Form 497K LOOMIS SAYLES FUNDS I

|

|

Summary Prospectus |

|

Loomis Sayles Securitized Asset Fund |

|

Ticker Symbol: Institutional Class (LSSAX) |

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at www.loomissayles.com/Prospectus. You can also get this information at no cost by calling 800-633-3330 or by sending an e-mail request to [email protected]. The Fund’s Prospectus and Statement of Additional Information (“SAI”), each dated February 1, 2023, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

The Fund’s investment objective is to seek a high level of current income consistent with capital preservation.

FUND FEES & EXPENSES

The following table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund*. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in this table.

The Fund does not impose a sales charge, a redemption fee or an exchange fee.

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment)* |

Institutional Class |

|

Management fees |

0.00% |

|

Distribution and/or service (12b-1) fees |

0.00% |

|

Other expenses |

0.00% |

|

Total annual fund operating expenses |

0.00% |

| * | The amounts shown in the table are 0.00% to reflect the fact that the Fund does not pay any advisory, administration or distribution and service fees, and that Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has agreed to pay certain expenses of the Fund. You should be aware, however, that shares of the Fund are available only to institutional investment advisory clients of Loomis Sayles and Natixis Advisors, LLC (“Natixis Advisors”) and to participants in certain approved “wrap fee” programs sponsored by broker-dealers and investment advisers that may be affiliated or unaffiliated with the Fund, Loomis Sayles or Natixis Advisors. The institutional investment advisory clients of Loomis Sayles and Natixis Advisors pay Loomis Sayles or Natixis Advisors a fee for their investment advisory services, while participants in “wrap fee” programs pay a “wrap” fee to the program’s sponsor. The “wrap fee” program sponsors in turn pay fees to Natixis Advisors. Participants in “wrap fee” programs should carefully read the wrap fee brochure provided to them by their program’s sponsor. The brochure is required to include information about the fees charged by the “wrap fee” program sponsor and the fees paid by such sponsor to Natixis Advisors. Investors pay no additional fees or expenses to purchase shares of the Fund. Investors will, however, indirectly pay a proportionate share of those costs, such as brokerage commissions, taxes and extraordinary expenses that are borne by the Fund through a reduction in their net asset value. See the section “Management” in the Statutory Prospectus. |

Example

The example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example does not take into account brokerage commissions and other fees to financial intermediaries that you may pay on your purchases and sales of shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 year |

3 years |

5 years |

10 years | ||||

|

Institutional Class |

$ |

0 |

$ |

0 |

$ |

0 |

$ |

0 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 140% of the average value of its portfolio.

1

fund summary

INVESTMENTS, RISKS AND PERFORMANCE

Principal Investment Strategies

Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings made for investment purposes) in a diversified portfolio of securitized assets, such as mortgage-backed and other asset-backed securities. The Fund may invest in asset-backed securities of any type, including residential and commercial asset-backed securities, asset-backed securities related to automobiles, credit cards, home equity loans, manufactured housing, utilities, and other miscellaneous asset-backed securities. The Fund may only buy securities that are rated investment-grade at the time of purchase by at least one of the three major rating agencies (Moody’s Investors Service, Inc., Fitch Investor Services, Inc. or S&P Global Ratings) or, if unrated, are determined by Loomis Sayles to be of comparable quality. It is expected that a majority of the Fund’s securities will be rated AAA or Aaa by at least one of the rating agencies at the time of purchase. The Fund may continue to hold securities that are downgraded in credit rating subsequent to their purchase if Loomis Sayles believes it would be advantageous to do so.

The Fund may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts (including on a “to be announced” basis) or by using investment techniques such as buybacks and dollar rolls.

