Form 497K LOOMIS SAYLES FUNDS I

|

|

Summary Prospectus |

|

Loomis Sayles Fixed Income Fund |

|

Ticker Symbol: Institutional Class (LSFIX) |

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at www.loomissayles.com/Prospectus. You can also get this information at no cost by calling 800-633-3330 or by sending an e-mail request to [email protected]. The Fund’s Prospectus and Statement of Additional Information (“SAI”), each dated February 1, 2023, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

The Fund’s investment objective is high total investment return through a combination of current income and capital appreciation.

FUND FEES & EXPENSES

The following table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in this table.

The Fund does not impose a sales charge, a redemption fee or an exchange fee.

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment) |

Institutional Class |

|

Management fees |

0.50% |

|

Distribution and/or service (12b-1) fees |

0.00% |

|

Other expenses |

0.08% |

|

Total annual fund operating expenses |

0.58% |

|

Fee waiver and/or expense reimbursement1 |

0.00% |

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement |

0.58% |

| 1 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 0.65% of the Fund’s average daily net assets, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through January 31, 2024 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below both (1) the class’ applicable expense limitation at the time such amounts were waived/reimbursed and (2) the class’ current applicable expense limitation. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

Example

The example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example does not take into account brokerage commissions and other fees to financial intermediaries that you may pay on your purchases and sales of shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 year |

3 years |

5 years |

10 years | ||||

|

Institutional Class |

$ |

59 |

$ |

186 |

$ |

324 |

$ |

726 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 36% of the average value of its portfolio.

1

fund summary

INVESTMENTS, RISKS AND PERFORMANCE

Principal Investment Strategies

Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings made for investment purposes) in fixed-income securities. The Fund may invest up to 35% of its assets in below investment-grade fixed-income securities (commonly known as “junk bonds”) and up to 20% of its assets in equity securities, such as common stocks and preferred stocks. Below investment-grade fixed-income securities are rated below investment-grade quality (i.e., none of the three major ratings agencies (Moody’s Investors Service, Inc., Fitch Investor Services, Inc. or S&P Global Ratings) have rated the securities in one of their respective top four ratings categories). The Fund’s fixed-income securities investments may include unrated securities (securities that are not rated by a rating agency) if Loomis Sayles determines that the securities are of comparable quality to rated securities that the Fund may purchase. The Fund may invest in fixed-income securities of any maturity.

In deciding which securities to buy and sell, Loomis Sayles may consider a number of factors related to the bond issue and the current bond market, including, for example, the stability and volatility of a country’s bond markets, the financial strength of the issuer, current interest rates, current valuations, Loomis Sayles’ expectations regarding general trends in interest rates and currency considerations. Loomis Sayles will also consider how purchasing or selling a bond would impact the overall portfolio’s risk profile (for example, its sensitivity to currency risk, interest rate risk and sector-specific risk) and potential return (income and capital gains).

Three themes typically drive the Fund’s investment approach. First, Loomis Sayles generally seeks fixed-income securities that are attractively valued relative to the Loomis Sayles’ credit research team’s assessment of credit risk. The broad coverage combined with the objective of identifying attractive investment opportunities makes this an important component of the investment approach. Second, the Fund may invest significantly in securities the prices of which Loomis Sayles believes are more sensitive to events related to the underlying issuer than to changes in general interest rates or overall market default rates. These securities may not have a direct correlation with changes in interest rates, thus helping to manage interest rate risk and to offer diversified sources for return. Third, Loomis Sayles analyzes different sectors of the economy and differences in the yields (“spreads”) of various fixed-income securities (U.S. government securities, investment-grade corporate securities, securitized assets, high-yield corporate securities, emerging market securities, non-U.S. sovereigns and credits, convertibles, bank loans and municipals) in an effort to find securities that it believes may produce attractive returns for the Fund in comparison to their risk.

