Form 497K Listed Funds Trust

Preferred-Plus ETF (IPPP) Listed on Cboe BZX Exchange, Inc. Summary Prospectus dated January 31, 2023 | |||||

Before you invest, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and its risks. The current prospectus and SAI dated January 31, 2023, as supplemented, are incorporated by reference into this Summary Prospectus. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.innovativeportfolios.com. You can also get this information at no cost by calling 1-800-617-0004 or by sending an e-mail request to ETF@usbank.com.

Investment Objective

The Preferred-Plus ETF (the “Fund”) seeks to provide income.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Shareholder Fees (fees paid directly from your investment) | None | |||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||

| Management Fees | 0.85% | |||||||

| Distribution and/or Service (12b-1) Fees | 0.00% | |||||||

| Other Expenses | 0.20% | |||||||

| Interest Expense | 0.20% | |||||||

Acquired Fund Fees and Expenses1 | 0.01% | |||||||

Total Annual Fund Operating Expenses2,3 | 1.06% | |||||||

1 Acquired Fund Fees and Expenses (“AFFE”) are the indirect costs of investing in other investment companies.

2 Restated to reflect the Fund’s current unified management fee as if it had been in effect during the previous fiscal year.

3 Total Annual Fund Operating Expenses do not correlate to the expense ratios in the Fund’s Financial Highlights because the Financial Highlights include only the direct operating expenses incurred by the Fund and exclude AFFE and Interest Expense.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example does not take into account brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year: | $108 | 3 Years: | $337 | 5 Years: | $585 | 10 Years: | $1,294 | ||||||||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in the Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. For the fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 65% of the average value of its portfolio.

Principal Investment Strategies

The Fund’s investment strategy is two-fold: (1) preferred securities, and (2) credit spread options on an S&P 500 ETF or Index; both of which are described in detail below.

1

Preferred Investment Strategy

The Fund pursues its objective primarily by investing in issues of preferred securities and debt securities that the Fund’s adviser, Innovative Portfolios, LLC (the “Adviser”), believes to be undervalued. In making this determination, the Adviser evaluates the fundamental characteristics of an issuer, including an issuer’s creditworthiness, and also takes into account prevailing market factors. In analyzing credit quality, the Adviser considers not only fundamental analysis, but also an issuer’s corporate and capital structure and the placement of the preferred or debt securities within that structure. In evaluating relative value, the Adviser also takes into account call, conversion and other structural security features, in addition to such factors as the likely directions of credit ratings and relative value versus other fixed-income security classes.

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings made for investment purposes) in a portfolio of preferred securities issued by U.S. and non-U.S. companies, including traditional preferred securities; hybrid preferred securities that have investment and economic characteristics of both preferred stock and debt securities; floating rate preferred securities; convertible preferred securities; and shares of other open-end (including other exchange-traded funds (“ETFs”)) and closed-end funds that invest primarily in preferred securities. The Fund may invest in preferred securities of all issuer capitalizations. The Fund may also invest in publicly-traded partnerships (“PTPs”).

The Fund intends to focus its investments in the Financials Sector (including securities issued by banks, diversified financials, and insurance companies). In addition, the Fund also may focus its investments in other sectors such as (but not limited to) energy, industrials, utilities, health care and telecommunications. The Adviser retains broad discretion to allocate the Fund’s investments across various sectors and industries.

The Fund may invest in preferred equity or debt securities of any maturity or credit rating, including investment grade securities, below investment grade securities (commonly known as “junk bonds”) and unrated securities. The Fund generally seeks to maintain a minimum weighted average senior debt rating of the issuing companies in which it invests of BBB-, which the Fund considers to be investment grade. Although a company’s senior debt rating may be BBB-, an underlying security issued by such company in which the Fund invests may have a lower rating than BBB-. A security must be rated no lower than B- or B3 in order to be purchased by the Fund (or if unrated, of similar quality in the opinion of the Adviser).

