Form 497K FRANKLIN NEW YORK TAX

SUMMARY PROSPECTUS | |||||||

FRANKLIN NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND | |||||||

Franklin New York Tax-Free Trust | |||||||

February 1, 2023 | |||||||

| |||||||

Class A | Class A1 | Class C | Class R6 | Advisor Class |

FKNQX | FKNIX | FKNCX | FKNRX | FNYZX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information, reports to shareholders and other information about the Fund online at www.franklintempleton.com/prospectus. You can also get this information at no cost by calling (800) DIAL BEN/342-5236 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, both dated February 1, 2023, as may be supplemented, are all incorporated by reference into this Summary Prospectus.

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

Fund Summary

Investment Goal

To provide investors with as high a level of income exempt from federal income taxes and New York State and New York City personal income taxes as is consistent with prudent investment management and the preservation of shareholders' capital.

Fees and Expenses of the Fund

These tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may qualify for sales charge discounts in Class A if you and your family invest, or agree to invest in the future, at least $100,000 in Franklin Templeton funds and certain other funds distributed through Franklin Distributors, LLC, the Fund’s distributor. More information about these and other discounts is available from your financial professional and under “Your Account” on page 33 in the Fund’s Prospectus and under “Buying and Selling Shares” on page 45 of the Fund’s Statement of Additional Information. In addition, more information about sales charge discounts and waivers for purchases of shares through specific financial intermediaries is set forth in Appendix A – “Intermediary Sales Charge Discounts and Waivers” to the Fund’s prospectus.

Please note that the tables and examples below do not reflect any transaction fees that may be charged by financial intermediaries, or commissions that a shareholder may be required to pay directly to its financial intermediary when buying or selling Class R6 or Advisor Class shares.

Shareholder Fees

(fees paid directly from your investment)

| Class A |

| Class A1 |

| Class C |

| Class R6 |

| Advisor

| |

Maximum Sales Charge

(Load) | 2.25% |

| 2.25% |

| None |

| None |

| None | |

Maximum Deferred Sales Charge | None | 1 | None | 1 | 1.00% |

| None |

| None | |

1. | There is a 1% contingent deferred sales charge that applies to investments of $250,000 or more (see "Investment of $250,000 or More" under "Choosing a Share Class") and purchases by certain retirement plans without an initial sales charge on shares sold within 18 months of purchase. | |||||||||

Click to view the fund’s prospectus or view the statement of additional information. | ||

2 | Summary Prospectus | franklintempleton.com |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A |

| Class A1 |

| Class C |

| Class R6 |

| Advisor

|

Management fees | 0.48% |

| 0.48% |

| 0.48% |

| 0.48% |

| 0.48% |

Distribution and service (12b-1) fees | 0.25% |

| 0.10% |

| 0.65% |

| None |

| None |

Other expenses | 0.12% |

| 0.12% |

| 0.11% |

| 0.06% |

| 0.12% |

Total annual Fund operating expenses | 0.85% |

| 0.70% |

| 1.24% |

| 0.54% |

| 0.60% |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| 1 Year |

| 3 Years |

| 5 Years |

| 10 Years |

Class A |

| $310 |

| $490 |

| $686 |

| $1,250 | |

Class A1 |

| $295 |

| $444 |

| $606 |

| $1,076 | |

Class C |

| $226 |

| $393 |

| $680 |

| $1,392 | |

Class R6 |

| $55 |

| $173 |

| $302 |

| $678 | |

Advisor Class |

| $61 |

| $192 |

| $335 |

| $750 | |

If you do not sell your shares: |

|

|

|

|

|

|

| ||

Class C |

| $126 |

| $393 |

| $680 |

| $1,392 | |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 8.56% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund invests at least 80% of its total assets in securities whose interest is free from federal income taxes, including the federal alternative minimum tax, and from New York State personal income taxes. As a non-fundamental policy, the Fund also normally invests at least 80% of its total

Click to view the fund’s prospectus or view the statement of additional information. | ||

franklintempleton.com | Summary Prospectus | 3 |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

assets in securities that pay interest free from New York City personal income taxes. Although the Fund tries to invest all of its assets in tax-free securities, it is possible that up to 20% of the Fund's total assets may be invested in securities that pay interest subject to federal or state income taxes, including interest that may be subject to the federal alternative minimum tax.