In deciding which equity securities to buy and sell, Loomis Sayles intends to emphasize dividend-paying stocks issued by companies with strong fundamentals and relatively limited anticipated volatility to supplement its fixed-income holdings. These securities will be selected with the same bottom-up investment process that is the foundation of the Fund’s overall strategy.

The Fund may invest up to 20% of its assets in foreign securities, including emerging market securities. The Fund may invest without limit in obligations of supranational entities (e.g., the World Bank). Although certain securities purchased by the Fund may be issued by domestic companies incorporated outside of the United States, the Adviser does not consider these securities to be foreign if the issuer is included in the U.S. fixed-income indices published by Bloomberg.

The fixed-income securities in which the Fund may invest include, among other instruments, corporate bonds and other debt securities (including junior and senior bonds), U.S. government securities, commercial paper, collateralized loan obligations, zero-coupon securities, mortgage-backed securities, stripped mortgage-backed securities, collateralized mortgage obligations and other asset-backed securities, including mortgage dollar rolls, when-issued securities, real estate investment trusts (“REITs”), securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A securities”), repurchase agreements and convertible securities. The Fund may also engage in options and futures transactions, foreign currency transactions (such as forward currency contracts) and swap transactions (including credit default swaps, in which one party agrees to make periodic payments to a counterparty in exchange for the right to receive a payment in the event of a default of the underlying reference security).

Principal Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Fund shares are not bank deposits and are not guaranteed, endorsed or insured by the Federal Deposit Insurance Corporation or any other government agency, and are subject to investment risks, including possible loss of the principal invested.

The significance of any specific risk to an investment in the Fund will vary over time, depending on the composition of the Fund’s portfolio, market conditions, and other factors. You should read all of the risk information presented below carefully, because any one or more of these risks may result in losses to the Fund.

2

fund summary

Credit/Counterparty Risk is the risk that the issuer or guarantor of a fixed-income security in which the Fund invests, or the counterparty to a derivative or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. As a result, the Fund may sustain losses or be unable or delayed in its ability to realize gains.

Below Investment-Grade Fixed-Income Securities Risk is the risk that the Fund’s investments in below investment-grade fixed-income securities may be subject to greater risks than other fixed-income securities, including being subject to greater levels of interest rate risk, credit risk (including a greater risk of default) and liquidity risk. The ability of the issuer to make principal and interest payments is predominantly speculative for below investment-grade fixed-income securities.

Currency Risk is the risk that the value of the Fund’s investments will fall as a result of changes in exchange rates. Loomis Sayles may elect not to hedge currency risk or may hedge imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Interest Rate Risk is the risk that the value of the Fund’s investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. The values of zero-coupon securities and securities with longer maturities are generally more sensitive to fluctuations in interest rates than other fixed-income securities. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund’s ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government and/or central bank monetary policy and action may also affect the level of interest rates.

Recently, there have been inflationary price movements, which have caused the fixed income securities markets to experience heightened levels of interest volatility and liquidity risk. The risks associated with rising interest rates may be particularly acute because of recent monetary policy measures.

Market/Issuer Risk is the risk that the market value of the Fund’s investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund’s investments, such as management performance, financial condition and demand for the issuers’ goods and services.

Cybersecurity and Technology Risk is the risk associated with the increasing dependence of the Fund, its service providers, and other market participants on complex information technology and communications systems. Such systems are subject to a number of different threats and risks that could adversely affect the Fund and its shareholders. Cybersecurity and other operational and technology issues may result in financial losses to the Fund and its shareholders.

Derivatives Risk is the risk that the value of the Fund’s derivative investments such as forward currency contracts, options, futures transactions and swap transactions will fall, for example, because of changes in the value of the underlying reference instruments, pricing difficulties or lack of correlation with the underlying investments. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. There is also the risk that the Fund may be unable to terminate or sell a derivative position at an advantageous time or price. The Fund’s derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund. This risk is greater for forward currency contracts, uncleared swaps and other over-the-counter (“OTC”) traded derivatives. Investing in derivatives gives rise to other risks, such as leverage risk, liquidity risk, credit/counterparty risk, interest rate risk and market/issuer risk. The use of derivatives may cause the Fund to incur losses greater than those which would have occurred had derivatives not been used.

