Form 497K Frost Family of Funds

Before you invest, you may want to review the Fund’s complete prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at https://www.frostbank.com/business/investments/mutual-funds. You can also get this information at no cost by calling 1-877-71-FROST (1-877-713-7678), by sending an e-mail request to [email protected], or by asking any financial intermediary that offers shares of the Fund. The Fund’s prospectus and statement of additional information, both dated November 28, 2021, as they may be amended from time to time, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

INVESTMENT OBJECTIVE

The Frost Growth Equity Fund (the “Fund”) seeks to achieve long-term capital appreciation.

FUND FEES AND EXPENSES

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in Institutional Class Shares, which are not reflected in the table or the example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

INSTITUTIONAL |

Investor |

|

Management Fees |

0.50% |

0.50% |

Distribution (12b-1) Fees |

None |

0.25% |

Other Expenses |

0.13% |

0.13% |

Total Annual Fund Operating Expenses |

0.63% |

0.88% |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 YEAR |

3 YEARS |

5 YEARS |

10 YEARS |

|

Institutional Class Shares |

$64 |

$202 |

$351 |

$786 |

Investor Class Shares |

$90 |

$281 |

$488 |

$1,084 |

1 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During its most recent fiscal year, the Fund’s portfolio turnover rate was 17% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

Under normal market conditions, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities. This investment policy may be changed by the Fund upon 60 days’ prior written notice to shareholders. The Fund intends to invest in companies of any market capitalization that Frost Investment Advisors, LLC (the “Adviser” or “Frost”) believes will have growing revenues and earnings. The Fund will generally invest in equity securities of domestic companies, but may also invest in equity securities of foreign companies and American Depositary Receipts (“ADRs”). The Adviser performs in-depth analyses of company fundamentals and factors affecting industries to identify companies displaying strong earnings and revenue growth relative to the overall market or relative to their peer group, improving returns on equity and a sustainable competitive advantage.

The Adviser focuses on a number of factors to assess the growth potential of individual companies, such as:

|

● |

Historical and expected organic revenue growth rates; |

|

● |

Historical and expected earnings growth rates; |

|

● |

Signs of accelerating growth potential; |

|

● |

Positive earnings revisions; |

|

● |

Earnings momentum; |

|

● |

Improving margin and return on equity trends; and |

|

● |

Positive price momentum. |

When an attractive growth opportunity is identified, the Adviser seeks to independently develop an intrinsic valuation for the stock. The Adviser believes that the value of a company is determined by discounting the company’s future cash flows or earnings. Valuation factors considered in identifying securities for the Fund’s portfolio include:

|

● |

Price/earnings ratio; |

|

● |

Price/sales ratio; |

2 |

|

● |

Price/earnings to growth ratio; |

|

● |

Enterprise value/earnings before interest, taxes, depreciation and amortization; |

|

● |

Enterprise value/sales; |

|

● |

Price/cash flow; |

|

● |

Balance sheet strength; and |

|

● |

Returns on equity and returns on invested capital. |

The Adviser also seeks to understand a firm’s competitive position and the industry dynamics in which the firm operates. The Adviser assesses industry growth potential, market share opportunities, cyclicality and pricing power. Further analysis focuses on corporate governance and management’s ability to create value for shareholders.

The Adviser augments its independent fundamental research process with quantitative screens and models. The models are derived from proprietary research or securities industry research studies and score companies based upon a number of fundamental factors. The Adviser uses quantitative analysis to provide an additional layer of objectivity, discipline and consistency to its equity research process. This quantitative analysis complements the fundamental analyses that the Adviser conducts on companies during its stock selection process.

The Fund seeks to buy and hold securities for the long term and seeks to keep portfolio turnover to a minimum. However, the Adviser may sell a security if its price exceeds the Adviser’s assessment of its fair value or in response to a negative company event, a change in management, poor relative price performance, achieved fair valuation, or a deterioration in a company’s business prospects, performance or financial strength.

The Fund is classified as “non-diversified,” which means that it may invest a larger percentage of its assets in a smaller number of issuers than a diversified fund.

PRINCIPAL RISKS

As with all mutual funds, there is no guarantee that the Fund will achieve its investment objective. You could lose money by investing in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the FDIC, or any government agency. The principal risks affecting shareholders’ investments in the Fund are set forth below.

