Form 497K GABELLI EQUITY SERIES

The Gabelli Global Financial Services Fund

A series of the Gabelli Equity Series Funds, Inc.

SUMMARY PROSPECTUS January 27, 2023

Class AAA (GAFSX), A (GGFSX), C (GCFSX), I (GFSIX)

Before you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Fund and its risks. You can find the Fund’s Prospectus and SAI and other information about the Fund online at www.gabelli.com. You can also get this information at no cost by calling 800-422-3554 or by sending an email request to [email protected]. The Fund’s Prospectus and SAI, both dated January 27, 2023, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Global Financial Services Fund seeks to provide capital appreciation.

Fees and Expenses of the Global Financial Services Fund:

This table describes the fees and expenses that you may pay if you buy and hold the following classes of shares of the Global Financial Services Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts on Class A shares if you and your family invest, or agree to invest in the future, at least $50,000 in Class A shares of the Gabelli family of mutual funds. More information about these and other discounts is available from your financial professional and in the section entitled, “Classes of Shares” on page 45 of the prospectus and in Appendix A, “Sales Charge Reductions and Waivers Available through Certain Intermediaries,” attached to the Global Financial Services Fund’s prospectus.

| Class AAA Shares |

Class A Shares |

Class C Shares |

Class I Shares | |||||||||||||||||

| Shareholder Fees |

||||||||||||||||||||

| (fees paid directly from your investment): |

||||||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases |

None | 5.75% | None | None | ||||||||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of redemption or offering price, whichever is lower) |

None | None | 1.00% | None | ||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends (as a percentage of amount invested) |

None | None | None | None | ||||||||||||||||

| Redemption Fees (as a percentage of amount redeemed for shares held 7 days or less) |

2.00% | 2.00% | 2.00% | 2.00% | ||||||||||||||||

| Exchange Fee |

None | None | None | None | ||||||||||||||||

| Annual Fund Operating Expenses |

||||||||||||||||||||

| (expenses that you pay each year as a percentage of the value of your investment): |

||||||||||||||||||||

| Management Fees |

1.00% | 1.00% | 1.00% | 1.00% | ||||||||||||||||

| Distribution and Service (Rule 12b-1) Fees |

0.25% | 0.25% | 1.00% | None | ||||||||||||||||

| Other Expenses(1) |

0.63% | 0.63% | 0.63% | 0.63% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Annual Fund Operating Expenses(1) |

1.88% | 1.88% | 2.63% | 1.63% | ||||||||||||||||

| Fee Waiver and/or Expense Reimbursement(1) |

(0.61)% | (0.61)% | (0.61)% | (0.61)% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Annual Fund Operating Expenses After Fee Wavier and/or Expense Reimbursement |

1.27% | 1.27% | 2.02% | 1.02% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | “Other Expenses” are based on estimated amounts for the current fiscal year. The Adviser has contractually agreed to waive its investment advisory fees and/or to reimburse expenses of the Global Financial Services Fund to the extent necessary to |

| maintain the Total Annual Global Financial Services Fund Operating Expenses After Fee Waiver and Expense Reimbursement (excluding brokerage costs, acquired fund fees and expenses, interest, taxes, and extraordinary expenses) at no more than an annual rate of 1.25%, 1.25%, 2.00%, and 1.00% for Class AAA, Class A, Class C, and Class I shares, respectively. Under this same arrangement, the Global Financial Services Fund has also agreed, during the two year period following the year of any such waiver or reimbursement by the Adviser, to repay such amount, but only to the extent the Global Financial Services Fund’s adjusted Total Annual Global Financial Services Fund Operating Expenses would not exceed an annual rate of 1.25%, 1.25%, 2.00%, and 1.00% for Class AAA, Class A, Class C, and Class I shares, respectively, after giving effect to the repayments. This arrangement is in effect through January 31, 2024, and may be terminated only by the Board of Directors of the Company before such time. The Global Financial Services Fund will carry forward any fees and expenses in excess of the expense limitation and repay the Adviser such amount provided the Global Financial Services Fund is able to do so without exceeding the lesser of (1) the expense limit in effect at the time of the waiver or reimbursement, as applicable, or (2) the expense limit in effect at the time of recoupment after giving effect to the repayment. |

Expense Example

This example is intended to help you compare the cost of investing in the Global Financial Services Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Global Financial Services Fund for the time periods shown and then redeem all of your shares at the end of those periods. The example assumes a waiver of expenses through the date of the expiration of the waiver, and reflects Total Annual Fund Operating Expenses following the date of the expiration of the waiver. The example also assumes that your investment has a 5% return each year and that the Global Financial Services Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class AAA Shares |