Loomis Sayles uses a bottom-up, fundamental research process to select individual securities for the Fund. The decision to buy or sell a particular security is largely driven by Loomis Sayles’ view of the fundamentals of the issue compared to the prevailing market valuation, which may be higher (suggesting a potential sell decision) or lower (suggesting a potential buy decision). Loomis Sayles also may seek to construct a portfolio with risk characteristics similar, but not identical to, certain of the securities in the Bloomberg U.S. Securitized Bond Index (the “Index”). Examples of typical risk characteristics that Loomis Sayles might consider include average life, credit quality, effective duration, yield curve exposure and sector exposure. The portfolio will not necessarily exhibit similarities with the Index for some or all risk characteristics. It is currently anticipated that the Fund’s effective duration will be within +/- 1 year of the effective duration of the Index.

In deciding which securities to buy and sell, Loomis Sayles will consider, among other things, the financial strength of the issuer, current interest rates, current valuations, Loomis Sayles’ expectations regarding future changes in interest rates and comparisons of the level of risk associated with particular investments with Loomis Sayles’ expectations concerning the potential return of those investments.

The Fund’s investments may also include, among other things, the following: fixed and floating-rate instruments, mortgage pass-through securities issued or guaranteed by agencies or instrumentalities of the U.S. government, collateralized mortgage obligations, commercial mortgage-backed securities, mortgage-related asset-backed securities, other collateralized asset-backed securities, securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A Securities”), U.S. government securities, corporate debt securities, zero-coupon securities, step coupon securities, commercial paper, structured notes, other mortgage-related securities (including adjustable rate mortgage securities, stripped mortgage-backed securities and mortgage dollar rolls), when-issued securities and repurchase agreements. The Fund may also invest in options, futures and swaps (including credit default swaps, in which one party agrees to make periodic payments to a counterparty in exchange for the right to receive a payment in the event of a default of the underlying reference security).

The Fund may also engage in active and frequent trading of securities. Frequent trading may produce a high level of taxable gains, including short-term capital gains taxable as ordinary income, as well as increased trading costs, which may lower the Fund’s return.

Principal Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Fund shares are not bank deposits and are not guaranteed, endorsed or insured by the Federal Deposit Insurance Corporation or any other government agency, and are subject to investment risks, including possible loss of the principal invested.

The significance of any specific risk to an investment in the Fund will vary over time, depending on the composition of the Fund’s portfolio, market conditions, and other factors. You should read all of the risk information presented below carefully, because any one or more of these risks may result in losses to the Fund.

Interest Rate Risk is the risk that the value of the Fund’s investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. The values of zero-coupon securities and securities with longer maturities are generally more sensitive to fluctuations in interest rates than other fixed-income securities. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund’s ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates.

2

fund summary

Recently, there have been inflationary price movements, which have caused the fixed income securities markets to experience heightened levels of interest volatility and liquidity risk. The risks associated with rising interest rates may be particularly acute because of recent monetary policy measures.

Mortgage-Related and Asset-Backed Securities Risk is the risk associated with the mortgages and assets underlying the securities, as well as the risk that the securities may be prepaid and result in the reinvestment of the prepaid amounts in securities with lower yields than the prepaid obligations. Conversely, there is a risk that a rise in interest rates will extend the life of a mortgage-related or asset-backed security beyond the expected prepayment time, typically reducing the security’s value, which is called extension risk. The Fund may also incur a loss when there is a prepayment of securities that were purchased at a premium. It also includes risks associated with investing in the mortgages underlying the mortgage-backed securities. The Fund’s investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets. The Fund’s investments in mortgage-related and other asset-backed securities are also subject to the risks associated with investments in fixed-income securities generally (e.g., credit/counterparty, liquidity, inflation and valuation risks).

Cybersecurity and Technology Risk is the risk associated with the increasing dependence of the Fund, its service providers, and other market participants on complex information technology and communications systems. Such systems are subject to a number of different threats and risks that could adversely affect the Fund and its shareholders. Cybersecurity and other operational and technology issues may result in financial losses to the Fund and its shareholders.

