Form 497K Frost Family of Funds

Before you invest, you may want to review the Fund’s complete prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at https://www.frostbank.com/business/investments/mutual-funds. You can also get this information at no cost by calling 1-877-71-FROST (1-877-713-7678), by sending an e-mail request to [email protected], or by asking any financial intermediary that offers shares of the Fund. The Fund’s prospectus and statement of additional information, both dated November 28, 2021, as they may be amended from time to time, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

INVESTMENT OBJECTIVE

The Frost Municipal Bond Fund (the “Fund”) seeks to provide a consistent level of current income exempt from federal income tax with a secondary emphasis on maximizing total return through capital appreciation.

FUND FEES AND EXPENSES

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in Institutional Class Shares, which are not reflected in the table or the example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

INSTITUTIONAL

|

Investor

|

|

Management Fees1 |

0.25% |

0.25% |

Distribution (12b-1) Fees |

None |

0.25% |

Other Expenses |

0.31% |

0.31% |

Total Annual Fund Operating Expenses2 |

0.56% |

0.81% |

|

1 |

Management Fees have been restated to reflect current fees. |

|

2 |

The Total Annual Fund Operating Expenses in this fee table do not correlate to the expense ratios in the Fund’s Financial Highlights because Management Fees have been restated to reflect current fees. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses (including waived investment advisory fees for the

1 |

period described in the footnote to the fee table) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 YEAR |

3 YEARS |

5 YEARS |

10 YEARS |

|

Institutional Class Shares |

$57 |

$179 |

$313 |

$701 |

Investor Class Shares |

$83 |

$259 |

$450 |

$1,002 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During its most recent fiscal year, the Fund’s portfolio turnover rate was 0% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in municipal securities that generate income exempt from federal income tax, but not necessarily the federal alternative minimum tax (“AMT”). These securities include securities of municipal issuers located in Texas as well as in other states, territories and possessions of the United States. This investment policy may not be changed without shareholder approval. The Fund may invest more than 25% of its total assets in bonds of issuers in Texas.

Frost Investment Advisors, LLC (the “Adviser” or “Frost”) considers the relative yield, maturity and availability of various types of municipal bonds and the general economic outlook in determining whether to over- or under-weight a specific type of municipal bond in the Fund’s portfolio. Duration adjustments are made relative to the Bloomberg Municipal Bond Index. The concept of duration is useful in assessing the sensitivity of a fixed income fund to interest rate movements, which are usually the main source of risk for most fixed income funds. Duration measures price volatility by estimating the change in price of a debt security for a 1% change in its yield. For example, a duration of five years means the price of a debt security will change about 5% for every 1% change in its yield. Thus, the higher the duration, the more volatile the security.

The Adviser, in constructing and maintaining the Fund’s portfolio, employs the following four primary strategies to varying degrees depending on its views of economic growth prospects, interest rate predictions and relative value assessments: interest rate positioning based on duration and yield curve

2 |

positioning, with a typical range of three years; asset category allocations; credit sector allocations relating to security ratings by the national ratings agencies; and individual security selection.

Securities will be considered for sale in the event of or in anticipation of a credit downgrade; to effect a change in duration or sector weighting of the Fund; to realize an aberration in a security’s valuation; or when the Adviser otherwise deems appropriate.

PRINCIPAL RISKS

As with all mutual funds, there is no guarantee that the Fund will achieve its investment objective. You could lose money by investing in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the FDIC, or any government agency. The principal risks affecting shareholders’ investments in the Fund are set forth below.

Market Risk – The risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally or particular industries. In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund.

Management Risk – The risk that the investment techniques and risk analyses applied by the Adviser will not produce the desired results and that legislative, regulatory, or tax developments may affect the investment techniques available to the Adviser and the individual portfolio manager in connection with managing the Fund. There is no guarantee that the investment objective of the Fund will be achieved.

Interest Rate Risk – As with most funds that invest in debt securities, changes in interest rates are one of the most important factors that could affect the value of your investment. Rising interest rates tend to cause the prices of debt securities (especially those with longer maturities) and the Fund’s share price to fall.

The concept of duration is useful in assessing the sensitivity of a fixed income fund to interest rate movements, which are usually the main source of risk for most fixed income funds. Duration measures price volatility by estimating the change in price of a debt security for a 1% change in its yield. For example, a duration of five years means the price of a debt security will change about 5% for every 1% change in its yield. Thus, the higher the duration, the more volatile the security.

3 |

Credit Risk – The credit rating or financial condition of an issuer may affect the value of a debt security. Generally, the lower the quality rating of a security, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults or becomes unable to honor its financial obligations, the security may lose some or all of its value. The issuer of an investment-grade security is more likely to pay interest and repay principal than an issuer of a lower rated bond. Adverse economic conditions or changing circumstances, however, may weaken the capacity of the issuer to pay interest and repay principal.

The Fund’s U.S. government securities are not guaranteed against price movements due to changing interest rates. Obligations issued by some U.S. government agencies are backed by the U.S. Treasury, while others are backed solely by the ability of the agency to borrow from the U.S. Treasury or by the government sponsored agency’s own resources. As a result, investments in securities issued by government sponsored agencies that are not backed by the U.S. Treasury are subject to higher credit risk than those that are.