S&P 500 Options Investment Strategy

The Fund intends to maintain approximately 10% asset exposure to a credit spread options strategy, although market conditions may dictate additional exposure. The Fund seeks to achieve a credit spread on an S&P 500 ETF or Index by selling/writing an out-of-the-money (an out-of-the-money put option is one whose strike price is lower than the market price of the underlying reference asset of the option) short put option each month while simultaneously purchasing an out-of-the-money long put option below the short option position. A credit spread is an options strategy that involves the purchase of one option and a sale of another option in the same class and with the same expiration but different strike prices. Such a strategy results in a net credit for entering the option position, and is profitable when the spreads narrow or expire. By buying a protective long put option, the Fund seeks to hedge any significant downside risk posed by the short put option. The short option premium is derived from “implied volatility” — the expected level of volatility priced into an option — and is higher, on average, than the volatility actually experienced on the security underlying the option.

For example, an option buyer typically pays a premium to an option seller, such as the Fund, that is priced based on the expected amount by which the value of the instrument underlying the option will move up or down. On average, this expected amount of value movement (or implied volatility) is generally greater than the amount by which the value of the underlying instrument actually moves (realized volatility). By entering into derivatives contracts, the Fund is, in essence, accepting a risk that its counterparty seeks to transfer in exchange for the premium received by the Fund under the derivatives contract. By providing this risk transfer service, the Fund seeks to benefit over the long-term from the difference between the level of volatility priced into the options it sells and the level of volatility realized on the securities underlying those options. There can be no assurance that the variance risk premium will be positive for the Fund’s investments at any time or on average and over time.

The premium paid for a long put option is typically priced based on the expected amount by which the value of the instrument underlying the option will move up or down. On average, this expected amount of value movement (or implied volatility) is generally greater than the amount by which the value of the underlying instrument actually moves (realized volatility). By entering into this derivative contract, the Fund is, in essence, transferring a risk that its counterparty seeks to accept in exchange for the premium received by the counterparty under the derivatives contract. By transferring this risk to a counterparty, the Fund seeks to benefit over the long-term from the difference in premium collected on the short put option premium above and the long option premium paid herein. There can be no assurance that the variance risk premium will be positive for the Fund’s investments at any time or on average and over time.

2

A put option typically gives the option buyer the right to sell, and obligates the option seller to purchase, a security at an agreed-upon price. Generally, the Fund intends to sell put options that are out-of-the-money. Options that are more substantially out-of-the-money generally would pay lower premiums than options that are at or slightly out-of-the-money. By selling put options, the Fund will sell protection against depreciation below the option exercise price to the option purchaser in exchange for an option premium. If an option is exercised, the Fund will either purchase or sell the security at the strike price or pay to the option holder the difference between the strike price and the current price level of the underlying equity security, ETF or index, depending on the terms of the option.

The potential returns of the Fund are generally limited to the amount of cash (premiums) the Fund receives when selling short puts, net of any cash (premiums) paid by the Fund to purchase long puts, plus the returns of the underlying Investments in which the Fund invests.

When the Fund enters into derivatives transactions, it is typically required to post collateral to secure its payment or delivery obligations. The Fund invests as indicated above in preferred securities. These securities will be used to meet margin requirements on the Fund’s option writing strategy. The Fund may write put options in respect of an underlying security in which the Fund does not have a short position (so-called “naked” put options). The Fund may hold positions in equities and ETFs to the extent necessary to meet margin requirements. Generally, the investment goal is to write options with a target of 10% spread notional exposure however market conditions may dictate more notional exposure. The Fund may be considered to have created investment leverage; leverage increases the volatility of the Fund and may result in losses greater than if the Fund had not been leveraged.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with those of other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s net asset value (“NAV”), trading price, yield, total return and/or ability to meet its investment objective. The following risks could affect the value of your investment in the Fund:

•Below Investment Grade Securities Risk. The Fund’s investments in below investment grade securities are subject to a greater risk of loss of income and principal than higher grade debt securities. The Fund’s investments in below investment grade securities also subject the Fund to greater levels of interest rate, credit and liquidity risk than funds that do not invest in such securities. Issuers of below investment grade securities are often highly leveraged and are more vulnerable to changes in the economy. These securities are considered predominately speculative with respect to the issuer’s continuing ability to make principal and interest payments.

