Form 497K FIDELITY NEW YORK MUNICI

Fidelity® New York Municipal Money Market Fund

Class

/Ticker

Institutional

/FNKXX

Fidelity

®

New York Municipal Money Market Fund was formerly known as Fidelity

®

New York AMT Tax-Free Money Market Fund.

Summary Prospectus

April 1, 2023

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus, reports to shareholders, and other information about the fund (including the fund's SAI) online at www.fidelity.com/funddocuments. You can also get this information at no cost by calling 1-800-FIDELITY or by sending an e-mail request to [email protected]. The fund's

prospectus

and

SAI

dated April 1, 2023 are incorporated herein by reference.

245 Summer Street, Boston, MA 02210

Fund Summary

Fund

/Class:

Fidelity® New York Municipal Money Market Fund

/Institutional

Investment Objective

Fidelity® New York Municipal Money Market Fund seeks as high a level of current income, exempt from federal income tax and New York State and City personal income taxes, as is consistent with preservation of capital.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

In addition to the fees and expenses described below, your broker may also require you to pay brokerage commissions on purchases and sales of certain share classes of the fund.

Shareholder fees

|

(fees paid directly from your investment)

|

None

|

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

|

Management fee

|

0.20

%

|

|

Distribution and/or Service (12b-1) fees

|

None

|

|

Other expenses

|

0.05

%

|

|

Total annual operating expenses

|

0.25

%

|

|

Fee waiver and/or expense reimbursement

A

|

0.05

%

|

|

Total annual operating expenses after fee waiver and/or expense reimbursement

|

0.20

%

|

A

Fidelity Management & Research Company LLC (FMR) has contractually agreed to reimburse Institutional Class of the fund to the extent that total operating expenses (excluding interest, certain taxes, fees and expenses of the Independent Trustees, extraordinary expenses, and acquired fund fees and expenses (including fees and expenses associated with a wholly owned subsidiary), if any, as well as non-operating expenses such as brokerage commissions and fees and expenses associated with the fund's securities lending program, if applicable), as a percentage of its average net assets, exceed 0.20% (the Expense Cap). If at any time during the current fiscal year expenses for Institutional Class of the fund fall below the Expense Cap, FMR reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the current fiscal year up to, but not in excess of, the Expense Cap. This arrangement

will remain in effect for at least one year from the effective date of the prospectus

. FMR may not terminate this arrangement without the approval of the Board of Trustees and may extend it in its discretion after that date.

This

example

helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that the fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that the fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

|

1 year

|

$

|

20

|

|

3 years

|

$

|

64

|

|

5 years

|

$

|

113

|

|

10 years

|

$

|

255

|

Principal Investment Strategies

- Normally investing in municipal money market securities.

- Normally investing at least 80% of assets in municipal securities whose interest is exempt from federal and New York State and City personal income taxes.

- Potentially investing up to 20% of assets in municipal securities whose interest is subject to New York State and City personal income taxes.

- Potentially investing more than 25% of total assets in municipal securities that finance similar types of projects.

- Investing in compliance with industry-standard regulatory requirements for money market funds for the quality, maturity, liquidity, and diversification of investments.

Principal Investment Risks

- Municipal Market Volatility.

The municipal market is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities.

- Interest Rate Changes.

Interest rate increases can cause the price of a money market security to decrease.

- Income Risk.

A low or negative interest rate environment can adversely affect the fund's yield.

- Foreign Exposure.

Entities providing credit support or a maturity-shortening structure that are located in foreign countries can be affected by adverse political, regulatory, market, or economic developments in those countries

.

- Geographic Concentration.

Unfavorable political or economic conditions within New York can affect the credit quality of issuers located in that state.

- Issuer-Specific Changes.

A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a money market security to decrease.

You could lose money by investing in the fund.

Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Performance

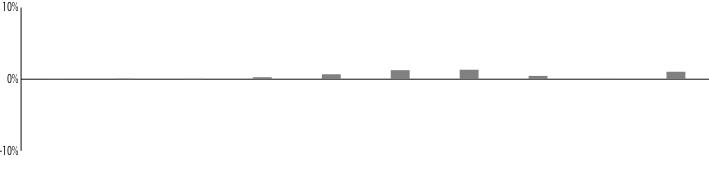

The following information is intended to help you understand the risks of investing in the fund.