Municipal Issuers Risk – There may be economic or political changes that impact the ability of municipal issuers to repay principal and to make interest payments on municipal securities. Changes in the financial condition or credit rating of municipal issuers also may adversely affect the value of the Fund’s municipal securities. Constitutional or legislative limits on borrowing by municipal issuers may result in reduced supplies of municipal securities. Moreover, certain municipal securities are backed only by a municipal issuer’s ability to levy and collect taxes.

High Yield Bond Risk – High yield, or “junk,” bonds are highly speculative securities that are usually issued by smaller less credit worthy and/or highly leveraged (indebted) companies. Compared with investment-grade bonds, high yield bonds carry a greater degree of risk and are less likely to make payments of interest and principal. Market developments and the financial and business conditions of the corporation issuing these securities influences their price and liquidity more than changes in interest rates, when compared to investment-grade debt securities. Insufficient liquidity in the junk bond market may make it more difficult to dispose of junk bonds and may cause the Fund to experience sudden and substantial price declines. A lack of reliable, objective data or market quotations may make it more difficult to value junk bonds accurately.

Texas Municipal Securities Risk – The Fund may invest more than 25% of its total assets in securities issued by Texas and its municipalities, and as a result is more vulnerable to unfavorable developments in Texas than funds that invest a lesser percentage of their assets in such securities. For example, important sectors of the State’s economy include the oil and gas industry (including drilling, production, refining, chemicals and energy-related manufacturing) and high technology manufacturing (including computers, electronics and telecommunications equipment), along with an increasing emphasis on

4 |

international trade. Each of these sectors has from time to time suffered from economic downturns. Adverse conditions in one or more of these sectors could have an adverse impact on Texas municipal securities.

State-Specific Risk – The Fund is subject to the risk that the economy of the states in which it invests, and the revenues underlying state municipal bonds, may decline. Investing primarily in a single state means that the Fund is more exposed to negative political or economic factors in that state than a fund that invests more widely.

Prepayment and Extension Risk – Prepayment and extension risk is the risk that a loan, bond or other security might be called or otherwise converted, prepaid or redeemed before maturity. This risk is primarily associated with corporate-backed, mortgage-backed and asset-backed securities. If a security is converted, prepaid or redeemed before maturity, particularly during a time of declining interest rates or spreads, the Fund may not be able to invest the proceeds in securities providing as high a level of income, resulting in a reduced yield to the Fund. Conversely, as interest rates rise or spreads widen, the likelihood of prepayment decreases. The Fund may be unable to capitalize on securities with higher interest rates or wider spreads because the Fund’s investments are locked in at a lower rate for a longer period of time.

Tax and Federal AMT Risk – The Fund will rely on the opinion of issuers’ bond counsel on the tax-exempt status of interest on municipal bond obligations. Neither the Fund nor the Adviser will independently review the bases for those tax opinions, which may ultimately be determined to be incorrect and subject the Fund and its shareholders to substantial tax liabilities. The Fund may invest in bonds subject to the federal AMT applicable to non-corporate shareholders. Shareholders subject to the federal AMT will be required to report the portion of the Fund’s distributions attributable to income from the bonds as a tax preference item in determining their amounts due under the federal AMT. The Fund may not be a suitable investment for individual retirement accounts (“IRAs”) and other tax-deferred arrangements.

LIBOR Replacement Risk – The elimination of the London Inter-Bank Offered Rate (“LIBOR”) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to LIBOR. The U.K. Financial Conduct Authority has announced that it intends to stop compelling or inducing banks to submit LIBOR rates after 2021. On March 5, 2021, the administrator of LIBOR clarified that the publication of LIBOR on a representative basis will cease for the one-week and two-month U.S. dollar LIBOR settings immediately after December 31, 2021, and for the remaining U.S. dollar LIBOR settings immediately after June 30, 2023. Alternatives to LIBOR are established or in development in most major currencies, including the Secured Overnight Financing Rate (“SOFR”), which is intended to replace U.S. dollar LIBOR. Markets are slowly developing in response to these new rates. Questions around liquidity impacted by these rates, and how to appropriately adjust these rates at the time of transition, remain a concern for the Fund. Accordingly, it is difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and fallbacks for both legacy and new products, instruments and contracts are commercially accepted.

5 |

PERFORMANCE INFORMATION

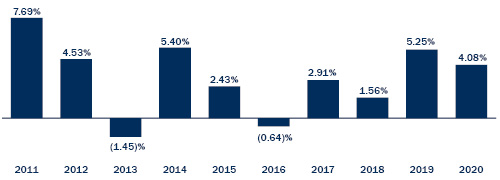

The bar chart and the performance table below illustrate the risks and volatility of an investment in the Fund by showing changes in the Fund’s Institutional Class Shares’ performance from year to year and by showing how the Fund’s average annual total returns for 1, 5 and 10 years and since inception compare with those of a broad measure of market performance.