•Cybersecurity Risk. Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets or proprietary information, or cause the Fund, the Adviser, and/or other service providers (including custodians and financial intermediaries) to suffer data breaches or data corruption. Additionally, cybersecurity failures or breaches of the electronic systems of the Fund, the Adviser, or the Fund’s other service providers, market makers, Authorized Participants (“APs”), the Fund’s primary listing exchange, or the issuers of securities in which the Fund invests have the ability to disrupt and negatively affect the Fund’s business operations, including the ability to purchase and sell Fund Shares, potentially resulting in financial losses to the Fund and its shareholders.

•Derivatives Securities Risk. The Fund invests in options that derive their performance from the performance of the S&P 500® Index. Derivatives, such as the options in which the Fund invests, can be volatile and involve various types and degrees of risks, depending upon the characteristics of a particular derivative. Derivatives may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in a derivative could have a substantial impact on the performance of the Fund. The Fund could experience a loss if its derivatives do not perform as anticipated, or are not correlated with the performance of their underlying asset or if the Fund is unable to purchase or liquidate a position because of an illiquid secondary market. The market for many derivatives is, or suddenly can become, illiquid. Changes in liquidity may result in significant, rapid, and unpredictable changes in the prices for derivatives.

•Distribution Policy Risk. The Fund’s distributions in respect of any period may exceed the amount of the Fund’s income and gains for that period. In that case, some or all of the Fund’s distributions may constitute a return of capital to shareholders. It is possible for the Fund to suffer substantial investment losses and simultaneously experience additional asset reductions as a result of its distributions to shareholders. A return of capital distribution generally will not be taxable but will decrease the shareholder’s cost basis in the shares of the Fund and will result in a higher capital gain or lower capital loss when those shares on which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets. A distribution constituting a return of capital

3

is not a distribution of income or capital gains earned by the Fund and should not be confused with the Fund’s “yield” or “income.”

•Equity Market Risk. The trading prices of equity securities and other instruments fluctuate in response to a variety of factors. The Fund’s NAV and market price may fluctuate significantly in response to these and other factors. As a result, an investor could lose money over short or long periods of time.

•ETF Risks. The Fund is an ETF and invests in other ETFs, and, as a result of this structure, is exposed directly or indirectly to the following risks:

◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as APs. In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. Shares may trade at a material discount to NAV and possibly face delisting if either: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

◦Costs of Buying or Selling Shares Risk. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

◦Shares May Trade at Prices Other Than NAV Risk. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant.

◦Trading Risk. Although Shares are listed for trading on the Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares.

•Financials Sector Risk. The Fund’s investments are exposed to issuers conducting business in the Financials Sector. The Fund is subject to the risk that the securities of such issuers will underperform the market as a whole due to legislative or regulatory changes, adverse market conditions and/or increased competition affecting the Financials Sector. The performance of companies in the Financials Sector may be adversely impacted by many factors, including, among others, government regulations, economic conditions, credit rating downgrades, changes in interest rates, and decreased liquidity in credit markets. The Financials Sector has experienced significant losses in the recent past, and the impact of more stringent capital requirements and of recent or future regulation on any individual financial company or on the Financials Sector as a whole cannot be predicted.

•Fixed Income Risk.

◦Call Risk. During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or repay the security before its stated maturity, and the Fund may have to reinvest the proceeds at lower interest rates, resulting in a decline in the Fund’s income.

◦Credit Risk. Debt issuers and other counterparties may not honor their obligations or may have their debt downgraded by ratings agencies.

◦Extension Risk. During periods of rising interest rates, certain debt obligations will be paid off substantially more slowly than originally anticipated and the value of those securities may fall sharply, resulting in a decline in the Fund’s income and potentially in the value of the Fund’s investments.

◦Interest Rate Risk. An increase in interest rates may cause the value of fixed-income securities held by the Fund to decline. The Fund may be subject to a greater risk of rising interest rates due to the recent historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. Variable and floating rate securities may increase or decrease in value in response to changes in interest rates, although generally to a lesser degree than fixed-income securities.