The information illustrates the changes in the performance of the fund's shares from year to year.

Past performance is not an indication of future performance.

Visit

www.fidelity.com or institutional.fidelity.com

for more recent performance information.

Year-by-Year Returns

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

|

|

0.02

%

|

0.06

%

|

0.04

%

|

0.28

%

|

0.69

%

|

1.26

%

|

1.32

%

|

0.46

%

|

0.01

%

|

1.04

%

|

|

|

During the periods shown in the chart:

|

Returns

|

Quarter ended

|

|

Highest Quarter Return

|

0.58

%

|

December 31, 2022

|

|

Lowest Quarter Return

|

0.00

%

|

March 31, 2015

|

Average Annual Returns

|

For the periods ended December 31, 2022

|

Past 1

year

|

Past 5

years

|

Past 10

years

|

|

Institutional Class

|

1.04

%

|

0.82

%

|

0.52

%

|

Investment Adviser

Fidelity Management & Research Company LLC (FMR) (the Adviser) is the fund's manager. Other investment advisers serve as sub-advisers for the fund.

Purchase and Sale of Shares

The fund is a retail money market fund. Shares of the fund are available only to accounts beneficially owned by natural persons.

The fund will involuntarily redeem accounts that are not beneficially owned by natural persons, as determined by the fund, in order to implement the fund's eligibility requirements as a retail money market fund. Shares held by these accounts will be sold at their net asset value per share calculated on the day that the fund closes the account position.

The fund may impose a fee upon the sale of fund shares or may temporarily suspend the ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

You may buy or sell shares through a Fidelity

®

brokerage or mutual fund account, or through an investment professional.

You may buy or sell shares in various ways:

Internet

www.fidelity.com or institutional.fidelity.com

Phone

Fidelity Automated Service Telephone (FAST

®

) 1-800-544-5555

To reach a Fidelity representative 1-800-544-6666

Mail

|

Additional purchases:

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

|

Redemptions:

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

|

TDD -

Service for the Deaf and Hearing Impaired

1-800-544-0118

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after an order is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

Even if the NYSE is closed, the fund will be open for business on those days on which the Federal Reserve Bank of New York (New York Fed) is open, the primary trading markets for the fund's portfolio instruments are open, and the fund's management believes there is an adequate market to meet purchase and redemption requests.

Institutional Class shares have a minimum initial investment of $1,000,000. The fund may waive or lower purchase minimums in other circumstances.

Tax Information

The fund seeks to earn income and pay dividends exempt from federal income tax and New York State and City personal income taxes.

A portion of the dividends you receive may be subject to federal, state, or local income tax, and, if applicable, may also be subject to the federal alternative minimum tax. You may also receive taxable distributions attributable to the fund's sale of municipal bonds.

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Company LLC (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity

®

funds, such as prospectuses, annual and semi-annual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. For certain types of accounts, we will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-877-208-0098. We will begin sending individual copies to you within 30 days of receiving your call.

Fidelity Distributors Company LLC (FDC) is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2023 FMR LLC. All rights reserved.

|

1.923873.115

|

NYO-SUM-0423

|

Fidelity® New York Municipal Money Market Fund

Class

/Ticker

Premium

/FSNXX

Fidelity

®

New York Municipal Money Market Fund was formerly known as Fidelity

®

New York AMT Tax-Free Money Market Fund.

Premium Class was formerly known as Fidelity

®

New York AMT Tax-Free Money Market Fund, a class of shares of the fund.

Summary Prospectus

April 1, 2023

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus, reports to shareholders, and other information about the fund (including the fund's SAI) online at www.fidelity.com/funddocuments. You can also get this information at no cost by calling 1-800-FIDELITY or by sending an e-mail request to [email protected]. The fund's

prospectus

and

SAI

dated April 1, 2023 are incorporated herein by reference.