$ | 129 | $ | 532 | $ | 959 | $ | 2,151 | ||||||||||||

| Class A Shares |

$ | 697 | $ | 1,076 | $ | 1,479 | $ | 2,603 | ||||||||||||

| Class C Shares |

$ | 305 | $ | 760 | $ | 1,341 | $ | 2,919 | ||||||||||||

| Class I Shares |

$ | 104 | $ | 455 | $ | 829 | $ | 1,882 | ||||||||||||

You would pay the following expenses if you did not redeem your shares of the Global Financial Services Fund:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class AAA Shares |

$ | 129 | $ | 532 | $ | 959 | $ | 2,151 | ||||||||||||

| Class A Shares |

$ | 697 | $ | 1,076 | $ | 1,479 | $ | 2,603 | ||||||||||||

| Class C Shares |

$ | 205 | $ | 760 | $ | 1,341 | $ | 2,919 | ||||||||||||

| Class I Shares |

$ | 104 | $ | 455 | $ | 829 | $ | 1,882 | ||||||||||||

Portfolio Turnover

The Global Financial Services Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the Global Financial Services Fund’s shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Global Financial Services Fund’s performance. During the most recent fiscal year, the Global Financial Services Fund’s portfolio turnover rate was 26% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Global Financial Services Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in the securities of companies principally engaged in the group of industries comprising the financial services sector. As a fundamental policy, the Global Financial Services Fund will concentrate (invest at least 25% of the value of its net assets) in the securities of companies principally engaged in the group of industries comprising the financial services sector. The Global Financial Services Fund may invest in the equity securities of such companies, such as common stock, or in the debt securities of such companies, such as corporate bonds or other financial instruments, in accordance with the foregoing 80% policy. The Global Financial Services Fund may invest in companies without regard to market capitalization and may invest in issuers in foreign

2

countries, including countries with developed or emerging markets. As a “global” fund, the Global Financial Services Fund invests in securities of issuers, or related investments thereof, located in at least three countries, and at least 40% of the Fund’s total net assets will be invested in securities of non-U.S. issuers or related investments thereof.

The Global Financial Services Fund considers a company to be principally engaged in the group of industries comprising the financial services sector if it devotes a significant portion of its assets to, or derives a significant portion of its revenues from, providing financial services. Such services include but are not limited to the following: commercial, consumer, and specialized banking and financing; asset management; publicly-traded, government sponsored financial enterprises; insurance; accountancy; mortgage REITs; brokerage; securities exchanges and electronic trading platforms; financial data, technology, and analysis; and financial transaction and other financial processing services.

The 1940 Act restricts the Global Financial Services Fund from acquiring the securities of any company that derives more than 15% of its gross revenues from securities related activities, such as a broker, dealer, underwriter or a federally registered investment adviser (a “Securities Related Issuer”), subject to exception. Under Rule 12d3-1 under the 1940 Act, however, the Global Financial Services Fund may generally purchase up to 5% of any class of equity securities of a Securities Related Issuer, or up to 10% of the outstanding principal amount of debt securities of a Securities Related Issuer, so long as, in each case, no more than 5% of the Global Financial Services Fund’s total assets are invested in the Securities Related Issuer. These limitations are measured at the time of investment. Rule 12d3-1 may operate to limit the size of the Global Financial Services Fund’s investment position with respect to one or more Securities Related Issuers. The 1940 Act also restricts the Global Financial Services Fund from acquiring any security issued by an insurance company if the Global Financial Services Fund owns, or will own as a result of the acquisition, more than 10% of the total outstanding voting stock of the insurance company. The 1940 Act may operate to limit the size of the Global Financial Services Fund’s investment position with respect to one or more insurance companies.

The Adviser’s investment philosophy with respect to buying and selling equity securities is to identify assets that are selling in the public market at a discount to their private market value (“PMV”). The Adviser defines PMV as the value informed purchasers are willing to pay to acquire assets with similar characteristics. The Adviser considers factors such as price, earnings expectations, earnings and price histories, balance sheet characteristics, and perceived management skills. The Adviser also considers changes in economic and political outlooks as well as individual corporate developments. Further, the Adviser looks for a catalyst, something indigenous to the company, its industry or geographic positioning that may surface additional value, including, but not limited to, industry developments, regulatory changes, changes in management, sale or spin-off of a division, or the development of a profitable new business. The Adviser expects to seek to sell any Global Financial Services Fund investments that lose their perceived value relative to other investments, which could occur because of, among other things, a security reaching a predetermined price target, a change to a company’s fundamentals that make the risk/reward profile unattractive, or a need to improve the overall risk/reward profile of the Global Financial Services Fund.