◦Floating Rate Notes Risk. Securities with floating or variable interest rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value if their interest rates do not rise as much, or as quickly, as interest rates in general. Conversely, floating rate securities will not generally increase in value if interest rates decline. A

4

decline in interest rates may result in a reduction of income received from floating rate securities held by the Fund and may adversely affect the value of the Fund’s shares. Generally, floating rate securities carry lower yields than fixed notes of the same maturity. The interest rate for a floating rate note resets or adjusts periodically by reference to a benchmark interest rate. The impact of interest rate changes on floating rate investments is typically mitigated by the periodic interest rate reset of the investments. Securities with longer durations tend to be more sensitive to interest rate changes, usually making them more volatile than securities with shorter durations. Floating rate notes generally are subject to legal or contractual restrictions on resale, may trade infrequently, and their value may be impaired when the Fund needs to liquidate such loans. Benchmark interest rates, such as the LIBOR, may not accurately track market interest rates.

◦Income Risk. The Fund’s income may decline if interest rates fall. This decline in income can occur because most of the debt instruments held by the Fund will have floating or variable interest rates.

◦Prepayment and Extension Risk: The risk that changes in interest rates, credit spreads or other factors will result in the call (repayment) of a debt instrument before it is expected. The Fund may have to invest the proceeds in lower yielding securities or that expectations of such early call will negatively impact the market price of the security. Extension risk is the risk that changes in the interest rates or credit spreads may result in lowering call expectations, which can cause prices to fall.

•Foreign Securities Risk. Investments in non-U.S. securities involve certain risks that may not be present with investments in U.S. securities. For example, investments in non-U.S. securities may be subject to risk of loss due to foreign currency fluctuations or to political or economic instability. There may be less information publicly available about a non-U.S. issuer than a U.S. issuer. Non-U.S. issuers may be subject to different accounting, auditing, financial reporting and investor protection standards than U.S. issuers. Investments in non-U.S. securities also may be subject to withholding or other taxes and may be subject to additional trading, settlement, custodial, and operational risks. With respect to certain countries, there is the possibility of government intervention and expropriation or nationalization of assets. Because legal systems differ, there also is the possibility that it will be difficult to obtain or enforce legal judgments in certain countries. Since foreign exchanges may be open on days when the Fund does not price its shares, the value of the securities in the Fund’s portfolio may change on days when shareholders will not be able to purchase or sell the Fund’s shares. Conversely, Shares may trade on days when foreign exchanges are closed. Each of these factors can make investments in the Fund more volatile and potentially less liquid than other types of investments.

•Implied Volatility Risk. When the Fund sells an option, it gains the amount of the premium it receives, but also incurs a liability representing the value of the option it has sold until the option is either exercised and finishes “in the money,” meaning it has value and can be sold, or the option expires worthless, or the expiration of the option is “rolled,” or extended forward. The value of the options in which the Fund invests is based partly on the volatility used by market participants to price such options (i.e., implied volatility). Accordingly, increases in the implied volatility of such options will cause the value of such options to increase (even if the prices of the options’ underlying stocks do not change), which will result in a corresponding increase in the liabilities of the Fund under such options and thus decrease the Fund’s NAV.

•Large Shareholder Risk. To the extent a large proportion of the shares of the Fund are highly concentrated or held by a small number of shareholders (or a single shareholder), including funds or accounts over which the Adviser or an affiliate of the Adviser has investment discretion, the Fund is subject to the risk that these shareholders will redeem Fund Shares in large amounts rapidly or unexpectedly. In addition, a third-party investor, the Adviser or an affiliate of the Adviser, an authorized participant, a lead market maker, or another entity may invest in the Fund and hold its investment solely to facilitate commencement of the Fund or to facilitate the Fund’s achieving a specified size or scale (i.e., a seed investor). In such case, an investor may own a majority of the Fund’s shares. Similar to other large shareholders, there is a risk that such seed investors may redeem all or a significant portion of their investment in the Fund with little or no notice to the Fund. Any such redemptions could adversely affect the ability of the Fund to conduct its investment program, including by causing the Fund to dispose of investments at unfavorable times or increase its cash holdings, diluting its investment returns. An unexpected large redemption also may have an adverse effect on the market price of the Fund’s Shares.