The Fund maintains a dollar-weighted average portfolio maturity of three to 10 years and only buys securities rated, at the time of purchase, in one of the top four ratings categories by one or more U.S. nationally recognized rating services or unrated or short-term rated securities of comparable credit quality.

The Fund may invest in insured municipal securities. Insured municipal securities are covered by insurance policies that guarantee the timely payment of principal and interest. The insurance premium costs, however, are typically reflected in a lower yield and/or higher price for the insured bond. It is important to note that insurance does not guarantee the market value of an insured security, or the Fund’s share price or distributions, and shares of the Fund are not insured.

The Fund may invest up to 35% of its assets in municipal securities issued by U.S. territories.

Although the investment manager will search for investments across a large number of municipal securities that finance different types of projects, from time to time, based on economic conditions, the Fund may have significant positions in municipal securities that finance similar types of projects.

The investment manager selects securities that it believes will provide the best balance between risk and return within the Fund’s range of allowable investments and typically invests with a long-term time horizon. This means it generally holds securities in the Fund’s portfolio for income purposes, although the investment manager may sell a security at any time if it believes it could help the Fund meet its goal. With a focus on income, individual securities are considered for purchase or sale based on various factors and considerations, including credit profile, risk, structure, pricing, portfolio impact, duration management, restructuring, opportunistic trading and tax loss harvesting opportunities.

Principal Risks

You could lose money by investing in the Fund. Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency of the U.S. government.

Interest Rate When interest rates rise, debt security prices generally fall. The opposite is also generally true: debt security prices rise when interest rates fall.

Click to view the fund’s prospectus or view the statement of additional information. | ||

4 | Summary Prospectus | franklintempleton.com |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

Interest rate changes are influenced by a number of factors, including government policy, monetary policy, inflation expectations, perceptions of risk, and supply of and demand for bonds. In general, securities with longer maturities or durations are more sensitive to interest rate changes.

Market The market values of securities or other investments owned by the Fund will go up or down, sometimes rapidly or unpredictably. The market value of a security or other investment may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all investments. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise.

The global outbreak of the novel strain of coronavirus, COVID-19, has resulted in market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. Efforts to contain the spread of COVID-19 have resulted in global travel restrictions and disruptions of healthcare systems, business operations and supply chains, layoffs, volatility in consumer demand for certain products, defaults and credit ratings downgrades, and other significant economic impacts. The effects of COVID-19 have impacted global economic activity across many industries and may heighten other pre-existing political, social and economic risks, locally or globally. The full impact of the COVID-19 pandemic is unpredictable and may adversely affect the Fund’s performance.

Credit An issuer of debt securities may fail to make interest payments or repay principal when due, in whole or in part. Changes in an issuer's financial strength or in a security's or government's credit rating may affect a security's value. A change in the credit rating of a municipal bond insurer that insures securities in the Fund’s portfolio may affect the value of the securities it insures, the Fund’s share price and Fund performance. The Fund might also be adversely impacted by the inability of an insurer to meet its insurance obligations.

New York The Fund invests predominantly in New York municipal securities. Therefore, events in New York are likely to affect the Fund’s investment and its performance. These events may include economic or political policy changes, tax base erosion, unfunded pension and healthcare liabilities, state constitutional limits on tax increases, budget deficits and other financial difficulties, and changes in the credit ratings assigned to municipal issuers of New York. The same is true of events in other states or U.S. territories, to the extent that the Fund has exposure to any other state or territory at any given time.

Focus The Fund may invest more than 25% of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project, such as proposed legislation on the financing of the project, a shortage of the materials needed for the project,

Click to view the fund’s prospectus or view the statement of additional information. | ||

franklintempleton.com | Summary Prospectus | 5 |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

or a declining need for the project, would likely affect all similar projects, thereby increasing market risk.

