the “ETF Risks” described above.

•REIT Risk. Investment in real estate companies, including REITs, exposes the Fund to the risks of owning real estate directly. Real estate is highly sensitive to general and local economic conditions and developments. The U.S. real estate market may experience and has, in the past, experienced a decline in value, with certain regions experiencing significant losses in property values. Many real estate companies, including REITs, utilize leverage (and some may be highly leveraged), which increases investment risk and the risk normally associated with debt financing, and could potentially increase the Fund’s volatility and losses. Exposure to such real estate may adversely affect Fund performance. Further, REITs are dependent upon specialized management skills, and their investments may be concentrated in relatively few properties, or in a small geographic area or a single property type. REITs also are subject to heavy cash flow dependency and, as a result, are particularly reliant on the proper functioning of capital markets. A variety of economic and other factors may adversely affect a lessee's ability to meet its obligations to a REIT. In the event of a default by a lessee, the REIT may experience delays in enforcing its rights as a lessor and may incur substantial costs associated in protecting its investments. In addition, a REIT could fail to qualify for favorable regulatory treatment.

5

•Sector Risk. The Fund’s investing approach may result in an emphasis on certain sectors or sub-sectors of the market at any given time. To the extent the Fund invests more heavily in one sector or sub-sector of the market, it thereby presents a more concentrated risk and its performance will be especially sensitive to developments that significantly affect those sectors or sub-sectors. In addition, the value of Shares may change at different rates compared to the value of shares of a fund with investments in a more diversified mix of sectors and industries. An individual sector or sub-sector of the market may have above-average performance during particular periods, but may also move up and down more than the broader market. The several industries that constitute a sector may all react in the same way to economic, political or regulatory events. The Fund’s performance could also be affected if the sectors or sub-sectors do not perform as expected. The quantitative nature of the screening process can lead to sector over-or-under weighting, and the lack of exposure to one or more sectors or sub-sectors may adversely affect performance.

•Tax Risk. The writing of options by the Fund may significantly reduce or eliminate its ability to make distributions eligible to be treated as qualified dividend income or eligible for the dividends received deduction for corporate shareholders. Options entered into by the Fund may also be subject to the federal tax rules applicable to straddles under the Internal Revenue Code of 1986, as amended (the “Code”). If positions held by the Fund were treated as “straddles” for federal income tax purposes, or the Fund’s risk of loss with respect to a position was otherwise diminished as set forth in Treasury regulations, dividends on stocks that are a part of such positions would not constitute qualified dividend income subject to such favorable income tax treatment in the hands of non-corporate shareholders or eligible for the dividends received deduction for corporate shareholders. In addition, generally, straddles are subject to certain rules that may affect the amount, character and timing of the Fund’s recognition of gains and losses with respect to straddle positions.

•U.S. Federal Reserve Policy Risk. In the 1970 and early 1980s interest rates increased to combat inflation under former Federal Reserve Chairman Paul Volker. Since peaking in 1981, interest rates were on a downward trajectory creating a 40-year bull market in fixed income with rates bottoming in 2020 during the COVID-19 crisis. Since the Financial Crisis, the Federal Reserve began a program of Quantitative Easing to increase cash in the economy and keep interest costs low. However, these accommodative policies have changed materially in 2022. To combat inflation, the Federal Reserve has been quickly increasing interest rates and has begun Quantitative Tightening (QT) of its Balance Sheets. There has been limited periods where interest rates increased rapidly and zero history of QT. As a result, it is difficult to predict the impact of these changes in interest rates and the slope of yield curve. These quickly changing conditions have materially impacted the capital market with future developments still greatly unknown. The weakening environment may cause decrease in valuations, increased volatility, and lower liquidity, especially in fixed-income markets. While some of these risks are limited to fixed-income securities, the interconnectedness of the capital markets has and will likely continue causing an impact in other asset classes such as equities, FX, and commodities. The ending of historically low interest rate environment may heighten these risks.

Performance

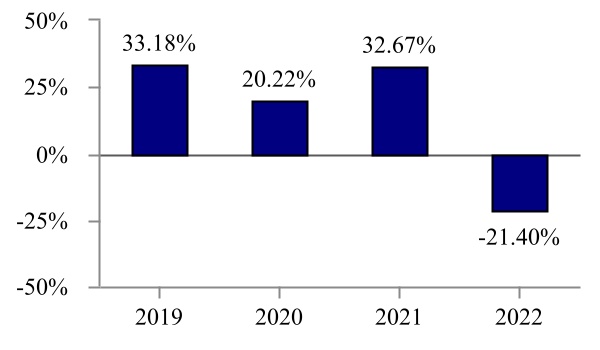

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance for calendar years ended December 31. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.innovativeportfolios.com.