Management Risk – The risk that the investment techniques and risk analyses applied by the Adviser will not produce the desired results and that legislative, regulatory, or tax developments may affect the investment techniques available to the Adviser and the individual portfolio manager in connection with managing the Fund. There is no guarantee that the investment objective of the Fund will be achieved.

3 |

Equity Risk – Since it purchases equity securities, the Fund is subject to the risk that stock prices will fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of the Fund’s equity securities may fluctuate drastically from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund. These factors contribute to price volatility, which is the principal risk of investing in the Fund.

Growth Style Risk – The price of equity securities rises and falls in response to many factors, including the historical and prospective earnings of the issuer of the stock, the value of its assets, general economic conditions, interest rates, investor perceptions, and market liquidity. The Fund may invest in securities of companies that the Adviser believes have superior prospects for robust and sustainable growth of revenues and earnings. These may be companies with new, limited or cyclical product lines, markets or financial resources, and the management of such companies may be dependent upon one or a few key people. The stocks of such companies can therefore be subject to more abrupt or erratic market movements than stocks of larger, more established companies or the stock market in general.

Sector Focus Risk – Because the Fund may, from time to time, be more heavily invested in particular sectors, the value of its shares may be especially sensitive to factors and economic risks that specifically affect those sectors. As a result, the Fund’s share price may fluctuate more widely than the value of shares of a mutual fund that invests in a broader range of sectors.

Foreign Company Risk – Investing in foreign companies, whether through investments made in foreign markets or made through the purchase of ADRs, which are traded on U.S. exchanges and represent an ownership in a foreign security, poses additional risks since political and economic events unique to a country or region will affect those markets and their issuers. These risks will not necessarily affect the U.S. economy or similar issuers located in the United States. In addition, investments in foreign companies are generally denominated in a foreign currency. As a result, changes in the value of those currencies compared to the U.S. dollar may affect (positively or negatively) the value of the Fund’s investments. These currency movements may occur separately from, and in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Securities of foreign companies may not be registered with the U.S. Securities and Exchange Commission (“SEC”) and foreign companies are generally not subject to the regulatory controls imposed on U.S. issuers and, as a consequence, there is generally less publicly available information about foreign securities than is available about domestic securities. Income from foreign

4 |

securities owned by the Fund may be reduced by a withholding tax at the source, which tax would reduce income received from the securities comprising the Fund’s portfolio. Foreign securities may also be more difficult to value than securities of U.S. issuers. In addition, periodic U.S. Government restrictions on investments in issuers from certain foreign countries may require the Fund to sell such investments at inopportune times, which could result in losses to the Fund. While ADRs provide an alternative to directly purchasing the underlying foreign securities in their respective national markets and currencies, investments in ADRs continue to be subject to many of the risks associated with investing directly in foreign securities.

Small- and Mid-Capitalization Company Risk – The small- and mid-capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, investments in these small- and mid-sized companies may pose additional risks, including liquidity risk, because these companies tend to have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, small- and mid- capitalization stocks may be more volatile than those of larger companies. These securities may be traded over-the-counter or listed on an exchange.

Non-Diversified Risk – The Fund is non-diversified, which means that it may invest in the securities of relatively few issuers. As a result, the Fund may be more susceptible to a single adverse economic or political occurrence affecting one or more of these issuers and may experience increased volatility due to its investments in those securities. However, the Fund intends to satisfy the diversification requirements for qualifying as a regulated investment company (a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

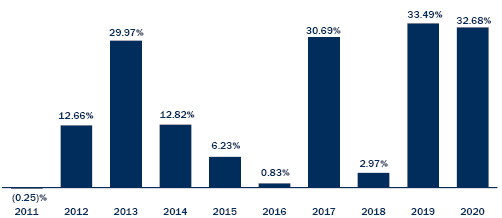

PERFORMANCE INFORMATION

The bar chart and the performance table below illustrate the risks and volatility of an investment in the Fund by showing changes in the Fund’s Institutional Class Shares’ performance from year to year and by showing how the Fund’s average annual total returns for 1, 5 and 10 years and since inception compare with those of a broad measure of market performance.