The Global Financial Services Fund may invest in non-U.S. equity securities through depositary receipts, including American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”), Global Depositary Receipts (“GDRs”) and other similar global instruments, which are generally subject to risks associated with equity securities and investments in foreign (non-U.S.) securities. ADRs are receipts issued by U.S. banks or trust companies in respect of securities of foreign issuers held on deposit for use in the U.S. securities markets. EDRs, which are sometimes referred to as Continental Depositary Receipts, are receipts issued in Europe, typically by non-U.S. banks and trust companies, that evidence ownership of either non-U.S. or domestic underlying securities. GDRs are depositary receipts structured like global debt issues to facilitate trading on an international basis. ADRs are usually denominated in U.S. dollars and dividends and other payments from the issuer are converted by the custodian into U.S. dollars before payment to receipt holders. In most other respects, ADRs, EDRs and GDRs for foreign securities have the same characteristics as the underlying securities.

Principal Risks

You may want to invest in the Global Financial Services Fund if:

| • | you are a long term investor |

| • | you seek capital appreciation |

| • | you believe that the market will favor financial services companies over the long term |

3

The Global Financial Services Fund’s share price will fluctuate with changes in the market value of the Global Financial Services Fund’s portfolio securities. Stocks are subject to market, economic, and business risks that may cause their prices to fluctuate. The Global Financial Services Fund is also subject to the risk that the Adviser’s judgments about above average growth potential of a particular company is incorrect and that the perceived value of such company’s stock is not realized by the market, or that the price of the Global Financial Services Fund’s portfolio securities will decline. An investment in the Global Financial Services Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. When you sell Global Financial Services Fund shares, they may be worth more or less than what you paid for them; you may lose money by investing in the Global Financial Services Fund.

Investing in the Global Financial Services Fund involves the following risks:

| • | Market Disruption, Inflation and Interest Rate Risk. General economic and market conditions, such as interest rates, availability of credit, inflation rates, economic uncertainty, supply chain disruptions, labor shortages, energy and other resource shortages, changes in laws, trade barriers, currency exchange controls and national and international political circumstances (including governmental responses to public health crises or the spread of infectious diseases), may have long-term negative effects on the U.S. and worldwide financial markets and economy, and thus the Fund. Inflation risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the value of money. Recently, inflation has increased to its highest level in decades, and the Federal Reserve has been raising the federal funds rate in response. General interest rate fluctuations may have a substantial negative impact on the Fund’s investments, the value of the Fund and the Fund’s rate of return. Recently, central banks such as the Federal Reserve Bank have been increasing interest rates in an effort to slow the rate of inflation. There is a risk that increased interest rates may cause the economy to enter a recession. Any such recession would negatively impact the Fund and the investments held by the Fund. |

| • | Equity Risk. Equity risk is the risk that the prices of the securities held by the Global Financial Services Fund will change due to general market and economic conditions, perceptions regarding the industries in which the companies issuing the securities participate, and the issuer company’s particular circumstances. |

| • | Concentration Risk. The Global Financial Services Fund concentrates its assets (i.e., invests 25% or more of its net assets) in securities of companies in the financial services sector, and, as a result, the Global Financial Services Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified. Accordingly, the Global Financial Services Fund is subject to the risk that its performance may be hurt disproportionately by the poor performance of relatively few securities. |

| • | Financial Services Risk. The Global Financial Services Fund will concentrate its investments in securities issued by financial services companies. Financial services companies can be significantly affected by changing economic conditions, demand for consumer loans, refinancing activity and intense competition, including price competition. Profitability can be largely dependent on the availability and cost of capital and the rate of consumer debt defaults, and can fluctuate significantly when interest rates change; unstable and/or rising interest rates, such as those that characterize the current market environment, may have a disproportionate adverse effect on companies in the financial services sector. Financial services companies are subject to extensive government regulation, which can change frequently and may adversely affect the scope of their activities, the prices they can charge and the amount of capital they must maintain, or may affect them in other ways that are unforeseeable. In the past, financial services companies in general experienced considerable financial distress, which led to the implementation of government programs designed to ease that distress. |

| • | Foreign Securities Risk. Investments in foreign securities involve risks relating to political, social, and economic developments abroad, as well as risks resulting from the differences between the regulations to which U.S. and foreign issuers and markets are subject. These risks include expropriation, differing accounting and disclosure standards, currency exchange risks, settlement difficulties, market illiquidity, difficulties enforcing legal rights, and greater transaction costs. These risks are more pronounced in the securities of companies located in emerging markets. |

| • | Emerging Market Risk. Foreign securities risks are more pronounced in emerging markets. Investments in emerging markets may experience sharp price swings, as there may be less government supervision and |

