Form 497K FAIRHOLME FUNDS INC

THE FAIRHOLME FUND (FAIRX)

A no-load, non-diversified fund seeking long-term growth of capital

SUMMARY PROSPECTUS

March 30, 2023

A series of

FAIRHOLME FUNDS, INC.

Managed by

FAIRHOLME CAPITAL MANAGEMENT

Before you invest, you may want to review the Fund’s Prospectus,

which contains more information about the Fund and its risks.

The Fund’s Prospectus and Statement of Additional Information,

both dated March 30, 2023, as may be amended or

supplemented, are incorporated by reference into this

Summary Prospectus. For free paper or electronic copies of the

Fund’s Prospectus and other information about the Fund, go to

www.fairholmefunds.com/prospectus, email a request to

[email protected], call (866) 202-2263, or ask any

financial advisor, bank, or broker-dealer who offers shares of the Fund.

THE FAIRHOLME FUND

(“The Fairholme Fund”)

Investment Objective

The Fairholme Fund’s investment objective is long-term growth of capital.

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold and sell shares of The Fairholme Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in shares of The Fairholme Fund, which are not reflected in the tables or the Example below.

| SHAREHOLDER FEES | ||||

| (Fees Paid Directly From Your Investment) | ||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of amount redeemed) |

None | |||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and Other Distributions (as a percentage of amount reinvested) |

None | |||

|

Redemption Fee Paid to the Fund (as a percentage of amount redeemed within 60 days of purchase, if applicable) |

2.00% | |||

| ANNUAL FUND OPERATING EXPENSES | ||||

| (Expenses That You Pay Each Year As A Percentage Of The Value Of Your Investment In The Fairholme Fund) |

||||

| Management Fees |

1.00% | |||

| Distribution (12b-1) Fees |

None | |||

| Other Expenses |

0.00% | |||

|

|

|

|||

|

Total Annual Fund Operating Expenses(a) |

1.00% | |||

| (a) | This table does not reflect the application of the management fee waiver discussed in the section of the Prospectus entitled “Investment Management,” pursuant to which the Manager (defined below) has agreed to waive, on a voluntary basis, a portion of the management fee of The Fairholme Fund to the extent necessary to limit the management fee paid to the Manager by The Fairholme Fund to an annual rate of 0.80% of the daily average net asset value of The Fairholme Fund (“Undertaking”). This Undertaking may be terminated by the Manager upon 60 days’ written notice to The Fairholme Fund. |

For more information about the management fee, see the “Investment Management” section of the Prospectus. Please note that the Total Annual Fund Operating Expenses in the table above does not correlate to the Ratio of Net Expenses to Average Net Assets found within the “Financial Highlights” section of the Prospectus, which reflects the actual operating expenses of The Fairholme Fund for the fiscal year ended November 30, 2022.

Example

This Example is intended to help you compare the cost of investing in The Fairholme Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in The Fairholme Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that The Fairholme Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $102 | $318 | $552 | $1,225 | |||

The amounts shown do not reflect the application of the Undertaking.

Portfolio Turnover

The Fairholme Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when The Fairholme Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect The Fairholme Fund’s performance. During the most recent fiscal year, The Fairholme Fund’s portfolio turnover rate was 2.54% of the average value of its portfolio.

1

Principal Investment Strategies

Fairholme Capital Management, L.L.C. (the “Manager”), the investment adviser to The Fairholme Fund, attempts, under normal circumstances, to achieve The Fairholme Fund’s investment objective by investing in a focused portfolio of equity and fixed-income securities. The proportion of The Fairholme Fund’s assets invested in each type of asset class will vary from time to time based upon the Manager’s assessment of general market and economic conditions. The Fairholme Fund may invest in, and may shift frequently among, asset classes and market sectors.

The equity securities in which The Fairholme Fund may invest include common and preferred stock (including convertible preferred stock), interests in publicly traded partnerships (“PTPs”), business trust shares, depository receipts, rights and warrants to subscribe for the purchase of equity securities, and interests in real estate investment trusts (“REITs”).

The fixed-income securities in which The Fairholme Fund may invest include U.S. corporate debt securities, non-U.S. corporate debt securities, bank debt (including bank loans and participations), U.S. Government and agency debt securities (including U.S. Treasury bills), short-term debt obligations of foreign governments and foreign money market instruments.

