Form 497K LEGG MASON PARTNERS INVE

| Summary Prospectus | January 30, 2023 |

Share class (Symbol): A (SHFVX), C (SFVCX), R (–), I (SFVYX), IS (LSISX)

CLEARBRIDGE

ALL CAP VALUE FUND

Before you invest, you may want to review the fund’s Prospectus, which contains more information about the fund and its risks. You can find the fund’s Prospectus and other information about the fund, including the fund’s statement of additional information and shareholder reports, online at www.franklintempleton.com/mutualfundsliterature. You can also get this information at no cost by calling the fund at 877-6LM-FUND/656-3863 or by sending an e-mail request to [email protected], or from your financial intermediary. The fund’s Prospectus and statement of additional information, each dated January 30, 2023 (as may be amended or supplemented from time to time), and the independent registered public accounting firm’s report and financial statements in the fund’s annual report to shareholders, dated September 30, 2022, are incorporated by reference into this Summary Prospectus.

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Investment objective

The fund seeks long-term capital growth. Current income is a secondary consideration.

Fees and expenses of the fund

The accompanying table describes the fees and expenses that you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in funds distributed through Franklin Distributors, LLC (“Franklin Distributors” or the “Distributor”), the fund’s distributor. More information about these and other discounts is available from your Service Agent, in the fund’s Prospectus on page 21 under the heading “Additional information about each share class,” in the appendix titled “Appendix: Waivers and Discounts Available from Certain Service Agents” on page A-1 of the fund’s Prospectus and in the fund’s Statement of Additional Information (“SAI”) on page 79 under the heading “Sales Charge Waivers and Reductions for Class A Shares.” “Service Agents” include banks, brokers, dealers, insurance companies, investment advisers, financial consultants or advisers, mutual fund supermarkets and other financial intermediaries that have entered into an agreement with the Distributor to sell shares of the fund.

If you purchase Class I shares or Class IS shares through a Service Agent acting solely as an agent on behalf of its customers, that Service Agent may charge you a commission. Such commissions, if any, are not charged by the fund and are not reflected in the fee table or expense example below.

|

2 |

ClearBridge All Cap Value Fund |

| Shareholder fees | ||||||||||

| (fees paid directly from your investment) | ||||||||||

| Class A | Class C | Class R | Class I | Class IS | ||||||

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | 5.501,2 | None | None | None | None | |||||

| Maximum deferred sales charge (load) (as a % of the lower of net asset value at purchase or redemption)3 | None4 | 1.00 | None | None | None | |||||

| Small account fee5 | $15 | $15 | None | None | None | |||||

| Annual fund operating expenses (%) | ||||||||||

| (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||

| Class A | Class C | Class R | Class I | Class IS | ||||||

| Management fees | 0.70 | 0.70 | 0.70 | 0.70 | 0.70 | |||||

| Distribution and/or service (12b-1) fees | 0.25 | 1.00 | 0.50 | None | None | |||||

| Other expenses | 0.19 | 0.16 | 0.226 | 0.10 | 0.05 | |||||

| Total annual fund operating expenses | 1.14 | 1.86 | 1.42 | 0.80 | 0.75 | |||||

| Fees waived and/or expenses reimbursed7 | N/A | — | (0.02) | — | (0.05) | |||||

| Total annual fund operating expenses after waiving fees and/or reimbursing expenses | 1.14 | 1.86 | 1.40 | 0.80 | 0.70 | |||||

| 1 | The sales charge is waived for shareholders purchasing Class A shares through accounts where Franklin Distributors is the broker-dealer of record (“Distributor Accounts”). |

| 2 | Shareholders purchasing Class A shares through certain Service Agents or in certain types of accounts may be eligible for a waiver of the sales charge. For additional information, see “Additional information about each share class — Sales charges” in the Prospectus. |

| 3 | Maximum deferred sales charge (load) may be reduced over time. |

| 4 | You may buy Class A shares in amounts of $1,000,000 or more at net asset value (without an initial sales charge), but if you redeem those shares within 18 months of their purchase, you will pay a contingent deferred sales charge of 1.00%. |

| 5 | If the value of your account is below $1,000 ($250 for retirement plans that are not employer-sponsored), the fund may charge you a fee of $3.75 per account that is determined and assessed quarterly by the fund or your Service Agent (with an annual maximum of $15.00 per account). Please contact your Service Agent or the fund for more information. |