Derivatives Risk is the risk that the value of the Fund’s derivative investments such as structured notes, options, futures transactions and swap transactions will fall, for example, because of changes in the value of the underlying reference instruments, pricing difficulties or lack of correlation with the underlying investments. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. There is also the risk that the Fund may be unable to terminate or sell a derivative position at an advantageous time or price. The Fund’s derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund. This risk is greater for uncleared swaps and other over-the-counter (“OTC”) traded derivatives. Investing in derivatives gives rise to other risks, such as leverage risk, liquidity risk, credit/counterparty risk, interest rate risk and market/issuer risk. The use of derivatives may cause the Fund to incur losses greater than those which would have occurred had derivatives not been used.

Leverage Risk is the risk associated with securities or investment practices (e.g., borrowing and the use of certain derivatives) that multiply small index, market or asset price movements into larger changes in value. Use of derivative instruments (such as futures and forward currency contracts) may involve leverage. When a derivative is used as a hedge against an offsetting position that the Fund also holds, any gains generated by the derivative should be substantially offset by losses on the hedged instrument, and vice versa. To the extent that the Fund uses a derivative for purposes other than as a hedge, or if the Fund hedges imperfectly, the Fund is directly exposed to the risks of that derivative and any loss generated by the derivative will not be offset by a gain. The use of leverage increases the impact of gains and losses on the Fund’s returns, and may lead to significant losses if investments are not successful.

Credit/Counterparty Risk is the risk that the issuer or guarantor of a fixed-income security in which the Fund invests, or the counterparty to a derivative or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. As a result, the Fund may sustain losses or be unable or delayed in its ability to realize gains.

Inflation/Deflation Risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the present value of future payments. As inflation increases, the real value of the Fund’s portfolio could decline. Inflation rates may change frequently and drastically. The Fund’s investments may not keep pace with inflation, which may result in losses to the Fund’s investors. Recently, inflation rates in the United States and elsewhere have been increasing. There can be no assurance that this trend will not continue or that efforts to slow or reverse inflation will not harm the economy and asset values. Deflation risk is the risk that prices throughout the economy decline over time - the opposite of inflation. Deflation may have an adverse effect on the creditworthiness of issuers and may make issuer default more likely, which may result in a decline in the value of the Fund’s portfolio.

Large Investor Risk is the risk associated with ownership of shares of the Fund that may be concentrated in one or a few large investors. Such investors may redeem shares in large quantities or on a frequent basis. Redemptions by a large investor can affect the performance of the Fund, may increase realized capital gains, including short-term capital gains taxable as ordinary income, may accelerate the realization of taxable income to shareholders and may increase transaction costs. These transactions potentially limit the use of any capital loss carryforwards and certain other losses to offset future realized capital gains (if any). Such transactions may also increase the Fund’s expenses.

LIBOR Risk is the risk that the transition away from the London Interbank Offered Rate (“LIBOR”) may lead to increased volatility and illiquidity in markets that are tied to LIBOR. LIBOR is a benchmark interest rate that is used extensively as a “reference rate” for financial

3

fund summary

instruments, including many corporate and municipal bonds, bank loans, asset-backed and mortgage-related securities, interest rate swaps and other derivatives. ICE Benchmark Administration, the administrator of LIBOR, ceased publication of most LIBOR settings on a representative basis at the end of 2021 and is expected to cease publication of the remaining U.S. dollar LIBOR settings on a representative basis after June 30, 2023. In addition, global regulators have announced that, with limited exceptions, no new LIBOR-based contracts should be entered into after 2021. The transition away from LIBOR poses a number of other risks, including changed values of LIBOR-related investments and reduced effectiveness of hedging strategies, each of which may adversely affect the Fund’s performance.

Liquidity Risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund’s investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. During times of market turmoil, there may be no buyers or sellers for securities in certain asset classes. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to significant liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. In other circumstances, liquid investments may become illiquid. Liquidity issues may also make it difficult to value the Fund’s investments. The Fund may invest in liquid investments that become illiquid due to financial distress, or geopolitical events such as sanctions, trading halts or wars.