•Leveraging Risk. The use of leverage, such as that embedded in options, could magnify the Fund’s gains or losses.

•LIBOR Discontinuance or Unavailability Risk. The CLO debt in which the Fund may invest bears interest based upon LIBOR (London InterBank Offered Rate), which is intended to represent the rate at which contributing banks may obtain short-term borrowings from each other in the London interbank market. On March 5, 2021, the U.K. Financial Conduct Authority (“FCA”) publicly announced that (i) immediately after December 31, 2021, publication of the 1-week and 2-month U.S. Dollar LIBOR settings will permanently cease (which took place as scheduled); (ii) immediately after June 30, 2023, publication of the overnight and 12-month U.S. Dollar LIBOR settings will permanently cease; and (iii) immediately after June 30, 2023, the 1-month, 3-month and 6-month U.S. Dollar LIBOR settings will cease to be provided or, subject to the FCA’s consideration of the

5

case, be provided on a synthetic basis and no longer be representative of the underlying market and economic reality they are intended to measure and that representativeness will not be restored. There is no assurance that the dates announced by the FCA will not change or that the administrator of LIBOR and/or regulators will not take further action that could impact the availability, composition or characteristics of LIBOR or the currencies and/or tenors for which LIBOR is published, and we recommend that you consult your advisors to stay informed of any such developments. Public and private sector industry initiatives are currently underway to implement new or alternative reference rates to be used in place of LIBOR, such as the Secured Overnight Financing Rate (SOFR). There is no assurance that any such alternative reference rate will be similar to or produce the same value or economic equivalence as LIBOR or that it will have the same volume or liquidity as did LIBOR prior to its discontinuance or unavailability, which may affect the value or liquidity or return on certain of the Fund’s investments and result in costs incurred in connection with closing out positions and entering into new trades.

•Liquidity Risk. Liquidity risk refers to the possibility that the Fund may not be able to buy or sell a security at a favorable price or time. Consequently, the Fund may have to accept a lower price to sell a security, sell other securities to raise cash, or decline an investment opportunity, any of which could have a negative effect on the Fund’s performance. Infrequent trading of securities also may lead to an increase in their price volatility.

•Management Risk. The Adviser continuously evaluates the Fund’s holdings, purchases and sales with a view to achieving the Fund’s investment objective. However, achievement of the stated investment objective cannot be guaranteed. The Adviser’s judgment about the markets, the economy, or companies may not anticipate actual market movements, economic conditions or company performance, and these factors may affect the return on your investment.

•Market Capitalization Risk.

◦Large-Capitalization Investing Risk. The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies also may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes.

◦Mid-Capitalization Investing Risk. The securities of mid-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large-capitalization companies. The securities of mid-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large-capitalization stocks or the stock market as a whole.

◦Small-Capitalization Investing Risk. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities of small-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole. There is typically less publicly available information concerning smaller-capitalization companies than for larger, more established companies.

•Market Risk. The trading prices of securities and other instruments fluctuate in response to a variety of factors. These factors include events impacting the entire market or specific market segments, such as political, market and economic developments, as well as events that impact specific issuers. The Fund’s NAV and market price, like security and commodity prices generally, may fluctuate significantly in response to these and other factors. As a result, an investor could lose money over short or long periods of time. U.S. and international markets have experienced significant periods of volatility in recent years due to a number of these factors, including the impact of the COVID-19 pandemic and related public health issues, growth concerns in the U.S. and overseas, uncertainties regarding interest rates, trade tensions and the threat of tariffs imposed by the U.S. and other countries. In addition, local, regional or global events such as war, including Russia’s invasion of Ukraine, acts of terrorism, spread of infectious diseases or other public health issues, recessions, rising inflation, or other events could have a significant negative impact on the Fund and its investments. These developments as well as other events could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets. It is unknown how long circumstances related to the COVID-19 pandemic will persist, whether they will reoccur in the future, whether efforts to support the economy and financial markets will be successful, and what additional implications may follow from the pandemic. The impact of these events and other epidemics or pandemics in the future could adversely affect Fund performance.