| 6 | Other expenses for Class R shares are estimated for the current fiscal year. Actual expenses may differ from estimates. |

| ClearBridge All Cap Value Fund |

|

3 |

|

| 7 | The manager has agreed to waive fees and/or reimburse operating expenses (other than interest, brokerage commissions, taxes, extraordinary expenses and acquired fund fees and expenses) so that the ratio of total annual fund operating expenses will not exceed 1.90% for Class C shares, 1.40% for Class R shares, 0.80% for Class I shares and 0.70% for Class IS shares, subject to recapture as described below. In addition, the ratio of total annual fund operating expenses for Class IS shares will not exceed the ratio of total annual fund operating expenses for Class I shares, subject to recapture as described below. These arrangements cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. The manager is permitted to recapture amounts waived and/or reimbursed to a class during the same fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual fund operating expenses have fallen to a level below the limits described above. In no case will the manager recapture any amount that would result, on any particular business day of the fund, in the class’ total annual fund operating expenses exceeding the applicable limits described above or any other lower limit then in effect. In addition, the manager has agreed to waive the fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. This management fee waiver is not subject to the recapture provision discussed above. |

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes:

| ● | You invest $10,000 in the fund for the time periods indicated |

| ● | Your investment has a 5% return each year and the fund’s operating expenses remain the same (except that any applicable fee waiver or expense reimbursement is reflected only through its expiration date) |

| ● | You reinvest all distributions and dividends without a sales charge |

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Number of years you own your shares ($) | ||||||||

| 1 year | 3 years | 5 years | 10 years | |||||

| Class A (with or without redemption at end of period) | 660 | 892 | 1,143 | 1,860 | ||||

| Class C (with redemption at end of period) | 289 | 585 | 1,006 | 1,993 | ||||

| Class C (without redemption at end of period) | 189 | 585 | 1,006 | 1,993 | ||||

| Class R (with or without redemption at end of period) | 143 | 448 | 775 | 1,701 | ||||

| Class I (with or without redemption at end of period) | 82 | 256 | 444 | 990 | ||||

| Class IS (with or without redemption at end of period) | 72 | 235 | 413 | 926 |

Portfolio turnover. The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 28% of the average value of its portfolio.

|

4 |

ClearBridge All Cap Value Fund |

Principal investment strategies

The fund invests primarily in common stocks and common stock equivalents, such as preferred stocks and securities convertible into common stocks, of companies the portfolio managers believe are undervalued in the marketplace. While the portfolio managers select investments primarily for their capital appreciation potential, secondary consideration is given to a company’s dividend record and the potential for an improved dividend return.

The fund invests in securities of large, well-known companies but may also invest a significant portion of its assets in securities of small to medium capitalization companies when the portfolio managers believe smaller capitalization companies offer more attractive value opportunities.

The fund may invest up to 25% of its net assets in equity securities of foreign issuers, either directly or through depositary receipts.

Principal risks

Risk is inherent in all investing. The value of your investment in the fund, as well as the amount of return you receive on your investment, may fluctuate significantly. You may lose part or all of your investment in the fund or your investment may not perform as well as other similar investments. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or by any bank or government agency. The following is a summary description of certain risks of investing in the fund.

Stock market and equity securities risk. The stock markets are volatile and the market prices of the fund’s equity securities may decline generally. Equity securities may include warrants, rights, exchange-traded and over-the-counter common stocks, preferred stock, depositary receipts, trust certificates, limited partnership interests and shares of other investment companies, including exchange-traded funds and real estate investment trusts. Equity securities may have greater price volatility than other asset classes, such as fixed income securities, and may fluctuate in price based on actual or perceived changes in a company’s financial condition and overall market and economic conditions and perceptions. If the market prices of the equity securities owned by the fund fall, the value of your investment in the fund will decline.