The Fund operated as the Frost Growth Equity Fund (the “Predecessor Growth Equity Fund”), a series of The Advisors’ Inner Circle Fund II, prior to the Fund’s acquisition of the assets and liabilities of the Predecessor Growth Equity Fund on June 24, 2019 (the “Growth Equity Fund Reorganization”). As a result of the Growth Equity Fund Reorganization, the Fund assumed the performance and accounting history of the Predecessor Growth Equity Fund. Accordingly, performance figures for periods prior to the date of the Growth Equity Fund Reorganization represent the performance of the Predecessor Growth Equity Fund.

5 |

Of course, the Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.frostinv.com or by calling 1-877-71-FROST.

Best Quarter |

Worst Quarter |

26.63% |

(14.70)% |

6/30/2020 |

9/30/2011 |

The performance information shown above is based on a calendar year. Year to date performance (non-annualized and before taxes) as of September 30, 2021: 14.59%.

Average Annual Total Returns for Periods Ended December 31, 2020

This table compares the Fund’s average annual total returns for the periods ended December 31, 2020 to those of an appropriate broad-based index.

Prior to March 31, 2015, Investor Class Shares of the Predecessor Growth Equity Fund were called “Class A Shares,” and shareholders were charged a sales charge on certain purchases of Class A Shares. The Investor Class Shares performance information provided in the table below for the period prior to March 31, 2015 represents the performance of the Predecessor Growth Equity Fund’s Investor Class Shares when they were called Class A Shares, but does not include the Maximum Sales Charge (Load) that was applicable to Class A Shares. If sales charges were included, the returns would be lower.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns will depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold

6 |

their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Institutional Class Shares only. After-tax returns for Investor Class Shares will vary.

FROST GROWTH EQUITY FUND |

1 Year |

5 Years |

10 YEARS |

Since |

Fund Returns Before Taxes |

||||

Institutional Class Shares |

32.68% |

19.17% |

15.45% |

11.81% |

Investor Class Shares |

32.46% |

18.87% |

15.17% |

12.03% |

Fund Returns After Taxes on Distributions |

||||

Institutional Class Shares |

31.56% |

15.84% |

13.25% |

10.11% |

Fund Returns After Taxes on Distributions and Sale of Fund Shares |

||||

Institutional Class Shares |

20.11% |

14.52% |

12.27% |

9.38% |

Russell 1000 Growth Index (reflects no deduction for fees, expenses, or taxes) |

38.49% |

21.00% |

17.21% |

13.62% |

|

1 |

Institutional Class Shares were offered beginning April 25, 2008. Investor Class Shares were offered beginning June 30, 2008. Index comparison begins April 25, 2008. |

INVESTMENT ADVISER

Frost Investment Advisors, LLC

PORTFOLIO MANAGER

John Lutz, CFA, Senior Research Analyst and Senior Fund Manager at Frost, has been a portfolio manager for the Fund since its inception in 2008. Mr. Lutz is supported by a team of appropriately trained, qualified analysts and traders.

7 |

TAX INFORMATION

The Fund intends to make distributions that may be taxed as ordinary income, qualified dividend income, or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or IRA, in which case your distribution will be taxed when withdrawn from the tax-deferred account.

PURCHASE AND SALE OF FUND SHARES

To purchase Institutional Class Shares of the Fund for the first time, you must invest at least $1,000,000. There is no minimum for subsequent investments.

To purchase Investor Class Shares of the Fund for the first time, you must invest at least $2,500 ($1,500 for IRAs). Your subsequent investments must be made in amounts of at least $500. Systematic planned contributions are required to be at least $100.

The Fund reserves the right to waive the minimum investment amounts in its sole discretion.

If you own your shares directly, you may redeem your shares on any day that the New York Stock Exchange (“NYSE”) is open for business (a “Business Day”) via Automated Clearing House (“ACH”) (subject to certain account minimums) or by contacting the Fund directly by mail at: Frost Funds, P.O. Box 219009, Kansas City, Missouri 64121-9009 (Express Mail Address: Frost Funds, c/o DST Systems, Inc., 430 West 7th Street, Kansas City, Missouri 64105) or telephone at 1-877-71-FROST.

If you own your shares through an account with a broker or other institution, contact that broker or institution to redeem your shares.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8 |

FIA-SM-001-0300

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Genie Energy to Report First Quarter 2024 Results

- Elavon and FreedomPay to transform payments for hospitality and retail in Europe

- Pulse Seismic Inc. Reports Q1 2024 Results and Increases Regular Dividend

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share