Management Risk is the risk that Loomis Sayles’ investment techniques will be unsuccessful and cause the Fund to incur losses.

Market/Issuer Risk is the risk that the market value of the Fund’s investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund’s investments, such as management performance, financial condition and demand for the issuers’ goods and services.

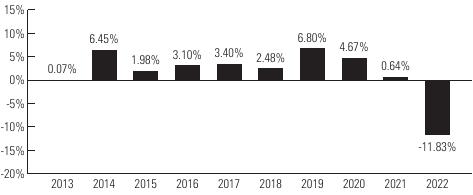

Risk/Return Bar Chart and Table

The following bar chart and table give an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the one-year, five-year and ten-year periods compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at www.loomissayles.com and/or by calling the Fund toll-free at 800-633-3330.

The bar chart and the table do not reflect any “wrap fees” that a participant in a “wrap” program may be required to pay to a program’s sponsor. See the section “Management” in the Statutory Prospectus. A “wrap fee” will reduce your return.

Total Returns for Institutional Class Shares

|

|

Highest Quarterly Return: |

|

Average Annual Total Returns |

|

|

|

|

(for the periods ended December 31, 2022) |

Past 1 Year |

Past 5 Years |

Past 10 Years |

|

Institutional Class - Return Before Taxes |

-11.83% |

0.33% |

1.65% |

|

Return After Taxes on Distributions |

-13.95% |

-2.02% |

-0.68% |

|

Return After Taxes on Distributions and Sale of Fund Shares |

-6.94% |

-0.64% |

0.29% |

|

Bloomberg U.S. Securitized Bond Index |

-11.67% |

-0.43% |

0.80% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education

4

fund summary

savings accounts, such as 529 plans, or individual retirement accounts. Index performance reflects no deduction for fees, expenses or taxes.

The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period.

MANAGEMENT

Investment Adviser

Loomis Sayles

Portfolio Managers

Ian Anderson, Vice President of Loomis Sayles, has served as portfolio manager of the Fund since 2013.

Stephen M. LaPlante, CFA®, Vice President of Loomis Sayles, has served as portfolio manager of the Fund since 2021.

Alessandro Pagani, CFA®, Vice President of Loomis Sayles, has served as portfolio manager of the Fund since 2010.

Barath W. Sankaran, CFA®, Vice President of Loomis Sayles, has served as portfolio manager of the Fund since 2021.

Jennifer M. Thomas, Vice President of Loomis Sayles, has served as portfolio manager of the Fund since 2021.

PURCHASE AND SALE OF FUND SHARES

The following chart shows the investment minimum for the Fund:

|

|

Minimum Initial Investment |

Minimum Subsequent Investment |

|

Institutional Class |

No Minimum |

No Minimum |

The Fund reserves the right to create investment minimums at its sole discretion.

Shares of the Fund are offered exclusively to investors in “wrap fee” programs approved by Natixis Advisors and/or Loomis Sayles and to institutional advisory clients of Loomis Sayles or Natixis Advisors that, in each case, meet the Fund’s policies as established by Loomis Sayles.

Shares normally can be redeemed only through the shareholder’s wrap program sponsor for shareholders owning shares through wrap accounts or, with respect to shareholders which are institutional advisory clients of Loomis Sayles or Natixis Advisors, by contacting Loomis Sayles by telephone at 800-633-3330 or by writing to Loomis Sayles Funds, P.O. Box 219594, Kansas City, MO 64121-9594.

TAX INFORMATION

Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-advantaged treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-advantaged arrangement.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

M-LSUSA77-0223

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- GA-ASI Selected to Build CCA for AFLCMC

- Orion Group’s Facilities Maintenance Business Enters Lock, Door, Safe, and Access Control Market Through Partnership with Academy Locksmith

- Vext Announces Delay of Annual Filings and Postponement of Conference Call

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share