Market events risk. The market values of securities or other assets will fluctuate, sometimes sharply and unpredictably, due to changes in general market conditions, overall economic trends or events, governmental actions or intervention, actions taken by the U.S. Federal Reserve or foreign central banks, market disruptions caused by trade disputes or other factors, political developments, armed conflicts, economic sanctions, major cybersecurity events, investor sentiment, the global and domestic effects of a pandemic, and other factors that may or may not be related to the issuer of the security or other asset. Economies and financial markets throughout the world are increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, public health events, terrorism, wars, natural disasters and other circumstances in one country or region could have profound impacts on global economies or markets. As a result, whether or not the fund invests in securities of issuers located in or with significant exposure to the countries or markets directly affected, the value and liquidity of the fund’s investments may be negatively affected. Following Russia’s recent invasion of Ukraine, Russian stocks lost all, or nearly all, of their market value. Other securities or markets could be similarly affected by past or future geopolitical or other events or conditions.

| ClearBridge All Cap Value Fund |

|

5 |

|

For example, the ongoing impact of COVID-19 and its subsequent variants have been rapidly evolving and have resulted in extreme volatility in the financial markets; reduced liquidity of many instruments; restrictions on international and, in some cases, local travel; significant disruptions to business operations (including business closures); strained healthcare systems; and disruptions to supply chains, consumer demand and employee availability. Some sectors of the economy and individual issuers have experienced particularly large losses. While in the process of gradually reversing, these circumstances may continue for an extended period of time and may result in a sustained domestic or even global economic downturn or recession, domestic and foreign political and social instability, damage to diplomatic and international trade relations and increased volatility and/or decreased liquidity in the securities markets. Developing or emerging market countries may be more impacted by the COVID-19 pandemic as they may have less established health care systems and may be less able to control or mitigate the effects of the pandemic. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken extraordinary actions to support local and global economies and the financial markets in response to the COVID-19 pandemic. This and other government intervention into the economy and financial markets to address the COVID-19 pandemic may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. Government actions to mitigate the economic impact of the pandemic have resulted in a large expansion of government deficits and debt, the long term consequences of which are not known. Recently, inflation and interest rates have increased and may rise further. The COVID-19 pandemic could adversely affect the value and liquidity of the fund’s investments, impair the fund’s ability to satisfy redemption requests, and negatively impact the fund’s performance. In addition, the COVID-19 pandemic, and measures taken to mitigate its effects, could result in disruptions to the services provided to the fund by its service providers.

Issuer risk. The market price of a security can go up or down more than the market as a whole and can perform differently from the value of the market as a whole, due to factors specifically relating to the security’s issuer, such as disappointing earnings reports by the issuer, unsuccessful products or services, loss of major customers, changes in management, corporate actions, negative perception in the marketplace, or major litigation or changes in government regulations affecting the issuer or the competitive environment. An individual security may also be affected by factors relating to the industry or sector of the issuer. The fund may experience a substantial or complete loss on an individual security. Historically, the prices of securities of small and medium capitalization companies have generally been more volatile than those of large capitalization companies. A change in financial condition or other event affecting a single issuer may adversely impact the industry or sector of the issuer or securities markets as a whole.

Illiquidity risk. Some assets held by the fund may be or become impossible or difficult to sell, particularly during times of market turmoil. These illiquid assets may also be difficult to value. Markets may become illiquid when, for instance, there are few, if any, interested buyers or sellers or when dealers are unwilling or unable to make a market for certain securities. As a general matter, dealers have been less willing to make markets for fixed income securities. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, or to try to limit losses, the fund may be forced to sell at a substantial loss or may not be able to sell at all.

|

6 |

ClearBridge All Cap Value Fund |

Dividend-paying stock risk. There is no guarantee that the issuers of the stocks held by the fund will pay dividends in the future or that, if dividends are paid, they will remain at their current levels or increase over time. The fund’s emphasis on dividend-paying stocks could cause the fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends or ability to pay dividends in the future. Dividend-paying stocks may not participate in a broad market advance to the same degree as other stocks, and a sharp rise in interest rates or economic downturn or other market or company-specific developments could cause a company to reduce or eliminate its dividend.

Foreign investments risk. The fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk as compared to investments in U.S. securities or issuers with predominantly domestic exposure, such as less liquid, less transparent, less regulated and more volatile markets. The value of the fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support, inadequate accounting standards and auditing and financial recordkeeping requirements, lack of information, political, economic, financial or social instability, terrorism, armed conflicts and other geopolitical events, and the impact of tariffs and other restrictions on trade or economic sanctions. Geopolitical or other events such as nationalization or expropriation could even cause the loss of the fund’s entire investment in one or more countries. In addition, there may be significant obstacles to obtaining information necessary for investigations into or litigation against issuers located in or operating in certain foreign markets, particularly emerging market countries, and shareholders may have limited legal remedies.