Tax-Exempt Securities Failure of a municipal security issuer to comply with applicable tax requirements may make income paid thereon taxable, resulting in a decline in the security’s value. In addition, there could be changes in applicable tax laws or tax treatments that reduce or eliminate the current federal income tax exemption on municipal securities or otherwise adversely affect the current federal or state tax status of municipal securities.

Income The Fund's distributions to shareholders may decline when prevailing interest rates fall, when the Fund experiences defaults on debt securities it holds or when the Fund realizes a loss upon the sale of a debt security.

Bond Insurers Market conditions or changes to ratings criteria could adversely impact the ratings of municipal bond insurance companies. Downgrades and withdrawal of ratings from municipal bond insurers have substantially limited the availability of insurance sought by municipal bond issuers thereby reducing the supply of insured municipal securities.

Because of the consolidation among municipal bond insurers the Fund is subject to additional risks including the risk that credit risk may be concentrated among fewer insurers and the risk that events involving one or more municipal bond insurers could have a significant adverse effect on the value of the securities insured by an insurer and on the municipal markets as a whole.

Prepayment Prepayment risk occurs when a debt security can be repaid in whole or in part prior to the security's maturity and the Fund must reinvest the proceeds it receives, during periods of declining interest rates, in securities that pay a lower rate of interest. Also, if a security has been purchased at a premium, the value of the premium would be lost in the event of prepayment. Prepayments generally increase when interest rates fall.

Liquidity From time to time, the trading market for a particular security or type of security or other investments in which the Fund invests may become less liquid or even illiquid. Reduced liquidity will have an adverse impact on the Fund’s ability to sell such securities or other investments when necessary to meet the Fund’s liquidity needs, which may arise or increase in response to a specific economic event or because the investment manager wishes to purchase particular investments or believes that a higher level of liquidity would be advantageous. Reduced liquidity will also generally lower the value of such securities or other investments. Market prices for such securities or other investments may be relatively volatile.

Click to view the fund’s prospectus or view the statement of additional information. | ||

6 | Summary Prospectus | franklintempleton.com |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

Management The Fund is subject to management risk because it is an actively managed investment portfolio. The Fund's investment manager applies investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results.

Cybersecurity Cybersecurity incidents, both intentional and unintentional, may allow an unauthorized party to gain access to Fund assets, Fund or customer data (including private shareholder information), or proprietary information, cause the Fund, the investment manager and/or their service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality or prevent Fund investors from purchasing, redeeming or exchanging shares or receiving distributions. The investment manager has limited ability to prevent or mitigate cybersecurity incidents affecting third party service providers, and such third party service providers may have limited indemnification obligations to the Fund or investment manager. Cybersecurity incidents may result in financial losses to the Fund and its shareholders, and substantial costs may be incurred in an effort to prevent or mitigate future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers experience cybersecurity incidents.

Because technology is frequently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the Fund's ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the Fund, the investment manager and their service providers are subject to the risk of cyber incidents occurring from time to time.

Performance

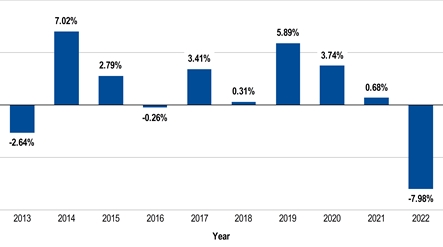

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You can obtain updated performance information at franklintempleton.com or by calling (800) DIAL BEN/342-5236.

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

Click to view the fund’s prospectus or view the statement of additional information. | ||

franklintempleton.com | Summary Prospectus | 7 |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

Class A Annual Total Returns

Best Quarter: | 2022, Q4 | 3.75% |

Worst Quarter: | 2022, Q1 | -6.16% |

Average Annual Total Returns

(figures reflect sales charges)