245 Summer Street, Boston, MA 02210

Fund Summary

Fund

/Class:

Fidelity® New York Municipal Money Market Fund

/Premium

Investment Objective

Fidelity® New York Municipal Money Market Fund seeks as high a level of current income, exempt from federal income tax and New York State and City personal income taxes, as is consistent with preservation of capital.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

In addition to the fees and expenses described below, your broker may also require you to pay brokerage commissions on purchases and sales of certain share classes of the fund.

Shareholder fees

|

(fees paid directly from your investment)

|

None

|

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

|

Management fee

|

0.20

%

|

|

Distribution and/or Service (12b-1) fees

|

None

|

|

Other expenses

|

0.10

%

|

|

Total annual operating expenses

|

0.30

%

|

This

example

helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that the fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that the fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

|

1 year

|

$

|

31

|

|

3 years

|

$

|

97

|

|

5 years

|

$

|

169

|

|

10 years

|

$

|

381

|

Principal Investment Strategies

- Normally investing in municipal money market securities.

- Normally investing at least 80% of assets in municipal securities whose interest is exempt from federal and New York State and City personal income taxes.

- Potentially investing up to 20% of assets in municipal securities whose interest is subject to New York State and City personal income taxes.

- Potentially investing more than 25% of total assets in municipal securities that finance similar types of projects.

- Investing in compliance with industry-standard regulatory requirements for money market funds for the quality, maturity, liquidity, and diversification of investments.

Principal Investment Risks

- Municipal Market Volatility.

The municipal market is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities.

- Interest Rate Changes.

Interest rate increases can cause the price of a money market security to decrease.

- Income Risk.

A low or negative interest rate environment can adversely affect the fund's yield.

- Foreign Exposure.

Entities providing credit support or a maturity-shortening structure that are located in foreign countries can be affected by adverse political, regulatory, market, or economic developments in those countries

.

- Geographic Concentration.

Unfavorable political or economic conditions within New York can affect the credit quality of issuers located in that state.

- Issuer-Specific Changes.

A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a money market security to decrease.

You could lose money by investing in the fund.

Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Performance

The following information is intended to help you understand the risks of investing in the fund.

The information illustrates the changes in the performance of the fund's shares from year to year.

Past performance is not an indication of future performance.

Visit

www.fidelity.com

for more recent performance information.

Year-by-Year Returns

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

|

|

0.02

%

|

0.06

%

|

0.04

%

|

0.23

%

|

0.59

%

|

1.16

%

|

1.22

%

|

0.39

%

|

0.01

%

|

0.95

%

|

|

|

During the periods shown in the chart:

|

Returns

|

Quarter ended

|

|

Highest Quarter Return

|

0.56

%

|

December 31, 2022

|

|

Lowest Quarter Return

|

0.00

%

|

March 31, 2021

|

Average Annual Returns

|

For the periods ended December 31, 2022

|

Past 1

year

|

Past 5

years

|

Past 10

years

|

|

Premium Class

|

0.95

%

|

0.75

%

|

0.47

%

|

Investment Adviser

Fidelity Management & Research Company LLC (FMR) (the Adviser) is the fund's manager. Other investment advisers serve as sub-advisers for the fund.

Purchase and Sale of Shares

The fund is a retail money market fund. Shares of the fund are available only to accounts beneficially owned by natural persons.

The fund will involuntarily redeem accounts that are not beneficially owned by natural persons, as determined by the fund, in order to implement the fund's eligibility requirements as a retail money market fund. Shares held by these accounts will be sold at their net asset value per share calculated on the day that the fund closes the account position.

The fund may impose a fee upon the sale of fund shares or may temporarily suspend the ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

You may buy or sell shares through a Fidelity

®

brokerage or mutual fund account, or through an investment professional.

You may buy or sell shares in various ways:

Internet

www.fidelity.com

Phone

Fidelity Automated Service Telephone (FAST

®

) 1-800-544-5555

To reach a Fidelity representative 1-800-544-6666

Mail

|

Additional purchases:

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

|

Redemptions:

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

|

TDD -

Service for the Deaf and Hearing Impaired

1-800-544-0118

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after an order is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

Even if the NYSE is closed, the fund will be open for business on those days on which the Federal Reserve Bank of New York (New York Fed) is open, the primary trading markets for the fund's portfolio instruments are open, and the fund's management believes there is an adequate market to meet purchase and redemption requests.