Emerging Markets Risk is the risk that the Fund’s investments in emerging markets may face greater foreign securities risk. Emerging markets investments are subject to greater risks arising from political or economic instability, war, nationalization or confiscatory taxation, currency exchange or repatriation restrictions, sanctions by other countries (such as the United States or the European Union), new or inconsistent government treatment of or restrictions on issuers and instruments, and an issuer’s unwillingness or inability to make dividend, principal or interest payments on its securities. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk is the risk that the value of the Fund’s investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk is the risk that the value of the Fund’s foreign investments will fall as a result of foreign political, social, economic, environmental, credit, informational or currency changes or other issues relating to foreign investing generally. Foreign securities may be

3

fund summary

subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity. The Fund’s investments in foreign securities may be subject to foreign withholding or other taxes, which would decrease the yield on those securities.

Inflation/Deflation Risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the present value of future payments. As inflation increases, the real value of the Fund’s portfolio could decline. Inflation rates may change frequently and drastically. The Fund’s investments may not keep pace with inflation, which may result in losses to the Fund’s investors. Recently, inflation rates in the United States and elsewhere have been increasing. There can be no assurance that this trend will not continue or that efforts to slow or reverse inflation will not harm the economy and asset values. Deflation risk is the risk that prices throughout the economy decline over time - the opposite of inflation. Deflation may have an adverse effect on the creditworthiness of issuers and may make issuer default more likely, which may result in a decline in the value of the Fund’s portfolio.

Leverage Risk is the risk associated with securities or investment practices (e.g., borrowing and the use of certain derivatives) that multiply small index, market or asset price movements into larger changes in value. Use of derivative instruments (such as futures and forward currency contracts) may involve leverage. When a derivative is used as a hedge against an offsetting position that the Fund also holds, any gains generated by the derivative should be substantially offset by losses on the hedged instrument, and vice versa. To the extent that the Fund uses a derivative for purposes other than as a hedge, or if the Fund hedges imperfectly, the Fund is directly exposed to the risks of that derivative and any loss generated by the derivative will not be offset by a gain. The use of leverage increases the impact of gains and losses on the Fund’s returns, and may lead to significant losses if investments are not successful.

Liquidity Risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund’s investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. During times of market turmoil, there may be no buyers or sellers for securities in certain asset classes. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to significant liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. In other circumstances, liquid investments may become illiquid. Liquidity issues may also make it difficult to value the Fund’s investments. The Fund may invest in liquid investments that become illiquid due to financial distress, or geopolitical events such as sanctions, trading halts or wars.

Management Risk is the risk that Loomis Sayles’ investment techniques will be unsuccessful and cause the Fund to incur losses.

Mortgage-Related and Asset-Backed Securities Risk is the risk associated with the mortgages and assets underlying the securities, as well as the risk that the securities may be prepaid and result in the reinvestment of the prepaid amounts in securities with lower yields than the prepaid obligations. Conversely, there is a risk that a rise in interest rates will extend the life of a mortgage-related or asset-backed security beyond the expected prepayment time, typically reducing the security’s value, which is called extension risk. The Fund may also incur a loss when there is a prepayment of securities that were purchased at a premium. It also includes risks associated with investing in the mortgages underlying the mortgage-backed securities. The Fund’s investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets. The Fund’s investments in mortgage-related and other asset-backed securities are also subject to the risks associated with investments in fixed-income securities generally (e.g., credit/counterparty, liquidity, inflation and valuation risks).

REITs Risk is the risk that the value of the Fund’s investments in REITs will fall as a result of changes in underlying real estate values, rising interest rates, limited diversification of holdings, higher costs and prepayment risk associated with related mortgages, as well as other risks particular to investments in real estate. Many REITs are highly leveraged, increasing their risk. The Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests in addition to the expenses of the Fund.