4

| regulation of business in such markets, and may entail risks relating to political and economic instability and expropriation, nationalization, confiscation or the imposition of restrictions on foreign investment, lack of hedging instruments, and restrictions on repatriation of capital invested. Securities markets in emerging markets may be less liquid and developed than those in the United States, potentially making prices erratic. Economic or political crises may detrimentally affect investments in emerging markets. Emerging market countries may experience substantial rates of inflation or deflation. The economies of developing countries tend to be dependent upon international trade. There may be little financial information available about emerging market issuers, and it may be difficult to obtain or enforce a judgment against them. Other risks include a high concentration of investors, financial intermediaries, and market capitalization and trading volume in a small number of issuers and industries; vulnerability to changes in commodity prices due to overdependence on exports, including gold and natural resources, overburdened infrastructure and obsolete or unseasoned financial systems; environmental problems; less developed legal systems; and less reliable securities custodial services and settlement practices. For all of these reasons, investments in emerging markets may be considered speculative. |

| • | Currency Risk. Fluctuations in exchange rates between the U.S. dollar and foreign currencies may negatively affect an investment. Adverse changes in exchange rates may erode or reverse any gains produced by foreign-currency denominated investments and may widen any losses. The Global Financial Services Fund may, but is not required to, seek to reduce currency risk by hedging part or all of its exposure to various foreign currencies. In addition, the Global Financial Services Fund’s investments could be adversely affected by delays in, or a refusal to grant, repatriation of funds or conversion of emerging market currencies. |

| • | Depositary Receipts. The Global Financial Services Fund may invest in non-U.S. equity securities through depositary receipts, including ADRs, EDRs, GDRs and other similar global instruments. While ADRs, EDRs and GDRs may not necessarily be denominated in the same currency as the securities into which they may be converted, many of the risks associated with foreign (non-U.S.) securities may also apply to ADRs, EDRs and GDRs. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities. Depositary receipts that are not sponsored by the issuer may be less liquid and there may be less readily available public information about the issuer. |

| • | Issuer Risk. The value of a security may decline for a number of reasons that directly relate to an issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception. |

| • | Management Risk. If the portfolio manager is incorrect in his assessment of the growth prospects of the securities the Global Financial Services Fund holds, then the value of the Global Financial Services Fund’s shares may decline. |

| • | Non-Diversification Risk. As a non-diversified mutual fund, more of the Global Financial Services Fund’s assets may be focused in the common stocks of a small number of issuers, which may make the value of the Global Financial Services Fund’s shares more sensitive to changes in the market value of a single issuer or industry than shares of a diversified mutual fund. |

| • | Small and Mid Capitalization Companies Risk. Investing in securities of small and mid-capitalization companies may involve greater risks than investing in larger, more established issuers. Small and mid capitalization companies may be less well established and may have a more highly leveraged capital structure, less liquidity, a smaller investor base, limited product lines, greater dependence on a few customers, or a few key personnel and similar factors that can make their business and stock market performance susceptible to greater fluctuation and volatility. As a result, the purchase or sale of more than a limited number of shares of a small and medium company may affect its market price. The Global Financial Services Fund may need a considerable amount of time to purchase or sell its positions in these securities. In addition, smaller or medium company stocks may not be well known to the investing public. |

| • | Large Capitalization Companies Risk. Companies with $10 billion or more in market capitalization are considered by the Adviser to be large capitalization companies. Large capitalization companies generally experience slower rates of growth in earnings per share than do mid and small capitalization companies. |