The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic and political conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation. The fund may be unable or may choose not to hedge its foreign currency exposure.

Valuation risk. The sales price the fund could receive for any particular portfolio investment may differ from the fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. These differences may increase significantly and affect fund investments more broadly during periods of market volatility. Investors who purchase or redeem fund shares on days when the fund is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the fund had not fair-valued securities or had used a different valuation methodology. The fund’s ability to value its investments may be impacted by technological issues and/or errors by pricing services or other third party service providers. The valuation of the fund’s investments involves subjective judgment, which may prove to be incorrect.

Value investing risk. The value approach to investing involves the risk that stocks may remain undervalued for long periods, undervaluation may become more severe, or perceived undervaluation may actually represent intrinsic value. Value stocks may underperform the overall equity market for an extended period while the market favors growth stocks. A value stock may

| ClearBridge All Cap Value Fund |

|

7 |

|

not increase in price as anticipated by the subadviser if other investors fail to recognize the company’s value and bid up the price or the factors that the subadviser believes will increase the price of the security do not occur or do not have the anticipated effect. Value stocks may go in and out of favor over time and the subadviser may sell a security prior to the security realizing a gain in connection with changed market perception regarding the value of the security.

Large capitalization company risk. Large capitalization companies may fall out of favor with investors based on market and economic conditions. In addition, larger companies may not be able to attain the high growth rates of successful smaller companies and may be less capable of responding quickly to competitive challenges and industry changes. As a result, the fund’s value may not rise as much as, or may fall more than, the value of funds that focus on companies with smaller market capitalizations.

Small and mid-capitalization company risk. The fund will be exposed to additional risks as a result of its investments in the securities of small and mid-capitalization companies. Small and mid-capitalization companies may fall out of favor with investors; may have limited product lines, operating histories, markets or financial resources; or may be dependent upon a limited management group. The prices of securities of small and mid-capitalization companies generally are more volatile than those of large capitalization companies and are more likely to be adversely affected than large capitalization companies by changes in earnings results and investor expectations or poor economic or market conditions, including those experienced during a recession. Securities of small and mid-capitalization companies may underperform large capitalization companies, may be harder to sell at times and at prices the portfolio managers believe appropriate and may have greater potential for losses.

Industry or sector focus risk. The fund may be susceptible to an increased risk of loss, including losses due to events that adversely affect the fund’s investments more than the market as a whole, to the extent that the fund may, from time to time, have greater exposure to the securities of a particular issuer or issuers within the same industry or sector.

Portfolio management risk. The value of your investment may decrease if the subadviser’s judgment about the attractiveness or value of, or market trends affecting, a particular security, industry, sector or region, or about market movements, is incorrect or does not produce the desired results, or if there are imperfections, errors or limitations in the models, tools and data used by the subadviser. In addition, the fund’s investment strategies or policies may change from time to time. Those changes may not lead to the results intended by the subadviser and could have an adverse effect on the value or performance of the fund.

Cybersecurity risk. Cybersecurity incidents, whether intentionally caused by third parties or otherwise, may allow an unauthorized party to gain access to fund assets, fund or customer data (including private shareholder information) or proprietary information, cause the fund, the manager, the subadvisers and/or their service providers (including, but not limited to, fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality, or prevent fund investors from purchasing, redeeming or exchanging shares, receiving distributions or receiving timely information regarding the fund or their investment in the fund. The fund, the manager, and the subadvisers have limited ability to prevent or mitigate cybersecurity incidents affecting third party service providers, and such third party service providers may have limited indemnification

|

8 |

ClearBridge All Cap Value Fund |

obligations to the fund, the manager and/or the subadviser. Cybersecurity incidents may result in financial losses to the fund and its shareholders, and substantial costs may be incurred in order to prevent or mitigate any future cybersecurity incidents. Issuers of securities in which the fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers experience cybersecurity incidents.

Because technology is frequently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the fund’s ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the fund, the manager, the subadvisers and their service providers are subject to the risk of cyber incidents occurring from time to time.