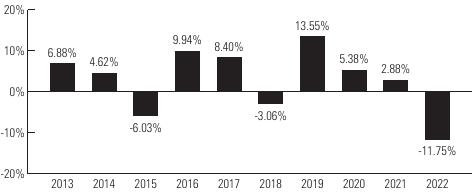

Risk/Return Bar Chart and Table

The following bar chart and table give an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the one-year, five-year and ten-year periods compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at www.loomissayles.com and/or by calling the Fund toll-free at 800-633-3330.

4

fund summary

Total Returns for Institutional Class Shares

|

|

Highest Quarterly Return: |

|

Average Annual Total Returns |

|

|

|

|

(for the periods ended December 31, 2022) |

Past 1 Year |

Past 5 Years |

Past 10 Years |

|

Institutional Class - Return Before Taxes |

-11.75% |

1.04% |

2.81% |

|

Return After Taxes on Distributions |

-12.21% |

-0.58% |

0.85% |

|

Return After Taxes on Distributions and Sale of Fund Shares |

-6.88% |

0.31% |

1.46% |

|

Bloombeg U.S. Government/Credit Bond Index |

-13.58% |

0.21% |

1.16% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for the Institutional Class of the Fund. Index performance reflects no deduction for fees, expenses or taxes. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period.

MANAGEMENT

Investment Adviser

Loomis Sayles

Portfolio Managers

Matthew J. Eagan, CFA®, Executive Vice President and Director of Loomis Sayles, has served as a portfolio manager of the Fund since 2012 and was an associate portfolio manager of the Fund from 2007 to 2012.

Brian P. Kennedy, Vice President of Loomis Sayles, has served as a portfolio manager of the Fund since 2016.

Elaine M. Stokes, Executive Vice President and Director of Loomis Sayles, has served as a portfolio manager of the Fund since 2012 and was an associate portfolio manager of the Fund from 2007 to 2012.

PURCHASE AND SALE OF FUND SHARES

The following information shows the investment minimum for various types of accounts:

Institutional Class Shares

Institutional Class shares of the Fund are generally subject to a minimum initial investment of $3,000,000 and a minimum subsequent investment of $50,000, except there is no minimum initial or subsequent investment for:

| • | Fund Trustees, former Fund trustees, employees of affiliates of the Loomis Sayles Funds and other individuals who are affiliated with any Loomis Sayles Fund (this also applies to any spouse, parents, children, siblings, grandparents, grandchildren and in-laws of those mentioned) and Natixis affiliate employee benefit plans. |

At the discretion of Natixis Advisors, clients of Natixis Advisors, and its affiliates may purchase Institutional Class shares of the Fund below the stated minimums. The minimum may also be waived for the clients of financial consultants and financial institutions that have a business relationship with Loomis Sayles, if such client invests at least $1,000,000 in the Fund.

The Fund’s shares are available for purchase and are redeemable on any business day directly from the Fund by writing to the Fund at

5

fund summary

Loomis Sayles Funds, P.O. Box 219594, Kansas City, MO 64121-9594, by exchange, by wire, by internet at www.loomissayles.com, by telephone at 800-633-3330, through the Automated Clearing House system, or, in the case of redemptions, by the Systematic Withdrawal Plan. See the section “How Fund Shares are Priced” in the Prospectus for details.

TAX INFORMATION

Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-advantaged treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-advantaged arrangement.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

M-LSUFI77-0223

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Quorum Announces Q4 and Year End 2023 Results

- LANTRONIX ALERT: Bragar Eagel & Squire, P.C. is Investigating Lantronix, Inc. on Behalf of Long-Term Stockholders and Encourages Investors to Contact the Firm

- ASCO 2024 | Ascentage Pharma to Present Four Studies, Including an Oral Report Featuring the Latest Data of Olverembatinib in SDH-Deficient GIST

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share