•Options Risk. Selling (writing) and buying options are speculative activities and entail greater than ordinary investment risks. The Fund’s use of put options can lead to losses because of adverse movements in the price or value of the underlying asset, which may be magnified by certain features of the options. When selling a put option, the Fund will receive a premium; however, this premium may not be enough to offset a loss incurred by the Fund if the price of the underlying asset is below the strike price by an amount equal to or greater than the premium. Purchasing of put options involves the payment of premiums, which may adversely affect the Fund’s performance. Purchasing a put option gives the purchaser of the option the right to sell a

6

specified quantity of an underlying asset at a fixed exercise price over a defined period of time. Purchased put options may expire worthless resulting in the Fund’s loss of the premium it paid for the option.

The value of an option may be adversely affected if the market for the option becomes less liquid or smaller, and will be affected by changes in the value or yield of the option’s underlying asset, an increase in interest rates, a change in the actual or perceived volatility of the stock market or the underlying asset and the remaining time to expiration. Additionally, the value of an option does not increase or decrease at the same rate as the underlying asset. The Fund’s use of options may reduce the Fund’s ability to profit from increases in the value of the underlying asset. If the price of the underlying asset of an option is above the strike price of a written put option, the value of the option, and consequently of the Fund, may decline significantly more than if the Fund invested directly in the underlying asset instead of using options.

Positions may be bought back for a gain or loss and rolled out in the future to create a new spread, and this may occur outside of the normal systematic strategy execution. In a strong market decline where the buyback involves an “in the money” (i.e., an option with a strike price less than the current level of the benchmark index) option, there may be a “debit” roll, whereby the cash needed to close out the option position exceeds the new sale’s proceeds.

•Other Investment Companies Risk. The risks of investment in other investment companies, including ETFs, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company. Investments in ETFs also are subject to the “ETF Risks” described above.

•Preferred Securities Risk. Preferred securities may pay fixed or adjustable rates of return and are subject to many of the risks associated with debt securities (e.g., interest rate risk, call risk and extension risk). In addition, preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. Because many preferred securities allow the issuer to convert their preferred security into common stock, preferred securities are often sensitive to declining common stock values. A company’s preferred securities generally pay dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred securities will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. Preferred securities of smaller companies may be more vulnerable to adverse developments than preferred stock of larger companies. In addition, preferred securities are subject to other risks, such as having no or limited voting rights, being subject to special redemption rights, having distributions deferred or skipped, having floating interest rates or dividends, which may result in a decline in value in a falling interest rate environment, having limited liquidity, changing or unfavorable tax treatments and possibly being issued by companies in heavily regulated industries. Preferred securities that do not have a maturity date are considered to be perpetual investments.

•Publicly Traded Partnership Risk. Investing in PTPs (including master limited partnerships) involves special risks in addition to those typically associated with publicly traded companies. PTPs are exposed to the risks of their underlying assets, which in many cases includes the same types of risks as energy and natural resources companies, such as commodity pricing risk, supply and demand risk and depletion and exploration risk. PTPs are also subject to capital markets risk, which is the risk that they may be unable to raise capital to execute their growth strategies. PTPs are also subject to tax risk, which is the risk that PTPs may lose their partnership status for tax purposes. The Fund’s ability to make investments in certain PTPs, including master limited partnerships, can be limited by the Fund’s intention to qualify as a regulated investment company, and if the Fund does not appropriately limit such investments or if such investments are re-characterized for U.S. federal income tax purposes, the Fund’s status as a regulated investment company may be jeopardized.