Premium Class shares have a minimum initial investment of $25,000. The fund may waive or lower purchase minimums in other circumstances.

Tax Information

The fund seeks to earn income and pay dividends exempt from federal income tax and New York State and City personal income taxes.

A portion of the dividends you receive may be subject to federal, state, or local income tax, and, if applicable, may also be subject to the federal alternative minimum tax. You may also receive taxable distributions attributable to the fund's sale of municipal bonds.

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Company LLC (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity

®

funds, such as prospectuses, annual and semi-annual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. For certain types of accounts, we will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-800-544-8544. We will begin sending individual copies to you within 30 days of receiving your call.

Fidelity Distributors Company LLC (FDC) is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2023 FMR LLC. All rights reserved.

|

1.923872.115

|

SNM-SUM-0423

|

Fidelity® New York Municipal Money Market Fund

Class

/Ticker

Fidelity® New York Municipal Money Market Fund

/FAWXX

Fidelity

®

New York Municipal Money Market Fund was formerly known as Fidelity

®

New York AMT Tax-Free Money Market Fund.

In this summary prospectus, the term "shares" (as it relates to the fund) means the class of shares offered through this summary prospectus.

Summary Prospectus

April 1, 2023

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus, reports to shareholders, and other information about the fund (including the fund's SAI) online at www.fidelity.com/funddocuments. You can also get this information at no cost by calling 1-800-FIDELITY or by sending an e-mail request to [email protected]. The fund's

prospectus

and

SAI

dated April 1, 2023 are incorporated herein by reference.

245 Summer Street, Boston, MA 02210

Fund Summary

Fund

/Class:

Fidelity® New York Municipal Money Market Fund

/Fidelity® New York Municipal Money Market Fund

Investment Objective

Fidelity® New York Municipal Money Market Fund seeks as high a level of current income, exempt from federal income tax and New York State and City personal income taxes, as is consistent with preservation of capital.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

In addition to the fees and expenses described below, your broker may also require you to pay brokerage commissions on purchases and sales of certain share classes of the fund.

Shareholder fees

|

(fees paid directly from your investment)

|

None

|

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

|

Management fee

|

0.20

%

|

|

Distribution and/or Service (12b-1) fees

|

None

|

|

Other expenses

|

0.22

%

|

|

Total annual operating expenses

|

0.42

%

|

This

example

helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that the fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that the fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

|

1 year

|

$

|

43

|

|

3 years

|

$

|

135

|

|

5 years

|

$

|

235

|

|

10 years

|

$

|

530

|

Principal Investment Strategies

- Normally investing in municipal money market securities.

- Normally investing at least 80% of assets in municipal securities whose interest is exempt from federal and New York State and City personal income taxes.

- Potentially investing up to 20% of assets in municipal securities whose interest is subject to New York State and City personal income taxes.

- Potentially investing more than 25% of total assets in municipal securities that finance similar types of projects.

- Investing in compliance with industry-standard regulatory requirements for money market funds for the quality, maturity, liquidity, and diversification of investments.

Principal Investment Risks

- Municipal Market Volatility.

The municipal market is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities.

- Interest Rate Changes.

Interest rate increases can cause the price of a money market security to decrease.

- Income Risk.

A low or negative interest rate environment can adversely affect the fund's yield.

- Foreign Exposure.

Entities providing credit support or a maturity-shortening structure that are located in foreign countries can be affected by adverse political, regulatory, market, or economic developments in those countries

.

- Geographic Concentration.

Unfavorable political or economic conditions within New York can affect the credit quality of issuers located in that state.

- Issuer-Specific Changes.

A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a money market security to decrease.

You could lose money by investing in the fund.

Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Performance

The following information is intended to help you understand the risks of investing in the fund.

The information illustrates the changes in the performance of Premium Class shares from year to year

.

Past performance is not an indication of future performance.

Visit

www.fidelity.com

for more recent performance information.