These and other risks are discussed in more detail in the Prospectus or in the Statement of Additional Information.

Performance

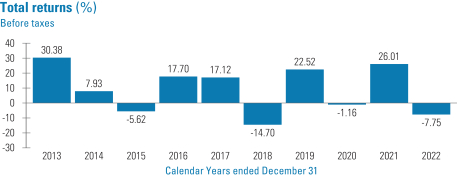

The accompanying bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the fund’s performance from year to year for Class A shares. The table shows the average annual total returns of each class of the fund that has been in operation for at least one full calendar year and also compares the fund’s performance with the average annual total returns of an index or other benchmark and an average. The table compares the fund’s performance with the average annual total returns of the Russell 3000 Value Index and the Lipper Multi-Cap Value Fund Average, a total return performance average of funds tracked by Lipper, Inc. that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time, which provides fund shareholders with a more meaningful comparison. Performance for classes other than those shown may vary from the performance shown to the extent the expenses for those classes differ. The fund makes updated performance information, including its current net asset value, available at www.franklintempleton.com/mutualfunds (select fund and share class), or by calling the fund at 877-6LM-FUND/656-3863.

The fund’s past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future.

Sales charges are not reflected in the accompanying bar chart, and if those charges were included, returns would be less than those shown.

| ClearBridge All Cap Value Fund |

|

9 |

|

Best Quarter (12/31/2020): 20.00 Worst Quarter (03/31/2020): (32.03)

| Average annual total returns (%) | ||||||||||

| (for periods ended December 31, 2022) | ||||||||||

| Class A | 1 year | 5 years | 10 years | Since inception | Inception date | |||||

| Return before taxes | (13.03) | 2.50 | 7.55 | |||||||

| Return after taxes on distributions | (14.43) | 0.82 | 5.23 | |||||||

| Return after taxes on distributions and sale of fund shares | (6.67) | 1.82 | 5.66 | |||||||

| Other Classes (Return before taxes only) | ||||||||||

| Class C | (9.23) | 3.08 | 7.50 | |||||||

| Class I | (7.44) | 4.11 | 8.61 | |||||||

| Class IS | (7.39) | 4.16 | N/A | 5.45 | 09/15/2017 | |||||

| Russell 3000 Value Index (reflects no deduction for fees, expenses or taxes)1 | (7.98) | 6.50 | 10.16 | |||||||

| Lipper Multi-Cap Value Fund Average (reflects fees and expenses but no deduction for sales charges or taxes)2 | (6.79) | 6.69 | 9.98 | |||||||

| 1 | For Class IS shares, for the period from the class’ inception date to December 31, 2022, the average annual total return of the Russell 3000 Value Index was 7.43%. |

| 2 | For Class IS shares, for the period from the class’ inception date to December 31, 2022, the average annual total return of the Lipper Multi-Cap Value Fund Average was 7.78%. |

The after-tax returns are shown only for Class A shares, are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for classes other than Class A will vary from returns shown for Class A. Returns after taxes on distributions and sale of fund shares are higher than returns before taxes for certain periods shown because they reflect the tax benefit of capital losses realized on the redemption of fund shares.

|

10 |

ClearBridge All Cap Value Fund |

Management

Investment manager: Legg Mason Partners Fund Advisor, LLC (“LMPFA”)

Subadviser: ClearBridge Investments, LLC (“ClearBridge”)

Portfolio managers: Primary responsibility for the day-to-day management of the fund lies with the following portfolio managers.

| Portfolio manager | Title | Portfolio manager of the fund since | ||

| Reed Cassady, CFA | Portfolio Manager of ClearBridge |

2021 | ||

| Albert Grosman | Managing Director and Portfolio Manager of ClearBridge |

2015 | ||

| Sam Peters, CFA | Managing Director and Portfolio Manager of ClearBridge |

2015 |

| ClearBridge All Cap Value Fund |

|

11 |

|

Purchase and sale of fund shares

You may purchase, redeem or exchange shares of the fund each day the New York Stock Exchange is open, at the fund’s net asset value determined after receipt of your request in good order, subject to any applicable sales charge.