5

| • | Limited Operating History. The Global Financial Services Fund commenced operations on October 1, 2018 and therefore has a limited operating history and may have higher expenses. There can be no assurance that the Global Financial Services Fund will grow to or maintain an economically viable size. The Global Financial Services Fund could cease operations, and investors may be required to liquidate or transfer their assets at a loss. However, the expense limitation in place limits this risk through the end of its term. |

| • | Value Investing Risk. The Global Financial Services Fund invests in “value” stocks. The portfolio manager may be wrong in the assessment of a company’s value and the stocks the Global Financial Services Fund holds may not reach what the portfolio manager believes are their full values. From time to time “value” investing falls out of favor with investors. During those periods, the Global Financial Services Fund’s relative performance may suffer. |

| • | Fixed Income Securities Risks. Because the Global Financial Services Fund may invest in fixed income securities, it is subject to the following risks: |

| • | Interest Rate Risk — When interest rates decline, the value of fixed income securities generally rises; and when interest rates rise, the value of such securities generally declines. The Global Financial Services Fund is subject to a greater risk of rising interest rates due to the current period of rising interest rates. There is a possibility that interest rates may continue to rise further in the future, particularly in response to actions of the Federal Reserve to combat the currently high rates of inflation. |

| • | Issuer Risk — Issuer risk is the risk that the value of a fixed income security may decline for a number of reasons which directly relate to the issuer. |

| • | Credit Risk — Credit risk is the risk that one or more fixed income securities in the Global Financial Services Fund’s portfolio will decline in price or fail to pay interest/ distributions or principal when due because the issuer of the security experiences a decline in its financial status. |

| • | Prepayment Risk — Prepayment risk is the risk that during periods of declining interest rates, borrowers may exercise their option to prepay principal earlier than scheduled, which could force the Global Financial Services Fund to reinvest in lower yielding securities. |

| • | Reinvestment Risk — Reinvestment risk is the risk that income from the Global Financial Services Fund’s portfolio will decline if the Global Financial Services Fund invests the proceeds from matured, traded or called fixed income securities at market interest rates that are below the Global Financial Services Fund portfolio’s current earnings rate. |

| • | Duration and Maturity Risk — In comparison to maturity (which is the date on which the issuer of a debt instrument is obligated to repay the principal amount), duration is a measure of the price volatility of a debt instrument as a result in changes in market rates of interest, based on the weighted average timing of the instrument’s expected principal and interest payments. In general, a portfolio of securities with a longer duration can be expected to be more sensitive to interest rate changes than a portfolio with a shorter duration. |

| • | Corporate Bonds Risk. The market value of a corporate bond generally may be expected to rise and fall inversely with interest rates. The market value of intermediate and longer term corporate bonds is generally more sensitive to changes in interest rates than is the market value of shorter term corporate bonds. |

| • | Non-Investment Grade Securities Risk. The prices of lower grade securities are more sensitive to negative developments, such as a decline in the issuer’s revenues or a general economic downturn, than are the prices of higher grade securities. Securities of below investment grade quality are predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal when due and therefore involve a greater risk of default. |

Performance

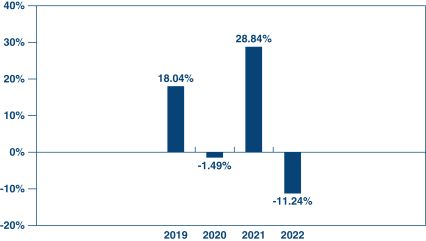

The bar chart and table that follow provide an indication of the risks of investing in the Global Financial Services Fund by showing changes in the Global Financial Services Fund’s performance from year to year, and by showing how the Global Financial Services Fund’s average annual returns for one year and the life of the Global Financial Services Fund compared with the MSCI World Financials Index and the Standard & Poor’s (“S&P”) 500 Index. As with all mutual funds, the Global Financial Services Fund’s past performance (before and after taxes) does not predict how the Global Financial Services Fund will perform in the future. Updated information on the Global Financial Services Fund’s results can be obtained by visiting www.gabelli.com.

6

THE GLOBAL FINANCIAL SERVICES FUND

(Total Returns for Class AAA Shares for the Year Ended December 31)

During the calendar year shown in the bar chart, the highest return for a quarter was 35.52% (quarter ended December 31, 2020) and the lowest return for a quarter was (38.30)% (quarter ended March 31, 2020).