•REIT Risk. Investment in real estate companies, including REITs, exposes the Fund to the risks of owning real estate directly. Real estate is highly sensitive to general and local economic conditions and developments. The U.S. real estate market may experience and has, in the past, experienced a decline in value, with certain regions experiencing significant losses in property values. Many real estate companies, including REITs, utilize leverage (and some may be highly leveraged), which increases investment risk and the risk normally associated with debt financing, and could potentially increase the Fund’s volatility and losses. Exposure to such real estate may adversely affect Fund performance. Further, REITs are dependent upon specialized management skills, and their investments may be concentrated in relatively few properties, or in a small geographic area or a single property type. REITs also are subject to heavy cash flow dependency and, as a result, are particularly reliant on the proper functioning of capital markets. A variety of economic and other factors may adversely affect a lessee's ability to meet its obligations to a REIT. In the event of a default by a lessee, the REIT may experience delays in enforcing its rights as a lessor and may incur substantial costs associated in protecting its investments. In addition, a REIT could fail to qualify for favorable regulatory treatment.

•Tax Risk. The writing of options by the Fund may significantly reduce or eliminate its ability to make distributions eligible to be treated as qualified dividend income or eligible for the dividends received deduction for corporate shareholders. Options entered into by the Fund may also be subject to the federal tax rules applicable to straddles under the Internal Revenue Code of 1986, as

7

amended (the “Code”). If positions held by the Fund were treated as “straddles” for federal income tax purposes, or the Fund’s risk of loss with respect to a position was otherwise diminished as set forth in Treasury regulations, dividends on stocks that are a part of such positions would not constitute qualified dividend income subject to such favorable income tax treatment in the hands of non-corporate shareholders or eligible for the dividends received deduction for corporate shareholders. In addition, generally, straddles are subject to certain rules that may affect the amount, character and timing of the Fund’s recognition of gains and losses with respect to straddle positions.

•U.S. Federal Reserve Policy Risk. In the 1970 and early 1980s interest rates increased to combat inflation under former Federal Reserve Chairman Paul Volker. Since peaking in 1981, interest rates were on a downward trajectory creating a 40-year bull market in fixed income with rates bottoming in 2020 during the COVID-19 crisis. Since the Financial Crisis, the Federal Reserve began a program of Quantitative Easing to increase cash in the economy and keep interest costs low. However, these accommodative policies have changed materially in 2022. To combat inflation, the Federal Reserve has been quickly increasing interest rates and has begun Quantitative Tightening (QT) of its Balance Sheets. There has been limited periods where interest rates increased rapidly and zero history of QT. As a result, it is difficult to predict the impact of these changes in interest rates and the slope of yield curve. These quickly changing conditions have materially impacted the capital market with future developments still greatly unknown. The weakening environment may cause decrease in valuations, increased volatility, and lower liquidity, especially in fixed-income markets. While some of these risks are limited to fixed-income securities, the interconnectedness of the capital markets has and will likely continue causing an impact in other asset classes such as equities, FX, and commodities. The ending of historically low interest rate environment may heighten these risks.

Performance

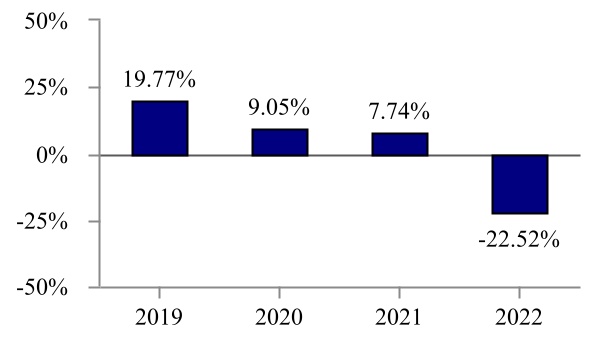

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance for calendar years ended December 31. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.innovativeportfolios.com.

As a result of a reorganization that occurred on March 7, 2022, the Fund acquired all of the assets and liabilities of the Preferred-Plus (the “Preferred-Plus Predecessor Fund”), a series of Collaborative Investment Series Trust, an open-end investment company registered under the Investment Company Act of 1940 (the “1940 Act”) that had the same investment objective and strategies as the Fund since the Preferred-Plus Predecessor Fund’s inception on December 24, 2018. The Fund assumed the NAV and performance history of the Preferred-Plus Predecessor Fund. Performance shown in the bar chart and table for periods prior to March 7, 2022 is that of the Preferred-Plus Predecessor Fund and is not the performance of the Fund. The Fund’s objective, policies, guidelines, and restrictions are in all material respects equivalent to those of the Preferred-Plus Predecessor Fund, which was created for reasons entirely unrelated to the establishment of a performance record.