The Fairholme Fund may also invest in “special situations,” which are situations when the securities of a company are expected to appreciate over time due to company-specific developments rather than general business conditions or movements of the market as a whole.

The Manager uses fundamental analysis to identify certain attractive characteristics of companies. Such characteristics may include: high free cash flow yields in relation to market values and risk-free rates; sensible capital allocation policies; strong competitive positions; solid balance sheets; liquidity and leverage; stress-tested owner/managers; participation in stressed industries having reasonable prospects for recovery; potential for long-term growth; significant tangible assets in relation to enterprise values; high returns on invested equity and capital; and the production of essential services and products. The Manager defines free cash flow as the cash a company would generate annually from operations after all cash outlays necessary to maintain the business in its current condition.

Although The Fairholme Fund normally holds a focused portfolio of equity and fixed-income securities, The Fairholme Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. In certain market conditions, the Manager may determine that it is appropriate for The Fairholme Fund to hold a significant cash position for an extended period of time.

The Fairholme Fund may also use other investment strategies and invest its assets in other types of investments, which are described in the section in the Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Fairholme Fund’s Statement of Additional Information (“SAI”).

Principal Risks of Investing in The Fairholme Fund

General/Market Risks. The market values of securities or other investments that The Fairholme Fund holds may fall, sometimes rapidly or unpredictably, or fail to rise for various reasons including changes or potential or perceived changes in U.S. or foreign economies, financial markets, interest rates, tax rates, the liquidity of investments and other factors including terrorism, war, regional and global conflicts, natural disasters and public health events and crises, including disease/virus outbreaks and epidemics. The resulting short-term and long-term effects and consequences of such events and factors on global and local economies and specific countries, regions, businesses, industries, and companies cannot necessarily be foreseen or predicted. From time to time, certain market segments (such as equity or fixed income), investment styles (such as growth or value), or other investment categories, may fall out of favor which may impair the value of an investment in The Fairholme Fund. An investment in The Fairholme Fund could lose money over short or long periods.

Equity Risk. The Fairholme Fund is subject to the risk that stock and other equity security prices may fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of The Fairholme Fund’s equity securities may fluctuate drastically from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These factors contribute to price volatility.

Small- to Medium-Capitalization Risk. Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- to mid-cap companies may have additional risks because, among other things, these companies have limited product lines, markets or financial resources.

Focused Portfolio and Non-Diversification Risks. The Fairholme Fund may have more volatility and is considered to have more risk than a fund that invests in securities of a greater number of issuers because changes in the value of a single issuer’s security may have a more significant effect, either negative or positive, on The Fairholme Fund’s net asset value (“NAV”). To the extent that The Fairholme Fund invests its assets in the securities of fewer issuers, The Fairholme Fund will be subject to greater risk of loss if any of those securities decreases in value or becomes impaired. To the extent that The Fairholme Fund’s investments are focused in a particular issuer, region, country, market, industry, asset class or other category, The Fairholme

2

Fund may be susceptible to loss due to adverse occurrences affecting that issuer, region, country, market, industry, asset class or other category. As of March 17, 2023, the securities of a single company comprised a substantial portion (over 75%) of The Fairholme Fund’s assets, which increases risks to The Fairholme Fund. The returns of The Fairholme Fund are tied to a significant extent to the performance of such securities.

Control and Substantial Positions Risk. The Fairholme Fund may invest in the securities of a company for the purpose of affecting the management or control of the company or may have or acquire a substantial position in the securities of a company, subject to applicable legal restrictions with respect to the investment. Such an investment imposes additional risks for The Fairholme Fund other than a possible decline in the value of the investment. These additional risks include: the application of statutory, regulatory and other requirements to The Fairholme Fund, or to the Manager and its affiliates, could restrict activities contemplated by The Fairholme Fund, or by the Manager and its affiliates, with respect to a portfolio company or limit the time and the manner in which The Fairholme Fund is able to dispose of its holdings or hedge such holdings; The Fairholme Fund, or the Manager and its affiliates, may be required to obtain relief from the Securities and Exchange Commission (the “SEC”) or its staff prior to engaging in certain activities with respect to a portfolio company that could be deemed a joint arrangement under the Investment Company Act of 1940, as amended (the “1940 Act”); The Fairholme Fund may incur substantial expenses and costs when taking control or other substantial positions in a company, including paying market prices for securities whose value The Fairholme Fund is required to discount when computing the NAV of The Fairholme Fund’s shares, and there is no guarantee that such expenses and costs can be recouped; and The Fairholme Fund could be exposed to various legal claims by governmental entities, or by a portfolio company, its security holders and its creditors, arising from, among other things, The Fairholme Fund’s status as an insider or control person of a portfolio company or from the Manager’s designation of directors to serve on the board of directors of a portfolio company.