Performance history will be available for Fidelity

®

New York Municipal Money Market Fund, a class of shares of Fidelity

®

New York Municipal Money Market Fund, after the class has been in operation for one calendar year.

Year-by-Year Returns

*

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

|

|

0.02

%

|

0.06

%

|

0.04

%

|

0.23

%

|

0.59

%

|

1.16

%

|

1.22

%

|

0.39

%

|

0.01

%

|

0.95

%

|

|

|

During the periods shown in the chart for Premium Class:

|

Returns

|

Quarter ended

|

|

Highest Quarter Return

|

0.56

%

|

December 31, 2022

|

|

Lowest Quarter Return

|

0.00

%

|

March 31, 2021

|

* The returns shown above are for Premium Class, a class of shares of the fund that is not offered through this prospectus. Fidelity® New York Municipal Money Market Fund would have substantially similar annual returns to Premium Class because the classes are invested in the same portfolio of securities. Fidelity® New York Municipal Money Market Fund's returns will be lower than Premium Class's returns to the extent that Fidelity® New York Municipal Money Market Fund has higher expenses.

Average Annual Returns

*

|

For the periods ended December 31, 2022

|

Past 1

year

|

Past 5

years

|

Past 10

years

|

|

Premium Class

|

0.95

%

|

0.75

%

|

0.47

%

|

* The returns shown above are for Premium Class, a class of shares of the fund that is not offered through this prospectus. Fidelity® New York Municipal Money Market Fund would have substantially similar annual returns to Premium Class because the classes are invested in the same portfolio of securities. Fidelity® New York Municipal Money Market Fund's returns will be lower than Premium Class's returns to the extent that Fidelity® New York Municipal Money Market Fund has higher expenses.

Investment Adviser

Fidelity Management & Research Company LLC (FMR) (the Adviser) is the fund's manager. Other investment advisers serve as sub-advisers for the fund.

Purchase and Sale of Shares

The fund is a retail money market fund. Shares of the fund are available only to accounts beneficially owned by natural persons.

The fund will involuntarily redeem accounts that are not beneficially owned by natural persons, as determined by the fund, in order to implement the fund's eligibility requirements as a retail money market fund. Shares held by these accounts will be sold at their net asset value per share calculated on the day that the fund closes the account position.

The fund may impose a fee upon the sale of fund shares or may temporarily suspend the ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

You may buy or sell shares through a Fidelity

®

brokerage or mutual fund account, or through an investment professional.

You may buy or sell shares in various ways:

Internet

www.fidelity.com

Phone

Fidelity Automated Service Telephone (FAST

®

) 1-800-544-5555

To reach a Fidelity representative 1-800-544-6666

Mail

|

Additional purchases:

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

|

Redemptions:

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

|

TDD -

Service for the Deaf and Hearing Impaired

1-800-544-0118

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after an order is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

Even if the NYSE is closed, the fund will be open for business on those days on which the Federal Reserve Bank of New York (New York Fed) is open, the primary trading markets for the fund's portfolio instruments are open, and the fund's management believes there is an adequate market to meet purchase and redemption requests.

There is no purchase minimum for shares of the fund offered in this prospectus.

Tax Information

The fund seeks to earn income and pay dividends exempt from federal income tax and New York State and City personal income taxes.

A portion of the dividends you receive may be subject to federal, state, or local income tax, and, if applicable, may also be subject to the federal alternative minimum tax. You may also receive taxable distributions attributable to the fund's sale of municipal bonds.

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Company LLC (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity

®

funds, such as prospectuses, annual and semi-annual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. For certain types of accounts, we will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-800-544-8544. We will begin sending individual copies to you within 30 days of receiving your call.

Fidelity Distributors Company LLC (FDC) is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2023 FMR LLC. All rights reserved.

|

1.9906063.101

|

NYS-R-SUM-0423

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Class Technologies Named in Top 10 of TIME's Global List of EdTech Companies

- GENESIS AND THE GENESIS INSPIRATION FOUNDATION SUPPORT STEAM EDUCATION AT GENESIS OF CENTRAL FLORIDA GRAND OPENING

- Federal Home Loan Bank of New York Announces First Quarter 2024 Operating Highlights

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share