As a result of a reorganization that occurred on March 7, 2022, the Fund acquired all of the assets and liabilities of the Dividend Performers (the “Dividend Performers Predecessor Fund”), a series of Collaborative Investment Series Trust, an open-end investment company registered under the Investment Company Act of 1940 (the “1940 Act”) that has had the same investment objectives and strategies as the Fund since the Dividend Performers Predecessor Fund’s inception on December 24, 2018. The Fund assumed the NAV and performance history of the Dividend Performers Predecessor Fund. Performance shown in the bar chart and table for periods prior to March 7, 2022 is that of the Dividend Performers Predecessor Fund and is not the performance of the Fund. The Fund’s objectives, policies, guidelines, and restrictions are in all material respects equivalent to those of the Dividend Performers Predecessor Fund, which was created for reasons entirely unrelated to the establishment of a performance record.

The Dividend Performers Predecessor Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

6

Calendar Year Total Returns

During the period of time shown in the bar chart, the highest quarterly return was 54.69% for the quarter ended June 30, 2020, and the lowest quarterly return was -44.54% for the quarter ended March 31, 2020.

Average Annual Total Returns

(for periods ended December 31, 2022)

Dividend Performers ETF | 1-Year | Since Inception* | ||||||

| Return Before Taxes | -21.40% | 14.11% | ||||||

| Return After Taxes on Distributions | -21.49% | 12.22% | ||||||

| Return After Taxes on Distributions and Sale of Shares | -12.60% | 10.63% | ||||||

NASDAQ U.S. Broad Dividend Achievers Index (reflects no deduction for fees, expenses, or taxes) | -5.78% | 14.66% | ||||||

S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | -18.11% | 14.94% | ||||||

* The Dividend Performers Predecessor Fund commenced operations on December 24, 2018.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Portfolio Management

| Adviser | Innovative Portfolios, LLC | ||||

Portfolio Managers | Dave Gilreath, CFP, Managing Director & Chief Investment Officer of the Adviser, has served as a portfolio manager of the Fund since its inception in March 2022 and previously served as a portfolio manager of the Dividend Performers Predecessor Fund from its inception on December 24, 2018 through March 7, 2022, when the Dividend Performers Predecessor Fund reorganized into the Fund. | ||||

Tom Kaiser, CFA, Portfolio Manager of the Adviser, has served as a portfolio manager of the Fund since its inception in March 2022 and previously served as a portfolio manager of the Dividend Performers Predecessor Fund from November 2021 through March 7, 2022, when the Dividend Performers Predecessor Fund reorganized into the Fund. | |||||

Purchase and Sale of Shares

The Fund issues and redeems Shares at NAV only in large blocks known as “Creation Units,” which only APs (typically, broker-dealers) may purchase or redeem. The Fund generally issues and redeems Creation Units in exchange for a portfolio of securities and/or a designated amount of U.S. cash.

Shares are listed on the Exchange, and individual Shares may only be bought and sold in the secondary market through a broker or dealer at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (the “bid” price) and the lowest price a seller is willing to accept for Shares (the “ask” price) when buying or selling Shares in the secondary market. The difference in the bid and ask prices is referred to as the “bid-ask spread.”

7

Recent information regarding the Fund’s NAV, market price, how often Shares traded on the Exchange at a premium or discount, and bid-ask spreads can be found on the Fund’s website at www.innovativeportfolios.com.

Tax Information

The Fund’s distributions are generally taxable as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an individual retirement account (“IRA”) or other tax-advantaged account. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts. See “Dividends, Distributions, and Taxes - Dividends and Distributions” for more information.

Financial Intermediary Compensation

If you purchase Shares through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), the Adviser or its affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange-traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Snoqualmie Casino Brings "Burning Trotman" – Top 7 Artists

- HR Tech Startup Remofirst Named a “Most Loved Workplace”

- Medicus Pharma Ltd. Announces Proposed Private Placement of Convertible Notes

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share