Industry/Sector Risk. To the extent The Fairholme Fund invests or maintains a significant portion of its assets in one or more issuers in a particular industry or industry sector, The Fairholme Fund will be subject to a greater degree to the risks particular to that industry or industry sector. Market or economic factors affecting issuers in that industry, group of related industries or sector could have a major effect on the value of The Fairholme Fund’s investments and NAV. As of March 17, 2023, the securities of an issuer in the real estate sector comprised a substantial portion of The Fairholme Fund’s assets. This investment exposes The Fairholme Fund to the risks of the real estate and real estate related sectors generally, and of that issuer, including risks relating to real estate investments and development in Northwest Florida, hospitality, and forestry. In this regard, the securities of a single real estate related issuer or a group of real estate issuers may underperform the market as a whole due to legislative or regulatory changes, adverse market conditions and/or increased competition affecting the real estate sector.

Inflation Risk. This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of The Fairholme Fund’s assets can decline as can the value of The Fairholme Fund’s distributions. This risk increases as The Fairholme Fund invests a greater portion of its assets in fixed-income securities with longer maturities.

Special Situation Risk. Investments in special situations may involve greater risks when compared to The Fairholme Fund’s other strategies due to a variety of factors. Mergers, reorganizations, liquidations or recapitalizations may fail or not be completed on the terms originally contemplated, and expected developments may not occur in a timely manner, or at all.

Cash Position Risk. To the extent that The Fairholme Fund holds large positions in cash or cash equivalents, there is a risk of lower returns and potential lost opportunities to participate in market appreciation.

Interest Rate Risk. Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations. The Fairholme Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the recent end of a period of historically low rates and the effect of potential central bank monetary policy, and government fiscal policy, initiatives and resulting market reactions to those initiatives.

Illiquid Investments Risk. The Fairholme Fund’s investments are subject to illiquid investments risk. This is the risk that the market for a security or other investment cannot accommodate an order to buy or sell the security or other investment in the desired timeframe, possibly preventing The Fairholme Fund from selling these securities at an advantageous price. This risk includes the risk that legal or contractual restrictions on the resale of a security may affect The Fairholme Fund’s ability to sell the security when deemed appropriate or necessary by the Manager. Derivatives and securities involving substantial market and credit risk tend to involve greater illiquid investments risk, and, in certain circumstances, illiquid investments risk may be greater for a particular security as a result of, among other things, changes in the markets relating to that security, increased selling of the security by market participants or increases in the size of the holding relative to other fund holdings or to the issuer’s total issuance. Over recent years illiquid investments risk has increased because the capacity of dealers in the secondary market to make markets in securities has decreased, even as overall markets have grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories.

3

Illiquid investments risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline. This risk also includes the risk that trading on an exchange may be halted because of market conditions.

An investment in The Fairholme Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Further discussion about other risks of investing in The Fairholme Fund may be found in the section in the Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Fairholme Fund’s SAI.

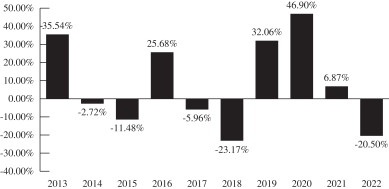

Past Performance

The bar chart and table set out below show The Fairholme Fund’s historical performance and provide some indication of the risks of investing in The Fairholme Fund by showing changes in The Fairholme Fund’s performance from year to year and by showing how The Fairholme Fund’s average annual total returns for the 1-, 5-, and 10-year periods and since inception compare to the performance of the S&P 500 Index. The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The S&P 500 Index assumes reinvestment of all dividends and distributions. Because indices cannot be invested in directly, these index returns do not reflect a deduction for fees, expenses or taxes. The Fairholme Fund’s past performance (before and after taxes) is not necessarily an indication of how The Fairholme Fund will perform in the future. Updated performance information for The Fairholme Fund may be obtained by calling 1-866-202-2263.