For periods ended December 31, 2022

|

| 1 Year |

| 5 Years |

| 10 Years |

| Since Inception |

| |

Franklin New York Intermediate-Term Tax-Free Income - Class A |

|

|

|

|

|

|

|

|

| |

| Return before taxes |

| -10.05% |

| -0.04% |

| 0.98% |

| — |

|

| Return after taxes on distributions |

| -10.05% |

| -0.04% |

| 0.98% |

| — |

|

| Return after taxes on distributions and sale of Fund shares |

| -5.24% |

| 0.50% |

| 1.32% |

| — |

|

Franklin New York Intermediate-Term Tax-Free Income - Class A1 |

| -9.91% |

| 0.08% |

| 1.06% |

| — |

| |

Franklin New York Intermediate-Term Tax-Free Income - Class C |

| -9.22% |

| -0.01% |

| 0.72% |

| — |

| |

Franklin New York Intermediate-Term Tax-Free Income - Class R6 |

| -7.66% |

| 0.70% |

| — |

| 0.68% | 1 | |

Franklin New York Intermediate-Term Tax-Free Income - Advisor Class |

| -7.73% |

| 0.63% |

| 1.38% |

| — |

| |

Bloomberg New York Municipal Bond Index (index reflects no deduction for fees, expenses or taxes) |

| -8.94% |

| 0.98% |

| 1.99% |

| — |

| |

1. | Since inception August 1, 2017. | |||||||||

Click to view the fund’s prospectus or view the statement of additional information. | ||

8 | Summary Prospectus | franklintempleton.com |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

Historical performance for Class A shares in the bar chart and table above prior to their inception is based on the performance of Class A1 shares and has been adjusted to reflect differences in Rule 12b-1 fees between classes.

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are shown only for Class A and after-tax returns for other classes will vary.

Investment Manager

Franklin Advisers, Inc. (Advisers)

Portfolio Managers

John Wiley

Senior Vice President of Advisers and portfolio manager of the Fund since 2020.

Christopher Sperry, CFA

Vice President of Advisers and portfolio manager of the Fund since 2020.

John Bonelli

Vice President of Advisers and portfolio manager of the Fund since 2020.

Michael Conn

Vice President of Advisers and portfolio manager of the Fund since 2020.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund on any business day online through our website at franklintempleton.com, by mail (Franklin Templeton Investor Services, P.O. Box 997151, Sacramento, CA 95899-7151), or by telephone at (800) 632-2301. For Class A, A1 and C, the minimum initial purchase for most accounts is $1,000 (or $25 under an automatic investment plan). Class R6 and Advisor Class are only available to certain qualified investors and the minimum initial investment will vary depending on the type of qualified investor, as described under "Your Account — Choosing a Share Class — Qualified Investors — Class R6" and "— Advisor Class" in the Fund's prospectus. There is no minimum investment for subsequent purchases.

Taxes

The Fund’s distributions are primarily exempt from regular federal, New York State and New York City income taxes for individual residents of New York. A portion of these distributions, however, may be subject to federal alternative minimum tax.

Click to view the fund’s prospectus or view the statement of additional information. | ||

franklintempleton.com | Summary Prospectus | 9 |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

The Fund may also make distributions that are taxable to you as ordinary income or capital gains.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's website for more information.

Click to view the fund’s prospectus or view the statement of additional information. | ||

10 | Summary Prospectus | franklintempleton.com |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

This page intentionally left blank

Click to view the fund’s prospectus or view the statement of additional information. | ||

franklintempleton.com | Summary Prospectus | 11 |

FRANKLIN

NEW YORK INTERMEDIATE-TERM TAX-FREE INCOME FUND

SUMMARY PROSPECTUS

This page intentionally left blank

Click to view the fund’s prospectus or view the statement of additional information. | ||

12 | Summary Prospectus | franklintempleton.com |

| |

Franklin Distributors, LLC One Franklin Parkway San Mateo, CA 94403-1906 franklintempleton.com Franklin New York Intermediate-Term Tax-Free Income Fund | |

Investment Company Act file #811-04787 © 2023 Franklin Templeton. All rights reserved.

| 1153 PSUM 02/23 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Four ONDA Partners Earn Placement on D Magazine’s Best Lawyers List

- Atlas Salt Inc. Announces Release with Conditions under the Environmental Protection Act for the Great Atlantic Salt Project

- Statement on behalf of the Maher Family

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share

10% Total Recycled Fiber 00070365

10% Total Recycled Fiber 00070365