| Average Annual Total Returns with maximum sales charges, if applicable) |

Past One Year |

Since Inception (October 1, 2018) | ||||||||

| The Global Financial Services Fund Class AAA Shares |

||||||||||

| Return Before Taxes |

(11.24)% | 2.84% | ||||||||

| Return After Taxes on Distributions |

(11.79)% | 2.38% | ||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

(6.26)% | 2.20% | ||||||||

| Class A Shares (first issued on 10/01/18) |

||||||||||

| Return Before Taxes |

(16.34)% | 1.46% | ||||||||

| Class C Shares (first issued on 10/01/18) |

||||||||||

| Return Before Taxes |

(12.80)% | 2.06% | ||||||||

| Class I Shares (first issued on 10/01/18) |

||||||||||

| Return Before Taxes |

(11.07)% | 3.08% | ||||||||

| MSCI World Financials Index (reflects no deduction for fees, |

(9.56)% | 5.22% | ||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(18.11)% | 8.58% | ||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return After Taxes on Distributions” because the investor is assumed to be able to use the capital loss from the sale of Fund shares to offset other taxable gains. After-tax returns are shown for only Class AAA shares, and after-tax returns for other classes will vary. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Global Financial Services Fund shares through tax-deferred arrangements, such as 401(k) plans or Individual Retirement Accounts, including Roth IRAs and SEP IRAs (collectively, “IRAs”).

Management

The Adviser. Gabelli Funds, LLC

The Portfolio Manager. Mr. Ian Lapey, a portfolio manager for the Adviser, is the portfolio manager of the Global Financial Services Fund.

7

Purchase and Sale of Fund Shares

The minimum initial investment for Class AAA, Class A, and Class C shares is $1,000 ($250 for “IRAs” or Coverdell Education Savings Plans). There is no minimum initial investment for Class AAA, Class A, and Class C shares in an automatic monthly investment plan. Class I shares are available to investors with a minimum investment of $10,000 when purchasing the shares directly through G.distributors, LLC, the Global Financial Services Fund’s distributor (“G.distributors” or the “Distributor”), or investors purchasing Class I shares through brokers or financial intermediaries that have entered into selling agreements with the Distributor specifically with respect to Class I shares, and which have different minimum investment amounts. If you transact in Class I Shares through a broker or financial intermediary, you may be required to pay a commission and/or other forms of compensation to the broker or financial intermediary. The Distributor reserves the right to waive or change minimum investment amounts. There is no minimum for subsequent investments.

Since the minimum initial investment amount for Class I shares of Global Financial Services Fund purchased through the Distributor has been reduced to $10,000, shareholders eligible to purchase other share classes of Global Financial Services Fund and making an initial investment of $10,000 should instead consider purchasing Class I shares of Global Financial Services Fund since Class I shares carry no sales load and no ongoing distribution fees. Investors and shareholders who wish to purchase shares of Global Financial Services Fund through a broker or financial intermediary should consult their broker or financial intermediary with respect to the purchase of shares of Global Financial Services Fund. Please refer to Global Financial Services Fund’s statutory prospectus for additional information about share class conversions and exchanges among funds managed by the Adviser or its affiliates.

You can purchase or redeem shares of the Global Financial Services Fund on any day the New York Stock Exchange (“NYSE”) is open for trading (a “Business Day”). You may purchase or redeem shares of the Global Financial Services Fund by written request via mail (The Gabelli Funds, P.O. Box 219204, Kansas City, MO 64121-9204), personal or overnight delivery (The Gabelli Funds, c/o SS&C Global Investor & Distribution Solutions, Inc., 430 W 7th Street STE 219204, Kansas City, MO 64105-1407), Internet, bank wire, or Automated Clearing House (“ACH”) system. You may also purchase shares of the Fund by telephone, if you have an existing account with banking instructions on file, or redeem at 800-GABELLI (800-422-3554).

Shares of the Global Financial Services Fund can also be purchased or sold through registered broker-dealers or other financial intermediaries that have entered into appropriate selling agreements with the Distributor. The broker-dealer or other financial intermediary will transmit these transaction orders to the Global Financial Services Fund on your behalf and send you confirmation of your transactions and periodic account statements showing your investments in the Global Financial Services Fund.

Tax Information

The Global Financial Services Fund expects that distributions will generally be taxable as ordinary income or long term capital gains, unless you are investing through a tax deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Global Financial Services Fund through a broker-dealer or other financial intermediary (such as a bank), the Global Financial Services Fund and its related companies may pay the intermediary for the sale of the Global Financial Services Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Global Financial Services Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

3630 multi 2023

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- MYTILINEOS ENERGY & METALS: FIRST QUARTER 2024 TRADING UPDATE

- UIICore unveiling / ECCMID announcement Analyst Targets

- UIICore unveiling / ECCMID announcement Analyst Targets

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share