Annual Returns for The Fairholme Fund for the Last 10 Calendar Years

| Best Quarter – 4th Qtr 2020: +51.40% | Worst Quarter – 2nd Qtr 2022: -28.04% | |

Average Annual Total Returns for The Fairholme Fund (for the periods ended December 31, 2022)

| Portfolio Returns | 1 Year | 5 Years | 10 Years |

Since Inception (12/29/1999) | ||||

| Return Before Taxes |

-20.50% | 4.84% | 5.74% | 8.89% | ||||

| Return After Taxes on Distributions |

-20.50% | 4.59% | 3.89% | 7.82% | ||||

| Return After Taxes on Distributions and Sale of The Fairholme Fund Shares |

-12.13% | 3.63% | 4.13% | 7.46% | ||||

|

S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

-18.11% | 9.42% | 12.56% | 6.28% | ||||

The theoretical “after-tax” returns shown in the table are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Your actual “after-tax” returns depend on your personal tax situation and may differ from the returns shown above. Also, “after-tax” return information is not relevant to shareholders who hold The Fairholme Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). The “after-tax” returns shown in the table reflect past tax effects and are not predictive of future tax effects.

The average annual total return after taxes on distributions and sale of The Fairholme Fund shares for the 1-year and 10-year periods are higher than the average annual total return after taxes on distributions for the same periods because of realized losses that would have been sustained upon the sale of The Fairholme Fund shares immediately after such 1-year and 10-year periods. In addition to the assumptions in the preceding paragraph, the calculation for the average annual total return after taxes on

4

distributions and sale of The Fairholme Fund shares assumes that an investor would have been able to immediately utilize the full realized loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisors regarding their personal tax situations.

Investment Adviser

Fairholme Capital Management, L.L.C., the Manager, provides investment advisory services to The Fairholme Fund.

Portfolio Manager

Bruce R. Berkowitz, Chief Investment Officer of the Manager, and the President and a Director of Fairholme Funds, Inc. (the “Company”), has been The Fairholme Fund’s lead portfolio manager since The Fairholme Fund’s inception. Mr. Berkowitz is responsible for the day-to-day management of The Fairholme Fund’s portfolio.

Purchase and Sale of The Fairholme Fund Shares

Purchases of shares of The Fairholme Fund are subject to the following minimum investment amounts (which may be waived by the Manager in its discretion):

| Minimum Investment To Open Account |

$10,000 for Regular Accounts |

$6,000 for IRAs | ||

|

Minimum Subsequent Investment (Non-Automatic Investment Plan Members) |

$1,000 for Regular Accounts and IRAs | |||

|

Minimum Subsequent Investment (Automatic Investment Plan Members) |

$250 per month minimum ($100 per month minimum for The Fairholme Fund shareholders who became AIP members prior to September 1, 2008) | |||

Shareholders eligible to purchase shares of The Fairholme Fund may do so through their financial intermediaries or by contacting The Fairholme Fund: (i) by telephone at 1-866-202-2263; (ii) by mail addressed to Fairholme Funds, Inc., P.O. Box 534443, Pittsburgh, PA 15253-4443; or (iii) by overnight delivery addressed to Fairholme Funds, Inc., Attention: 534443, 500 Ross Street, 154-0520, Pittsburgh, PA 15262; or (iv) online at www.fairholmefunds.com.

The Fairholme Fund reserves the right to limit the sale of shares to new investors and existing shareholders at any time. The Fairholme Fund may reject any order to purchase shares, and may withdraw the offering of shares at any time to any or all investors.

Shareholders may redeem shares of The Fairholme Fund through their financial intermediaries or by contacting The Fairholme Fund: (i) by telephone at 1-866-202-2263; (ii) by mail addressed to Fairholme Funds, Inc., P.O. Box 534443, Pittsburgh, PA 15253-4443; (iii) by overnight delivery addressed to Fairholme Funds, Inc., Attention: 534443, 500 Ross Street, 154-0520, Pittsburgh, PA 15262; or (iv) online at www.fairholmefunds.com.

Tax Information for The Fairholme Fund

The Fairholme Fund intends to make distributions that may be taxed as ordinary income or capital gains.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of The Fairholme Fund through a broker-dealer or other financial intermediary (such as a bank), The Fairholme Fund and its related companies may pay the intermediary for certain administrative and shareholder servicing functions. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend The Fairholme Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Fairholme Capital ManagementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share