The Preferred-Plus Predecessor Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

Calendar Year Total Returns

During the period of time shown in the bar chart, the highest quarterly return was 14.08% for the quarter ended June 30, 2020, and the lowest quarterly return was -19.85% for the quarter ended March 31, 2020.

8

Average Annual Total Returns

(for periods ended December 31, 2022)

Preferred-Plus ETF | 1-Year | Since Inception* | ||||||

| Return Before Taxes | -22.52% | 2.23% | ||||||

| Return After Taxes on Distributions | -23.49% | 0.31% | ||||||

| Return After Taxes on Distributions and Sale of Shares | -12.51% | 1.17% | ||||||

ICI BofA Core Plus Fixed Rate Preferred Securities Index** (reflects no deduction for fees, expenses, or taxes) | -20.71% | 1.31% | ||||||

S&P U.S. Preferred Stock Total Return Index** (reflects no deduction for fees, expenses, or taxes) | -18.93% | 2.97% | ||||||

* The Preferred-Plus Predecessor Fund commenced operations on December 24, 2018.

** Effective March 7, 2022, the Preferred-Plus Predecessor Fund changed its primary benchmark from the S&P U.S. Preferred Stock Total Return Index, which does not impose minimum credit ratings, to the ICE BofA Core Plus Fixed Rate Preferred Securities Index, because its minimum credit rating was more appropriate to the strategy of the Preferred-Plus Predecessor Fund and the Fund, which also imposes a minimum credit rating.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Portfolio Management

Adviser | Innovative Portfolios, LLC | ||||

Portfolio Managers | JR Humphreys, CFA, CAIA, Senior Portfolio Manager of the Adviser, has served as a portfolio manager of the Fund since its inception in March 2022 and previously served as a portfolio manager of the Preferred-Plus Predecessor Fund from its inception on December 24, 2018 through March 7, 2022, when the Preferred-Plus Predecessor Fund reorganized into the Fund. | ||||

Dave Gilreath, CFP, Managing Director & Chief Investment Officer of the Adviser, has served as a portfolio manager of the Fund since its inception in March 2022 and previously served as a portfolio manager of the Preferred-Plus Predecessor Fund from its inception on December 24, 2018 through March 7, 2022, when the Preferred-Plus Predecessor Fund reorganized into the Fund. | |||||

Purchase and Sale of Shares

The Fund issues and redeems Shares at NAV only in large blocks known as “Creation Units,” which only APs (typically, broker-dealers) may purchase or redeem. The Fund generally issues and redeems Creation Units in exchange for a portfolio of securities and/or a designated amount of U.S. cash.

Shares are listed on the Exchange, and individual Shares may only be bought and sold in the secondary market through a broker or dealer at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (the “bid” price) and the lowest price a seller is willing to accept for Shares (the “ask” price) when buying or selling Shares in the secondary market. The difference in the bid and ask prices is referred to as the “bid-ask spread.”

Recent information regarding the Fund’s NAV, market price, how often Shares traded on the Exchange at a premium or discount, and bid-ask spreads can be found on the Fund’s website at www.innovativeportfolios.com.

Tax Information

Fund distributions are generally taxable as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an individual retirement account (“IRA”) or other tax-advantaged account. Distributions in excess of the Fund’s current and accumulated earnings and profits are treated as a tax-free return of capital to the extent of your basis in the shares and as capital gain thereafter. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts. See “Dividends, Distributions, and Taxes - Dividends and Distributions” for more information.

9

Financial Intermediary Compensation

If you purchase Shares through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), the Adviser or its affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange-traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

10

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Herc Holdings Reports Strong First Quarter 2024 Results and Affirms 2024 Full Year Guidance

- Eaton’s Mobility Group Chosen to Supply Electromechanical Variable Valve Actuation Technology to Great Wall Motor

- Henry Schein Medical Announces Winner of Its 2024 Rising Star Award

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share