The Fund operated as the Frost Municipal Bond Fund (the “Predecessor Municipal Bond Fund”), a series of The Advisors’ Inner Circle Fund II, prior to the Fund’s acquisition of the assets and liabilities of the Predecessor Municipal Bond Fund on June 24, 2019 (the “Municipal Bond Fund Reorganization”). As a result of the Municipal Bond Fund Reorganization, the Fund assumed the performance and accounting history of the Predecessor Municipal Bond Fund. Accordingly, performance figures for periods prior to the date of the Municipal Bond Fund Reorganization represent the performance of the Predecessor Municipal Bond Fund.

Of course, the Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.frostinv.com or by calling 1-877-71-FROST.

Best Quarter |

Worst Quarter |

2.68% |

(2.80)% |

6/30/2011 |

12/31/2016 |

The performance information shown above is based on a calendar year. Year to date performance (non-annualized and before taxes) as of September 30, 2021: 0.98%.

6 |

Average Annual Total Returns for Periods Ended December 31, 2020

This table compares the Fund’s average annual total returns for the periods ended December 31, 2020 to those of an appropriate broad-based index.

Prior to March 31, 2015, Investor Class Shares of the Predecessor Municipal Bond Fund were called “Class A Shares,” and shareholders were charged a sales charge on certain purchases of Class A Shares. The Investor Class Shares performance information provided in the table below for the period prior to March 31, 2015 represents the performance of the Predecessor Municipal Bond Fund’s Investor Class Shares when they were called Class A Shares, but does not include the Maximum Sales Charge (Load) that was applicable to Class A Shares. If sales charges were included, the returns would be lower.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns will depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or IRAs. After-tax returns are shown for Institutional Class Shares only. After-tax returns for Investor Class Shares will vary.

FROST MUNICIPAL BOND FUND |

1 YEAR |

5 YEARS |

10 YEARS |

Since |

Fund Returns Before Taxes |

||||

Institutional Class Shares |

4.08% |

2.61% |

3.14% |

3.35% |

Investor Class Shares |

3.91% |

2.39% |

2.89% |

3.07% |

Fund Returns After Taxes on Distributions |

||||

Institutional Class Shares |

2.96% |

2.35% |

2.99% |

3.23% |

Fund Returns After Taxes on Distributions and Sale of Fund Shares |

||||

Institutional Class Shares |

3.96% |

2.50% |

3.00% |

3.21% |

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) |

5.21% |

3.91% |

4.63% |

4.58% |

|

1 |

Institutional Class Shares were offered beginning April 25, 2008. Investor Class Shares were offered beginning August 28, 2008. Index comparison begins April 25, 2008. |

7 |

INVESTMENT ADVISER

Frost Investment Advisors, LLC

PORTFOLIO MANAGER

Jeffery Elswick, Director of Fixed Income, Managing Director, Co-Chief Investment Officer and Senior Fund Manager at Frost, has been a portfolio manager for the Fund since its inception in 2008. Mr. Elswick is supported by a team of appropriately trained, qualified analysts and fixed income traders.

TAX INFORMATION

The Fund’s distributions of interest on municipal obligations generally are not subject to federal income tax; however, the Fund may distribute taxable dividends, including distributions of short-term capital gains, and long-term capital gains. In addition, interest on certain obligations may be subject to the federal AMT for non-corporate shareholders. Depending on the laws of the state of your residence, you may be subject to state tax on all or a portion of Fund distributions. The Fund may not be a suitable investment for IRAs and other tax-deferred arrangements.

PURCHASE AND SALE OF FUND SHARES

To purchase Institutional Class Shares of the Fund for the first time, you must invest at least $1,000,000. There is no minimum for subsequent investments.

To purchase Investor Class Shares of the Fund for the first time, you must invest at least $2,500 ($1,500 for IRAs). Your subsequent investments must be made in amounts of at least $500. Systematic planned contributions are required to be at least $100.

The Fund reserves the right to waive the minimum investment amounts in its sole discretion.

If you own your shares directly, you may redeem your shares on any day that the New York Stock Exchange (“NYSE”) is open for business (a “Business Day”) via Automated Clearing House (“ACH”) (subject to certain account minimums) or by contacting the Fund directly by mail at: Frost Funds, P.O. Box 219009, Kansas City, Missouri 64121-9009 (Express Mail Address: Frost Funds, c/o DST Systems, Inc., 430 West 7th Street, Kansas City, Missouri 64105) or telephone at 1-877-71-FROST.

If you own your shares through an account with a broker or other institution, contact that broker or institution to redeem your shares.

8 |

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

9 |

FIA-SM-007-0300

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cryogenic Tank Market to Reach USD 10 Billion by 2031 Driven by Surging Demand for Clean Energy Solutions

- Duchenne UK and Parent Project Muscular Dystrophy Award $500,000 to Evaluate Safety and Tolerability of Muscle Progenitor Cells in Phase 1 Trial

- Sneaker Impact Partners with Miami-Dade County Clerk of Court & Comptroller to Champion Sustainability Movement

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share