The fund’s initial and subsequent investment minimums generally are set forth in the accompanying table:

| Investment minimum initial/additional investment ($) | ||||||||||

| Class A | Class C1 | Class R | Class I | Class IS | ||||||

| General | 1,000/50 | 1,000/50 | N/A | 1 million/ None2 |

N/A | |||||

| Uniform Gifts or Transfers to Minor Accounts | 1,000/50 | 1,000/50 | N/A | 1 million/ None2 |

N/A | |||||

| IRAs | 250/50 | 250/50 | N/A | 1 million/ None2,3 |

N/A3 | |||||

| SIMPLE IRAs | None/ None |

None/ None |

N/A | 1 million/ None2 |

N/A | |||||

| Systematic Investment Plans | 25/25 | 25/25 | N/A | 1 million/ None2,4 |

N/A4 | |||||

| Clients of Eligible Financial Intermediaries | None/ None |

N/A | None/ None |

None/ None5 |

None/ None5 | |||||

| Eligible Investment Programs | None/ None |

N/A | None/ None |

None/ None |

None/ None | |||||

| Omnibus Retirement Plans | None/ None |

None/ None |

None/ None |

None/ None |

None/ None | |||||

| Individual Retirement Plans except as noted | None/ None |

None/ None |

N/A | 1 million/ None2 |

N/A | |||||

| Institutional Investors | 1,000/50 | 1,000/50 | N/A | 1 million/ None |

1 million/ None | |||||

| 1 | Class C shares are not available for purchase through Distributor Accounts. |

| 2 | Available to investors investing directly with the fund. |

| 3 | IRA accountholders who purchase Class I or Class IS shares through a Service Agent acting as agent on behalf of its customers are subject to the initial and subsequent minimums of $250/$50. If a Service Agent does not have this arrangement in place with the Distributor, the initial and subsequent minimums listed in the table apply. Please contact your Service Agent for more information. |

| 4 | Investors investing through a Systematic Investment Plan who purchase Class I or Class IS shares through a Service Agent acting as agent on behalf of its customers are subject to the initial and subsequent minimums of $25/$25. If a Service Agent does not have this arrangement in place with the Distributor, the initial and subsequent minimums listed in the table apply. Please contact your Service Agent for more information. |

| 5 | Individual investors who purchase Class I shares or Class IS shares through a Service Agent acting as agent on behalf of its customers are subject to the initial and subsequent minimums of $1,000/$50. If a Service Agent does not have this arrangement in place with the Distributor, the initial and subsequent minimums listed in the table apply. Please contact your Service Agent for more information. |

Your Service Agent may impose higher or lower investment minimums, or may impose no minimum investment requirement.

For more information about how to purchase, redeem or exchange shares, and to learn which classes of shares are available to you, you should contact your Service Agent, or, if you hold your shares or plan to purchase shares through the fund, you should contact the fund by phone at 877-6LM-FUND/656-3863, by regular mail at Legg Mason Funds, P.O. Box 33030, St. Petersburg, FL

|

12 |

ClearBridge All Cap Value Fund |

33733-8030 or by express, certified or registered mail at Legg Mason Funds, 100 Fountain Parkway, St. Petersburg, FL 33716-1205.

Tax information

The fund’s distributions are generally taxable as ordinary income or capital gains.

Payments to broker/dealers and other financial intermediaries

The fund’s related companies pay Service Agents for the sale of fund shares, shareholder services and other purposes. These payments create a conflict of interest by influencing your Service Agent or its employees or associated persons to recommend the fund over another investment. Ask your financial adviser or salesperson or visit your Service Agent’s or salesperson’s website for more information.

| ClearBridge All Cap Value Fund |

|

13 |

|

(This page is intentionally left blank.)

(This page is intentionally left blank.)

|

||||

| Franklin Distributors, LLC 100 International Drive Baltimore, MD 21202 franklintempleton.com

ClearBridge All Cap Value Fund | ||||

| Investment Company Act file #811-06444 © 2022 Franklin Templeton. All rights reserved.

|

FD0206SP 01/23 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Agents Win Again! Epique Realty Amazes with Incredible Last Benefit Reveal at PowerCON: Delta Dental and Vision

- Celestica Announces Election of Directors and Approval to Proceed with Share Reclassification

- Macerich Celebrates Earth Month With ‘You Pledge We Plant’ Campaign, Industry Recognition

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share 10% Total Recycled Fiber 00268134

10% Total Recycled Fiber 00268134